SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2024

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Conclusion of fundraising from Eletrobras

and Chesf

Rio de Janeiro, June 19, 2024 – Centrais

Elétricas Brasileiras S/A – Eletrobras informs, in addition to the relevant facts disclosed by the Company on June 5, 2024

and June 18, 2024:

| (i) | the conclusion of the disbursement of the funds subject to the raising of financial resources abroad contracted

by Eletrobras with Citibank N.A. - Loan 4,131 - with the Company receiving the total amount of R$ 4 billion over a period of 2 years;

and |

| (ii) | the settlement of the public offering, carried out by the subsidiary Companhia Hidro Elétrica do

São Francisco – Chesf, of the 3rd issuance of simple debentures, not convertible into shares, of the unsecured type, with

additional fiduciary guarantee, in a single series, subject to public distribution, under automatic registration, intended exclusively

for professional investors, and in the context of which Eletrobras assumed the commitment of guarantor and main payer, in the total amount

of R$ 4.9 billion. |

The table below presents a summary containing

the final conditions obtained and the allocation of the settled Chesf Debentures:

| Company |

Chesf |

| Series |

Only |

| Type |

Simple debentures |

| Due date |

06.15.2031 |

| Final Fee |

IPCA + 6.7670% |

| Volume allocated (R$) |

4.9 billion |

Concomitantly with the aforementioned operation,

Chesf also carried out a Swap operation, so that the final cost of this issue will be equivalent to the DI Rate + 0.31% p.a.

As announced in the relevant facts of June 5

and 18, 2024, considering the settlement of R$ 2 billion in Eletrobras commercial notes, funding in the total amount of R$10.9 billion

was completed.

More information on the terms and conditions

of Loan 4,131 and Chesf's Debentures is available in the minutes of the Company's Board of Directors Meeting held on June 5, 2024 and

in Chesf's offering documents, available for consultation on the websites of the CVM (https://gov.br/cvm), the Company (https://ri.eletrobras.com)

and/or Chesf (https://www.chesf.com.br/relainvest/), as the case may be.

Eduardo Haiama

Vice President of Finance and Investor

Relations

This document may contain estimates and projections

that are not statements of fact that have occurred in the past, but reflect the beliefs and expectations of our management and may constitute

estimates and projections about future events within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities and Exchange Act of 1934, as amended. The words "believes", "may", "may",

"estimates", "continues", "anticipates", "intends", "expects" and the like are intended

to identify estimates that necessarily involve risks and uncertainties, whether known or not. Known risks and uncertainties include, but

are not limited to: general economic, regulatory, political and commercial conditions in Brazil and abroad, variations in interest rates,

inflation and the value of the Brazilian Real, changes in volumes and patterns of consumer use of electricity, competitive conditions,

our level of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the

reservoirs used to operate our hydroelectric plants, our financing and capital investment plans, existing and future government regulations,

and other risks described in our annual report and other documents filed with the SEC. Estimates and projections speak only as of the

date on which they were expressed and we undertake no obligation to update any such estimates or projections due to the occurrence of

new information or upcoming events. The future results of the Companies' operations and initiatives may differ from current expectations

and the investor should not rely solely on the information contained herein. This material contains calculations that may not reflect

accurate results due to rounding performed.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: June 19, 2024

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Eduardo Haiama

|

|

| |

Eduardo Haiama

Vice-President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

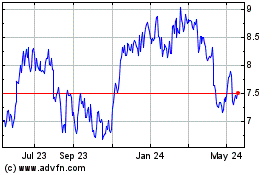

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

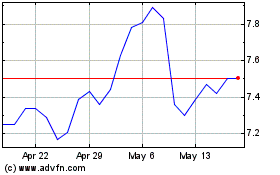

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Jan 2024 to Jan 2025