0001101026false--12-31Q120240.00127896552382356000011010262024-01-012024-03-310001101026zivo:ThreePrivateTransactionsMember2024-01-012024-03-310001101026zivo:ThreePrivateTransactionsMember2024-03-310001101026zivo:TwentyPrivateunRegisteredMember2024-01-012024-03-310001101026zivo:GAExpenseMember2023-01-012023-03-310001101026zivo:GAExpenseMember2024-01-012024-03-310001101026us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001101026us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001101026zivo:MembersOfTheBoardOfDirectorsMember2023-01-012023-03-310001101026zivo:MembersOfTheBoardOfDirectorsMember2024-01-012024-03-310001101026us-gaap:ShortTermDebtMember2023-02-140001101026us-gaap:ShortTermDebtMember2024-03-050001101026us-gaap:ShortTermDebtMember2024-03-012024-03-050001101026us-gaap:ShortTermDebtMember2023-02-012023-02-140001101026us-gaap:ShortTermDebtMember2024-03-310001101026us-gaap:RetainedEarningsMember2024-03-310001101026us-gaap:AdditionalPaidInCapitalMember2024-03-310001101026zivo:CommonStocksMember2024-03-310001101026us-gaap:RetainedEarningsMember2024-01-012024-03-310001101026us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001101026zivo:CommonStocksMember2024-01-012024-03-310001101026us-gaap:RetainedEarningsMember2023-12-310001101026us-gaap:AdditionalPaidInCapitalMember2023-12-310001101026zivo:CommonStocksMember2023-12-3100011010262023-03-310001101026us-gaap:RetainedEarningsMember2023-03-310001101026us-gaap:AdditionalPaidInCapitalMember2023-03-310001101026zivo:CommonStocksMember2023-03-310001101026us-gaap:RetainedEarningsMember2023-01-012023-03-310001101026us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001101026zivo:CommonStocksMember2023-01-012023-03-3100011010262022-12-310001101026us-gaap:RetainedEarningsMember2022-12-310001101026us-gaap:AdditionalPaidInCapitalMember2022-12-310001101026zivo:CommonStocksMember2022-12-3100011010262023-01-012023-03-3100011010262023-12-3100011010262024-03-3100011010262024-05-100001101026zivo:CommonStockParValueMember2024-01-012024-03-310001101026zivo:WarrantsPurchaseOfCommonStockMember2024-01-012024-03-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________.

Commission File Number: 001-40449

Zivo Bioscience, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 87-0699977 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

21 East Long Lake Road, Ste. 100, Bloomfield Hills MI | | 48304 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 248-452-9866

______________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

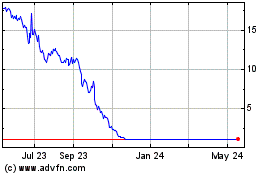

Common Stock, par value $0.001 per share | | ZIVO | | OTCQB |

Warrants to purchase shares of Common Stock, par value $0.001 per share | | ZIVOW | | OTC Pink |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At May 10, 2024, there were 2,831,943 issued and outstanding shares of Common Stock of the registrant.

FORM 10-Q

ZIVO BIOSCIENCE, INC.

INDEX

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

(UNAUDITED)

| | March 31, | | | December 31, | |

| | 2024 | | | 2023 | |

ASSETS | | | | | | |

| | | | | | |

CURRENT ASSETS: | | | | | | |

Cash | | $ | 138,641 | | | $ | 274,380 | |

Accounts receivable | | | 3,735 | | | | 3,735 | |

Prepaid expenses | | | 568,241 | | | | 147,262 | |

Total current assets | | | 710,617 | | | | 425,377 | |

OTHER ASSETS: | | | | | | | | |

Operating lease - right of use asset | | | 73,721 | | | | 98,280 | |

Security deposit | | | 32,058 | | | | 32,058 | |

Total other assets | | | 105,779 | | | | 130,338 | |

TOTAL ASSETS | | $ | 816,396 | | | $ | 555,715 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT): |

CURRENT LIABILITIES: | | | | | | | | |

Accounts payable | | $ | 705,841 | | | $ | 993,090 | |

Accounts payable – related party | | | 211,170 | | | | 172,670 | |

Current portion of long-term operating lease | | | 79,033 | | | | 106,342 | |

Convertible debentures payable | | | 240,000 | | | | 240,000 | |

Loan Payable | | | 460,053 | | | | - | |

Accrued interest | | | 101,278 | | | | 100,686 | |

Accrued liabilities – employee bonus | | | 1,287,920 | | | | 1,148,770 | |

Total current liabilities | | | 3,085,295 | | | | 2,761,558 | |

LONG TERM LIABILITIES: | | | - | | | | - | |

TOTAL LIABILITIES | | | 3,085,295 | | | | 2,761,558 | |

COMMITMENTS AND CONTINGENCIES | | | | | | | | |

STOCKHOLDERS’ EQUITY (DEFICIT): | | | | | | | | |

Common stock, $0.001 par value, 25,000,000 and 25,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 2,789,655 and 2,382,356 issued and outstanding at March 31, 2024, and December 31, 2023, respectively | | | 2,791 | | | | 2,383 | |

Additional paid-in capital | | | 122,588,510 | | | | 121,373,488 | |

Accumulated deficit | | | (124,860,200 | ) | | | (123,581,714 | ) |

Total stockholders’ equity (deficit) | | | (2,268,899 | ) | | | (2,205,843 | ) |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | 816,396 | | | $ | 555,715 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | Three Months ended March 31, 2024 | | | Three Months ended March 31, 2023 | |

