Full Year 2024 Highlights and 2025 Guidance

- Revenue: $816 million, a 10% year-over-year

increase

- Orders: $780 million and book-to-bill ratio of 96%

- Net loss: $135 million

- Adjusted EBITDA: $100 million, a 49% increase from

2023

- Operating cash flow and free cash flow: $92 million and $105

million, respectively

- Shareholder return program: $2 million repurchased in

January 2025

- 2025 adjusted EBITDA guidance: $85 - $105 million

Forum Energy Technologies, Inc. (NYSE: FET) today announced

fourth quarter 2024 revenue of $201 million and orders of $190

million. Fourth quarter net loss of $104 million includes a

non-cash, pre-tax intangible asset impairment of $119 million and

an $11 million tax valuation allowance release. Net loss for 2024

was $135 million, or $11.00 per diluted share. Adjusted net loss

for the quarter was $6 million and $11 million for 2024.1

Neal Lux, President and Chief Executive Officer, remarked, “2024

was a fantastic year for FET. We began by closing the Variperm

acquisition, which contributed meaningfully to our financial

results. Consolidated revenue was up $78 million and adjusted

EBITDA increased $33 million, resulting in a 42% incremental

margin. EBITDA margin increased by over 300 basis points to 12%.

This strong growth and our efficient working capital management

generated free cash flow of $105 million, the highest since

2015.

“We ended the year refinancing our long-term debt, solidifying

our balance sheet, and providing flexibility to return capital to

shareholders. In December, we announced a $75 million share

repurchase authorization and began executing this program in

January. Going forward, we expect to allocate 50% of our free cash

flow to net debt reduction, with the remainder to strategic

investments, including share repurchases. With our confidence in

the long-term outlook and a free cash flow yield well above our

peers, we are unlikely to find a better investment than FET

shares.

“During 2024, we implemented our “Beat the Market” strategy to

grow profitable market share by focusing on niche markets,

delivering innovative solutions, and leveraging our global

manufacturing footprint. This strategy, combined with the Variperm

acquisition, led to 15% market share growth as measured by revenue

per global rig. With continued market share gains and a favorable

long-term energy investment climate, FET is well positioned to

increase revenue and free cash flow over time.

“In the near term, commodity prices remain range bound due to

excess production capacity and slower demand growth. We expect

global drilling and completion activity to be down 2% to 5% in

2025. Our forecast assumes we overcome most, if not all, of the

activity decline through market share gains. Therefore, full year

2025 adjusted EBITDA and free cash flow guidance ranges are $85 to

$105 million and $40 to $60 million, respectively.”

_____________________________

1 See Tables 1-6 for a reconciliation of

GAAP to non-GAAP financial information, including a breakdown of

adjusting items.

Segment Results (unless

otherwise noted, comparisons are fourth quarter 2024 versus third

quarter 2024)

Drilling and Completions segment revenue was $111 million, a 10%

decrease, primarily related to lower capital equipment, wireline

cable and coiled tubing sales due to the decline in U.S.

completions activity. Orders were $103 million, or a book-to-bill

ratio of 93%, on lower orders for drilling and stimulation-related

capital equipment. Segment adjusted EBITDA was $10 million, a 34%

decrease, resulting primarily from lower revenue and unfavorable

product mix. The Drilling and Completions segment provides

consumable products and capital equipment for drilling, subsea,

coiled tubing, wireline, and stimulation markets.

Artificial Lift and Downhole segment revenue was $90 million, a

7% increase, primarily related to higher demand for our processing

equipment technologies, as well as increased sales of our

artificial lift products. Orders were $87 million, a 14% increase,

due to elevated Production Equipment orders. Segment adjusted

EBITDA was $19 million, an 11% increase, mainly due to higher sales

of our artificial lift products and processing equipment

technologies. The Artificial Lift and Downhole segment engineers,

manufactures, and supplies products for well construction,

artificial lift, and oil and natural gas processing.

FET® is a global manufacturing company, serving the oil, natural

gas, industrial and renewable energy industries. With headquarters

located in Houston, Texas, FET provides value added solutions aimed

at improving the safety, efficiency, and environmental impact of

our customers' operations. For more information, please visit

www.f-e-t.com.

