UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to § 240.14a-12 |

ZYVERSA

THERAPEUTICS, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box)

| ☒ |

No

fee required. |

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY

PROXY STATEMENT, SUBJECT TO COMPLETION, DATED DECEMBER 20, 2024

ZYVERSA

THERAPEUTICS, INC.

2200

N. Commerce Parkway, Suite 208

Weston,

Florida 33326

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on Tuesday, March 4, 2025

Dear

Stockholder:

You

are cordially invited to attend the 2025 Special Meeting of Stockholders (the “Special Meeting”) of ZyVersa Therapeutics,

Inc., a Delaware corporation. The meeting will be held in a virtual-only format via live webcast on Tuesday, March 4, 2025, at 9:00 a.m.

Eastern Time. To access the webcast, please visit http://www.virtualshareholdermeeting.com/ZVSA2025SM and enter the 16-digit control

number included in your Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied

your proxy materials. The purposes of the Special Meeting are as follows:

| |

1. |

To

approve the issuance of up to an aggregate of 1,637,000 shares of the Company’s common stock issuable upon the exercise of

certain warrants to purchase the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d). |

| |

|

|

| |

2. |

To

conduct any other business properly brought before the meeting. |

Please

monitor the Investor Relations section of our website at http://investors.zyversa.com for updated information regarding the Special Meeting.

If you are planning to attend our virtual Special Meeting, please check the website one week prior to the Special Meeting date. As always,

we encourage you to submit a proxy to vote your shares prior to the Special Meeting.

These

items of business are more fully described in the Proxy Statement accompanying this notice.

The

record date for the Special Meeting is January 7, 2025. Only stockholders of record at the close of business on that date or their proxies

may vote at the meeting or any adjournment thereof.

By

Order of the Board of Directors

Stephen

C. Glover

Chief

Executive Officer, President, and Chairman of the Board of Directors

Weston,

Florida

__________,

2025

We

are primarily providing access to our proxy materials over the internet pursuant to the U.S. Securities and Exchange Commission’s

notice and access rules. On or about January 17, 2025, we expect to mail to our stockholders a Notice of Internet Availability of Proxy

Materials that will indicate how to access our Proxy Statement on the internet and will include instructions on how you can receive a

paper copy of the Special Meeting materials, including the notice of Special Meeting, Proxy Statement, and proxy card.

Whether

or not you expect to attend the meeting electronically, please submit a proxy for your shares promptly using the directions on your Notice,

or, if you elected to receive printed proxy materials by mail, your proxy card, by one of the following methods: (1) over the internet

at http://www.proxyvote.com, (2) by telephone by calling the toll-free number 1-800-690-6903, or (3) if you elected to receive printed

proxy materials by mail, by marking, dating, and signing your proxy card and returning it in the accompanying postage-paid envelope.

Even if you have submitted a proxy, you may still vote electronically if you attend the virtual meeting. Please note, however, that if

your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you must obtain a proxy issued

in your name from that record holder.

TABLE

OF CONTENTS

PRELIMINARY

PROXY STATEMENT, SUBJECT TO COMPLETION, DATED DECEMBER 20, 2024

ZYVERSA

THERAPEUTICS, INC.

2200

N. Commerce Parkway, Suite 208

Weston,

Florida 33326

PROXY

STATEMENT

FOR

THE 2025 SPECIAL MEETING OF STOCKHOLDERS

March

4, 2025

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Who

is ZyVersa Therapeutics, Inc.?

ZyVersa

Therapeutics, Inc. (the “Company,” “ZyVersa,” “we,” “us,” or “our”) is a

clinical stage biopharmaceutical company leveraging proprietary technologies to develop drugs for patients with chronic renal or inflammatory

diseases with high unmet medical needs. Our mission is to develop drugs that optimize health outcomes and improve patients’ quality

of life.

We

have two proprietary globally licensed drug development platforms, each of which was discovered by research scientists at the University

of Miami, Miller School of Medicine (the “University of Miami” or “University”). These development platforms

are:

| |

● |

Cholesterol

Efflux MediatorTM VAR 200 (2-hydroxypropyl-beta-cyclodextrin or “2HPβCD”) is an injectable drug in clinical

development for treatment of renal diseases. VAR 200 was licensed from L&F Research LLC on December 15, 2015. L&F Research

was founded by the University of Miami research scientists who discovered the use of VAR 200 for renal diseases. |

| |

|

|

| |

● |

Inflammasome

ASC Inhibitor IC 100 is a humanized monoclonal antibody in preclinical development for treatment of inflammatory conditions. IC 100

was licensed from InflamaCore, LLC on April 18, 2019. InflamaCore, LLC was founded by the University of Miami research scientists

who invented IC 100. |

We

believe that each of our product candidates has the potential to treat numerous indications in their respective therapeutic areas. Our

strategy is to focus on indication expansion to maximize commercial potential.

Our

renal pipeline is initially focused on rare, chronic glomerular diseases. Our lead indication for VAR 200 is focal segmental glomerulosclerosis

(“FSGS”). On January 21, 2020, we filed an Investigational New Drug application (“IND”) for VAR 200, and the

United States Food and Drug Administration (“FDA”) has allowed our development plans to proceed to a Phase 2a trial in patients

with FSGS based on the risk/benefit profile of the active ingredient (2HPβCD). Prior to initiating a Phase 2a trial in patients

with FSGS, we are planning to initiate a small open-label Phase 2a trial in patients with diabetic kidney disease in which we expect

to obtain patient proof-of-concept data more quickly than in an FSGS trial. This will enable assessment of drug effects as patients proceed

through treatment and will provide insights for developing a lager Phase 2a/b protocol in patients with FSGS. An IND amendment for evaluation

of VAR 200 in a Phase 2a trial in patients with diabetic kidney disease was filed with the FDA on February 16, 2024. VAR 200 has pharmacologic

proof-of-concept data in animal models representative of FSGS, Alport Syndrome, and diabetic kidney disease, providing opportunity for

indication expansion.

