false2024Q2Catalent, Inc.6/30FALSEFALSE00015967830.010.011,000,000,0001,000,000,000181,000,000180,000,000180,000,000179,000,0000.010.01100,000,000100,000,000————42461,7561,596REVISIONS OF PREVIOUSLY ISSUED FINANCIAL STATEMENTSAs described in the Amended Fiscal 2022 10-K, in preparing the consolidated financial statements for the three and nine months ended March 31, 2023, the Company identified a $26 million error related to the over-recognition of revenue in the consolidated financial statements it issued with respect to its fiscal year ended June 30, 2022. This error resulted from the misapplication of the contract modification guidance in accordance with ASC 606, Revenue from Contracts with Customers, related to one of the Company’s customer arrangements. The Company assessed the materiality of the error both quantitatively and qualitatively and determined this error to be immaterial to those consolidated financial statements. However, the Company concluded that the effect of correcting the error in the quarter ended March 31, 2023 would materially misstate the Company’s unaudited consolidated financial statements for the three and nine months ended March 31, 2023 and, accordingly, determined that it was necessary to revise the consolidated financial statements it previously issued with respect to the fiscal year ended June 30, 2022.

The following tables reflect the impact of this revision on the Company’s consolidated balance sheet as of June 30, 2022:

| | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheet | | June 30, 2022 |

| (Dollars in millions) | | As Previously | | | | |

| | Reported | | Adjustment | | As Revised |

| Prepaid expenses and other | | $ | 625 | | | $ | 1 | | | $ | 626 | |

| Total current assets | | 2,916 | | | 1 | | | 2,917 | |

| Total assets | | 10,507 | | | 1 | | | 10,508 | |

| Other accrued liabilities | | 620 | | | 26 | | | 646 | |

| Total current liabilities | | 1,072 | | | 26 | | | 1,098 | |

| Deferred income taxes | | 202 | | | (5) | | | 197 | |

| Total liabilities | | 5,712 | | | 21 | | | 5,733 | |

| Retained earnings | | 538 | | | (20) | | | 518 | |

| Total shareholders' equity | | 4,795 | | | (20) | | | 4,775 | |

| Total liabilities and shareholders' equity | | $ | 10,507 | | | $ | 1 | | | 10,508 | |

| | | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

______________________________ | | | | | | | | | | | | | | |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

For the quarterly period ended December 31, 2023

or | | | | | | | | | | | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | |

001-36587

(Commission File Number)

_____________________________

Catalent, Inc.

(Exact name of registrant as specified in its charter)

_____________________________ | | | | | | | | |

| Delaware | 20-8737688 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 14 Schoolhouse Road | |

| Somerset, | New Jersey | 08873 |

(Address of principal executive offices)_______ | (Zip code) |

(732) 537-6200

Registrant's telephone number, including area code

____________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

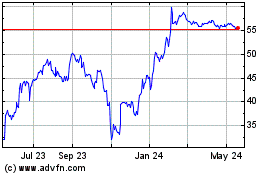

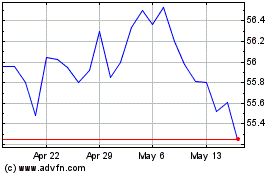

Common Stock, $0.01 par value per share | CTLT | New York Stock Exchange |

____________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☒ | | Accelerated filer | | ¨ |

Non-accelerated filer | ¨ | | Smaller reporting company | ¨ |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ☒ No

On January 31, 2024, there were 180,737,675 shares of the Registrant's common stock, par value $0.01 per share, issued and outstanding.

CATALENT, INC.

Index to Form 10-Q

For the Three and Six Months Ended December 31, 2023

| | | | | | | | |

| Item | | Page |

| | |

| Part I. | | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Part II. | | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| |

| |

Special Note Regarding Forward-Looking Statements

In addition to historical information, this Quarterly Report on Form 10-Q of Catalent, Inc. (“Catalent” or the “Company”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included in this Quarterly Report on Form 10-Q are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate. Any forward-looking statement is subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements.

Some of the factors that may cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements include, but are not limited to, those summarized below, in addition to those described more fully (i) from time to time in reports that we have filed or in the future may file with the Securities and Exchange Commission (the “SEC”), and (ii) under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the "Fiscal 2023 10-K").

Risks Relating to Our Business and the Industry in Which We Operate

•Actions of activist shareholders could impact the pursuit of our business strategies and adversely affect our results of operations, financial condition, or share price.

•We anticipate being subject to increasing focus by our investors, regulators, customers, and other stakeholders on environmental, social, and governance (“ESG”) matters.

•Any failure to implement fully, monitor, and continuously improve our quality management strategy could lead to quality or safety issues and expose us to significant costs, potential liability, and adverse publicity.

•We have experienced, and may continue to experience, productivity issues and higher-than-expected costs at certain of our facilities, which have resulted in, and may continue to result in, material and adverse impacts on our financial condition and results of operations.

•The declining demand for various COVID-19 vaccines and treatments from both patients and governments around the world has affected and may continue to affect sales of the COVID-19 products we manufacture and our financial condition.

•The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products.

•Our results of operations are subject to fluctuations in the costs, availability, and suitability of the components of the products we manufacture, including active pharmaceutical ingredients, excipients, purchased components, and raw materials, and other supplies or equipment we need to run our business.

•Our goodwill has been subject to impairment and may be subject to further impairment in the future, which could have a material adverse effect on our results of operations, financial condition, or future operating results.

•Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

•We may acquire businesses and offerings that complement or expand our business or divest non-strategic businesses or assets. We may not be able to complete desired transactions, and such transactions, if executed, pose significant risks, including risks relating to our ability to successfully and efficiently integrate acquisitions or execute on dispositions and realize anticipated benefits therefrom. The failure to execute or realize the full benefits from any such transaction could have a negative effect on our operations and profitability.

•We may become subject to litigation, other proceedings, and government investigations relating to us or our operations, and the ultimate outcome of any such matter may have an impact on our business, prospects, financial condition, and results of operations.

•Our global operations are subject to economic and political risks, including risks resulting from continuing inflation, disruptions to global supply chains, destabilization of a regional or national banking system, or from the Ukrainian-Russian war or the effect of the evolving nature of the recent war in Gaza between Israel and Hamas, which could affect the profitability of our operations or require costly changes to our procedures.

•We use advanced information and communication systems to run our operations, compile and analyze financial and operational data, and communicate among our employees, customers, and counterparties, and the risks generally associated with information and communications systems could adversely affect our results of operations. We continuously work to install new, and upgrade existing, systems and provide employee awareness training around phishing, malware, and other cybersecurity risks to enhance the protections available to us, but such protections may be inadequate to address malicious attacks or inadvertent compromises affecting data security or the operability of such systems.

•Artificial intelligence-based platforms present new risks and challenges to our business.

•Our cash, cash equivalents, and financial investments could be adversely affected if the financial institutions in which we hold our cash, cash equivalents, and financial investments fail.

