0000019745falseAugust 8, 2024falseNYSE00000197452024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

CHESAPEAKE UTILITIES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-11590 | | 51-0064146 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation or organization) | | File Number) | | Identification No.) |

500 Energy Lane, Dover, DE 19901

(Address of principal executive offices, including Zip Code)

(302) 734-6799

(Registrant's Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock - par value per share $0.4867 | CPK | New York Stock Exchange, Inc. |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, Chesapeake Utilities Corporation issued a press release announcing its financial results for the quarter and six months ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On August 8, 2024, Chesapeake Utilities Corporation posted a presentation that will be used during its conference call on August 9, 2024, to discuss the Company’s financial results for the quarter and six months ended June 30, 2024, on its website (www.chpk.com) under the “Investors” section. This presentation is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 99.1 - Press Release of Chesapeake Utilities Corporation, dated August 8, 2024. Exhibit 99.2 - Second Quarter 2024 Earnings Call Presentation

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

|

CHESAPEAKE UTILITIES CORPORATION |

|

| /s/ Beth W. Cooper |

| Beth W. Cooper |

| Executive Vice President, Chief Financial Officer, Treasurer, and Assistant Corporate Secretary |

|

| Date: August 8, 2024 |

FOR IMMEDIATE RELEASE

August 8, 2024

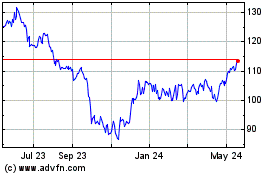

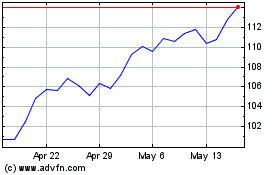

NYSE Symbol: CPK

CHESAPEAKE UTILITIES CORPORATION REPORTS SECOND QUARTER

2024 RESULTS

•Net income and earnings per share ("EPS")* were $18.3 million and $0.82, respectively, for the second quarter of 2024, and $64.4 million and $2.89, respectively, for the six months ended June 30, 2024

•Adjusted net income and Adjusted EPS**, which exclude transaction and transition-related expenses attributable to the acquisition and integration of Florida City Gas ("FCG"), were $19.3 million and $0.86, respectively, for the second quarter of 2024 and $66.1 million and $2.96, respectively, for the six months ended June 30, 2024

•Adjusted gross margin** growth of $61.8 million during the first half of 2024 driven by contributions from FCG, natural gas organic growth and continued pipeline expansion projects, regulatory initiatives and additional customer consumption

•Multiple pipeline projects received approval to proceed, supporting continued natural gas demand in Delaware and Florida and driving incremental margins for 2025 and beyond

•Results continue to track in line with Management's expectations, and the Company continues to affirm 2024 EPS and capital guidance

Dover, Delaware — Chesapeake Utilities Corporation (NYSE: CPK) (“Chesapeake Utilities” or the “Company”) today announced financial results for the three and six months ended June 30, 2024.

Net income for the second quarter of 2024 was $18.3 million ($0.82 per share) compared to $16.1 million ($0.90 per share) in the second quarter of 2023. Excluding transaction and transition-related expenses associated with the fourth quarter 2023 acquisition of FCG, adjusted net income was $19.3 million, or $0.86 per share compared to $16.1 million ($0.90 per share) reported in the prior-year period. The net income and adjusted net income growth represented 13.3 percent and 19.5 percent, respectively.

For the second quarter of 2024, incremental contributions from FCG, additional margin from regulated infrastructure programs, and growth in the Company's natural gas distribution businesses and continued pipeline expansion projects to support distribution growth were offset by the financing impacts of the FCG acquisition, including increased interest expense related to debt issued and additional shares outstanding.

During the first half of 2024, net income was $64.4 million ($2.89 per share) compared to $52.5 million ($2.94 per share) in the prior-year period. Excluding the transaction and transition-related expenses, adjusted net income was $66.1 million ($2.96 per share) compared to $52.5 million ($2.94 per share) for the same period in 2023.

Earnings for the first half of 2024 were primarily impacted by the factors discussed for the second quarter as well as additional adjusted gross margin from increased customer consumption experienced earlier in the year.

“Our results this quarter demonstrate the opportunities in our high-growth service areas, the value of our unregulated businesses and our commitment to operational excellence,” said Jeff Householder, chair,

president and CEO. “We continue to remain on-track with the integration of FCG, experienced continued strong customer growth of approximately 4 percent across our Delmarva and Florida footprints and managed expenses prudently, driving 41 percent of adjusted gross margin to operating income on a year-to-date basis.”

“This performance is in line with our expectations for 2024 and is driven by our ability to execute on our growth strategy: developing and investing record levels of capital, advancing our regulatory agenda and continuing our business transformation efforts,” Householder continued. “Through the second quarter of this year, we invested $160 million in capital expenditures, received regulatory approval for three (3) new transportation projects, and are going live with a new enterprise-wide utility billing system in the third quarter. Our achievements thus far enable us to affirm our full-year 2024 adjusted EPS guidance of $5.33 to $5.45 per share and 2024 capital expenditures guidance of $300 to $360 million. The team’s consistent focus on customer service and our growth strategy positions us for continued longer-term growth as well.”

Earnings and Capital Investment Guidance

The Company continues to affirm its 2024 EPS guidance of $5.33 to $5.45 in adjusted earnings per share given the incremental margin opportunities present across the Company’s businesses, investment opportunities within and surrounding FCG, regulatory initiatives and operating synergies.

The Company also affirms its previously announced 2024 capital expenditure guidance of $300 million to $360 million, as well as the capital expenditure guidance for the five-year period ended 2028 that will range from $1.5 billion to $1.8 billion. This investment forecast is projected to result in a 2025 EPS guidance range of $6.15 to $6.35, as well as a 2028 EPS guidance range of $7.75 to $8.00. This implies an EPS growth rate of approximately 8 percent from the 2025 EPS guidance range.

*Unless otherwise noted, EPS and Adjusted EPS information are presented on a diluted basis.

Non-GAAP Financial Measures

**This press release including the tables herein, include references to both Generally Accepted Accounting Principles ("GAAP") and non-GAAP financial measures, including Adjusted Gross Margin, Adjusted Net Income and Adjusted EPS. A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non-GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period.

The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue-producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. The Company calculates Adjusted Net Income and Adjusted EPS by deducting costs and expenses associated with significant acquisitions that may affect the comparison of period-over-period results. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The Company believes that these non-GAAP measures are useful and meaningful to investors as a basis for making investment decisions, and provide investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses these non-GAAP financial measures in assessing a business unit and Company performance. Other companies may calculate these non-GAAP financial measures in a different manner.

The following tables reconcile Gross Margin, Net Income, and EPS, all as defined under GAAP, to our non-GAAP measures of Adjusted Gross Margin, Adjusted Net Income and Adjusted EPS for each of the periods presented.

Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2024 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 130,625 | | | $ | 41,419 | | | $ | (5,772) | | | $ | 166,272 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (27,378) | | | (18,006) | | | 5,744 | | | (39,640) | |

| Depreciation & amortization | | (14,657) | | | (3,223) | | | 3 | | | (17,877) | |

Operations & maintenance expenses (1) | | (12,255) | | | (7,893) | | | 3 | | | (20,145) | |

| Gross Margin (GAAP) | | 76,335 | | 76335 | 12,297 | | | (22) | | | 88,610 | |

Operations & maintenance expenses (1) | | 12,255 | | | 7,893 | | | (3) | | | 20,145 | |

| Depreciation & amortization | | 14,657 | | | 3,223 | | | (3) | | | 17,877 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 103,247 | | | $ | 23,413 | | | $ | (28) | | | $ | 126,632 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended June 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 101,141 | | | $ | 40,751 | | | $ | (6,299) | | | $ | 135,593 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (23,886) | | | (18,116) | | | 6,209 | | | (35,793) | |

| Depreciation & amortization | | (13,035) | | | (4,269) | | | 1 | | | (17,303) | |

Operations & maintenance expenses (1) | | (9,240) | | | (7,520) | | | (2) | | | (16,762) | |

| Gross Margin (GAAP) | | 54,980 | | | 10,846 | | | (91) | | | 65,735 | |

Operations & maintenance expenses (1) | | 9,240 | | | 7,520 | | | 2 | | | 16,762 | |

| Depreciation & amortization | | 13,035 | | | 4,269 | | | (1) | | | 17,303 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 77,255 | | | $ | 22,635 | | | $ | (90) | | | $ | 99,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, 2024 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 299,051 | | | $ | 124,522 | | | $ | (11,557) | | | $ | 412,016 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (77,296) | | | (55,060) | | | 11,499 | | | (120,857) | |

| Depreciation & amortization | | (27,194) | | | (7,704) | | | 5 | | | (34,893) | |

Operations & maintenance expenses (1) | | (24,991) | | | (16,315) | | | 1 | | | (41,305) | |

| Gross Margin (GAAP) | | 169,570 | | | 45,443 | | | (52) | | | 214,961 | |

Operations & maintenance expenses (1) | | 24,991 | | | 16,315 | | | (1) | | | 41,305 | |

| Depreciation & amortization | | 27,194 | | | 7,704 | | | (5) | | | 34,893 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 221,755 | | | $ | 69,462 | | | $ | (58) | | | $ | 291,159 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Six Months Ended June 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 243,411 | | | $ | 123,916 | | | $ | (13,605) | | | $ | 353,722 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (79,174) | | | (58,687) | | | 13,479 | | | (124,382) | |

| Depreciation & amortization | | (25,987) | | | (8,503) | | | 4 | | | (34,486) | |

Operations & maintenance expenses (1) | | (18,527) | | | (15,996) | | | 3 | | | (34,520) | |

| Gross Margin (GAAP) | | 119,723 | | | 40,730 | | | (119) | | | 160,334 | |

Operations & maintenance expenses (1) | | 18,527 | | | 15,996 | | | (3) | | | 34,520 | |

| Depreciation & amortization | | 25,987 | | | 8,503 | | | (4) | | | 34,486 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 164,237 | | | $ | 65,229 | | | $ | (126) | | | $ | 229,340 | |

(1) Operations & maintenance expenses within the condensed consolidated statements of income are presented in accordance with regulatory requirements and to provide comparability within the industry. Operations & maintenance expenses which are deemed to be directly attributable to revenue producing activities have been separately presented above in order to calculate Gross Margin as defined under US GAAP.

Adjusted Net Income and Adjusted EPS

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | June 30, | | |

| (in thousands, except per share data) | | 2024 | | 2023 | | | | |

| Net Income (GAAP) | | $ | 18,271 | | | $ | 16,133 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 1,006 | | | — | | | | | |

| Adjusted Net Income (Non-GAAP) | | $ | 19,277 | | | $ | 16,133 | | | | | |

| | | | | | | | |

Weighted average common shares outstanding - diluted (2) | | 22,335 | | | 17,852 | | | | | |

| | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 0.82 | | | $ | 0.90 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.04 | | | — | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP) | | $ | 0.86 | | | $ | 0.90 | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Six Months Ended | | |

| | June 30, | | |

| (in thousands, except per share data) | | 2024 | | 2023 | | | | |

| Net Income (GAAP) | | $ | 64,439 | | | $ | 52,477 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 1,683 | | | — | | | | | |

| Adjusted Net Income (Non-GAAP) | | $ | 66,122 | | | $ | 52,477 | | | | | |

| | | | | | | | |

Weighted average common shares outstanding - diluted (2) | | 22,320 | | | 17,842 | | | | | |

| | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 2.89 | | | $ | 2.94 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.07 | | | — | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP) | | $ | 2.96 | | | $ | 2.94 | | | | | |

(1) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

(2) Weighted average shares for the three and six months ended June 30, 2024 reflect the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

Operating Results for the Quarters Ended June 30, 2024 and 2023

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 126,632 | | | $ | 99,800 | | | $ | 26,832 | | | 26.9 | % |

| Depreciation, amortization and property taxes | 26,703 | | | 23,628 | | | 3,075 | | | 13.0 | % |

| FCG transaction and transition-related expenses | 1,374 | | | — | | | 1,374 | | | NMF |

| Other operating expenses | 57,765 | | | 47,826 | | | 9,939 | | | 20.8 | % |

| Operating income | $ | 40,790 | | | $ | 28,346 | | | $ | 12,444 | | | 43.9 | % |

Operating income for the second quarter of 2024 was $40.8 million, an increase of $12.4 million or 43.9 percent compared to the same period in 2023. Excluding transaction and transition-related expenses associated with the acquisition and integration of FCG, operating income increased $13.8 million or 48.7 percent compared to the prior-year period. An increase in adjusted gross margin in the second quarter of 2024 was driven by contributions from the acquisition of FCG, incremental margin from regulatory initiatives, natural gas organic growth and continued pipeline expansion projects and improvements from the Company's unregulated businesses. Higher operating expenses were driven largely by the operating expenses of FCG, increased payroll, benefits and other employee-related expenses, and higher insurance and vehicle expenses compared to the prior-year period. Increases in depreciation, amortization and property taxes attributable to growth projects and FCG were partially offset by a $2.3 million reserve surplus amortization mechanism ("RSAM") adjustment from FCG and lower depreciation from our electric operations due to revised rates from an approved electric depreciation study.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 103,247 | | | $ | 77,255 | | | $ | 25,992 | | | 33.6 | % |

| Depreciation, amortization and property taxes | 22,863 | | | 18,854 | | | 4,009 | | | 21.3 | % |

| FCG transaction and transition-related expenses | 1,374 | | | — | | | 1,374 | | | NMF |

| Other operating expenses | 38,505 | | | 29,110 | | | 9,395 | | | 32.3 | % |

| Operating income | $ | 40,505 | | | $ | 29,291 | | | $ | 11,214 | | | 38.3 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

| Contribution from FCG | $ | 23,367 | |

| Margin from regulated infrastructure programs | 1,340 | |

| Natural gas growth including conversions (excluding service expansions) | 1,253 | |

| Natural gas transmission service expansions, including interim services | 563 | |

| |

| |

| |

| Other variances | (531) | |

| Quarter-over-quarter increase in adjusted gross margin** | $ | 25,992 | |

(1) Includes adjusted gross margin contributions from permanent base rates that became effective in March 2023.

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| FCG operating expenses | $ | 8,597 | |

| Payroll, benefits and other employee-related expenses | 679 | |

| Other variances | 119 | |

| Quarter-over-quarter increase in other operating expenses | $ | 9,395 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 23,413 | | | $ | 22,635 | | | $ | 778 | | | 3.4 | % |

| Depreciation, amortization and property taxes | 3,843 | | | 4,777 | | | (934) | | | (19.6) | % |

| Other operating expenses | 19,332 | | | 18,851 | | | 481 | | | 2.6 | % |

| Operating income (loss) | $ | 238 | | | $ | (993) | | | $ | 1,231 | | | NMF |

The major components of the change in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Contributions from acquisition | | $ | 160 | |

| Increased propane customer consumption | | 117 | |

| | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased level of virtual pipeline services | | 587 | |

| Aspire Energy | | |

| Increased margins - rate changes and gathering fees | | 251 | |

| Other variances | | (337) | |

| Quarter-over-quarter increase in adjusted gross margin** | | $ | 778 | |

The major components of the increase in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| Increased insurance related costs | | $ | 283 | |

| Increased vehicle expenses | | 246 | |

| Other variances | | (48) | |

| Quarter-over-quarter increase in other operating expenses | | $ | 481 | |

Operating Results for the Six Months Ended June 30, 2024 and 2023

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 291,159 | | | $ | 229,340 | | | $ | 61,819 | | | 27.0 | % |

| Depreciation, amortization and property taxes | 52,813 | | | 47,118 | | | 5,695 | | | 12.1 | % |

| FCG transaction and transition-related expenses | 2,295 | | | — | | | 2,295 | | | NMF |

| Other operating expenses | 115,676 | | | 98,961 | | | 16,715 | | | 16.9 | % |

| Operating income | $ | 120,375 | | | $ | 83,261 | | | $ | 37,114 | | | 44.6 | % |