Our

Inflammasome ASC Inhibitor IC 100 is nearing completion of preclinical development. Our focus is on advancing IC 100 toward an IND submission

followed by initiation of a Phase 1 trial in patients with obesity and certain metabolic complications, our lead indication. IC 100 has

preclinical data in animal models representing six different indications, each demonstrating that IC 100 attenuates pathogenic inflammasome

signaling pathways leading to reduced inflammation and improved histopathological and/or functional outcomes. Those indications are stroke-related

cardiovascular injury, retinopathy of prematurity (“ROP”), multiple sclerosis (“MS”), acute respiratory distress

syndrome (“ARDS”), spinal cord injury, and traumatic brain injury (TBI). Likewise, preclinical studies are underway in Alzheimer’s

and Parkinson’s diseases, and preparations are underway to initiate IND-enabling preclinical studies in obesity with metabolic

complications.

Business

Combination

On

December 12, 2022 (the “Closing Date”), we consummated the previously announced Business Combination (as defined below) pursuant

to the terms of that certain Business Combination Agreement (the “Business Combination Agreement”), by and among ZyVersa

Therapeutics, Inc., a Florida corporation (“Old ZyVersa”), the representative of Old ZyVersa’s shareholders named therein

(the “Securityholder Representative”), Larkspur Health Acquisition Corp., a Delaware corporation (“Larkspur”),

and Larkspur Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Larkspur (“Merger Sub”). Pursuant to

the terms of the Business Combination Agreement (and upon all other conditions of the Business Combination Agreement being satisfied

or waived), on the Closing Date of the Business Combination and transactions contemplated thereby (the “Business Combination”),

(i) Larkspur changed its name to “ZyVersa Therapeutics, Inc.”, a Delaware corporation (the “Company”) and (ii)

Merger Sub merged with and into Old ZyVersa (the “Merger”), with Old ZyVersa as the surviving company in the Merger and,

after giving effect to such Merger, Old ZyVersa became a wholly-owned subsidiary of the Company.

Prior

to the completion of the Business Combination, the Company was a shell company. Following the Business Combination, the business of Old

ZyVersa is the business of the Company. The Company was incorporated in the State of Delaware on March 17, 2021 and its subsidiary, Old

ZyVersa, was incorporated on March 11, 2014. Larkspur Merger Sub, Inc. was incorporated in the State of Delaware on July 13, 2022.

Our

principal executive offices are located at 2200 North Commerce Parkway, Suite 208, Weston, Florida 33326, and our telephone number is

(754) 231-1688. Our website address is http://www.zyversa.com. The information contained on or otherwise accessible through our website

is not part of this proxy statement.

Unless

expressly indicated or the context otherwise requires, references in this proxy statement to the “Company,” “ZyVersa,”

“we,” “us”, and “our” refer to ZyVersa (and the business of Old ZyVersa which became the business

of ZyVersa after giving effect to the Business Combination).

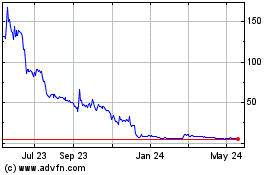

Reverse

Stock Splits

The

Company effected a 1-for-35 reverse split (the “2023 Reverse Stock Split”) of the Company’s issued and outstanding

common stock on December 4, 2023. As a result of the 2023 Reverse Stock Split, every 35 shares of the Company’s common stock, either

issued or outstanding, immediately prior to the filing and effectiveness of the 2023 Reverse Stock Split, was automatically combined

and converted (without any further act) into one share of fully paid and nonassessable share of common stock. No fractional shares were

issued in connection with the 2023 Reverse Stock Split. In addition, the Company effected a 1-for-10 reverse split (the “2024 Reverse

Stock Split”) of the Company’s issued and outstanding common stock on April 25, 2024. As a result of the 2024 Reverse Stock

Split, every 10 shares of the Company’s common stock, either issued or outstanding, immediately prior to the filing and effectiveness

of the 2024 Reverse Stock Split, was automatically combined and converted (without any further act) into one share of fully paid and

nonassessable share of common stock. No fractional shares were issued in connection with the 2024 Reverse Stock Split. Unless otherwise

indicated, all share numbers herein give effect to both the 2023 Reverse Stock Split and the 2024 Reverse Stock Split.

Why

did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant

to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy

materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (“Notice”),

because the board of directors of the Company is soliciting your proxy to vote at the Special Meeting of Stockholders to be held on March

4, 2025 (the “Special Meeting”), including at any adjournment or postponement of the Special Meeting. All stockholders will

have the ability to access the proxy materials on the website referred to in your Notice, or request to receive a printed set of the

proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy can be found in your

Notice.

We

intend to mail the Notice of Internet Availability of Proxy Materials on or about January 17, 2025, to all stockholders of record entitled

to vote at the Special Meeting.

Will

I receive any other proxy materials by mail?

No,

you will not receive any other proxy materials by mail unless you request a paper copy of proxy materials. To request that a full set

of the proxy materials be sent to your specified postal address, please go to http://www.proxyvote.com, call +1 (800) 579-1639, or send

an email to sendmaterial@proxyvote.com. Please have your proxy card in hand when you access the website or call, and follow the instructions

provided therein. You will need your unique 16-digit control number from your Notice of Internet Availability of Proxy Materials, your

proxy card, or in the instructions that accompanied your proxy materials. If you are requesting materials by email, please include in

the subject line your unique 16-digit control number from your proxy card.

How

do I attend the Special Meeting?

The

meeting will be held in a virtual-only format via live webcast on Tuesday, March 4, 2025, at 9:00 a.m. Eastern Time. You will be able

to listen and participate in the Special Meeting as well as vote and submit your questions during the live webcast of the meeting by

visiting http://www.virtualshareholdermeeting.com//ZVSA2025SM and entering the 16-digit control number included in your Notice, on your

proxy card, or in the instructions that accompanied your proxy materials.

Information

on how to vote electronically at the Special Meeting is discussed below. As always, we encourage you to submit a proxy to vote your shares

prior to the Special Meeting.

Who

can vote at the Special Meeting?

Only

stockholders of record at the close of business on January 7, 2025, will be entitled to vote at the Special Meeting. On this record date,

there were 2,508,191 shares of common stock outstanding and entitled to vote.