Risks Relating to Our Indebtedness

•The size of our indebtedness and the obligations associated with it could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or in our industry or to deploy capital to grow our business, expose us to interest-rate risk to the extent of our variable-rate debt, or prevent us from meeting our obligations under our indebtedness. These risks may be increased in a recessionary environment, particularly as sources of capital may become less available or more expensive.

•Despite our high indebtedness level, we and our subsidiaries are still capable of incurring significant additional debt, which could further exacerbate the risks associated with our substantial indebtedness.

•Our interest expense on our variable-rate debt may continue to increase if and to the extent that policymakers combat inflation through interest-rate increases on benchmark financial products.

•Despite the limitations in our debt agreements, we retain the ability to take certain actions that may interfere with our ability to timely pay our substantial indebtedness.

•We may not be able to pay our indebtedness when it becomes due.

•We are currently using and may in the future use derivative financial instruments to reduce our exposure to market risks from changes in interest rates on our variable-rate indebtedness or changes in currency exchange rates, and any such instrument may expose us to risks related to counterparty credit worthiness or non-performance of these instruments.

Risks Relating to Ownership of Our Common Stock

•We do not presently maintain effective disclosure controls and procedures due to material weaknesses we have identified in our internal controls over financial reporting. Failure to remediate these material weaknesses or any other material weakness or significant deficiencies have resulted in a revision of our financial statements, in the future could result in material misstatements in our financial statements and have caused, and in the future could cause us to fail to timely meet our periodic reporting obligations.

•Our stock price has historically been and may continue to be volatile, and a holder of shares of our Common Stock may not be able to resell such shares at or above the price such stockholder paid, or at all, and could lose all or part of such investment as a result.

•Future sales, or the perception of future sales, of our Common Stock, by us or our existing stockholders could cause the market price for our Common Stock to decline.

•We are no longer eligible to use the Form S-3 registration statement, which could impair our capital-raising activities.

•Provisions in our organizational documents could delay or prevent a change of control.

We caution that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties, and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. There can be no assurance that (i) we have correctly measured or identified all of the factors affecting our business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct, or (iv) our strategy, which is based in part on this analysis, will be successful. All forward-looking statements in this report apply only as of the date of this report or as of the date they were made and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

Social Media

We use our website (catalent.com), Facebook page (facebook.com/CatalentPharmaSolutions), LinkedIn page (linkedin.com/company/catalent-pharma-solutions/) and Twitter account (@catalentpharma) as channels of distribution of information concerning our activities, our offerings, our various businesses, and other related matters. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings, and public conference calls and webcasts. The information contained on or accessible through our website, our social media channels, or any other website that we may maintain is not a part of this Quarterly Report.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Catalent, Inc.

Consolidated Statements of Operations

(Unaudited; dollars in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, | | | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Net revenue | $ | 1,024 | | | $ | 1,149 | | | $ | 2,006 | | | $ | 2,171 | | | | | |

| Cost of sales | 853 | | | 762 | | | 1,666 | | | 1,526 | | | | | |

| Gross margin | 171 | | | 387 | | | 340 | | | 645 | | | | | |

| Selling, general, and administrative expenses | 250 | | | 226 | | | 455 | | | 422 | | | | | |

| | | | | | | | | | | |

| Goodwill impairment (adjustments) charges | (2) | | | — | | | 687 | | | — | | | | | |

| Other operating expense, net | 35 | | | 23 | | | 36 | | | 25 | | | | | |

| Operating (loss) earnings | (112) | | | 138 | | | (838) | | | 198 | | | | | |

| Interest expense, net | 66 | | | 47 | | | 124 | | | 79 | | | | | |

| Other expense (income), net | 4 | | | (23) | | | 17 | | | 2 | | | | | |

| (Loss) earnings before income taxes | (182) | | | 114 | | | (979) | | | 117 | | | | | |

| Income tax expense (benefit) | 24 | | | 33 | | | (14) | | | 36 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net (loss) earnings | $ | (206) | | | $ | 81 | | | $ | (965) | | | $ | 81 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | |

| Basic | | | | | | | | | | | |

| | | | | | | | | | | |

| Net (loss) earnings | $ | (1.13) | | | $ | 0.45 | | | $ | (5.31) | | | $ | 0.45 | | | | | |

| Diluted | | | | | | | | | | | |

| | | | | | | | | | | |

| Net (loss) earnings | $ | (1.13) | | | $ | 0.44 | | | $ | (5.31) | | | $ | 0.45 | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Comprehensive Loss

(Unaudited; dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) earnings | $ | (206) | | | $ | 81 | | | $ | (965) | | | $ | 81 | |

| Other comprehensive (loss) income, net of tax | | | | | | | |

| Foreign currency translation adjustments | 37 | | | 118 | | | (2) | | | (17) | |

| Pension and other post-retirement adjustments | 4 | | | — | | | 4 | | | — | |

| Net change in marketable securities | — | | | 1 | | | — | | | 2 | |

| | | | | | | |

| | | | | | | |

| Derivatives and hedges | (7) | | | — | | | (2) | | | 14 | |

| Other comprehensive income (loss), net of tax | 34 | | | 119 | | | — | | | (1) | |

| Comprehensive (loss) income | $ | (172) | | | $ | 200 | | | $ | (965) | | | $ | 80 | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Balance Sheets

(Unaudited; in millions, except share and per share data)

| | | | | | | | | | | |

| December 31,

2023 | | June 30,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 229 | | | $ | 280 | |

Trade receivables, net of allowance for credit losses of $42 and $46, respectively | 843 | | | 1,002 | |

| Inventories | 775 | | | 777 | |

| Prepaid expenses and other | 723 | | | 633 | |

| | | |

| Total current assets | 2,570 | | | 2,692 | |

Property, plant, and equipment, net of accumulated depreciation of $1,756 and $1,596, respectively | 3,777 | | | 3,682 | |

| Other assets: | | | |

| Goodwill | 2,351 | | | 3,039 | |

| Other intangibles, net | 911 | | | 980 | |

| Deferred income taxes | 55 | | | 55 | |

| Other long-term assets | 324 | | | 329 | |

| Total assets | $ | 9,988 | | | $ | 10,777 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Current portion of long-term obligations and other short-term borrowings | $ | 46 | | | $ | 536 | |

| Accounts payable | 407 | | | 424 | |

| Other accrued liabilities | 583 | | | 570 | |

| Total current liabilities | 1,036 | | | 1,530 | |

| Long-term obligations, less current portion | 4,959 | | | 4,313 | |

| Pension liability | 101 | | | 100 | |

| Deferred income taxes | 50 | | | 76 | |

| Other liabilities | 155 | | | 147 | |

| Commitment and contingencies (see Note 14) | | | |

| | | |

| Total liabilities | 6,301 | | | 6,166 | |

| | | |

| Shareholders' equity: | | | |

Common stock, $0.01 par value; 1.00 billion shares authorized at December 31, 2023 and June 30, 2023; 181 million and 180 million issued and outstanding at December 31, 2023 and June 30, 2023, respectively | 2 | | | 2 | |

