|

Pricing Supplement

No. E163

To prospectus supplement dated April 26, 2024 and

prospectus dated April 26, 2024

|

Registration Statement No. 333-278331

Rule 424(b)(2) |

Deutsche Bank AG

$478,000 Floating Rate Senior Debt Funding Notes

Linked to the Consumer Price Index due February 13, 2030

General

| · | The notes pay interest monthly in arrears at a

variable rate per annum equal to the lagging year-over-year percentage change in the Consumer Price Index plus a Spread, subject

to the Minimum Interest Rate, as specified below. The Consumer Price Index for purposes of the notes is the non-seasonally adjusted U.S.

City Average All Items Consumer Price Index for All Urban Consumers, as published on Bloomberg Page “CPURNSA” (or any successor

page). Because the Consumer Price Index is one measure of price inflation in the United States, the return on your notes will depend on

U.S. inflation levels, as measured by the Consumer Price Index. All payments

on the notes, including interest payments and the repayment of principal at maturity, are subject to the credit of the Issuer. |

| · | Unsecured, unsubordinated senior preferred obligations

of Deutsche Bank AG due February 13, 2030 |

| · | The notes are intended to qualify as eligible

liabilities for the minimum requirement for own funds and eligible liabilities of the Issuer. |

| · | Minimum denominations of $1,000 (the “Principal

Amount”) and integral multiples in excess thereof |

| · | The notes priced on February 10, 2025 (the “Trade

Date”) and are expected to settle on February 13, 2025 (the “Settlement Date”). Delivery of the notes in

book-entry form only will be made through The Depository Trust Company (“DTC”). |

Key Terms

| Issuer: |

Deutsche Bank AG |

| Issue Price: |

100.00% |

| Consumer Price Index: |

The “Consumer Price Index” or “CPI” means the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) published by the Bureau of Labor Statistics of the U.S. Department of Labor (the “BLS”) on Bloomberg page CPURNSA (or any successor page), as determined by the calculation agent in accordance with the procedures set forth under “Consumer Price Index—Determination of the CPI Rate” in this pricing supplement. |

| Interest Rate: |

For each Interest Period, the notes will bear interest equal to the CPI Rate determined for that Interest Period plus the Spread, subject to the Minimum Interest Rate. Interest will be payable monthly in arrears on each Interest Payment Date, based on an unadjusted 30/360 day count convention. In no case will the amount payable on any Interest Payment Date be less than the Minimum Interest Rate. |

| Minimum Interest Rate: |

1.75% per annum |

| CPI Rate: |

For each Interest Period, the lagging year-over-year percentage change in the CPI, calculated as set forth below under “Consumer Price Index—Determination of the CPI Rate” in this pricing supplement. |

| Spread: |

1.75% |

(Key Terms continued

on next page)

Investing in the notes involves a number of

risks. See “Risk Factors” beginning on page PS–6 of the accompanying prospectus supplement

and page 20 of the accompanying prospectus and “Selected Risk Considerations” beginning on page PS–7

of this pricing supplement.

The Issuer’s estimated value of the notes

on the Trade Date is $971.06 per $1,000 Principal Amount of notes, which is less than the Issue Price. Please see “Issuer’s

Estimated Value of the Notes” on page PS–3 of this pricing supplement for additional information.

By acquiring the notes, you will be bound

by and will be deemed irrevocably to consent to the imposition of any Resolution Measure (as defined below) by the competent

resolution authority, which may include the write down of all, or a portion, of any payment on the notes or the conversion

of the notes into ordinary shares or other instruments of ownership. If any Resolution Measure becomes applicable to us, you

may lose some or all of your investment in the notes. Please see “Resolution Measures” beginning on page 75

in the accompanying prospectus and “Resolution Measures and Deemed Agreement” on page PS–4 of this pricing

supplement for more information.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing

supplement or the accompanying prospectus supplement or prospectus. Any representation to the contrary is a criminal offense.

| |

Price to Public |

Discounts and Commissions(1) |

Proceeds to Us(1) |

| Per Note |

$1,000.00 |

$20.50 |

$979.50 |

| Total |

$478,000.00 |

$8,470.00 |

$469,530.00 |

| (1) | Deutsche Bank Securities Inc. (“DBSI”) and UBS Securities LLC (“UBS”)

are the agents in connection with the sale of the notes. The notes will be sold with varying underwriting discounts and commissions in

an amount not to exceed $20.50 per note. For more detailed information about discounts and commissions, please see “Supplemental

Plan of Distribution (Conflicts of Interest)” in this pricing supplement. |

DBSI, one of the agents for this offering, is our

affiliate. For more information, see “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement.

The notes are not deposits or savings accounts

and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other U.S. or foreign governmental

agency or instrumentality.

| Deutsche Bank Securities |

UBS Securities LLC |

February 10, 2025

| |

(Key Terms continued from previous page) |

| Interest Periods: |

Each period from, and including, an Interest Payment Date (or the Settlement Date in the case of the first Interest Period) to, but excluding, the following Interest Payment Date (or the Maturity Date in the case of the final Interest Period). |

| Interest Payment Dates: |

Monthly, on the 13th calendar day of

each month, beginning on March 13, 2025 and ending on the Maturity Date.

If any scheduled Interest Payment Date (including

the Maturity Date) is not a Business Day, the payment of interest and principal (if applicable) will be paid on the first following day

that is a Business Day. Notwithstanding the foregoing, such payment will be made with the full force and effect as if made on such scheduled

Interest Payment Date, and no adjustment will be made to the amount payable.

|

| Business Day: |

Any day other than a day that is (i) a Saturday or Sunday, (ii) a day on which banking institutions generally in the City of New York are authorized or obligated by law, regulation or executive order to close, (iii) a day on which transactions in U.S. dollars are not conducted in the City of New York or (iv) a day on which T2 is not operating |

| Trade Date: |

February 10, 2025 |

| Settlement Date: |

February 13, 2025 |

| Maturity Date: |

February 13, 2030 |

| Listing: |

The notes will not be listed on any securities exchange. |

| CUSIP / ISIN: |

25160YEH7 / US25160YEH71 |

Issuer’s Estimated Value of the Notes

The Issuer’s estimated

value of the notes is equal to the sum of our valuations of the following two components of the notes: (i) a bond and (ii) an embedded

derivative(s). The value of the bond component of the notes is calculated based on the present value of the stream of cash payments associated

with a conventional bond with a principal amount equal to the Principal Amount of notes, discounted at an internal funding rate, which

is determined primarily based on our market-based yield curve, adjusted to account for our funding needs and objectives for the period

matching the term of the notes. The internal funding rate is typically lower than the rate we would pay when we issue conventional debt

securities on equivalent terms. This difference in funding rate, as well as the agent’s commissions, if any, and the estimated cost

of hedging our obligations under the notes, reduces the economic terms of the notes to you and is expected to adversely affect the price

at which you may be able to sell the notes in any secondary market. The value of the embedded derivative(s) is calculated based on our

internal pricing models using relevant parameter inputs such as expected interest rates and mid-market levels of price and volatility

of the assets underlying the notes or any futures, options or swaps related to such underlying assets. Our internal pricing models are

proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect.

