As filed with the Securities and Exchange Commission

on October 24, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

CELESTICA

INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS

CHARTER)

| ONTARIO, CANADA |

98-0185558 |

| (STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) |

(I.R.S. EMPLOYER IDENTIFICATION NO.) |

| 5140 Yonge Street, Suite 1900 |

|

| Toronto, Ontario, Canada |

M2N 6L7 |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) |

(ZIP CODE) |

AMENDED AND RESTATED DIRECTORS’ SHARE

COMPENSATION PLAN

(FULL TITLE OF THE PLAN)

Arnold & Porter Kaye Scholer LLP

Attention: Managing Attorney

250 West 55th Street, New York, New York 10019-9710

(NAME AND ADDRESS OF AGENT FOR SERVICE)

(212) 836-8000

(Telephone

number, including area code, of agent for service)

copies to:

Joel I. Greenberg, Esq.

Sara Adler, Esq.

Arnold & Porter Kaye Scholer LLP

250 West 55th Street

New York, N.Y. 10019-9710

(212) 836-8000 |

|

Matthew

Merkley, Esq.

Blake, Cassels & Graydon LLP

199 Bay Street, Suite 4000

Commerce Court West

Toronto, Ontario M5L 1A9 Canada

(416) 863-2400 |

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

x |

Accelerated filer |

¨ |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

This Registration Statement

on Form S-8 is filed by Celestica Inc. (Registrant) for the purpose of registering 50,000 of the Registrant’s Common Shares,

without par value (Common Shares), issuable under its Amended and Restated Directors’ Share Compensation Plan (Plan).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing

the information specified in Part I of Form S-8 are omitted from this Registration Statement in accordance with the provisions

of Rule 428 under the Securities Act of 1933, as amended (Securities Act), and the introductory Note to Part I of Form S-8.

Such documents will be sent or given to participants in the Plan as specified by Securities Act Rule 428(b)(1). Such documents need

not be filed with the Securities and Exchange Commission (Commission) either as part of this Registration Statement or as prospectuses

or prospectus supplements pursuant to Securities Act Rule 424. Such documents and the documents incorporated by reference herein

pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of

the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference |

The Registrant hereby incorporates

by reference into this Registration Statement the following documents:

| (b) | Exhibit 99.1

to the Registrant’s Report on Form 6-K furnished to the Commission on January 30,

2024, containing the Registrant’s Unaudited Interim Condensed Consolidated Financial

Statements for the quarter and year ended December 31, 2023, and the accompanying notes

thereto; |

| (c) | Exhibit 99.1

and Exhibit 99.2 to the Registrant’s Report on Form 6-K furnished to the

Commission on April 25, 2024, containing the Registrant’s Management’s Discussion

and Analysis of Financial Condition and Results of Operations for the three months ended

March 31, 2024, and its Unaudited Interim Condensed Consolidated Financial Statements

for the three months ended March 31, 2024 and the accompanying notes thereto, respectively; |

| (d) | the

Registrant’s Report on Form 6-K furnished to the Commission on April 25,

2024, containing the Registrant’s Certificate and Articles and Amendment, effective

April 25, 2024, Certificate and Restated Articles of Incorporation effective April 25,

2024, and form of Common Share Certificate; |

| (f) | Exhibit 99.1

and Exhibit 99.2 to the Registrant’s Report on Form 6-K furnished to the

Commission on July 25, 2024, containing the Registrant’s Management’s Discussion

and Analysis of Financial Condition and Results of Operations for the three and six months

ended June 30, 2024, and its Unaudited Interim Condensed Consolidated Financial Statements

for the three and six months ended June 30, 2024 and the accompanying notes thereto,

respectively; |

| (g) | Exhibit 99.1

and Exhibit 99.2 and to the Registrant’s

Report on Form 6-K furnished to the Commission on October 23, 2024, containing

the Registrant’s Management’s Discussion and Analysis of Financial Condition

and Results of Operations for the three and nine months ended September 30, 2024, and

its Unaudited Interim Condensed Consolidated Financial Statements for the three and nine

months ended September 30, 2024 and the accompanying notes thereto, respectively; and |

| (h) | The

description of the Registrant’s Common Shares contained in its Registration Statement

on Form 8-A/A, filed with the Commission on April 25, 2024. |

All documents subsequently

filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (Exchange

Act), after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities

offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference

into this Registration Statement and to be a part hereof from the date of filing of such documents. The Registrant will not, however,

incorporate by reference in this Registration Statement any documents or portions thereof that are not deemed “filed” with

the Commission, including any information furnished by the Registrant on Form 6-K or pursuant to Item 2.02 or Item 7.01 of its Current

Reports on Form 8-K (when applicable) unless, and except to the extent, specified in such reports.