REVENUES: | | | | | | |

Product revenue | | $ | 35,720 | | | $ | - | |

Total revenues | | | 35,720 | | | | - | |

| | | | | | | | |

COSTS OF GOODS SOLD | | | | | | | | |

Product costs | | | 23,218 | | | | - | |

Total costs of goods sold | | | 23,218 | | | | - | |

| | | | | | | | |

GROSS MARGIN | | | 12,502 | | | | - | |

| | | | | | | | |

COSTS AND EXPENSES: | | | | | | | | |

General and administrative | | | 975,574 | | | | 1,568,377 | |

Research and development | | | 312,767 | | | | 401,797 | |

| | | | | | | | |

Total costs and expenses | | | 1,288,341 | | | | 1,970,174 | |

| | | | | | | | |

LOSS FROM OPERATIONS | | | (1,275,839 | ) | | | (1,970,174 | ) |

| | | | | | | | |

OTHER (EXPENSE): | | | | | | | | |

Interest expense | | | (2,648 | ) | | | (2,968 | ) |

Total other expense | | | (2,648 | ) | | | (2,968 | ) |

| | | | | | | | |

NET LOSS | | $ | (1,278,486 | ) | | $ | (1,973,142 | ) |

| | | | | | | | |

BASIC AND DILUTED LOSS PER SHARE | | $ | (0.47 | ) | | $ | (1.26 | ) |

WEIGHTED AVERAGE BASIC AND DILUTED SHARES OUTSTANDING | | | 2,748,294 | | | | 1,569,943 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’

EQUITY (DEFICIT)

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND MARCH 31, 2023

(UNAUDITED)

| | | | | | | | Additional Paid in | | | Accumulated | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

Balance, December 31, 2022 | | | 1,569,943 | | | $ | 1,570 | | | $ | 115,792,338 | | | $ | (115,804,530 | ) | | $ | (10,622 | ) |

Employee and director equity-based compensation | | | - | | | | - | | | | 242,102 | | | | - | | | | 242,102 | |

Net loss for the three months ended March 31, 2023 | | | - | | | | - | | | | - | | | | (1,973,142 | ) | | | (1,973,142 | ) |

Balance, March 31, 2023 | | | 1,569,943 | | | $ | 1,570 | | | $ | 116,034,440 | | | $ | (117,777,672 | ) | | $ | (1,741,662 | ) |

| | | | | | | | Additional Paid in | | | Accumulated | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

Balance, December 31, 2023 | | | 2,382,356 | | | $ | 2,383 | | | $ | 121,373,488 | | | $ | (123,581,714 | ) | | $ | (2,205,843 | ) |

Employee and director equity-based compensation | | | - | | | | - | | | | 112,104 | | | | - | | | | 112,104 | |

Private sales of common stock - other | | | 350,633 | | | | 351 | | | | 972,193 | | | | - | | | | 972,544 | |

Private sales of common stock – related party | | | 56,666 | | | | 57 | | | | 130,725 | | | | - | | | | 130,782 | |

Net loss for the three months ended March 31, 2024 | | | - | | | | - | | | | - | | | | (1,278,486 | ) | | | (1,278,486 | ) |

Balance, March 31, 2024 | | | 2,789,655 | | | $ | 2,791 | | | $ | 122,588,510 | | | $ | (124,860,200 | ) | | $ | (2,268,899 | ) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(UNAUDITED)

| | For the Three Months Ended March 31, 2024 | | | For the Three Months Ended March 31, 2023 | |

Cash Flows for Operating Activities: | | | | | | |

Net loss | | $ | (1,278,486 | ) | | $ | (1,973,142 | ) |

Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

Non cash lease expense | | | 24,559 | | | | 21,590 | |

Employee and director equity-based compensation | | | 112,104 | | | | 242,102 | |

Amortization of deferred R&D obligations participation agreements | | | - | | | | (125,028 | ) |

Changes in assets and liabilities: | | | | | | | | |

Prepaid expenses | | | (420,979 | ) | | | (617,197 | ) |

Accounts payable | | | (287,249 | ) | | | 141,110 | |

Accounts payable – related party | | | 38,500 | | | | 38,500 | |

Lease liabilities | | | (27,309 | ) | | | (23,069 | ) |

Accrued liabilities | | | 139,742 | | | | 166,161 | |

Net cash (used in) operating activities | | | (1,699,118 | ) | | | (2,128,973 | ) |

| | | | | | | | |

Cash Flows from Investing Activities: | | | | | | | | |

Net cash from by investing activities | | | - | | | | - | |

| | | | | | | | |

Cash Flow from Financing Activities: | | | | | | | | |

Proceeds of loans payable, other | | | 517,560 | | | | 605,600 | |

Payments of loans payable, other | | | (57,507 | ) | | | (67,289 | ) |

Proceeds from private sales of common stock - other | | | 972,544 | | | | - | |

Proceeds from private sales of common stock – related party | | | 130,782 | | | | - | |

Net cash provided by financing activities | | | 1,563,379 | | | | 538,311 | |

| | | | | | | | |

Increase (decrease) in cash | | | (135,739 | ) | | | (1,590,662 | ) |

Cash at beginning of period | | | 274,380 | | | | 1,799,263 | |

Cash at end of period | | $ | 138,641 | | | $ | 208,601 | |

| | | | | | | | |

Supplemental disclosures of cash flow information: | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 2,056 | | | $ | 2,377 | |

Income Taxes | | $ | | | | $ | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Continued)

Supplemental Disclosure of Non-Cash Investing and Financing Activities:

Three Months Ended March 31, 2024:

During the quarter ended March 31, 2024, the Company had no non-cash investing or financing transactions.