The Issuer’s estimated

value of the notes on the Trade Date (as disclosed on the cover of this pricing supplement) is less than the Issue Price of the notes.

The difference between the Issue Price and the Issuer’s estimated value of the notes on the Trade Date is due to the inclusion in

the Issue Price of the agent’s commissions, if any, and the cost of hedging our obligations under the notes through one or more

hedge counterparties (which may be one or more of our affiliates). Such hedging cost includes our or our hedge counterparty’s expected

cost of providing such hedge, as well as the profit we or our hedge counterparty expect to realize in consideration for assuming the risks

inherent in providing such hedge.

The Issuer’s estimated

value of the notes on the Trade Date does not represent the price at which we or any of our affiliates would be willing to purchase your

notes in the secondary market at any time. Assuming no changes in market conditions or our creditworthiness and other relevant factors,

the price, if any, at which we or our affiliates would be willing to purchase the notes from you in secondary market transactions, if

at all, would generally be lower than both the Issue Price and the Issuer’s estimated value of the notes on the Trade Date. Our

purchase price, if any, in secondary market transactions will be based on the estimated value of the notes determined by reference to

(i) the then-prevailing internal funding rate (adjusted by a spread) or another appropriate measure of our cost of funds and (ii) our

pricing models at that time, less a bid spread determined after taking into account the size of the repurchase, the nature of the assets

underlying the notes and then-prevailing market conditions. The price we report to financial reporting services and to distributors of

our notes for use on customer account statements would generally be determined on the same basis. However, during the period of approximately

six months beginning from the Settlement Date, we or our affiliates may, in our sole discretion, increase the purchase price determined

as described above by an amount equal to the declining differential between the Issue Price and the Issuer’s estimated value of

the notes on the Trade Date, prorated over such period on a straight-line basis, for transactions that are individually and in the aggregate

of the expected size for ordinary secondary market repurchases.

RESOLUTION MEASURES AND DEEMED AGREEMENT

On May 15, 2014, the European

Parliament and the Council of the European Union adopted a directive establishing a framework for the recovery and resolution of credit

institutions and investment firms (Directive 2014/59/EU, as amended the “Bank Recovery and Resolution Directive” or

the “BRRD”), which was implemented into German law by the German Recovery and Resolution Act (Sanierungs- und Abwicklungsgesetz,

or, as amended, the “Resolution Act”), which became effective on January 1, 2015. The BRRD and the Resolution Act provided

national resolution authorities with a set of resolution powers to intervene in the event that a bank is failing or likely to fail and

certain other conditions are met. From January 1, 2016, the power to initiate Resolution Measures applicable to significant banking groups

(such as Deutsche Bank Group) in the European Banking Union was transferred to the European Single Resolution Board which, based on the

European Union regulation establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment

firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund (Regulation (EU) No 806/2014, as amended, the “SRM

Regulation”), works in close cooperation with the European Central Bank, the European Commission and the national resolution

authorities. Pursuant to the SRM Regulation, the Resolution Act and other applicable rules and regulations, the notes may be subject to

any Resolution Measure by the competent resolution authority if we become, or are deemed by the competent supervisory authority to have

become, “non-viable” (as defined under the then-applicable law) and are unable to continue our regulated banking activities

without a Resolution Measure becoming applicable to us.

By acquiring the notes, you

will be bound by and will be deemed irrevocably to consent to the provisions set forth in the accompanying prospectus, which we have summarized

below. Under the relevant resolution laws and regulations as applicable to us from time to time, the notes may be subject to the powers

exercised by the competent resolution authority to: (i) write down, including to zero, any payment on the notes; (ii) convert the notes

into ordinary shares of (a) the Issuer, (b) any group entity or (c) any bridge bank or other instruments of ownership of such entities

qualifying as common equity tier 1 capital (and the issue to or conferral on the holders (including the beneficial owners) of such ordinary

shares or instruments); and/or (iii) apply any other resolution measure including, but not limited to, any transfer of the notes to another

entity, the amendment, modification or variation of the terms and conditions of the notes or the cancellation of the notes. The write-down

and conversion powers are commonly referred to as the “bail-in tool” and the bail-in tool and each of the other resolution

measures are hereinafter referred to as a “Resolution Measure.” A “group entity” refers to an entity that

is included in the corporate group subject to a Resolution Measure. A “bridge bank” refers to a newly chartered German bank

that would receive some or all of our equity securities, assets, liabilities and material contracts, including those attributable to our

branches and subsidiaries, in a resolution proceeding.

Furthermore, by acquiring

the notes, you:

| · | are

deemed irrevocably to have agreed, and you will agree: (i) to be bound by, to acknowledge and to accept any Resolution Measure and any

amendment, modification or variation of the terms and conditions of the notes to give effect to any Resolution Measure; (ii) that you

will have no claim or other right against us arising out of any Resolution Measure; and (iii) that the imposition of any Resolution Measure

will not constitute a default or an event of default under the notes, under the Amended and Restated Senior Debt Funding Indenture dated

August 3, 2021, as amended and supplemented by the First Supplemental Senior Debt Funding Indenture dated as of April 26, 2024, in each

case among us, Delaware Trust Company, as trustee, and Deutsche Bank Trust Company Americas, as paying agent, authenticating agent, issuing

agent and registrar (as amended and supplemented from time to time, the “Indenture”), or for the purposes of, but

only to the fullest extent permitted by, the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”); |

| · | waive,

to the fullest extent permitted by the Trust Indenture Act and applicable law, any and all claims against the trustee and the paying

agent, the issuing agent and the registrar (each, an “indenture agent”) for, agree not to initiate a suit against

the trustee or the indenture agents in respect of, and agree that the trustee and the indenture agents will not be liable for, any action

that the trustee or any of the indenture agents takes, or abstains from taking, in either case in accordance with the imposition of a

Resolution Measure by the competent resolution authority with respect to the notes; and |

| · | will

be deemed to have: (i) consented to the imposition of any Resolution Measure as it may be imposed without any prior notice by the competent

resolution authority of its decision to exercise such power with respect to the notes; (ii) authorized, directed and requested DTC and

any direct participant in DTC or other intermediary through which you hold such notes to take any and all necessary action, if required,

to implement the imposition of any Resolution Measure with respect to the notes as it may be imposed, without any further |

action

or direction on your part or on the part of the trustee or the indenture agents; and (iii) acknowledged and accepted that the Resolution

Measure provisions described herein and in the “Resolution Measures” section of the accompanying prospectus are exhaustive

on the matters described herein and therein to the exclusion of any other agreements, arrangements or understandings between you and

the Issuer relating to the terms and conditions of the notes.

This is only a summary,

for more information please see the accompanying prospectus dated April 26, 2024, including the risk factors beginning on page

20 of such prospectus.

SUMMARY

You should read

this pricing supplement together with the prospectus supplement dated April 26, 2024 relating to our Senior Debt Funding Notes, Series

E of which these notes are a part and the prospectus dated April 26, 2024. You may access these documents on the website of the Securities

and Exchange Commission (the “SEC”) at.www.sec.gov as follows (or, if such address

has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus supplement dated April 26, 2024: |

https://www.sec.gov/Archives/edgar/data/1159508/000095010324005864/crt_dp210218-424b2.pdf

| · | Prospectus dated April 26, 2024: |

https://www.sec.gov/Archives/edgar/data/1159508/000119312524118649/d776815d424b21.pdf

Our Central Index

Key, or CIK, on the SEC website is 0001159508. As used in this pricing supplement, “we,” “us” or

“our” refers to Deutsche Bank AG, including, as the context requires, acting through one of its branches.