Operating income for the first half of 2024 was $120.4 million, an increase of $37.1 million compared to the same period in 2023. Excluding transaction and transition-related expenses associated with the acquisition and integration of FCG, operating income increased $39.4 million or 47.3 percent compared to the prior-year period. An increase in adjusted gross margin in the first half of 2024 was driven by contributions from the acquisition of FCG, natural gas organic growth and continued pipeline expansion projects, incremental margin from regulatory initiatives, higher customer consumption and contributions from the Company's unregulated businesses. Higher operating expenses largely associated with FCG were partially offset by lower payroll, benefits and other employee-related expenses compared to the prior-year period. Increases in depreciation, amortization and property taxes attributable to growth projects and FCG were partially offset by a $5.7 million RSAM adjustment from FCG and lower depreciation from our electric operations due to revised rates from an approved electric depreciation study.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended | | | | |

| June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 221,755 | | | $ | 164,237 | | | $ | 57,518 | | | 35.0 | % |

| Depreciation, amortization and property taxes | 43,818 | | | 37,524 | | | 6,294 | | | 16.8 | % |

| FCG transaction and transition-related expenses | 2,295 | | | — | | | 2,295 | | | NMF |

| Other operating expenses | 77,028 | | | 59,797 | | | 17,231 | | | 28.8 | % |

| Operating income | $ | 98,614 | | | $ | 66,916 | | | $ | 31,698 | | | 47.4 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

| Contribution from FCG | $ | 48,326 | |

| Natural gas growth including conversions (excluding service expansions) | 3,169 | |

| Margin from regulated infrastructure programs | 2,618 | |

| Natural gas transmission service expansions, including interim services | 2,154 | |

Rate changes associated with the Florida natural gas base rate proceeding (1) | 1,630 | |

| |

| |

| Other variances | (379) | |

| Period-over-period increase in adjusted gross margin** | $ | 57,518 | |

(1) Includes adjusted gross margin contributions from permanent base rates that became effective in March 2023.

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| FCG operating expenses | $ | 17,887 | |

| Payroll, benefits and other employee-related expenses | (1,109) | |

| Other variances | 453 | |

| Period-over-period increase in other operating expenses | $ | 17,231 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended

June 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 69,462 | | | $ | 65,229 | | | $ | 4,233 | | | 6.5 | % |

| Depreciation, amortization and property taxes | 8,998 | | | 9,598 | | | (600) | | | (6.3) | % |

| Other operating expenses | 38,797 | | | 39,379 | | | (582) | | | (1.5) | % |

| Operating income | $ | 21,667 | | | $ | 16,252 | | | $ | 5,415 | | | 33.3 | % |

The major components of the change in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Increased propane customer consumption | | $ | 1,505 | |

| Contributions from acquisition | | 598 | |

| Increased propane margins and service fees | | 463 | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased level of virtual pipeline services | | 487 | |

| Aspire Energy | | |

| Increased margins - rate changes and gathering fees | | 1,189 | |

| | |

| Other variances | | (9) | |

| Period-over-period increase in adjusted gross margin** | | $ | 4,233 | |

The major components of the decrease in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| Decreased payroll, benefits and other employee-related expenses | | $ | (1,083) | |

| Increased insurance related costs | | 655 | |

| Increased vehicle expenses | | 386 | |

| Other variances | | (540) | |

| Period-over-period decrease in other operating expenses | | $ | (582) | |

Forward-Looking Statements

Matters included in this release may include forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements. Please refer to the Safe Harbor for Forward-Looking Statements in the Company’s 2023 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the second quarter of 2024 for further information on the risks and uncertainties related to the Company’s forward-looking statements.

Conference Call

Chesapeake Utilities (NYSE: CPK) will host a conference call on Friday, August 9, 2024 at 8:30 a.m. Eastern Time to discuss the Company’s financial results for the three and six months ended June 30, 2024. To listen to the Company’s conference call via live webcast, please visit the Events & Presentations section of the Investors page on www.chpk.com. For investors and analysts that wish to participate by phone for the question and answer portion of the call, please use the following dial-in information:

Toll-free: 800.445-7795

International: 203.518.9856

Conference ID: CPKQ224

A replay of the presentation will be made available on the previously noted website following the conclusion of the call.

About Chesapeake Utilities Corporation

Chesapeake Utilities Corporation is a diversified energy delivery company, listed on the New York Stock Exchange. Chesapeake Utilities Corporation offers sustainable energy solutions through its natural gas

transmission and distribution, electricity generation and distribution, propane gas distribution, mobile compressed natural gas utility services and solutions, and other businesses.

Please note that Chesapeake Utilities Corporation is not affiliated with Chesapeake Energy, an oil and natural gas exploration company headquartered in Oklahoma City, Oklahoma.

For more information, contact:

Beth W. Cooper

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Corporate Secretary

302.734.6022

Michael D. Galtman

Senior Vice President and Chief Accounting Officer

302.217.7036

Lucia M. Dempsey

Head of Investor Relations

347.804.9067

Financial Summary

(in thousands, except per-share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended | | |

| June 30, | | June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Adjusted Gross Margin | | | | | | | | | | | |

| Regulated Energy segment | $ | 103,247 | | | $ | 77,255 | | | $ | 221,755 | | | $ | 164,237 | | | | | |

| Unregulated Energy segment | 23,413 | | | 22,635 | | | 69,462 | | | 65,229 | | | | | |

| Other businesses and eliminations | (28) | | | (90) | | | (58) | | | (126) | | | | | |

| Total Adjusted Gross Margin** | $ | 126,632 | | | $ | 99,800 | | | $ | 291,159 | | | $ | 229,340 | | | | | |

| | | | | | | | | | | |

| Operating Income (Loss) | | | | | | | | | | | |

| Regulated Energy segment | $ | 40,505 | | | $ | 29,291 | | | $ | 98,614 | | | $ | 66,916 | | | | | |

| Unregulated Energy segment | 238 | | | (993) | | | 21,667 | | | 16,252 | | | | | |

| Other businesses and eliminations | 47 | | | 48 | | | 94 | | | 93 | | | | | |

| Total Operating Income | 40,790 | | | 28,346 | | | 120,375 | | | 83,261 | | | | | |

| Other income, net | 1,110 | | | 831 | | | 1,305 | | | 1,107 | | | | | |

| Interest charges | 16,813 | | | 6,964 | | | 33,839 | | | 14,196 | | | | | |

| Income Before Income Taxes | 25,087 | | | 22,213 | | | 87,841 | | | 70,172 | | | | | |

| Income taxes | 6,816 | | | 6,080 | | | 23,402 | | | 17,695 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net Income | $ | 18,271 | | | $ | 16,133 | | | $ | 64,439 | | | $ | 52,477 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted Average Common Shares Outstanding: (1) | | | | | | | | | | | |

| Basic | 22,284 | | | 17,794 | | | 22,267 | | | 17,777 | | | | | |

| Diluted | 22,335 | | | 17,852 | | | 22,320 | | | 17,842 | | | | | |

| | | | | | | | | | | |

Earnings Per Share of Common Stock | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Basic | $ | 0.82 | | $ | 0.91 | | $ | 2.89 | | $ | 2.95 | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Diluted | $ | 0.82 | | $ | 0.90 | | $ | 2.89 | | $ | 2.94 | | | | |

| | | | | | | | | | | |

| Adjusted Net Income and Adjusted Earnings Per Share | | | | | | | | | | | |

| Net Income (GAAP) | $ | 18,271 | | | $ | 16,133 | | | $ | 64,439 | | | $ | 52,477 | | | | | |