Non-GAAP Financial Measures

The Company presents its financial results in accordance with

GAAP. However, management believes that non-GAAP measures are

useful tools for evaluating the Company's overall financial

performance. Not all companies define these measures in the same

way. In addition, these non-GAAP financial measures are not a

substitute for those prepared in accordance with GAAP and should,

therefore, be considered only as a supplement. Please see the

attached schedules for reconciliations between GAAP and the

non-GAAP financial measures used in this press release.

Forward Looking Statements and Other Legal Disclosure

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

Company expects, believes or anticipates will or may occur in the

future are forward-looking statements. Without limiting the

generality of the foregoing, forward-looking statements contained

in this press release specifically include the expectations of

plans, strategies, objectives and anticipated financial and

operating results of the Company, including any statement about the

Company's outlook, future financial position, liquidity and capital

resources, operations, performance, cash flow, acquisitions,

returns, capital expenditure budgets, new product development

activities, strategic investments, share repurchases, costs and

other guidance included in this press release.

These statements are based on certain assumptions made by the

Company based on management's experience and perception of

historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company,

which may cause actual results to differ materially from those

implied or expressed by the forward-looking statements. Among other

things, these include the volatility of oil and natural gas prices,

oilfield development activity levels, the availability of raw

materials and specialized equipment, the Company's ability to

deliver backlog in a timely fashion, the availability of skilled

and qualified labor, competition in the oil and natural gas

industry, governmental regulation and taxation of the oil and

natural gas industry, the Company's ability to implement new

technologies and services, the availability and terms of capital,

and uncertainties regarding environmental regulations or litigation

and other legal or regulatory developments affecting the Company's

business, and other important factors that could cause actual

results to differ materially from those projected as described in

the Company's filings with the U.S. Securities and Exchange

Commission.

Any forward-looking statement speaks only as of the date on

which such statement is made and the Company undertakes no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Forum Energy Technologies,

Inc.

Condensed consolidated

statements of net income (loss)

(Unaudited)

Three months ended

December 31,

September 30,

(in millions, except per share

information)

2024

2023

2024

Revenue

$

201.0

$

185.2

$

207.8

Cost of sales

138.5

135.5

142.1

Gross profit

62.5

49.7

65.7

Operating expenses

Selling, general and administrative

expenses

54.6

45.0

56.3

Transaction expenses

—

2.9

0.6

Impairment of intangible assets

119.1

—

—

Gain on sale-leaseback transactions and

other

(4.4

)

—

(0.1

)

Total operating expenses

169.3

47.9

56.8

Operating income (loss)

(106.8

)

1.8

8.9

Other expense (income)

Interest expense

6.4

4.6

7.7

Loss on extinguishment of debt

0.6

—

1.8

Foreign exchange losses (gains) and other,

net

(6.6

)

9.1

9.6

Total other expense

0.4

13.7

19.1

Loss before income taxes

(107.2

)

(11.9

)

(10.2

)

Income tax expense (benefit)

(3.7

)

4.9

4.6

Net income (loss) (1)

$

(103.5

)

$

(16.8

)

$

(14.8

)

Weighted average shares

outstanding

Basic

12.3

10.2

12.3

Diluted

12.3

10.2

12.3

Loss per share

Basic

$

(8.39

)

$

(1.64

)

$

(1.20

)

Diluted

$

(8.39

)

$

(1.64

)

$

(1.20

)

(1) Refer to Table 1 for schedule of

adjusting items.

Forum Energy Technologies,

Inc.

Condensed consolidated

statements of net income (loss)

(Unaudited)

Year ended

December 31,

(in millions, except per share

information)

2024

2023

Revenue

$

816.4

$

738.9

Cost of sales

561.4

534.7

Gross profit

255.0

204.2

Operating expenses

Selling, general and administrative

expenses

219.3

180.4

Transaction expenses

7.7

2.9

Impairment of intangible assets

119.1

—

Loss (gain) on sale-leaseback transactions

and other

(4.3

)

0.2

Total operating expenses

341.8

183.5

Operating income (loss)

(86.8

)

20.7

Other expense

Interest expense

31.5

18.3

Loss on extinguishment of debt

2.9

—

Foreign exchange losses and other, net

7.2

10.2

Total other expense

41.6

28.5

Loss before income taxes

(128.4

)

(7.8

)

Income tax expense

6.9

11.1

Net income (loss) (1)

$

(135.3

)

$

(18.9

)

Weighted average shares

outstanding

Basic

12.3

10.2

Diluted

12.3

10.2

Loss per share

Basic

$

(11.00

)

$

(1.85

)

Diluted

$

(11.00

)

$

(1.85

)

(1) Refer to Table 2 for schedule of

adjusting items.

