ESI Group: PRESS RELEASE OF NOVEMBER 30 2023

November 30 2023 - 12:45AM

Business Wire

Regulatory News:

ESI Group (Paris:ESI)

This press release does not constitute an offer to acquire

shares and is not intended for distribution in jurisdictions where

the Offer is not authorized.

ON THE AVAILABILITY OF THE OFFER DOCUMENT

AND INFORMATION RELATING TO THE LEGAL, FINANCIAL AND ACCOUNTING

CHARACTERISTICS OF KEYSIGHT TECHNOLOGIES NETHERLANDS B.V.

IN CONNECTION WITH THE TENDER OFFER FOR THE

SHARES OF ESI INITIATED BY Keysight

Technologies Netherlands B.V. PRESENTED BY

J.P.Morgan

BNP

PARIBAS

Bank presenting the

Offer

Bank presenting the Offer and

acting as guarantor

OFFER PRICE: 155 euros per ESI

Group share. DURATION OF THE OFFER: 25 trading days. The timetable

of the tender offer (the “Offer”) will be determined by the

Autorité des marchés financiers (the “AMF”) in accordance

with the provisions of its general regulation (the “AMF General

Regulation”).

AUTORITÉ DES MARCHÉS

FINANCIERS | AMF

This press release (the “Press

Release”) was prepared and made available to the public on

November 30, 2023 in accordance with the provisions of articles

23-27 2° and 231-28 of the AMF General Regulation.

Pursuant to Article L. 621-8 of the French

Monetary and Financial Code and Article 231-23 of the AMF General

Regulation, the AMF has, in accordance with its clearance decision

dated November 28, 2023, affixed the visa n°23-492 on the offer

document (the “Offer Document”). The Offer Document was

prepared by Keysight Technologies Netherlands B.V. and renders its

signatories liable. The visa, in accordance with the provisions of

Article L. 621-8-1, I of the French Monetary and Financial Code,

has been granted after the AMF verified “whether the document is

complete and comprehensible, and whether the information it

contains is consistent”. It does not imply either the approval of

the appropriateness of the transaction nor the authentication of

the accounting and financial information presented.

IMPORTANT NOTICE

In accordance with the provisions of

Article L. 433-4 II of the French Monetary and Financial Code and

Articles 237-1 et seq. of the AMF General Regulation, in the event

that, at the end of the Offer, the number of ESI Group shares not

tendered by the minority shareholders (with the exception of the

shares subject to a liquidity mechanism) would represent no more

than 10% of the share capital and voting rights of ESI Group,

Keysight Technologies Netherlands B.V. intends to ask the AMF for

the implementation, within ten (10) trading days following the

publication of the results of the Offer, or, if the Offer is

re-opened, within three (3) months following the closing of the

reopened offer (the “Reopened Offer”), of a squeeze-out

procedure in order to transfer the ESI Group shares not tendered in

the Offer (other than the shares subject to a liquidity mechanism

and treasury shares), in return for a compensation per share equal

to the Offer price, i.e., EUR 155 per share, net of all costs.

The Offer is not and will not be proposed

in any jurisdiction where it would not permitted by applicable law.

Acceptance of the Offer by persons residing in countries other than

France and the United States of America may be subject to specific

obligations or restrictions imposed by legal or regulatory

provisions. The recipients of the Offer are solely responsible for

compliance with such laws and it is therefore their responsibility,

before accepting the Offer, to determine whether these laws exist

and are applicable, with the assistance of their own advisors.

The Offer will be made in the United Sates

of America pursuant to Section 14(e) of the U.S. Securities

Exchange Act of 1934, as amended (the “1934 Act”) and

Regulation 14E of the 1934 Act, subject to exemptions provided by

Rule 14d-1(c) of the 1934 Act for a Tier I tender offer.

For more information, see paragraph 2.16

(Offer restrictions outside of France) of the Offer Document.

The Offer Document must be read jointly with all other documents

published in connection with the Offer.

In accordance with article 231-28 of the AMF’s general

regulation, the information relating to the legal, financial and

accounting characteristics of Keysight Technologies Netherlands

B.V. was filed with the AMF on November 28, 2023, and made

available to the public on November 29, 2023.

This information and the Offer Document approved by the AMF is

available on the websites of the AMF (www.amf-france.org) and ESI

Group (https://investors.esi-group.com/fr) and may be obtained free

of charge at the registered office of ESI Group (3 bis Rue

Saarinen, Immeuble le Séville, 94528 Rungis Cedex, France) and

at:

J.P. Morgan SE 14 Place

Vendôme

75001 Paris

France

BNP Paribas

16 Boulevard des Italiens

75009 Paris

France

Avertissement

This Press Release has been prepared for information purposes

only. It does not constitute an offer to the public. The

distribution of this Press Release, the Offer and its acceptance

may be subject to specific regulations or restrictions in certain

countries. The Offer is not directed at persons subject to such

restrictions, either directly or indirectly, and may not be

accepted from any jurisdiction where the Offer would be subject to

such restrictions. This press release is not intended for

distribution in such countries. Accordingly, persons in possession

of this press release are responsible for informing themselves

about and complying with any local restrictions that may apply.

Keysight Technologies Netherlands B.V. declines any liability

for any violation by any person of such restrictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231129119851/en/

ESI Group

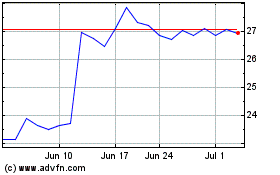

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Jun 2024 to Jul 2024

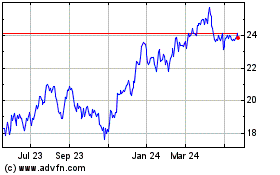

Element Solutions (NYSE:ESI)

Historical Stock Chart

From Jul 2023 to Jul 2024