FCG transaction and transition-related-expenses, net (2) | 1,006 | | | — | | | 1,683 | | | — | | | | | |

| Adjusted Net Income (Non-GAAP)** | $ | 19,277 | | | $ | 16,133 | | | $ | 66,122 | | | $ | 52,477 | | | | | |

| | | | | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | $ | 0.82 | | | $ | 0.90 | | | $ | 2.89 | | | $ | 2.94 | | | | | |

FCG transaction and transition-related-expenses, net (2) | 0.04 | | | — | | | 0.07 | | | — | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP)** | $ | 0.86 | | | $ | 0.90 | | | $ | 2.96 | | | $ | 2.94 | | | | | |

(1) Weighted average shares for the three and six months ended June 30, 2024 reflect the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

(2) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

Financial Summary Highlights

Key variances between the second quarter of 2023 and 2024 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

| Second Quarter of 2023 Adjusted Results | | $ | 22,213 | | | $ | 16,133 | | | $ | 0.90 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increased Adjusted Gross Margins: | | | | | | |

| Contributions from acquisitions | | 23,527 | | | 17,135 | | | 0.77 | |

| Margin from regulated infrastructure programs* | | 1,340 | | | 976 | | | 0.04 | |

| Natural gas growth including conversions (excluding service expansions) | | 1,253 | | | 912 | | | 0.04 | |

| Increased level of virtual pipeline services | | 587 | | | 428 | | | 0.02 | |

| Natural gas transmission service expansions, including interim services* | | 563 | | | 410 | | | 0.02 | |

| Improved Aspire Energy performance - rate changes and gathering fees | | 251 | | | 183 | | | — | |

| | 27,521 | | | 20,044 | | | 0.89 | |

| | | | | | |

| Increased Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| FCG operating expenses | | (9,720) | | | (7,079) | | | (0.32) | |

| Payroll, benefits and other employee-related expenses | | (772) | | | (562) | | | (0.02) | |

| Insurance related costs | | (559) | | | (407) | | | (0.02) | |

| Vehicle expenses | | (250) | | | (182) | | | (0.01) | |

| Depreciation, amortization and property tax costs (includes FCG) | | (1,951) | | | (1,421) | | | (0.06) | |

| | (13,252) | | | (9,651) | | | (0.43) | |

| | | | | | |

| Interest charges | | (9,849) | | | (7,173) | | | (0.32) | |

| Increase in shares outstanding due to 2023 and 2024 equity offerings*** | | — | | | — | | | (0.18) | |

| Net other changes | | (172) | | | (76) | | | — | |

| | (10,021) | | | (7,249) | | | (0.50) | |

Second Quarter of 2024 Adjusted Results** | | $ | 26,461 | | | $ | 19,277 | | | $ | 0.86 | |

* Refer to Major Projects and Initiatives Table for additional information.

** Transaction and transition-related expenses attributable to the acquisition and integration of FCG have been excluded from the Company’s non GAAP measures of adjusted net income and adjusted EPS. See reconciliations above for a detailed comparison to the related GAAP measures.

*** Reflects the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

Key variances between the six months ended June 30, 2023 and June 30, 2024 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

| Six months ended June 30, 2023 Adjusted Results | | $ | 70,172 | | | $ | 52,477 | | | $ | 2.94 | |

| | | | | | |

| Non-recurring Items: | | | | | | |

| Absence of benefit associated with a reduction in the PA state tax rate | | — | | | (1,284) | | | (0.06) | |

| | — | | | (1,284) | | | (0.06) | |

| | | | | | |

| Increased Adjusted Gross Margins: | | | | | | |

| Contributions from acquisitions | | 48,924 | | | 35,891 | | | 1.61 | |

| Natural gas growth including conversions (excluding service expansions) | | 3,169 | | | 2,325 | | | 0.10 | |

| Margin from regulated infrastructure programs* | | 2,618 | | | 1,921 | | | 0.09 | |

| Natural gas transmission service expansions, including interim services* | | 2,154 | | | 1,580 | | | 0.07 | |

| Changes in customer consumption | | 1,842 | | | 1,352 | | | 0.06 | |

| Rate changes associated with the Florida natural gas base rate proceeding* | | 1,630 | | | 1,196 | | | 0.05 | |

| Improved Aspire Energy performance - rate changes and gathering fees | | 1,189 | | | 872 | | | 0.04 | |

| Increased level of virtual pipeline services | | 487 | | | 358 | | | 0.02 | |

| Increased propane margins and fees | | 463 | | | 340 | | | 0.01 | |

| | 62,476 | | | 45,835 | | | 2.05 | |

| | | | | | |

| (Increased) Decreased Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| FCG operating expenses | | (20,133) | | | (14,770) | | | (0.66) | |

| Insurance related costs | | (1,084) | | | (795) | | | (0.04) | |

| Vehicle expenses | | (403) | | | (295) | | | (0.01) | |

| Payroll, benefits and other employee-related expenses | | 2,192 | | | 1,608 | | | 0.07 | |

| Depreciation, amortization and property tax costs (includes FCG) | | (3,449) | | | (2,530) | | | (0.11) | |

| | (22,877) | | | (16,782) | | | (0.75) | |

| | | | | | |

| Interest charges | | (19,643) | | | (14,410) | | | (0.65) | |

| Increase in shares outstanding due to 2023 and 2024 equity offerings*** | | — | | | — | | | (0.59) | |

| Net other changes | | 8 | | | 286 | | | 0.02 | |

| | (19,635) | | | (14,124) | | | (1.22) | |

Six months ended June 30, 2024 Adjusted Results** | | $ | 90,136 | | | $ | 66,122 | | | $ | 2.96 | |

* Refer to Major Projects and Initiatives Table for additional information.

** Transaction and transition-related expenses attributable to the acquisition and integration of FCG have been excluded from the Company’s non GAAP measures of adjusted net income and adjusted EPS. See reconciliations above for a detailed comparison to the related GAAP measures.

*** Reflects the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

Recently Completed and Ongoing Major Projects and Initiatives

The Company continuously pursues and develops additional projects and initiatives to serve existing and new customers, further grow its businesses and earnings, and increase shareholder value. The following table includes all major projects and initiatives that are currently underway or recently completed. The Company's practice is to add new projects and initiatives to this table once negotiations or details are substantially final and/or the associated earnings can be estimated. Major projects and initiatives that have generated consistent year-over-year adjusted gross margin contributions are removed from the table at the beginning of the next calendar year.

The related descriptions of projects and initiatives that accompany the table include only new items and/or items where there have been significant developments, as compared to the Company's prior quarterly filings. A comprehensive discussion of all projects and initiatives reflected in the table below can be found in the Company's second quarter 2024 Quarterly Report on Form 10-Q.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin |

| Three Months Ended | | Six Months Ended | | Year Ended | | Estimate for |

| June 30, | | June 30, | | December 31, | | Fiscal |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 | | 2023 | | 2024 | | 2025 |

| Pipeline Expansions: | | | | | | | | | | | | | |

| Southern Expansion | $ | 586 | | | $ | 455 | | | $ | 1,172 | | | $ | 486 | | | $ | 586 | | | $ | 2,344 | | | $ | 2,344 | |

| Beachside Pipeline Expansion | 603 | | | 603 | | | 1,206 | | | 603 | | | 1,810 | | | 2,451 | | | 2,414 | |

| North Ocean City Connector | — | | | — | | | — | | | — | | | — | | | — | | | 494 | |

| St. Cloud / Twin Lakes Expansion | 146 | | | — | | | 292 | | | — | | | 264 | | | 584 | | | 2,752 | |

| Wildlight | 205 | | | 67 | | | 404 | | | 93 | | | 471 | | | 1,423 | | | 2,038 | |