Preferred stock, $0.01 par value; 100 million shares authorized at December 31, 2023 and June 30, 2023;0 shares issued and outstanding at December 31, 2023 and June 30, 2023 | — | | | — | |

| | | |

| Additional paid in capital | 4,742 | | | 4,701 | |

| (Accumulated deficit) retained earnings | (703) | | | 262 | |

| Accumulated other comprehensive loss | (354) | | | (354) | |

| | | |

| | | |

| Total shareholders' equity | 3,687 | | | 4,611 | |

| Total liabilities and shareholders' equity | $ | 9,988 | | | $ | 10,777 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statement of Changes in Shareholders' Equity

(Unaudited; dollars in millions, except share data in thousands)

Three Months Ended December 31, 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at September 30, 2023 | 180,521 | | | $ | 2 | | | $ | 4,724 | | | | | $ | (497) | | | $ | (388) | | | | | $ | 3,841 | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 147 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 16 | | | | | — | | | — | | | | | 16 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Employee stock purchase plan | — | | | — | | | 2 | | | | | — | | | — | | | | | 2 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (206) | | | — | | | | | (206) | | | |

Other comprehensive income, net

of tax | — | | | — | | | — | | | | | — | | | 34 | | | | | 34 | | | |

| Balance at December 31, 2023 | 180,668 | | | $ | 2 | | | $ | 4,742 | | | | | $ | (703) | | | $ | (354) | | | | | $ | 3,687 | | | |

Three Months Ended December 31, 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at September 30, 2022 | 179,901 | | | $ | 2 | | | $ | 4,674 | | | | | $ | 538 | | | $ | (514) | | | | | $ | 4,700 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 87 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 10 | | | | | — | | | — | | | | | 10 | | | |

Cash paid, in lieu of

equity, for tax withholding

obligations | — | | | — | | | (2) | | | | | — | | | — | | | | | (2) | | | |

| | | | | | | | | | | | | | | | | |

| Employee stock purchase plan | — | | | — | | | 4 | | | | | — | | | — | | | | | 4 | | | |

| | | | | | | | | | | | | | | | | |

| Net earnings | — | | | — | | | — | | | | | 81 | | | — | | | | | 81 | | | |

Other comprehensive loss, net of tax | — | | | — | | | — | | | | | — | | | 119 | | | | | 119 | | | |

| Balance at December 31, 2022 | 179,988 | | | $ | 2 | | | $ | 4,686 | | | | | $ | 619 | | | $ | (395) | | | | | $ | 4,912 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statement of Changes in Shareholders' Equity

(Unaudited; dollars in millions, except share data in thousands)

Six months ended December 31, 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Retained Earnings | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | | |

| Balance at June 30, 2023 | 180,273 | | | $ | 2 | | | $ | 4,701 | | | | | $ | 262 | | | $ | (354) | | | | | $ | 4,611 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 395 | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 35 | | | | | — | | | — | | | | | 35 | | | |

| | | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 1 | | | | | — | | | — | | | | | 1 | | | |

| Employee stock purchase plan | — | | | — | | | 5 | | | | | — | | | — | | | | | 5 | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | | | (965) | | | — | | | | | (965) | | | |

Other comprehensive income,

net of tax | — | | | — | | | — | | | | | — | | | — | | | | | — | | | |

| Balance at December 31, 2023 | 180,668 | | | $ | 2 | | | $ | 4,742 | | | | | $ | (703) | | | $ | (354) | | | | | $ | 3,687 | | | |

Six Months Ended December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of Common Stock | | Common Stock | | Additional Paid in Capital | | | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | | | Total Shareholders' Equity | |

| Balance at June 30, 2022 | 179,302 | | | $ | 2 | | | $ | 4,649 | | | | | $ | 518 | | | $ | (394) | | | | | $ | 4,775 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Share issuances related to stock- based compensation | 686 | | | — | | | — | | | | | — | | | — | | | | | — | | |

| | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 29 | | | | | — | | | — | | | | | 29 | | |

| | | | | | | | | | | | | | | | |

| Exercise of stock options | — | | | — | | | 1 | | | | | — | | | — | | | | | 1 | | |

| Employee stock purchase plan | — | | | — | | | 7 | | | | | — | | | — | | | | | 7 | | |

| | | | | | | | | | | | | | | | |

| Net earnings | — | | | — | | | — | | | | | 81 | | | — | | | | | 81 | | |

Other comprehensive income,

net of tax | — | | | — | | | — | | | | | — | | | (1) | | | | | (1) | | |

| Balance at December 31, 2022 | 179,988 | | | $ | 2 | | | $ | 4,686 | | | | | $ | 599 | | | $ | (395) | | | | | $ | 4,892 | | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Consolidated Statements of Cash Flows

(Unaudited; dollars in millions)

| | | | | | | | | | | |

| Six Months Ended December 31, |

| 2023 | | 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net (loss) earnings | $ | (965) | | | $ | 81 | |

| | | |

| | | |

Adjustments to reconcile net (loss) earnings to net cash from operations: | | | |

| Depreciation and amortization | 233 | | | 202 | |

| Goodwill impairment charges | 687 | | | — | |

| Non-cash foreign currency transaction loss, net | 11 | | | 1 | |

| Non-cash restructuring charges | 7 | | | 7 | |

Amortization of debt issuance costs | 6 | | | 4 | |

Impairments charges and loss/gain on sale of assets, net | 14 | | | (1) | |

| | | |

| | | |

| | | |

Stock-based compensation | 35 | | | 29 | |

| Provision for deferred income taxes | (27) | | | 13 | |

| Provision for bad debts and inventory | 44 | | | 67 | |

| Pension settlement charges | 3 | | | — | |

| Change in operating assets and liabilities: | | | |

| Decrease in trade receivables | 165 | | | 148 | |

| Increase in inventories | (46) | | | (180) | |

| Decrease in accounts payable | (40) | | | (68) | |

Other assets/accrued liabilities, net—current and non-current | (85) | | | (181) | |

| | | |

| | | |

| Net cash provided by operating activities | 42 | | | 122 | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | | | |

| Acquisition of property, equipment, and other productive assets | (178) | | | (317) | |

| Proceeds from maturity of marketable securities | — | | | 61 | |

| Proceeds from sale of property and equipment | 1 | | | 7 | |

| | | |

| | | |

| Payment for acquisitions, net of cash acquired | — | | | (474) | |

| Payment for investments | (2) | | | (1) | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (179) | | | (724) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from borrowings | 815 | | | 625 | |

| | | |

| | | |

| Payments related to long-term obligations | (722) | | | (32) | |

Financing fees paid | (16) | | | (4) | |

| | | |

| | | |

| | | |

| | | |

| Exercise of stock options | 1 | | | 1 | |

| Other financing activities | 6 | | | 7 | |

| | | |

| | | |

| Net cash provided by financing activities | 84 | | | 597 | |

| Effect of foreign currency exchange on cash and cash equivalents | 2 | | | (2) | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | (51) | | | (7) | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 280 | | | 449 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 229 | | | $ | 442 | |

| SUPPLEMENTARY CASH FLOW INFORMATION: | | | |

| Interest paid | $ | 112 | | | $ | 83 | |

| Income taxes paid, net | $ | 31 | | | $ | 38 | |

| Non-cash purchase of property, equipment, and other productive assets | $ | 21 | | | $ | 13 | |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

Catalent, Inc.