Forum Energy Technologies,

Inc.

Condensed consolidated balance

sheets

(Unaudited)

(in millions of dollars)

December 31,

2024

December 31,

2023

Assets

Current assets

Cash and cash equivalents

$

44.7

$

46.2

Accounts receivable—trade, net

153.9

146.7

Inventories, net

265.5

299.6

Other current assets

31.5

37.1

Total current assets

495.6

529.6

Property and equipment, net of accumulated

depreciation

63.4

61.4

Operating lease assets

70.4

55.4

Goodwill and intangible assets, net

170.9

168.0

Other long-term assets

15.7

6.7

Total assets

$

816.0

$

821.1

Liabilities and equity

Current liabilities

Current portion of long-term debt

$

1.9

$

1.2

Other current liabilities

200.0

203.1

Total current liabilities

201.9

204.3

Long-term debt, net of current portion

186.5

129.6

Other long-term liabilities

107.8

74.5

Total liabilities

496.2

408.4

Total equity

319.8

412.7

Total liabilities and equity

$

816.0

$

821.1

Forum Energy Technologies,

Inc.

Condensed consolidated cash

flow information

(Unaudited)

Year ended

December 31,

(in millions of dollars)

2024

2023

Cash flows from operating

activities

Net loss

$

(135.3

)

$

(18.9

)

Depreciation and amortization

53.7

34.7

Impairment of intangible assets

119.1

—

Inventory write down

2.7

2.8

Loss on extinguishment of debt

2.9

—

Gain on sale-leaseback transactions

(4.9

)

—

Other noncash items and changes in working

capital

54.0

(10.4

)

Net cash provided by operating

activities

92.2

8.2

Cash flows from investing

activities

Capital expenditures for property and

equipment

(8.1

)

(7.9

)

Proceeds from sale of property and

equipment

0.7

1.3

Acquisition of businesses, net of cash

acquired

(150.4

)

—

Proceeds from sale-leaseback

transactions

20.3

—

Net cash used in investing

activities

(137.5

)

(6.6

)

Cash flows from financing

activities

Borrowings of debt

874.3

451.7

Repayments of debt

(819.5

)

(453.0

)

Repurchases of stock

—

(3.5

)

Payments of withheld taxes on stock-based

compensation plans

(1.1

)

(2.5

)

Deferred financing costs

(8.5

)

(0.3

)

Net cash provided by (used in)

financing activities

45.2

(7.6

)

Effect of exchange rate changes on

cash

(1.4

)

1.1

Net decrease in cash, cash equivalents

and restricted cash

$

(1.5

)

$

(4.9

)

Forum Energy Technologies,

Inc.

Supplemental schedule -

Segment information

(Unaudited)

As Reported

As Adjusted (3)

Three months ended

Three months ended

(in millions of dollars)

December 31,

2024

December 31,

2023

September 30,

2024

December 31,

2024

December 31,

2023

September 30,

2024

Revenue

Drilling and Completions

$

111.1

$

126.6

$

123.6

$

111.1

$

126.6

$

123.6

Artificial Lift and Downhole

89.9

58.6

84.2

89.9

58.6

84.2

Eliminations

—

—

—

—

—

—

Total revenue

$

201.0

$

185.2

$

207.8

$

201.0

$

185.2

$

207.8

Operating income (loss)

Drilling and Completions

$

3.3

$

4.0

$

7.0

$

3.8

$

4.7

$

7.3

Operating margin %

3.0

%

3.2

%

5.7

%

3.4

%

3.7

%

5.9

%

Artificial Lift and Downhole

12.9

7.4

10.8

13.1

7.4

10.8

Operating margin %

14.3

%

12.6

%

12.8

%

14.6

%

12.6

%

12.8

%

Corporate

(8.4

)

(6.7

)

(8.4

)

(8.5

)

(6.7

)

(8.3

)

Total segment operating income

(loss)