| Lake Wales | 114 | | | 38 | | | 228 | | | 38 | | | 265 | | | 454 | | | 454 | |

| Newberry | 72 | | | — | | | 72 | | | — | | | — | | | 1,364 | | | 2,585 | |

| Boynton Beach | — | | | — | | | — | | | — | | | — | | | — | | | 3,342 | |

| New Smyrna Beach | — | | | — | | | — | | | — | | | — | | | — | | | 1,710 | |

| Central Florida Reinforcement | — | | | — | | | — | | | — | | | — | | | 476 | | | 1,182 | |

| Warwick | — | | | — | | | — | | | — | | | — | | | 258 | | | 1,858 | |

| Renewable Natural Gas Supply Projects | — | | | — | | | — | | | — | | | — | | | — | | | 5,460 | |

| Total Pipeline Expansions | 1,726 | | | 1,163 | | | 3,374 | | | 1,220 | | | 3,396 | | | 9,354 | | | 26,633 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CNG/RNG/LNG Transportation and Infrastructure | 3,505 | | | 2,905 | | | 6,940 | | | 6,426 | | | 11,181 | | | 13,500 | | | 14,500 | |

| | | | | | | | | | | | | |

| Regulatory Initiatives: | | | | | | | | | | | | | |

| Florida GUARD program | 865 | | | — | | | 1,454 | | | — | | | 353 | | | 3,231 | | | 5,602 | |

| FCG SAFE Program | 689 | | | — | | | 1,101 | | | — | | | — | | | 2,683 | | | 5,293 | |

| Capital Cost Surcharge Programs | 777 | | | 703 | | | 1,608 | | | 1,423 | | | 2,829 | | | 3,979 | | | 4,374 | |

Florida Rate Case Proceeding (1) | 4,005 | | | 3,873 | | | 9,600 | | | 7,970 | | | 15,835 | | | 17,153 | | | 17,153 | |

Maryland Rate Case (2) | — | | | — | | | — | | | — | | | — | | | TBD | | TBD |

| Electric Storm Protection Plan | 677 | | | 436 | | | 1,307 | | | 642 | | | 1,326 | | | 2,433 | | | 3,951 | |

| Total Regulatory Initiatives | 7,013 | | | 5,012 | | | 15,070 | | | 10,035 | | | 20,343 | | | 29,479 | | | 36,373 | |

| | | | | | | | | | | | | |

| Total | $ | 12,244 | | | $ | 9,080 | | | $ | 25,384 | | | $ | 17,681 | | | $ | 34,920 | | | $ | 52,333 | | | $ | 77,506 | |

(1) Includes adjusted gross margin during 2023 comprised of both interim rates and permanent base rates which became effective in March 2023.

(2) Rate case application and depreciation study filed with the Maryland PSC in January 2024. See additional information provided below.

Detailed Discussion of Major Projects and Initiatives

Pipeline Expansions

St. Cloud / Twin Lakes Expansion

In July 2022, Peninsula Pipeline filed a petition with the Public Service Commission ("PSC") for the State of Florida for approval of its Transportation Service Agreement with the Company's Florida subsidiary, Florida Public Utilities ("FPU"), for an additional 2,400 Dts/day of firm service in the St. Cloud, Florida area. As part of this agreement, Peninsula Pipeline constructed a pipeline extension and regulator station for FPU. The extension supports new incremental load due to growth in the area, including providing service, most immediately, to the residential development Twin Lakes. The expansion also improves reliability and provides operational benefits to FPU’s existing distribution system in the area, supporting future growth. The project went into service in July 2023.

In February 2024, Peninsula Pipeline filed a petition with the Florida PSC for approval of an amendment to its Transportation Service Agreement with FPU for an additional 10,000 Dts/day of firm service in the St. Cloud, Florida area. Peninsula Pipeline will construct pipeline expansions that will allow FPU to serve the future communities that are expected in that area. The Florida PSC approved the project in May 2024, and it is expected to be complete in the fourth quarter of 2025.

Newberry Expansion

In April 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreement with FPU for an additional 8,000 Dts/day of firm service in the Newberry, Florida area. The petition was approved by the Florida PSC in the third quarter of 2023. Peninsula Pipeline will construct a pipeline extension, which will be used by FPU to support the development of a natural gas distribution system to provide gas service to the City of Newberry. A filing to address the acquisition and conversion of existing Company owned propane community gas systems in Newberry was made in November 2023. The Florida PSC approved it in April 2024. The Company began the conversions of the community gas systems in the second quarter of 2024.

East Coast Reinforcement Projects

In December 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreements with FPU for projects that will support additional supply to communities on the East Coast of Florida. The projects are driven by the need for increased supply to coastal portions of the state that are experiencing significant population growth. Peninsula Pipeline will construct several pipeline extensions which will support FPU’s distribution system in the areas of Boynton Beach and New Smyrna Beach with an additional 15,000 Dts/day and 3,400 Dts/day, respectively. The Florida PSC approved the projects in March 2024. Construction is projected to be complete in the first and second quarters of 2025 for Boynton Beach and New Smyrna Beach, respectively.

Central Florida Reinforcement Projects

In February 2024, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreements with FPU for projects that will support additional supply to communities located in Central Florida. The projects are driven by the need for increased supply to communities in central Florida that are experiencing significant population growth. Peninsula Pipeline will construct several pipeline extensions which will support FPU’s distribution system around the Plant City and Lake Mattie areas of Florida with an additional 5,000 Dts/day and 8,700 Dts/day, respectively. The Florida PSC approved the projects in May 2024. Completion of the projects is projected for the fourth quarter of 2024 for Plant City and the fourth quarter of 2025 for Lake Mattie.

Warwick

In July 2024, the Company announced plans to extend Eastern Shore's transmission deliverability by constructing an additional 4.4 miles of six inch steel pipeline. The project will reinforce the supply and

growth for our Delaware division distribution system and expand further into Maryland for anticipated future growth. The project is estimated to be in service during the fourth quarter of 2024.

Pioneer Supply Header Pipeline Project

In March 2024, Peninsula Pipeline filed a petition with the Florida PSC for its approval of Firm Transportation Service Agreements with both FCG and FPU for a project that will support greater supply growth of natural gas service in southeast Florida. The project consists of the transfer of a pipeline asset from FCG to Peninsula Pipeline. Peninsula Pipeline will proceed to provide transportation service to both FCG and FPU using the pipeline asset, which supports continued customer growth and system reinforcement of these distribution systems. The Florida PSC approved the petition in July 2024.

Renewable Natural Gas Supply Projects

In February 2024, Peninsula Pipeline filed a petition with the Florida PSC for approval of Transportation Service Agreements with FCG for projects that will support the transportation of additional renewable energy supply to FCG. The projects, located in Florida’s Brevard, Indian River and Miami-Dade counties, will bring renewable natural gas produced from local landfills into FCG’s natural gas distribution system. Peninsula Pipeline will construct several pipeline extensions which will support FCG's distribution system in Brevard County, Indian-River County, and Miami-Dade County. Benefits of these projects include increased gas supply to serve expected FCG growth, strengthened system reliability and additional system flexibility. The Florida PSC approved the petition at it's July 2024 meeting with the projects estimated to be completed in the first half of 2025.

Regulatory Initiatives

Maryland Natural Gas Rate Case

In January 2024, the Company's natural gas distribution businesses in Maryland, CUC-Maryland Division, Sandpiper Energy, Inc., and Elkton Gas Company (collectively, “Maryland natural gas distribution businesses”) filed a joint application for a natural gas rate case with the Maryland PSC. In connection with the application, we are seeking approval of the following: (i) permanent rate relief of approximately $6.9 million; (ii) authorization to make certain changes to tariffs to include a unified rate structure and to consolidate the Maryland natural gas distribution businesses which we anticipate will be called Chesapeake Utilities of Maryland, Inc.; and (iii) authorization to establish a rider for recovery of the costs associated with our new technology systems. The outcome of the application is subject to review and approval by the Maryland PSC. Rate changes are suspended until December 2024.

