UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 20, 2024

CONSOL Energy Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38147 |

|

82-1954058 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

| 275 Technology Drive Suite 101 |

| Canonsburg, Pennsylvania 15317 |

| (Address of principal executive offices) |

| (Zip code) |

Registrant’s telephone number, including area code:

(724) 416-8300

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

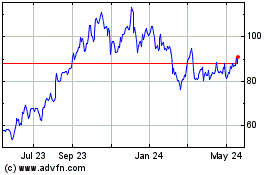

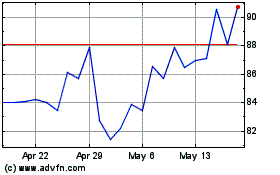

| Common Stock, $0.01 par value |

|

CEIX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On August 20, 2024, CONSOL Energy Inc., a Delaware corporation (“CONSOL”), entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Mountain Range Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of CONSOL (“Merger Sub”), and Arch Resources, Inc., a Delaware corporation (“Arch”).

The Merger Agreement provides for the combination of CONSOL and Arch in an all-stock merger of equals

transaction upon the terms and subject to the conditions set forth in the Merger Agreement. The combined company will be renamed “Core Natural Resources, Inc.” and will be headquartered in Canonsburg, Pennsylvania, with its common stock

trading on the New York Stock Exchange (“NYSE”). The board of directors of each of CONSOL and Arch have unanimously approved the Merger Agreement and the transactions contemplated thereby.

The Merger. Upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into Arch

(the “Merger”), with Arch continuing as the surviving corporation in the Merger and a direct, wholly owned subsidiary of CONSOL. At the effective time of the Merger (the “Effective Time”), each share of Class A common stock,

par value $0.01 per share, and Class B common stock, par value $0.01 per share, of Arch (together, “Arch Common Stock”), issued and outstanding immediately prior to the Effective Time (other than certain excluded shares) will be

converted automatically into the right to receive 1.326 shares of common stock, par value $0.01 per share, of CONSOL (“CONSOL Common Stock”).

Post-Closing Governance. CONSOL and Arch have also agreed to certain governance-related matters. At the Effective Time, the combined

company’s board of directors will have eight members, consisting of (a) four directors designated by CONSOL, which will include James A. Brock, CONSOL’s Chairman and Chief Executive Officer, and (b) four directors

designated by Arch, which will include Paul A. Lang, Arch’s Chief Executive Officer, and Richard Navarre, Arch’s Chair of its board of directors, who will serve as Lead Independent Director on the combined company’s board of

directors. In addition, at the Effective Time, Mr. Brock will be appointed to serve as the Executive Chair of the combined company’s board of directors, and Mr. Lang will be appointed to serve as the Chief Executive Officer of the

combined company. The Merger Agreement further provides that, among other officer appointments, Mitesh Thakkar will be the President and Chief Financial Officer of the combined company. At the Effective Time, CONSOL will amend its bylaws in the form

attached as an Annex to the Merger Agreement in order to provide, among other things, for supermajority director voting requirements in connection with the combined company’s board of directors’ ability to modify certain of the agreed-upon

governance terms set forth in the Merger Agreement for a specified period of time following the Effective Time.

Closing

Conditions. The closing of the Merger is subject to customary conditions, including: (i) approval by holders of Arch Common Stock of a proposal to adopt the Merger Agreement and by holders of CONSOL Common Stock of a proposal to approve the

issuance of CONSOL Common Stock in the Merger and an amendment to CONSOL’s certificate of incorporation to increase the authorized shares of common stock thereunder; (ii) the expiration or termination of the waiting period under the

Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended; (iii) receipt of clearances, approvals and consents under certain applicable foreign regulatory laws; (iv) the effectiveness of a registration statement on Form S-4 that will be filed by CONSOL for the issuance of the shares of CONSOL Common Stock; (v) the authorization of the listing of the shares of CONSOL Common Stock on the NYSE to be issued in the Merger, subject

only to official notice of issuance; and (vi) the representations and warranties of CONSOL and Arch being true and correct (subject to certain qualifications). The obligation of Arch to consummate the Merger is further conditioned upon the

receipt of a customary tax opinion of counsel to Arch that the Merger should qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

Representations, Warranties and Covenants. The Merger Agreement contains customary representations and warranties of CONSOL and Arch

relating to their respective businesses, financial statements and public filings, among other matters, in each case generally subject to customary qualifications. Additionally, the Merger Agreement provides for customary pre-closing covenants of each of CONSOL and Arch, including (i) to conduct its business in the ordinary course (subject to certain exceptions); (ii) to cooperate with respect to seeking regulatory approvals

subject to specified limitations; (iii) to hold a meeting of its stockholders to obtain the requisite stockholder approvals contemplated by the Merger Agreement, as applicable; (iv) not to solicit proposals relating to alternative business

combination transactions; and (v) subject to certain exceptions, not to enter into any discussion concerning, or provide confidential information in connection with, alternative business combination transactions.

Termination. The Merger Agreement contains provisions granting each of CONSOL and

Arch the right to terminate the Merger Agreement under specified circumstances, including: (i) if the Merger is not completed by August 20, 2025 (which date may be extended to November 20, 2025 in certain circumstances); (ii) if

either CONSOL’s or Arch’s stockholders fail to approve a required proposal in connection with the Merger; (iii) if a final nonappealable governmental order has been issued prohibiting the Merger; (iv) if the other party has

breached its representations, warranties or covenants in the Merger Agreement, subject to certain conditions; or (v) if the other party’s board of directors has changed its recommendation in connection with the Merger. In the event of a

termination of the Merger Agreement under certain specified circumstances, Arch or CONSOL, as applicable, would be required to pay the other party a termination fee equal to $82.0 million. In addition, if the Merger Agreement is terminated due

to a failure of CONSOL’s stockholders or Arch’s stockholders to approve the applicable proposals, CONSOL or Arch, as applicable, will be required to reimburse the other party for its expenses incurred in connection with the transaction in

an amount not to exceed $23.5 million.

The foregoing description of the Merger Agreement and the transactions contemplated thereby

does not purport to be complete and is subject to and qualified in its entirety by reference to the Merger Agreement, a copy of which is attached hereto as Exhibit 2.1 and which is incorporated by reference herein.

The Merger Agreement has been included to provide security holders and investors with information regarding its terms. It is not intended to

provide any other factual information about CONSOL, Arch or any other person. The representations, warranties and covenants contained in the Merger Agreement were made solely for purposes of the Merger Agreement and as of specific dates, were solely

for the benefit of the parties to the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the

parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to security holders. Security holders and

investors are not third-party beneficiaries under the Merger Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of CONSOL or Arch.

Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in CONSOL’s or Arch’s public

disclosures.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

On August 20, 2024, the board of directors of CONSOL approved,

subject to the closing of the Merger and effective immediately prior to the Effective Time, of (i) the acceleration and vesting of each existing CONSOL restricted stock unit award granted under the 2020 Amended and Restated Omnibus Performance

Incentive Plan (the “Plan”), including to James A. Brock, Kurt Salvatori, John Rothka and Mitesh Thakkar, that is outstanding both as of the date of the execution of the Merger Agreement and immediately prior to the Effective Time and

(ii) the acceleration and vesting of each performance-based restricted stock unit award and each performance-based cash unit award granted under the Plan, including to Messrs. Brock, Salvatori, Rothka and Thakkar, that is outstanding both as of

the date of the execution of the Merger Agreement and immediately prior to the Effective Time, with the performance goal achievement to be determined by the Compensation Committee based on the better of the target level of achievement or actual

achievement through the Effective Time.