Stockholder

of Record: Shares Registered in Your Name

If

on January 7, 2025, your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust

Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote electronically by internet before or at

the virtual Special Meeting. Before the virtual Special Meeting, you may also vote by phone or mail. Voting directions are summarized

below. Whether or not you plan to attend the virtual Special Meeting, we urge you to submit a proxy in advance of the meeting to ensure

your vote is counted. You may still attend the virtual Special Meeting and vote at the Special Meeting even if you have already submitted

a proxy to vote.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If

on January 7, 2025, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar

organization, then you are the beneficial owner of shares held in “street name” and your Notice is being forwarded to you

by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the

Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your

account. You may still attend the Special Meeting by visiting http://www.virtualshareholdermeeting.com/ZVSA2025SM and entering the 16-digit

control number included in your Notice. However, since you are not the stockholder of record, you may not vote your shares electronically

at the meeting unless you have requested and obtained a valid proxy from your broker or other agent. If you obtained a valid proxy from

your broker or other agent, you may vote electronically at the virtual Special Meeting by visiting http://www.virtualshareholdermeeting.com/ZVSA2025SM

and entering the 16-digit control number included in your Notice.

What

am I voting on?

There

is one matter scheduled for a vote:

|

● |

Proposal

No. 1 - To approve the issuance of up to an aggregate of 1,637,000 shares of the Company’s common stock issuable upon the exercise

of certain warrants to purchase the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d). |

What

if another matter is properly brought before the meeting?

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are

properly brought before the meeting, the persons named in the accompanying proxy may vote on those matters in accordance with their best

judgment.

How

do I vote?

Proposal

No. 1: You may vote “For” or “Against” or abstain from voting on the proposal to approve the issuance of

up to an aggregate of 1,637,000 shares of the Company’s common stock issuable upon the exercise of certain warrants to purchase

the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d) (Proposal No. 1).

The

procedures for voting are fairly simple:

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote by internet before or at the virtual Special Meeting. Before the virtual Special Meeting,

you may also vote by phone or mail. Voting directions are summarized below. Whether or not you plan to attend the virtual meeting, we

urge you to submit a proxy in advance of the meeting to ensure your vote is counted. You may still attend the virtual Special Meeting

and vote at the meeting even if you have already submitted a proxy to vote.

| |

● |

To

Submit a Proxy to Vote by Internet Before the Meeting: Go to http://www.proxyvote.com up until 11:59 p.m. Eastern Time on March

3, 2025 to ensure your vote is counted. Follow the instructions to obtain your records and to create an electronic voting instruction

form. You will be asked to provide your unique 16-digit control number that appears on your Notice, proxy card, or other proxy materials. |

| |

|

|

| |

● |

To

Vote by Internet At the Special Meeting: Go to http://www.virtualshareholdermeeting.com/ZVSA2025SM and enter the 16-digit control

number that appears on your Notice, proxy card, or other proxy materials and follow the instructions. |

| |

|

|

| |

● |

To

Submit a Proxy to Vote by Phone: Dial 1-800-690-6903 toll-free using a touch-tone phone up until 11:59 p.m. Eastern Time on March

3, 2025 to ensure your vote is counted. Follow the recorded instructions. You will be asked to provide your unique 16-digit control

number that appears on your Notice, proxy card, or other proxy materials. |

| |

|

|

| |

● |

To

Submit a Proxy to Vote by Mail: Mark, sign, and date your proxy card and return it promptly in the postage-paid envelope provided,

or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing

voting instructions from that organization rather than from the Company. Simply follow the voting instructions in your Notice to ensure

that your vote is counted.

To

vote electronically at the virtual Special Meeting, you must request and obtain a valid proxy form from your broker, bank, or other agent.

Follow the instructions from your broker or bank included with these proxy materials. If you obtain a valid proxy from your broker or

other agent, you may vote at the virtual meeting by visiting http://www.virtualshareholdermeeting.com/ZVSA2025SM and enter the 16-digit

control number included in your proxy materials.

The

ability to submit a proxy by internet allows you to submit a proxy to vote your shares online, with procedures designed to ensure the

authenticity and correctness of your proxy vote instructions. If you choose to submit a proxy to vote your shares online by internet,

please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers

and telephone companies.

How

many votes do I have?

On

each matter to be voted upon, you have one vote for each share of common stock you hold as of the close of business on January 7, 2025.

What

happens if I do not vote?

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record and do not submit a proxy to vote in advance of the virtual Special Meeting by internet, phone, or mail,

and you do not vote electronically at the virtual Special Meeting, your shares will not be voted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your

broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange, or NYSE, deems the particular

proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares

with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under

the rules and interpretations of NYSE, which apply regardless of whether an issuer is listed on the NYSE or Nasdaq, “non-routine”

matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections

of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and

on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported.

Proposal No. 1 is a “non-routine” matter and, accordingly, your broker or nominee may not vote your shares on Proposal No.

1 without your instructions.

What

if I mail a proxy card or otherwise submit a proxy to vote but do not make specific choices?

If

you return a signed and dated proxy card or otherwise submit a proxy to vote without marking voting selections, your shares will be voted

“For” the approval of the issuance of up to an aggregate of 1,637,000 shares of the Company’s common stock issuable

upon the exercise of certain warrants to purchase the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d).

If

any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your

shares using your proxyholder’s best judgment.

Who

is paying for this proxy solicitation?

The

Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also

solicit proxies in person or by other means of communication. Directors and employees will not be paid any additional compensation for

soliciting proxies. The Company may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials

to beneficial owners. We may retain Morrow Sodali LLC to aid in the solicitation of proxies. If retained, we anticipate that Morrow Sodali

LLC will receive a fee of approximately $15,000, as well as reimbursement for certain costs and out-of-pocket expenses incurred by them

in connection with their services, all of which will be paid by the Company.

What

does it mean if I receive more than one Notice?

If

you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting

instructions on each of your Notices to ensure that all of your shares are voted.

Can

I change my vote after submitting my proxy?

Stockholder

of Record: Shares Registered in Your Name

Yes.

You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke

your proxy in any one of the following ways:

| |

● |

You

may submit another properly completed proxy card with a later date. |

| |

|

|

| |

● |

You

may grant a subsequent proxy by telephone or through the internet. |

| |

|

|

| |

● |

You

may send a timely written notice that you are revoking your proxy to our Secretary at 2200 N. Commerce Parkway, Suite 208, Weston,

Florida 33326. |

| |

|

|

| |

● |

You

may attend the Special Meeting virtually and vote electronically by visiting http://www.virtualshareholdermeeting.com/ZVSA2025SM

and entering the 16-digit control number included in your Notice, on your proxy card, or in the instructions that accompanied your

proxy materials. Simply attending or participating in the Special Meeting will not, by itself, revoke your proxy. |

Your

latest proxy card or other proxy is the one that is counted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank

to revoke your proxy.

How

are votes counted?