Maryland Natural Gas Depreciation Study

In January 2024, the Company's Maryland natural gas distribution businesses filed a joint petition for approval of its proposed unified depreciation rates with the Maryland PSC. A settlement agreement between the Company, PSC staff and the Office of People's Counsel was reached and the final order approving the settlement agreement went into effect in July 2024 which will include an annual benefit of $1.2 million.

FCG SAFE Program

In April 2024, FCG filed a petition with the Florida PSC to more closely align the SAFE Program with FPU's GUARD program. Specifically, the requested modifications will enable FCG to accelerate remediation related to problematic pipe and facilities consisting of obsolete and exposed pipe. If approved, these efforts will serve to improve the safety and reliability of service to FCG's customers. These modifications, if approved, will result in an estimated additional $50 million in capital expenditures associated with the SAFE Program which would increase the total projected capital expenditures to $255 million over a 10-year period. The Commission decision is expected in September 2024.

Delaware Natural Gas Rate Case

In May 2024, the Company's Delaware natural gas division provided notice to the Delaware PSC of its intent to file a petition seeking a general rate base increase based on a test period ending in December 2024. The filing is expected to be submitted to the Delaware PSC in August 2024 and the outcome of the application will be subject to review and approval by the Delaware PSC.

FPU Electric Rate Case

In June 2024, the Company provided notice to the Florida PSC of its intent to file a petition seeking a general rate base increase based on a 2025 projected test year. The filing is expected to be submitted to the Florida PSC in August 2024 and the outcome of the application will be subject to review and approval by the Florida PSC.

Other Major Factors Influencing Adjusted Gross Margin

Weather and Consumption

Weather was not a significant factor to adjusted gross margin in the second quarter of 2024 compared to the same period in 2023.

For the six months ended June 30, 2024, higher consumption which includes the effects of colder weather conditions compared to the prior-year period resulted in a $1.8 million increase in adjusted gross margin. While temperatures through June 30, 2024 were colder than the prior-year period, they were approximately 12.5 percent and 12.8 percent warmer, respectively, compared to normal temperatures in our Delmarva and Ohio service territories.

The following table summarizes HDD and CDD variances from the 10-year average HDD/CDD ("Normal") for the three and six months ended June 30, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Six Months Ended | | |

| June 30, | | | | June 30, | | |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| Delmarva | | | | | | | | | | | |

| Actual HDD | 319 | | | 276 | | | 43 | | | 2,281 | | | 2,050 | | | 231 | |

| 10-Year Average HDD ("Normal") | 387 | | | 408 | | | (21) | | | 2,608 | | | 2,693 | | | (85) | |

| Variance from Normal | (68) | | | (132) | | | | | (327) | | | (643) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual HDD | 41 | | | 26 | | | 15 | | | 511 | | | 370 | | | 141 | |

| 10-Year Average HDD ("Normal") | 41 | | | 44 | | | (3) | | | 511 | | | 549 | | | (38) | |

| Variance from Normal | — | | | (18) | | | | | — | | | (179) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Ohio | | | | | | | | | | | |

| Actual HDD | 478 | | | 678 | | | (200) | | | 3,137 | | | 3,062 | | | 75 | |

| 10-Year Average HDD ("Normal") | 631 | | | 631 | | | — | | | 3,596 | | | 3,596 | | | — | |

| Variance from Normal | (153) | | | 47 | | | | | (459) | | | (534) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual CDD | 1,115 | | | 937 | | | 178 | | | 1,296 | | | 1,260 | | | 36 | |

| 10-Year Average CDD ("Normal") | 978 | | | 952 | | | 26 | | | 1,195 | | | 1,144 | | | 51 | |

| Variance from Normal | 137 | | | (15) | | | | | 101 | | | 116 | | | |

Natural Gas Distribution Growth

The average number of residential customers served on the Delmarva Peninsula increased by approximately 3.7 percent and 3.9 percent, respectively, for the three and six months ended June 30, 2024 while our legacy Florida Natural Gas distribution business increased by approximately 3.7 percent and 3.6 percent, respectively, during the same periods.

The details of the adjusted gross margin increase are provided in the following table:

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin** |

| Three Months Ended | | Six Months Ended |

| June 30, 2024 | | June 30, 2024 |

| (in thousands) | Delmarva Peninsula | | Florida | | Delmarva Peninsula | | Florida |

| Customer growth: | | | | | | | |

| Residential | $ | 352 | | | $ | 647 | | | $ | 842 | | | $ | 1,527 | |

| Commercial and industrial | 124 | | | 130 | | | 280 | | | 520 | |

Total customer growth (1) | $ | 476 | | | $ | 777 | | | $ | 1,122 | | | $ | 2,047 | |

(1) Customer growth amounts for the legacy Florida operations include the effects of revised rates associated with the Company's natural gas base rate proceeding, but exclude the effects of FCG.

Capital Investment Growth and Capital Structure Updates

The Company's capital expenditures were $159.5 million for the six months ended June 30, 2024. The following table shows a range of the forecasted 2024 capital expenditures by segment and by business line:

| | | | | | | | | | | |

| 2024 |

| (in thousands) | Low | | High |

| Regulated Energy: | | | |

| Natural gas distribution | $ | 150,000 | | | $ | 170,000 | |

| Natural gas transmission | 90,000 | | | 120,000 | |

| Electric distribution | 25,000 | | | 28,000 | |

| Total Regulated Energy | 265,000 | | | 318,000 | |

| Unregulated Energy: | | | |

| Propane distribution | 13,000 | | | 15,000 | |

| Energy transmission | 5,000 | | | 6,000 | |

| Other unregulated energy | 13,000 | | | 15,000 | |

| Total Unregulated Energy | 31,000 | | | 36,000 | |

| Other: | | | |

| Corporate and other businesses | 4,000 | | | 6,000 | |

| Total 2024 Forecasted Capital Expenditures | $ | 300,000 | | | $ | 360,000 | |

The capital expenditure projection is subject to continuous review and modification. Actual capital requirements may vary from the above estimates due to a number of factors, including changing economic conditions, supply chain disruptions, capital delays that are greater than currently anticipated, customer growth in existing areas, regulation, new growth or acquisition opportunities and availability of capital.

The Company's target ratio of equity to total capitalization, including short-term borrowings, is between 50 and 60 percent. The Company's equity to total capitalization ratio, including short-term borrowings, was approximately 48 percent as of June 30, 2024.

Chesapeake Utilities Corporation and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | | |

| | June 30, | | June 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| (in thousands, except per share data) | | | | | | | | | | | | |

| Operating Revenues | | | | | | | | | | | | |

| Regulated Energy | | $ | 130,625 | | | $ | 101,141 | | | $ | 299,051 | | | $ | 243,411 | | | | | |

| Unregulated Energy | | 41,419 | | | 40,751 | | | 124,522 | | | 123,916 | | | | | |

| Other businesses and eliminations | | (5,772) | | | (6,299) | | | (11,557) | | | (13,605) | | | | | |

| Total Operating Revenues | | 166,272 | | | 135,593 | | | 412,016 | | | 353,722 | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| Natural gas and electricity costs | | 27,378 | | | 23,886 | | | 77,296 | | | 79,174 | | | | | |

| Propane and natural gas costs | | 12,262 | | | 11,907 | | | 43,561 | | | 45,208 | | | | | |

| Operations | | 52,339 | | | 42,163 | | | 103,899 | | | 86,930 | | | | | |

| FCG transaction and transition-related expenses | | 1,374 | | | — | | | 2,295 | | | — | | | | | |

| Maintenance | | 5,561 | | | 5,258 | | | 11,464 | | | 10,362 | | | | | |

| Depreciation and amortization | | 17,877 | | | 17,303 | | | 34,893 | | | 34,486 | | | | | |

| Other taxes | | 8,691 | | | 6,730 | | | 18,233 | | | 14,301 | | | | | |

| Total operating expenses | | 125,482 | | | 107,247 | | | 291,641 | | | 270,461 | | | | | |

| Operating Income | | 40,790 | | | 28,346 | | | 120,375 | | | 83,261 | | | | | |

| Other income, net | | 1,110 | | | 831 | | | 1,305 | | | 1,107 | | | | | |

| Interest charges | | 16,813 | | | 6,964 | | | 33,839 | | | 14,196 | | | | | |

| Income Before Income Taxes | | 25,087 | | | 22,213 | | | 87,841 | | | 70,172 | | | | | |

| Income taxes | | 6,816 | | | 6,080 | | | 23,402 | | | 17,695 | | | | | |

| Net Income | | $ | 18,271 | | | $ | 16,133 | | | $ | 64,439 | | | $ | 52,477 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | |

| Basic | | 22,284 | | | 17,794 | | | 22,267 | | | 17,777 | | | | | |

| Diluted | | 22,335 | | | 17,852 | | | 22,320 | | | 17,842 | | | | | |

| | | | | | | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Basic | | $ | 0.82 | | | $ | 0.91 | | | $ | 2.89 | | | $ | 2.95 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diluted | | $ | 0.82 | | | $ | 0.90 | | | $ | 2.89 | | | $ | 2.94 | | | | | |

| | | | | | | | | | | | |

| Adjusted Net Income and Adjusted Earnings Per Share | | | | | | | | | | | | |

| Net Income (GAAP) | | $ | 18,271 | | | $ | 16,133 | | | $ | 64,439 | | | $ | 52,477 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 1,006 | | | — | | | 1,683 | | | — | | | | |

| Adjusted Net Income (Non-GAAP)** | | $ | 19,277 | | | $ | 16,133 | | | $ | 66,122 | | | $ | 52,477 | | | | | |

| | | | | | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 0.82 | | | $ | 0.90 | | | $ | 2.89 | | | $ | 2.94 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.04 | | | — | | | 0.07 | | | — | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP)** | | $ | 0.86 | | | $ | 0.90 | | | $ | 2.96 | | | $ | 2.94 | | | | | |

(1) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| Assets | | June 30,

2024 | | December 31,

2023 |

| (in thousands, except per share data) | | | | |

| Property, Plant and Equipment | | | | |

| Regulated Energy | | $ | 2,515,712 | | | $ | 2,418,494 | |

| Unregulated Energy | | 420,074 | | | 410,807 | |

| Other businesses and eliminations | | 32,645 | | | 30,310 | |

| Total property, plant and equipment | | 2,968,431 | | | 2,859,611 | |

| Less: Accumulated depreciation and amortization | | (546,598) | | | (516,429) | |

| Plus: Construction work in progress | | 157,347 | | | 113,192 | |

| Net property, plant and equipment | | 2,579,180 | | | 2,456,374 | |

| Current Assets | | | | |

| Cash and cash equivalents | | 6,430 | | | 4,904 | |

| Trade and other receivables | | 56,362 | | | 74,485 | |

| Less: Allowance for credit losses | | (2,195) | | | (2,699) | |

| Trade and other receivables, net | | 54,167 | | | 71,786 | |

| Accrued revenue | | 20,177 | | | 32,597 | |

| Propane inventory, at average cost | | 6,511 | | | 9,313 | |

| Other inventory, at average cost | | 19,715 | | | 19,912 | |

| Regulatory assets | | 19,646 | | | 19,506 | |

| Storage gas prepayments | | 2,801 | | | 4,695 | |

| Income taxes receivable | | 9,865 | | | 3,829 | |

| Prepaid expenses | | 12,549 | | | 15,407 | |

| Derivative assets, at fair value | | 1,180 | | | 1,027 | |

| Other current assets | | 3,236 | | | 2,723 | |

| Total current assets | | 156,277 | | | 185,699 | |

| Deferred Charges and Other Assets | | | | |

| Goodwill | | 507,856 | | | 508,174 | |

| Other intangible assets, net | | 15,910 | | | 16,865 | |

| Investments, at fair value | | 13,620 | | | 12,282 | |

| Derivative assets, at fair value | | 192 | | | 40 | |

| Operating lease right-of-use assets | | 11,201 | | | 12,426 | |

| Regulatory assets | | 83,594 | | | 96,396 | |

| Receivables and other deferred charges | | 12,923 | | | 16,448 | |

| Total deferred charges and other assets | | 645,296 | | | 662,631 | |

| Total Assets | | $ | 3,380,753 | | | $ | 3,304,704 | |

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited) | | | | | | | | | | | | | | |

| Capitalization and Liabilities | | June 30,

2024 | | December 31,

2023 |

| (in thousands, except per share data) | | | | |

| Capitalization | | | | |

| Stockholders’ equity | | | | |

| Preferred stock, par value $0.01 per share (authorized 2,000 shares), no shares issued and outstanding | | $ | — | | | $ | — | |

| Common stock, par value $0.4867 per share (authorized 50,000 shares) | | 10,854 | | | 10,823 | |

| Additional paid-in capital | | 755,751 | | | 749,356 | |

| Retained earnings | | 525,525 | | | 488,663 | |

| Accumulated other comprehensive loss | | (1,576) | | | (2,738) | |

| Deferred compensation obligation | | 9,703 | | | 9,050 | |

| Treasury stock | | (9,703) | | | (9,050) | |

| Total stockholders’ equity | | 1,290,554 | | | 1,246,104 | |

| Long-term debt, net of current maturities | | 1,174,762 | | | 1,187,075 | |

| Total capitalization | | 2,465,316 | | | 2,433,179 | |

| Current Liabilities | | | | |

| Current portion of long-term debt | | 18,592 | | | 18,505 | |

| Short-term borrowing | | 207,091 | | | 179,853 | |

| Accounts payable | | 69,041 | | | 77,481 | |

| Customer deposits and refunds | | 44,775 | | | 46,427 | |

| Accrued interest | | 3,652 | | | 7,020 | |

| Dividends payable | | 14,272 | | | 13,119 | |

| Accrued compensation | | 12,519 | | | 16,544 | |

| Regulatory liabilities | | 19,677 | | | 13,719 | |

| Income taxes payable | | — | | | — | |

| Derivative liabilities, at fair value | | 27 | | | 354 | |

| Other accrued liabilities | | 20,547 | | | 13,362 | |

| Total current liabilities | | 410,193 | | | 386,384 | |

| Deferred Credits and Other Liabilities | | | | |

| Deferred income taxes | | 283,322 | | | 259,082 | |

| Regulatory liabilities | | 192,710 | | | 195,279 | |

| Environmental liabilities | | 2,402 | | | 2,607 | |

| Other pension and benefit costs | | 16,102 | | | 15,330 | |

| Derivative liabilities, at fair value | | 12 | | | 927 | |

| Operating lease - liabilities | | 9,341 | | | 10,550 | |

| Deferred investment tax credits and other liabilities | | 1,355 | | | 1,366 | |

| Total deferred credits and other liabilities | | 505,244 | | | 485,141 | |

Environmental and other commitments and contingencies (1) | | | | |

| Total Capitalization and Liabilities | | $ | 3,380,753 | | | $ | 3,304,704 | |

(1) Refer to Note 6 and 7 in the Company's Quarterly Report on Form 10-Q for further information.