Also on August 20, 2024, the board of directors of CONSOL determined that the Merger will qualify

as a “Change in Control” (as defined therein) for purposes of each Change in Control and Severance Agreement between CONSOL and each executive officer party to such agreement, including Messrs. Salvatori, Rothka and Thakkar, outstanding as

of immediately prior to the Effective Time (the “CIC Agreements”) and the Employment Agreement between CONSOL and Mr. Brock (the “Brock Agreement”). For the avoidance of doubt, each equity award and CIC Agreement will otherwise

remain subject to all other terms and conditions of the applicable agreement, including the requirement of continuous employment through the vesting date.

In addition, on August 20, 2024, Mr. Brock entered into a Waiver, Acknowledgment and Amendment, a copy of which is attached hereto as Exhibit

10.1 and which is incorporated by reference herein, pursuant to which (i) the Brock Agreement will be deemed amended to reflect Mr. Brock’s new role as Executive Chair, to whom the Chief Executive Officer will report, following the Effective

Time and (ii) Mr. Brock agrees that his change in duties upon completion of the Merger will not constitute “Good Reason” for purposes of and as defined in the Brock Agreement.

In connection with the execution of the Merger Agreement, the board of directors of CONSOL declared a dividend equal to $0.25 per share of

CONSOL Common Stock. The dividend will be payable in cash on September 13, 2024 to holders of record of CONSOL Common Stock as of the close of business on August 30, 2024.

On August 21, 2024, CONSOL and Arch issued a joint press release announcing that they had entered into the Merger Agreement. A copy of

the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

In addition, on August 21, 2024, CONSOL

and Arch released a joint investor presentation. A copy of the joint investor presentation is attached hereto as Exhibit 99.2 and incorporated by reference herein.

Cautionary Statement Regarding Forward-Looking Information

This report contains certain “forward-looking statements” within the meaning of federal securities laws. Forward-looking statements

may be identified by words such as “anticipates,” “believes,” “could,” “continue,” “estimate,” “expects,” “intends,” “will,” “should,” “may,”

“plan,” “predict,” “project,” “would” and similar expressions. Forward-looking statements are not statements of historical fact and reflect CONSOL’s and Arch’s current views about future events. Such

forward-looking statements include, without limitation, statements about the benefits of the proposed transaction involving CONSOL and Arch, including future financial and operating results, CONSOL’s and Arch’s plans, objectives,

expectations and intentions, the expected timing and likelihood of completion of the proposed transaction, and other statements that are not historical facts, including estimates of coal reserves, estimates of future production, assumptions

regarding future coal pricing, planned delivery of coal to markets and the associated costs, future results of operations, projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can

be given that the forward-looking statements contained in this report will occur as projected, and actual results may differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions

that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite CONSOL and Arch stockholder

approvals; the risk that CONSOL or Arch may be unable to obtain governmental and regulatory approvals required for the proposed transaction (and the risk that such approvals may result in the imposition of conditions that could adversely affect the

combined company or the expected benefits of the proposed transaction); the risk that an event, change or other circumstance could give rise to the termination of the proposed transaction; the risk that a condition to closing of the proposed

transaction may not be satisfied; the risk of delays in completing the proposed transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the proposed transaction may

not be fully realized or may take longer to realize than expected; the risk that any announcement relating to the proposed transaction could have adverse effects on the market price of CONSOL Common Stock or Arch Common Stock; the risk of litigation

related to the proposed transaction; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing business operations and opportunities as

a result of the proposed transaction; the risk of adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; the dilution caused by CONSOL’s

issuance of additional shares of its capital stock in connection with the proposed transaction; changes in coal prices, which may be caused by numerous factors, including changes in the domestic and foreign supply of and demand for coal and the

domestic and foreign demand for steel and electricity; the volatility in commodity and capital equipment prices for coal mining operations; the presence or recoverability of estimated reserves; the ability to replace reserves; environmental and

geological risks; mining and operating risks; the risks related to the availability, reliability and cost-effectiveness of transportation facilities and fluctuations in transportation costs; foreign currency, competition, government regulation or

other actions; the ability of management to execute its plans to meet its goals; risks associated with the evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions; natural and man-made disasters; civil unrest, pandemics, and conditions that may result from legislative, regulatory, trade and policy changes; and other risks inherent in CONSOL’s and Arch’s businesses.

All such factors are difficult to predict, are beyond CONSOL’s and Arch’s control,

and are subject to additional risks and uncertainties, including those detailed in CONSOL’s annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q, and current reports on Form 8-K that are available on its website at

https://investors.consolenergy.com/sec-filings and on the SEC’s website at http://www.sec.gov, and those detailed in Arch’s annual report on Form 10-K for

the year ended December 31, 2023, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Arch’s website at https://investor.archrsc.com/sec-filings/ and on the SEC’s website at http://www.sec.gov.

Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. Neither CONSOL nor Arch

undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking

statements that speak only as of the date hereof.

No Offer or Solicitation

This report is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, CONSOL intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Arch and CONSOL and that will also constitute a prospectus of CONSOL. Each of Arch and CONSOL may also file other relevant documents with the SEC regarding the

proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that Arch or CONSOL may file with the SEC. The definitive joint proxy statement/prospectus (if and when

available) will be mailed to stockholders of Arch and CONSOL. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCH, CONSOL AND THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the registration statement and joint proxy statement/prospectus (if and

when available) and other documents containing important information about Arch, CONSOL and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the

registration statement and joint proxy statement/prospectus (if and when available) and other documents filed with the SEC by Arch may be obtained free of charge on Arch’s website at

https://investor.archrsc.com/sec-filings/ or, alternatively, by directing a request by mail to Arch’s Corporate Secretary at One CityPlace Drive, Suite 300, St. Louis, Missouri, 63141. Copies of the

registration statement and joint proxy statement/prospectus (if and when available) and other documents filed with the SEC by CONSOL may be obtained free of charge on CONSOL’s website at

https://investors.consolenergy.com/sec-filings or, alternatively, by directing a request by mail to CONSOL’s Corporate Secretary at 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania 15317.