Notes to Unaudited Consolidated Financial Statements

1. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Catalent, Inc. (“Catalent” or the “Company”) directly and wholly owns PTS Intermediate Holdings LLC (“Intermediate Holdings”). Intermediate Holdings directly and wholly owns Catalent Pharma Solutions, Inc. (“Operating Company”). The financial results of Catalent are comprised of the financial results of Operating Company and its subsidiaries on a consolidated basis.

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three and six months ended December 31, 2023 are not necessarily indicative of the results that may be expected for the year ending June 30, 2024. The consolidated balance sheet at June 30, 2023 has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information on the Company's accounting policies and footnotes, refer to the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023 filed with the Securities and Exchange Commission (the “SEC”) on December 8, 2023.

Reportable Segments

Set forth below is a summary description of the Company's two current operating and reportable segments.

Biologics—The Biologics segment provides development and manufacturing for biologic proteins; cell, gene, and other nucleic acid therapies; plasmid DNA ("pDNA"); induced pluripotent stem cells ("iPSCs"), and oncolytic viruses; and vaccines. It also provides formulation, development, and manufacturing for parenteral dose forms, including vials, prefilled syringes, and cartridges; analytical development and testing services for large molecules.

Pharma and Consumer Health—The Pharma and Consumer Health segment comprises the Company’s market-leading capabilities for complex oral solids, softgel formulations, Zydis® fast-dissolve technologies, and gummy, soft chew, and lozenge dosage forms; formulation, development, and manufacturing platforms for oral, nasal, inhaled, and topical dose forms; and clinical trial development and supply services.

Each segment reports through a separate management team and ultimately reports to the Company's President and Chief Executive Officer, who is designated as the Chief Operating Decision Maker for segment reporting purposes. The Company's operating segments are the same as its reportable segments.

Foreign Currency Translation

The financial statements of the Company’s operations are generally measured using the local currency as the functional currency. Adjustments to translate the assets and liabilities of operations outside the United States (“U.S.”) into U.S. dollars are accumulated as a component of other comprehensive income utilizing period-end exchange rates. Since July 1, 2018, the Company has accounted for its Argentine operations as highly inflationary.

Concentrations of Credit Risk and Major Customers

Concentration of credit risk, with respect to accounts receivable, is limited due to the large number of customers and their dispersion across different geographic areas. The customers are primarily concentrated in the pharmaceutical, biopharmaceutical and consumer products industries. The Company does not normally require collateral or any other security to support credit sales. The Company performs ongoing credit evaluations of its customers’ financial conditions and maintains reserves for credit losses. Such losses historically have been within the Company’s expectations.

As of December 31, 2023 and June 30, 2023, the Company had one customer that represented 27% and 20%, respectively, of its aggregate net trade receivables and current contract asset values, primarily associated with the Company's Biologics segment. After performing a risk assessment of this customer, the Company has determined that a reserve is not warranted as of December 31, 2023. Additionally, the Company had one customer in its Biologics segment that represented approximately 16% of consolidated net revenue during the three and six months ended December 31, 2023. The Company had one customer that represented approximately 13% of net revenue and another customer that represented approximately 10% of net revenue during the three months ended December 31, 2022. For the six months ended December 31, 2022, the Company had one customer that represented 11% of net revenue and two customers that each represented 10% of net revenue.

Depreciation

Depreciation expense was $88 million and $69 million for the three months ended December 31, 2023 and 2022, respectively. Depreciation expense was $166 million and $135 million for the six months ended December 31, 2023 and 2022, respectively. Depreciation expense includes amortization of assets related to finance leases. The Company charges repairs and maintenance costs to expense as incurred.

Amortization

Amortization expense related to other intangible assets was $33 million and $34 million for the three months ended December 31, 2023 and 2022, respectively. Amortization expense related to other intangible assets was $67 million for both the six months ended December 31, 2023 and 2022.

Research and Development Costs

The Company expenses research and development costs as incurred. Research and development costs amounted to $4 million for both the three months ended December 31, 2023 and 2022. Research and development costs amounted to $8 million and $9 million for the six months ended December 31, 2023 and 2022, respectively.

2. REVENUE RECOGNITION

The Company recognizes revenue in accordance with ASC 606, Revenue from Contracts with Customers. The Company generally earns its revenue by supplying goods or providing services under contracts with its customers in three primary revenue streams: manufacturing and commercial product supply, development services, and clinical supply services. The Company measures the revenue from customers based on the consideration specified in its contracts, excluding any sales incentive or amount collected on behalf of a third party, that the Company expects to be entitled to receive in exchange for transferring the promised goods to and/or performing services for the customer (the “Transaction Price”). To the extent the Transaction Price includes variable consideration, the Company estimates the amount of variable consideration that should be included in the Transaction Price utilizing either the expected value method or the most likely amount method, depending on which method is expected to better predict the amount of consideration to which the Company will be entitled. The value of variable consideration is included in the Transaction Price if, and to the extent, it is probable that a significant reversal of the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. These estimates are re-assessed each reporting period, as required, and any adjustment required is recorded on a cumulative catch-up basis, which would affect revenue and net income in the period of adjustment.

The Company’s customer contracts generally include provisions entitling the Company to a termination penalty when the customer terminates prior to the contract’s nominal end date. The termination penalties in customer contracts vary but are generally considered substantive for accounting purposes and create enforceable rights and obligations throughout the stated durations of the contracts. The Company accounts for a contract termination as a contract modification in the period in which the customer gives notice of termination. The determination of the contract termination penalty is based on the terms stated in the relevant customer agreement. As of the modification date, the Company updates its estimate of the Transaction Price using the expected value method, subject to constraints, and to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. These estimates are re-assessed each reporting period, as required, and any adjustment required is recorded on a cumulative catch-up basis, which would affect revenue and net income in the period of adjustment.

Where multiple performance obligations exist in a single contract, the Company allocates consideration to each performance obligation using the “relative standalone selling price” as defined under ASC 606. Generally, the Company utilizes observable standalone selling prices in its allocations of consideration. If observable standalone selling prices are not available, the Company estimates the applicable standalone selling price using a cost-plus-margin approach or an adjusted market assessment approach, in each case, representing the amount that the Company believes the market is willing to pay for the applicable service. Payment is typically due 30 to 45 days following the invoice date, based on the payment terms set forth in the applicable customer agreement.

The Company generally expenses sales commissions as incurred because either the amortization period is one year or less, or the balance with an amortization period greater than one year is not material.