This

pricing supplement, together with the documents listed above, contains the terms of the notes and supersedes all other prior or contemporaneous

oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas,

structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among

other things, the matters set forth in this pricing supplement and in “Risk Factors” in the accompanying prospectus supplement

and prospectus. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the notes.

In

making your investment decision, you should rely only on the information contained or incorporated by reference in this pricing supplement

relevant to your investment and the accompanying prospectus supplement and prospectus with respect to the notes offered by this pricing

supplement and with respect to Deutsche Bank AG. We have not authorized anyone to give you any additional or different information. The

information in this pricing supplement and the accompanying prospectus supplement and prospectus may only be accurate as of the dates

of each of these documents, respectively.

You

should be aware that the regulations of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the laws of

certain jurisdictions (including regulations and laws that require brokers to ensure that investments are suitable for their customers)

may limit the availability of the notes. This pricing supplement and the accompanying prospectus supplement and prospectus do not constitute

an offer to sell or a solicitation of an offer to buy the notes under any circumstances in which such offer or solicitation is unlawful.

We

are offering to sell, and are seeking offers to buy, the notes only in jurisdictions where such offers and sales are permitted.

Neither the delivery of this pricing supplement nor the accompanying prospectus supplement or prospectus nor any sale made hereunder

implies that there has been no change in our affairs or that the information in this pricing supplement and accompanying prospectus supplement

and prospectus is correct as of any date after the date hereof.

You

must (i) comply with all applicable laws and regulations in force in any jurisdiction in connection with the possession

or distribution of this pricing supplement and the accompanying prospectus supplement and prospectus and the purchase, offer or

sale of the notes and (ii) obtain any consent, approval or permission required to be obtained by you for the

purchase, offer or sale by you of the notes under the laws and regulations applicable to you in force in any jurisdiction to which

you are subject or in which you make such purchases, offers or sales; neither we nor the agents shall have any responsibility

therefor.

SELECTED RISK

CONSIDERATIONS

An

investment in the notes involves risks. This section describes the most significant risks relating to the notes. For a complete list of

risk factors, please see the accompanying prospectus supplement and prospectus.

Risks

Relating to the Notes Generally

| · | THE

INTEREST RATE COULD BE AS LOW AS THE MINIMUM INTEREST RATE — Interest payable

on the notes is linked to the lagging year-over-year percentage change in the level of the CPI as determined for each Interest Period.

If the CPI remains approximately constant over a particular year-over-year reference period, which is likely to occur when there is little

or no inflation, investors in the notes will receive an interest payment for the related Interest Payment Date at a rate equal to approximately

the Spread. If the CPI decreases in a particular year-over-year reference period, which is likely to occur when there is deflation, investors

in the notes will receive an interest payment for the related Interest Payment Date at a rate equal to the Minimum Interest Rate. |

| · | THE

INTEREST RATE ON THE NOTES MAY BE LOWER THAN THE RATE OTHERWISE PAYABLE ON CONVENTIONAL DEBT SECURITIES ISSUED BY US WITH SIMILAR MATURITIES

— If there are only minimal increases, no changes or decreases in the

CPI measured monthly on a lagging year-over-year basis, the Interest Rate on the notes will be below what we would currently expect to

pay as of the date of this pricing supplement if we issued a conventional debt security with the same maturity as the notes. The Board

of Governors of the Federal Reserve System (the “FRB”) currently targets an inflation rate of 2.00% per year, as measured

by “core” inflation measures (excluding items that tend to fluctuate often or dramatically, such as food and energy items).

You should understand that if the FRB is successful in reaching and maintaining a stable target rate, and if changes in the level of

the CPI correspond to this target rate, the effective yield on your notes will be less than that which we would be pay on a conventional

fixed-rate non-redeemable note of comparable maturity. |

Risks

Relating to the Issuer

| · | THE

NOTES ARE SUBJECT TO THE CREDIT OF DEUTSCHE BANK AG — The notes are unsecured and unsubordinated obligations of Deutsche Bank

AG, ranking in priority to its senior non-preferred obligations, and are not, either directly or indirectly, an obligation

of any third party. Any interest payments to be made on the notes and the repayment of principal at maturity depend on the ability of

Deutsche Bank AG to satisfy its obligations as they become due. An actual or anticipated downgrade in Deutsche Bank AG’s credit

rating or increase in the credit spreads charged by the market for taking Deutsche Bank AG’s credit risk will likely have an adverse

effect on the value of the notes. As a result, the actual and perceived creditworthiness of Deutsche Bank AG will affect the value of

the notes. Any future downgrade could materially affect Deutsche Bank AG’s funding costs and cause the trading price of the notes

to decline significantly. Additionally, under many derivative contracts to which Deutsche Bank AG is a party, a downgrade could require

it to post additional collateral, lead to terminations of contracts with accompanying payment obligations or give counterparties additional

remedies. In the event Deutsche Bank AG were to default on its payment obligations or become subject to a Resolution Measure, you might

not receive interest and principal payments owed to you under the terms of the notes and you could lose your entire investment. |

| · | THE

NOTES MAY BE WRITTEN DOWN, BE CONVERTED INTO ORDINARY SHARES OR OTHER INSTRUMENTS OF OWNERSHIP OR BECOME SUBJECT TO OTHER RESOLUTION

MEASURES. YOU MAY LOSE SOME OR ALL OF YOUR INVESTMENT IF ANY SUCH MEASURE BECOMES APPLICABLE TO US —

Pursuant to the SRM Regulation, the Resolution Act and other applicable rules and regulations described above under “Resolution

Measures and Deemed Agreement,” the notes are subject to the powers exercised by the competent resolution authority to impose Resolution

Measures on us, which may include: (i) writing down, including to zero, any claim for payment on the notes; (ii) converting the notes

into ordinary shares of (x) the Issuer, (y) any group entity or (z) any bridge bank or other instruments of ownership of such entities

qualifying as common equity tier 1 capital (and the issue to or conferral on the holders (including the beneficial owners) of such ordinary

shares or instruments); or (iii) applying any other resolution measure including, but not limited to, transferring the notes to another

entity, amending, modifying or varying the terms and conditions of the notes or cancelling the notes. The competent resolution authority

may apply Resolution |

Measures

individually or in any combination. Imposition of a Resolution Measure would likely occur if the competent supervisory authority determines

that we are failing or likely to fail and that certain other conditions are met (as set forth under the applicable law). The BRRD, the

Resolution Act and, as applicable, the SRM Regulation are intended to eliminate the need for public support of troubled banks, and you

should be aware that public support, if any, would only potentially be used by the competent supervisory authority as a last resort after

having assessed and exploited, to the maximum extent practicable, the resolution tools, including the bail-in tool.

By acquiring

the notes, you would have no claim or other right against us arising out of any Resolution Measure and we would have no obligation to

make payments under the notes following the imposition of such Resolution Measure. In particular, the imposition of any Resolution Measure

will not constitute a default or an event of default under the notes, under the Indenture or for the purposes of, but only to the fullest

extent permitted by, the Trust Indenture Act. Furthermore, it will be difficult to predict when, if at all, a Resolution Measure might

become applicable to us in our individual case. Accordingly, secondary market trading in the notes may not follow the trading behavior

associated with similar types of securities issued by other financial institutions which may be or have been subject to a Resolution

Measure.

In addition,

by your acquisition of the notes, you waive, to the fullest extent permitted by the Trust Indenture Act and applicable law, any and all

claims against the trustee and the indenture agents for, agree not to initiate a suit against the trustee or the indenture agents in

respect of, and agree that the trustee and the indenture agents will not be liable for, any action that the trustee or the indenture

agents take, or abstain from taking, in either case in accordance with the imposition of a Resolution Measure by the competent resolution

authority with respect to the notes. Accordingly, you may have limited or circumscribed rights to challenge any decision of the competent

resolution authority to impose any Resolution Measure.

| · | OUR

SENIOR DEBT FUNDING SECURITIES, INCLUDING THE NOTES OFFERED HEREIN, ARE INTENDED TO QUALIFY AS ELIGIBLE LIABILITIES WITHIN THE MEANING

OF ARTICLE 72B(2), WITH THE EXCEPTION OF POINT (D), CRR FOR THE MINIMUM REQUIREMENT FOR OWN FUNDS AND ELIGIBLE LIABILITIES UNDER THE

ISSUER REGULATORY CAPITAL PROVISIONS APPLICABLE TO US. THEY ARE EXPECTED TO CONSTITUTE “SENIOR PREFERRED” DEBT SECURITIES

AND WOULD, IF INSOLVENCY PROCEEDINGS ARE OPENED AGAINST US OR IF RESOLUTION MEASURES ARE IMPOSED ON US, BEAR LOSSES AFTER OUR “SENIOR

NON-PREFERRED” DEBT INSTRUMENTS BUT BEFORE OTHER LIABILITIES WITH AN EVEN MORE SENIOR RANK, FOR EXAMPLE, COVERED DEPOSITS AND DEPOSITS

HELD BY NATURAL PERSONS AND MICRO, SMALL AND MEDIUM-SIZED ENTERPRISES —The

notes are intended to qualify as eligible liabilities instruments within the meaning of Article 72b(2), with the exception of point (d),

CRR for the minimum requirement for own funds and eligible liabilities, as described and provided for in the bank regulatory capital

provisions to which we are subject, including restrictions on the aggregate amount of similar instruments that we may use for such purposes,

but do not constitute senior non-preferred debt instruments within the meaning of Section 46f(6) sentence 1 of the German Banking Act

(Kreditwesengesetz). The notes will constitute our unsecured and unsubordinated obligations ranking pari passu among themselves

and with all of our other unsecured and unsubordinated obligations, subject, however, to statutory priorities conferred upon certain

unsecured and unsubordinated obligations in the event of any Resolution Measures imposed on us or in the event of our dissolution, liquidation,

insolvency or composition, or if other proceedings are opened for the avoidance of the insolvency of, or against, us; in accordance with

Section 46f(5) of the German Banking Act (Kreditwesengesetz), our obligations under the notes will rank in priority to our senior

non-preferred obligations under (i) any of our debt instruments (Schuldtitel) within the meaning of Section 46f(6) sentence

1 of the German Banking Act (including the senior non-preferred obligations under any such debt instruments that we issued before July

21, 2018 and that are subject to Section 46f(9) of the German Banking Act) or any successor provision and (ii) eligible liabilities

within the meaning of Articles 72a and 72b(2) of Regulation (EU) No 575/2013 of the European Parliament and of the Council, as amended,

supplemented or replaced from time to time (the “CRR”).You as holder of notes may not set off or net your claims arising

under the notes against any of our claims. No collateral or guarantee shall be provided at any time to secure claims of a holder of notes

under the notes; any collateral or guarantee already provided or granted in the future in connection with our other liabilities may not

be used for claims under the notes. |

No subsequent

agreement may enhance the seniority of the obligations as described above or shorten the term of the notes or any applicable notice period.

Any redemption, repurchase or termination of the notes prior to their scheduled maturity is subject to the prior approval of the competent

resolution authority.

If insolvency

proceedings are opened against us or if Resolution Measures are imposed on us, our “senior preferred” debt securities (including

the notes offered herein) are expected to be among the unsecured unsubordinated obligations that would bear losses after our “senior

non-preferred” debt instruments, including our non-structured senior debt securities issued before July 21, 2018.

On the

other hand, there are liabilities with an even more senior rank, for example, covered deposits and deposits held by natural persons and

micro, small and medium-sized enterprises. Therefore, you may lose some or all of your investment in the notes offered herein if insolvency

proceedings are opened against us or a Resolution Measure becomes applicable to us.

| · | THE

NOTES CONTAIN LIMITED EVENTS OF DEFAULT, AND THE REMEDIES AVAILABLE THEREUNDER ARE LIMITED — As described in “Description

of Debt Securities—Senior Debt Funding Securities—Events of Default” in the accompanying prospectus, the notes provide

for no event of default other than the opening of insolvency proceedings against us by a German court having jurisdiction over us. In

particular, the imposition of a Resolution Measure will not constitute an event of default with respect to the Indenture or the notes. |

If an

event of default occurs, holders of the notes have only limited enforcement remedies. If an event of default with respect to the notes

occurs or is continuing, either the trustee or the holders of not less than 33 1⁄3% in aggregate principal amount of all outstanding

debt securities issued under the Indenture, including the notes, voting as one class, may declare the principal amount of the notes and

interest accrued thereon to be due and payable immediately. We may issue further series of debt securities under the Indenture and these

would be included in that class of outstanding debt securities.

In particular,

holders of the notes will have no right of acceleration in the case of a default in the payment of principal of, interest on, or other

amounts owing under, the notes. If such a default occurs and is continuing with respect to the notes, the trustee and the holders of

the notes could take legal action against us, but they may not accelerate the maturity of the notes. Moreover, if we fail to make any

payment because of the imposition of a Resolution Measure, the trustee and the holders of the notes would not be permitted to take such

action, and in such a case you may permanently lose the right to the affected amounts.

Holders

will also have no rights of acceleration due to a default in the performance of any of our other covenants under the notes.

Risks

Relating to the Estimated Value of the Notes and any Secondary Market

| · | THE

ISSUER’S ESTIMATED VALUE OF THE NOTES ON THE TRADE DATE WILL BE LESS THAN THE ISSUE PRICE OF THE NOTES — The Issuer’s

estimated value of the notes on the Trade Date (as disclosed on the cover of this pricing supplement) is less than the Issue Price of

the notes. The difference between the Issue Price and the Issuer’s estimated value of the notes on the Trade Date is due to the

inclusion in the Issue Price of the agent’s commissions, if any, and the cost of hedging our obligations under the notes through

one or more hedge counterparties (which may be one or more of our affiliates). Such hedging cost includes our or our hedge counterparty’s

expected cost of providing such hedge, as well as the profit we or our hedge counterparty expect to realize in consideration for assuming

the risks inherent in providing such hedge. The Issuer’s estimated value of the notes is determined by reference to an internal

funding rate and our pricing models. The internal funding rate is typically lower than the rate we would pay when we issue conventional

debt securities on equivalent terms. This difference in funding rate, as well as the agent’s commissions, if any, and the estimated

cost of hedging our obligations under the notes, reduces the economic terms of the notes to you and is expected to adversely affect the

price at which you may be able to sell the notes in any secondary market. In addition, our internal pricing models are proprietary and

rely in part on certain assumptions about future events, which may prove to be incorrect. If at any time a third party dealer were to

quote a price to purchase your notes or otherwise value your notes, that price or value may differ materially from the estimated value

of the notes determined by reference to our internal funding rate and pricing models. This difference is |

due to,

among other things, any difference in funding rates, pricing models or assumptions used by any dealer who may purchase the notes in the

secondary market.

| · | ASSUMING

NO CHANGES IN MARKET CONDITIONS AND OTHER RELEVANT FACTORS, THE PRICE YOU MAY RECEIVE FOR YOUR NOTES IN SECONDARY MARKET TRANSACTIONS

WOULD GENERALLY BE LOWER THAN BOTH THE ISSUE PRICE AND THE ISSUER’S ESTIMATED VALUE OF THE NOTES ON THE TRADE DATE —

While the payment(s) on the notes described in this pricing supplement is based on the full Principal Amount of notes, the Issuer’s

estimated value of the notes on the Trade Date (as disclosed on the cover of this pricing supplement) is less than the Issue Price of

the notes. The Issuer’s estimated value of the notes on the Trade Date does not represent the price at which we or any of our affiliates

would be willing to purchase your notes in the secondary market at any time. Assuming no changes in market conditions or our creditworthiness

and other relevant factors, the price, if any, at which we or our affiliates would be willing to purchase the notes from you in secondary

market transactions, if at all, would generally be lower than both the Issue Price and the Issuer’s estimated value of the notes

on the Trade Date. Our purchase price, if any, in secondary market transactions would be based on the estimated value of the notes determined

by reference to (i) the then-prevailing internal funding rate (adjusted by a spread) or another appropriate measure of our cost of funds

and (ii) our pricing models at that time, less a bid spread determined after taking into account the size of the repurchase, the nature

of the assets underlying the notes and then-prevailing market conditions. The price we report to financial reporting services and to

distributors of our notes for use on customer account statements would generally be determined on the same basis. However, during the

period of approximately six months beginning from the Settlement Date, we or our affiliates may, in our sole discretion, increase the

purchase price determined as described above by an amount equal to the declining differential between the Issue Price and the Issuer’s

estimated value of the notes on the Trade Date, prorated over such period on a straight-line basis, for transactions that are individually

and in the aggregate of the expected size for ordinary secondary market repurchases. |

In addition

to the factors discussed above, the value of the notes and our purchase price in secondary market transactions after the Trade Date,

if any, will vary based on many economic and market factors, including our creditworthiness, and cannot be predicted with accuracy. These

changes may adversely affect the value of your notes, including the price you may receive in any secondary market transactions. Any sale

prior to the Maturity Date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments.

Accordingly, you should be able and willing to hold your notes to maturity.

| · | THE

NOTES WILL NOT BE LISTED AND THERE WILL LIKELY BE LIMITED LIQUIDITY —

The notes will not be listed on any securities exchange. There may be little or no secondary

market for the notes. We or our affiliates intend to act as market makers for the notes but are not required to do so and

may cease such market making activities at any time. Even if there is a secondary market, it

may not provide enough liquidity to allow you to trade or sell the notes when you wish to do so or at a price advantageous to you. Because

we do not expect that other market makers will participate significantly in the secondary market for the notes, the price at which you

may be able to sell your notes is likely to depend on the price, if any, at which we or our affiliates are willing to buy the notes.

If, at any time, we or our affiliates do not act as market makers, it is likely that there would be little or no secondary market for

the notes. |

| · | MANY

ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE NOTES — The value of the notes prior to maturity will be affected

by a number of economic and market factors that may either offset or magnify each other, including: |

| o | the actual or anticipated level of the CPI; |

| o | the volatility of the level of the CPI; |

| o | the time remaining to the maturity of the notes; |

| o | trends relating to inflation; |

| o | interest rates

and yields in the markets generally; |

| o | geopolitical conditions and economic, financial, political, regulatory or

judicial events that affect the markets generally; |

| o | supply and demand for the notes; and |

| o | our creditworthiness, including actual or anticipated downgrades in our

credit ratings. |

During

the term of the notes, it is possible that their value may decline significantly due to the factors described above, and any sale prior

to the Maturity Date could result in a substantial loss to you. You must hold the notes to maturity to receive the repayment of principal.

Risks

Relating to the CPI

| · | MANY

FACTORS, INCLUDING UNITED STATES MONETARY POLICY, MAY INFLUENCE U.S. INFLATION RATES, AND COULD MATERIALLY AND ADVERSELY AFFECT THE VALUE

OF THE NOTES — The FRB uses the tools of monetary policy, including conducting open market operations, imposing reserve requirements,

permitting depository institutions to hold contractual clearing balances and extending credit through its discount window facility, to

alter the federal funds rate, which in turn affects the U.S. money supply, interest rates and rates of inflation. One way that the FRB

might foster price stability and reduce inflation is to raise the target federal funds rate. If the FRB employs monetary policy to reduce

inflation, the level of the CPI may decrease or experience a lower rate of change, which would adversely affect the value of and the

return on the notes. |

Although

we expect U.S. monetary policy to influence the rate of inflation and, accordingly, the level of the CPI, inflation is influenced by

a number of unpredictable factors and there can be no assurance that the FRB’s policies or actions will be effective. For example,

in 2009, despite multiple measures taken by the FRB to provide liquidity to the economy, inflation rates remained extremely low. Other

factors that influence interest rates or inflation rates generally may include sentiment regarding underlying strength in the U.S., European

and global economies, expectations regarding the level of price inflation, sentiment regarding credit quality in U.S., European and global

credit markets, supply and demand of various consumer goods, services and energy resources and the performance of capital markets generally.

| · | THE

MANNER IN WHICH THE BLS CALCULATES THE CPI MAY CHANGE IN THE FUTURE AND ANY SUCH CHANGE MAY AFFECT THE VALUE OF THE NOTES —

There can be no assurance that the BLS will not change the method by which it calculates the CPI. In addition, changes in the way the

CPI is calculated could reduce the level of the CPI and lower the interest payments with respect to the notes. Accordingly, the amount

of interest, if any, payable on the notes, and therefore the value of the notes, may be significantly reduced. If the CPI is substantially

altered or discontinued, a modified or substitute index may be employed to calculate the interest payable on the notes, and any such

modification or substitution may adversely affect the value of and the return on the notes. You will have no rights against the BLS,

the publisher of the CPI, even though the amount you receive on each Interest Payment Date will depend upon the level of the CPI. The

BLS is not in any way involved in this offering and has no obligations relating to the notes or the holders of the notes. |

| · | THE

MANNER IN WHICH INFLATION IS MEASURED FOR PURPOSES OF THE NOTES MAY DIFFER FROM OTHER MEASURES OF INFLATION IN IMPORTANT WAYS —

The year-over-year percentage change in the level of the CPI is just one measure of price inflation in the United States. This measure

may not reflect the actual levels of inflation affecting holders of the notes. Moreover, this measure may be more volatile than other

measures of inflation. The CPI includes prices of all items measured by the BLS, including items that may be particularly volatile such

as energy and food items. Significant fluctuations in the prices of these items may have a significant effect on changes in the CPI and

may cause the CPI to be more volatile than similar indices excluding these items. Moreover, measuring the year-over-year percentage change

in the level of the CPI each month may result in a more volatile measure of inflation than alternative measures, such as the percentage

change in the average level of the CPI from one year to the next. |

| · | THE

HISTORICAL LEVELS OF THE CPI ARE NOT AN INDICATION OF THE FUTURE LEVELS OF THE CPI — The historical levels of the CPI are not

an indication of the future levels of the CPI during the term of the notes. In the past, the CPI has experienced periods of volatility

and such volatility may occur in the future. |

Fluctuations

and trends in the CPI that have occurred in the past are not necessarily indicative, however, of fluctuations that may occur in the future.

Holders of the notes will receive interest payments that will be affected by changes in the CPI. Changes in the CPI are a function of

the changes in specified consumer prices over time, which result from the interaction of many factors over which we have no control.

Risks

Relating to Conflicts of Interest

| · | WE,

UBS OR OUR OR THEIR SUBSIDIARIES OR AFFILIATES MAY PUBLISH RESEARCH THAT COULD AFFECT THE MARKET VALUE OF THE NOTES — We, UBS

or our or their subsidiaries or affiliates may, at present or in the future, publish research reports with respect to movements in interest

rates generally, or the CPI specifically. This research is modified from time to time without notice and may express opinions or provide

recommendations that are inconsistent with purchasing or holding the notes. Any of these activities may affect the market value of such

notes. |

| · | THE

CALCULATION AGENT WILL HAVE THE AUTHORITY TO MAKE DETERMINATIONS THAT COULD ADVERSELY AFFECT THE RETURN ON AND THE MARKET VALUE OF THE

NOTES — The Calculation Agent will determine the level of the CPI on any date of determination and may be required to make

other determinations that affect the return on the notes. In making these determinations, the calculation agent may be required to make

discretionary judgments, including determining the level of the CPI if not published on its Bloomberg screen page; if the CPI is discontinued

or substantially altered, as determined by the calculation agent by reference to the applicable successor index or, if no such substitute

index is chosen or the level of the CPI is not available for any other reason, as determined by the calculation agent in its sole discretion,

taking into account general market practice at the time. |

THE CONSUMER PRICE INDEX

Determination of the CPI Rate

The “CPI Rate” means, with respect to an Interest

Period, the lagging year-over-year percentage change in the CPI (which may be negative), calculated as follows:

CPIt-3 – CPIt-15

CPIt-15

where,

| • | the “CPIt-3” is the level of the CPI for the third calendar month prior to the calendar month of the Interest

Payment Date relating to that Interest Period; and |

| • | the “CPIt-15” is the level of the CPI for the fifteenth calendar month prior to the calendar month of Interest

Payment Date relating to that Interest Period. |

For example, with respect to an Interest Payment

Date in January 2026, the CPIt-3 is the level of the CPI for October 2025 and the CPIt-15 is the level of the CPI for October

2024. We refer to the twelve-month period from CPIt-15 to CPIt-3 as the “year-over-year reference period.”

If the CPI Rate with respect to an Interest Period

is negative and when added to the Spread is less than the Minimum Interest Rate, the Interest Rate for that Interest Period will equal

the Minimum Interest Rate. In no case will the amount payable on any Interest Payment Date be less than the Minimum Interest Rate.

The calculation agent will determine the CPI Rate,

the Interest Rate and the amount of interest payable for each Interest Period on the third Business Day preceding the relevant Interest

Payment Date (the “Interest Determination Date”)

If by 3:00 p.m., New York City time, on any Interest

Determination Date the CPI is not published on Bloomberg screen CPURNSA (or any successor source) for any relevant month, but has otherwise

been published by the BLS, the calculation agent will determine the CPI as reported by the BLS for such month using such other source

as appears on its face to accurately set forth the CPI as reported by the BLS, as determined by the calculation agent.

In calculating CPIt-3 and Ref -15,

the calculation agent will use the most recently available value of the CPI determined as described above on the applicable Interest Determination

Date, even if such value has been adjusted from a prior reported value for the relevant month. However, if a value of CPIt-3 and

CPIt-15 used by the calculation agent on any Interest Determination Date to determine the Interest Rate on the notes (an “original

CPI level”) is subsequently revised by the BLS, the calculation agent will continue to use the original CPI level, and the Interest

Rate determined on such Interest Determination Date will not be revised.

If the CPI is rebased to a different year or period

and the CPI for the 1982-1984 reference period is no longer used, the base reference period for the notes will continue to be the 1982-1984

reference period as long as the 1982-1984 CPI continues to be published.

If, while the notes are outstanding, the CPI is

discontinued or substantially altered, as determined by the calculation agent in its sole discretion, the calculation agent will determine

the Interest Rate on the notes by reference to the applicable substitute index that is chosen by the Secretary of the Treasury for the

Department of the Treasury’s Inflation-Protected Securities as described at Appendix B, Section I, Paragraph B.4 of Part IV of 69

Federal Register No. 144 (July 28, 2004) or, if no such substitute index is chosen or the level of the CPI is not available for any other

reason, the CPI will be determined by the calculation agent in its sole discretion, taking into account general market practice at the

time.

Additional Information about the CPI

According to the publicly available information

provided by the BLS, the CPI is a measure of the average change over time in the prices paid by urban consumers for a market basket of

goods and services, including food and beverages, housing, apparel, transportation, medical care, recreation, education and communication,

and other goods and services. In calculating the CPI, price changes for the various items are averaged together with weights that represent

their significance in the spending of urban households in the United States. The CPI is a market-accepted measure of inflation.

The contents of the market basket of goods and services

and the weights assigned to the various items are updated periodically to take into account changes in consumer expenditure patterns.

The CPI is expressed in relative terms based on a reference period for which the level is set at 100 (currently the base reference period

used by the BLS is 1982–1984). For example, because the CPI level for the 1982–1984 reference period is 100, an increase of

16.5 percent from that period would be shown as 116.5.

All information contained in this pricing supplement

regarding the CPI is derived from publicly available information published by the BLS or other publicly available sources. Such information

reflects the policies of the BLS as stated in such sources, and such policies are subject to change by the BLS. We have not independently

verified any information relating to the CPI. The BLS is under no obligation to continue to publish the CPI and may discontinue publication

of the CPI at any time. The consequences of the BLS discontinuing the CPI are described above.

HYPOTHETICAL INTEREST RATE CALCULATION

Below are hypothetical illustrations

of the Interest Rate that would have resulted with respect to a hypothetical Interest Period ending in January 2026 assuming the hypothetical

levels of the CPI indicated below. These examples are for purposes of illustration only and the values used in the examples may have been

rounded for ease of analysis. These examples are intended to illustrate the effect of general trends in the CPI on the amount of interest

payable to you on the notes. The hypothetical levels of the CPI used in the examples below do not reflect the actual levels of the CPI.

For historical data regarding the actual levels of the CPI, see the historical information set forth herein. As a result, this hypothetical

illustration should not be taken as an indication of any actual Interest Rates that may be payable on the notes.

Assuming a hypothetical Interest

Period ending in January 2026, which would relate to a hypothetical Interest Payment Date occurring in January 2026, the hypothetical

Interest Rate on the notes payable on such hypothetical Interest Payment Date would be calculated as follows:

Example 1. The CPI increases during the year-over-year reference

period.

Step 1: Calculate the CPI Rate for the applicable Interest Period:

CPI Rate = CPIt-3 –CPIt-15

CPIt-15

Assuming CPIt-3 is 309.000,

which is the hypothetical level of the CPI for October 2025, the third calendar month prior to the calendar month of the January 2026

hypothetical Interest Payment Date relating to that Interest Period; and

CPIt-15 is 300.000, which

is the hypothetical level of the CPI for October 2024, the fifteenth calendar month prior to the calendar month of the January 2026 hypothetical

Interest Payment Date relating to that Interest Period.

CPI Rate = 309.000 – 300.000

300.000

CPI Rate = 3.000%

Step 2: Calculate the Interest Rate for the applicable Interest

Period:

Interest Rate = CPI Rate + 1.750%

Interest Rate = 3.000% + 1.750%

Interest Rate = 4.750%

Therefore, on the January 2026 hypothetical Interest Payment Date, you

would receive an interest payment equal to $3.958 per $1,000 principal amount of notes, i.e., $1,000 × 4.750% × (30/360).

Example

2. The CPI decreases during the year-over-year reference period.

Step 1: Calculate the CPI Rate for the applicable Interest Period:

CPI Rate = CPIt-3 –CPIt-15

CPIt-15

Assuming CPIt-3 is 294.000,

which is the hypothetical level of the CPI for October 2025, the third calendar month prior to the calendar month of the January 2026

hypothetical Interest Payment Date relating to that Interest Period; and

CPIt-15 is 300.000, which

is the hypothetical level of the CPI for October 2024, the fifteenth calendar month prior to the calendar month of the January 2026 hypothetical

Interest Payment Date relating to that Interest Period.

CPI Rate = 294.000 – 300.000

300.000

CPI Rate = -2.000%

Step 2: Calculate the Interest Rate for the applicable Interest

Period:

Interest Rate = CPI Rate + 1.750%

Interest Rate = -2.000% + 1.750%

Interest Rate = -0.250%

In no event will the Interest Rate payable on the notes be less than

the Minimum Interest Rate. Therefore, the Interest Rate applicable to the hypothetical Interest Payment Date in this example would be

1.750% (the Minimum Interest Rate), and you would receive an interest payment equal to $1.458 per $1,000 principal amount of notes, i.e.,

$1,000 × 1.750% × (30/360).

HISTORICAL

INFORMATION

We

obtained the historical levels of the CPI in the graphs below from Bloomberg L.P. and we have not participated in the preparation of,

or verified, such information. The historical levels of the CPI should not be taken as an indication of future performance and no assurance

can be given as to the future movements of the CPI during the term of the notes.

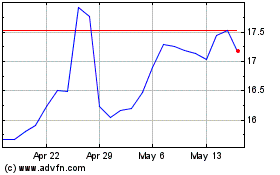

The

following graph sets forth the levels of the CPI for each month in the period from December 2019 through December 2024. The level of the

CPI for December 2024 was 315.605.

Provided

below is a graph that sets forth the hypothetical interest rates for the period from December 2019 through December 2024 that would have

resulted from the historical levels of the CPI presented above and the Spread.

TAX CONSIDERATIONS

You

should review carefully the section of the accompanying prospectus supplement entitled “United States Federal Income Taxation.”

The discussion below applies to you only if you are an initial purchaser of notes acquiring them for their Issue Price as stated on the

cover of this document.

Although

not free from doubt, in the opinion of our special tax counsel, Davis Polk & Wardwell LLP, the notes will be treated for U.S. federal

income tax purposes as debt, and the remainder of this discussion so assumes. Based on current market conditions, we intend to treat the

notes for U.S. federal income tax purposes as “variable rate debt instruments” and that are issued without original issue

discount. Under this treatment, all stated interest on the notes will generally be treated as qualified stated interest and

be taxable to you at the time it accrues or is received in accordance with your method of tax accounting. See the section entitled “United

States Federal Income Taxation — Tax Consequences to U.S. Holders — VRDI Notes” in the accompanying prospectus supplement.

Possible

Alternative Tax Treatment of an Investment in the Notes

If

the notes were not treated as variable rate debt instruments, they would instead be treated as “contingent payment debt instruments.”

In that case, (i) you would be required to recognize interest income based on our “comparable yield” for a similar non-contingent

debt instrument and a “projected payment schedule” in respect of the notes, adjusted each year to take account for the difference

between the actual and the projected payments in that year, and (ii) you generally would be required to treat any income on a taxable

disposition as interest income and any loss as ordinary loss to the extent of previous interest inclusions, with the balance treated as

capital loss. See the section entitled “United States Federal Income Taxation — Tax Consequences to U.S. Holders — CPDI

Notes” in the accompanying prospectus supplement.

Non-U.S.

holders. If you are a non-U.S. holder, we do not believe that you should be required to provide an IRS Form W-8 in order to avoid

30% U.S. withholding tax with respect to interest payments on the notes, although the IRS could challenge this position. However, you

should in any event expect to be required to provide an appropriate IRS Form W-8 or other documentation in order to establish an exemption

from backup withholding, as described under the heading “United States Federal Income Taxation — Tax Consequences to Non-U.S.

Holders” in the accompanying prospectus supplement. If any withholding is required, we will not be required to pay any additional

amounts with respect to amounts withheld.

For

a discussion of certain German tax considerations relating to the notes, you should refer to the section in the accompanying prospectus

supplement entitled “Taxation by Germany of Non-Resident Holders.”

You

should consult your tax adviser regarding the U.S. federal tax consequences of an investment in the notes, as well as tax consequences

arising under the laws of any state, local or non-U.S. taxing jurisdiction.

USE OF PROCEEDS; HEDGING

The

net proceeds we receive from the sale of the notes will be used for general corporate purposes, as more particularly described in “Use

of Proceeds” in the accompanying prospectus.

We

or our affiliates may acquire a long or short position in securities similar to the notes from time to time and may, in our or their sole

discretion, hold or resell those securities. Although we have no reason to believe that any of these activities will have a material impact

on the value of the notes, we cannot assure you that these activities will not have such an effect.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS

OF INTEREST)

Under the terms and subject

to the conditions contained in the Distribution Agreement entered into between Deutsche Bank AG and DBSI, as agent thereunder, or between

Deutsche Bank AG and UBS or another agent that may be party to the Distribution Agreement from time to time (each, an “Agent,”

and collectively with DBSI, the “Agents”), each Agent participating in this offering of notes will agree to purchase,

and we will agree to sell, the Principal Amount of notes set forth on the cover of this pricing supplement.

Notes sold by the Agents to

the public will initially be offered at the Issue Price set forth on the cover of this pricing supplement. If all of the notes are not

sold at the Issue Price, the Agents may change the offering price and the other selling terms.

The Agents will receive an

underwriting discount of up to $20.50 per note, and from such underwriting discount will allow selected dealers a selling concession of

up to $20.50 per note.

The Agents and/or any dealers

that participate with the Agents in the distribution of the notes may be deemed to be underwriters, and any discounts or commissions received

by them and any profit on the resale of the notes by them may be deemed to be underwriting discounts or commissions.

We own, directly or indirectly,

all of the outstanding equity securities of DBSI. The net proceeds received from the sale of the notes may be used, in part, by DBSI or

one of its affiliates in connection with hedging our obligations under the notes. Because DBSI is both our affiliate and a member of FINRA,

the underwriting arrangements for this offering must comply with the requirements of FINRA Rule 5121 regarding a FINRA member firm’s

distribution of the securities of an affiliate and related conflicts of interest. In accordance with FINRA Rule 5121, DBSI may not make

sales in offerings of the notes to any of its discretionary accounts without the prior written approval of the customer.

DBSI or another Agent may

act as principal or agent in connection with offers and sales of the notes in the secondary market. Secondary market offers and sales

will be made at prices related to market prices at the time of such offer or sale; accordingly, the Agents or a dealer may change the

public offering price, concession and discount after the offering has been completed.

In order to facilitate the

offering of the notes, the Agents may engage in transactions that stabilize, maintain or otherwise affect the price of the notes. Specifically,

an Agent may sell more notes than it is obligated to purchase in connection with the offering, creating a naked short position in the

notes for its own account. Such Agent must close out any naked short position by purchasing the notes in the open market. A naked short

position is more likely to be created if an Agent is concerned that there may be downward pressure on the price of the notes in the open

market after pricing that could adversely affect investors who purchase in the offering. As an additional means of facilitating the offering,

the Agents may bid for, and purchase, notes in the open market to stabilize the price of the notes. Any of these activities may raise

or maintain the market price of the notes above independent market levels or prevent or slow a decline in the market price of the notes.

The Agents are not required to engage in these activities and may end any of these activities at any time.

No action has been or will

be taken by us, the Agents or any dealer that would permit a public offering of the notes or possession or distribution of this pricing

supplement, the accompanying prospectus supplement or prospectus other than in the United States, where action for that purpose is required.

No offers, sales or deliveries of the notes, or distribution of this pricing supplement, the accompanying prospectus supplement or prospectus

or any other offering material relating to the notes, may be made in or from any jurisdiction except in circumstances which will result

in compliance with any applicable laws and regulations and will not impose any obligations on us, the Agents or any dealer.

Each

Agent has represented and agreed, and any other Agent through which we may offer the notes will represent and agree, that if any notes

are to be offered outside the United States, it will not offer or sell any such notes in any jurisdiction if such offer or sale would

not be in compliance with any applicable law or regulation or if any consent, approval or permission is needed for such offer or sale

by it or for or on behalf of the Issuer unless such consent, approval or permission has been previously obtained and such Agent will obtain

any consent, approval or permission required by it for the subscription, offer, sale or delivery of the notes, or the distribution of

any offering materials, under the laws and regulations in force in any jurisdiction to which it is subject or in or from which it makes

any subscription, offer, sale or delivery.

Notice to Prospective Investors in the EEA

This pricing

supplement and the accompanying prospectus supplement and prospectus have been prepared on the basis that any offer of notes in any Member

State of the European Economic Area (“EEA”) will be made pursuant to an exemption under Regulation (EU) 2017/1129 (as

amended, the “Prospectus Regulation”) from the requirement to publish a prospectus for offers of notes. The accompanying

prospectus supplement and the accompanying prospectus are not a prospectus for the purposes of the Prospectus Regulation.

Prohibition of Sales To EEA Retail Investors

The notes

are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any

retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined

in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning

of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify

as a professional client as defined in point (10) of Article 4(1) of MiFID II or (iii) not a qualified investor as defined in the Prospectus

Regulation . The expression an offer includes the communication in any form and by any means of sufficient information on the terms of

the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes. Consequently no key

information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or

selling the notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling

the notes or otherwise making them available to any retail investor in the EEA be unlawful under the PRIIPs Regulation.

Notice to Prospective Investors in the UK

This pricing

supplement and the accompanying prospectus supplement and prospectus have been prepared on the basis that any offer of notes in the United

Kingdom (“UK”) will be made pursuant to an exemption under Regulation (EU) 2017/1129 as it forms part of domestic law

by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”) from the requirement to publish

a prospectus for offers of notes. The accompanying prospectus supplement and the accompanying prospectus are not a prospectus for the

purposes of the UK Prospectus Regulation.

Prohibition of Sales to UK Retail Investors

The notes

are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any

retail investor in the UK. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined

in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal)

Act 2018 (“EUWA”); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act

2000, as amended (“FSMA”), and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where

that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it

forms part of domestic law by virtue of the EUWA or (iii) not a qualified investor as defined in Article 2 of the UK Prospectus Regulation.

The expression an offer includes the communication in any form and by any means of sufficient information on the terms of the offer and

the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes. Consequently no key information

document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”)

for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering

or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

Validity of the Notes

In the opinion of Davis Polk & Wardwell LLP,

as special United States products counsel to the Issuer, when the notes offered by this pricing supplement have been issued by the Issuer

pursuant to the Indenture, the trustee and/or paying agent has made, in accordance with the instructions from the Issuer, the appropriate

entries or notations in its records relating to the master global note that represents such notes (the “master note”), and

such notes have been delivered against payment as contemplated herein, such notes will be valid and binding obligations of the Issuer,

enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights

generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good

faith, fair dealing and the lack of bad faith) and possible judicial or regulatory actions or applications giving effect to governmental

actions or foreign laws affecting creditors’ rights, provided that such counsel expresses no opinion as to (i) the effect of fraudulent

conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above and (ii) the validity, legally

binding effect or enforceability of any provision that permits

holders to collect any portion of the stated principal

amount upon acceleration of the notes to the extent determined to constitute unearned interest. This opinion is given as of the date hereof

and is limited to the laws of the State of New York. Insofar as this opinion involves matters governed by German law, Davis Polk &

Wardwell LLP has relied, without independent investigation, on the opinion of Group Legal Services of Deutsche Bank AG, dated April 26,

2024, filed as an exhibit to the opinion of Davis Polk & Wardwell LLP, and this opinion is subject to the same assumptions, qualifications

and limitations with respect to such matters as are contained in such opinion of Group Legal Services of Deutsche Bank AG. In addition,

this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the Indenture and

the authentication of the master note by the authenticating agent and the validity, binding nature and enforceability of the Indenture

with respect to the trustee, all as stated in the opinion of Davis Polk & Wardwell LLP dated April 26, 2024, which has been filed

as an exhibit to the Registration Statement referred to above.

424B2

EX-FILING FEES

0001159508

333-278331

0001159508

2025-02-11

2025-02-11

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

F-3

DEUTSCHE BANK AKTIENGESELLSCHAFT

Narrative Disclosure

The maximum aggregate offering price of the securities to which the prospectus relates

is $478,000.

The prospectus is a final prospectus for the related

offering.

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FnlPrspctsFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |