Revenue of $448 million vs. $399 million in

prior year

FICO (NYSE:FICO), a leading predictive analytics and decision

management software company, today announced results for its third

fiscal quarter ended June 30, 2024.

Third Quarter Fiscal 2024 GAAP Results

Net income for the quarter totaled $126.3 million, or $5.05 per

share, versus $128.8 million, or $5.08 per share, in the prior year

period. The third quarter in Fiscal 2023 included a large one-time

favorable expense adjustment.

Net cash provided by operating activities for the quarter was

$213.3 million versus $122.6 million in the prior year period.

Third Quarter Fiscal 2024 Non-GAAP Results

Non-GAAP Net Income for the quarter was $156.4 million versus

$143.4 million in the prior year period. Non-GAAP EPS for the

quarter was $6.25 versus $5.66 in the prior year period. Free cash

flow was $205.7 million for the current quarter versus $121.8

million in the prior year period. The Non-GAAP financial measures

are described in the financial table captioned “Non-GAAP Results”

and are reconciled to the corresponding GAAP results in the

financial tables at the end of this release.

Third Quarter Fiscal 2024 GAAP Revenue

The company reported revenues of $447.8 million for the quarter

as compared to $398.7 million reported in the prior year

period.

“We delivered significant growth throughout the business, with

strong adoption of FICO 10 T and FICO Platform,” said Will Lansing,

chief executive officer. “We are pleased to announce that we are

raising our full year guidance.”

Revenues for the third quarter of fiscal 2024 for the company’s

two operating segments were as follows:

- Scores revenues, which include the company’s

business-to-business (B2B) scoring solutions, and

business-to-consumer (B2C) solutions, were $241.4 million in the

third quarter, compared to $201.8 million in the prior year period,

an increase of 20%. B2B revenue increased 27%, driven largely by

higher unit prices, which were partially offset by a decrease in

mortgage origination volumes. B2C revenue decreased 2% from the

prior year period due to lower volumes on myFICO.com business.

- Software revenues, which include the company’s analytics and

digital decisioning technology, were $206.4 million in the third

quarter, compared to $196.9 million in the prior year period, an

increase of 5%, mainly due to increased recurring revenue,

partially offset by a decrease in professional services. Software

Annual Recurring Revenue was up 10% year-over-year, consisting of

31% platform ARR growth and 3% non-platform growth. Software

Dollar-Based Net Retention Rate was 108% at June 30, 2024, with

platform software at 124% and non-platform software at 101%.

Outlook

The company is updating its previously provided guidance for

fiscal 2024:

Previous 2024 Guidance

Updated 2024 Guidance

Revenues

$1.690 billion

$1.700 billion

GAAP Net Income

$495 million

$500 million

GAAP EPS

$19.70

$19.90

Non-GAAP Net Income

$573 million

$582 million

Non-GAAP EPS

$22.80

$23.16

The Non-GAAP financial measures are described in the financial

table captioned “Reconciliation of Non-GAAP Guidance.”

Company to Host Conference Call

The company will host a webcast on July 31, 2024 at 5:00 p.m.

Eastern Time (2:00 p.m. Pacific Time) to report its third quarter

fiscal 2024 results and provide various strategic and operational

updates. The call can be accessed at FICO's web site at

www.fico.com/investors. A replay of the webcast will be available

at our Past Events page through July 31, 2025.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 215 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail, and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 2.6 billion

payment cards from fraud, to improving financial inclusion, to

increasing supply chain resiliency. The FICO® Score, used by 90% of

top US lenders, is the standard measure of consumer credit risk in

the US and has been made available in over 40 other countries,

improving risk management, credit access and transparency.

Learn more at http://www.fico.com

Join the conversation at https://twitter.com/fico &

http://www.fico.com/en/blogs/

For FICO news and media resources, visit www.fico.com/news.

FICO is a registered trademark of Fair Isaac Corporation in the

US and other countries.

Statement Concerning Forward-Looking Information

Except for historical information contained herein, the

statements contained in this news release that relate to FICO or

its business are forward-looking statements within the meaning of

the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements are subject to

risks and uncertainties that may cause actual results to differ

materially, including the success of the Company’s Software

segment’s business strategy, the Company’s ability to continue to

develop new and enhanced products and services, the maintenance of

its existing relationships and ability to create new relationships

with customers and key alliance partners, disruptions and

uncertainties with respect to global economic conditions as well as

in industries and markets of the Company and its customers, the

Company’s ability to keep up with rapidly changing technologies,

its ability to recruit and retain qualified personnel, competition,

regulatory changes applicable to the use of consumer credit and

other data, the failure to protect such data, the failure to

realize the anticipated benefits of any acquisitions, or

divestitures, and material adverse developments in global economic

conditions or the occurrence of certain other world events such as

geopolitical tensions, military conflicts, the level and volatility

of interest rates, the level of inflation, the continuing effects

of the COVID-19 pandemic, an actual recession or fears of a

recession, trade policies and tariffs, and political and

governmental instability. Additional information on these risks and

uncertainties and other factors that could affect FICO's future

results are described from time to time in FICO's SEC reports,

including its Annual Report on Form 10-K for the year ended

September 30, 2023 and its subsequent filings with the SEC. If any

of these risks or uncertainties materializes, FICO's results could

differ materially from its expectations. Investors are cautioned

not to place undue reliance on any such forward-looking statements,

which speak only as of the date they are made. FICO disclaims any

intent or obligation to update these forward-looking statements,

whether as a result of new information, future events or

otherwise.

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

June 30, 2024

September 30, 2023

(In thousands)

Assets

Current assets:

Cash and cash equivalents

$

156,043

$

136,778

Accounts receivable, net

437,637

387,947

Prepaid expenses and other current

assets

37,455

31,723

Total current assets

631,135

556,448

Marketable securities and investments

44,034

34,237

Property and equipment, net

34,128

10,966

Operating lease right-of-use assets

26,087

25,703

Goodwill and intangible assets, net

776,806

774,244

Other assets

196,641

173,683

Total assets

$

1,708,831

$

1,575,281

Liabilities and Stockholders’

Deficit

Current liabilities:

Accounts payable and other accrued

liabilities

$

80,226

$

78,487

Accrued compensation and employee

benefits

92,731

102,471

Deferred revenue

149,259

136,730

Current maturities on debt

15,000

50,000

Total current liabilities

337,216

367,688

Long-term debt

2,104,943

1,811,658

Operating lease liabilities

18,420

23,903

Other liabilities

77,558

60,022

Total liabilities

2,538,137

2,263,271

Stockholders’ deficit

(829,306

)

(687,990

)

Total liabilities and stockholders’

deficit

$

1,708,831

$

1,575,281

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

Quarter Ended June 30,

Nine Months Ended June

30,

2024

2023

2024

2023

(In thousands, except per

share data)

Revenues:

On-premises and SaaS software

$

183,785

$

172,059

$

529,633

$

471,203

Professional services

22,614

24,851

63,637

74,348

Scores

241,450

201,778

670,447

578,273

Total revenues

447,849

398,688

1,263,717

1,123,824

Operating expenses:

Cost of revenues

88,225

71,846

258,632

228,221

Research and development

44,217

41,455

127,732

118,354

Selling, general and administrative

124,881

108,081

340,077

301,234

Amortization of intangible assets

275

275

825

825

Gain on product line asset sale

—

—

—

(1,941

)

Total operating expenses

257,598

221,657

727,266

646,693

Operating income

190,251

177,031

536,451

477,131

Other expense, net

(22,933

)

(19,244

)

(65,809

)

(63,972

)

Income before income taxes

167,318

157,787

470,642

413,159

Provision for income taxes

41,062

29,029

93,522

85,208

Net income

$

126,256

$

128,758

$

377,120

$

327,951

Earnings per share:

Basic

$

5.12

$

5.16

$

15.24

$

13.10

Diluted

$

5.05

$

5.08

$

15.01

$

12.91

Shares used in computing earnings per

share:

Basic

24,646

24,959

24,743

25,040

Diluted

25,015

25,337

25,129

25,399

FAIR ISAAC CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended June

30,

2024

2023

(In thousands)

Cash flows from operating

activities:

Net income

$

377,120

$

327,951

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

10,012

11,642

Share-based compensation

109,457

89,750

Changes in operating assets and

liabilities

(74,700

)

(93,763

)

Gain on product line asset sale

—

(1,941

)

Other, net

(15,403

)

(28,773

)

Net cash provided by operating

activities

406,486

304,866

Cash flows from investing

activities:

Purchases of property and equipment

(7,130

)

(3,169

)

Capitalized internal-use software

costs

(11,298

)

—

Net activity from marketable

securities

(2,006

)

(3,679

)

Cash transferred, net of proceeds, from

product line asset sale

—

(6,126

)

Net cash used in investing activities

(20,434

)

(12,974

)

Cash flows from financing

activities:

Proceeds from revolving line of credit and

term loans

795,000

339,000

Payments on revolving line of credit and

term loans

(538,250

)

(265,250

)

Proceeds from issuance of treasury stock

under employee stock plans

15,680

15,615

Taxes paid related to net share settlement

of equity awards

(137,223

)

(75,443

)

Repurchases of common stock

(498,171

)

(285,158

)

Other, net

(2,017

)

—

Net cash used in financing activities

(364,981

)

(271,236

)

Effect of exchange rate changes on

cash

(1,806

)

9,164

Increase in cash and cash equivalents

19,265

29,820

Cash and cash equivalents, beginning of

period

136,778

133,202

Cash and cash equivalents, end of

period

$

156,043

$

163,022

FAIR ISAAC CORPORATION

NON-GAAP RESULTS

(Unaudited)

Quarter Ended June 30,

Nine Months Ended June

30,

2024

2023

2024

2023

(In thousands, except per

share data)

GAAP net income

$

126,256

$

128,758

$

377,120

$

327,951

Amortization of intangible assets

275

275

825

825

Gain on product line asset sale

—

—

—

(1,941

)