Any statement contained herein,

or in any document (or portion thereof) incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently

filed or furnished document (or portion thereof) which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed to constitute a part of this Registration Statement,

except as so modified or superseded.

| Item 4. | Description of Securities |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel |

Not applicable.

| Item 6. | Indemnification of Directors and Officers |

Under the Business Corporations

Act (Ontario), a registrant may indemnify a present or former director or officer or a person who acts or acted at the registrant’s

request as a director or officer, or an individual acting in a similar capacity, of another entity, against all costs, charges and expenses,

including an amount paid to settle an action or satisfy a judgment, reasonably incurred by that individual in respect of any civil, criminal,

administrative, investigative or other proceeding in which the individual is involved because of that association with the registrant

or other entity; provided that the individual acted honestly and in good faith with a view to the best interests of the registrant or,

as the case may be, to the best interests of such other entity and, in the case of a criminal or administrative action or proceeding

that is enforced by a monetary penalty, had reasonable grounds for believing that the individual’s conduct was lawful. Such indemnification

may be made in connection with a derivative action only with court approval. An individual is entitled to indemnification from a registrant

as a matter of right if the individual was not judged by a court or other competent authority to have committed any fault or omitted

to do anything that the individual ought to have done and the individual fulfilled the conditions set forth above. Under such Act, a

registrant may advance money to a director, officer or other individual for the costs, charges and expenses of a proceeding referred

to above, but the individual must repay the money if the individual does not fulfil the conditions set forth above.

In accordance with and subject

to the Business Corporations Act (Ontario), the by-laws of the Registrant provide for indemnification of a director or officer of the

Registrant, a former director or officer of the Registrant, or a person who acts or acted at the Registrant’s request as a director

or officer, or an individual acting in a similar capacity, of another entity, and such person’s heirs and legal representatives,

against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by such

person in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved because

of that association with the Registrant or other entity, if such person acted honestly and in good faith with a view to the best interests

of the Registrant or, as the case may be, to the best interests of the other entity for which such person acted as a director or officer

or in a similar capacity at the Registrant’s request. Also, the by-laws provide that the Registrant may advance money to a director,

officer or other person for the costs, charges and expenses of a proceeding referred to above, but the person shall repay the money if

the person does not fulfill the conditions set forth above.

The directors and officers

of the Registrant are covered by directors’ and officers’ insurance policies.

| Item 7. | Exemption From Registration Claimed. |

Not applicable.

Pursuant to Item 8(a)(1) of Form S-8, no opinion of counsel

is included herein as none of the securities to be issued under the Plan will be original issuance securities.

* Filed herewith.

(a) The

undersigned registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration

Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes

in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the "Calculation of

Registration Fee" table in the effective Registration Statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or

any material change to such information in this Registration Statement;

Provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13

or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(3) To remove

from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The

Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant's

annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing

of an employee benefit plan's annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated

by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions or otherwise, the Registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a

director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by

such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Toronto, Province of Ontario, Country of Canada, on the 23rd day of October, 2024.

| |

CELESTICA INC. |

| |

|

|

| |

By: |

/s/ Robert A. Mionis |

| |

Robert A. Mionis |

| |

President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE

PRESENTS, that each person whose signature appears below constitutes and appoints Robert A. Mionis, Mandeep Chawla and Douglas Parker,

and each of them, as such individual’s true and lawful attorney in fact and agent with full power of substitution, for such individual

in any and all capacities, to sign any and all amendments to this Registration Statement on Form S-8 (including post-effective amendments),

and to file the same, with all exhibits thereto and other documents in connection therewith, with the Commission, granting unto said

attorney in fact, proxy and agent full power and authority to do and perform each and every act and thing requisite and necessary to

be done in connection therewith, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and

confirming all that said attorney in fact, proxy and agent, or the individual’s substitute, may lawfully do or cause to be done

by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date

indicated.

| SIGNATURE |

TITLE |

DATE |

| |

|

|

| /s/ Robert A. Mionis |

Director, President and Chief Executive Officer |

October 23, 2024 |

| Robert A. Mionis |

(Principal Executive Officer) |

|

| |

|

|

| /s/ Mandeep Chawla |

Chief Financial Officer |

October 23, 2024 |

| Mandeep Chawla |

(Principal Financial Officer and principal accounting officer) |

|

| |

|

|

| /s/ Michael M. Wilson |

Chair of Board and Director |

October 23, 2024 |

| Michael M. Wilson |

|

|

| |

|

|

| /s/ Kulvinder (Kelly) Ahuja |

Director |

October 23, 2024 |

| Kulvinder (Kelly) Ahuja |

|

|

| |

|

|

| /s/ Robert A. Cascella |

Director |

October 23, 2024 |

| Robert A. Cascella |

|

|

| |

|

|

| /s/ Françoise Colpron |

Director |

October 23, 2024 |

| Françoise Colpron |

|

|

| |

|

|

| /s/ Jill Kale |

Director |

October 23, 2024 |

| Jill Kale |

|

|

| |

|

|

| /s/ Laurette T. Koellner |

Director |

October 23, 2024 |

| Laurette T. Koellner |

|

|

| |

|

|

| /s/ Luis A. Müller |

Director |

October 23, 2024 |

| Luis A. Müller |

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the

requirements of Section 6(a) of the Securities Act, the undersigned has signed this Registration Statement, solely in the capacity

of the duly authorized representative of Celestica Inc. in the United States, on the 23rd day of October, 2024.

| |

CELESTICA INC.

(Authorized U.S. Representative) |

| |

| |

|

|

| |

By: |

/s/ Robert A. Mionis |

| |

|

Name: |

Robert A. Mionis |

| |

|

Title: |

President and Chief Executive Officer |

EXHIBIT INDEX

Exhibit 23.1

KPMG LLP

Bay Adelaide Centre

333 Bay Street, Suite 4600

Toronto Ontario M5H 2S5

Telephone (416) 777-8500

Fax (416) 777-8818

www.kpmg.ca

Consent of Independent Registered Public Accounting

Firm

The Board of Directors

Celestica Inc.:

We consent to the use of our report dated

March 8, 2024, on the consolidated financial statements of Celestica Inc. (the “Entity”), which comprise the consolidated

balance sheets as of December 31, 2023 and December 31, 2022, the related consolidated statements of operations, comprehensive

income, changes in equity and cash flows for each of the years in the three-year period ended December 31, 2023, and the related

notes, and our report dated March 8, 2024 on the effectiveness of the Entity’s internal control over financial reporting

as of December 31, 2023, which are incorporated by reference in this Registration Statement on Form S-8 of the Entity and are

included in the Entity’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the United States

Securities and Exchange Commission on March 11, 2024.

/s/ KPMG LLP

Chartered Professional Accountants, Licensed Public Accountants

October 24, 2024

Toronto, Canada

Exhibit 99.1

CELESTICA

INC.

DIRECTORS'

SHARE COMPENSATION PLAN

| 1. | Each director of Celestica Inc. (the “Corporation”) who is not an employee of the Corporation

or any of its subsidiaries (an “Eligible Director”) shall make an annual election (a “Share Compensation Election”),

on or before the last business day of each calendar year, to be paid 50%, 75% or 100% of the aggregate of: |

| (i) | the annual fee (“Annual Board Fee”) payable to such Eligible Director for services

rendered as a member or the Chair (as applicable) of the Board of Directors of the Corporation (the “Board”); |

| (ii) | the travel fees payable to such Eligible Director (“Travel Fees”); and |

| (iii) | where applicable, the fee payable to such Eligible Director for services rendered as Chair of the Audit

Committee of the Board, Chair of the Compensation Committee of the Board, and/or Chair of any other standing or ad hoc committee

of the Board from time to time (“Committee Chair Fees” and, together with Travel Fees “Other Compensation”); |

in each case in respect of the immediately

following calendar year (each calendar year, a “Compensation Period”) in deferred share units (each a “DSU”)

as described in more detail herein or in RSUs, as defined in the Corporation’s Long-Term Incentive Plan, as amended from time to

time (the “LTIP”), which RSUs will be granted pursuant to the LTIP but on terms that comply with paragraph 3 (provided

that an Eligible Director may not elect both DSUs and RSUs for the same Compensation Period). The percentage referred to above is hereinafter

each referred to as a “Share Compensation Election Percentage”. Annual Board Fees and Other Compensation shall all

be as determined by the Board from time to time and are collectively referred to as “Annual Compensation”.

| 2. | An Eligible Director may elect to receive RSUs in respect of a Compensation Period only if the Eligible

Director is, at the time the election is made, in compliance with the minimum share ownership requirements applicable to the Eligible

Director under any share ownership policy or guideline adopted by the Board of Directors of the Corporation from time to time. |

| 3. | RSUs granted pursuant to an election under paragraph 1 or paragraph 5 shall be governed by the terms of

the LTIP, provided that the Share Unit Grant Agreement (as defined in the LTIP) evidencing the allocation of such RSUs shall specify that

they will vest in three equal installments on the first, second and third anniversaries of the Date of Grant (as defined in the LTIP and

determined as provided in paragraph 7(b)), with each such anniversary being a Release Date (as defined in the LTIP) for the RSUs that

vest on such date, provided that any RSUs that remain outstanding and unvested on the date, subject to paragraph 14, on which the Eligible

Director is no longer any of the following: (i) a director of the Corporation; or (ii) an employee of the Corporation; (the

“Retirement Date”) shall immediately vest in full as of such date and such Retirement Date shall be a Release Date

for the RSUs that vest on such Retirement Date. |

| 4. | Subject to the terms of this Plan, each DSU shall entitle an Eligible Director to receive, in accordance

with either paragraph 9 or paragraph 10, a subordinate voting share of the Corporation (a “Share”) or a cash payment

equal to the value of a Share following the Eligible Director’s Retirement Date. |

| 5. | An individual who becomes an Eligible Director during a Compensation Period shall make a Share Compensation

Election and select a Share Compensation Election Percentage to apply in respect of the portion of the Annual Compensation for such Compensation

Period payable in respect of the Corporation’s quarterly financial periods (“Fiscal Quarters”) that commence

after the date such Share Compensation Election is made. A Share Compensation Election made under this paragraph 5 shall not be effective

in respect of the Eligible Director’s Annual Compensation for the Compensation Period in which the individual becomes an Eligible

Director if: (i) such election is not made within 30 days after the individual becomes an Eligible Director; or (ii) to the

extent required by Section 409A of the United States Internal Revenue Code of 1986, as amended from time to time (the “Code”),

the individual previously participated in this Plan or any other plan that is required to be aggregated with this Plan for purposes of

Section 409A of the Code. Any amount of Annual Compensation for the Fiscal Quarter in which an individual becomes an Eligible Director

shall be provided in the form of DSUs. |

| 6. | If an Eligible Director does not make a Share Compensation Election in accordance with paragraph 1 or

5, as applicable, his or her Share Compensation Election Percentage for the Compensation Period or portion thereof, as applicable, for

Annual Compensation awarded in respect of such Compensation Period shall be deemed to be 100% in DSUs. |

| 7. | Annual Compensation is paid to Eligible Directors quarterly, in arrears. The number of DSUs and/or RSUs

that an Eligible Director may receive in respect of each Fiscal Quarter shall be determined as follows: |

| (a) | The number of DSUs to be allocated to an Eligible Director in respect of his or her Annual Compensation

shall be equal to one quarter of the Eligible Director’s Annual Compensation for the applicable Compensation Period, or, in the

event that the date on which an Eligible Director ceases to be an Eligible Director (the “Termination Date”) occurs

during a Fiscal Quarter, a prorated amount of such instalment that reflects the Eligible Director’s actual period of service as

an Eligible Director from the commencement of the applicable Fiscal Quarter to the Eligible Director’s Termination Date, multiplied

by (ii) the Share Compensation Election Percentage, divided by (iii) the closing price of the Shares on the New York Stock Exchange)

(the “NYSE”) on the last trading day of the Fiscal Quarter in respect of which the instalment is to be paid or, in

the event that the Eligible Director’s Termination Date occurs prior to the end of a Fiscal Quarter, such price on the last trading

day of the immediately preceding Fiscal Quarter. Such DSUs shall be credited to the Eligible Director’s Account (as defined below)

as of the last day of the applicable Fiscal Quarter or, in the event that the Eligible Director’s Termination Date occurs prior

to the end of such Fiscal Quarter, as of the Eligible Director’s Termination Date. |

| (b) | The number of RSUs to be allocated to an Eligible Director in respect of his or her Annual Compensation

shall be calculated in accordance with section 19.4 of the LTIP, provided that: (i) the amount of each Grant shall be equal to one

quarter of the Eligible Director’s Annual Compensation for the applicable Compensation Period, or, in the event that the an Eligible

Director’s Termination Date occurs during a Fiscal Quarter, a prorated amount of such quarterly instalment that reflects the Eligible

Director’s actual period of service as an Eligible Director from the commencement of the applicable Fiscal Quarter to the Eligible

Director’s Termination Date, multiplied by the Share Compensation Election Percentage; and (ii) the Date of Grant shall be

the last day of each Fiscal Quarter in the applicable Compensation Period. |

| 8. | The Corporation shall keep or cause to be kept records for each Eligible Director, including an account

(the “Account”) showing the number of DSUs, determined in accordance with paragraph 7(a), rounded to two decimal places,

that the Eligible Director has been granted. A written confirmation of the balance in each Eligible Director’s Account shall be

provided by the Corporation to the Eligible Director at least annually, but the Corporation shall have no obligation to issue any certificate

or other instrument evidencing the DSUs. Records of RSUs granted to an Eligible Director pursuant to an election under this Plan shall

be maintained in accordance with the LTIP. |

| 9. | Subject to paragraph 10, on the date that is forty-five (45) days

following the Eligible Director’s Retirement Date or the following business day if such forty-fifth (45th) day is not a business

day (the “Valuation Date”), or as soon as practicable thereafter (but in all cases within ninety (90) days following

the Eligible Director’s Retirement Date), the Corporation, through its Share Plan Administrator, shall deliver to the Eligible Director

the number of Shares that equals the number of DSUs in the Eligible Director’s Account on the Valuation Date, less such number of

Shares the value of which is required to satisfy applicable withholding taxes and source deductions. The Administrator shall, in accordance

with the instructions of the Eligible Director or the Eligible Director’s legal representative, as applicable, deliver to the Eligible

Director or the Eligible Director’s legal representative, as applicable, a certificate representing such Shares, or credit such

Shares to an account with a broker in the name of the Eligible Director or the Eligible Director’s legal representative, as applicable,

as soon as practicable thereafter. Settlement of RSUs granted to an Eligible Director pursuant to an election under this Plan shall be

made in accordance with the LTIP. |

| 10. | The Corporation shall have the right, in its sole discretion, to pay all

or a portion of the value of an Eligible Director’s DSUs to the Eligible Director or the Eligible Director’s legal representative,

as applicable, in a lump sum cash payment in an amount equal to the product obtained by multiplying the number of DSUs in the Eligible

Director’s Account on the Valuation Date by the closing price of the Shares on the NYSE (or, if the Shares are not listed on the

NYSE, then on the over the counter market, or, if the Shares are not listed on the over the counter market, the fair market value of the

Shares as determined by the Board in good faith) on the Valuation Date, less applicable withholding taxes and source deductions, and shall

do so if there is no public market for the Shares. Such lump sum payments shall be made on the Valuation Date, or as soon as practicable

thereafter (but in all cases within ninety (90) days following the Eligible Director’s Retirement Date). |

| 11. | Each Eligible Director who receives Shares under this Plan shall comply with all applicable securities

regulations and policies of the Corporation relating to the purchase and sale of Shares. |

| 12. | In the event of a (i) capital reorganization, (ii) merger, (iii) amalgamation,

(iv) offer for shares of the Corporation which if successful would entitle the offeror to acquire all of the shares of the Corporation

or all of one or more particular class(es) of shares of the Corporation to which the offer relates, (v) sale of a material portion

of the assets of the Corporation, (vi) arrangement or other scheme of reorganization (a “Reorganization”) or proposed

Reorganization, or (vii) an increase or decrease in the outstanding Shares as a result of a stock split, consolidation, subdivision,

reclassification or recapitalization but, for greater certainty, not as a result of the issuance of Shares for additional consideration,

by way of a stock dividend or other distribution in the ordinary course or as a result of a rights offering, the Corporation may adjust

the Account of each Eligible Director in such manner as the Corporation determines, in its discretion, is equitable to reflect such event.

The adjustment so made by the Corporation, if any, shall be conclusive and binding for all purposes of this Plan, and Eligible Directors

(and any person claiming through an Eligible Director) shall have no other rights as a result of any change in the Shares or of any other

event. In the event of a Reorganization, RSUs granted to an Eligible Director pursuant to an election under this Plan shall be

subject to adjustment in accordance with the LTIP. |

| 13. | The Corporation may amend or terminate the Plan in whole or in part at any time as it deems necessary

or appropriate, but no such amendment or termination shall, without the consent of the Eligible Director or unless required by law, adversely

affect the rights of an Eligible Director with respect to DSUs to which the Eligible Director is then entitled under the Plan. Notwithstanding

the foregoing, any amendment of the Plan shall be such that the Plan continuously meets the requirements of paragraph 6801(d) of

the regulations under the Income Tax Act (Canada) or any successor to such provision. |

| 14. | The Corporation intends that the Plan comply with the requirements of section 409A of the Code, insofar

as this Plan pays benefits that are subject to taxation under the Code that are subject to section 409A of the Code, and intends

to administer the Plan accordingly. If any one or more provisions of the Plan may be interpreted to comply with, or be exempt from, Section 409A

of the Code, then such provision(s) shall be so interpreted. For greater certainty, notwithstanding anything in the Plan to the contrary,

with respect to all Plan benefits payable to or with respect to an Eligible Director (if any Plan benefits payable to or with respect

to that Eligible Director are subject to taxation under the Code and are subject to section 409A of the Code), “Retirement

Date” shall mean the date on which the Eligible Director has experienced a “separation from service” as defined in Section 409A

of the Code and applicable regulations and guidance thereunder such that it is reasonably anticipated that no further services will be

performed and provided that, in any event, all payments under the Plan to Eligible Directors who are subject to taxation under the Code

shall be made in compliance with Section 409A of the Code. |

| 15. | The Board shall have full power and authority, subject to the provisions hereof, to construe and interpret

the Plan. The Board’s decisions, determinations and interpretations shall be final, conclusive and binding on all past, present

and future Eligible Directors and all other persons, if any, having an interest herein. Neither the Board nor its members shall be liable

for any action, omission or determination made in good faith with respect to the Plan. |

As amended and restated as at December 11, 2023

S-8

S-8

EX-FILING FEES

0001030894

CELESTICA INC

Fees to be Paid

0001030894

2024-10-22

2024-10-22

0001030894

1

2024-10-22

2024-10-22

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-8

|

|

CELESTICA INC

|

|

Table 1: Newly Registered Securities

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

1

|

Equity

|

Common Shares, without par value

|

Other

|

50,000

|

$

56.96

|

$

2,848,000.00

|

0.0001531

|

$

436.03

|

|

Total Offering Amounts:

|

|

$

2,848,000.00

|

|

$

436.03

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

Net Fee Due:

|

|

|

|

$

436.03

|

|

1

|

(1) This registration statement covers 50,000 Common Shares issuable under Celestica Inc.'s Amended and Restated Directors' Share Compensation Plan (Plan). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), this Registration Statement shall also cover any additional Common Shares which become issuable under the Plan with respect to the securities identified in the above table pursuant to anti-dilution and adjustment provisions thereof resulting from stock splits, stock dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) promulgated under the Securities Act. The "Proposed Maximum Offering Price Per Unit" and "Maximum Aggregate Offering Price" are based on the average high and low prices of the Common Shares reported on the New York Stock Exchange on October 21, 2024.

|

|

|

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Oct. 22, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Shares, without par value

|

| Amount Registered | shares |

50,000

|

| Proposed Maximum Offering Price per Unit |

56.96

|

| Maximum Aggregate Offering Price |

$ 2,848,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 436.03

|

| Offering Note |

(1) This registration statement covers 50,000 Common Shares issuable under Celestica Inc.'s Amended and Restated Directors' Share Compensation Plan (Plan). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (Securities Act), this Registration Statement shall also cover any additional Common Shares which become issuable under the Plan with respect to the securities identified in the above table pursuant to anti-dilution and adjustment provisions thereof resulting from stock splits, stock dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) promulgated under the Securities Act. The "Proposed Maximum Offering Price Per Unit" and "Maximum Aggregate Offering Price" are based on the average high and low prices of the Common Shares reported on the New York Stock Exchange on October 21, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

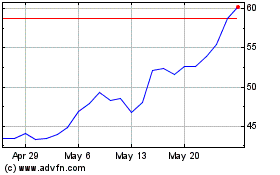

Celestica (NYSE:CLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Celestica (NYSE:CLS)

Historical Stock Chart

From Dec 2023 to Dec 2024