UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-38146

ZK

INTERNATIONAL GROUP CO., LTD.

(Translation

of registrant’s name into English)

c/o Zhejiang Zhengkang Industrial Co., Ltd.

No. 678 Dingxiang Road, Binhai Industrial

Park

Economic & Technology Development Zone

Wenzhou, Zhejiang Province

People’s Republic of China 325025

Tel: +86-577-86852999

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

On February 15, 2024, ZK International

Group Co., Ltd. (the “Company”) received a written notice from the Listing Qualifications Department of the Nasdaq Stock

Market, LLC (“Nasdaq”) notifying the Company that, based on the closing bid price of the Company’s ordinary shares,

no par value (the “Ordinary Shares”), for the last 30 consecutive trading days, the Company no longer complies with the minimum

bid price requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5450(a)(1) requires listed securities

to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing Rule 5810(c)(3)(A) provides

that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues for a period of 30 consecutive trading

days.

Pursuant to the Nasdaq Listing Rules, the Company

has been provided an initial compliance period of 180 calendar days to regain compliance with the Minimum Bid Price Requirement. To regain

compliance, the closing bid price of the Ordinary Shares must be at least $1.00 per share for a minimum of 10 consecutive trading days

prior to August 13, 2024, and the Company must otherwise satisfy The Nasdaq Capital Market’s requirements for listing.

If the Company does not regain compliance by August

13, 2024, the Company may be eligible for an additional 180 calendar day compliance period. To qualify, the Company would be required,

among other things, to meet the continued listing requirement for market value of publicly held shares, which the Company does not currently

meet, as well as all other standards for initial listing on the Nasdaq Capital Market, with the exception of the Minimum Bid Price Requirement,

and would need to provide written notice of its intention to cure the bid price deficiency during the second compliance period.

If the Company does not regain compliance within the allotted compliance period(s), including any extensions that may be granted by Nasdaq,

Nasdaq will provide notice that the Company’s Ordinary Shares will be subject to delisting. The Company would then be entitled to

appeal Nasdaq’s determination to a Nasdaq Listing Qualifications Panel and request a hearing.

The Company intends to monitor the closing bid

price of the Ordinary Shares and consider its available options to resolve the noncompliance with the Minimum Bid Price Requirement. There

can be no assurance that the Company will be able to regain compliance with the Nasdaq Capital Market’s continued listing requirements

or that Nasdaq will grant the Company a further extension of time to regain compliance, if applicable.

On February 20, 2024, the Company received a written

notice from Nasdaq notifying the Company that, since the Company has not yet filed its Form 20-F for the year ended September 30, 2023

(the “Filing”), it no longer complies with Nasdaq Listing Rules for continued listing under Listing Rule 5250(c)(1).

Under Nasdaq Listing Rules, the Company has 60

calendar days to submit a plan to regain compliance and if Nasdaq accepts the Company’s plan, Nasdaq can grant the Company an exception

of up to 180 calendar days from the Filing’s due date, or until August 13, 2024, to regain compliance.

The Company shall submit its plan to Nasdaq no

later than April 22, 2024. If Nasdaq does not accept the Company’s plan, the Company will have the opportunity to appeal that decision

to a Nasdaq Listing Qualifications Panel and request a hearing.

The notices have no immediate effect on the listing

of the Ordinary Shares at this time and the Ordinary Shares will continue to trade on the Nasdaq Capital Market under the symbol “ZKIN.”.

On February 22, 2024,

the Company issued a press release entitled “[ZK International Receives Nasdaq Notices Regarding Minimum Bid Requirements

and Not Timely Filing of Annual Report on Form 20-F]”. A copy of the press release is furnished herewith as Exhibit 99.1.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 22, 2024 |

ZK INTERNATIONAL GROUP CO., LTD. |

| |

|

|

| |

By: |

/s/ Jiancong Huang |

| |

Name: |

Jiancong Huang |

| |

Title: |

Chief Executive Officer and Chairman of the Board |

Exhibit 99.1

ZK International Receives Nasdaq Notices Regarding

Listing Deficiency

WENZHOU, China, February 22,

2024 /PRNewswire/ -- ZK International Group Co., Ltd. (Nasdaq: ZKIN) ("ZKIN," "ZK International"

or the "Company"), a leading provider of advanced steel products, announced that it received the Nasdaq notices

regarding minimum bid requirements and not timely filing of annual report on Form 20-F

On February 15, 2024, the Company

received a written notice from the Listing Qualifications Department of the Nasdaq Stock Market, LLC (“Nasdaq”) notifying

the Company that, based on the closing bid price of the Company’s ordinary shares, no par value (the “Ordinary Shares”),

for the last 30 consecutive trading days, the Company no longer complies with the minimum bid price requirement for continued listing

on the Nasdaq Capital Market. Nasdaq Listing Rule 5450(a)(1) requires listed securities to maintain a minimum bid price of

$1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure

to meet the Minimum Bid Price Requirement exists if the deficiency continues for a period of 30 consecutive trading days.

