Eaton Vance Tax-Advantaged Dividend Income Fund Report of Earnings

January 24 2006 - 10:00AM

Business Wire

Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE: EVT), a

closed-end management investment company, today announced the

earnings of the Fund for the three months ended November 30, 2005.

The Fund's fiscal year ends on August 31, 2006. For the three

months ended November 30, 2005, the Fund had net investment income

of $26,917,326 ($0.370 per common share). From this amount, the

Fund paid dividends on preferred shares of $6,294,614 (equal to

$0.086 for each common share), resulting in net investment income

after the preferred dividends of $20,622,712 or $0.284 per common

share. In comparison, for the three months ended November 30, 2004,

the Fund had net investment income of $26,179,142 ($0.359 per

common share). From this amount, the Fund paid dividends on

preferred shares of $3,007,101 (equal to $0.041 for each common

share), resulting in net investment income after the preferred

dividends of $23,172,041 or $0.318 per common share. Net realized

and unrealized losses for the three months ended November 30, 2005

were $25,767,467 ($.354 per common share) In comparison, net

realized and unrealized gains for the three months ended November

30, 2004 were $131,336,940 ($1.803 per common share). On November

30, 2005, net assets applicable to common shares of the Fund were

$1,779,073,217. The net asset value per common share on November

30, 2005 was $24.43 based on 72,835,900 common shares outstanding.

In comparison, on November 30, 2004, net assets of the Fund were

$1,669,993,375. The net asset value per common share on November

30, 2004 was $22.93 based on 72,835,900 common shares outstanding.

The Fund is managed by Eaton Vance Management, a subsidiary of

Eaton Vance Corp., which is listed on the New York Stock Exchange

under the symbol EV. Eaton Vance and its affiliates had

approximately $112 billion in assets under management as of

December 31, 2005. Eaton Vance Management will make available

periodic summary information regarding portfolio investments. Those

interested should call Eaton Vance Marketing at (617) 482-8260. -0-

*T EATON VANCE TAX-ADVANTAGED DIVIDEND INCOME FUND SUMMARY OF

RESULTS OF OPERATIONS (in thousands, except per share amounts)

Three Months Three Months Ended Ended November 30, November 30,

------------- ------------ 2005 2004 ------------- ------------

Gross investment income $31,535 $30,594 Operating expenses 4,618

4,415 ------------- ------------ Net investment income $26,917

$26,179 Net realized and unrealized gains (losses) on investments

($25,767) $131,337 Preferred dividends paid (6,295) (3,007)

------------- ------------ Net increase (decrease) in net assets

from operations ($5,145) $154,509 ============= ============

Earnings per Common Share Outstanding

------------------------------------------ Gross investment income

$0.433 $0.420 Operating expenses 0.063 0.061 -------------

------------ Net investment income $0.370 $0.359 Net realized and

unrealized gains (losses) on investments ($0.354) $1.803 Preferred

dividends paid (0.086) (0.041) ------------- ------------ Net

increase (decrease) in net assets from operations $0.070 $2.121

============= ============ Net investment income $0.370 $0.359

Preferred dividends paid (0.086) (0.041) ------------- ------------

Net investment income after preferred dividends $0.284 $0.318

============= ============ Net Asset Value at November 30 (Common

Shares) ------------------------------------------- Net assets

(000) $1,779,073 $1,669,993 Shares outstanding (000) 72,836 72,836

Net asset value per share outstanding $24.43 $22.93 Market Value

Summary (Common Shares) ------------------------------------------

Market price on NYSE at November 30 $21.89 $20.49 High market price

(three months ended November 30) $22.35 $20.63 Low market price

(three months ended November 30) $20.56 $19.20 *T

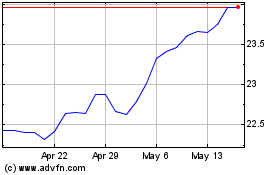

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

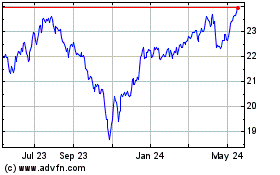

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jul 2023 to Jul 2024