Cementos Pacasmayo S.A.A. Announces Consolidated Results For Fourth Quarter 2022

February 14 2023 - 8:41PM

Business Wire

Cementos Pacasmayo S.A.A. and subsidiaries (NYSE: CPAC; BVL:

CPACASC1) (“the Company” or “Pacasmayo”) a leading cement company

serving the Peruvian construction industry, announced today its

consolidated results for the fourth quarter (“4Q22”) and the full

year (“2022”) ended December 31, 2022. These results have been

prepared in accordance with International Financial Reporting

Standards (“IFRS”) and are stated in nominal Peruvian Soles

(S/).

4Q22 FINANCIAL AND OPERATIONAL HIGHLIGHTS:

(All comparisons are to 4Q21, unless otherwise stated)

- Revenues increased 1.7%, mainly due to an increase in

average prices of bagged cement, as inflationary pressures have

affected our costs of raw materials and energy.

- Sales volume of cement, concrete and precast decreased

7.7%, mainly due to a moderation in sales volume from the peak

levels reached last year, as well as the slowdown related to some

blocked roads during December.

- Consolidated EBITDA of S/121.0 million, a 14.5%

decrease, mainly due to non-recurrent expenses. Despite this

increase, this quarter’s EBITDA is similar to the one achieved in

previous quarters.

- Consolidated EBITDA margin of 22.7%, a 4.3 percentage

point decrease.

- Net income of S/ 38.9 million, a 24.6% decrease mainly

due to decreased operating profit as mentioned above, as well as a

slight increase in income tax expense.

- The Sustainability Yearbook 2023 - We are honored to

have been included in the Yearbook by S&P, for the third

consecutive year. This Yearbook incorporates companies that score

in the top 15% of their industry globally and have a gap of less

than 30% from the leader's Global ESG score.

2022 FINANCIAL AND OPERATIONAL HIGHLIGHTS:

(All comparisons are to 2021, unless otherwise stated)

- Revenues increased 9.2%, mainly due to the

above-mentioned reasons.

- Sales volume of cement, concrete and precast decreased

5.3%, mainly due to the moderation in sales volume mentioned

above.

- Consolidated EBITDA of S/ 493.9 million, an 8.8%

increase, mainly due to increased revenues this year, as well as

higher operating profit for the first nine months of the year since

we were able to optimize our cost structure to improve

profitability.

- Consolidated EBITDA margin of 23.3%, similar to

2021.

- Net income of S/ 176.8 million, a 15.4% increase mainly

due to increased sales and operating profit as mentioned

above.

For a full version of Cementos Pacasmayo’s Fourth Quarter

2022 Earnings Release, please visit

https://www.cementospacasmayo.com.pe/inversionistas/reportes

CONFERENCE CALL

INFORMATION:

Cementos Pacasmayo will host a conference call on Wednesday,

February 15, 2023, to discuss these results at 09:30 a.m.

Eastern and Lima Time.

To access the call, please dial:

(888)-506-0062 from within the U.S.

+1 (973) 528-0011 from outside the U.S.

Access code: 113189

There will also be a live Audio Webcast of the event at:

https://www.webcaster4.com/Webcast/Page/1644/47461

About Cementos Pacasmayo S.A.A.

Cementos Pacasmayo S.A.A. is a cement company, located in the

Northern region of Peru. In February 2012, the Company’s shares

were listed on The New York Stock Exchange - Euronext under the

ticker symbol "CPAC". With more than 65 years of operating history,

the Company produces, distributes and sells cement and

cement-related materials, such as concrete blocks and ready-mix

concrete. Pacasmayo’s products are primarily used in construction,

which has been one of the fastest-growing segments of the Peruvian

economy in recent years. The Company also produces and sells

quicklime for use in mining operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230214005909/en/

Cementos Pacasmayo S.A.A. In Lima, Peru: Manuel Ferreyros, CFO

Claudia Bustamante Investor Relations Manager +51-958699760

cbustamante@cpsaa.com.pe

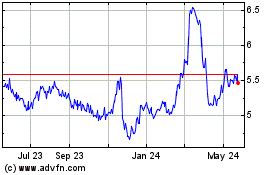

Cementos Pacasmayo SAA (NYSE:CPAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

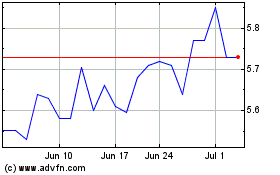

Cementos Pacasmayo SAA (NYSE:CPAC)

Historical Stock Chart

From Dec 2023 to Dec 2024