Votes

will be counted by the inspector of elections appointed for the meeting, who will count votes “For” and “Against,”

abstentions, and, if applicable, broker non-votes. Assuming a quorum is present, abstentions and broker non-votes, if any, will have

no effect on the outcome of Proposal No. 1.

What

are “broker non-votes”?

As

discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee does not have

discretionary authority to vote the shares. When there is at least one “routine” matter to be considered at a meeting, and

a broker exercises its discretionary authority on any such “routine matter” with respect to any uninstructed shares, “broker

non-votes” occur with respect to the “non-routine” matters for which the broker lacks discretionary authority to vote

such uninstructed shares.

How

many votes are needed to approve Proposal No. 1?

Proposal

No. 1 must be approved by the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) on

such proposal. Abstentions and broker non-votes will have no effect on this proposal.

What

is the quorum requirement?

A

quorum of stockholders is generally required to hold a valid meeting of stockholders. A quorum is present if the holders of thirty-three

and one-third percent (33 1/3%) of the voting power of the stock issued and outstanding and entitled to vote at a meeting are present

in person (virtually, in the case of this virtual Special Meeting) or are represented by proxy.

Any

shares that you hold of record will be counted towards the establishment of a quorum only if you submit a valid proxy or if you or your

proxy attends the meeting virtually. If you are a beneficial holder of shares held through a broker, bank, or other nominee, your shares

will be counted towards the establishment of a quorum if you provide voting instructions with respect to such shares or if you obtain

a proxy to vote such shares and attend the meeting virtually.

Shares

for which abstentions or broker non-votes occur on any proposal will be counted towards the establishment of a quorum.

How

can I find out the results of the voting at the Special Meeting?

Preliminary

voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form

8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time

to file a current report on Form 8-K within four business days after the meeting, we intend to file a current report on Form 8-K to publish

preliminary results and, within four business days after the final results are known to us, file an additional current report on Form

8-K to publish the final results.

What

can I do if I need technical assistance during the meeting?

If

you encounter any difficulties accessing the virtual meeting during the meeting time, please call the technical support number that will

be posted on the live webcast log-in page.

If

I can’t attend the meeting, how do I vote or listen to it later?

You

do not need to attend the virtual Special Meeting to vote if you submitted a proxy to vote in advance of the meeting. A replay of the

meeting, including the questions answered during the meeting, will be available at https://investors.zyversa.com for one year following

the meeting date.

What

happens if a change to the Special Meeting date or time is necessary due to exigent circumstances?

We

intend to hold the Special Meeting in a virtual-format only via live webcast. Please monitor the Investor Relations section of our website

at https://investors.zyversa.com for updated information. If you are planning to attend our Special Meeting virtually, please check the

website one week prior to the Special Meeting date. As always, we encourage you to vote your shares prior to the Special Meeting.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which

are subject to the “safe harbor” created by those sections, concerning our business, operations, and financial performance

and condition as well as our plans, objectives, and expectations for business operations and financial performance and condition. Any

statements contained herein that are not of historical facts may be deemed to be forward-looking statements. You can identify these statements

by words such as “anticipate,” “assume,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “should,” “will,” “would,”

and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are

based on current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s

beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties,

and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this proxy

statement may turn out to be inaccurate. Factors that could materially affect our business operations and financial performance and condition

include, but are not limited to, those risks and uncertainties described herein, under “Item 1A – Risk Factors” in

our Annual Report on Form 10-K for the year ended December 31, 2023, and any risk factors disclosed in subsequent Quarterly Reports on

Form 10-Q. You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place

undue reliance on the forward-looking statements. The forward-looking statements are based on information available to us as of the filing

date of this proxy statement. Unless required by law, we do not intend to publicly update or revise any forward-looking statements to

reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in the reports we

will file from time to time with the SEC after the date of this proxy statement.

This

proxy statement also contains market data related to our business and industry. These market data include projections that are based

on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these

assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow

at these projected rates may harm on our business, results of operations, financial condition, and the market price of our common stock.

PROPOSAL

NO. 1

Approval

of Issuance of Common Stock Upon Exercise of Certain Warrants in Accordance with Nasdaq Listing Rule 5635(d).

| What

am I voting on? |

|

Approval

of the issuance of up to an aggregate of 1,637,000 shares of the Company’s common stock issuable upon the exercise of certain

warrants to purchase the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d). |

| Vote

recommendation: |

|

“FOR”

the approval of the issuance of up to an aggregate of 1,637,000 shares of the Company’s common stock issuable upon the exercise

of certain warrants to purchase the Company’s common stock, in accordance with Nasdaq Listing Rule 5635(d). |

| Vote

required: |

|

A

majority in voting power of the of the votes cast on the proposal (excluding abstentions and broker non-votes). |

| Effect

of abstentions: |

|

None. |

| Effect

of broker non-votes: |

|

None. |

General

We

are asking stockholders to approve the issuance of the shares of our common stock underlying the New Warrants (such shares, the “New

Shares”), in accordance with Nasdaq Listing Rule 5635(d), as described in more detail below.

Warrant

Issuance

On

November 5, 2024, we entered into a warrant exercise inducement offer letter agreement (the “Inducement Letter”) with certain

holders (the “Holders”) of outstanding (i) Series A Common Stock purchase warrants (the “Series A Warrants”)

exercisable for up to an aggregate of 199,950 shares of our common stock, (ii) Series B Common Stock purchase warrants (the “Series

B Warrants”) exercisable for up to an aggregate of 139,950 shares of our common stock, (iii) Series A-1 Common Stock purchase warrants

(the “Series A-1 Warrants”) exercisable for up to an aggregate of 392,000 shares of common stock, and (iv) Series B-1 Common

Stock purchase warrants (the “Series B-1 Warrants”) exercisable for up to an aggregate of 86,600 shares of common stock (collectively,

the “Existing Warrants”), which Existing Warrants were issued by us on December 11, 2023 and August 2, 2024. The Series A

Warrants and the Series B Warrants were exercisable at an exercise price of $12.50 per share and the Series A-1 Warrants and the Series

B-1 Warrants were exercisable at an exercise price of $3.46 per share.

