Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of the

Abaxx

Commodity Exchange and Clearinghouse (“Abaxx Singapore”),

and producer of the

SmarterMarkets™ Podcast,

summarizes development activities over the past quarter and the

general progress of the Company’s business plans. Abaxx also

announces that it completed a financing of approximately CAD

$1,013,000 through the private placement of an unsecured

convertible debenture of the Company with an existing shareholder.

Further details of these updates are provided below.

Corporate Milestone

Highlights

- Risk and

Regulatory: Concluded public consultation on Exchange and

Clearinghouse rules; ongoing engagement with the Monetary Authority

of Singapore (“MAS”) to complete remaining conditions for final

AHC, ACH, and RMO licensing in Q4 2023.

- Commercial:

Began a commodity broker engagement program in advance of initial

trading, has executed a first cooperation agreement with Vanir

Global Markets Pte. Ltd, a global energy and environmental

interdealer brokerage (IDB) firm providing market participants

further access to Abaxx Exchange's suite of products via their

extensive relationships in global energy and environmental

markets.

- Exchange

Product Development: Submitted a Notification of Impending Listing

of Futures Contracts to the MAS for Nickel Sulphate Futures;

efforts on carbon and precious metals market solutions continue.

Abaxx has also begun initial product scoping for lithium benchmark

contracts following constructive engagement with market

participants in recent battery metal market events.

- Systems and

Operations: Continued integration and certification testing of

third-party clearing and exchange independent software vendors

(ISVs) in production environments.

- Strategic

Financing: The strategic financing process for Abaxx Singapore is

progressing, with an expected conclusion in early Q4. Abaxx has

signed non-binding term sheets as well as definitive agreements

with corporate strategic investors, as previously disclosed on

August 14th, 2023.

- Abaxx Console

Apps and ID++ Protocol: Advanced design and development work on

prototyping of tools for carbon and commodity markets. Held initial

pilot project discussions during the quarter with a number of

prospective stakeholders, including a global commodity trading

firm, voluntary carbon market registry, and a sovereign

jurisdiction looking to enhance identity credential technology in

financial markets.

Abaxx has made significant progress in its

strategic initiatives over the recent months. The Company's efforts

have been centered around technological advancements, regulatory

engagements, and expanding its market presence, all of which are

crucial in addressing global challenges, including the ongoing

energy transition and global supply chain investment cycle.

The following press release provides a detailed

update on these developments. These actions underscore Abaxx's

commitment to delivering long term shareholder value and ensuring

the company's growth in a rapidly changing financial and regulatory

landscape.

Abaxx Exchange and Clearing

Developments

Risk and Regulatory: Since our

last update, the Company concluded its public consultation on the

rules and procedures of the Exchange and Clearing House.

Engagements with the MAS continued regarding any remaining

regulatory review and licensing requirements for the Approved

Clearing House (ACH), Approved Holding Company (AHC) and Recognised

Market Operator (RMO) licenses. These licensing requirements are

still subject to final regulatory approval by the MAS.

Commercial: Abaxx has executed

an agreement with Vanir Global Markets Pte. Ltd, a global energy

and environmental interdealer brokerage (IDB) firm providing market

participants further access to Abaxx Exchange's suite of products

via their extensive relationships in global energy and

environmental markets. The continued utilization of IDBs by global

energy, metals and environmental markets will be enhanced by

allowing these trades to occur and be submitted to the Abaxx

Exchange and Clearinghouse as block trades. This agreement will

also facilitate a reciprocation data partnership that will

strengthen our price discovery and transparency processes that will

benefit all Abaxx Exchange participants.

Abaxx delivered one of only ten presentations at

Gastech’s annual LNG conference which attracted over 40,000 global

attendees earlier this month. Abaxx’s Chief Commercial Officer Joe

Raia was also invited to participate in a closed-door LNG

Leadership Roundtable as the only futures exchange representative —

consisting of over 20 leaders including participants from Vitol,

RWE, Osaka Gas and Petrochina. We also held our 2nd Asia Pacific

Petroleum Conference (APPEC) week cocktail reception garnering over

220 attendees from over 50 different companies including OTC

Brokers, LNG Trading firms, Bank and Non-Bank futures commission

merchants (FCMs).

Systems and Operations: The

Company continues integration and certification testing of

third-party clearing and exchange ISVs into production

environments.

Exchange Product Development:

Abaxx Singapore submitted a Notification of Impending Listing of

Futures Contracts to the MAS. Abaxx intends to include its first

battery metals futures contract on the launch slate with LNG and

Carbon contracts. Positive industry response to nickel sulphate

futures development has yielded encouraging prospects on additional

battery metal solutions. Abaxx continues work on carbon market

solutions as the market continues implementing structure around

Article 6 requirements. Abaxx is working closely with industry

participants to continue implementation of its staged strategy as

opportunities to enhance standards emerge. Precious metals

solutions remain in Stage 3 of development. The effort in precious

metals is broader than futures market development and we look

forward to sharing more details at the appropriate time.

Abaxx Console Apps and ID++

Protocol: In Q3 2023, our Digital Product and Engineering

Teams advanced development on the project Venice pilot which pairs

existing Abaxx Technologies console apps with newly developed tools

to create an application suite that connects qualified participants

looking to transact in global carbon markets. Engineering teams

completed tests designed to validate viability of using ID++ and

prototyped tools to create a secure bridge between enterprise cloud

and distributed networks.