7.8

4.7

9.4

8.4

5.4

9.8

Other items not in segment operating

income (loss) (1)

(114.6

)

(2.9

)

(0.5

)

(0.3

)

—

—

Total operating income (loss)

$

(106.8

)

$

1.8

$

8.9

$

8.1

$

5.4

$

9.8

Operating margin %

(53.1

)%

1.0

%

4.3

%

4.0

%

2.9

%

4.7

%

EBITDA (2)

Drilling and Completions

$

(106.7

)

$

3.8

$

4.5

$

9.5

$

12.1

$

14.5

EBITDA margin %

(96.0

)%

3.0

%

3.6

%

8.6

%

9.6

%

11.7

%

Artificial Lift and Downhole

18.8

8.5

17.2

19.3

8.7

17.4

EBITDA margin %

20.9

%

14.5

%

20.4

%

21.5

%

14.8

%

20.7

%

Corporate

(0.8

)

(10.9

)

(10.6

)

(6.6

)

(5.4

)

(6.1

)

Total EBITDA

$

(88.7

)

$

1.4

$

11.1

$

22.2

$

15.4

$

25.8

EBITDA margin %

(44.1

)%

0.8

%

5.3

%

11.0

%

8.3

%

12.4

%

(1) Includes transaction

expenses, gain on sale-leaseback transaction and gain (loss) on

disposal of assets and other.

(2) The Company believes that the

presentation of EBITDA is useful to the Company's investors because

EBITDA is an appropriate measure for evaluating the Company's

operating performance and liquidity that reflects the resources

available for strategic opportunities including, among others,

investing in the business, strengthening the balance sheet,

repurchasing the Company's securities and making strategic

acquisitions. In addition, EBITDA is a widely used benchmark in the

investment community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information.

(3) Refer to Table 1 for schedule

of adjusting items.

Forum Energy Technologies,

Inc.

Supplemental schedule -

Segment information

(Unaudited)

As Reported

As Adjusted (3)

Year ended

Year ended

(in millions of dollars)

December 31,

2024

December 31,

2023

December 31,

2024

December 31,

2023

Revenue

Drilling and Completions

$

470.8

$

502.6

$

470.8

$

502.6

Artificial Lift and Downhole

345.7

236.3

345.7

236.3

Eliminations

(0.1

)

—

(0.1

)

—

Total revenue

$

816.4

$

738.9

$

816.4

$

738.9

Operating income (loss)

Drilling and Completions

$

17.8

$

19.4

$

20.5

$

20.9

Operating margin %

3.8

%

3.9

%

4.4

%

4.2

%

Artificial Lift and Downhole

48.9

31.6

49.1

32.1

Operating margin %

14.1

%

13.4

%

14.2

%

13.6

%

Corporate

(31.0

)

(27.2

)

(30.5

)

(26.4

)

Total segment operating income

(loss)

35.7

23.8

39.1

26.6

Other items not in segment operating

income (loss) (1)

(122.5

)

(3.1

)

(0.4

)

0.6

Total operating income (loss)

$

(86.8

)

$

20.7

$

38.7

$

27.2

Operating margin %

(10.6

)%

2.8

%

4.7

%

3.7

%

EBITDA (2)

Drilling and Completions

$

(84.6

)

$

40.1

$

49.2

$

50.9

EBITDA margin %

(18.0

)%

8.0

%

10.5

%

10.1

%

Artificial Lift and Downhole

73.0

36.2

74.4

37.6

EBITDA margin %

21.1

%

15.3

%

21.5

%

15.9

%

Corporate

(31.6

)

(31.1

)

(23.6

)

(21.4

)

Total EBITDA

$

(43.2

)

$

45.2

$

100.0

$

67.1

EBITDA margin %

(5.3

)%

6.1

%

12.2

%

9.1

%

(1) Includes transaction

expenses, gain on sale-leaseback transaction and gain (loss) on

disposal of assets and other.

(2) The Company believes that the

presentation of EBITDA is useful to the Company's investors because

EBITDA is an appropriate measure for evaluating the Company's

operating performance and liquidity that reflects the resources

available for strategic opportunities including, among others,

investing in the business, strengthening the balance sheet,

repurchasing the Company's securities and making strategic

acquisitions. In addition, EBITDA is a widely used benchmark in the

investment community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information.

