BILL Extends Leadership in Payments with New Capabilities to Deliver More Choice and Faster Speed for SMBs and Accountants

September 25 2024 - 7:55AM

Business Wire

Innovative offerings provide businesses with

more flexibility, control, and access to capital

BILL (NYSE:BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today announced new payment

offerings for SMBs and accountants to make payments faster, easier,

and more secure. The new capabilities, which are part of BILL’s

powerful payments engine, include a new international payment

option, Local Transfer, as well as enhancements to BILL’s Instant

Payment and Invoice Financing payment offerings.

“SMBs are increasingly facing more complexity as they make

payments to vendors, partners, and customers both locally and

around the world,” said Mary Kay Bowman, EVP, GM of Payments and

Financial Services at BILL. “This is why BILL continues to enhance

our payment experiences to give SMBs more flexibility to make the

payment choices businesses need and to manage and optimize their

cash flow. BILL's sophisticated payment infrastructure gives SMBs

the ability to meet unique customer and supplier payment needs,

while accelerating payment speed and reducing risk.”

Send International Funds in Local Currency Faster with Local

Transfer

Local Transfer, a new BILL Accounts Payable option, empowers

businesses to make faster same-day international payments to

vendors in their local currency without the need to go through

intermediary banks and incur the associated fees. Transactions via

BILL’s Local Transfer option are delivered directly to local banks

abroad, enabling businesses to pay overseas vendors ‘like a local’

from anywhere in the world.

Key benefits include:

- Faster international payments: Local Transfer payments

in local currency can arrive as soon as the same day. They can be

delivered up to 4 days faster than FX (foreign exchange) wires, and

up to 3 days faster than USD wires sent via BILL.

- Save money and minimize exchange rate risk: Faster

international payments enhance cash flow efficiency and limit the

possibility of currency fluctuations, which helps minimize exchange

rate exposure. Businesses pay no intermediary bank fees or wire

fees for payments made in a vendor’s local currency. Vendors also

receive local currency payments sent via Local Transfer without

incurring a wire receiving fee. Exchange rates may apply.

- Save time and increase productivity: Businesses can

centralize international and domestic payments through one secure,

synchronized financial operations platform.

Enhanced Payments Capabilities Expand Breadth of Payment

Choices

New enhancements to BILL’s payments experience provide

businesses with more flexibility, control, and access to capital to

help SMBs better manage and optimize their cash flow.

- Send payments in real time: Businesses can now send

payments to their vendors in the U.S. within minutes with the new

BILL Accounts Payable Instant Payment option, which leverages a

real-time payment network between financial institutions. Payments

can be sent and received instantly, 24/7, and on holidays or

weekends, allowing businesses to maximize cash flow in real

time.

- Get easier access to capital: BILL Accounts Receivable

Invoice Financing* is a short-term line of credit. Businesses that

get paid with BILL can receive an advance against outstanding

invoices and improve their cash flow. A new simplified Invoice

Financing process allows businesses to access up to $100,000 in

financing in as little as 5-10 minutes** after completing a

one-time, easy credit line approval process that does not affect

their credit score. Businesses can avoid waiting 30+ days to get

paid, and no additional application is needed for subsequent

financing requests.

SMBs and Accountants See Value in BILL’s Robust Payment

Offerings

Robert Bess, CEO of DayOne Solutions "At DayOne

Solutions, the speed of international payments is one of our top

priorities. We pay our contractors in the Philippines in their

local currency, the peso, and it would take an average of 5 to 7

days from the invoice date for them to receive their money. We were

thrilled to discover BILL’s international payment capability Local

Transfer that has helped us speed up our payments to same-day

delivery. BILL has effectively given me and my overseas team 3 to 5

days back. The process is now so straightforward and fast—I simply

review and pay."

Patrick Curtis, CPA, CGMA, Shareholder at Rubino

“BILL is a requirement for our clients and is an important part of

our Rubino CAS technology stack. We tell clients, ‘This is our tech

stack, and BILL is a part of that.’ We drive that change. Our

clients appreciate that BILL’s payment choices provide security,

flexibility, and control for their payment needs. BILL’s payment

capabilities make clients—and us—feel confident about using BILL.

BILL has become a vital capability for Rubino’s clients.”

Availability

- BILL’s Local Transfer option for international payments is

currently available in 15 countries and will soon become available

in 40 countries.

- Enhancements to Instant Payment and Invoice Financing are

available now. To get started today, request a demo here.

* BILL Invoice Financing line of credit is issued by WebBank and

offered through Bill.com Capital 3, LLC. See FAQs for more details.

** Requires an eligible bank account that supports instant

payments. Payments made to non-eligible accounts will be delivered

via ACH, which typically arrive in 1-2 business days.

About BILL

BILL (NYSE:BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240925536798/en/

Press Contact: John Welton john.welton@hq.bill.com

IR Contact: Karen Sansot ksansot@hq.bill.com

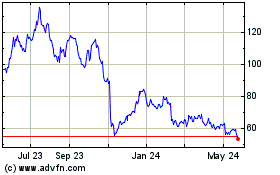

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

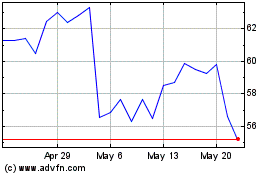

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025