Three Months Ended March 31, 2023:

During the quarter ended March 31, 2023, the Company had no non-cash investing or financing transactions.

ZIVO BIOSCIENCE, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 - BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements include the accounts of Zivo Bioscience, Inc. and its wholly owned subsidiaries (collectively, “we,” “our,” “us,” “ZIVO,” or the “Company”). All significant intercompany accounts and transactions have been eliminated in consolidation. In the opinion of the Company’s management, the financial statements contain all adjustments (consisting of only normal recurring adjustments) necessary to present fairly the information set forth therein. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The condensed consolidated financial statements have also been prepared on a basis substantially consistent with, and should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2023 and the notes thereto, included in its Annual Report on Form 10-K that was filed with the Securities and Exchange Commission on March 15, 2024.

Going Concern

The Company has incurred net losses since inception, experienced negative cash flows from operations for the quarter ended March 31, 2024, and has an accumulated deficit of $124,860,200. The Company has historically financed its operations primarily through the issuance of common stock, warrants, and debt.

The Company expects to continue to incur operating losses and net cash outflows until such time as it generates a level of revenue to support its cost structure. There is no assurance that the Company will achieve profitable operations, and, if achieved, whether it will be sustained on a continued basis. The Company intends to fund ongoing activities by utilizing its current cash on hand and by raising additional capital through equity and/or debt financings. There can be no assurance that the Company will be successful in raising that additional capital or that such capital, if available, will be on terms that are acceptable to the Company. If the Company is unable to raise sufficient additional capital, the Company may be compelled to reduce the scope of its operations and planned capital expenditures.

These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date the financial statements are issued. The Company’s condensed consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets and satisfaction of liabilities in the ordinary course of business; no adjustments have been made relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company not continue as a going concern.

NOTE 2 - DEBT

On March 5, 2024, the Company entered into a short-term unsecured loan agreement to finance a portion of the Company's directors' and officers', and employment practices liability insurance premiums. The note in the amount of $517,560 carries an 8.5% annual percentage rate and will be paid down in nine equal monthly payments of $59,562 beginning on March 10, 2024. As of March 31, 2024, a principal balance of $460,053 remains outstanding.

On February 14, 2023, the Company entered into a short-term unsecured loan agreement to finance a portion of the Company's directors' and officers', and employment practices liability insurance premiums. The note in the amount of $605,600 carries a 8.4% annual percentage rate and will be paid down in nine equal monthly payments of $69,666 beginning on March 10, 2023. As of November 9, 2023, the loan was fully paid.

NOTE 3 - DEFERRED R&D OBLIGATIONS - PARTICIPATION AGREEMENTS

For the three months ended March 31, 2024 and 2023, the Company recognized $0 and $125,030, respectively, as a contra R&D expense related to personnel and third-party expenses to develop the subject technology, respectively. For the three months ended March 31, 2024 and 2023, $0 and $31,274, respectively, of this total contra R&D expense was attributed to deferred R&D obligations funded by a related party.

NOTE 4 – STOCKHOLDERS' EQUITY

Equity Sales

During the quarter ended March 31, 2024, the Company sold common stock in 20 private unregistered transactions resulting in total proceeds of $1,103,326 and the issuance of 407,299 shares of common stock. Included in the totals are 56,666 shares of common stock sold to related parties for proceeds of $130,782. The Company had no sales of common stock in the quarter ended March 31, 2023.

Equity Compensation

For the quarter ended March 31, 2024, the Company recognized expense of $112,104 for equity compensation to members of the Board of Directors and certain employees. The total expense amount was related to equity awards from prior periods as no new equity awards were granted in the quarter. $34,648 of the total expense for the quarter was related to R&D and the remaining $77,456 was for G&A.

For the quarter ended March 31, 2023, the Company expensed $242,102 for equity compensation to members of the Board of Directors and certain employees. The total expense amount was related to equity awards from prior periods as no new equity awards were granted in the quarter. $77,383 of the total expense for the quarter was related to R&D and the remaining $164,719 was for G&A.

NOTE 5 - COMMITMENTS AND CONTINGENCIES

Employment Agreements

At March 31, 2024, the Company had compensation agreements with its President / Chief Executive Officer, and Chief Financial Officer.

Legal Contingencies

The Company may become a party to litigation in the normal course of business. In the opinion of management, there are no pending legal matters involving the Company that would have a material adverse effect upon the Company’s financial condition, results of operation or cash flows.

NOTE 6 - INCOME TAX

The Company and its subsidiaries are subject to US federal and state income taxes. Income tax expense is the total of the current year income tax due or refundable and the change in deferred tax assets and liabilities. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred tax assets are reduced by a valuation allowance when, in the opinion of Management, it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. The Company does not expect to realize the net deferred tax asset and as such has recorded a full valuation allowance.

Income tax expense for the three months ended March 31, 2024 and 2023 is based on the estimated annual effective tax rate. Based on the Company’s effective tax rate and full valuation allocation, tax expense is expected to be $0 for 2024.

