00018245022024Q1FALSE12/3166.67P3YP3Dxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesachr:lineOfBusinessxbrli:pureachr:interestachr:installmentachr:voteachr:trancheachr:aircraftachr:milestone00018245022024-01-012024-03-310001824502us-gaap:CommonClassAMember2024-01-012024-03-310001824502us-gaap:WarrantMember2024-01-012024-03-310001824502us-gaap:CommonClassAMember2024-05-030001824502us-gaap:CommonClassBMember2024-05-0300018245022024-03-3100018245022023-12-310001824502us-gaap:CommonClassAMember2023-12-310001824502us-gaap:CommonClassAMember2024-03-310001824502us-gaap:CommonClassBMember2024-03-310001824502us-gaap:CommonClassBMember2023-12-3100018245022023-01-012023-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001824502us-gaap:AdditionalPaidInCapitalMember2023-12-310001824502us-gaap:RetainedEarningsMember2023-12-310001824502us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-03-310001824502us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001824502us-gaap:RetainedEarningsMember2024-01-012024-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001824502us-gaap:AdditionalPaidInCapitalMember2024-03-310001824502us-gaap:RetainedEarningsMember2024-03-310001824502us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001824502us-gaap:AdditionalPaidInCapitalMember2022-12-310001824502us-gaap:RetainedEarningsMember2022-12-310001824502us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100018245022022-12-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-03-310001824502us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001824502us-gaap:RetainedEarningsMember2023-01-012023-03-310001824502us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001824502us-gaap:AdditionalPaidInCapitalMember2023-03-310001824502us-gaap:RetainedEarningsMember2023-03-310001824502us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100018245022023-03-310001824502us-gaap:MoneyMarketFundsMember2024-03-310001824502us-gaap:MoneyMarketFundsMember2023-12-310001824502us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel1Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel2Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel3Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502achr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502achr:PrivatePlacementWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel2Memberachr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel3Memberachr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502achr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001824502us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel1Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel2Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberachr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502achr:PublicWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502achr:PrivatePlacementWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel2Memberachr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberachr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502achr:PrivatePlacementWarrantsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:FairValueMeasurementsRecurringMember2023-12-310001824502us-gaap:MeasurementInputSharePriceMemberachr:PublicWarrantsMember2024-03-310001824502us-gaap:MeasurementInputSharePriceMemberachr:PublicWarrantsMember2023-12-310001824502us-gaap:MeasurementInputSharePriceMember2024-03-310001824502us-gaap:MeasurementInputSharePriceMember2023-12-310001824502us-gaap:MeasurementInputExercisePriceMember2024-03-310001824502us-gaap:MeasurementInputExercisePriceMember2023-12-310001824502us-gaap:MeasurementInputExpectedDividendRateMember2024-03-310001824502us-gaap:MeasurementInputExpectedDividendRateMember2023-12-3100018245022023-01-012023-12-310001824502us-gaap:MeasurementInputPriceVolatilityMember2024-03-310001824502us-gaap:MeasurementInputPriceVolatilityMember2023-12-310001824502us-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001824502us-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberachr:PrivatePlacementWarrantsAndAccruedTechnologyAndDisputeResolutionAgreementMember2023-12-310001824502us-gaap:FairValueInputsLevel3Memberachr:PrivatePlacementWarrantsAndAccruedTechnologyAndDisputeResolutionAgreementMember2024-01-012024-03-310001824502us-gaap:FairValueInputsLevel3Memberachr:PrivatePlacementWarrantsAndAccruedTechnologyAndDisputeResolutionAgreementMember2024-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMemberachr:AccruedTechnologyAndDisputeResolutionAgreementMember2024-01-012024-03-310001824502achr:UnitedAirlinesIncMember2022-08-090001824502achr:UnitedStatesAirForceMember2023-09-190001824502achr:UnitedAirlinesIncMember2024-01-012024-03-310001824502achr:UnitedAirlinesIncMember2023-01-012023-03-310001824502us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001824502us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001824502us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001824502us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001824502us-gaap:WarrantMember2024-01-012024-03-310001824502us-gaap:WarrantMember2023-01-012023-03-310001824502us-gaap:EmployeeStockMember2024-01-012024-03-310001824502us-gaap:EmployeeStockMember2023-01-012023-03-310001824502us-gaap:FurnitureAndFixturesMember2024-03-310001824502us-gaap:FurnitureAndFixturesMember2023-12-310001824502us-gaap:VehiclesMember2024-03-310001824502us-gaap:VehiclesMember2023-12-310001824502us-gaap:ComputerEquipmentMember2024-03-310001824502us-gaap:ComputerEquipmentMember2023-12-310001824502achr:ComputerSoftwareMember2024-03-310001824502achr:ComputerSoftwareMember2023-12-310001824502achr:WebsiteDesignMember2024-03-310001824502achr:WebsiteDesignMember2023-12-310001824502us-gaap:LeaseholdImprovementsMember2024-03-310001824502us-gaap:LeaseholdImprovementsMember2023-12-310001824502us-gaap:ConstructionInProgressMember2024-03-310001824502us-gaap:ConstructionInProgressMember2023-12-310001824502us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001824502us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001824502achr:CreditFacilityMemberachr:SynovusBankLoansMember2024-03-310001824502achr:CreditFacilityMemberachr:SynovusBankLoansMember2023-12-310001824502us-gaap:SecuredDebtMember2023-10-050001824502us-gaap:SecuredDebtMemberachr:SynovusBankLoansMember2023-11-140001824502srt:ScenarioForecastMemberus-gaap:SecuredDebtMemberachr:SynovusBankLoansMember2026-11-140001824502us-gaap:SecuredDebtMemberachr:SecuredOvernightFinancingRateSOFRMember2023-10-052023-10-050001824502us-gaap:SecuredDebtMemberachr:SynovusBankLoansMember2023-10-052023-10-050001824502achr:CreditFacilityMembersrt:MinimumMemberachr:SynovusBankLoansMember2024-03-310001824502achr:CreditFacilityMembersrt:MaximumMemberachr:SynovusBankLoansMember2024-03-310001824502achr:CreditFacilityMemberachr:SynovusBankLoansMember2024-01-012024-03-310001824502us-gaap:LineOfCreditMemberus-gaap:StandbyLettersOfCreditMember2024-03-310001824502achr:FirstBoeingInvestmentMemberus-gaap:PrivatePlacementMemberus-gaap:CommonClassAMember2023-08-100001824502us-gaap:PrivatePlacementMember2023-08-100001824502us-gaap:CommonClassBMember2024-01-012024-03-310001824502achr:AtTheMarketProgramMember2023-11-012023-11-300001824502achr:AtTheMarketProgramMembersrt:MaximumMember2023-11-012023-11-300001824502achr:AtTheMarketProgramMember2024-01-012024-03-310001824502achr:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2022-04-300001824502achr:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2022-06-012022-06-300001824502achr:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2024-01-010001824502us-gaap:EmployeeStockMember2021-08-012021-08-310001824502achr:A2021EmployeeStockPurchasePlanMemberus-gaap:CommonClassAMember2024-01-012024-01-010001824502achr:A2021EmployeeStockPurchasePlanMemberus-gaap:CommonClassAMember2024-03-310001824502us-gaap:EmployeeStockMember2023-12-010001824502us-gaap:EmployeeStockMember2023-12-012023-12-010001824502us-gaap:EmployeeStockMember2024-01-012024-03-310001824502us-gaap:EmployeeStockMember2023-01-012023-03-310001824502us-gaap:EmployeeStockMember2024-03-310001824502achr:AnnualEquityAwardsMember2024-01-012024-03-310001824502achr:AnnualEquityAwardsMember2023-01-012023-03-310001824502us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001824502us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001824502us-gaap:EmployeeStockOptionMember2024-03-310001824502us-gaap:RestrictedStockUnitsRSUMember2023-12-310001824502us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001824502us-gaap:RestrictedStockUnitsRSUMember2024-03-310001824502achr:QuarterlyEquityAwardsMemberus-gaap:RestrictedStockUnitsRSUMemberachr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502achr:QuarterlyEquityAwardsMemberachr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502achr:A2021EquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001824502srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMemberachr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMemberachr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502us-gaap:ShareBasedCompensationAwardTrancheOneMemberachr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502achr:AmendedAndRestated2021PlanMember2024-01-012024-03-310001824502us-gaap:RestrictedStockUnitsRSUMemberachr:AmendedAndRestated2021PlanMember2024-03-262024-03-260001824502achr:PerformanceStockUnitsMembersrt:MinimumMemberachr:AmendedAndRestated2021PlanMember2024-03-262024-03-260001824502srt:MaximumMemberachr:PerformanceStockUnitsMemberachr:AmendedAndRestated2021PlanMember2024-03-262024-03-260001824502achr:PerformanceStockUnitsMemberachr:AmendedAndRestated2021PlanMember2024-03-262024-03-260001824502achr:PerformanceStockUnitsMember2024-03-262024-03-260001824502achr:PerformanceStockUnitsMember2024-03-260001824502us-gaap:RestrictedStockUnitsRSUMember2021-09-162021-09-160001824502us-gaap:RestrictedStockUnitsRSUMember2021-09-160001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2021-09-152021-09-150001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-142022-04-140001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2023-07-132023-07-130001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-130001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2023-07-130001824502us-gaap:CommonClassBMemberus-gaap:RestrictedStockUnitsRSUMember2024-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2024-03-310001824502us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMemberachr:ReversedInJuly2023Member2023-01-012023-03-310001824502us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001824502us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-08-012023-08-310001824502achr:VendorMember2023-08-310001824502us-gaap:WarrantMember2023-12-310001824502us-gaap:WarrantMember2023-01-012023-12-310001824502us-gaap:WarrantMember2024-03-310001824502us-gaap:WarrantMember2024-01-012024-03-3100018245022021-01-290001824502achr:WarrantAgreementMemberachr:UnitedAirlinesIncMember2021-01-292021-01-290001824502achr:WarrantAgreementMemberachr:UnitedAirlinesIncMemberus-gaap:CommonClassAMember2021-01-290001824502achr:WarrantAgreementMemberachr:UnitedAirlinesIncMember2021-01-290001824502achr:SubMilestoneOneMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-092022-08-090001824502achr:SubMilestoneTwoMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-092022-08-090001824502achr:SubMilestoneThreeMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-092022-08-090001824502achr:SubMilestoneThreeMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-090001824502achr:SubMilestoneFourMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-092022-08-090001824502achr:SubMilestoneFourMemberachr:AmendedUnitedWarrantAgreementMemberachr:UnitedAirlinesIncMember2022-08-090001824502achr:SubMilestoneOneAndTwoMember2022-08-090001824502achr:WarrantAgreementMember2023-01-012023-03-310001824502achr:UnitedMember2023-08-012023-08-310001824502achr:StellantisNVMemberus-gaap:CommonClassAMember2023-01-032023-01-030001824502achr:StellantisNVMemberus-gaap:CommonClassAMember2023-01-030001824502achr:StellantisNVMember2023-01-030001824502achr:WarrantExercisablePeriodOneMemberachr:StellantisNVMember2023-01-032023-01-030001824502achr:StellantisNVMemberachr:WarrantExercisablePeriodTwoMember2023-01-032023-01-030001824502achr:WarrantExercisablePeriodThreeMemberachr:StellantisNVMember2023-01-032023-01-030001824502achr:StellantisNVMemberachr:WarrantsForCollaborationAgreementMember2024-01-012024-03-310001824502achr:StellantisNVMemberachr:WarrantsForCollaborationAgreementMember2023-01-012023-03-310001824502achr:StellantisNVMemberus-gaap:CommonClassAMember2023-06-232023-06-230001824502achr:StellantisNVMemberus-gaap:CommonClassAMember2023-06-230001824502us-gaap:CommonStockMemberachr:StellantisNVMember2023-08-102023-08-100001824502achr:PublicWarrantsMember2024-03-310001824502achr:PublicWarrantsMember2024-01-012024-03-310001824502achr:PublicWarrantsMemberus-gaap:CommonClassAMember2024-03-310001824502achr:PrivatePlacementWarrantsMember2024-03-310001824502achr:PrivatePlacementWarrantsMember2024-01-012024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39668