Share-based compensation expense

42,435

32,995

109,457

89,750

Income tax adjustments

(10,939

)

(8,314

)

(27,949

)

(22,046

)

Excess tax benefit

(1,636

)

(818

)

(27,345

)

(11,734

)

Adjustment to tax reserves and valuation

allowance

—

(9,500

)

—

(9,500

)

Non-GAAP net income

$

156,391

$

143,396

$

432,108

$

373,305

GAAP diluted earnings per share

$

5.05

$

5.08

$

15.01

$

12.91

Amortization of intangible assets

0.01

0.01

0.03

0.03

Gain on product line asset sale

—

—

—

(0.08

)

Share-based compensation expense

1.70

1.30

4.36

3.53

Income tax adjustments

(0.44

)

(0.33

)

(1.11

)

(0.87

)

Excess tax benefit

(0.07

)

(0.03

)

(1.09

)

(0.46

)

Adjustment to tax reserves and valuation

allowance

—

(0.37

)

—

(0.37

)

Non-GAAP diluted earnings per share

$

6.25

$

5.66

$

17.20

$

14.70

Free cash flow

Net cash provided by operating

activities

$

213,331

$

122,623

$

406,486

$

304,866

Capital expenditures

(7,645

)

(793

)

(18,428

)

(3,169

)

Free cash flow

$

205,686

$

121,830

$

388,058

$

301,697

Note: The numbers may not sum to total due

to rounding.

About Non-GAAP Financial Measures

To supplement the consolidated GAAP financial statements, the

company uses the following non-GAAP financial measures: non-GAAP

net income, non-GAAP EPS, and free cash flow. Non-GAAP net income

and non-GAAP EPS exclude, to the extent applicable, such items as

the impact of amortization expense, share-based compensation

expense, restructuring and acquisition-related, excess tax benefit,

and adjustment to tax valuation allowance items. Free cash flow

excludes capital expenditures. The presentation of these financial

measures is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

Management uses these non-GAAP financial measures for financial

and operational decision-making and as a means to evaluate

period-to-period comparisons. Our management believes these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance and liquidity by excluding

certain items that may not be indicative of recurring business

results including significant non-cash expenses. We believe

management and investors benefit from referring to these non-GAAP

financial measures in assessing our performance when planning,

forecasting and analyzing future periods. These non-GAAP financial

measures also facilitate management’s internal comparisons to

historical performance and liquidity as well as comparisons to our

competitors’ operating results. We believe these non-GAAP financial

measures are useful to investors because they allow for greater

transparency with respect to key measures used by management in its

financial and operating decision-making.

FAIR ISAAC CORPORATION

RECONCILIATION OF NON-GAAP

GUIDANCE

(Unaudited)

Previous Fiscal 2024

Guidance

Updated Fiscal 2024

Guidance

(In millions, except per share

data)

GAAP net income

$

495

$

500

Amortization of intangible assets

1

1

Share-based compensation expense

140

149

Income tax adjustments

(35

)

(39

)

Excess tax benefit

(28

)

(29

)

Non-GAAP net income

$

573

$

582

GAAP diluted earnings per share

$

19.70

$

19.90

Amortization of intangible assets

0.04

0.04

Share-based compensation expense

5.57

5.93

Income tax adjustments

(1.39

)

(1.55

)

Excess tax benefit

(1.11

)

(1.15

)

Non-GAAP diluted earnings per share

$

22.80

$

23.16

Note: The numbers may not sum to total due

to rounding.

About Non-GAAP Financial Measures

To supplement the consolidated GAAP financial statements, the

company uses the following non-GAAP financial measures: non-GAAP

net income, non-GAAP EPS, and free cash flow. Non-GAAP net income

and non-GAAP EPS exclude, to the extent applicable, such items as

the impact of amortization expense, share-based compensation

expense, restructuring and acquisition-related, excess tax benefit,

and adjustment to tax valuation allowance items. Free cash flow

excludes capital expenditures. The presentation of these financial

measures is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

Management uses these non-GAAP financial measures for financial

and operational decision-making and as a means to evaluate

period-to-period comparisons. Our management believes these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance and liquidity by excluding

certain items that may not be indicative of recurring business

results including significant non-cash expenses. We believe

management and investors benefit from referring to these non-GAAP

financial measures in assessing our performance when planning,

forecasting and analyzing future periods. These non-GAAP financial

measures also facilitate management’s internal comparisons to

historical performance and liquidity as well as comparisons to our

competitors’ operating results. We believe these non-GAAP financial

measures are useful to investors because they allow for greater

transparency with respect to key measures used by management in its

financial and operating decision-making.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731354164/en/

Investors/Analysts: Dave Singleton Fair Isaac Corporation

(800) 459-7125 investor@fico.com

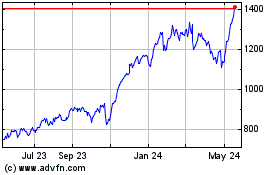

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

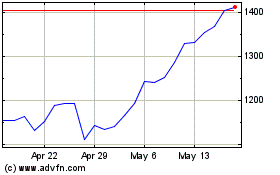

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024