NOTE 7 - SUBSEQUENT EVENTS

The Company sold and issued 42,288 shares of common stock in three private transactions on April 2, 2024, April 26, 2024, and May 7, 2024, to a related party investor for total proceeds of $330,000.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this report are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors which may cause our or our industry’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to statements regarding:

· | our ability to raise the funds we need to continue our operations; |

· | our goal to generate revenues and become profitable; |

· | regulation of our product; |

· | market acceptance of our product and derivatives thereof; |

· | the results of current and future testing of our product; |

· | the anticipated performance and benefits of our product; |

· | the ability to generate licensing fees; and |

· | our financial condition or results of operations. |

In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “could”, “would”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “projects”, “predicts”, “potential”, “likely” and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this report. Except as otherwise required by law, we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained in this report to reflect any change in our expectations or any change in events, conditions or circumstances on which any of our forward-looking statements are based. We qualify all of our forward-looking statements by these cautionary statements.

You should refer to the section entitled “Risk Factors” of the Company’s Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements will prove to be accurate. No forward-looking statement is a guarantee of future performance.

Overview:

We are a research and development company operating in both the biotech and agtech sectors, with an intellectual property portfolio comprised of proprietary algal and bacterial strains, biologically active molecules and complexes, production techniques, cultivation techniques and patented or patent-pending inventions for applications in human and animal health.

Biotech - ZIVO Product Candidates

ZIVO is developing bioactive compounds derived from its proprietary algal culture, targeting human and animal diseases, such as poultry coccidiosis, bovine mastitis, human cholesterol, and canine osteoarthritis. As part of its therapeutic strategy, ZIVO will continue to seek strategic partners for late stage development, regulatory preparation and commercialization of its products in key global markets.

Review of isolated active materials derived from our proprietary algal culture and their potential treatment applications led us to identify a product candidate for treating coccidiosis in broiler chickens as the best option for most rapidly generating significant revenue because coccidiosis is a global poultry industry issue, and because the clinical testing cycle for chickens is shorter than for other species. Most of the global animal health companies have products for the coccidiosis market; however, they are mostly antibiotic- or ionophore-based with essentially no new technology having been introduced in the last 60 years.

Agtech - ZIVO’s Algal Biomass

ZIVO’s algal biomass is currently produced in Peru. ZIVO’s algal biomass contains Vitamin A, protein, iron, important fatty acids, non-starch polysaccharides and other micronutrients that position the product as a viable functional food ingredient and nutritional enhancement for human and animal use and as a viable functional ingredient for skin care products.

Through our direction and technology, a site in Peru has been successful in consistently producing our proprietary algae. Our team has been working toward building commercial-scale algae ponds using a ZIVO proprietary design, and we are in the middle of a project to grow our algae in a penultimate scale pond. Once we are successful at this scale, we plan to invest in full commercial-scale ponds and product processing equipment.

The Company currently has contracts for the sale and production of its algal biomass. ZIVO has engaged an independent distributor, ZWorldwide, Inc., who has begun to sell the product, branded ZivolifeTM, with an initial focus on the North American green powder food market with the product being grown in Peru.

Additional Indications

Pending additional funding, ZIVO may also pursue the following indications:

Biotech:

| o | Bovine Mastitis: ZIVO is developing a treatment for bovine mastitis derived from its proprietary algal culture and the bioactive agents contained within. |

| | |

| o | Canine Joint Health: Studies have indicated the potential of a chondroprotective property when a compound fraction was introduced into ex vivo canine joint tissues. |

| | |

| o | Human Immune Modulation: Early human immune cell in vitro and in vivo studies have indicated that one of the isolated and characterized biologically active molecules in the Company’s portfolio may serve as an immune modulator with potential application in multiple disease situations. |

Agtech:

| o | Companion Animal Food Ingredient: The self-affirmed GRAS process was completed for ZIVO algal biomass in late 2018 and updated in early 2023 to validate its suitability for human consumption as an ingredient in foods and beverages. We plan to leverage this work into viable food and nutritional supplements for companion animals. |

| | |

| o | Skin Health: ZIVO is developing its algal biomass as a skin health ingredient, the Company has engaged in some limited topical skin product testing started in the third quarter of 2020, and we plan to perform clinical efficacy claim studies planned for ingestible and topical products. |

Results of Operations for the three months ended March 31, 2024 and 2023

The following table summarizes ZIVO’s operating results for the periods indicated:

| | Quarter ended March 31, | |

| | 2024 | | | 2023 | |

Total revenues | | $ | 35,720 | | | $ | - | |

Total costs of goods sold | | | 23,218 | | | | - | |

Gross margin | | | 12,502 | | | | - | |

Costs and expenses: | | | | | | | | |

Research and development | | | 312,767 | | | | 401,797 | |

General and administrative | | | 975,574 | | | | 1,568,377 | |

Total costs and expenses | | | 1,288,341 | | | | 1,970,174 | |

Loss from operations | | | (1,275,839 | ) | | | (1,970,174 | ) |

Other (expense) | | | | | | | | |

Interest expense | | | (2,648 | ) | | | (2,968 | ) |

Total other expense | | | (2,648 | ) | | | (2,968 | ) |

Net loss | | $ | (1,278,486 | ) | | $ | (1,973,142 | ) |

Revenue

During the three months ended March 31, 2024, the Company recorded commercial revenue relating to sales of the Company’s dried algal biomass product as a human food or food ingredient. The $35,720 for the quarter ending March 31, 2024 is an increase over the $0 in revenue in the same quarter in the comparable prior year. The Company started selling its algal biomass product in the second quarter of 2023; as a result, the $35,720 increase is due to no recorded revenue in the three months ended March 31, 2023.

Costs of Goods Sold

Cost of goods sold for the quarter ended March 31, 2024 was $23,218. This is $23,218 higher than the same period last year, attributable to product volume as no product was shipped in the comparable prior year period.

General and Administrative Expenses.

General and administrative expenses were approximately $975,000 for the three months ended March 31, 2024, as compared to approximately $1.6 million for the comparable prior period. The $590,000 decrease versus the same quarter last year was primarily driven by a $55,000 decrease in labor expenses, a $485,000 reduction in professional fees, and a $50,000 decrease in other overhead. Labor related decreases of $55,000 included lower non-cash equity-based compensation of $80,000 versus the prior year period, partially offset by $25,000 increase in benefits expense. Professional services were $485,000 lower in the period ending March 31, 2024 versus the prior year primarily driven by lower legal and accounting expenses versus the same period last year when the Company incurred higher professional services as part of its funding activities. Other overhead decreased by $50,000 driven by $20,000 lower D&O insurance premiums, $20,000 lower travel expenses, and $10,000 lower listing fees as the Company changed to the OTC markets.

Research and Development Expenses

For the three months ended March 31, 2024, the Company incurred roughly $300,000 in R&D expenses, as compared to roughly $400,000 for the comparable period in 2023. In the three months ended March 31, 2024, the Company’s research and development spending included no amortization of deferred R&D obligations for the participation agreements compared to approximately $125,000 in the comparable prior year period. (See Note 3: Deferred R&D Obligations - Participation Agreements)

In the quarter ended March 31, 2024, excluding this amortization, the Company had gross R&D spending of approximately $300,000; a $215,000 decrease in spending from the first quarter of 2023. Of these costs in 2024, $300,000 is for salary related cost, a decrease of approximately $30,000 from the prior year. The decrease is fully explained by lower stock-related compensation costs. Third party research and development spending and other expenses of $15,000 was about $180,000 lower from the prior year.

| | Quarter ended March 31, 2024 | | | Quarter ended March 31, 2023 | |

Labor and other internal expenses | | $ | 297,914 | | | $ | 333,359 | |

External research expenses | | | 14,853 | | | | 193,468 | |

Total gross R&D expenses | | | 312,767 | | | | 526,827 | |

Less contra-expense for amortization of deferred R&D obligation - participation agreements | | | - | | | | (125,030 | ) |

Research and development | | $ | 312,767 | | | $ | 401,797 | |

Subject to the availability of funding, the Company expects its R&D costs to grow as we work to complete the research in the development of natural bioactive compounds for use as dietary supplements and food ingredients, as well as biologics for medicinal and pharmaceutical applications in humans and animals. The Company’s scientific efforts are focused on the metabolic aspects of oxidation and inflammation, with a parallel program to validate and license products for healthy immune response.

Liquidity and Capital

As of March 31, 2024, our principal source of liquidity consisted of cash of $138,641. The Company expects to continue to incur significant expenses and increasing operating and net losses for the foreseeable future until and unless we generate an adequate level of revenue from potential commercial sales to cover expenses. The sources of cash to date have been limited proceeds from the issuances of notes with warrants, common stock with and without warrants and unsecured loans. In the three months ended March 31, 2024, the Company raised approximately $1.1 million from direct sale of 407,299 shares of common stock in private transactions to qualified individuals. The shares were priced at the prior day’s closing price of the common stock on the OTCQB market.

Participation Agreements

From April 13, 2020, through May 14, 2021, the Company entered into twenty-one License Co-Development Participation Agreements (the “Participation Agreements”) with certain accredited investors (“Participants”) for an aggregate of $2,985,000. The Participation Agreements provide for the issuance of warrants to such Participants and allows the Participants to participate in the fees (the “Fees”) from licensing or selling bioactive ingredients or molecules derived from ZIVO’s algae cultures. Specifically, ZIVO has agreed to provide to the Participants a 44.775% “Revenue Share” of all license fees generated by ZIVO from any licensee.

The Participation Agreements allow the Company the option to buy back the right, title and interest in the Revenue Share for an amount equal to the amount funded plus a forty percent (40%) premium, if the option is exercised less than 18 months following execution, and for either forty (40%) or fifty percent (50%) if the option is exercised more than 18 months following execution. Pursuant to the terms of twelve of the Participation Agreements, the Company may not exercise its option until it has paid the Participants a revenue share equal to a minimum of thirty percent (30%) of the amount such Participant’s total payment amount. Pursuant to the terms of the one of the Participation Agreements, the Company may not exercise its option until it has paid the Participant a revenue share equal to a minimum of one hundred forty percent (140%) of the amount such Participant’s total payment amount. Five of the Participation Agreements have no minimum threshold payment. Once this minimum threshold is met, the Company may exercise its option by delivering written notice to a Participant of its intent to exercise the option, along with repayment terms of the amount funded, which may be paid, in the Company’s sole discretion, in one lump sum or in four (4) equal quarterly payments. If the Company does not make such quarterly payments timely for any quarter, then the Company shall pay the prorate Revenue Share amount, retroactive on the entire remaining balance owed, that would have been earned during such quarter until the default payments have been made and the payment schedule is no longer in default.

Funding Requirements

Management has noted the existence of substantial doubt about our ability to continue as a going concern. Our existing cash will not be sufficient to fund our operating expenses through at least twelve months from the date of this filing. To continue to fund operations, we will need to secure additional funding through public or private equity or debt financings, through collaborations or partnerships with other companies or other sources. We may not be able to raise additional capital on terms acceptable to us, or at all. Any failure to raise capital when needed could compromise our ability to execute on our business plan. If we are unable to raise additional funds, or if our anticipated operating results are not achieved, we believe planned expenditures may need to be reduced in order to extend the time period that existing resources can fund our operations. If we are unable to obtain the necessary capital, it may have a material adverse effect on our operations and the development of our technology, or we may have to cease operations altogether.

Our material cash requirements relate to the funding of our ongoing product development, accounts payable, and accrued expenses including executive and employee bonuses. The development of our product candidates is subject to numerous uncertainties, and we could use our cash resources sooner than we expect. Additionally, the process of development is costly, and the timing of progress in pre-clinical tests and clinical trials is uncertain. Our ability to successfully transition to profitability will be dependent upon achieving further regulatory approvals and achieving a level of product sales adequate to support our cost structure. We cannot assure you that we will ever be profitable or generate positive cash flow from operating activities.

Statement of Cash Flows

Cash Flows from Operating Activities. During the three months ended March 31, 2024, our operating activities used $1.7 million in cash, a decrease of cash used of roughly $400,000 from the comparable prior period when the Company used approximately $2.1 million for operating activities. For the quarter ended March 31, 2024, the Company experienced a $700,000 lower net loss and spent $200,000 less in prepaid expenses primarily for directors’ and officers’ insurance, these favorable cash uses versus last year period were partially offset by $400,000 of cash used to lower the Company’s accounts payable obligations.

Cash Flows from Investing Activities. During the three months ended March 31, 2024 and 2023, there were no investing activities.

Cash Flows from Financing Activities. During the three months ended March 31, 2024, our financing activities generated approximately $1.6 million, an increase of approximately $1.1 million from the comparable prior period when the Company generated approximately $540,000 from financing activities. The Company, in the quarter ended March 31, 2024, raised $1.1 million from private sales of common stock, this was partially lessened by $88,000 as a result of net proceeds of $517,560 from the establishment of a short-term loan which was lower than the $605,600 loan in the first quarter of 2023. The following table shows a summary of our cash flows for the periods indicated:

| | Three months ended March 31, | |

| | 2024 | | | 2023 | |

Net cash provided by (used in): | | | | | | |

Operating activities | | $ | (1,699,118 | ) | | $ | (2,128,973 | ) |

Investing activities | | | - | | | | - | |

Financing activities | | | 1,563,379 | | | | 538,311 | |

Net increase (decrease) in cash and cash equivalents | | $ | (135,739 | ) | | $ | (1,590,662 | ) |

We estimate that we would require approximately $5 million in cash over the next 12 months in order to fund our basic operations, excluding our R&D initiatives. Based on this cash requirement, we have a near term need for additional funding to continue to develop our products and intellectual property. Historically, we have had substantial difficulty raising funds from external sources. If we are unable to raise the required capital, we will be forced to curtail our business operations, including our R&D activities.

Critical Accounting Policies and Significant Judgments and Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP. The preparation of these financial statements requires us to make estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities as of the dates of the balance sheets and the reported amounts of revenue and expenses during the reporting periods. In accordance with GAAP, we base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances at the time such estimates are made. Actual results may differ materially from our estimates and judgments under different assumptions or conditions. We periodically review our estimates in light of changes in circumstances, facts and experience. The effects of material revisions in estimates are reflected in our financial statements prospectively from the date of the change in estimate.

For a discussion of our critical accounting estimates, please read Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 15, 2024. There have been no material changes to the critical accounting estimates previously disclosed in our Annual Report on Form 10-K.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable for smaller reporting companies.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) under the Exchange Act) are designed to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission and to ensure that information required to be disclosed is accumulated and communicated to management, including our principal executive and financial officers, to allow timely decisions regarding disclosure. The Chief Executive Officer, as our principal executive officer, and the Chief Financial Officer, as our principal financial and accounting officer, have reviewed the effectiveness of our disclosure controls and procedures and, based on their evaluation, have concluded that the disclosure controls and procedures were not effective as the material weaknesses identified as of December 31, 2023 in our Annual Report on Form 10-K and described below, continue to exist as of March 31, 2024.

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act. Our internal control over financial reporting is a process designed under the supervision of our Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not detect or prevent misstatements. Also, projections of any evaluation of the effectiveness to future periods are subject to risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management utilized the criteria established in the Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to conduct an assessment of the effectiveness of our internal control over financial reporting as of December 31, 2023. As previously reported, we identified material weaknesses that continued to exist at December 31, 2023. In addition, in connection with the audit of our consolidated financial statements for the year ended December 31, 2023, we identified additional material weaknesses in internal control over financial reporting, as described below.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Material Weaknesses in Internal Control Over Financial Reporting

Management has determined that the Company had the following material weaknesses in its internal control over financial reporting:

Control Environment, Risk Assessment, and Monitoring

As previously discussed in our Annual Report for the year ended December 31, 2023, management had concluded that our internal control over financial reporting was not effective as of December 31, 2023 , due to: (i) lack of structure and responsibility, insufficient number of qualified resources, and inadequate oversight and accountability over the performance of controls, (ii) ineffective identification and assessment or risks impacting internal control over financial reporting, and (iii) ineffective evaluation and determination as to whether the components of internal control were present and functioning.