(3) Refer to Table 2 for schedule

of adjusting items.

Forum Energy Technologies,

Inc.

Supplemental schedule - Orders

information

(Unaudited)

Three months ended

(in millions of dollars)

December 31,

2024

December 31,

2023

September 30,

2024

Orders

Drilling and Completions

$

103.0

$

113.8

$

129.5

Artificial Lift and Downhole

87.0

46.5

76.3

Total orders

$

190.0

$

160.3

$

205.8

Revenue

Drilling and Completions

$

111.1

$

126.6

$

123.6

Artificial Lift and Downhole

89.9

58.6

84.2

Total revenue

$

201.0

$

185.2

$

207.8

Book to bill ratio (1)

Drilling and Completions

0.93

0.90

1.05

Artificial Lift and Downhole

0.97

0.79

0.91

Total book to bill ratio

0.95

0.87

0.99

(1) The book-to-bill ratio is calculated

by dividing the dollar value of orders received in a given period

by the revenue earned in that same period. The Company believes

that this ratio is useful to investors because it provides an

indication of whether the demand for our products is strengthening

or declining. A ratio of greater than one is indicative of

improving market demand, while a ratio of less than one would

suggest weakening demand. In addition, the Company believes the

book-to-bill ratio provides more meaningful insight into future

revenues for our business than other measures, such as order

backlog, because the majority of the Company's products are

activity based consumable items or shorter cycle capital equipment,

neither of which are typically ordered by customers far in

advance.

Forum Energy Technologies,

Inc.

Reconciliation of GAAP to

non-GAAP financial information

(Unaudited)

Table 1 - Adjusting

items

Three months ended

December 31, 2024

December 31, 2023

September 30, 2024

(in millions, except per share

information)

Operating income

(loss)

EBITDA (1)

Net income (loss)

Operating income

(loss)

EBITDA (1)

Net income (loss)

Operating income

(loss)

EBITDA (1)

Net income (loss)

As reported

$

(106.8

)

$

(88.7

)

$

(103.5

)

$

1.8

$

1.4

$

(16.8

)

$

8.9

$

11.1

$

(14.8

)

% of revenue

(53.1

)%

(44.1

)%

1.0

%

0.8

%

4.3

%

5.3

%

Restructuring and other costs

0.9

0.9

0.9

0.7

0.7

0.7

0.3

0.3

0.3

Transaction expenses

—

—

—

2.9

2.9

2.9

0.6

0.6

0.6

Inventory and other working capital

adjustments

(0.2

)

(0.2

)

(0.2

)

—

—

—

—

—

—

Impairment of intangible assets

119.1

119.1

119.1

—

—

—

—

—

—

Stock-based compensation expense

—

2.0

—

—

1.2

—

—

2.2

—

Loss on extinguishment of debt

—

0.6

0.6

—

—

—

—

1.8

1.8

Loss (gain) on foreign exchange, net

(2)

—

(6.6

)

(6.6

)

—

9.2

9.2

—

9.8

9.8

Gain on sale-leaseback transactions

(4.9

)

(4.9

)

(4.9

)

—

—

—

—

—

—

Release of valuation allowance on deferred

tax assets

—

—

(11.3

)

—

—

—

—

—

—

As adjusted(1)

$

8.1

$

22.2

$

(5.9

)

$

5.4

$

15.4

$

(4.0

)

$

9.8

$

25.8

$

(2.3

)

% of revenue

4.0

%

11.0

%

2.9

%

8.3

%

4.7

%

12.4

%

Diluted shares outstanding as reported

12.3

10.2

12.3

Diluted shares outstanding as adjusted

12.3

10.2

12.3

Diluted EPS - as reported

$

(8.39

)

$

(1.64

)

$

(1.20

)

Diluted EPS - as adjusted

$

(0.48

)

$

(0.39

)

$

(0.19

)

(1) The Company believes that the

presentation of EBITDA, adjusted EBITDA, adjusted operating loss,

adjusted net loss and adjusted diluted EPS are useful to the

Company's investors because (i) each of these financial metrics are

useful to investors to assess and understand operating performance,

especially when comparing those results with previous and

subsequent periods or forecasting performance for future periods,

primarily because management views the excluded items to be outside

of the Company's normal operating results and (ii) EBITDA is an

appropriate measure of evaluating the company's operating

performance and liquidity that reflects the resources available for

strategic opportunities including, among others, investing in the

business, strengthening the balance sheet, repurchasing the

Company's securities and making strategic acquisitions. In

addition, these benchmarks are widely used in the investment

community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information.

(2) Foreign exchange, net

primarily relates to cash and receivables denominated in U.S.

dollars by some of our non-U.S. subsidiaries that report in a local

currency, and therefore the loss (gain) has no economic impact in

dollar terms.

Forum Energy Technologies,

Inc.

Reconciliation of GAAP to

non-GAAP financial information

(Unaudited)

Table 2 - Adjusting

items

Year ended

December 31, 2024

December 31, 2023

(in millions, except per share

information)

Operating (income)

loss

EBITDA (1)

Net income (loss)

Operating (income)

loss

EBITDA (1)

Net income (loss)

As reported

$

(86.8

)

$

(43.2

)

$

(135.3

)

$

20.7

$

45.2

$

(18.9

)

% of revenue

(10.6

)%

(5.3

)%

2.8

%

6.1

%

Restructuring and other costs

3.8

3.8

3.8

3.1

3.1

3.1

Transaction expenses

7.7

7.7

7.7

3.9

3.9

3.9

Inventory and other working capital

adjustments

(0.2

)

(0.2

)

(0.2

)

(0.5

)

(0.5

)

(0.5

)

Impairment of intangible assets

119.1

119.1

119.1

—

—

—

Stock-based compensation expense

—

7.2

—

—

4.6

—

Loss on extinguishment of debt

—

2.9

2.9

—

—

—

Loss on foreign exchange, net (2)

—

7.6

7.6

—

10.8

10.8

Gain on sale-leaseback transactions

(4.9

)

(4.9

)

(4.9

)

—

—

—

Release of valuation allowance on deferred

tax assets

—

—

(11.3

)

—

—

—

As adjusted (1)

$

38.7

$

100.0

$

(10.6

)

$

27.2

$

67.1

$

(1.6

)

% of revenue

4.7

%

12.2

%

3.7

%

9.1

%

Diluted shares outstanding as reported

12.3

10.2

Diluted shares outstanding as adjusted

12.3

10.2

Diluted EPS - as reported

$

(11.00

)

$

(1.85

)

Diluted EPS - as adjusted

$

(0.86

)

$

(0.16

)

(1) The Company believes that the

presentation of EBITDA, adjusted EBITDA, adjusted operating loss,

adjusted net loss and adjusted diluted EPS are useful to the

Company's investors because (i) each of these financial metrics are

useful to investors to assess and understand operating performance,

especially when comparing those results with previous and

subsequent periods or forecasting performance for future periods,

primarily because management views the excluded items to be outside

of the Company's normal operating results and (ii) EBITDA is an

appropriate measure of evaluating the company's operating

performance and liquidity that reflects the resources available for

strategic opportunities including, among others, investing in the

business, strengthening the balance sheet, repurchasing the

Company's securities and making strategic acquisitions. In

addition, these benchmarks are widely used in the investment

community. See the attached separate schedule for the

reconciliation of GAAP to non-GAAP financial information.

(2) Foreign exchange, net

primarily relates to cash and receivables denominated in U.S.

dollars by some of our non-U.S. subsidiaries that report in a local

currency, and therefore the loss (gain) has no economic impact in

dollar terms.

Forum Energy Technologies,

Inc.

Reconciliation of GAAP to

non-GAAP financial information

(Unaudited)

Table 3 - Adjusting

Items

Three months ended

(in millions of dollars)

December 31,

2024

December 31,

2023

September 30,

2024

EBITDA reconciliation (1)

Net income (loss)

$

(103.5

)

$

(16.8

)

$

(14.8

)

Interest expense

6.4

4.6

7.7

Depreciation and amortization

12.1

8.7

13.6

Income tax expense (benefit)

(3.7

)

4.9

4.6

EBITDA

$

(88.7

)

$

1.4

$

11.1

(1) The Company believes adjusted EBITDA

is useful to investors because it is an appropriate measure of

evaluating operating performance and liquidity. It reflects the

resources available for strategic opportunities including, among

others, investing in the business, strengthening the balance sheet,

repurchasing the Company’s securities, and making strategic

acquisitions. In addition, adjusted EBITDA is a widely used

benchmark in the investment community.