Participants in the Solicitation

Arch,

CONSOL and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Arch, including

a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Arch’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on March 27, 2024, including under the

headings “Executive Compensation,” “Director Compensation,” “Equity Compensation Plan Information,” and “Security Ownership of Directors and Executive Officers.” To the extent holdings of Arch Common Stock by

the directors and executive officers of Arch have changed from the amounts

of Arch Common Stock held by such persons as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 (“Form

3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with the SEC, including: the Form 3 filed

by George John Schuller on March 19, 2024; and the Forms 4 filed by Pamela Butcher on March 13, 2024, March 18, 2024 and June 17, 2024, James Chapman on March 11, 2024, Paul Demzik on March 5, 2024, John Eaves on

March 8, 2024, Patrick Kriegshauser on March 18, 2024 and June 17, 2024, Holly Koeppel on March 18, 2024 and June 17, 2024, Richard Navarre on March 18, 2024, and June 17, 2024, George John Schuller on

March 21, 2024, Peifang Zhang on March 18, 2024 and June 17, 2024 and John Ziegler on March 8, 2024. Information about the directors and executive officers of CONSOL, including a description of their direct or indirect interests, by

security holdings or otherwise, is set forth in CONSOL’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 1, 2024, including under the headings “Board of Directors and Compensation

Information,” “Executive Compensation Information” and “Beneficial Ownership of Securities.” To the extent holdings of CONSOL Common Stock by the directors and executive officers of CONSOL have changed from the amounts of

CONSOL Common Stock held by such persons as reflected therein, such changes have been or will be reflected on Forms 3, Forms 4 or Forms 5, in each case filed with the SEC, including: the Forms 4 filed by James Brock on May 24, 2024 and

July 1, 2024, John Mills on May 9, 2024, Cassandra Chia-Wei Pan on May 9, 2024, Valli Perera on May 9, 2024, Joseph Platt on May 9, 2024 and John Rothka on March 8, 2024. Other

information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and joint proxy statement/prospectus and

other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from Arch or CONSOL using the sources indicated above.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated August 20, 2024, by and among CONSOL Energy Inc., Mountain Range Merger Sub Inc. and Arch Resources, Inc.† |

|

|

| 10.1 |

|

Waiver, Acknowledgment and Amendment, dated August 20, 2024, by and between CONSOL Energy Inc. and James A. Brock |

|

|

| 99.1 |

|

Joint Press Release dated August 21, 2024 |

|

|

| 99.2 |

|

Joint Investor Presentation dated August 21, 2024 |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

| † |

Schedules (or similar attachments) have been omitted pursuant to Item 601(a)(5) of Regulation S-K. CONSOL hereby undertakes to furnish supplementally copies of any of the omitted schedules upon request by the Securities and Exchange Commission. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| CONSOL ENERGY INC. |

|

|

| By: |

|

/s/ Miteshkumar B. Thakkar |

|

|

Miteshkumar B. Thakkar |

|

|

Chief Financial Officer and President |

Dated: August 21, 2024

Exhibit 2.1

Execution Version

AGREEMENT AND PLAN OF MERGER

by and among

CONSOL

ENERGY INC.,

MOUNTAIN RANGE MERGER SUB INC.

and

ARCH RESOURCES,

INC.

Dated as of August 20, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I CERTAIN DEFINITIONS |

|

|

2 |

|

| 1.1 |

|

Certain Definitions |

|

|

2 |

|

| 1.2 |

|

Terms Defined Elsewhere |

|

|

2 |

|

| ARTICLE II THE MERGER |

|

|

4 |

|

| 2.1 |

|

The Merger |

|

|

4 |

|

| 2.2 |

|

Closing |

|

|

4 |

|

| 2.3 |

|

Effects of the Merger |

|

|

5 |

|

| 2.4 |

|

Organizational Documents of the Surviving Corporation |

|

|

5 |

|

| 2.5 |

|

Organizational Documents of Parent |

|

|

5 |

|

| 2.6 |

|

Directors and Officers of the Surviving Corporation |

|

|

5 |

|

| 2.7 |

|

Directors and Officers of Parent |

|

|

6 |

|

| 2.8 |

|

Combined Company HQ, Name and Trading Symbol |

|

|

6 |

|

| ARTICLE III EFFECT OF THE MERGER ON THE CAPITAL STOCK OF THE COMPANY AND MERGER SUB;