Pursuant

to the Inducement Letter, the Holders agreed to exercise the Existing Warrants for cash at a reduced exercise price of $2.06 per share

in consideration of the Company’s agreement to issue each Holder new warrants to purchase up to a number of shares of common stock

equal to 200% of the number of shares of common stock issued pursuant to such Holders’ exercise of Existing Warrants, comprised

of new Series A-2 warrants to purchase up to 1,637,000 shares of our common stock (the “New Warrants”) with an exercise term

of five years from the initial exercise date. The initial exercise date of the New Warrants is the Stockholder Approval Date (as defined

below), and the exercise price thereof is $2.06 per share. If all of the New Warrants are exercised in full, the Company will receive

aggregate gross proceeds of approximately $3.4 million.

The

issuance of the New Shares is subject to stockholder approval in accordance with Nasdaq Listing Rule 5635(d) of The Nasdaq Stock Market

LLC (“Stockholder Approval” and the date on which Stockholder Approval is received and deemed effective, the “Stockholder

Approval Date”). We agreed to convene a stockholders’ meeting on or before the 120th day following the closing of the warrant

inducement transaction to approve the issuance of the New Shares upon exercise of the New Warrants, if required, with the recommendation

of our board of directors that such proposal be approved. We agreed to solicit proxies from our stockholders in connection therewith

in the same manner as all other management proposals in such proxy statement and all management-appointed proxyholders shall vote their

proxies in favor of such proposal. Consequently, we are including this Proposal No. 1 in this proxy statement.

We

agreed to file a registration statement on Form S-3 (or other appropriate form if the Company is not then S-3 eligible) on or before

December 20, 2024, to register the resale of the shares of common stock underlying the New Warrants and to use commercially reasonable

efforts to cause such registration statement to become effective within 120 days of its initial filing.

The

summary of the terms of the New Warrants above is qualified in its entirety by reference to the copy of the form of the New Warrant,

which is included herewith as Annex A, and incorporated herein by reference. You should read this summary together with the form

evidencing the New Warrants.

Stockholder

Approval

As

described above, pursuant to the Inducement Letter, we agreed to hold a meeting of stockholders on or before the 120th day following

the closing of the warrant inducement transaction to obtain Stockholder Approval. The recommendation of our board of directors is that

such proposal be approved, we are soliciting proxies from our stockholders in connection therewith. If we do not obtain Stockholder Approval

at this Special Meeting, we are required to call a meeting of stockholders every 90 days thereafter to seek Stockholder Approval until

the earlier of the date that Stockholder Approval is obtained or the New Warrants are no longer outstanding. As discussed above, one

of the purposes of the Special Meeting is to satisfy the above requirement of the Inducement Letter.

A

vote in favor of this Proposal No. 1 is a vote “FOR” approval of the issuance of the New Shares upon exercise of the New

Warrants issued under the terms of the Inducement Letter. The exercise of the New Warrants, in their entirety, could result in the issuance

of 20% or more of our common stock outstanding as of November 6, 2024, the date that we issued the New Warrants.

Nasdaq

Listing Rule 5635(d) requires stockholder approval in connection with a transaction other than a public offering involving the sale,

issuance, or potential issuance by the Company of common stock (or securities convertible into or exercisable for common stock) equal

to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for a price that is less than the

lower of (i) the Company’s Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the

binding agreement, or (ii) the average of the Company’s Nasdaq Official Closing Price (as reflected on Nasdaq.com) for the five

trading days immediately preceding the signing of the binding agreement.

The

New Warrants were issued in connection with the exercise of the Existing Warrants pursuant to the terms of the Inducement Letter (as

further described above) but were not and are not exercisable at all prior to Stockholder Approval. Accordingly, because the New Shares

issuable upon exercise of the New Warrants issued under the Inducement Letter total more than 19.99% of our outstanding shares of common

stock on the date the New Warrants were issued, and because the New Warrants further have anti-dilutive rights, we are seeking stockholder

approval of this proposal in respect of the issuance of the shares of common stock upon the exercise of the New Warrants pursuant to

Nasdaq Listing Rule 5635(d).

Potential

Adverse Effects - Dilution and Impact on Existing Stockholders

The

issuance of shares of common stock upon exercise of the New Warrants will have a dilutive effect on current stockholders in that the

percentage ownership of the Company held by such current stockholders will decline as a result of the issuance of the New Shares. This

means also that our current stockholders will own a smaller interest in us as a result of the exercise of the New Warrants and therefore

have less ability to influence significant corporate decisions requiring stockholder approval. Issuance of the New Shares could also

have a dilutive effect on the book value per share and any future earnings per share. Dilution of equity interests could also cause prevailing

market prices for our common stock to decline.

If

the New Warrants are exercised in full for cash, a total of 1,637,000 shares of common stock will be issuable to the Holder of the New

Warrants and this dilutive effect may be material to current stockholders of the Company.

Risks

Related to the New Warrants

Provisions

of the New Warrants could discourage an acquisition of us by a third party.

Certain

provisions of the New Warrants could make it more difficult or expensive for a third party to acquire us. The New Warrants prohibit us

from engaging in certain transactions constituting “fundamental transactions” unless, in certain situations and among other

things, the surviving entity assumes our obligations under the New Warrants. Further, the New Warrants provide that, in the event of

certain transactions constituting “fundamental transactions,” with some exceptions, holders of such warrants will have the

right, at their option, to receive from us or a successor entity the same type or form of consideration (and in the same proportion)

that is being offered and paid to the holders of our common stock in the fundamental transaction in the amount of the Black Scholes value

(as described in such warrants) of the unexercised portion of the applicable New Warrants on the date of the consummation of the fundamental

transaction. These and other provisions of the New Warrants could prevent or deter a third party from acquiring us even where the acquisition

could be beneficial to the holders of our common stock.

The

New Warrants may be accounted for as liabilities and the changes in value of such New Warrants may have a material effect on our financial

results.

We

are currently evaluating the terms of the New Warrants. It is possible that we and/or our auditors will conclude that, because of the

terms of such New Warrants, such New Warrants should be accounted for as liability instruments. As a result, we would be required to

classify the New Warrants as liabilities. Under the liability accounting treatment, we would be required to measure the fair value of

these instruments at the end of each reporting period and recognize changes in the fair value from the prior period in our operating

results for the current period. As a result of the recurring fair value measurement, our financial statements and results of operations

may fluctuate quarterly based on factors that are outside our control. In the event the New Warrants are required to be accounted for

under liability accounting treatment, we will recognize noncash gains or losses due to the quarterly fair valuation of these warrants,

which could be material. The impact of changes in fair value on our financial results may have an adverse effect on the market price

of our common stock and/or our stockholders’ equity, which may make it harder for us to, or prevent us from, meeting the continued

listing standards of Nasdaq.

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1 TO AUTHORIZE THE ISSUANCE OF THE NEW SHARES UPON EXERCISE OF THE

NEW WARRANTS ISSUED UNDER THE TERMS OF THE INDUCEMENT LETTER AND PURSUANT TO NASDAQ LISTING RULE 5635(d).

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth beneficial ownership of the Company’s common stock as of January 7, 2025 by:

| |

● |

each

of the Company’s named executive officers, directors, and director nominees; |

| |

|

|

| |

● |

all

of the Company’s executive officers, directors, and director nominees as a group; and |

| |

|

|

| |

● |

each

person known to be the beneficial owner of more than 5% of the outstanding common stock of the Company. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she, or it possesses sole or shared voting or investment power over that security. Under those rules, beneficial ownership includes

securities that the individual or entity has the right to acquire, such as through the exercise of warrants or stock options or the vesting

of restricted stock units, within 60 days of January 7, 2025. Shares subject to warrants or options that are currently exercisable or

exercisable within 60 days of January 7, 2025 or subject to restricted stock units that vest within 60 days of January 7, 2025 are considered

outstanding and beneficially owned by the person holding such warrants, options, or restricted stock units for the purpose of computing

the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any

other person.

Certain

beneficial owners of our common stock own warrants to purchase shares of our common stock that contain blockers preventing the holder

from exercising its warrants if as a result of such exercise the holder would beneficially own more than 4.99% or 9.99%, as applicable,

of our common stock. In preparing the table below, we have given affect to those blockers where applicable. Except as noted by footnote,

and subject to community property laws where applicable, based on the information provided to the Company, the persons and entities named

in the table below have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise

indicated, the business address of each beneficial owner listed in the table below is c/o ZyVersa Therapeutics, Inc., 2200 N. Commerce

Parkway, Suite 208, Weston, Florida 33326.

The

beneficial ownership of our common stock is based on 2,508,191 shares of common stock issued and outstanding as of January 7, 2025, based

on our knowledge and publicly available information. Unless otherwise indicated, the business address of each beneficial owner listed

in the table below is c/o ZyVersa Therapeutics, Inc., 2200 N. Commerce Parkway, Suite 208, Weston, Florida 33326.

| Name and Address of Beneficial Owners | |

Number of

Shares

Beneficially

Owned | | |

Percentage of

Shares

Beneficially

Owned | |

| Directors and named executive officers | |

| | | |

| | |

| Stephen C. Glover(1) | |

| 4,423 | | |

| * | |

| Min Chul Park, Ph.D.(2) | |

| 159 | | |

| * | |

| Robert G. Finizio(3) | |

| 216 | | |

| * | |

| Peter Wolfe(4) | |

| 715 | | |

| * | |

| Karen Cashmere(5) | |

| 459 | | |

| * | |

| Pablo A. Guzman, M.D.(6) | |

| 506 | | |

| * | |

| James Sapirstein(7) | |

| 44 | | |

| * | |

| Gregory Freitag(8) | |

| 44 | | |

| * | |

| All executive officers, directors, and director nominees as a group (8 individuals) | |

| 6,566 | | |

| * | |

| Other 5% beneficial owners | |

| | | |

| | |

| Anson Investments Master Fund LP(9) | |

| 278,378 | | |

| 9.99 | % |

| Armistice Capital Master Fund Ltd.(10) | |

| 278,378 | | |

| 9.99 | % |

| * |

Less

than 1.0% |

| |

|

| (1) |

Includes

1,821 shares of common stock held by Stephen C. Glover and affiliates, consisting of (i) 1,308 shares of common stock held of record

by Stephen C. Glover; (ii) 126 shares of common stock held of record by MedicaRx Inc.; (iii) 245 shares of common stock held of record

by Asclepius Life Sciences Fund, LP; (iv) 142 shares of common stock held of record by Asclepius Master Fund, LTD. The amount also

includes options and warrants that are exercisable as of or within 60 days of January 7, 2025 for 2,370 and 232, respectively, shares

of common stock. Mr. Glover is the managing director of MedicaRx Inc., the managing director of Asclepius Master Fund, LTD, and the

managing member of Asclepius Life Sciences Fund, LP. |

| |

|

| (2) |

Represents

options that are exercisable as of or within 60 days of January 7, 2025 for 159 shares of common stock. |

| |

|

| (3) |

Represents

options that are exercisable as of or within 60 days of January 7, 2025 for 216 shares of common stock. |

| |

|

| (4) |

Represents:

(i) 127 shares of common stock; and (ii) options and warrants that are exercisable as of or within 60 days of January 7, 2025 for

536 and 52, respectively, shares of common stock. |

| |

|

| (5) |

Represents

options that are exercisable as of or within 60 days of January 7, 2025 for 459 shares of common stock. |

| |

|

| (6) |

Represents:

(i) 76 shares of common stock; and (ii) options and warrants that are exercisable as of or within 60 days of January 7, 2025 for

404 and 26, respectively, shares of common stock. |

| |

|

| (7) |

Represents

options that are exercisable as of or within 60 days of January 7, 2025 for 44 shares of common stock. |

| |

|

| (8) |

Represents

options that are exercisable as of or within 60 days of January 7, 2025 for 44 shares of common stock. |

| |

|

| (9) |

Consists

of warrants to purchase 278,378 shares of common stock, but excludes warrants to purchase 325,622 shares of common stock that are

not currently exercisable as a result of the 9.99% beneficial ownership limitation blocker contained in such warrants but given the

increase in outstanding shares of the Company since such filing, all warrants held are disclosed here. The securities are held of

record by Anson Investments Master Fund LP. Amin Nathoo and Moez Kassam are directors of Anson Advisors, Inc., and Tony Moore is

principal of Anson Fund Management LP, each has voting and dispositive power over the securities held by Anson Investments Master

Fund LP. The business address for Anson Investments Master Fund LP is 181 Bay Street, Suite 4200, Toronto, ON, M5J 2T3. |

| |

|

| (10) |

Consists

of warrants to purchase 278,378 shares of common stock but excludes warrants to purchase 678,822 shares of common stock that are

not currently exercisable as a result of the 9.99% beneficial ownership limitation blocker contained in such warrants but given the

increase in outstanding shares of the Company since such filing, all warrants held are disclosed here. The securities are held of

record by Armistice Capital Master Fund Ltd. Steve Boyd is the CIO of Armistice Capital, LLC and has sole voting and dispositive

power over the securities held by Armistice Capital Master Fund Ltd. The business address for Armistice Capital Master Fund Ltd.is

510 Madison Avenue, 7th Floor, New York NY 10022. |

HOUSEHOLDING

OF PROXY MATERIALS

The

SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for Notices of Internet

Availability of Proxy Materials or other Special Meeting materials with respect to two or more stockholders sharing the same address

by delivering a single Notice of Internet Availability of Proxy Materials or other Special Meeting materials addressed to those stockholders.

This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost

savings for companies.

This

year, a number of brokers with account holders who are Company stockholders will be “householding” our proxy materials. A

single Notice of Internet Availability of Proxy Materials will be delivered to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding”

communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Notice of Internet

Availability of Proxy Materials, please notify your broker. Stockholders who currently receive multiple copies of the Notices of Internet

Availability of Proxy Materials at their addresses and would like to request “householding” of their communications should

contact their brokers.

OTHER

MATTERS

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are

properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance

with their best judgment.

It

is important that your shares of common stock be represented at the Special Meeting, regardless of the number of shares that you hold.

As always, we encourage you to submit a proxy to vote your shares prior to the Special Meeting.

By

Order of the Board of Directors

Stephen

C. Glover

Chief

Executive Officer, President, and Chairman of the Board of Directors

__________,

2025

Annex A

NEITHER

THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION

OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED

(THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS

OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. THIS SECURITY AND THE SECURITIES ISSUABLE UPON EXERCISE

OF THIS SECURITY MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT WITH A REGISTERED BROKER-DEALER OR OTHER LOAN WITH A FINANCIAL

INSTITUTION THAT IS AN “ACCREDITED INVESTOR” AS DEFINED IN RULE 501(A) UNDER THE SECURITIES ACT OR OTHER LOAN SECURED BY

SUCH SECURITIES.

Series

A-2 COMMON STOCK PURCHASE WARRANT

ZYVERSA

THERAPEUTICS, INC.

| Warrant

Shares: [●] |

Issue

Date: November [•], 2024 |

THIS

Series A-2 COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies

that, for value received, _______. or its assigns (the “Holder”) is entitled, upon the terms and subject to the limitations

on exercise and the conditions hereinafter set forth, at any time or times on or after the Stockholder Approval Date (the “Initial

Exercise Date”) and on or prior to 5:00 p.m. (New York City time) on the five-year anniversary of the Initial Exercise Date

(the “Termination Date”) but not thereafter, to subscribe for and purchase from ZyVersa Therapeutics, Inc.,

a Delaware corporation (the “Company”), up to [•] shares of common stock, par value $0.0001 per share (the “Common

Stock”) (as subject to adjustment hereunder, the “Warrant Shares”). The purchase price of one share of Common

Stock under this Warrant shall be equal to the Exercise Price, as defined in Section 2(b).

Section

1. Definitions. In addition to the terms defined elsewhere in this Warrant, the following terms have the meanings indicated

in this Section 1.

“Affiliate”

means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control

with a Person, as such terms are used in and construed under Rule 405 under the Securities Act.

“Board

of Directors” means the board of directors of the Company.

“Business

Day” means any day other than Saturday, Sunday or other day on which commercial banks in The City of New York are authorized

or required by law to remain closed.

“Commission”

means the United States Securities and Exchange Commission.

“Common

Stock” means the common stock of the Company, par value $0.0001 per share, and any other class of securities into which such

securities may hereafter be reclassified or changed.

“Common

Stock Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire

at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is

at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability

company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Rule

144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted

from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect

as such Rule.

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Stockholder

Approval” refers to when the Company has received approval to issue the Warrants.

“Stockholder

Approval Date” means the date on which Stockholder Approval is received and deemed effective.

“Subsidiary”

means any subsidiary of the Company and shall, where applicable, also include any direct or indirect subsidiary of the Company formed

or acquired after the date hereof.

“Trading

Day” means a day on which the Common Stock is traded on a Trading Market

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date

in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market or the New York

Stock Exchange (or any successors to any of the foregoing).

“Warrants”

means this Warrant and other Common Stock purchase warrants issued by the Company pursuant to that certain letter agreement, dated November

[5], 2024, among the Company and warrant holders signatory thereto.

Section

2. Exercise

(a)

Exercise of Warrant. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time

or times on or after the Initial Exercise Date (or the Stockholder Approval Date for the Warrants) and on or before the Termination Date

by delivery to the Company of a duly executed facsimile copy or PDF copy submitted by e-mail (or e-mail attachment) of the Notice of

Exercise in the form annexed hereto as Exhibit A (the “Notice of Exercise”). Within the earlier of (i)

one (1) Trading Day and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined in Section 2(d)(i)

herein) following the date of exercise as aforesaid, the Holder shall deliver the aggregate Exercise Price for the number of Warrant

Shares specified in the applicable Notice of Exercise by wire transfer or cashier’s check drawn on a United States bank unless

the cashless exercise procedure specified in Section 2(c) below is specified in the applicable Notice of Exercise. No ink-original

Notice of Exercise shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of

Exercise be required. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this

Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised

in full, at which time, the Holder shall surrender this Warrant to the Company for cancellation within three (3) Trading Days of the

date on which the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a

portion of the total number of Warrant Shares purchasable hereunder shall have the effect of lowering the outstanding number of Warrant

Shares purchasable hereunder by the number of Warrant Shares equal to the applicable number of Warrant Shares purchased in connection

with such partial exercise. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the

date of such purchases. The Company shall deliver any objection to any Notice of Exercise within one (1) Trading Day of receipt of such

notice. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph,

following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at

any given time may be less than the amount stated on the face hereof.

(b)

Exercise Price. The exercise price per share of Common Stock under this Warrant shall be $[●]1, subject to adjustment

hereunder (the “Exercise Price”).

1

NTD: The average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five (5) Trading Days immediately

preceding the day of an exercise of Existing Common Warrants.