Control Activities and Information and Communication

These material weaknesses contributed to the following additional material weaknesses within certain business processes and the information technology environment:

· | Management did not design and maintain appropriate information technology general controls in the areas of user access, vendor management controls, and segregation of duties, including controls over the recording and review of journal entries, related to certain information technology systems that support the Company’s financial reporting process. |

| |

· | Management did not design, implement, and retain appropriate documentation of formal accounting policies, procedures, and controls across substantially all of the company's business processes over; (i) the financial reporting process, including management review controls over key disclosures and financial statement support schedules, (ii) the monthly financial close process, including journal entries and account reconciliations and (iii) the completeness and accuracy of information used by control owners in the operation of certain controls, to achieve timely, complete, accurate financial accounting, reporting. |

| |

· | Management did not design and implement controls over the accounting, classification, and application of United States Generally Accounting Principles (“US GAAP”) relating to income taxes, stock-based compensation, and deferred research and development obligations - participation agreements accounting. Specifically: |

| · | Management did not identify controls over the review of the tax provision, including the valuation analysis related to deferred tax assets, considerations for uncertain tax positions, the preparation of the income tax footnote and required disclosures and selecting and applying accounting policies; |

| | |

| · | Management did not identify controls over the accounting and classification of deferred research and development obligations - participation agreements; and |

| | |

| · | Management did not identify controls over the valuation of stock-based compensation for option awards to employees and members of the board of directors. |

Based on the assessment and identification of the material weaknesses described above, management has concluded that, as of March 31, 2024, our internal control over financial reporting was not effective and could lead to a material misstatement of account balances or disclosures. Accordingly, management has concluded that these control deficiencies constitute material weaknesses.

However, after giving full consideration to these material weaknesses, and the additional analyses and other procedures that we performed to ensure that our consolidated financial statements included in this Quarterly Report on Form 10-Q were prepared in accordance with U.S. GAAP, our management has concluded that our consolidated financial statements present fairly, in all material respects, our financial position, results of operations and cash flows for the periods disclosed in conformity with U.S. GAAP.

Remediation Plans

Management has been implementing and continues to implement measures designed to ensure that control deficiencies contributing to the material weaknesses are remediated, such that these controls are designed, implemented, and operating effectively. The remediation actions include:

· | Developing a training program and educating control owners concerning the principles of the Internal Control - Integrated Framework (2013) issued by COSO; |

| |

· | Implementing a risk assessment process by which management identifies risks of misstatement related to all account balances; |

| |

· | Developing internal controls documentation, including comprehensive accounting policies and procedures over financial processes and related disclosures; |

· | Enhancing policies and procedures to retain adequate documentary evidence for certain management review controls over certain business processes including precision of review and evidence of review procedures performed to demonstrate effective operation of such controls; |

| |

· | Engaging outside resources for complex accounting matters and drafting and retaining position papers for all complex, non-recurring transactions; |

| |

· | Developing monitoring activities and protocols that will allow us to timely assess the design and the operating effectiveness of controls over financial reporting and make necessary changes to the design of controls, if any; |

| |

· | Segregating key functions within our financial and information technology processes supporting our internal controls over financial reporting; |

| |

· | Reassessing and formalizing the design of certain accounting and information technology policies relating to security and change management controls, including user access reviews, including assessing the need for implementing a more robust information technology system; and |

| |

· | Continuing to enhance and formalize our accounting, business operations, and information technology policies, procedures, and controls to achieve complete, accurate, and timely financial accounting, reporting and disclosures. |

Changes in Internal Control Over Financial Reporting

Except for the remediation actions discussed above, there was no other change in our internal control over financial reporting identified in connection with the evaluation required by Rule 13a-15(d) and 15d-15(d) of the Exchange Act that occurred during the quarter ending March 31, 2024, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

From time to time, we may be subject to litigation and claims arising in the ordinary course of business.

In our opinion, we are not currently a party to any material legal proceedings, and we are not aware of any pending or threatened legal proceedings that are material to our financial condition, either individually or in the aggregate.

Item 1A. Risk Factors

There have been no material changes in our risk factors previously disclosed in Part I, Item 1A “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. You should carefully consider the risks and uncertainties described therein.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

The following is a summary of all securities that we have issued since January 1, 2024 without registration under the Securities Act of 1933, as amended (the “Securities Act”):

Common Stock:

Name | Form | Date | Amount Received | Common Stock Shares |

Mark Strome Living Trust | Purchase of Common Stock | 2-Jan-24 | $125,000 | 100,000 |

David Mendelson | Purchase of Common Stock | 3-Jan-24 | $60,000 | 50,000 |

Javid Malik | Purchase of Common Stock | 8-Jan-24 | $25,000 | 8,865 |

Ozzy Naser | Purchase of Common Stock | 9-Jan-24 | $45,000 | 15,570 |

Chitayat-Mahboubian Family Trust | Purchase of Common Stock | 9-Jan-24 | $72,250 | 25,000 |

Mark Strome Living Trust | Purchase of Common Stock | 9-Jan-24 | $216,750 | 75,000 |

Geroge Family Fund | Purchase of Common Stock | 10-Jan-24 | $47,544 | 14,584 |

Mansour GST Trust | Purchase of Common Stock | 10-Jan-24 | $25,000 | 7,668 |

Mendelson Family Trust | Purchase of Common Stock | 16-Jan-24 | $75,000 | 18,656 |

Mendelson Family Trust | Purchase of Common Stock | 22-Jan-24 | $30,000 | 4,512 |