Forum Energy Technologies,

Inc.

Reconciliation of GAAP to

non-GAAP financial information

(Unaudited)

Table 4 - Adjusting

Items

Year ended

(in millions of dollars)

December 31,

2024

December 31,

2023

EBITDA reconciliation (1)

Net income (loss)

$

(135.3

)

$

(18.9

)

Interest expense

31.5

18.3

Depreciation and amortization

53.7

34.7

Income tax expense

6.9

11.1

EBITDA

$

(43.2

)

$

45.2

(1) The Company believes adjusted EBITDA

is useful to investors because it is an appropriate measure of

evaluating operating performance and liquidity. It reflects the

resources available for strategic opportunities including, among

others, investing in the business, strengthening the balance sheet,

repurchasing the Company’s securities, and making strategic

acquisitions. In addition, adjusted EBITDA is a widely used

benchmark in the investment community.

Forum Energy Technologies,

Inc.

Free cash flow

(Unaudited)

Table 5 - Adjusting

items

Three months ended

(in millions of dollars)

December 31,

2024

December 31,

2023

September 30,

2024

Free cash flow, before acquisitions,

reconciliation (1)

Net cash provided by operating

activities

$

38.5

$

11.3

$

25.6

Capital expenditures for property and

equipment

(2.4

)

(2.4

)

(1.3

)

Proceeds from sale of property and

equipment

0.5

—

0.2

Proceeds from sale-leaseback

transactions

20.3

—

—

Free cash flow, before acquisitions

$

56.9

$

8.9

$

24.5

(1) The Company believes free cash flow,

before acquisitions is an important measure because it encompasses

both profitability and capital management in evaluating

results.

Forum Energy Technologies,

Inc.

Free cash flow

(Unaudited)

Table 6 - Adjusting

items

Year ended

(in millions of dollars)

December 31,

2024

December 31,

2023

Free cash flow, before acquisitions,

reconciliation (1)

Net cash provided by operating

activities

$

92.2

$

8.2

Capital expenditures for property and

equipment

(8.1

)

(7.9

)

Proceeds from sale of property and

equipment

0.7

1.3

Proceeds from sale-leaseback

transactions

20.3

—

Free cash flow, before acquisitions

$

105.1

$

1.6

(1) The Company believes free cash flow,

before acquisitions is an important measure because it encompasses

both profitability and capital management in evaluating

results.

Forum Energy Technologies,

Inc.

Supplemental schedule -

Product line revenue

(Unaudited)

Three months ended

(in millions of dollars)

December 31,

2024

December 31,

2023

September 30,

2024

Revenue

$

%

$

%

$

%

Drilling

$

35.5

17.6

%

$

41.6

22.5

%

$

35.8

17.2

%

Subsea

18.6

9.3

%

27.6

14.9

%

20.9

10.1

%

Stimulation and Intervention

31.1

15.5

%

32.1

17.3

%

38.0

18.3

%

Coiled Tubing

25.9

12.9

%

25.3

13.7

%

28.9

13.9

%

Drilling and Completions

111.1

55.3

%

126.6

68.4

%

123.6

59.5

%

Downhole

51.5

25.6

%

21.7

11.7

%

50.6

24.4

%

Production Equipment

21.7

10.8

%

22.7

12.3

%

18.0

8.7

%

Valve Solutions

16.7

8.3

%

14.2

7.6

%

15.6

7.4

%

Artificial Lift and Downhole

89.9

44.7

%

58.6

31.6

%

84.2

40.5

%

Eliminations

—

—

%

—

—

%

—

—

%

Total revenue

$

201.0

100.0

%

$

185.2

100.0

%

$

207.8

100.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220656113/en/

Rob Kukla Director of Investor Relations 281.994.3763

rob.kukla@f-e-t.com

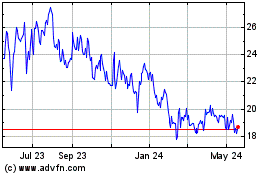

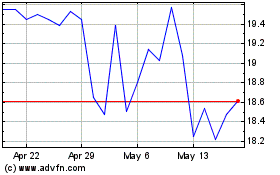

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Feb 2024 to Feb 2025