EXCHANGE |

|

|

6 |

|

| 3.1 |

|

Effect of the Merger on Capital Stock |

|

|

6 |

|

| 3.2 |

|

Treatment of Equity Compensation Awards |

|

|

8 |

|

| 3.3 |

|

Payment for Securities; Exchange |

|

|

9 |

|

| 3.4 |

|

No Appraisal Rights |

|

|

13 |

|

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

|

14 |

|

| 4.1 |

|

Organization, Standing and Power |

|

|

14 |

|

| 4.2 |

|

Capital Structure |

|

|

14 |

|

| 4.3 |

|

Authority; No Violations; Consents and Approvals |

|

|

16 |

|

| 4.4 |

|

Consents |

|

|

17 |

|

| 4.5 |

|

SEC Documents; Financial Statements |

|

|

17 |

|

| 4.6 |

|

Absence of Certain Changes or Events |

|

|

18 |

|

| 4.7 |

|

No Undisclosed Material Liabilities |

|

|

19 |

|

| 4.8 |

|

Information Supplied |

|

|

19 |

|

| 4.9 |

|

Company Permits; Compliance with Applicable Law |

|

|

20 |

|

| 4.10 |

|

Compensation; Benefits |

|

|

21 |

|

| 4.11 |

|

Labor Matters |

|

|

23 |

|

| 4.12 |

|

Taxes |

|

|

23 |

|

| 4.13 |

|

Litigation |

|

|

25 |

|

| 4.14 |

|

Intellectual Property |

|

|

25 |

|

| 4.15 |

|

Real Property |

|

|

26 |

|

| 4.16 |

|

Mining; Financial Assurances |

|

|

27 |

|

| 4.17 |

|

Environmental Matters |

|

|

27 |

|

| 4.18 |

|

Material Contracts |

|

|

28 |

|

| 4.19 |

|

Insurance |

|

|

31 |

|

| 4.20 |

|

Opinion of Financial Advisor |

|

|

31 |

|

| 4.21 |

|

Brokers |

|

|

32 |

|

| 4.22 |

|

Related Party Transactions |

|

|

32 |

|

| 4.23 |

|

Takeover Laws |

|

|

32 |

|

| 4.24 |

|

No Additional Representations |

|

|

32 |

|

i

|

|

|

|

|

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

|

|

33 |

|

| 5.1 |

|

Organization, Standing and Power |

|

|

33 |

|

| 5.2 |

|

Capital Structure |

|

|

34 |

|

| 5.3 |

|

Authority; No Violations; Consents and Approvals |

|

|

35 |

|

| 5.4 |

|

Consents |

|

|

36 |

|

| 5.5 |

|

SEC Documents; Financial Statements |

|

|

37 |

|

| 5.6 |

|

Absence of Certain Changes or Events |

|

|

38 |

|

| 5.7 |

|

No Undisclosed Material Liabilities |

|

|

38 |

|

| 5.8 |

|

Information Supplied |

|

|

39 |

|

| 5.9 |

|

Parent Permits; Compliance with Applicable Law |

|

|

39 |

|

| 5.10 |

|

Compensation; Benefits |

|

|

40 |

|

| 5.11 |

|

Labor Matters |

|

|

42 |

|

| 5.12 |

|

Taxes |

|

|

43 |

|

| 5.13 |

|

Litigation |

|

|

44 |

|

| 5.14 |

|

Intellectual Property |

|

|

44 |

|

| 5.15 |

|

Real Property |

|

|

45 |

|

| 5.16 |

|

Mining; Financial Assurances |

|

|

46 |

|

| 5.17 |

|

Environmental Matters |

|

|

46 |

|

| 5.18 |

|

Material Contracts |

|

|

48 |

|

| 5.19 |

|

Insurance |

|

|

50 |

|

| 5.20 |

|

Opinion of Financial Advisor |

|

|

51 |

|

| 5.21 |

|

Brokers |

|

|

51 |

|

| 5.22 |

|

Related Party Transactions |

|

|

51 |

|

| 5.23 |

|

Ownership of Company Common Stock |

|

|

51 |

|

| 5.24 |

|

Merger Sub Business Conduct |

|

|

51 |

|

| 5.25 |

|

No Additional Representations |

|

|

52 |

|

| ARTICLE VI COVENANTS AND AGREEMENTS |

|

|

52 |

|

| 6.1 |

|

Conduct of the Company Business Pending the Merger |

|

|

52 |

|

| 6.2 |

|

Conduct of Parent Business Pending the Merger |

|

|

57 |

|

| 6.3 |

|

No Solicitation by the Company |

|

|

61 |

|

| 6.4 |

|

No Solicitation by Parent |

|

|

67 |

|

| 6.5 |

|

Preparation of Joint Proxy Statement and Registration Statement |

|

|

73 |

|

| 6.6 |

|

Stockholders Meetings |

|

|

75 |

|

| 6.7 |

|

Access to Information |

|

|

77 |

|

| 6.8 |

|

HSR and Other Approvals |

|

|

79 |

|

| 6.9 |

|

Employee Matters |

|

|

81 |

|

| 6.10 |

|

Indemnification; Directors’ and Officers’ Insurance |

|

|

83 |

|

| 6.11 |

|

Transaction Litigation |

|

|

85 |

|

| 6.12 |

|

Public Announcements |

|

|

85 |

|

| 6.13 |

|

Advice of Certain Matters; Control of Business |

|

|

85 |

|

| 6.14 |

|

Reasonable Best Efforts; Notification |

|

|

86 |

|

| 6.15 |

|

Section 16 Matters |

|

|

86 |

|

| 6.16 |

|

Stock Exchange Listing and Delistings |

|

|

86 |

|

| 6.17 |

|

Financing and Indebtedness |

|

|

87 |

|

| 6.18 |

|

Tax Matters |

|

|

87 |

|

ii

|

|

|

|

|

|

|

| 6.19 |

|

Takeover Laws |

|

|

87 |

|

| 6.20 |

|

Obligations of Merger Sub |

|

|

88 |

|

| 6.21 |

|

Dividends |

|

|

88 |

|

| ARTICLE VII CONDITIONS PRECEDENT |

|

|

88 |

|

| 7.1 |

|

Conditions to Each Party’s Obligation to Consummate the Merger |

|

|

88 |

|

| 7.2 |

|

Additional Conditions to Obligations of Parent and Merger Sub |

|

|

89 |

|

| 7.3 |

|

Additional Conditions to Obligations of the Company |

|

|

89 |

|

| 7.4 |

|

Frustration of Closing Conditions |

|

|

91 |

|

| ARTICLE VIII TERMINATION |

|

|

91 |

|

| 8.1 |

|

Termination |

|

|

91 |

|

| 8.2 |

|

Notice of Termination; Effect of Termination |

|

|

92 |

|

| 8.3 |

|

Expenses and Other Payments |

|

|

93 |

|

| ARTICLE IX GENERAL PROVISIONS |

|

|

95 |

|

| 9.1 |

|

Survival |

|

|

95 |

|

| 9.2 |

|

Notices |

|

|

96 |

|

| 9.3 |

|

Rules of Construction |

|

|

97 |

|

| 9.4 |

|

Counterparts |

|

|

99 |

|

| 9.5 |

|

Entire Agreement; No Third Party Beneficiaries |

|

|

99 |

|

| 9.6 |

|

Governing Law; Venue; Waiver of Jury Trial |

|

|

100 |

|

| 9.7 |

|

Severability |

|

|

101 |

|

| 9.8 |

|

Assignment |

|

|

101 |

|

| 9.9 |

|

Specific Performance |

|

|

101 |

|

| 9.10 |

|

Amendment |

|

|

102 |

|

| 9.11 |

|

Extension; Waiver |

|

|

102 |

|

Annex A Certain Definitions

Annex B Form of CONSOL Energy Inc. Charter Amendment

Annex C Form of Certificate of Incorporation of the Surviving Corporation

Annex D Form of A&R Bylaws of Core Natural Resources

iii

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER, dated as of August 20, 2024 (this “Agreement”), is being entered into by and

among CONSOL Energy Inc., a Delaware corporation (“Parent”), Mountain Range Merger Sub Inc., a Delaware corporation and a wholly owned Subsidiary of Parent (“Merger Sub”), and Arch Resources, Inc., a Delaware

corporation (the “Company”).

WHEREAS, the Board of Directors of the Company (the “Company Board”), at a

meeting duly called and held by unanimous vote, (a) determined that this Agreement and the Transactions, including the Merger (each as defined below), are fair to, and in the best interests of, the Company and the holders of Company Common

Stock (as defined below), (b) approved and declared advisable this Agreement and the Transactions, including the Merger, and (c) resolved to recommend that the holders of Company Common Stock adopt this Agreement;

WHEREAS, the Board of Directors of Parent (the “Parent Board”), at a meeting duly called and held by unanimous vote,

(a) determined that this Agreement and the Transactions, including the issuance of the shares of common stock of Parent, par value $0.01 per share (“Parent Common Stock”), pursuant to this Agreement (the “Parent Stock

Issuance”), and the amendment of the Parent Charter (as defined below) in the form set forth in Annex B to increase the number of shares of Parent Common Stock (as defined below) authorized thereunder (the “Parent Charter

Amendment”), are fair to, and in the best interests of, Parent and the holders of Parent Common Stock, (b) approved and declared advisable this Agreement and the Transactions, including the Parent Stock Issuance and the Parent Charter

Amendment, and (c) resolved to recommend that the holders of Parent Common Stock approve the Parent Stock Issuance and the Parent Charter Amendment;

WHEREAS, the Board of Directors of Merger Sub (the “Merger Sub Board”) has unanimously (a) determined that this

Agreement and the Transactions, including the Merger, are fair to, and in the best interests of, Merger Sub and its sole stockholder, and (b) approved and declared advisable this Agreement and the Transactions, including the Merger;

WHEREAS, Parent, as the sole stockholder of Merger Sub, has duly executed and delivered to Merger Sub and the Company a written consent, to be

effective by its terms immediately following execution of this Agreement, adopting this Agreement, pursuant to Sections 228 and 251(c) of the Delaware General Corporation Law, as amended (the “DGCL”);

WHEREAS, Parent, Merger Sub and the Company desire to effect a strategic business combination on the terms and subject to the conditions set

forth in this Agreement; and

WHEREAS, for U.S. federal income tax purposes, it is intended that the Merger qualify as a

“reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and this Agreement constitute, and be adopted as, a “plan of reorganization” within the

meaning of Treasury Regulations §§ 1.368-2(g) and 1.368-3(a).

NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and agreements contained in this Agreement,

and for other valuable consideration, the receipt and sufficiency of which are acknowledged, Parent, Merger Sub and the Company, intending to be legally bound, agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

1.1

Certain Definitions. As used in this Agreement, the capitalized terms have the meanings ascribed to such terms in Annex A or as otherwise defined elsewhere in this Agreement.