Archer Aviation Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | | 85-2730902 |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) |

| | | |

190 West Tasman Drive, San Jose, CA | | | 95134 |

| (Address of principal executive offices) | | | (Zip Code) |

(650) 272-3233

Registrant's telephone number, including area code

N/A

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

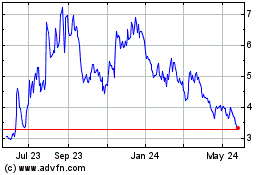

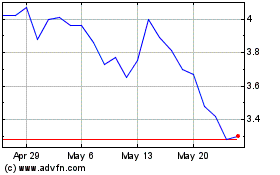

Class A common stock, par value $0.0001 per share | ACHR | New York Stock Exchange |

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share | ACHR WS | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of May 3, 2024, the number of shares of the registrant’s Class A common stock outstanding was 285,344,759, and the number of shares of the registrant’s Class B common stock outstanding was 38,213,136.

Archer Aviation Inc.

Form 10-Q

For the Quarterly Period Ended March 31, 2024

Table of Contents

ARCHER AVIATION INC.

Archer Aviation Inc., a Delaware corporation (prior to the closing of the Business Combination (as defined below), “Legacy Archer”), Atlas Crest Investment Corp., a Delaware Corporation (“Atlas”) and Artemis Acquisition Sub Inc., a Delaware corporation and a direct, wholly-owned subsidiary of Atlas (“Merger Sub”) entered into a merger agreement (the “Business Combination Agreement”) on February 10, 2021, as amended. The transactions contemplated by the terms of the Business Combination Agreement were completed on September 16, 2021 (the “Closing”). Following the Closing, Legacy Archer changed its name from Archer Aviation Inc. to Archer Aviation Operating Corp., and Atlas changed its name from Atlas Crest Investment Corp. to Archer Aviation Inc. and it became the successor registrant with the SEC.