David Mendelson | Purchase of Common Stock | 22-Jan-24 | $30,000 | 4,512 |

Mullally Trust | Purchase of Common Stock | 22-Jan-24 | $20,000 | 3,008 |

Terry Farida | Purchase of Common Stock | 24-Jan-24 | $51,000 | 5,000 |

Johnny Karmo | Purchase of Common Stock | 24-Jan-24 | $25,000 | 2,450 |

David Mendelson | Purchase of Common Stock | 31-Jan-24 | $30,000 | 3,792 |

David Mendelson | Purchase of Common Stock | 27-Mar-24 | $60,000 | 7,500 |

Mendelson Family Trust | Purchase of Common Stock | 28-Mar-24 | $35,000 | 4,516 |

Common Stock – Related Parties:

Name | Form | Date | Amount Received | Common Stock Shares |

Alison Cornell | Purchase of Common Stock | 3-Jan-24 | $50,000 | 41,666 |

HEP Investments, LLC | Purchase of Common Stock | 5-Jan-24 | $25,000 | 8,802 |

HEP Investments, LLC | Purchase of Common Stock | 6-Mar-24 | $55,782 | 6,198 |

HEP Investments, LLC | Purchase of Common Stock | 2-Apr-24 | $100,000 | 13,333 |

HEP Investments, LLC | Purchase of Common Stock | 26-Apr-24 | $100,000 | 12,500 |

HEP Investments, LLC | Purchase of Common Stock | 7-May-24 | $130,000 | 16,455 |

None of the foregoing transactions involved any underwriters, underwriting discounts or commissions, or any public offering. We believe the offers, sales and issuances of the above securities were exempt from registration under the Securities Act by virtue of Section 4(a)(2) of the Securities Act because the issuance of securities to the recipients did not involve a public offering, or in reliance on Rule 701 because the transactions were pursuant to compensatory benefit plans or contracts relating to compensation as provided under such rule. The recipients of the securities in each of these transactions represented their intentions to acquire the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate legends were placed upon the stock certificates issued in these transactions. All recipients had adequate access, through their relationships with us, to information about Zivo. The sales of these securities were made without any general solicitation or advertising.

Item 3. Defaults upon Senior Securities

Not applicable.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

Item 6. Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| ZIVO BIOSCIENCE, INC. | |

Date: May 13, 2024 | | | |

| | | |

| By: | /s/ John B. Payne | |

| | John B. Payne | |

| | Chief Executive Officer | |

| | | |

| By: | /s/ Keith R. Marchiando | |

| | Keith R. Marchiando | |

| | Chief Financial Officer | |

nullnullnullnull

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=zivo_CommonStockParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=zivo_WarrantsPurchaseOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.1.1.u2

CONDENSED CONSOLIDATED BALANCE SHEET - USD ($)

|

Mar. 31, 2024 |

Dec. 31, 2023 |

| CURRENT ASSETS: |

|

|

| Cash |

$ 138,641

|

$ 274,380

|

| Accounts receivable |

3,735

|

3,735

|

| Prepaid expenses |

568,241

|

147,262

|

| Total current assets |

710,617

|

425,377

|

| OTHER ASSETS: |

|

|

| Operating lease - right of use asset |

73,721

|

98,280

|

| Security deposit |

32,058

|

32,058

|

| Total other assets |

105,779

|

130,338

|

| TOTAL ASSETS |

816,396

|

555,715

|

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT): |

|

|

| Accounts payable |

705,841

|

993,090

|

| Accounts payable - related party |

211,170

|

172,670

|

| Current portion of long-term operating lease |

79,033

|

106,342

|

| Convertible debentures payable |

240,000

|

240,000

|

| Loan Payable |

460,053

|

0

|

| Accrued interest |

101,278

|

100,686

|

| Accrued liabilities - employee bonus |

1,287,920

|

1,148,770

|

| Total current liabilities |

3,085,295

|

2,761,558

|

| LONG TERM LIABILITIES: |

0

|

0

|

| TOTAL LIABILITIES |

3,085,295

|

2,761,558

|

| STOCKHOLDERS' EQUITY (DEFICIT): |

|

|

| Common stock, $0.001 par value, 25,000,000 and 25,000,000 shares authorized as of March 31, 2024 and December 31, 2023; 2,789,655 and 2,382,356 issued and outstanding at March 31, 2024, and December 31, 2023, respectively |

2,791

|

2,383

|

| Additional paid-in capital |

122,588,510

|

121,373,488

|

| Accumulated deficit |

(124,860,200)

|

(123,581,714)

|

| Total stockholders' equity (deficit) |

(2,268,899)

|

(2,205,843)

|

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

$ 816,396

|

$ 555,715

|

| X |

- DefinitionCarrying value as of the balance sheet date of liabilities incurred (and for which invoices have typically been received) and payable to vendors for goods and services received that are used in an entity's business. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19(a))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccountsPayableCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount, after allowance for credit loss, of right to consideration from customer for product sold and service rendered in normal course of business. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 310

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Subparagraph (d)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480833/946-310-45-1

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(5))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(5)(b))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 954

-SubTopic 310

-Name Accounting Standards Codification

-Section 45

-Paragraph 1

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481058/954-310-45-1

| Name: |

us-gaap_AccountsReceivableNet |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionCarrying value as of the balance sheet date of obligations incurred and payable, pertaining to costs that are statutory in nature, are incurred on contractual obligations, or accumulate over time and for which invoices have not yet been received or will not be rendered. Examples include taxes, interest, rent and utilities. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.20)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccruedLiabilitiesCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of excess of issue price over par or stated value of stock and from other transaction involving stock or stockholder. Includes, but is not limited to, additional paid-in capital (APIC) for common and preferred stock. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are recognized. Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1