1.2 Terms Defined Elsewhere. As used in this Agreement, the following capitalized terms are defined in this Agreement as referenced in

the following table:

|

|

|

|

|

| Term |

|

Section |

|

| A&R Bylaws |

|

|

2.5 |

|

| Agreement |

|

|

Preamble |

|

| Applicable Date |

|

|

4.5(a) |

|

| Book-Entry Shares |

|

|

3.3(b)(ii) |

|

| Certificate of Merger |

|

|

2.2(b) |

|

| Certificates |

|

|

3.3(b)(i) |

|

| Closing |

|

|

2.2(a) |

|

| Closing Date |

|

|

2.2(a) |

|

| Code |

|

|

Recitals |

|

| Company |

|

|

Preamble |

|

| Company Alternative Acquisition Agreement |

|

|

6.3(d)(iv) |

|

| Company Board |

|

|

Recitals |

|

| Company Board Recommendation |

|

|

4.3(a) |

|

| Company Budget |

|

|

6.1(b) |

|

| Company Capital Stock |

|

|

4.2(a) |

|

| Company Change of Recommendation |

|

|

6.3(d)(vii) |

|

| Company Class A Common Stock |

|

|

3.1(b)(i) |

|

| Company Class B Common Stock |

|

|

3.1(b)(i) |

|

| Company Common Stock |

|

|

3.1(b)(i) |

|

| Company Contracts |

|

|

4.18(b) |

|

| Company Disclosure Letter |

|

|

Article IV |

|

| Company Employee |

|

|

6.9(a) |

|

| Company Equity Plan |

|

|

4.2(a) |

|

| Company Financial Assurances |

|

|

4.16(a) |

|

| Company Intellectual Property |

|

|

4.14(a) |

|

| Company Leased Real Property |

|

|

4.15 |

|

| Company Material Adverse Effect |

|

|

4.1 |

|

| Company Owned Real Property |

|

|

4.15 |

|

2

|

|

|

|

|

| Company Permits |

|

|

4.9(a) |

|

| Company Preferred Stock |

|

|

4.2(a) |

|

| Company Real Property |

|

|

4.15 |

|

| Company Real Property Lease |

|

|

4.15 |

|

| Company SEC Documents |

|

|

4.5(a) |

|

| Company Stockholders Meeting |

|

|

4.4 |

|

| Company Tax Counsel |

|

|

6.18 |

|

| Company Tax Opinion |

|

|

6.18 |

|

| Confidentiality Agreement |

|

|

6.7(b) |

|

| Converted Shares |

|

|

3.1(b)(iii) |

|

| Creditors’ Rights |

|

|

4.3(a) |

|

| D&O Insurance |

|

|

6.10(d) |

|

| DGCL |

|

|

Recitals |

|

| Effective Time |

|

|

2.2(b) |

|

| Eligible Shares |

|

|

3.1(b)(i) |

|

| e-mail |

|

|

9.2 |

|

| End Date |

|

|

8.1(b)(ii) |

|

| Environmental Claims |

|

|

4.17(f) |

|

| Environmental Permits |

|

|

4.17(b) |

|

| Exchange Agent |

|

|

3.3(a) |

|

| Exchange Fund |

|

|

3.3(a) |

|

| Exchange Ratio |

|

|

3.1(b)(i) |

|

| Excluded Shares |

|

|

3.1(b)(iii) |

|

| FASB 410 |

|

|

4.16(b) |

|

| Financial Assurances |

|

|

4.16(a) |

|

| Fraud and Bribery Laws |

|

|

4.9(f) |

|

| GAAP |

|

|

4.5(b) |

|

| HSR Act |

|

|

4.4 |

|

| Indemnified Liabilities |

|

|

6.10(a) |

|

| Indemnified Persons |

|

|

6.10(a) |

|

| Joint Proxy Statement |

|

|

4.4 |

|

| Letter of Transmittal |

|

|

3.3(b)(i) |

|

| Material Company Insurance Policies |

|

|

4.19 |

|

| Material Parent Insurance Policies |

|

|

5.19 |

|

| Merger |

|

|

2.1 |

|

| Merger Consideration |

|

|

3.1(b)(i) |

|

| Merger Sub |

|

|

Preamble |

|

| Merger Sub Board |

|

|

Recitals |

|

| New Plans |

|

|

6.9(a) |

|

| Old Plans |

|

|

6.9(c) |

|

| Parent |

|

|

Preamble |

|

| Parent Alternative Acquisition Agreement |

|

|

6.4(d)(iv) |

|

| Parent Board |

|

|

Recitals |

|

| Parent Board Recommendation |

|

|

5.3(a) |

|

| Parent Budget |

|

|

6.2(b) |

|

| Parent Capital Stock |

|

|

5.2(a) |

|

| Parent Change of Recommendation |

|

|

6.4(d)(vii) |

|

| Parent Charter Amendment |

|

|

Recitals |

|

| Parent Common Stock |

|

|

Recitals |

|

| Parent Contracts |

|

|

5.18(b) |

|

| Parent Disclosure Letter |

|

|

Article V |

|

| Parent Employee |

|

|

6.9(a) |

|

3

|

|

|

|

|

| Parent Equity Plan |

|

|

5.2(a) |

|

| Parent Financial Assurances |

|

|

5.16(a) |

|

| Parent Intellectual Property |

|

|

5.14(a) |

|

| Parent Leased Real Property |

|

|

5.15 |

|

| Parent Material Adverse Effect |

|

|

5.1 |

|

| Parent Owned Real Property |

|

|

5.15 |

|

| Parent Permits |

|

|

5.9(a) |

|

| Parent Preferred Stock |

|

|

5.2(a) |

|

| Parent Real Property |

|

|

5.15 |

|

| Parent Real Property Lease |

|

|

5.15 |

|

| Parent RSU Award |

|

|

3.2(a) |

|

| Parent SEC Documents |

|

|

5.5(a) |

|

| Parent Stock Issuance |

|

|

Recitals |

|

| Parent Tax Counsel |

|

|

6.18 |

|

| Registration Statement |

|

|

4.8 |

|

| Surviving Corporation |

|

|

2.1 |

|

| Tail Period |

|

|

6.10(d) |

|

| Terminable Breach |

|

|

8.1(b)(iii) |

|

| Transaction Litigation |

|

|

6.11 |

|

| Vested PSU Award |

|

|

3.2(b) |

|

ARTICLE II

THE MERGER

2.1 The

Merger. Upon the terms and subject to the conditions of this Agreement, at the Effective Time, Merger Sub will be merged with and into the Company in accordance with the provisions of the DGCL (the “Merger”). As a result of the

Merger, the separate existence of Merger Sub shall cease and the Company shall continue its existence under the laws of the State of Delaware as the surviving corporation (in such capacity, the Company is sometimes referred to in this Agreement as

the “Surviving Corporation”).

2.2 Closing.

(a) The closing of the Merger (the “Closing”), shall take place at 9:00 a.m., New York City time, on the date that is the

third Business Day immediately following the satisfaction or (to the extent permitted by applicable Law) waiver in accordance with this Agreement of all of the conditions set forth in Article VII (other than any such conditions which by their

nature cannot be satisfied until the Closing Date, which shall be required to be so satisfied or (to the extent permitted by applicable Law) waived in accordance with this Agreement on the Closing Date) remotely by exchange of documents and

signatures (or their electronic counterparts) or, if agreed by Parent and the Company, at the offices of Wachtell, Lipton, Rosen & Katz in New York, New York, or such other place as Parent and the Company may agree in writing. For purposes

of this Agreement, “Closing Date” shall mean the date on which the Closing occurs.

4

(b) On the Closing Date, the Company and Merger Sub shall file a certificate of merger

prepared and executed in accordance with the relevant provisions of the DGCL (the “Certificate of Merger”) with the Office of the Secretary of State of the State of Delaware. The Merger shall become effective upon the filing and

acceptance of the Certificate of Merger with the Office of the Secretary of State of the State of Delaware, or at such later time as shall be agreed upon in writing by Parent and the Company and specified in the Certificate of Merger (the

“Effective Time”).