As used in this Quarterly Report on Form 10-Q, unless the context requires otherwise, references to “Archer”, the “Company”, “we”, “us”, and “our”, and similar references refer to Archer Aviation Inc. and its wholly-owned subsidiaries, unless the context otherwise requires).

“Archer” and our other registered and common law trade names and trademarks of ours appearing in this Quarterly Report are our property. This Quarterly Report contains additional trade names and trademarks of other companies. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Quarterly Report”) contains forward-looking statements. All statements, other than statements of present or historical fact, included or incorporated by reference in this Quarterly Report regarding our future financial performance, as well as our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Quarterly Report, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

These forward-looking statements are based on information available as of the date of this Quarterly Report, and current expectations, assumptions, hopes, beliefs, intentions and strategies regarding future events. Accordingly, forward-looking statements in this Quarterly Report and in any document incorporated herein by reference should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include those described in Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 29, 2024 (the “Annual Report”). Readers are urged to carefully review and consider the various disclosures made in this Quarterly Report, the Annual Report, and other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Moreover, new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks and uncertainties, the future events and circumstances discussed in this Quarterly Report and the Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements.

Part I - Financial Information

Item 1. Financial Statements

Archer Aviation Inc.

Consolidated Condensed Balance Sheets

(In millions, except share and per share data; unaudited)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 405.8 | | | $ | 464.6 | |

| Restricted cash | 6.7 | | | 6.9 | |

| Prepaid expenses | 7.7 | | | 7.9 | |

| Other current assets | 1.8 | | | 0.8 | |

| Total current assets | 422.0 | | | 480.2 | |

| Property and equipment, net | 72.1 | | | 57.6 | |

| Intangible assets, net | 0.4 | | | 0.4 | |

| Right-of-use assets | 8.7 | | | 8.9 | |

| Other long-term assets | 7.7 | | | 7.2 | |

| Total assets | $ | 510.9 | | | $ | 554.3 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 14.1 | | | $ | 14.3 | |

| Current portion of lease liabilities | 3.3 | | | 2.8 | |

| Accrued expenses and other current liabilities | 52.8 | | | 96.9 | |

| Total current liabilities | 70.2 | | | 114.0 | |

| Notes payable | 18.1 | | | 7.2 | |

| Lease liabilities, net of current portion | 12.4 | | | 13.2 | |

| Warrant liabilities | 19.1 | | | 39.9 | |

| Other long-term liabilities | 11.9 | | | 12.9 | |

| Total liabilities | 131.7 | | | 187.2 | |

Commitments and contingencies (Note 7) | | | |

| Stockholders’ equity | | | |

Preferred stock, $0.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of March 31, 2024 and December 31, 2023 | — | | | — | |

Class A common stock, $0.0001 par value; 700,000,000 shares authorized; 281,950,734 and 265,617,341 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | — | | | — | |

Class B common stock, $0.0001 par value; 300,000,000 shares authorized; 38,032,375 and 38,165,615 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | — | | | — | |

| Additional paid-in capital | 1,644.5 | | | 1,515.9 | |

| Accumulated deficit | (1,265.3) | | | (1,148.8) | |

| Accumulated other comprehensive loss | — | | | — | |

| Total stockholders’ equity | 379.2 | | | 367.1 | |

Total liabilities and stockholders’ equity | $ | 510.9 | | | $ | 554.3 | |

See accompanying notes to consolidated condensed financial statements.

Archer Aviation Inc.

Consolidated Condensed Statements of Operations

(In millions, except share and per share data; unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating expenses | | | |

| Research and development | $ | 83.5 | | | $ | 65.8 | |

General and administrative | 58.7 | | | 44.1 | |

| Other warrant expense | — | | | 2.1 | |

| Total operating expenses | 142.2 | | | 112.0 | |

| Loss from operations | (142.2) | | | (112.0) | |

Other income (expense), net | 20.6 | | | (2.7) | |

| Interest income, net | 5.3 | | | 1.6 | |

| Loss before income taxes | (116.3) | | | (113.1) | |

| Income tax expense | (0.2) | | | — | |

| Net loss | $ | (116.5) | | | $ | (113.1) | |

| | | |

| Net loss per share, basic and diluted | $ | (0.36) | | | $ | (0.46) | |

| Weighted-average shares outstanding, basic and diluted | 320,256,596 | | | 247,274,541 | |

See accompanying notes to consolidated condensed financial statements.

Archer Aviation Inc.

Consolidated Condensed Statements of Comprehensive Loss

(In millions; unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net loss | $ | (116.5) | | | $ | (113.1) | |

| Other comprehensive income: | | | |

| Unrealized gain on available-for-sale securities, net of tax | — | | | 0.7 | |

| Comprehensive loss | $ | (116.5) | | | $ | (112.4) | |

See accompanying notes to consolidated condensed financial statements.

Archer Aviation Inc.

Consolidated Condensed Statements of Stockholders’ Equity

(In millions, except share data; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | | | Accumulated

Other

Comprehensive

Loss | | |

| Class A | | Class B | | | Accumulated Deficit | | | Total |

| Shares | | Amount | | Shares | | Amount | | | | |

| Balance as of December 31, 2023 | 265,617,341 | | | $ | — | | | 38,165,615 | | | $ | — | | | $ | 1,515.9 | | | $ | (1,148.8) | | | $ | — | | | $ | 367.1 | |

| Conversion of Class B common stock to Class A common stock | 200,000 | | | — | | | (200,000) | | | — | | | — | | | — | | | — | | | — | |

| Issuance of restricted stock units and restricted stock expense | 4,873,123 | | | — | | | — | | | — | | | 34.0 | | | — | | | — | | | 34.0 | |

| Exercise of stock options | 186,529 | | | — | | | 66,760 | | | — | | | — | | | — | | | — | | | — | |

| Issuance of warrants and warrant expense | — | | | — | | | — | | | — | | | 48.9 | | | — | | | — | | | 48.9 | |

| Exercise of warrants | 4,503,845 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Common stock issued under at-the-market program | 6,569,896 | | | — | | | — | | | — | | | 33.9 | | | — | | | — | | | 33.9 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 11.8 | | | — | | | — | | | 11.8 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (116.5) | | | — | | | (116.5) | |

| Balance as of March 31, 2024 | 281,950,734 | | | $ | — | | | 38,032,375 | | | $ | — | | | $ | 1,644.5 | | | $ | (1,265.3) | | | $ | — | | | $ | 379.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | | | Accumulated

Other

Comprehensive

Loss | | |

| Class A | | Class B | | | Accumulated Deficit | | | Total |

| Shares | | Amount | | Shares | | Amount | | | | |

| Balance as of December 31, 2022 | 177,900,738 | | | $ | — | | | 63,738,197 | | | $ | — | | | $ | 1,185.0 | | | $ | (690.9) | | | $ | (0.8) | | | $ | 493.3 | |

| Conversion of Class B common stock to Class A common stock | 2,250,000 | | | — | | | (2,250,000) | | | — | | | — | | | — | | | — | | | — | |

| Issuance of restricted stock units and restricted stock expense | 2,191,898 | | | — | | | — | | | — | | | 18.8 | | | — | | | — | | | 18.8 | |

| Exercise of stock options | 316,116 | | | — | | | 233,190 | | | — | | | 0.1 | | | — | | | — | | | 0.1 | |

| Issuance of warrants and warrant expense | — | | | — | | | — | | | — | | | 6.3 | | | — | | | — | | | 6.3 | |

| Common stock withheld related to net share settlement of equity awards | (786,342) | | | — | | | — | | | — | | | (2.3) | | | — | | | — | | | (2.3) | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 6.3 | | | — | | | — | | | 6.3 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (113.1) | | | — | | | (113.1) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 0.7 | | | 0.7 | |

| Balance as of March 31, 2023 | 181,872,410 | | | $ | — | | | 61,721,387 | | | $ | — | | | $ | 1,214.2 | | | $ | (804.0) | | | $ | (0.1) | | | $ | 410.1 | |

See accompanying notes to consolidated condensed financial statements.