Pursuant to the Nasdaq Listing Rules, the Company

has been provided an initial compliance period of 180 calendar days to regain compliance with the Minimum Bid Price Requirement. To regain

compliance, the closing bid price of the Ordinary Shares must be at least $1.00 per share for a minimum of 10 consecutive trading days

prior to August 13, 2024, and the Company must otherwise satisfy The Nasdaq Capital Market’s requirements for listing.

If the Company does not regain compliance by

August 13, 2024, the Company may be eligible for an additional 180 calendar day compliance period. To qualify, the Company would

be required, among other things, to meet the continued listing requirement for market value of publicly held shares, which the Company

does not currently meet, as well as all other standards for initial listing on the Nasdaq Capital Market, with the exception of the Minimum

Bid Price Requirement, and would need to provide written notice of its intention to cure the bid price deficiency during the

second compliance period. If the Company does not regain compliance within the allotted compliance period(s), including any extensions

that may be granted by Nasdaq, Nasdaq will provide notice that the Company’s Ordinary Shares will be subject to delisting. The

Company would then be entitled to appeal Nasdaq’s determination to a Nasdaq Listing Qualifications Panel and request a hearing.

The Company intends to monitor the closing bid

price of the Ordinary Shares and consider its available options to resolve the noncompliance with the Minimum Bid Price Requirement.

There can be no assurance that the Company will be able to regain compliance with the Nasdaq Capital Market’s continued listing

requirements or that Nasdaq will grant the Company a further extension of time to regain compliance, if applicable.

On February 20, 2024, the Company received

a written notice from Nasdaq notifying the Company that, since the Company has not yet filed its Form 20-F for the year ended September 30,

2023 (the “Filing”), it no longer complies with Nasdaq Listing Rules for continued listing under Listing Rule 5250(c)(1).

Under Nasdaq Listing Rules, the Company has 60

calendar days to submit a plan to regain compliance and if Nasdaq accepts the Company’s plan, Nasdaq can grant the Company an exception

of up to 180 calendar days from the Filing’s due date, or until August 13, 2024, to regain compliance.

The Company shall submit its plan to Nasdaq no

later than April 22, 2024. If Nasdaq does not accept the Company’s plan, the Company will have the opportunity to appeal that

decision to a Nasdaq Listing Qualifications Panel and request a hearing.

The notices have no immediate effect on the listing

of the Ordinary Shares at this time and the Ordinary Shares will continue to trade on the Nasdaq Capital Market under the symbol “ZKIN.”.

For more information please visit www.ZKInternationalGroup.com.

Additionally, please follow the Company on Twitter, Facebook, YouTube, and Weibo.

For further information on the Company's SEC filings please visit www.sec.gov.

About ZK International Group Co., Ltd.:

ZK International Group Co., Ltd. is a China-based

engineering company building and investing in innovative technologies for the modern world. With a focus on designing and implementing

next-generation solutions through industrial, environmental and software engineering, ZKIN owns 28 patents, 21 trademarks, 2 Technical

Achievement Awards, and 10 National and Industry Standard Awards.

ZKIN’s core business is to engineer and

manufacture patented high-performance stainless steel and carbon steel pipe products that effectively deliver high quality, highly-sustainable

and environmentally sound drinkable water to the Chinese, Asia and European markets. ZK International is Quality Management System

Certified (ISO9001), Environmental Management System Certified (ISO1401), and a National Industrial Stainless Steel Production Licensee.

It has supplied stainless steel pipelines for over 2,000 projects, which include the Beijing National Airport, the "Water Cube"

and "Bird's Nest", which were venues for the 2008 Beijing Olympics. ZK International is preparing to capitalize on the $850

Billion commitment made by the Chinese Government to improve the quality of water, which has been stated to be 70% unfit for human contact.

Safe Harbor Statement

This news release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. Without limiting the generality of

the foregoing, words such as "may," "will," "expect," "believe," "anticipate," "intend,"

"could," "estimate" or "continue" or the negative or other variations thereof or comparable terminology

are intended to identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations

of future events or circumstances are forward-looking statements. These forward-looking statements are not guarantees of future performance

and are subject to certain risks, uncertainties and assumptions that are difficult to predict and many of which are beyond the control

of ZK International. Actual results may differ from those projected in the forward-looking statements due to risks and uncertainties,

as well as other risk factors that are included in the Company’s filings with the U.S. Securities and Exchange Commission. Although

ZK International believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could

prove inaccurate and, therefore, there can be no assurance that the results contemplated in forward-looking statements will be realized.

In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information

should not be regarded as a representation by ZK International or any other person that their objectives or plans will be achieved. ZK

International does not undertake any obligation to revise the forward-looking statements contained herein to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated events.

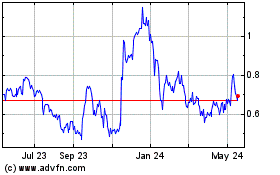

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

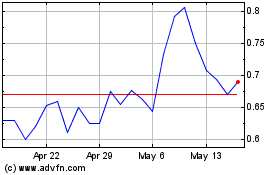

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Jan 2024 to Jan 2025