Artisan Partners International Value Group Update

October 07 2024 - 8:34AM

Artisan Partners Asset Management Inc. (NYSE: APAM) announced today

the addition of Brian Louko as portfolio manager and Scott Bartley

as director on the Artisan Partners International Value Group. In

the coming months, Mr. Louko will build out the team and launch a

strategy focused on global special situations and flexible capital

opportunities.

The new strategy represents a natural expansion of degrees of

investment freedom for the International Value Group. Mr. Louko

will lead an investment team located in Boston focused on the

principles of value investing with the objective of generating

long-term wealth-building returns. David Samra, Founding Portfolio

Manager of the International Value Group, will serve in an advisory

capacity to Mr. Louko for the new strategy.

Prior to joining Artisan, Mr. Louko was a director at Benefit

Street Partners, where he focused on distressed and special

situations investing. Prior to that, he served as a research

analyst at MAST Capital Management, advisor and CFO at Embed.ly, as

well as director of capital markets credit risk at Fidelity

Investments. Mr. Louko holds a bachelor’s degree in business with a

focus on finance/accounting from Northeastern University and a

master’s degree in business administration from Columbia Business

School.

Mr. Bartley was previously a director at Paceline Equity

Partners, where he led the corporate credit origination team, which

is responsible for sourcing, negotiating and underwriting private

loans to middle market borrowers across a broad range of industries

and sectors. Prior to that, he held various positions, including at

MAST Capital Management and Advent International, sourcing and

evaluating potential long and short equity, high yield, leveraged

loan and distressed opportunities for investment. Mr. Bartley holds

a bachelor’s degree in economics from Brown University.

Regarding Mr. Louko’s and Mr. Bartley’s joining the Artisan

Partners International Value Group, Mr. Samra said, “For many years

we have tried to find the correct structure and the right talent

that would allow us to take advantage of select situations that

present alternative capital opportunities and offer the potential

for equity-like returns. We believe that Brian and Scott are well

positioned to lead that effort.”

Artisan Partners President Jason Gottlieb added, “We are excited

for this opportunity to further build upon our first-generation

International Value Group with this unique alternative investing

strategy, led by Brian Louko. Brian brings a thoughtful and

complementary value lens and utilizes additional degrees of freedom

through an expansive investment opportunity set beyond equities,

which we believe will be additive to the International Value

Group.”

About Artisan Partners Artisan Partners is a

global investment management firm that provides a broad range of

high value-added investment strategies in growing asset classes to

sophisticated clients around the world. Since 1994, the firm has

been committed to attracting experienced, disciplined investment

professionals to manage client assets. Artisan Partners’ autonomous

investment teams oversee a diverse range of investment strategies

across multiple asset classes. Strategies are offered through

various investment vehicles to accommodate a broad range of client

mandates.

Press InquiriesEileen

Kwei800.399.1770eileen.kwei@artisanpartners.com

Investments will rise and fall with market fluctuations

and investor capital is at risk. International investments involve

special risks, including currency fluctuation, lower liquidity,

different accounting methods and economic and political systems,

and higher transaction costs that may cause a loss of principal.

Fixed income securities carry interest rate risk and credit risk

for both the issuer and counterparty and investors may lose

principal value. In general, when interest rates rise, fixed income

values fall. High income securities are speculative, experience

greater price volatility and have a higher degree of credit and

liquidity risk than bonds with a higher credit rating. Value

securities may underperform other asset types during a given

period.

Artisan Partners Limited Partnership (APLP) is an investment

adviser registered with the U.S. Securities and Exchange Commission

(SEC). Artisan Partners UK LLP (APUK) is authorized and regulated

by the Financial Conduct Authority and is a registered investment

adviser with the SEC. APEL Financial Distribution Services Limited

(AP Europe) is regulated by the Central Bank of Ireland. APLP, APUK

and AP Europe are collectively, with their parent company and

affiliates, referred to as Artisan Partners herein.

This announcement is for information purposes only and does not

constitute an offer, an invitation or a solicitation for investment

or subscription for shares of funds or investment services in any

country. Any person who is in possession of this material is hereby

notified that no action has or will be taken that would allow an

offering of any Artisan Partners product or service unless in

compliance with local regulations. Neither this announcement nor

any other material relative to this announcement have been

submitted to any local regulatory authority for prior review or

approval. This material is intended for the recipient’s information

and use only and may not be distributed or made available (in whole

or in part) in any local jurisdiction, directly or indirectly,

except as permitted by local law and regulation.

© 2024 Artisan Partners. All rights reserved.

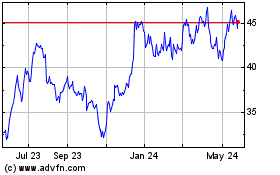

Artisan Partners Asset M... (NYSE:APAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

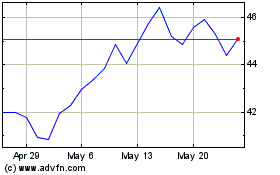

Artisan Partners Asset M... (NYSE:APAM)

Historical Stock Chart

From Feb 2024 to Feb 2025