Archer Aviation Inc.

Consolidated Condensed Statements of Cash Flows

(In millions; unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (116.5) | | | $ | (113.1) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation, amortization and other | 2.3 | | | 1.0 | |

| Debt discount and issuance cost amortization | — | | | 0.2 | |

| Stock-based compensation | 40.7 | | | 25.7 | |

| Change in fair value of warrant liabilities and other warrant costs | (20.8) | | | 5.0 | |

| Non-cash lease expense | 0.7 | | | 1.4 | |

| Research and development warrant expense | 2.1 | | | 4.2 | |

| Other warrant expense | — | | | 2.1 | |

| Technology and dispute resolution agreements expense | 5.6 | | | — | |

| Interest income on short-term investments | — | | | (0.2) | |

| Accretion and amortization income of short-term investments | — | | | (2.0) | |

| Changes in operating assets and liabilities: | | | |

| Prepaid expenses | 0.2 | | | 3.0 | |

| Other current assets | (1.1) | | | (0.3) | |

| Other long-term assets | (0.6) | | | (0.6) | |

| Accounts payable | — | | | 2.5 | |

| Accrued expenses and other current liabilities | 1.7 | | | 8.9 | |

| Operating lease right-of-use assets and lease liabilities, net | (0.8) | | | (1.2) | |

| Other long-term liabilities | — | | | (0.3) | |

| Net cash used in operating activities | (86.5) | | | (63.7) | |

| Cash flows from investing activities | | | |

Proceeds from maturities of short-term investments | — | | | 314.0 | |

| Purchase of property and equipment | (17.3) | | | (11.4) | |

Net cash provided by (used in) investing activities | (17.3) | | | 302.6 | |

| Cash flows from financing activities | | | |

| Proceeds from issuance of debt | 11.0 | | | — | |

| Repayment of long-term debt | — | | | (2.5) | |

| Payment of debt issuance costs | (0.1) | | | — | |

| Payments for taxes related to net share settlement of equity awards | — | | | (2.3) | |

| Proceeds from shares issued under at-the-market program | 33.9 | | | — | |

Net cash provided by (used in) financing activities | 44.8 | | | (4.8) | |

Net increase (decrease) in cash, cash equivalents, and restricted cash | (59.0) | | | 234.1 | |

| Cash, cash equivalents, and restricted cash, beginning of period | 471.5 | | | 72.3 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 412.5 | | | $ | 306.4 | |

| | | |

| Supplemental Cash Flow Information: | | | |

| Cash paid for interest | $ | 0.2 | | | $ | 0.3 | |

| Non-cash investing and financing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued expenses | $ | 10.0 | | | $ | 5.8 | |

See accompanying notes to consolidated condensed financial statements.

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

Note 1 - Organization and Nature of Business

Organization and Nature of Business

Archer Aviation Inc. (the “Company”), a Delaware corporation, with its headquarters located in San Jose, California, is an aerospace company. The Company is designing and developing electric vertical takeoff and landing (“eVTOL”) aircraft for use in urban air mobility (“UAM”) networks. The Company’s mission is to unlock the skies, freeing everyone to reimagine how they move and spend time.

The Company’s Planned Lines of Business

Upon receipt of all necessary Federal Aviation Administration (“FAA”) certifications and any other government approvals necessary for the Company to manufacture and operate its aircraft, the Company intends to operate two complementary lines of business. The Company’s core focus is direct-to-consumer offerings (“Archer UAM”) with its secondary focus being business-to-business offerings (“Archer Direct”).

Archer UAM

The Company plans to operate its own UAM ecosystem initially in select major cities. The Company’s UAM ecosystem will operate using its eVTOL aircraft which is currently in development.

Archer Direct

The Company also plans to selectively sell a certain amount of its eVTOL aircraft along with ancillary products and services to third parties.

Note 2 - Liquidity and Going Concern

Since the Company’s formation, the Company has devoted substantial effort and capital resources to the design and development of its planned eVTOL aircraft and UAM network. Funding of these activities has primarily been through the net proceeds received from the issuance of related and third-party debt (Note 6 - Notes Payable), and the sale of preferred and common stock to related and third parties (Note 8 - Preferred and Common Stock). Through March 31, 2024, the Company has incurred cumulative losses from operations, negative cash flows from operating activities, and has an accumulated deficit of $1,265.3 million. As of March 31, 2024, the Company had cash and cash equivalents of $405.8 million, which management believes will be sufficient to fund the Company’s current operating plan for at least the next 12 months from the date these consolidated condensed financial statements were issued.

There can be no assurance that the Company will be successful in achieving its business plans, that the Company’s current capital will be sufficient to support its ongoing business plans, or that any additional financing will be available in a timely manner or on acceptable terms, if at all. If the Company’s business plans require it to raise additional capital, but the Company is unable to do so, it may be required to alter, or scale back its aircraft design, development and certification programs, as well as its manufacturing capabilities, or be unable to fund capital expenditures. Any such events would have a material adverse effect on the Company’s financial position, results of operations, cash flows, and ability to achieve the Company’s intended business plans.

Note 3 - Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated condensed financial statements have been prepared pursuant to the rules and regulations of the SEC for interim financial information. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States (“U.S. GAAP”) for complete financial statements. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of financial position, results of operations, and cash flows for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. The unaudited

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

consolidated condensed financial statements should be read in conjunction with the Company’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2023 set forth in the Company’s Annual Report on Form 10-K filed with the SEC on February 29, 2024. The December 31, 2023 consolidated condensed balance sheet was derived from audited financial statements but does not include all disclosures required by U.S. GAAP.

The Company has provided a discussion of significant accounting policies, estimates, and judgments in the Company’s audited consolidated financial statements. There have been no changes to the Company’s significant accounting policies since December 31, 2023 which are expected to have a material impact on the Company’s financial position, results of operations, or cash flows.

Cash, Cash Equivalents, and Restricted Cash

Cash consists of cash on deposit with financial institutions. Cash equivalents consist of short-term, highly liquid financial instruments that are readily convertible to cash and have maturities of three months or less from the date of purchase. As of March 31, 2024 and December 31, 2023, the Company’s cash and cash equivalents included money market funds of $297.5 million and $339.6 million, respectively.

Restricted cash consists primarily of cash held as security for the Company’s standby letters of credit. Refer to Note 7 - Commitments and Contingencies for further details.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported in the consolidated condensed balance sheets that sum to amounts reported on the consolidated condensed statements of cash flows (in millions):

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Cash and cash equivalents | $ | 405.8 | | | $ | 464.6 | |

| Restricted cash | 6.7 | | | 6.9 | |

| Total cash, cash equivalents, and restricted cash | $ | 412.5 | | | $ | 471.5 | |

Short-Term Investments

The Company had short-term investments in marketable securities with original maturities of less than one year, including United States Treasury securities, corporate debt securities and commercial paper. The Company classifies its marketable securities as available-for-sale at the time of purchase and reevaluates such classification at each balance sheet date. These marketable securities are carried at fair value, and unrealized gains and losses are recorded in other comprehensive loss in the consolidated condensed statements of comprehensive loss, which is reflected as a component of stockholders’ equity. These marketable securities are assessed as to whether those with unrealized loss positions are other than temporarily impaired. The Company considers impairments to be other than temporary if they are related to deterioration in credit risk or if it is likely the securities will be sold before the recovery of their cost basis. If the impairment is deemed other than temporary, the security is written down to its fair value and a loss is recognized in other income (expense), net. Realized gains and losses from the sale of marketable securities and from declines in value deemed to be other than temporary are determined based on the specific identification method and recognized in other income (expense), net in the consolidated condensed statements of operations. As of March 31, 2024 and December 31, 2023, the Company had no short-term investments.

Fair Value Measurements

The Company applies the provisions of Accounting Standards Codification (“ASC”) 820, Fair Value Measurement, which defines a single authoritative definition of fair value, sets out a framework for measuring fair value and expands on required disclosures about fair value measurements. The provisions of ASC 820 relate to financial assets and liabilities as well as other assets and liabilities carried at fair value on a recurring and nonrecurring basis. The standard clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, the standard establishes a three-tier value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date.

Level 2Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability.

Level 3Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at the measurement date.

The carrying amounts of the Company’s cash, accounts payable, accrued compensation, and accrued liabilities approximate their fair values due to the short-term nature of these instruments.

The following tables present information about the Company’s assets and liabilities that are measured at fair value on a recurring basis as of March 31, 2024 and December 31, 2023 and indicate the fair value hierarchy of the valuation inputs the Company utilized to determine such fair value (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 |

| Description | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | |

| Cash equivalents: | | | | | | | | |

| Money market funds | | $ | 297.5 | | | $ | — | | | $ | — | | | $ | 297.5 | |

| | | | | | | | |

| Liabilities: | | | | | | | | |

| Warrant liability – public warrants | | $ | 12.5 | | | $ | — | | | $ | — | | | $ | 12.5 | |

| Warrant liability – private placement warrants | | $ | — | | | $ | — | | | $ | 6.6 | | | $ | 6.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2023 |

| Description | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | |

| Cash equivalents: | | | | | | | | |

| Money market funds | | $ | 339.6 | | | $ | — | | | $ | — | | | $ | 339.6 | |

| | | | | | | | |

| Liabilities: | | | | | | | | |

| Warrant liability – public warrants | | $ | 25.4 | | | $ | — | | | $ | — | | | $ | 25.4 | |

| Warrant liability – private placement warrants | | $ | — | | | $ | — | | | $ | 14.5 | | | $ | 14.5 | |

| Accrued technology and dispute resolutions agreements liability | | $ | — | | | $ | — | | | $ | 44.0 | | | $ | 44.0 | |

Cash Equivalents

The Company’s cash equivalents consist of short-term, highly liquid financial instruments that are readily convertible to cash and have maturities of three months or less from the date of purchase. The Company classifies its money market funds as Level 1, because they are valued based on quoted market prices in active markets.

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

The following table presents a summary of the Company’s cash equivalents as of March 31, 2024 and December 31, 2023 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of March 31, 2024 |

| Description | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Cash equivalents: | | | | | | | | |

| Money market funds | | $ | 297.5 | | | $ | — | | | $ | — | | | $ | 297.5 | |

| Total | | $ | 297.5 | | | $ | — | | | $ | — | | | $ | 297.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2023 |

| Description | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Cash equivalents: | | | | | | | | |

| Money market funds | | $ | 339.6 | | | $ | — | | | $ | — | | | $ | 339.6 | |

| Total | | $ | 339.6 | | | $ | — | | | $ | — | | | $ | 339.6 | |

Public Warrants

The measurement of the public warrants as of March 31, 2024 is classified as Level 1 due to the use of an observable market quote in an active market under the ticker “ACHR WS”. The quoted price of the public warrants was $0.72 and $1.46 per warrant as of March 31, 2024 and December 31, 2023, respectively.

Private Placement Warrants

The Company utilizes a Monte Carlo simulation model for the private placement warrants at each reporting period, with changes in fair value recognized in the consolidated condensed statements of operations. The estimated fair value of the private placement warrant liability is determined using Level 3 inputs. Inherent in a Monte Carlo simulation model are assumptions related to expected share-price volatility, expected life, risk-free interest rate, and dividend yield.

The key inputs into the Monte Carlo simulation model for the private placement warrants are as follows:

| | | | | | | | | | | | | | |

| Input | | March 31,

2024 | | December 31,

2023 |

| Stock price | | $ | 4.62 | | | $ | 6.14 | |

| Strike price | | $ | 11.50 | | | $ | 11.50 | |

| Dividend yield | | 0.0 | % | | 0.0 | % |

| Term (in years) | | 2.5 | | 2.7 |

| Volatility | | 65.5 | % | | 70.2 | % |

| Risk-free rate | | 4.5 | % | | 4.0 | % |

Accrued Technology and Dispute Resolution Agreements Liability

Under the Technology and Dispute Resolution Agreements, the Company recognized an accrued technology and dispute resolution agreements liability related to the Wisk Warrant (capitalized terms defined below). See Note 7 - Commitments and Contingencies for further details. The Company utilizes a Monte Carlo simulation model for the accrued technology and dispute resolution agreements liability at each reporting period, with changes in fair value recognized in the consolidated condensed statements of operations. The estimated fair value of the accrued technology and dispute resolution agreements liability is determined using Level 3 inputs. Inherent in a Monte Carlo simulation model are assumptions related to expected share-price volatility, expected life, risk-free interest rate, and dividend yield.

The key inputs into the Monte Carlo simulation model for the accrued technology and dispute resolution agreements liability are as follows:

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

| | | | | | | | |

| Input | | December 31, 2023 |

| Stock price | | $ | 6.14 | |

| Strike price | | $ | 0.01 | |

| Dividend yield | | 0.0 | % |

| Term (in years) | | 0.1 |

| Volatility | | 60.0 | % |

| Risk-free rate | | 5.4 | % |

The following table presents the change in fair value of the Company’s Level 3 private placement warrants and accrued technology and dispute resolution agreements liability during the three months ended March 31, 2024 (in millions):

| | | | | |

Balance as of December 31, 2023 | $ | 58.5 | |

| Change in fair value | 2.4 | |

Less: settlement of accrued technology and dispute resolution agreements liability | (54.3) | |

Balance as of March 31, 2024 | $ | 6.6 | |

In connection with the change in fair value of the Company’s private placement warrants, the Company recognized a gain of $7.9 million and a loss of $2.1 million within other income (expense), net in the consolidated condensed statements of operations during the three months ended March 31, 2024 and 2023, respectively. Refer to Note 11 - Liability Classified Warrants for additional information about the public and private placement warrants.

In connection with the change in fair value of the accrued technology and dispute resolution agreements liability, the Company recognized a loss of $10.3 million within general and administrative expenses in the consolidated condensed statements of operations during the three months ended March 31, 2024. Refer to Note 7 - Commitments and Contingencies for additional information about the accrued technology and dispute resolution agreements liability.

Financial Instruments Not Recorded at Fair Value on a Recurring Basis

Certain financial instruments, including debt, are not measured at fair value on a recurring basis in the consolidated condensed balance sheets. The fair value of debt as of March 31, 2024 approximates its carrying value (Level 2). Refer to Note 6 - Notes Payable for additional information.

Assets and Liabilities Recorded at Fair Value on a Non-Recurring Basis

Certain assets and liabilities are subject to measurement at fair value on a non-recurring basis if there are indicators of impairment or if they are deemed to be impaired as a result of an impairment review.

Intangible Assets, Net

Intangible assets consist solely of domain names and are recorded at cost, net of accumulated amortization, and if applicable, impairment charges. Amortization of domain names is provided over a 15-year estimated useful life on a straight-line basis or based on the pattern in which economic benefits are consumed, if reliably determinable. The Company reviews intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company has analyzed a variety of factors to determine if any circumstance could trigger an impairment loss, and, at this time and based on the information presently known, no event has occurred and indicated that it is more likely than not that an impairment loss has been incurred. Therefore, the Company did not record any impairment charges for its intangible assets for the three months ended March 31, 2024 and 2023.

As of March 31, 2024 and December 31, 2023, the net carrying amounts for domain names were $0.4 million and $0.4 million, respectively, and were recorded in the Company’s consolidated condensed balance sheets.

Cloud Computing Arrangements

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

The Company capitalizes certain implementation costs incurred in the application development stage of projects related to its cloud computing arrangements that are service contracts. Capitalized implementation costs are recognized in other long-term assets in the consolidated condensed balance sheets and amortized on a straight-line basis over the fixed, noncancellable term of the associated hosting arrangement plus any reasonably certain renewal periods. Costs related to preliminary project activities and post-implementation activities are expensed as incurred. As of March 31, 2024 and December 31, 2023, the net carrying amounts of the Company’s capitalized cloud computing implementation costs were $6.7 million and $6.4 million, respectively.

Contract Liabilities

The Company records contract liabilities related to differences between the timing of cash receipts from the customer and the recognition of revenue. As of March 31, 2024 and December 31, 2023, the Company’s contract liability balances were $10.8 million and $10.8 million, respectively, and recorded in other long-term liabilities in the Company’s consolidated condensed balance sheets. As of March 31, 2024 and December 31, 2023, the Company’s contract liabilities consisted of a $10.0 million pre-delivery payment received from United Airlines, Inc. (“United”) under the terms of the Amended United Purchase Agreement (defined below) (see Note 9 - Stock-Based Compensation), and a $0.8 million installment payment received under a contract order with the United States Air Force for the design, development, and ground test of the Company’s production aircraft, Midnight. No revenues were recognized during the three months ended March 31, 2024 and 2023.

Net Loss Per Share

Basic net loss per share is calculated by dividing net loss attributable to common stockholders by the weighted-average number of common shares outstanding. For all periods presented, the calculation of basic net loss per share excludes shares issued upon the early exercise of stock options where the vesting conditions have not been satisfied. Common stock purchased pursuant to an early exercise of stock options is not deemed to be outstanding for accounting purposes until those shares vest. The Company also excludes unvested shares subject to repurchase in the number of shares outstanding in the consolidated condensed balance sheets and statements of stockholders’ equity.

Because the Company reported net losses for all periods presented, diluted loss per share is the same as basic loss per share.

Contingently issuable shares, including equity awards with performance conditions, are considered outstanding common shares and included in the computation of basic net loss per share as of the date that all necessary conditions to earn the awards have been satisfied. Prior to the end of the contingency period, the number of contingently issuable shares included in diluted net loss per share is based on the number of shares, if any, that would be issuable under the terms of the arrangement at the end of the reporting period.

Because the Company reported net losses for all periods presented, all potentially dilutive common stock equivalents are antidilutive and have been excluded from the calculation of net loss per share. The diluted net loss per common share was the same for Class A and Class B common shares because they are entitled to the same liquidation and dividend rights.

The following table presents the number of antidilutive shares excluded from the calculation of diluted net loss per share:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Options to purchase common stock | 2,915,738 | | | 4,722,137 | |

| Unvested restricted stock units | 35,015,943 | | | 44,265,187 | |

| Warrants | 47,011,560 | | | 43,347,301 | |

Shares issuable under the Employee Stock Purchase Plan (Note 9) | 1,091,452 | | | 641,727 | |

| Total | 86,034,693 | | | 92,976,352 | |

Comprehensive Loss

Comprehensive loss includes all changes in equity during the period from non-owner sources. The Company’s comprehensive loss consists of its net loss and its unrealized gains or losses on available-for-sale securities.

Recent Accounting Pronouncements

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

Recently Issued Accounting Pronouncements Not Yet Adopted

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which expands reportable segment disclosure requirements through enhanced disclosures about significant segment expenses, interim segment profit or loss and assets, and how the Chief Operating Decision Maker uses reported segment profit or loss information in assessing segment performance and allocating resources. The update is effective for annual periods beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024 on a retrospective basis. Early adoption is permitted. The Company is currently evaluating the impact of ASU 2023-07 on its disclosures within its consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires disclosure of incremental income tax information related to the income tax rate reconciliation and expanded disclosures of income taxes paid, among other disclosure requirements. The update is effective for annual periods beginning after December 15, 2024 on a prospective basis, and retrospective application is permitted. The Company is currently evaluating the impact of ASU 2023-09 on its disclosures within its consolidated financial statements.

Note 4 - Property and Equipment, Net

Property and equipment, net, consisted of the following (in millions):

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Furniture, fixtures, and equipment | $ | 9.0 | | | $ | 7.9 | |

| Vehicles | 0.1 | | | 0.1 | |

| Computer hardware | 5.4 | | | 5.3 | |

| Computer software | 1.5 | | | 1.5 | |

| Website design | 0.8 | | | 0.8 | |

| Leasehold improvements | 32.5 | | | 33.0 | |

| Construction in progress | 33.5 | | | 18.4 | |

| Total property and equipment | 82.8 | | | 67.0 | |

| Less: Accumulated depreciation | (10.7) | | | (9.4) | |

| Total property and equipment, net | $ | 72.1 | | | $ | 57.6 | |

Construction in progress includes costs incurred for the Company’s manufacturing facilities to be constructed in Covington, Georgia and other assets that have not yet been placed in service.

The following table presents depreciation expense included in each respective expense category in the consolidated condensed statements of operations (in millions):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Research and development | $ | 2.0 | | | $ | 0.7 | |

| General and administrative | 0.1 | | | 0.2 | |

| Total depreciation expense | $ | 2.1 | | | $ | 0.9 | |

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

Note 5 - Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in millions):

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Accrued professional fees | $ | 9.8 | | | $ | 9.5 | |

| Accrued employee costs | 12.7 | | | 16.7 | |

| Accrued parts and materials | 15.9 | | | 12.1 | |

| Taxes payable | 1.3 | | | 1.4 | |

| Accrued capital expenditures | 8.6 | | | 9.2 | |

| Accrued cloud computing implementation costs | 0.4 | | | 0.3 | |

Accrued technology and dispute resolution agreements liability (Note 7) | — | | | 44.0 | |

| Other current liabilities | 4.1 | | | 3.7 | |

| Total | $ | 52.8 | | | $ | 96.9 | |

Note 6 - Notes Payable

The Company’s notes payable consisted of the following (in millions):

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| Synovus Bank Loan | $ | 18.5 | | | $ | 7.5 | |

| Loan unamortized discount and loan issuance costs | (0.4) | | | (0.3) | |

| Total debt, net of discount and loan issuance costs | 18.1 | | | 7.2 | |

| Less current portion, net of discount and loan issuance costs | — | | | — | |

| Total long-term notes payable, net of discount and loan issuance costs | $ | 18.1 | | | $ | 7.2 | |

Synovus Bank Loan

On October 5, 2023, the Company entered into a credit agreement (the “Credit Agreement”) with Synovus Bank, as administrative agent and lender, and the additional lenders (the “Lenders”) from time to time. The Company may request the Lenders to provide multiple term loan advances (together, the “Loan”) in an aggregate principal amount of up to $65.0 million for the construction and development of the Company’s manufacturing facility in Covington, Georgia.

The Company is required to make 120 monthly interest payments from November 14, 2023 until maturity, and 84 equal monthly principal installments from November 14, 2026 until maturity. The Credit Agreement matures on the earlier of October 5, 2033 or the date on which the outstanding Loan has been declared or automatically becomes due and payable pursuant to the terms of the Credit Agreement.

The interest rate on the Loan is a floating rate per annum equal to secured overnight financing rate (as defined in the Credit Agreement) plus the applicable margin of 2.0%, which increases by 5.0% per annum upon the occurrence of an event of default.

The Company’s obligations under the Credit Agreement are secured by funds in a collateral account and the Credit Agreement is guaranteed by the Company’s domestic subsidiaries. The Company may prepay with certain premium that links to the passage of time, and in certain circumstances would be required to prepay the Loan under the Credit Agreement without payment of a premium. The Credit Agreement contains customary representations and warranties, customary affirmative and negative covenants, and customary events of default. As of March 31, 2024, the Company was in compliance with all the covenants of the Credit Agreement.

The Company has drawn down $18.5 million of the Loan as of March 31, 2024. The effective interest rate for the draw downs ranged from 7.6% to 8.1% as of March 31, 2024. The loan issuance costs will be amortized to interest expense over the contractual term of the Loan. During the three months ended March 31, 2024, the Company recognized interest expense of $0.3 million, including an immaterial amount related to the amortization of issuance costs within interest income, net in the

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

consolidated condensed statements of operations. The carrying value of the Loan, net of unamortized issuance costs of $0.4 million, was $18.1 million as of March 31, 2024.

The future scheduled principal maturities of the Loan as of March 31, 2024 are as follows (in millions):

| | | | | |

Remaining 2024 | $ | — | |

| 2025 | — | |

| 2026 | $ | 0.1 | |

| 2027 | $ | 0.7 | |

| 2028 | $ | 0.7 | |

| Thereafter | $ | 17.0 | |

| $ | 18.5 | |

Note 7 - Commitments and Contingencies

Operating Leases

The Company leases office, lab, hangar, and storage facilities under various operating lease agreements with lease periods expiring between 2024 and 2030 and generally containing periodic rent increases and various renewal and termination options.

The Company’s lease costs were as follows (in millions):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating lease cost | $ | 1.2 | | | $ | 1.8 | |

| Short-term lease cost | 0.1 | | | — | |

| Total lease cost | $ | 1.3 | | | $ | 1.8 | |

The Company’s weighted-average remaining lease term and discount rate as of March 31, 2024 and 2023 were as follows:

| | | | | | | | | | | |

| 2024 | | 2023 |

| Weighted-average remaining lease term (in months) | 53 | | 48 |

| Weighted-average discount rate | 14.6 | % | | 13.9 | % |

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

The minimum aggregate future obligations under the Company’s non-cancelable operating leases as of March 31, 2024 were as follows (in millions):

| | | | | |

Remaining 2024 | $ | 4.6 | |

| 2025 | 5.7 | |

| 2026 | 4.7 | |

| 2027 | 2.1 | |

| 2028 | 2.2 | |

| Thereafter | 4.4 | |

| Total future lease payments | 23.7 | |

| Less: leasehold improvement allowance | (1.1) | |

| Total net future lease payments | 22.6 | |

| Less: imputed interest | (6.9) | |

| Present value of future lease payments | $ | 15.7 | |

Supplemental cash flow information and non-cash activities related to right-of-use assets and lease liabilities were as follows (in millions):

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating cash outflows from operating leases | $ | 1.1 | | | $ | 1.6 | |

| Operating lease liabilities from obtaining right-of-use assets | $ | 0.3 | | | $ | 0.1 | |

Finance Lease

In February 2023, the Company entered into a lease arrangement with the Newton County Industrial Development Authority (the “Authority”) for the Company’s manufacturing facilities to be constructed in Covington, Georgia. In connection with the lease arrangement, the Authority issued a taxable revenue bond (the “Bond”), which was acquired by the Company. The arrangement is structured so that the Company’s lease payments to the Authority equal and offset the Authority’s bond payments to the Company. Accordingly, the Company offsets the finance lease obligation and the Bond on its consolidated condensed balance sheets.

Letters of Credit

As of March 31, 2024, the Company had standby letters of credit in the aggregate outstanding amount of $5.7 million, secured with restricted cash.

Litigation

During the ordinary course of the business, the Company may be subject to legal proceedings, various claims, and litigation. Such proceedings can be costly, time consuming, and unpredictable, and therefore, no assurance can be given that the final outcome of such proceedings will not materially impact the Company’s financial condition or results of operations.

Wisk Litigation and Settlement

On April 6, 2021, Wisk Aero LLC (“Wisk”) brought a lawsuit against the Company in the United States District Court for the Northern District of California alleging misappropriation of trade secrets and patent infringement. The Company filed certain counterclaims for defamation, tortious interference and unfair competition.

On August 10, 2023, the Company, the Boeing Company (“Boeing”) and Wisk entered into a series of agreements that provide for, among other things, certain investments by Boeing into the Company and an autonomous flight technology collaboration between Wisk and the Company, the issuance of certain warrants to Wisk and resolution of the federal and state court litigation between the parties (the “Technology and Dispute Resolution Agreements”).

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

Pursuant to a private placement transaction entered into by the Company on August 10, 2023, Boeing subscribed to purchase shares of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”), and received registration rights with respect to such shares of Common Stock and the shares of Common Stock underlying the Wisk Warrant (as defined below) pursuant to a registration rights agreement.

Pursuant to the Technology and Dispute Resolution Agreements, the Company issued Wisk a warrant to purchase up to 13,176,895 shares of Common Stock with an exercise price of $0.01 per share (the “Wisk Warrant”). The Wisk Warrant has now vested and became exercisable, subject to the terms and conditions of the underlying warrant agreement, for the full amount of such shares.

The Company recorded the initial vested share tranche within equity at its fair value. The Company recognized technology and dispute resolution agreements expense for the initial vested tranche upon issuance. The Company recorded the unvested portion of the Wisk Warrant as liabilities at their fair value and adjusts the warrants to fair value at each reporting period. This liability is subject to remeasurement at each balance sheet date until exercised, and any change in fair value is recognized as a gain or loss in the Company’s consolidated condensed statements of operations. The initial offsetting entry to the warrant liability was technology and dispute resolution agreements expense. During the three months ended March 31, 2024, the Company recorded a loss of $10.3 million to recognize the change in fair value of the warrant upon issuance and recorded the outstanding warrant within equity at its fair value.

Note 8 - Preferred and Common Stock

Preferred Stock

As of March 31, 2024, no shares of preferred stock were outstanding, and the Company has no present plans to issue any shares of preferred stock.

Class A and Class B Common Stock

Except for voting rights and conversion rights, or as otherwise required by applicable law, the shares of the Company’s Class A common stock and Class B common stock have the same powers, preferences, and rights and rank equally, share ratable and are identical in all respects as to all matters. The rights, privileges, and preferences are as follows:

Voting

Holders of the Company’s Class A common stock are entitled to one vote per share on all matters to be voted upon by the stockholders, and holders of Class B common stock are entitled to ten votes per share on all matters to be voted upon by the stockholders. The holders of Class A common stock and Class B common stock will generally vote together as a single class on all matters submitted to a vote of the stockholders, unless otherwise required by Delaware law or the Company’s amended and restated certificate of incorporation.

Dividends

Holders of Class A common stock and Class B common stock are entitled to receive such dividends, if any, as may be declared from time to time by the Company’s Board of Directors in its discretion out of funds legally available therefor. No dividends on common stock have been declared by the Company’s Board of Directors through March 31, 2024, and the Company does not expect to pay dividends in the foreseeable future.

Preemptive Rights

Stockholders have no preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to Class A common stock and Class B common stock.

Conversion

Each share of Class B common stock is convertible at any time at the option of the holder into one share of Class A common stock. In addition, each share of Class B common stock will automatically convert into one share of Class A common

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

stock upon transfer to a non-authorized holder. In addition, Class B common stock is subject to “sunset” provisions, under which all shares of Class B common stock will automatically convert into an equal number of shares of Class A common stock upon the earliest to occur of (i) the ten-year anniversary of the closing of the Business Combination, (ii) the date specified by the holders of two-thirds of the then outstanding Class B common stock, voting as a separate class, and (iii) when the number of Class B common stock represents less than 10% of the aggregate number of Class A common stock and Class B common stock then outstanding. In addition, each share of Class B common stock will automatically convert into an equal number of Class A common stock upon the earliest to occur of (a) in the case of a founder of the Company, the date that is nine months following the death or incapacity of such founder, and, in the case of any other holder, the date of the death or incapacity of such holder, (b) in the case of a founder of the Company, the date that is 12 months following the date that such founder ceases to provide services to the Company and its subsidiaries as an executive officer, employee or director of the Company, and, in the case of any other holder, immediately at the occurrence of any such event, and (c) in the case of a founder of the Company or any other holder, at least 80% (subject to customary capitalization adjustments) of the Class B common stock held by such founder or holder (on a fully as converted/as exercised basis) as of immediately following the closing of the Business Combination having been transferred (subject to exceptions for certain permitted transfers).

During the three months ended March 31, 2024 and 2023, 200,000 and 2,250,000 shares of Class B common stock were converted into Class A common stock, respectively.

Liquidation

In the event of the Company’s voluntary or involuntary liquidation, dissolution, distribution of assets or winding-up, subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of the Company’s common stock will be entitled to receive an equal amount per share of all of the Company’s assets of whatever kind available for distribution to stockholders, after the rights of the holders of any preferred stock have been satisfied.

At-The-Market Program

In November 2023, the Company entered into an Open Market Sales AgreementSM (the “Sales Agreement”) with Cantor Fitzgerald & Co., as the sales agent, pursuant to which the Company may offer and sell shares of the Company’s Class A common stock having an aggregate offering amount of up to $70.0 million (the “ATM Program”). The Company will pay Cantor Fitzgerald & Co. a commission rate of up to 3.0% of the gross proceeds from the sale of any shares of Class A common stock pursuant to the ATM Program. During the three months ended March 31, 2024, the Company sold 6,569,896 shares of Class A common stock for net proceeds of $33.9 million. As of March 31, 2024, the Company had $14.6 million remaining eligible for sale under the ATM Program.

Note 9 - Stock-Based Compensation

Amended and Restated 2021 Plan

In August 2021, the Company adopted the 2021 Equity Incentive Plan (the “2021 Plan”), which was approved by the stockholders of the Company in September 2021 and became effective immediately upon the closing of the Business Combination. In April 2022, the Company amended and restated the 2021 Plan (the “Amended and Restated 2021 Plan”), which was approved by the stockholders of the Company in June 2022. The aggregate number of shares of Class A common stock that may be issued under the plan increased to 34,175,708. In addition, the number of shares of Class A common stock reserved for issuance under the Amended and Restated 2021 Plan will automatically increase on January 1st of each year following this amendment, starting on January 1, 2023 and ending on (and including) January 1, 2031, in an amount equal to the lesser of (i) 5.0% of the total number of shares of Class A and Class B common stock outstanding on December 31 of the preceding year, or (ii) a lesser number of shares of Class A common stock determined by the Board of Directors prior to the date of the increase (the “EIP Evergreen Provision”). The EIP Evergreen Provision is calculated using the number of legally outstanding shares of common stock and includes shares, such as unvested shares pursuant to early exercised stock options, that are not considered outstanding for accounting purposes. In accordance therewith, the number of shares of Class A common stock reserved for issuance under the Amended and Restated 2021 Plan increased by 15,320,111 shares on January 1, 2024. The Amended and Restated 2021 Plan provides for the grant of incentive and non-statutory stock options, stock appreciation rights,

Archer Aviation Inc.

Notes to Consolidated Condensed Financial Statements (Unaudited)

restricted stock awards, restricted stock units, performance awards, and other awards to employees, directors, and non-employees.