Eastman Chemical Company (NYSE:EMN) announced its third-quarter

2024 financial results.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241031853691/en/

- Strong year-over-year sales volume/mix growth with improvement

in all operating segments

- Adjusted EBIT margin increased 360 basis points compared to

last year through volume/mix growth, operating leverage, and

commercial excellence

- Continued to make good progress on Kingsport methanolysis

operations and the build of our sales funnel for 2025

- Made investment decision to move forward with the Longview,

Texas, methanolysis facility

- Returned $195 million of cash to shareholders, including $100

million of share repurchases

(In millions, except per share amounts;

unaudited)

3Q24

3Q23

Sales revenue

$

2,464

$

2,267

Earnings before interest and taxes

(“EBIT”)

329

256

Adjusted EBIT*

366

256

Earnings per diluted share

1.53

1.49

Adjusted earnings per diluted share*

2.26

1.47

Net cash provided by operating

activities

396

514

*For non-core and unusual items excluded from adjusted

earnings and for adjusted provision for income taxes, segment

adjusted EBIT margins, and net debt, reconciliations to reported

company and segment earnings and total borrowings for all periods

presented in this release, see Tables 3A, 3B, 4A, and 6.

“Our third-quarter results were driven by strong sales

volume/mix growth, operating leverage, and continued commercial

excellence,” said Mark Costa, Board Chair and CEO. “Underlying

end-market trends remained largely unchanged from the second

quarter, consistent with our expectations. In many of our specialty

product lines, we continue to grow above underlying end markets,

including automotive. During this prolonged period of muted demand,

I am proud of the way the Eastman team has worked to find ways to

deliver on our earnings and cash commitments this year. In the

circular economy, I am excited to announce that we have made an

investment decision and will be moving forward with the

construction of a second methanolysis facility in Longview, Texas.

We continue to make good progress on ramping up our Kingsport

methanolysis facility, although we had more downtime than

expected.”

Corporate Results 3Q 2024 versus 3Q 2023

Sales revenue increased 9 percent primarily due to 8 percent

higher sales volume/mix.

Higher sales volume/mix across all segments was driven by the

end of customer inventory destocking across most key end markets

and innovation driving growth above underlying market trends.

EBIT increased primarily due to higher sales volume/mix, higher

spreads in Chemical Intermediates, and improved asset utilization.

This was partially offset by higher variable compensation and by

operating costs for the Kingsport methanolysis facility.

Segment Results 3Q 2024 versus 3Q 2023

Advanced Materials – Sales revenue increased 5 percent

due to 8 percent higher sales volume/mix partially offset by 3

percent lower selling prices.

Higher sales volume/mix was driven by the end of customer

inventory destocking across key end markets as well as continued

growth of premium interlayers products in the automotive end

market. This growth was partially offset by lower selling

prices.

EBIT increased primarily due to higher sales volume/mix and

improved asset utilization that was partially offset by higher

costs associated with the Kingsport methanolysis facility.

Additives & Functional Products – Sales revenue

increased 11 percent due to 11 percent higher sales volume/mix.

Higher sales volume/mix was driven primarily by the end of

customer inventory destocking across key end markets and heat

transfer fluid project fulfillments.

EBIT increased primarily due to higher sales volume/mix.

Fibers – Sales revenue increased 4 percent due to 2

percent higher sales volume/mix and 2 percent higher selling

prices.

Higher selling prices were driven by acetate tow price

increases. Sales volume/mix increased primarily due to

textiles.

EBIT was slightly up primarily due to improved price-cost.

Chemical Intermediates – Sales revenue increased 13

percent due to 7 percent higher sales volume/mix and 6 percent

higher selling prices.

Higher sales volume/mix and higher selling prices were driven by

the end of customer inventory destocking and improved market

conditions compared to the prior year period.

EBIT increased primarily due to improved olefin and derivative

spreads.

Cash Flow

In third quarter 2024, cash provided by operating activities was

$396 million. The company returned $195 million to stockholders

through share repurchases and dividends. See Table 5. Priorities

for uses of available cash for 2024 include organic growth

investments, payment of the quarterly dividend, and share

repurchases.

2024 Outlook

Commenting on the outlook for full-year 2024, Costa said, “We

are proud to have delivered another strong quarter in this period

of prolonged macroeconomic weakness. As expected, sales volume

improved from last year mostly due to the lack of customer

inventory destocking. With destocking over, our demand has

reconnected to our end markets, which remain stable. In the fourth

quarter, we expect to see normal seasonal volume declines across

most of our markets. We also expect to continue to leverage our

innovation-driven growth model to drive growth above our markets.

