GE Chief Received Special Stock Award Now Worth $100 Million

March 11 2021 - 7:13PM

Dow Jones News

By Thomas Gryta and Theo Francis

Larry Culp voluntarily gave up his salary after Covid-19 struck

and also declined his cash bonus, yet the General Electric Co. boss

last year received a special stock award that at the end of 2020

was valued at more than $100 million.

Most of Mr. Culp's reported 2020 compensation came from a pair

of performance-linked stock awards: an annual grant valued at $15

million in early March and a longer-term grant in August initially

valued at $57.1 million, according to a regulatory filing Thursday.

His salary for the year was $653,409.

GE said its chairman and chief executive won't receive any of

the August stock grant until 2024 and the values of both awards

will fluctuate based on the company's performance. At year-end, the

company valued the full August award at $100.4 million, assuming

additional targets are met.

"In April 2020, in light of the business challenges and economic

uncertainty resulting from the Covid-19 pandemic, Mr. Culp

voluntarily forfeited his salary for the remainder of 2020," GE

said in its filing. Mr. Culp was entitled to a $2.5 million salary

and a cash bonus valued at up to $3.75 million, which he

declined.

Over the summer, the GE board revised the CEO's contract,

extending it until 2024 and awarding him the special stock grant

"in recognition of Mr. Culp's essential role in leading GE's

ongoing transformation," according to the filing.

The extension also reset the baseline stock price for reaching

the performance goals to $6.67. The shares were about $12 when he

took the CEO role in 2018.

GE reached its first performance goal in December, ensuring Mr.

Culp at least 4.6 million GE shares, which were valued at about $47

million at the time. He could receive up to 4.6 million more shares

if targets are met.

"Larry's compensation remains overwhelmingly tied to GE's

performance, with the performance shares targeting a significant

return to shareholders, and no performance shares will be earned

unless Larry remains with GE through the extended term of the

agreement," the company said in the filing.

Mr. Culp became the first CEO from outside of GE after deep

problems in its power unit and financial services arm forced GE to

slash its dividend and sell off businesses. He previously served as

lead director on GE's board.

https://www.wsj.com/articles/can-larry-culp-fix-ge-1538798476

Mr. Culp has focused on cutting debt and generating more cash to

turn around the conglomerate, but the pandemic hit the company hard

because of its reliance on the air travel industry. GE ultimately

cut a quarter of its 52,000 aviation workers last year.

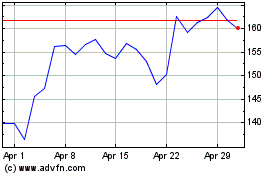

GE shares have performed well, more than doubling in the past

six months, as investors get more confident in the company's

turnaround. This week he struck a deal to sell off a big part of GE

Capital and promised to wind down the troubled segment. The shares

closed Thursday at $12.27.

(END) Dow Jones Newswires

March 11, 2021 19:58 ET (00:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

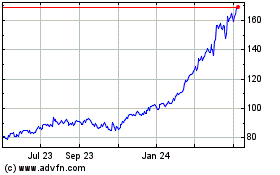

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2024 to May 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

From May 2023 to May 2024