(c)

Cashless Exercise. Notwithstanding anything to the contrary set forth herein, if at the time of exercise hereof there is no effective

registration statement registering, or the prospectus contained therein is not available for the issuance of, the Warrant Shares to the

Holder, then this Warrant may only be exercised, in whole or in part, at such time by means of a “cashless exercise” in which

the Holder shall be entitled to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

(A)

= as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise if such Notice of

Exercise is (1) both executed and delivered pursuant to Section 2(a) hereof on a day that is not a Trading Day or (2) both executed

and delivered pursuant to Section 2(a) hereof on a Trading Day prior to the opening of “regular trading hours” (as

defined in Rule 600(b) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, (ii) the Bid Price of the

Common Stock on the principal Trading Market as reported by Bloomberg L.P. (“Bloomberg”) as of the time of the Holder’s

execution of the applicable Notice of Exercise if such Notice of Exercise is executed during “regular trading hours” on a

Trading Day and is delivered within two (2) hours thereafter (including until two (2) hours after the close of “regular trading

hours” on a Trading Day) pursuant to Section 2(a) hereof or (iii) the VWAP on the date of the applicable Notice of Exercise

if the date of such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and delivered pursuant to Section

2(a) hereof after the close of “regular trading hours” on such Trading Day;

(B)

= the Exercise Price of this Warrant, as adjusted hereunder; and

(X)

= the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such

exercise were by means of a cash exercise rather than a cashless exercise.

If

Warrant Shares are issued in such a cashless exercise, the parties acknowledge and agree that in accordance with Section 3(a)(9) of the

Securities Act, the Warrant Shares shall take on the registered characteristics of the Warrants being exercised. The Company agrees not

to take any position contrary to this Section 2(c).

“Bid

Price” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock

is then listed or quoted on a Trading Market, the bid price of the Common Stock for the time in question (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m.

(New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the VWAP of the Common Stock

for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for

trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar organization or

agency succeeding to its functions of reporting prices), the most recent bid price per share of Common Stock so reported, or (d) in all

other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the

Purchasers of a majority in interest of the Securities then outstanding and reasonably acceptable to the Company, the fees and expenses

of which shall be paid by the Company.

“Trading

Day” means any day on which the Trading Market is open for trading, including any day on which the Trading Market is open for

trading for a period of time less than the customary time.

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m.

(New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price

of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then

listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on The Pink Open Market (or a similar

organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of Common Stock so reported,

or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good

faith by the Purchasers of a majority in interest of the Securities then outstanding and reasonably acceptable to the Company, the fees

and expenses of which shall be paid by the Company.

(d)

Mechanics of Exercise.

i.

Delivery of Warrant Shares Upon Exercise. The Company shall cause the Warrant Shares purchased hereunder to be transmitted to

the Holder by crediting the account of the Holder’s or its designee’s balance account with The Depository Trust Company through

its Deposit or Withdrawal at Custodian system (“DWAC”) if the Company is then a participant in such system and either

(A) there is an effective registration statement permitting the issuance of the Warrant Shares to or resale of the Warrant Shares by

Holder or (B) the Warrant Shares are eligible for resale by the Holder without volume or manner-of-sale limitations pursuant to Rule

144 (assuming cashless exercise of the Warrant), and otherwise by physical delivery of the Warrant Shares, registered in the Company’s

share register in the name of the Holder or its designee, for the number of Warrant Shares set forth in the Notice of Exercise to the

address specified by the Holder in such Notice of Exercise by the date that is the earliest of (i) two (2) Trading Days after the delivery

to the Company of the Notice of Exercise, (ii) one (1) Trading Day after delivery of the aggregate Exercise Price to the Company, and

(iii) the number of Trading Days comprising the Standard Settlement Period after the delivery to the Company of the Notice of Exercise

(such date, the “Warrant Share Delivery Date”). Upon delivery of the Notice of Exercise, the Holder shall be deemed

for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised,

irrespective of the date of delivery of the Warrant Shares, provided that payment of the aggregate Exercise Price (other

than in the case of a cashless exercise) is received within the earlier of (i) two (2) Trading Days and (ii) the number of Trading Days

comprising the Standard Settlement Period following delivery of the Notice of Exercise. If the Company fails for any reason to deliver

to the Holder the Warrant Shares subject to a Notice of Exercise by the Warrant Share Delivery Date, the Company shall pay to the Holder,

in cash, as liquidated damages and not as a penalty, for each $1,000 of Warrant Shares subject to such exercise (based on the VWAP of

the Common Stock on the date of the applicable Notice of Exercise), $10 per Trading Day (increasing to $20 per Trading Day on the fifth

Trading Day after the Warrant Share Delivery Date) for each Trading Day after such Warrant Share Delivery Date until such Warrant Shares

are delivered or Holder rescinds such exercise. The Company agrees to maintain a transfer agent (the “Transfer Agent”)

that is a participant in the FAST program so long as this Warrant remains outstanding and exercisable. As used herein, “Standard

Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary

Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Exercise. The Holder and any

assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase

of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time will be

less than the amount stated on the face hereof.

ii.

Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of

a Holder and upon surrender of this Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Warrant

evidencing the rights of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in

all other respects be identical with this Warrant.

iii.

Rescission Rights. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section

2(d)(i) by the Warrant Share Delivery Date, then the Holder will have the right to rescind such exercise.

iv.

Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to

the Holder, if the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares in accordance with the provisions

of Section 2(d)(i) above pursuant to an exercise on or before the Warrant Share Delivery Date, and if after such date the Holder

is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise purchases,

shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving

upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder the amount, if any, by which

(x) the Holder’s total purchase price (including brokerage commissions, if any) for the Warrant Shares so purchased exceeds (y)

the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection

with the exercise at issue times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B)

at the option of the Holder, either reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise

was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of shares of Common Stock

that would have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the

Holder purchases shares of Common Stock having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted exercise

of Warrants with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of the immediately preceding

sentence the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts

payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence satisfactory to the Company with respect to

the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at

law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s

failure to timely deliver Warrant Shares upon exercise of the Warrant as required pursuant to the terms hereof.

v.

No Fractional Shares or Scrip. No fractional Warrant Shares or scrip representing fractional Warrant Shares shall be issued upon

the exercise of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise,

the Company shall, at its election and in lieu of the issuance of such fractional Warrant Share, either (i) pay cash in an amount equal

to such fraction multiplied by the Exercise Price or (ii) round up to the next whole Warrant Share.

vi.

Charges, Taxes and Expenses. The issuance and delivery of Warrant Shares shall be made without charge to the Holder for any issue

or transfer tax or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall