Cazoo Announces First Quarter 2022 Financial Results

May 03 2022 - 5:30AM

Business Wire

Record revenues up 159% YoY to £295m in Q1

with Retail units sold up 53% quarter on quarter

- Record revenues of £295m up 159% YoY driven

by continued strong retail sales growth

- Vehicles sold up 102% YoY to 19,713 in Q1

as demand for proposition continues to grow

- Retail units sold in Q1 up 53% sequentially

aided by increased website inventory levels

- Further progress in France & Germany

and preparing for launch in Italy & Spain mid-year

- Continued ramp in UK reconditioning

capabilities resulting in record UK website inventory

- Strong cash position following the issuance

of $630 million convertible notes in February

Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”),

Europe’s leading online car retailer, which makes buying and

selling a car as simple as ordering any other product online today,

has announced its financial results for the three months ended

March 31, 2022.

Alex Chesterman OBE, Founder & CEO of Cazoo,

commented, “I am extremely pleased with our record Q1 revenues

and unit sales as we are starting to see the benefits from the

significant strategic steps that we took during 2021. We achieved

over 50% sequential quarterly growth in retail units sold in the

period, driven by increased inventory available on our website,

supporting our thesis that increased reconditioning output leads to

greater sales. As we advance through 2022 we aim to continue to

ramp up our reconditioning capacity which we expect to lead to

further growth and allow us to continue our progress towards our

long-term market share ambitions.

This strong acceleration in growth comes despite a rapidly

changing macroeconomic backdrop in our markets. While we are very

mindful of the wider macroeconomic uncertainties, we remain laser

focused on the execution of our strategy as we continue to make

progress against our previously detailed expectations for the year.

We expect any macro headwinds to be transitory in nature and remain

extremely excited by the enormous market opportunity for Cazoo and

are very confident in achieving our long-term growth and margin

targets.”

Stephen Morana, Chief Financial Officer of Cazoo, added,

“I am encouraged by the progress we have made in Q1, significantly

increasing our revenue by 159% year-on-year driven by strong UK

retail sales. As previously detailed, our Q1 UK retail GPU was

impacted in the short term from investments made in the second half

of last year with the launch of our car buying channel and bringing

our UK reconditioning in-house. We expect a significant improvement

in our UK Retail GPU in Q2 and throughout the rest of the year as

we start to see the benefits of these investments.”

Summary Results

Three months ended

March 31,

2022

(unaudited)

2021

(unaudited)

Change

Vehicles Sold

19,713

9,762

+102%

Retail

13,353

7,785

+72%

Wholesale

6,360

1,977

+222%

Revenue (£m)

295

114

+159%

Retail (£m)1

231

97

+138%

Wholesale (£m)

42

6

+587%

Other (£m)2

22

11

+105%

UK Retail GPU (£)3

124

143

-19

Gross Profit (£m)

2

4

-2

Gross Margin (%)

0.5%

3.3%

-2.8%pts

1 ‘Retail revenue’ excludes £3 million of sales in Q1

2022 where Cazoo sold vehicles as an agent for third parties and

only the net commission received from those sales is recorded

within ‘Retail revenue’ (Q1 2021: £1 million). 2 ‘Other

revenue’ includes ancillary products, subscription, remarketing and

servicing income. 3 UK Retail GPU (Gross Profit per Unit) is

derived from UK retail and ancillary product revenues, divided by

UK retail units sold (net of returns). ‘UK Retail GPU’ was

previously referred to as ‘Retail GPU’ as we did not have non-UK

retail revenues prior to December 2021.

First Quarter 2022 Financial highlights

- Strong growth in Revenue up 159% YoY, to £295 million in Q1

- Retail revenue up 138% YoY driven by continued strong uptake of

our proposition

- Wholesale revenue up 587% YoY following the launch of our car

buying channel

- Vehicles sold up 102% YoY to 19,713 in Q1

- Retail units sold up 53% versus Q4 2021 aided by increased

available inventory

- Increased wholesale unit volumes as more cars sourced directly

from consumers

- UK Retail GPU of £124, broadly stable YoY

- Upfront investments at launch of car buying channel last year

impacting margin

- Investments made while bringing UK reconditioning in-house

- Gross profit of £2 million, with a margin of 0.5%

First Quarter 2022 Strategic highlights

- Continued to build out our UK end-to-end reconditioning

capabilities

- Growth of UK website inventory to record levels of c6,500

vehicles as at March 31, 2022

- Continued to invest capex and opex to support further growth in

reconditioning capability

- Strong momentum from car buying channel

- Record level of over 30% of retail units sold in the period

sourced directly from consumers

- Maintained high level of purchases without supply constraints

while optimising pricing levels

- Further progress in expanding addressable market in the EU

- France and Germany continued to scale since launch in late Q4

2021

- Preparations continued for launch of Cazoo into both Spain and

Italy in summer 2022

- Raised significant funds for further build out of operations,

brand and infrastructure

- Issued $630 million of convertible notes to an investor group

led by Viking Global Investors

- Secured €50 million asset-backed finance for subscription

business in France and Germany

- Acquired brumbrum, Italy’s leading online car retailer and

subscription platform

- Strong team and relationships which supports planned launch in

Italy this year

- Provides first EU in-house vehicle preparation site with

potential output of 15,000 cars per year

Conference Call

Cazoo will host a conference call today, May 3, 2022, at 8 a.m.

ET. Investors and analysts interested in participating in the call

are invited to dial 1-877-704-6255, or for international callers,

1-215-268-9947. A webcast of the call will also be available on the

investor relations page of the Company’s website at

https://investors.cazoo.co.uk.

About Cazoo - www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK & Europe by providing better

selection, value, transparency, convenience and peace of mind. Our

aim is to make buying or selling a car no different to ordering any

other product online, where consumers can simply and seamlessly

buy, sell, finance or subscribe to a car entirely online for

delivery or collection in as little as 72 hours. Cazoo was founded

in 2018 by serial entrepreneur Alex Chesterman OBE, is backed by

some of the leading technology investors globally and is publicly

traded (NYSE: CZOO).

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the “safe harbour” provisions of the Private

Securities Litigation Reform Act of 1995. The expectations,

estimates, and projections of the business of Cazoo may differ from

its actual results and, consequently, you should not rely on

forward-looking statements as predictions of future events. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (1) realizing the benefits expected from the business

combination (the “Business Combination”) with Ajax I; (2) achieving

the expected revenue growth and effectively managing growth; (3)

executing Cazoo’s expansion strategy in the UK and Europe; (4)

achieving and maintaining profitability in the future; (5) having

access to suitable and sufficient vehicle inventory for resale to

customers and for Cazoo’s subscription offering and reconditioning

and selling inventory expeditiously and efficiently; (6)

availability of credit for vehicle financing and the affordability

of interest rates; (7) expanding Cazoo’s subscription offering; (8)

increasing Cazoo’s service offerings and price optimization; (9)

effectively promoting Cazoo’s brand and increasing brand awareness;

(10) expanding Cazoo’s product offerings and introducing additional

products and services; (11) enhancing future operating and

financial results; (12) acquiring and integrating other companies;

(13) acquiring and protecting intellectual property; (14)

attracting, training and retaining key personnel; (15) complying

with laws and regulations applicable to Cazoo’s business; (16)

global inflation and cost increases for labor, fuel, materials and

services; (17) geopolitical and macroeconomic conditions and their

impact on prices for goods and services and on consumer

discretionary spending; (18) successfully deploying the proceeds

from the Business Combination and the issuance of $630 million of

convertible notes to an investor group led by Viking Global

Investors; and (19) other risks and uncertainties set forth in the

sections entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the registration statement on Form

F-1 and the prospectus included therein filed by Cazoo Group Ltd

(f/k/a Capri Listco). The foregoing list of factors is not

exhaustive. You should carefully consider the foregoing factors and

the disclosure included in other documents filed by Cazoo from time

to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Cazoo assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Cazoo gives no assurance that it will

achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220503005177/en/

Investor Relations: Cazoo: Robert Berg, Director of

Investor Relations and Corporate Finance, investors@cazoo.co.uk

ICR: cazoo@icrinc.com

Media: Cazoo: Lawrence Hall, Group Communications

Director, lawrence.hall@cazoo.co.uk Brunswick: Chris

Blundell/Simone Selzer +44 20 7404 5959 /

cazoo@brunswickgroup.com

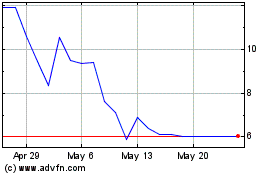

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Mar 2025 to Apr 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Apr 2024 to Apr 2025