2.3 Effects of the Merger. At the Effective Time, the Merger shall have the effects set forth

in this Agreement and the applicable provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, from and after the Effective Time, all the property, rights, privileges, powers and franchises of each of the Company

and Merger Sub shall vest in the Surviving Corporation, and all debts, Liabilities, obligations, restrictions, disabilities and duties of each of the Company and Merger Sub shall become the debts, Liabilities, obligations, restrictions, disabilities

and duties of the Surviving Corporation.

2.4 Organizational Documents of the Surviving Corporation. At the Effective Time, by

virtue of the Merger and without any further action on the part of Parent, the Company, Merger Sub or any other Person, (a) the certificate of incorporation of the Company in effect immediately prior to the Effective Time shall be amended and

restated in its entirety to be in the form set forth in Annex C, and as so amended shall be the certificate of incorporation of the Surviving Corporation, until duly amended, subject to Section 6.10(b), as provided

in such certificate of incorporation or in accordance with applicable Law, and (b) the bylaws of the Company in effect immediately prior to the Effective Time shall be amended and restated in their entirety to be in the form of the bylaws of

Merger Sub in effect immediately prior to the Effective Time, except that the name of the Surviving Corporation shall be as mutually agreed between the parties, and as so amended shall be the bylaws of the Surviving Corporation, until duly amended,

subject to Section 6.10(b), as provided in such bylaws or in accordance with applicable Law.

2.5

Organizational Documents of Parent. Parent shall take all necessary actions to cause (a) subject to the receipt of the Parent Stockholder Charter Approval prior to the Effective Time, the Parent Charter Amendment to become effective at

the Effective Time and (b) as of the Effective Time, the bylaws of Parent to be amended and restated in their entirety in the form set forth in Annex D (the “A&R Bylaws”), and Parent’s amended and restated

certificate of incorporation, as amended to date and by the Parent Charter Amendment, and the A&R Bylaws, shall be the certificate of incorporation and bylaws, respectively, of Parent until thereafter amended in accordance with the provisions

thereof and applicable Law.

2.6 Directors and Officers of the Surviving Corporation. The directors of Merger Sub immediately prior

to the Effective Time shall be the initial directors of the Surviving Corporation. The officers of Merger Sub immediately prior to the Effective Time shall be the initial officers of the Surviving Corporation. Such directors and officers shall serve

until their respective successors have been duly elected or appointed and qualified or until their earlier death, resignation or removal in accordance with the Organizational Documents of the Surviving Corporation.

5

2.7 Directors and Officers of Parent.

(a) Prior to the Effective Time, Parent shall take all actions as may be necessary to cause (i) the number of directors constituting the

Parent Board as of the Effective Time to be eight, consisting of four directors to be designated by Parent and four directors to be designated by the Company, and (ii) the Parent Board as of the Effective Time to be as set forth on

Schedule 2.7(a) of the Company Disclosure Letter. From and after the Effective Time, each person designated as a director of Parent shall serve as a director until such person’s successor shall be appointed or such

person’s earlier death, resignation or removal in accordance with the Organizational Documents of Parent.

(b) Prior to the Effective

Time, Parent shall take all actions as may be necessary to cause at the Effective Time: James A. Brock, who shall also be a member of the Parent Board effective as of the Effective Time in accordance with Section 2.7(a), to

be appointed to serve as the Executive Chair of the Parent Board; Paul A. Lang, who shall also be a director of the Parent Board effective as of the Effective Time in accordance with Section 2.7(a), to be appointed to serve

as the Chief Executive Officer of Parent; and the other officers of Parent to be as set forth on Schedule 2.7(b) of the Company Disclosure Letter. Subject to the terms of any employment agreement, each such officer shall serve until such

officer’s successor shall be appointed or such officer’s earlier death, resignation, retirement, disqualification or removal in accordance with the Organizational Documents of Parent. If, before the Effective Time, any such person is

unable or unwilling to serve as an officer of Parent, then a substitute officer shall be selected by mutual written agreement of Parent and the Company.

2.8 Combined Company HQ, Name and Trading Symbol. Immediately following the Closing, the principal offices of Parent and its

Subsidiaries (including the Surviving Corporation) shall be located at 275 Technology Drive, Canonsburg, Pennsylvania 15317. At the Effective Time, the name of Parent shall be “Core Natural Resources, Inc.” Parent may also take all actions

necessary to change the NYSE ticker symbol of Parent, as of the Effective Time, to be as mutually agreed between Parent and the Company.

ARTICLE III

EFFECT OF

THE MERGER ON THE CAPITAL STOCK OF THE COMPANY

AND MERGER SUB; EXCHANGE

3.1 Effect of the Merger on Capital Stock. At the Effective Time, by virtue of the Merger and without any action on the part of Parent,

Merger Sub, the Company or any holder of any securities of Parent, Merger Sub or the Company:

(a) Capital Stock of Merger Sub.

Each share of capital stock of Merger Sub issued and outstanding immediately prior to the Effective Time shall be converted into and shall represent one fully paid and nonassessable share of common stock, par value $0.01 per share, of the Surviving

Corporation, which shall constitute the only outstanding shares of common stock of the Surviving Corporation immediately following the Effective Time.

(b) Capital Stock of the Company.

(i) Subject to the other provisions of this Article III, each share of Class A common stock, par value $0.01 per

share of the Company (the “Company Class A Common Stock”), and Class B common stock, par value $0.01 per share of the Company (the “Company Class B Common Stock”, and

together with the Company Class A Common Stock, “Company Common Stock”), issued and outstanding immediately prior to the Effective Time (excluding any Excluded Shares or Converted Shares (collectively, the “Eligible

Shares”)) shall be converted into the right to receive from Parent that number of fully paid and nonassessable shares of Parent Common Stock equal to the Exchange Ratio (the “Merger Consideration”). As used in this

Agreement, “Exchange Ratio” means 1.326.

6

(ii) All such Eligible Shares, when so converted pursuant to

Section 3.1(b)(i), shall cease to be outstanding and shall automatically be cancelled and cease to exist. Each holder of a share of Company Common Stock that was outstanding immediately prior to the Effective Time (other

than Excluded Shares and Converted Shares) shall cease to have any rights with respect thereto, except the right to receive (A) the Merger Consideration, (B) any dividends or other distributions in accordance with

Section 3.3(g) and (C) any cash to be paid in lieu of any fractional shares of Parent Common Stock in accordance with Section 3.3(h), in each case to be issued or paid in consideration

therefor upon the exchange of any Certificates or Book-Entry Shares, as applicable, in accordance with Section 3.3(a).

(iii) All shares of Company Common Stock held by the Company as treasury shares or by Parent or Merger Sub immediately prior to

the Effective Time and, in each case, not held on behalf of third parties (collectively, “Excluded Shares”), shall automatically be cancelled and cease to exist as of the Effective Time, and no consideration shall be delivered in

exchange therefor. Each share of Company Common Stock that is owned by any direct or indirect Subsidiary of the Company or Parent (other than Merger Sub) (“Converted Shares”) shall automatically be converted into a number of fully

paid and nonassessable shares of Parent Common Stock equal to the Exchange Ratio (subject to adjustment in accordance with Section 3.1(c)).