We expect to benefit from commercial excellence and the continued

flow through of lower raw material and energy costs in our

specialty businesses. While we have made significant progress

achieving consistent production rates at the Kingsport methanolysis

facility, it has taken us longer than expected to achieve those

rates. Despite these challenges, the strong results we have

delivered in our base business enable us to keep the midpoint of

our full-year adjusted EPS guidance unchanged. Taking these factors

together, we expect 2024 EPS to be between $7.50 and $7.70 and for

2024 cash from operations to approach $1.3 billion, reflecting a

targeted increase in working capital to support growth in 2025. I

remain confident in our ability to deliver earnings growth and

strong cash flow going forward.”

The full-year 2024 projected adjusted diluted EPS and Earnings

Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”)

exclude any non-core, unusual, or nonrecurring items. Our financial

results forecasts do not include non-core items (such as

mark-to-market pension and other postretirement benefit gain or

loss, and asset impairments and restructuring charges) or any

unusual or non-recurring items because we are unable to predict

with reasonable certainty the financial impact of such items. These

items are uncertain and depend on various factors, and we are

unable to reconcile projected adjusted diluted EPS and EBITDA

excluding non-core and any unusual or non-recurring items to

reported GAAP diluted EPS or net earnings without unreasonable

efforts.

Forward-Looking Statements

The information in this release and other statements by the

company may contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act with respect to,

among other items: projections and estimates of earnings, revenues,

volumes, pricing, margins, cost reductions, expenses, taxes,

liquidity, capital expenditures, cash flow, dividends, share

repurchases or other financial items, statements of management’s

plans, strategies and objectives for future operations, and

statements regarding future economic, industry or market conditions

or performance. Such projections and estimates are based upon

certain preliminary information, internal estimates, and management

assumptions, expectations, and plans. Forward-looking statements

are subject to a number of risks and uncertainties, and actual

performance or results could differ materially from that

anticipated by any forward-looking statements. Forward-looking

statements speak only as of the date they are made, and the company

undertakes no obligation to update or revise any forward-looking

statement. Other important assumptions and factors that could cause

actual results to differ materially from those in the

forward-looking statements are detailed in the company’s filings

with the Securities and Exchange Commission (the “SEC”), which are

accessible on the SEC’s website at www.sec.gov and the company’s

website at www.eastman.com.

Conference Call and Webcast Information

Eastman will host a conference call with industry analysts on

Nov. 1, 2024, at 8:00 a.m. ET. To listen to the live webcast of the

conference call and view the accompanying slides and prepared

remarks, go to investors.eastman.com, Events & Presentations.

The slides and prepared remarks to be discussed during the call and

webcast will be available at investors.eastman.com at approximately

4:15 p.m. ET on Oct. 31, 2024. To listen via telephone, the dial-in

number is +1 (833) 470-1428, passcode: 170609. A web replay, a

replay in downloadable MP3 format, and the accompanying slides and

prepared remarks will be available at investors.eastman.com, Events

& Presentations. A telephone replay will be available

continuously beginning at approximately 1:00 p.m. Eastern Time,

Nov. 1, 2024, through 11:59 p.m. Eastern Time, Nov. 11, 2024, Toll

Free at +1 (866) 813-9403, passcode 986486.

Founded in 1920, Eastman is a global specialty materials company

that produces a broad range of products found in items people use

every day. With the purpose of enhancing the quality of life in a

material way, Eastman works with customers to deliver innovative

products and solutions while maintaining a commitment to safety and

sustainability. The company’s innovation-driven growth model takes

advantage of world-class technology platforms, deep customer

engagement, and differentiated application development to grow its

leading positions in attractive end markets such as transportation,

building and construction, and consumables. As a globally inclusive

and diverse company, Eastman employs approximately 14,000 people

around the world and serves customers in more than 100 countries.

The company had 2023 revenue of approximately $9.2 billion and is

headquartered in Kingsport, Tennessee, USA. For more information,

visit www.eastman.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031853691/en/

Media: Tracy Kilgore Addington 423-224-0498 /

tracy@eastman.com

Investors: Greg Riddle 212-835-1620 / griddle@eastman.com

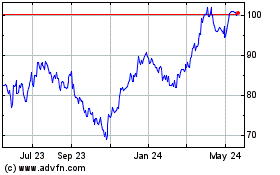

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Dec 2024 to Jan 2025

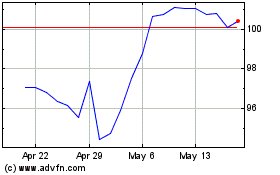

Eastman Chemical (NYSE:EMN)

Historical Stock Chart

From Jan 2024 to Jan 2025