Chesapeake Utilities Corporation and Subsidiaries

Distribution Utility Statistical Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, 2024 | | For the Three Months Ended June 30, 2023 |

| Delmarva NG Distribution | | Florida Natural Gas Distribution | | Florida City Gas Distribution | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | | | | | | |

| Residential | $ | 15,930 | | | $ | 11,275 | | | $ | 12,918 | | | $ | 11,225 | | | $ | 16,878 | | | $ | 12,188 | | | $ | 11,023 | |

| Commercial and Industrial | 10,323 | | | 26,721 | | | 16,968 | | | 12,134 | | | 11,093 | | | 28,740 | | | 12,253 | |

Other (1) | (2,962) | | | 1,921 | | | 2,608 | | | (813) | | | (3,858) | | | (162) | | | (242) | |

| Total Operating Revenues | $ | 23,291 | | | $ | 39,917 | | | $ | 32,494 | | | $ | 22,546 | | | $ | 24,113 | | | $ | 40,766 | | | $ | 23,034 | |

| | | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | | | | | | | |

| Residential | 823,378 | | | 525,878 | | | 427,062 | | | 71,226 | | | 765,193 | | | 472,147 | | | 66,835 | |

| Commercial and Industrial | 2,248,283 | | | 10,132,993 | | | 2,784,296 | | | 95,646 | | | 2,220,105 | | | 10,054,518 | | | 74,086 | |

| Other | 58,603 | | | 572,126 | | | 1,470,769 | | | — | | | 63,787 | | | — | | | — | |

| Total | 3,130,264 | | | 11,230,997 | | | 4,682,127 | | | 166,872 | | | 3,049,085 | | | 10,526,665 | | | 140,921 | |

| | | | | | | | | | | | | |

| Average Customers | | | | | | | | | | | | | |

| Residential | 100,964 | | | 91,439 | | | 113,673 | | | 25,762 | | | 97,333 | | | 88,188 | | | 25,755 | |

| Commercial and Industrial | 8,367 | | | 8,486 | | | 8,551 | | | 7,359 | | | 8,249 | | | 8,405 | | | 7,378 | |

| Other | 25 | | | — | | | 110 | | | — | | | 22 | | | 6 | | | — | |

| Total | 109,356 | | | 99,925 | | | 122,334 | | | 33,121 | | | 105,604 | | | 96,599 | | | 33,133 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended June 30, 2024 | | For the Six Months Ended June 30, 2023 |

| Delmarva NG Distribution | | Florida Natural Gas Distribution | | Florida City Gas Distribution | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | | | | | | |

| Residential | $ | 51,726 | | | $ | 26,618 | | | $ | 27,949 | | | $ | 22,651 | | | $ | 58,898 | | | $ | 28,684 | | | $ | 22,380 | |

| Commercial and Industrial | 27,890 | | | 57,774 | | | 36,402 | | | 22,917 | | | 32,518 | | | 54,479 | | | 23,994 | |

Other (1) | (4,637) | | | 3,481 | | | 4,020 | | | (3,058) | | | (6,911) | | | 3,961 | | | (603) | |

| Total Operating Revenues | $ | 74,979 | | | $ | 87,873 | | | $ | 68,371 | | | $ | 42,510 | | | $ | 84,505 | | | $ | 87,124 | | | $ | 45,771 | |

| | | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | | | | | | | |

| Residential | 3,261,532 | | | 1,366,919 | | | 1,026,399 | | | 143,247 | | | 3,056,513 | | | 1,225,903 | | | 135,352 | |

| Commercial and Industrial | 5,675,456 | | | 20,248,545 | | | 5,768,923 | | | 183,473 | | | 5,607,936 | | | 20,362,474 | | | 142,789 | |

| Other | 147,701 | | | 1,303,132 | | | 3,069,512 | | | — | | | 151,323 | | | 627,934 | | | — | |

| Total | 9,084,689 | | | 22,918,596 | | | 9,864,834 | | | 326,720 | | | 8,815,772 | | | 22,216,311 | | | 278,141 | |

| | | | | | | | | | | | | |

| Average Customers | | | | | | | | | | | | | |

| Residential | 100,749 | | | 90,955 | | | 113,350 | | | 25,733 | | | 96,922 | | | 87,757 | | | 25,686 | |

| Commercial and Industrial | 8,382 | | | 8,480 | | | 8,535 | | | 7,365 | | | 8,260 | | | 8,407 | | | 7,369 | |

| Other | 25 | | | — | | | 105 | | | — | | | 23 | | | 6 | | | — | |

| Total | 109,156 | | | 99,435 | | | 121,990 | | | 33,098 | | | 105,205 | | | 96,170 | | | 33,055 | |

| | | | | | | | | | | | | |

(1) Operating Revenues from "Other" sources include unbilled revenue, under (over) recoveries of fuel cost, conservation revenue, other miscellaneous charges, fees for billing services provided to third parties and adjustments for pass-through taxes.

1 Second Quarter 2024 Earnings Call Presentation August 9, 2024 scan here for an electronic copy

2 Safe Harbor for Forward-Looking Statements Safe Harbor Statement Some of the statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable law. Such forward-looking statements may be identified by the use of words, such as “project,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “continue,” “potential,” “forecast” or other similar words, or future or conditional verbs such as “may,” “will,” “should,” “would” or “could.” These statements represent our intentions, plans, expectations, assumptions and beliefs about our future financial performance, business strategy, projected plans and objectives. These statements are subject to many risks and uncertainties and actual results may materially differ from those expressed in these forward-looking statements. Please refer to Chesapeake Utilities Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC and other SEC filings concerning factors that could cause those results to be different than contemplated in this presentation. Non-GAAP Financial Information This presentation includes non-GAAP financial measures including Adjusted Gross Margin, Adjusted Net Income and Adjusted Earnings Per Share (“EPS*”). A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non- GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue- producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. The Company calculates Adjusted Net Income and Adjusted EPS by deducting costs and expenses associated with significant acquisitions that may affect the comparison of period-over-period results. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The Company believes that these non-GAAP measures are useful and meaningful to investors as a basis for making investment decisions and provide investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses these non-GAAP financial measures in assessing a business unit and Company performance. Other companies may calculate these non-GAAP financial measures in a different manner. See Appendix for a reconciliation of Gross Margin, Net Income and EPS, all as defined under GAAP, to our non-GAAP measures of Adjusted Gross Margin, Adjusted Net Income, and Adjusted EPS for each of the periods presented. *Unless otherwise noted, EPS and Adjusted EPS information is presented on a diluted basis.

3 Safety Moment: Hurricane & General Emergency Preparedness • Being prepared means having your own food, water and other supplies to last for at least 72 hours • A disaster supplies kit is a collection of basic items your household may need in the event of an emergency • Visit Ready.gov for a checklist of supplies, including a printable version from FEMA • Completed its annual Hurricane Season Preparedness Drill in July • Lessons learned were already put to the test this past week with Hurricane Debby • While there were significant impacts to communities in Florida and beyond, we are grateful that outages have been limited • Our teams have responded efficiently to ensure safe and reliable service for our customers • FPU continues to show improved electric reliability metrics, including reducing the frequency and duration of outages by ~10% Personal Emergency Preparedness

4 Today’s Presenters Jeff Householder Chair of the Board, President & Chief Executive Officer Beth Cooper Executive Vice President, Chief Financial Officer, Treasurer & Asst. Corporate Secretary Lucia Dempsey Head of Investor Relations Jim Moriarty Executive Vice President, General Counsel, Corporate Secretary & Chief Policy and Risk Officer

5 Adjusted Diluted EPS1 Continued Strong Financial Performance in 2024 1 Adjusted Diluted Earnings Per Share Growth from Continuing Operations; 2024 excludes transaction / transition-related costs associated with the FCG acquisition. $2.04 $2.10 $0.90 $0.86 $2.94 $2.96 YTD 2023 YTD 2024 Q1 Q2 Q2 2024 Results • Adjusted Gross Margin: $126.6M, up 27% from Q2 2023 • Adjusted Net Income: $19.3M, up 19% from Q2 2023 Earnings Guidance Reaffirmed • FY 2024 Adjusted EPS of $5.33 - $5.45 per share • FY 2025 Adjusted EPS of $6.15 - $6.35 per share • FY 2028 Adjusted EPS of $7.75 - $8.00 per share CapEx Guidance Reaffirmed • YTD 2024 Capital Expenditures of $160M • 2024 Capital Expenditure Guidance: $300M - $360M • 2024 - 2028 5-Year CapEx Guidance: $1.5B - $1.8B Key Financial Highlights