Customer contracts that include commitments by the Company to make facility space or equipment available may be deemed to include lease components, which are evaluated under ASC 842, Leases. For arrangements that contain both lease and non-lease components, consideration in the contract is allocated on a relative standalone selling-price basis. Determining the lease term and contract term of non-lease components, as well as the variable and fixed consideration in these arrangements, including when variability is resolved, often requires management judgment in order to determine the allocation to the lease and non-lease components.

Manufacturing & Commercial Product Supply Revenue

Manufacturing and commercial product supply revenue consists of revenue earned by manufacturing products supplied to customers under long-term commercial supply arrangements. In these arrangements, the customer typically owns and supplies the active pharmaceutical ingredient (“API”) or other proprietary materials used in the manufacturing process. The contract generally includes the terms of the manufacturing services and related product quality assurance procedures to comply with regulatory requirements. Due to the regulated nature of the Company’s business, these contract terms are highly interdependent and, therefore, are considered to be a single combined performance obligation. The transaction price is generally stated in the agreement as a fixed price per unit, with no contractual provision for a refund or price concession. In most circumstances, control is transferred to the customer over time, creating a corresponding right to recognize the related revenue, because there is no alternative use to the Company for the asset created and the Company has an enforceable right to payment for performance completed as of that date. The selection of the method for measuring progress towards the completion of the Company’s performance obligation requires judgment and is based on the nature of the products to be manufactured. For the majority of the Company’s arrangements, progress is measured based on the units of product that have successfully completed the contractually required product quality assurance process, because the conclusion of that process defines the time when the applicable contract and the related regulatory requirements permit the customer to exercise control over the product’s disposition. The customer is typically responsible for arranging the shipping and handling of product following completion of the quality assurance process. Payment is typically due 30 to 45 days after invoice date, based on the payment terms set forth in the applicable customer agreement.

Beginning in the third quarter of fiscal 2023, the Company began recognizing commercial revenue for certain contracts in its Biologics segment that have a notably long manufacturing cycle, and for which the customer exercises control over the product throughout the manufacturing process. For these contracts, revenue is recognized over time and progress is measured using an input method based on effort expended, which provides an appropriate depiction of the Company’s progress toward fulfilling its performance obligation.

Development Services and Clinical Supply Revenue

Development services contracts generally take the form of short-term, fee-for-service arrangements. Performance obligations vary, but frequently include biologic cell-line development, performing formulation, analytical stability, or other services related to product development, and providing manufacturing services for products that are under development or otherwise not intended for commercial sale. They can also include a combination of the following services: the manufacturing, packaging, storage, distribution, destruction, and inventory management of customer clinical trial material, as well as the sourcing of comparator drug products on behalf of customers to be used in clinical trials to compare performance with the drug under clinical investigation. The transaction prices for these arrangements are fixed and include amounts stated in the contracts for each promised service, and each service is generally considered to be a separate performance obligation. In most instances, the Company recognizes revenue over time because there is no alternative use to the Company for the asset created and the Company has an enforceable right to payment for performance completed as of that date.

The Company measures progress toward the completion of its performance obligations satisfied over time based on the nature of the services to be performed. For certain types of arrangements, revenue is recognized over time and measured using

an output method based on the completion of tasks and activities that are performed to satisfy a performance obligation. For certain types of arrangements, revenue is recognized over time and measured using an input method based on effort expended. Each of these methods provides an appropriate depiction of the Company’s progress toward fulfilling its performance obligations for its respective arrangement. In certain development services arrangements that require a portion of the contract consideration to be received in advance at the commencement of the contract, such advance payment is initially recorded as a contract liability. In certain clinical supply arrangements, revenue is recognized at the point in time when control transfers, which occurs upon either the delivery of the related output of the service to the customer or the completion of quality testing with respect to the product, and the Company has an enforceable right to payment based on the terms of the arrangement.

The Company records revenue for comparator sourcing arrangements on a net basis because it is acting as an agent that does not control the product or service before it is transferred to the customer. Payment for comparator sourcing activity is typically received in advance at the commencement of the contract and is initially recorded as a contract liability.

The Company generally expenses sales commissions as incurred because either the amortization period is one year or less, or the balance with an amortization period greater than one year is not material.

The following tables reflect net revenue for the three and six months ended December 31, 2023 and 2022, by type of activity and reportable segment (in millions):

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 278 | | | $ | 373 | | | $ | 651 | |

| Development services & clinical supply | 160 | | | 214 | | | 374 | |

| Total | $ | 438 | | | $ | 587 | | | $ | 1,025 | |

| Inter-segment revenue elimination | | (1) | |

| Combined net revenue | | $ | 1,024 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 76 | | | $ | 364 | | | $ | 440 | |

| Development services & clinical supply | 504 | | | 206 | | | 710 | |

| Total | $ | 580 | | | $ | 570 | | | $ | 1,150 | |

| Inter-segment revenue elimination | (1) | |

| Combined net revenue | | $ | 1,149 | |

| | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2023 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 560 | | | $ | 707 | | | $ | 1,267 | |

| Development services & clinical supply | 326 | | | 414 | | | 740 | |

| Total | $ | 886 | | | $ | 1,121 | | | $ | 2,007 | |

| Inter-segment revenue elimination | | (1) | |

| Combined net revenue | | $ | 2,006 | |

| | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2022 | Biologics | | Pharma and Consumer Health | | Total |

| Manufacturing & commercial product supply | $ | 171 | | | $ | 678 | | | $ | 849 | |

| Development services & clinical supply | 932 | | | 391 | | | 1,323 | |

| Total | $ | 1,103 | | | $ | 1,069 | | | $ | 2,172 | |

| Inter-segment revenue elimination | (1) | |

| Combined net revenue | | $ | 2,171 | |

The following table allocates revenue by the location where the goods were made or the service performed:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Six Months Ended

December 31, |

| (Dollars in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| United States | | $ | 653 | | | $ | 734 | | | $ | 1,298 | | | $ | 1,432 | |

| Europe | | 324 | | | 356 | | | 599 | | | 630 | |

| Other | | 86 | | | 88 | | | 173 | | | 169 | |

| Elimination of revenue attributable to multiple locations | | (39) | | | (29) | | | (64) | | | (60) | |

| Total | | $ | 1,024 | | | $ | 1,149 | | | $ | 2,006 | | | $ | 2,171 | |

Contract Liabilities

Contract liabilities relate to cash consideration that the Company receives in advance of satisfying the related performance obligations. The contract liabilities balances (current and non-current) as of December 31, 2023 and June 30, 2023 are as follows:

| | | | | | | | |

| (Dollars in millions) | | |

| | |

| Balance at June 30, 2023 | | $ | 180 | |

| | |

| | |

| | |

| | |

| Balance at December 31, 2023 | | $ | 219 | |

| Revenue recognized in the period from amounts included in contracts liability at the beginning of the period: | | $ | (114) | |

Contract liabilities that will be recognized within 12 months of December 31, 2023 are accounted for in Other accrued liabilities and those that will be recognized longer than 12 months after December 31, 2023 are accounted for in Other liabilities.

Contract Assets

Contract assets primarily relate to the Company's conditional right to receive consideration for services that have been performed for customers as of December 31, 2023 relating to the Company's development and commercial services but had not yet been invoiced as of December 31, 2023. Contract assets are transferred to trade receivables, net when the Company’s right to receive the consideration becomes unconditional. Contract assets totaled $495 million and $417 million as of December 31, 2023 and June 30, 2023, respectively. Contract assets expected to transfer to trade receivables within 12 months are accounted for within Prepaid expenses and other. Contract assets expected to transfer to trade receivables longer than 12 months are accounted for within Other long-term assets.

As of December 31, 2023, the Company's aggregate contract asset balance increased $78 million or 19% compared to June 30, 2023. The majority of this increase is related to large development and commercial programs in the Biologics segment, such as manufacturing and development services for gene therapy offerings, where revenue is recorded over time and the ability to invoice customers is dictated by contractual terms. As of December 31, 2023, the Company recorded no reserve against its aggregate contract asset balance.

Performance Obligations

Remaining performance obligations represent firm orders for future development services as well as manufacturing and commercial product supply, including minimum volume commitments, for which there are incomplete performance obligations for work not yet completed under executed contracts. Remaining performance obligations as of December 31, 2023 were $692 million. The Company expects to recognize approximately 36% of the remaining performance obligations in existence as of December 31, 2023 after June 30, 2024.

3. BUSINESS COMBINATIONS

Metrics Contract Services Acquisition

In October 2022, the Company acquired 100% of Metrics Contract Services (“Metrics”) from Mayne Pharma Group Limited for $474 million in cash. Metrics, based in Greenville, North Carolina, is an oral solids development and manufacturing business specializing in the manufacture of drugs containing highly potent active pharmaceutical ingredients. The operations and facility acquired have become part of the Company’s Pharma and Consumer Health segment.

The Company accounted for the Metrics transaction using the acquisition method in accordance with ASC 805, Business Combinations. The Company funded this acquisition with a portion of the proceeds of an October 2022 drawdown from its senior secured revolving credit facility. The Company estimated fair values at the date of acquisition for the allocation of consideration to the net tangible and intangible assets acquired and liabilities assumed.

The purchase price allocation to assets acquired and liabilities assumed in the transaction is as follows:

| | | | | |

| (Dollars in millions) | Final Purchase Price Allocation |

| Trade receivables, net | $ | 15 | |

| Inventories | 5 | |

| Property, plant, and equipment | 195 | |

| Other intangibles, net | 52 | |

| |

| Other, net | (12) | |

| Goodwill | 219 | |

| Total assets acquired and liabilities assumed | $ | 474 | |

The carrying value of trade receivables, inventory, and trade payables, as well as certain other current and non-current assets and liabilities generally represented the fair value at the date of acquisition.

Other intangibles, net consists of customer relationships of $52 million, which were valued using the multi-period, excess-earnings method, a method that values the intangible asset using the present value of the after-tax cash flows attributable to the intangible asset only. The significant assumptions used in developing the valuation included the estimated annual net cash flows (including application of an appropriate margin to forecasted revenue, selling and marketing costs, return on working capital, contributory asset charges, and other factors), the discount rate that appropriately reflects the risk inherent in each future cash flow stream, and an assessment of the asset’s life cycle, as well as other factors. The assumptions used in the financial forecasts were based on historical data, supplemented by current and anticipated growth rates, management plans, and market-comparable information. Fair-value determinations require considerable judgment and are sensitive to changes in underlying assumptions and factors. The customer relationship intangible asset has a weighted average useful life of 12 years.

Property, plant, and equipment was valued using the cost approach, which is based on current replacement and/or reproduction cost of the asset as new, less depreciation attributable to physical, functional, and economic factors. The Company then determined the remaining useful life based on the anticipated life of the asset and Company policy for similar assets.

Goodwill was allocated to the Pharma and Consumer Health segment. Goodwill is mainly comprised of the growth from an expected increase in capacity utilization and potential new customers. The goodwill resulting from the Metrics acquisition is not deductible for tax purposes.

Results of the business acquired were not material to the Company's consolidated statement of operations, financial position, or cash flows.

4. GOODWILL

The following table summarizes the changes between June 30, 2023 and December 31, 2023 in the carrying amount of goodwill in total and by segment:

| | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Biologics | | Pharma and Consumer Health | | | | | | Total |

| Balance at June 30, 2023 | $ | 1,563 | | | $ | 1,476 | | | | | | | $ | 3,039 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Foreign currency translation adjustments | 2 | | | (3) | | | | | | | (1) | |

Impairment (1) | (392) | | | (295) | | | | | | | (687) | |

| Balance at December 31, 2023 | $ | 1,173 | | | $ | 1,178 | | | | | | | $ | 2,351 | |

(1) Represents gross impairment charges in the period. Accumulated goodwill impairment charges amount to $897 million.

Goodwill Impairment Charges

As a result of the Consumer Health reporting unit's underperformance of recent operating results relative to expectations, the current macroeconomic conditions impacting the consumer health and biotechnology industries, and increased interest rates, the Company assessed the current and future economic outlook as of September 30, 2023 for its reporting units in its Pharma and Consumer Health and Biologics segments and identified indicators for impairment of the goodwill previously recorded for two of its reporting units. The evaluation began with a qualitative assessment of the Company's Consumer Health and Biomodalities reporting units to determine if it was more likely than not that the fair value of the reporting units was less than its carrying value. The qualitative assessment did not indicate that it was more likely than not that the fair value exceeded the carrying value in its Consumer Health and Biomodalities reporting units, which led to a quantitative assessment for the corresponding reporting units.

The Company estimated the fair value of its reporting units using a combination of the income and market approaches. In performing the goodwill impairment test, the Company used a terminal revenue growth rate of 3.5% and discount rates ranging from 9% to 10% in its estimation of fair value. The evaluation performed resulted in impairment charges of $687 million with respect to the Consumer Health and Biomodalities reporting units.

While the Company believes the assumptions it used were reasonable and commensurate with the views of a market participant, changes in key assumptions, including increasing the discount rate, lowering forecasts for revenue and operating margin or lowering the long-term growth rate could lead to the conclusion that an additional impairment was appropriate.

A qualitative assessment was performed as of December 31, 2023, which yielded no indicators of impairment.