Abaxx Corporate Update

Debenture Financing: Abaxx

Technologies has completed a financing (the “Debenture Financing”)

of USD$750,000 (approximately CAD $1,013,000) through the private

placement of an unsecured convertible debenture of the Company (the

“Debenture”). The proceeds are expected to be used for general

corporate and working capital purposes.

The Debenture shall mature on December 15, 2023

(the “Maturity Date”) and is convertible at the option of the

holder (the “Conversion Option”) into common shares (the “Common

Shares”) of the Company from time to time and at any time at a

conversion price of CAD $7.15 per Common Share (the “Conversion

Price”). The Debenture shall bear interest at an annual rate of

10%, compounding monthly and payable in cash on the Maturity Date.

The Debenture is unsecured, non-voting and carries no right to

participate in the earnings of the Company. The Company will also

be entitled to prepay the amount owing under the Debenture at any

time prior to the Maturity Date without penalty. The securities

issued in connection with the Debenture Financing shall be subject

to a four-month and one-day hold period following issuance, in

accordance with applicable securities legislation.

First Tranche of Strategic

Financing: Abaxx Singapore, consistent with its initiative

for a US$20 million to US$35 million best efforts equity private

placement of preferred shares (the “Preferred Shares”) of Abaxx

Singapore (the “Offering”), has formalized an investment agreement

with an initial corporate investor. This agreement allows for

participation in an offering of 2,144,563 Preferred Shares and

Ordinary Shares in the first tranche (the “First Tranche”) of the

Offering. The anticipated closure of the Offering has now been

revised to October 2023. Notably, the investor for the Preferred

Shares in the First Tranche is recognized as a leading global

market infrastructure operator.

About Abaxx Technologies

Abaxx is a development-stage financial software

and market infrastructure company creating proprietary

technological infrastructure for both global commodity exchanges

and digital marketplaces. The company’s formative technology

increases transaction velocity, data security, and facilitates

improved risk management in the majority-owned Abaxx Commodity

Exchange (Abaxx Singapore Pte. Ltd.) - a commodity futures exchange

seeking final regulatory approvals as a Recognized Market Operator

(“RMO”) and Approved Clearing House (“ACH”) with the Monetary

Authority of Singapore (“MAS”). Abaxx is a founding shareholder in

Base Carbon Inc. and the creator and producer of the

SmarterMarkets™ podcast.

For more information please visit abaxx.tech, abaxx.exchange and

smartermarkets.media.

For more information about this press release, please

contact:Steve Fray, CFOTel: 416-786-4381

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

"forward-looking statements" which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx or the Company’s future plans, objectives, or

goals, including words to the effect that Abaxx expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as “seeking”, “believes”, “anticipates”,

“expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”.

Since forward-looking statements are based on assumptions and

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Although these statements

are based on information currently available to Abaxx, Abaxx does

not provide any assurance that actual results will meet

management’s expectations. Risks, uncertainties, and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects, and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this

news release includes but is not limited to, Abaxx’s objectives,

goals or future plans, the planned use of proceeds from the

Debenture Financing, regulatory approval for the Debenture

Financing, statements regarding anticipated exchange listings,

receipt of regulatory approvals, timing of the commencement of

operations, financial predictions, and estimates of market

conditions. Such factors include, among others: risks relating to

the global economic climate; dilution; the Company’s limited

operating history; future capital needs and uncertainty of

additional financing; the competitive nature of the industry;

currency exchange risks, including risks relating to conversion of

Debenture Financing proceeds; the need for Abaxx to manage its

planned growth and expansion; the effects of product development

and need for continued technology change; protection of proprietary

rights; the effect of government regulation and compliance on Abaxx

and the industry; the ability to list the Company’s securities on

stock exchanges in a timely fashion or at all; network security

risks; the ability of Abaxx to maintain properly working systems;

reliance on key personnel; global economic and financial market

deterioration impeding access to capital or increasing the cost of

capital; and volatile securities markets impacting security pricing

unrelated to operating performance. In addition, particular factors

which could impact future results of the business of Abaxx include

but are not limited to: operations in foreign jurisdictions,

protection of intellectual property rights, contractual risk,

third-party risk; clearinghouse risk, malicious actor risks,

third-party software license risk, system failure risk, risk of

technological change; dependence of technical infrastructure; and

changes in the price of commodities, capital market conditions,

restriction on labor and international travel and supply chains.

Abaxx has also assumed that no significant events occur outside of

Abaxx’s normal course of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on Abaxx's forward-looking statements and information to

make decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Abaxx has assumed that the material factors referred to in the

previous paragraph will not cause such forward-looking statements

and information to differ materially from actual results or events.

However, the list of these factors is not exhaustive and is subject

to change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking information contained in this press release

represents the expectations of Abaxx as of the date of this press

release and, accordingly, is subject to change after such date.

Readers should not place undue importance on forward-looking

information and should not rely upon this information as of any

other date. Abaxx does not undertake to update this information at

any particular time except as required in accordance with

applicable laws. Cboe Canada Exchange does not accept

responsibility for the adequacy or accuracy of this press

release.

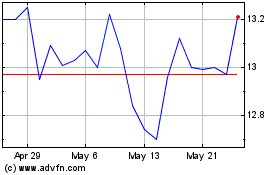

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Abaxx Technologies (NEO:ABXX)

Historical Stock Chart

From Jan 2024 to Jan 2025