(c) Impact of Stock Splits, Etc. Without limiting the Parties’ respective obligations under Section 6.1

and Section 6.2, in the event of any change in (i) the number or class of Eligible Shares, or securities convertible or exchangeable into or exercisable for Eligible Shares, or (ii) the number or class of shares

of Parent Common Stock, or securities convertible or exchangeable into or exercisable for shares of Parent Common Stock (including options to purchase Parent Common Stock), in each case issued and outstanding after the entry into this Agreement and

prior to the Effective Time by reason of any stock split, reverse stock split, stock dividend, subdivision, reclassification, recapitalization, combination, exchange of shares or the like, the Exchange Ratio and the Merger Consideration shall be

equitably adjusted to reflect the effect of such change and, as so adjusted, shall from and after the date of such event, be the Exchange Ratio and the Merger Consideration, subject to further adjustment in accordance with this

Section 3.1(c). Nothing in this Section 3.1(c) shall be construed to permit the Parties to take any action except to the extent consistent with, and not otherwise prohibited by, the terms of this

Agreement.

7

3.2 Treatment of Equity Compensation Awards.

(a) Company RSU Awards. Effective as of the Effective Time (i) except as provided in Section 3.2(a)(ii),

each Company RSU Award that is outstanding immediately prior to the Effective Time (and any related cash dividend equivalents) shall, by virtue of the Merger and without any action on the part of the holder thereof, fully vest, be cancelled and

automatically converted into the right to receive, within five Business Days following the Effective Time, (A) a number of newly issued shares of Parent Common Stock equal to the product (rounded to the nearest whole number) of (x) the

number of shares of Company Common Stock subject to such Company RSU Award as of immediately prior to the Effective Time (whether vested or unvested), multiplied by (y) the Exchange Ratio; provided, however, that Parent shall withhold

the number of shares of Parent Common Stock as reasonably determined by Parent to satisfy any tax withholding obligations associated with the settlement of such Company RSU Award (with any fractional shares of Parent Common Stock treated in

accordance with Section 3.3(h) of this Agreement), and (B) payment in cash of any accrued and unpaid dividend equivalents related to such Company RSU Award (as determined immediately prior to the Effective Time), less

applicable withholdings, and (ii) effective as of the Effective Time, each Company RSU Award that is granted after the execution of this Agreement and outstanding and unvested immediately prior to the Effective Time shall, by virtue of the

Merger and without any action on the part of the holder thereof, be converted into a restricted stock unit award corresponding to a number of shares of Parent Common Stock (each, a “Parent RSU Award”) (rounded to the nearest whole

number of shares) equal to the product of (x) the number of shares of Company Common Stock subject to such Company RSU Award as of immediately prior to the Effective Time (whether vested of unvested), multiplied by (y) the Exchange

Ratio. Each Parent RSU Award shall have the same terms and conditions as the corresponding Company RSU Award had immediately prior to the Effective Time.

(b) Company PSU Awards. Effective as of the Effective Time (i) except as provided in Section 3.2(b)(ii),

each Company PSU Award that is outstanding as of immediately prior to the Effective Time (and any related cash dividend equivalents) shall, by virtue of the Merger and without any action on the part of the holder thereof, be converted into the right

to receive, within five Business Days following the Effective Time, (A) a number of newly issued shares of Parent Common Stock equal to the product (rounded to the nearest whole number) of (I) the number of shares of Company Common Stock

subject to such Company PSU Award as of immediately prior to the Effective Time equal to the greater of (x) 100% of the target number of shares of Company Common Stock subject to the Company PSU Award and (y) the number of shares of Company

Common Stock subject to the portion of the Company PSU Award that would have vested as of the Effective Time based on actual achievement of the performance goals related to such Company PSU Award as of the Effective Time (as applicable, the

“Vested PSU Award”), multiplied by (II) the Exchange Ratio; provided, however, that Parent shall withhold the number of shares of Parent Common Stock as reasonably determined by Parent to satisfy any tax withholding

obligations associated with the settlement of such Company PSU Award (with any fractional shares of Parent Common Stock treated in accordance with Section 3.3(h) of this Agreement), and (B) payment in cash of any

dividend equivalents related to the Vested PSU Award (as determined immediately prior to the Effective Time), less applicable withholdings, and (ii) each Company PSU Award that is granted after the execution of this Agreement and is outstanding

as of immediately prior to the Effective Time shall, by virtue of the Merger and without any action on the part of the holder thereof, be converted into a Parent RSU Award (rounded to the nearest whole number of shares) equal to the product obtained

by multiplying (x) the target number of shares of Company Common Stock subject to such Company PSU Award by (y) the Exchange Ratio. Each Parent RSU Award shall have the same terms and conditions as the corresponding Company PSU Award had

immediately prior to the Effective Time except that vesting of the award will be subject only to continuous service, and any performance-based objectives shall cease to apply.

8

(c) Company Equity Plan. As of the Effective Time, Parent shall assume the Company

Equity Plan with the number of shares reserved and remaining for issuance under such Company Equity Plan adjusted to a number of shares of Parent Common Stock determined by multiplying the number of shares of Company Common Stock reserved and

remaining for issuance under such Company Equity Plan immediately prior to the Effective Time by the Exchange Ratio, rounded down to the nearest whole share.

(d) Administration. Prior to the Effective Time, the Company Board or the Compensation Committee of the Company Board shall adopt such

resolutions as are required to effectuate the treatment of the Company RSU Awards and the Company PSU Awards pursuant to the terms of this Section 3.2.

3.3 Payment for Securities; Exchange.

(a) Exchange Agent; Exchange Fund. Prior to the Effective Time, Parent shall enter into, or cause Merger Sub to enter into, an

agreement with Parent’s or the Company’s transfer agent, or another firm reasonably acceptable to the Company and Parent, to act as agent for the holders of Eligible Shares (the “Exchange Agent”) and to receive the Merger

Consideration and to make payments in respect of any dividends or other distributions with respect to Parent Common Stock pursuant to Section 3.3(g) and in lieu of fractional shares pursuant to

Section 3.3(h), in each case to which such holders shall become entitled pursuant to this Article III. Prior to the filing of the Certificate of Merger, Parent shall deposit, or cause to be deposited, with the

Exchange Agent, for the benefit of the holders of Eligible Shares, for distribution in accordance with this Article III through the Exchange Agent a number of shares of Parent Common Stock constituting at least the amount necessary to satisfy

the payment of the Merger Consideration to the holders of Eligible Shares pursuant to this Article III. Parent agrees to make available to the Exchange Agent, from time to time as needed, cash in immediately available funds in an amount

sufficient to pay any dividends or other distributions pursuant to Section 3.3(g). The Exchange Agent shall, pursuant to irrevocable instructions, deliver the Merger Consideration contemplated to be issued in exchange for

Eligible Shares pursuant to this Agreement out of the Exchange Fund to the holders of Eligible Shares (after taking into account all Eligible Shares then held by such holder). Except as contemplated by this Section 3.3(a)

and Sections 3.3(g) and 3.3(h), the Exchange Fund shall not be used for any other purpose. Any cash and shares of Parent Common Stock deposited with the Exchange Agent (including as payment for fractional shares in accordance with

Section 3.3(h) and any dividends or other distributions in accordance with Section 3.3(g)) shall hereinafter be referred to as the “Exchange Fund.” Parent or the Surviving

Corporation shall pay all charges and expenses, including those of the Exchange Agent, in connection with the exchange of Eligible Shares pursuant to this Agreement. The cash portion of the Exchange Fund may be invested by the Exchange Agent as

reasonably directed by Parent; provided, that any investment of such cash shall be limited to direct short-term obligations of, or short-term obligations fully guaranteed as to principal and interest by, the U.S. government; provided,

further, that no such investment or loss thereon shall affect the amounts payable to holders of Eligible Shares pursuant to this Article III, and following any losses from any such investment, Parent shall reasonably promptly deposit

(or cause to be deposited) additional cash in immediately available funds to the Exchange Agent for

9

the benefit of the holders of Eligible Shares at the Effective Time in the amount of such losses, which additional cash will be deemed to be part of the Exchange Fund. Any interest or other

income resulting from investment of the cash portion of the Exchange Fund shall, at the discretion of Parent, become part of the Exchange Fund, and any amounts in excess of the amounts payable under this Agreement shall be promptly returned to

Parent or the Surviving Corporation.

