First Trust Intermediate Duration Preferred & Income Fund

(the "Fund") (NYSE: FPF) has declared the Fund’s regularly

scheduled monthly common share distribution in the amount of

$0.1375 per share payable on May 15, 2024, to shareholders of

record as of May 2, 2024. The ex-dividend date is expected to be

May 1, 2024. The monthly distribution information for the Fund

appears below.

First Trust

Intermediate Duration Preferred & Income Fund (FPF):

Distribution per share:

$0.1375

Distribution Rate based on the April 19,

2024 NAV of $18.57:

8.89%

Distribution Rate based on the April 19,

2024 closing market price of $17.06:

9.67%

The majority, and possibly all, of this distribution will be

paid out of net investment income earned by the Fund. A portion of

this distribution may come from net short-term realized capital

gains or return of capital. The final determination of the source

and tax status of all 2024 distributions will be made after the end

of 2024 and will be provided on Form 1099-DIV.

The Fund has a practice of seeking to maintain a relatively

stable monthly distribution which may be changed periodically.

First Trust Advisors L.P. ("FTA") believes the practice may benefit

the Fund's market price and premium/discount to the Fund's NAV. The

practice has no impact on the Fund's investment strategy and may

reduce the Fund's NAV.

The Fund is a diversified, closed-end management investment

company that seeks to provide a high level of current income. The

Fund has a secondary objective of capital appreciation. The Fund

seeks to achieve its investment objectives by investing in

preferred and other income-producing securities. Under normal

market conditions, the Fund will invest at least 80% of its Managed

Assets in a portfolio of preferred and other income-producing

securities issued by U.S. and non-U.S. companies, including

traditional preferred securities, hybrid preferred securities that

have investment and economic characteristics of both preferred

securities and debt securities, floating-rate and fixed-to-floating

rate preferred securities, debt securities, convertible securities

and contingent convertible securities.

FTA is a federally registered investment advisor and serves as

the Fund's investment advisor. FTA and its affiliate First Trust

Portfolios L.P. ("FTP"), a FINRA registered broker-dealer, are

privately-held companies that provide a variety of investment

services. FTA has collective assets under management or supervision

of approximately $226 billion as of March 28, 2024 through unit

investment trusts, exchange-traded funds, closed-end funds, mutual

funds and separate managed accounts. FTA is the supervisor of the

First Trust unit investment trusts, while FTP is the sponsor. FTP

is also a distributor of mutual fund shares and exchange-traded

fund creation units. FTA and FTP are based in Wheaton,

Illinois.

Stonebridge Advisors LLC ("Stonebridge"), the Fund's investment

sub-advisor, is a registered investment advisor specializing in

preferred and hybrid securities. Stonebridge was formed in December

2004 by First Trust Portfolios L.P. and Stonebridge Asset

Management, LLC. The company had assets under management or

supervision of approximately $11.8 billion as of January 31, 2024.

These assets come from separate managed accounts, unified managed

accounts, unit investment trusts, an open-end mutual fund, actively

managed exchange-traded funds, and the Fund.

Principal Risk Factors: Risks are inherent in all investing.

Certain risks applicable to the Fund are identified below, which

includes the risk that you could lose some or all of your

investment in the Fund. The principal risks of investing in the

Fund are spelled out in the Fund's annual shareholder reports. The

order of the below risk factors does not indicate the significance

of any particular risk factor. The Fund also files reports, proxy

statements and other information that is available for

review.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost. There can be no assurance that the Fund's investment

objectives will be achieved. The Fund may not be appropriate for

all investors.

Market risk is the risk that a particular investment, or shares

of a fund in general may fall in value. Investments held by the

Fund are subject to market fluctuations caused by real or perceived

adverse economic conditions, political events, regulatory factors

or market developments, changes in interest rates and perceived

trends in securities prices. Shares of a fund could decline in

value or underperform other investments as a result. In addition,

local, regional or global events such as war, acts of terrorism,

market manipulation, government defaults, government shutdowns,

regulatory actions, political changes, diplomatic developments, the

imposition of sanctions and other similar measures, spread of

infectious disease or other public health issues, recessions,

natural disasters or other events could have significant negative

impact on a fund and its investments.

Current market conditions risk is the risk that a particular

investment, or shares of the fund in general, may fall in value due

to current market conditions. As a means to fight inflation, the

Federal Reserve and certain foreign central banks have raised

interest rates and expect to continue to do so, and the Federal

Reserve has announced that it intends to reverse previously

implemented quantitative easing. Recent and potential future bank

failures could result in disruption to the broader banking industry

or markets generally and reduce confidence in financial

institutions and the economy as a whole, which may also heighten

market volatility and reduce liquidity. Ongoing armed conflicts

between Russia and Ukraine in Europe and among Israel, Hamas and

other militant groups in the Middle East, have caused and could

continue to cause significant market disruptions and volatility

within the markets in Russia, Europe, the Middle East and the

United States. The hostilities and sanctions resulting from those

hostilities have and could continue to have a significant impact on

certain fund investments as well as fund performance and liquidity.

The COVID-19 global pandemic, or any future public health crisis,

and the ensuing policies enacted by governments and central banks

have caused and may continue to cause significant volatility and

uncertainty in global financial markets, negatively impacting

global growth prospects.

Preferred/hybrid and debt securities in which the Fund invests

are subject to various risks, including credit risk, interest rate

risk, and call risk. Credit risk is the risk that an issuer of a

security will be unable or unwilling to make dividend, interest

and/or principal payments when due and that the value of a security

may decline as a result. Credit risk may be heightened for the Fund

because it invests in below investment grade securities, which

involve greater risks than investment grade securities, including

the possibility of dividend or interest deferral, default or

bankruptcy. Interest rate risk is the risk that the value of

fixed-rate securities in the Fund will decline because of rising

market interest rates. Call risk is the risk that performance could

be adversely impacted if an issuer calls higher-yielding debt

instruments held by the Fund. These securities are also subject to

issuer risk, floating rate and fixed-to-floating rate risk,

prepayment risk, reinvestment risk, subordination risk and

liquidity risk.

The risks associated with trust preferred securities typically

include the financial condition of the financial institution that

creates the trust, as the trust typically has no business

operations other than holding the subordinated debt issued by the

financial institution and issuing the trust preferred securities

and common stock backed by the subordinated debt

Interest rate risk is the risk that securities will decline in

value because of changes in market interest rates. The duration of

a security will be expected to change over time with changes in

market factors and time to maturity. Although the Fund seeks to

maintain a duration, under normal market circumstances, excluding

the effects of leverage, of between three and eight years, if the

effect of the Fund's use of leverage was included in calculating

duration, it could result in a longer duration for the Fund.

Because the Fund is concentrated in the financials sector, it

will be more susceptible to adverse economic or regulatory

occurrences affecting this sector, such as changes in interest

rates, loan concentration and competition.

Investment in non-U.S. securities is subject to the risk of

currency fluctuations and to economic and political risks

associated with such foreign countries.

Investments in securities of issuers located in emerging market

countries are considered speculative and there is a heightened risk

of investing in emerging markets securities. Financial and other

reporting by companies and government entities also may be less

reliable in emerging market countries. Shareholder claims that are

available in the U.S., as well as regulatory oversight and

authority that is common in the U.S., including for claims based on

fraud, may be difficult or impossible for shareholders of

securities in emerging market countries or for U.S. authorities to

pursue.

To the extent a fund invests in floating or variable rate

obligations that use the London Interbank Offered Rate ("LIBOR") as

a reference interest rate, it is subject to LIBOR Risk. LIBOR has

ceased to be made available as a reference rate and there is no

assurance that any alternative reference rate, including the

Secured Overnight Financing Rate ("SOFR"), will be similar to or

produce the same value or economic equivalence as LIBOR. The

unavailability or replacement of LIBOR may affect the value,

liquidity or return on certain fund investments and may result in

costs incurred in connection with closing out positions and

entering into new trades. Any potential effects of the transition

away from LIBOR on a fund or on certain instruments in which a fund

invests is difficult to predict and could result in losses to the

fund.

Contingent Capital Securities provide for mandatory conversion

into common stock of the issuer under certain circumstances, which

may limit the potential for income and capital appreciation and,

under certain circumstances, may result in complete loss of the

value of the investment.

Reverse repurchase agreements involve leverage risk, the risk

that the purchaser fails to return the securities as agreed upon,

files for bankruptcy or becomes insolvent. The Fund may be

restricted from taking normal portfolio actions during such time,

could be subject to loss to the extent that the proceeds of the

agreement are less than the value of securities subject to the

agreement and may experience adverse tax consequences.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

shareholder reports and other regulatory filings.

The information presented is not intended to constitute an

investment recommendation for, or advice to, any specific person.

By providing this information, First Trust is not undertaking to

give advice in any fiduciary capacity within the meaning of ERISA,

the Internal Revenue Code or any other regulatory framework.

Financial professionals are responsible for evaluating investment

risks independently and for exercising independent judgment in

determining whether investments are appropriate for their

clients.

The Fund's daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

https://www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240422692219/en/

Press Inquiries Ryan Issakainen 630-765-8689 Analyst Inquiries

Jeff Margolin 630-915-6784 Broker Inquiries Sales Team

866-848-9727

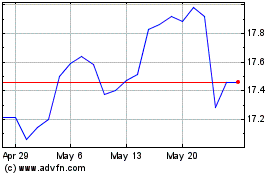

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

From Oct 2024 to Nov 2024

First Trust Intermediate... (NYSE:FPF)

Historical Stock Chart

From Nov 2023 to Nov 2024