5. LONG-TERM OBLIGATIONS AND SHORT-TERM BORROWINGS

Long-term obligations and short-term borrowings consisted of the following at December 31, 2023 and June 30, 2023:

| | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Maturity | | December 31, 2023 | | June 30, 2023 |

| Senior secured credit facilities | | | | | |

| Term loan facility B-3 (7.471% as of December 31, 2023) | February 2028 | | $ | 1,411 | | | $ | 1,418 | |

| Term loan facility B-4 (8.356% as of December 31, 2023) | February 2028 | | 600 | | | — | |

| Revolving credit facility | November 2027 | | — | | | 500 | |

| 5.000% senior notes due 2027 | July 2027 | | 500 | | | 500 | |

2.375% Euro senior notes due 2028(1) | March 2028 | | 910 | | | 904 | |

| 3.125% senior notes due 2029 | February 2029 | | 550 | | | 550 | |

| 3.500% senior notes due 2030 | April 2030 | | 650 | | | 650 | |

| Financing lease obligations | 2023 to 2038 | | 398 | | | 341 | |

Other obligations(2) | 2023 to 2028 | | 36 | | | 25 | |

| Unamortized discount and debt issuance costs | | | (50) | | | (39) | |

| Total debt | | | $ | 5,005 | | | $ | 4,849 | |

Less: current portion of long-term obligations and other short-term

borrowings | | | 46 | | | 536 | |

| Long-term obligations, less current portion | | | $ | 4,959 | | | $ | 4,313 | |

(1) The change in the carrying value of this euro-denominated debt was due to fluctuations in foreign currency exchange rates.

(2) The increase in other obligations is primarily associated with $15 million in proceeds from a failed sale-leaseback transaction that occurred in the three months ended September 30, 2023.

On November 22, 2023, Operating Company, entered into Amendment No. 10 (the “Tenth Amendment”) to its Amended and Restated Credit Agreement dated May 20, 2014 (as amended, the “Credit Agreement”), which Tenth Amendment further extends the deadlines by which the Operating Company is required to deliver to the administrative agent (i) its audited financial statements as at the end of and for the fiscal year ended June 30, 2023, together with the auditor’s report and opinion on such audited financial statements, to January 26, 2024, and (ii) its unaudited financial statements as at the end of and for the fiscal quarter ending September 30, 2023 to March 13, 2024.

On December 19, 2023, Operating Company entered into Amendment No. 11 (the “Eleventh Amendment”) to the Credit Agreement. Pursuant to the Eleventh Amendment, the Operating Company incurred $600 million aggregate principal amount of U.S. dollar-denominated term B-4 loans (the “Term B-4 Loans”).The Term B-4 Loans are a new class of term loans under the Credit Agreement, with an interest rate, at Operating Company’s option, of either (i) the term SOFR rate plus 3.00% or (ii) the base rate plus 2.00%; provided, that the term SOFR rate shall not be less than 0.50%. The Term B-4 Loans have a maturity date of February 2028, quarterly amortization of principal equal to 1.00% with payments on the last business day of March, June, September, and December. The proceeds of the Term B-4 Loans, after payment of fees and expenses, were used to repay the existing Revolving Credit Facility under the Credit Agreement, plus accrued and unpaid interest thereon.

The Revolving Credit Facility requires compliance with a net leverage covenant when there is a 30% or more draw outstanding at a period end. As of December 31, 2023, we were in compliance with all covenants under the Credit Agreement.

In addition to outstanding borrowings under the Revolving Credit facility, the available capacity under the Revolving Credit Facility is further reduced by the aggregate value of all outstanding letters of credit under the Credit Agreement. As of December 31, 2023, Operating Company had $1.09 billion of available capacity under the Revolving Credit Facility, due to $6 million of outstanding letters of credit.

Measurement of the Estimated Fair Value of Debt

The estimated fair value of the Company’s senior secured credit facilities and other senior indebtedness is classified as a Level 2 determination (see Note 10, Fair Value Measurements to our consolidated financial statements, for a description of the method by which fair value classifications are determined) in the fair-value hierarchy and is calculated by using a discounted cash flow model with a market interest rate as a significant input. The carrying amounts and the estimated fair values of the Company’s principal categories of debt as of December 31, 2023 and June 30, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2023 | | June 30, 2023 |

| (Dollars in millions) | Fair Value Measurement | | Carrying Value | | Estimated Fair Value | | Carrying Value | | Estimated Fair Value |

| | | | | | | | | |

| | | | | | | | | |

| 5.000% senior notes due 2027 | Level 2 | | $ | 500 | | | $ | 499 | | | $ | 500 | | | $ | 482 | |

| 2.375% Euro senior notes due 2028 | Level 2 | | 910 | | | 836 | | | 904 | | | 784 | |

| 3.125% senior notes due 2029 | Level 2 | | 550 | | | 508 | | | 550 | | | 481 | |

| 3.500% senior notes due 2030 | Level 2 | | 650 | | | 598 | | | 650 | | | 566 | |

| Senior secured credit facilities & other | Level 2 | | 2,445 | | | 2,225 | | | 2,284 | | | 2,141 | |

| Subtotal | | | $ | 5,055 | | | $ | 4,666 | | | $ | 4,888 | | | $ | 4,454 | |

Unamortized discount and debt issuance

costs | | | (50) | | | — | | | (39) | | | — | |

| Total debt | | | $ | 5,005 | | | $ | 4,666 | | | $ | 4,849 | | | $ | 4,454 | |

6. (LOSS) EARNINGS PER SHARE

The Company computes (loss) earnings per share of the Company’s common stock, par value $0.01 (the “Common Stock”) using the treasury stock method. Diluted net (loss) earnings per share is computed using the weighted average number of shares of Common Stock outstanding plus the weighted average number of shares of Common Stock that would be issued assuming exercise or conversion of all potentially dilutive instruments. Dilutive securities having an anti-dilutive effect on diluted net earnings per share are excluded from the calculation. The dilutive effect of the securities that are issuable under the Company’s equity incentive plans are reflected in diluted earnings per share by application of the treasury stock method. The reconciliations between basic and diluted earnings per share attributable to Catalent common shareholders for the three and six months ended December 31, 2023 and 2022, respectively, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| (In millions except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| Net (loss) earnings | $ | (206) | | | $ | 81 | | | $ | (965) | | | $ | 81 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average shares outstanding - basic | 182 | | | 181 | | | 181 | | | 180 | |

| Weighted average dilutive securities issuable - stock plans | — | | | — | | | — | | | 1 | |

| Weighted average shares outstanding - diluted | 182 | | | 181 | | | 181 | | | 181 | |

| | | | | | | |

| (Loss) earnings per share: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | (1.13) | | | $ | 0.45 | | | $ | (5.31) | | | $ | 0.45 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | (1.13) | | | $ | 0.44 | | | $ | (5.31) | | | $ | 0.45 | |

Shares with an antidilutive effect on the weighted average shares outstanding for the three and six months ended December 31, 2023 and 2022 were not material.

7. OTHER EXPENSE (INCOME), NET

The components of other expense (income), net for the three and six months ended December 31, 2023 and 2022 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| (Dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Foreign currency losses (gains) (1) | $ | 4 | | | $ | (25) | | | 15 | | | (1) | |

| Other | — | | | 2 | | | 2 | | | 3 | |

| Total other expense (income), net | $ | 4 | | | $ | (23) | | | $ | 17 | | | $ | 2 | |

(1) Foreign currency remeasurement gains/losses include both cash and non-cash transactions.

8. RESTRUCTURING COSTS

From time to time, the Company implements plans to restructure certain operations, both domestically and internationally. The restructuring plans focused on various aspects of operations, including, among others, closing and consolidating certain manufacturing operations, rationalizing headcount and aligning operations in a strategic and more cost-efficient structure. In addition, the Company may incur restructuring charges in the future in cases where a material change in the scope of operation with its business occurs. Employee-related restructuring costs consist primarily of severance costs and also include outplacement services provided to employees who have been involuntarily terminated and duplicate payroll costs during transition periods. Facility exit and other such restructuring costs consist of equipment relocation costs and costs associated with planned facility expansions and closures to streamline Company operations.

During the fiscal year ended June 30, 2023, the Company adopted plans to reduce costs, consolidate facilities, and optimize its infrastructure across the organization. During the three months ended December 31, 2023, the Company extended its restructuring efforts to reduce costs and headcount in both its Biologics and Pharma and Consumer Health segments.

In October 2023, and in connection with the Company's restructuring plans, the Company committed to a plan to close operations at its San Francisco facility and to transfer those operations to other sites within its network. The Company expects to incur cash and non-cash charges of at least $25 million in connection with the site closure, primarily related to a pension liability from a multi-employer pension plan and accelerated depreciation of property, plant and equipment in the second half of fiscal 2024. Results for the three months ended December 31, 2023 are reflected in the tables below under the Pharma and Consumer Health segment.

In connection with these restructuring plans, the Company reduced its headcount by approximately 300 employees and incurred cumulative employee-related charges of approximately $12 million, primarily associated with cash severance programs through December 31, 2023.

Restructuring costs for the three and six months ended December 31, 2023 and 2022 were recorded in Other Operating Expense in the Consolidated Statement of Operations.

The following table summarizes the charges recorded within restructuring costs:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

(Dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Restructuring costs: | | | | | | | |

| Employee-related reorganization | $ | 10 | | | $ | 12 | | | $ | 12 | | | $ | 14 | |

| Facility exit and other costs | 7 | | | 11 | | | 7 | | | 13 | |

| Total restructuring costs | $ | 17 | | | $ | 23 | | | $ | 19 | | | $ | 27 | |

The following table summarizes the charges recorded within restructuring costs by segment. These amounts are excluded from Segment EBITDA as described in Note 15, Segment Information.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

(Dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

| Restructuring costs: | | | | | | | |

| Biologics | $ | 6 | | | $ | 18 | | | $ | 7 | | | $ | 18 | |

| Pharma and Consumer Health | 10 | | | 1 | | | 11 | | | 4 | |

| Non-segment (Corporate) | 1 | | | 4 | | | 1 | | | 5 | |

| Total restructuring costs | $ | 17 | | | $ | 23 | | | $ | 19 | | | $ | 27 | |

The following tables summarizes the change in the employee separation-related liability associated with the restructuring plans.

| | | | | |

| Employee-related restructuring |

(Dollars in millions) | |

| Balance, June 30, 2023 | $ | 19 | |

| Charges | 12 | |

| Payments | (15) | |

| Balance, December 31, 2023 | $ | 16 | |

9. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

Risk Management Objective of Using Derivatives

The Company is exposed to fluctuations in the currency exchange rates applicable to its investments in operations outside the U.S. While the Company does not actively hedge against changes in foreign currency, the Company has mitigated exposure from its investments in its European operations by denominating a portion of its debt in euros. At December 31, 2023, the Company had euro-denominated debt outstanding of $910 million (U.S. dollar equivalent), which is designated and qualifies as a hedge against its net investment in its European operations. For non-derivatives designated and qualifying as net investment hedges, the effective portion of translation gains or losses are reported in accumulated other comprehensive loss as part of the cumulative translation adjustment. The following table summarizes net investment hedge activity during the three and six months ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| (Dollars in millions) | 2023 | | 2022 | | 2023 | | 2022 |

Unrealized foreign exchange loss within other comprehensive income | $ | (38) | | | $ | (85) | | | $ | (6) | | | $ | (4) | |

| | | | | | | |

The net accumulated gain on the instrument designated as a hedge as of December 31, 2023 within other comprehensive loss was approximately $91 million. Amounts are reclassified out of accumulated other comprehensive loss into earnings when the entity to which the gains and losses relate is either sold or substantially liquidated.

Interest-Rate Swap

In February 2021, the Company entered into an interest-rate swap agreement with Bank of America N.A. (the “2021 Rate Swap”) as a hedge against the economic effect of a portion of the variable interest obligation associated with its Term B-3 Loans. The 2021 Rate Swap effectively fixed the rate of interest payable on that portion of the Term B-3 Loans, thereby reducing the impact of future interest rate changes on future interest expense. As a result of the 2021 Rate Swap, the variable portion of the applicable interest rate on $500 million of the Term B-3 Loans is now effectively fixed at 0.9985%.

To conform with the adoption of Topic 848, Reference Rate Reform and the Eighth Amendment, the Company amended the 2021 Rate Swap in June 2023 (the “2023 Rate Swap”). The 2023 Rate Swap continues to effectively fix the rate of interest payable on the same portion of our U.S. dollar-denominated term loans under our senior secured credit facilities. As a result of

the 2023 Rate Swap, the variable portion of the applicable interest rate on $500 million of the U.S. dollar-denominated term loans is now effectively fixed at 0.9431%.

The 2023 Rate Swap continues to qualify for a cash-flow hedge. The Company evaluates hedge effectiveness at the inception of the hedge and on an ongoing basis. The cash flows associated with the 2023 Rate Swap amendment is reported in cash provided by operating activities in the consolidated statements of cash flows. The unrealized loss recorded in stockholder's equity related to the mark-to-market change in the 2021 Rate Swap during the three and six months ended December 31, 2023 was $2 million.

A summary of the estimated fair value of the 2021 Rate Swap reported in the consolidated balance sheets is stated in the table below:

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | June 30, 2023 |

| (Dollars in millions) | Balance Sheet Classification | | Estimated Fair Value | | Balance Sheet Classification | | Estimated Fair Value |

| Interest-rate swap | Other long-term assets | | $ | 59 | | | Other long-term assets | | $ | 62 | |

10. FAIR VALUE MEASUREMENTS

ASC 820, Fair Value Measurement, defines fair value as the exit price that would be received to sell an asset or paid to transfer a liability. Fair value is a market-based measurement that should be determined using assumptions that market participants would use in pricing an asset or liability. Valuation techniques used to measure fair value should maximize the use of observable inputs and minimize the use of unobservable inputs. To measure fair value, the Company uses the following fair value hierarchy based on three levels of inputs, of which Level 1 and Level 2 are considered observable and Level 3 is considered unobservable:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Inputs other than Level 1 that are observable for the asset or liability, either directly or indirectly, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data by correlation or other means.