(b) Payment Procedures.

(i) Certificates. As soon as reasonably practicable after the Effective Time, Parent shall cause the Exchange Agent to

deliver to each record holder, as of immediately prior to the Effective Time, of an outstanding certificate or certificates that immediately prior to the Effective Time represented Eligible Shares (“Certificates”), a notice advising

such holders of the effectiveness of the Merger and a letter of transmittal (“Letter of Transmittal”) (which shall specify that delivery shall be effected, and risk of loss and title to the Certificates shall pass, only upon proper

delivery of the Certificates to the Exchange Agent) and instructions for use in effecting the surrender of Certificates for payment of the Merger Consideration, which Letter of Transmittal and instructions shall be in a customary form and agreed to

by Parent and the Company prior to the Closing. Upon surrender to the Exchange Agent of a Certificate, together with the Letter of Transmittal, duly completed and validly executed in accordance with the instructions thereto, and such other customary

documents as may be reasonably required by the Exchange Agent or Parent, the holder of such Certificate shall be entitled to receive in exchange therefor (A) one or more shares of Parent Common Stock (which shall be in uncertificated book-entry

form) representing, in the aggregate, the whole number of shares of Parent Common Stock, if any, that such holder has the right to receive pursuant to Section 3.1 (after taking into account all shares of Company Common

Stock then held by such holder), and (B) a check in the amount equal to the cash payable in lieu of any fractional shares of Parent Common Stock pursuant to Section 3.3(h) and dividends and other distributions pursuant

to Section 3.3(g).

(ii) Non-DTC Book-Entry

Shares. As soon as reasonably practicable after the Effective Time, Parent shall cause the Exchange Agent to deliver to each record holder, as of immediately prior to the Effective Time, of Eligible Shares represented by book-entry

(“Book-Entry Shares”) not held through DTC, (A) a notice advising such holders of the effectiveness of the Merger, (B) a statement reflecting the number of shares of Parent Common Stock (which shall be in uncertificated

book-entry form) representing, in the aggregate, the whole number of shares of Parent Common Stock that such holder has the right to receive pursuant to Section 3.1 (after taking into account all shares of Company Common

Stock then held by such holder) and (C) a check in the amount equal to the cash payable in lieu of any fractional shares of Parent Common Stock pursuant to Section 3.3(h) and dividends and other distributions pursuant

to Section 3.3(g).

(iii) DTC Book-Entry Shares. With respect to Book-Entry Shares held

through DTC, Parent and the Company shall cooperate to establish procedures with the Exchange Agent and DTC to ensure that the Exchange Agent will transmit to DTC or its nominees as soon as reasonably practicable on or after the Closing Date, upon

surrender of Eligible Shares held of record by DTC or its nominees in accordance with DTC’s customary surrender procedures, the Merger Consideration, cash in lieu of fractional shares of Parent Common Stock, if any, and any dividends or other

distributions, in each case, that DTC has the right to receive pursuant to this Article III.

10

(iv) No interest shall be paid or accrued on any amount payable for Eligible

Shares pursuant to this Article III.

(v) With respect to Certificates, if payment of the Merger Consideration

(including any dividends or other distributions with respect to Parent Common Stock pursuant to Section 3.3(g) and any cash in lieu of fractional shares of Parent Common Stock pursuant to

Section 3.3(h)) is to be made to a Person other than the record holder of such Eligible Shares, it shall be a condition of payment that shares so surrendered shall be properly endorsed or shall be otherwise in proper form

for transfer and that the Person requesting such payment shall have paid any transfer and other similar Taxes required by reason of the payment of the Merger Consideration (including any dividends or other distributions with respect to Parent Common

Stock pursuant to Section 3.3(g) and any cash in lieu of fractional shares of Parent Common Stock pursuant to Section 3.3(h)) to a Person other than the registered holder of such shares

surrendered, or shall have established to the reasonable satisfaction of Parent that such Taxes either have been paid or are not applicable. With respect to Book-Entry Shares, payment of the Merger Consideration (including any dividends or other

distributions with respect to Parent Common Stock pursuant to Section 3.3(g) and any cash in lieu of fractional shares of Parent Common Stock pursuant to Section 3.3(h)) shall only be made to the

Person in whose name such Book-Entry Shares are registered in the stock transfer books of the Company as of the Effective Time. Until surrendered as contemplated by this Section 3.3(b)(v), each Certificate shall be deemed

at any time after the Effective Time to represent only the right to receive upon such surrender the Merger Consideration payable in respect of such shares of Company Common Stock, cash in lieu of any fractional shares of Parent Common Stock to which

such holder is entitled pursuant to Section 3.3(h) and any dividends or other distributions to which such holder is entitled pursuant to Section 3.3(g).

(c) Termination of Rights. All Merger Consideration (including any dividends or other distributions with respect to Parent Common Stock

pursuant to Section 3.3(g) and any cash in lieu of fractional shares of Parent Common Stock pursuant to Section 3.3(h)) paid upon the surrender of and in exchange for Eligible Shares, in accordance

with the terms hereof shall be deemed to have been paid in full satisfaction of all rights pertaining to such Company Common Stock. At the Effective Time, the stock transfer books of the Surviving Corporation shall be closed immediately, and there

shall be no further registration of transfers on the stock transfer books of the Surviving Corporation of the shares of Company Common Stock that were outstanding immediately prior to the Effective Time. If, after the Effective Time, Certificates or

Book-Entry Shares are presented to the Surviving Corporation for any reason, they shall be cancelled and exchanged for the Merger Consideration payable in respect of the Eligible Shares previously represented by such Certificates or Book-Entry

Shares (other than Certificates or Book-Entry Shares evidencing Excluded Shares or Converted Shares), any cash in lieu of fractional shares of Parent Common Stock to which the holders thereof are entitled pursuant to

Section 3.3(h) and any dividends or other distributions to which the holders thereof are entitled pursuant to Section 3.3(g), without any interest thereon.

11

(d) Termination of Exchange Fund. Any portion of the Exchange Fund that remains

undistributed to the former stockholders of the Company on the twelve (12)-month anniversary of the Closing Date shall be delivered to Parent, upon demand, and any former common stockholders of the Company who have not theretofore received the

Merger Consideration, any cash in lieu of fractional shares of Parent Common Stock to which they are entitled pursuant to Section 3.3(h) and any dividends or other distributions with respect to Parent Common Stock to which