Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 10 2022 - 5:16AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

January 2022

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

São Paulo,

January 10, 2022 - GOL Linhas Aéreas Inteligentes S.A. (NYSE: GOL and B3: GOLL4), (“GOL” or “Company”),

Brazil’s largest airline, today provides an Investor Update on its expectations for the fourth quarter of 2021. The information

below is preliminary and unaudited. The Company will discuss its 4Q21 results in a conference call on February 17, 2022.

|

Overall Commentary

|

|

·

GOL expects a Loss Per Share (EPS) and a Loss Per American Depositary

Share (EPADS) for 3Q21 of approximately R$1.331 and US$0.481, respectively.

·

EBITDA margin for the quarter is expected to be approximately

35%², an increase in relation to the quarter ended in December 2020 (29.5%²).

·

Passenger unit revenue (PRASK) for the fourth quarter is expected

to be up approximately 35% year over year.

·

Non-fuel unit costs (CASK ex-fuel) are expected to decrease by

approximately 12%2 in relation to the fourth quarter of the prior year, primarily due to increased productivity (increase in

ASKs, aircraft utilization and operating efficiency), partially offset by increased depreciation from ten net additional aircraft in the

fleet. Fuel unit costs (fuel CASK) are expected to increase by approximately 55% year-over-year, driven by a 75% increase in the average

fuel price which was partially offset by a more fuel efficient fleet resulting in a 5% reduction in fuel consumption per flight hour.

On a constant fuel unit cost basis to the quarter ended December 2020, the EBITDA margin for the quarter would have been approximately

39%².

·

GOL’s financial leverage, as measured by the Net Debt3/EBITDA5

ratio, was approximately 5.6x at the end of the December 2021 quarter (4.7x in IFRS-16). The Company amortized approximately R$200 million

of debt in the quarter, and total liquidity at quarter-end is expected to be at R$3.6 billion.

|

|

Preliminary and Unaudited Projection

|

|

EBITDA Margin2

EBIT Margin2

Other Revenue (cargo, loyalty, other)

Average fuel price per liter

Average exchange rate

Passenger unit revenue (PRASK)

CASK Ex-fuel2,4

Total Demand – RPK

Total Capacity – ASK

Total Capacity – Seats

|

December Quarter 2021

~35%

~28%

~7% of total net revenues

~R$4.11

R$5.58

December Quarter 2021

vs. December Quarter 2020

Up ~35%

Down ~12%

Up 15.4%

Up 13.2%

Up 20.9%

|

|

|

1.

|

Excluding gains and losses on currency and Exchangeable

Senior Notes.

|

|

|

2.

|

Excluding non-operating expenses and depreciation

related to fleet idleness and personnel costs not directly related to operations of approximately R$804 million in 4Q21 and R$665 million

in 4Q20.

|

|

|

3.

|

Including 7x annual aircraft lease payments and excluding

perpetual bonds.

|

|

|

4.

|

Cash and cash equivalents, restricted cash, accounts

receivables and deposits (does not include unencumbered assets).

|

|

|

5.

|

4Q21E EBITDA annualized.

|

|

1

|

|

Investor Relations

ri@voegol.com.br

www.voegol.com.br/ir

+55(11) 2128-4700

About

GOL Linhas Aéreas Inteligentes S.A.

GOL

is Brazil's largest airline, leader in the corporate and leisure segments. Since its founding in 2001, it has been the airline with the

lowest unit cost in Latin America, which has enabled the democratization of air transportation. The Company has alliances with American

Airlines and Air France-KLM, in addition to making available to Customers many codeshare and interline agreements, bringing more convenience

and ease of connections to any place served by these partnerships. With the purpose of "Being First for Everyone", GOL offers

the best travel experience to its passengers, including: the largest inventory of seats and the most legroom; the most complete platform

with internet, movies and live TV; and the best loyalty program, SMILES. In cargo transportation, GOLLOG delivers parcels to various regions

in Brazil and abroad. The Company has a team of 15,000 highly qualified airline professionals focused on Safety, GOL's number one value,

and operates a standardized fleet of 127 Boeing 737 aircraft. GOL's shares are traded on the NYSE (GOL) and the B3 (GOLL4). For further

information, visit www.voegol.com.br/ir.

Disclaimer

The information contained in this press release has not

been subject to any independent audit or review and contains “forward-looking” statements, estimates and projections that

relate to future events, which are, by their nature, subject to significant risks and uncertainties. All statements other than statements

of historical fact contained in this press release including, without limitation, those regarding GOL’s future financial position

and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets in which GOL operates or

is seeking to operate, and any statements preceded by, followed by or that include the words “believe”, “expect”,

“aim”, “intend”, “will”, “may”, “project”, “estimate”, “anticipate”,

“predict”, “seek”, “should” or similar words or expressions, are forward-looking statements. The future

events referred to in these forward-looking statements involve known and unknown risks, uncertainties, contingencies and other factors,

many of which are beyond GOL’s control, that may cause actual results, performance or events to differ materially from those expressed

or implied in these statements. These forward-looking statements are based on numerous assumptions regarding GOL’s present and future

business strategies and the environment in which GOL will operate in the future and are not a guarantee of future performance. Such forward-looking

statements speak only as at the date on which they are made. None of GOL or any of its affiliates, officers, directors, employees and

agents undertakes any duty or obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise, except to the extent required by law. None of GOL or any of its affiliates, officers, directors, employees, professional

advisors and agents make any representation, warranty or prediction that the results anticipated by such forward-looking statements will

be achieved, and such forward-looking statements represent, in each case, only one of many possible scenarios and should not be viewed

as the most likely or standard scenario. Although GOL believes that the estimates and projections in these forward-looking statements

are reasonable, they may prove materially incorrect and actual results may materially differ. As a result, you should not rely on these

forward-looking statements.

Non-GAAP

Measures

To be consistent with industry practice, GOL discloses so-called

non-GAAP financial measures which are not recognized under IFRS or U.S. GAAP, including “Net Debt”, “Adjusted Net Debt”,

“total liquidity” and "EBITDA". The Company’s management believes that disclosure of non-GAAP measures provides

useful information to investors, financial analysts and the public in their review of its operating performance and their comparison of

its operating performance to the operating performance of other companies in the same industry and other industries. However, these non-GAAP

items do not have standardized meanings and may not be directly comparable to similarly-titled items adopted by other companies. Potential

investors should not rely on information not recognized under IFRS as a substitute for the GAAP measures of earnings or liquidity in making

an investment decision.

|

2

|

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: January 10, 2022

|

GOL LINHAS AÉREAS INTELIGENTES S.A.

|

|

|

|

|

|

|

|

By:

|

/s/ Richard F. Lark, Jr.

|

|

|

|

Name: Richard F. Lark, Jr.

Title: Investor Relations Officer

|

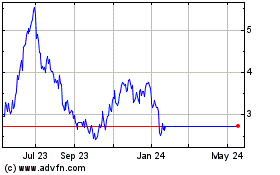

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Nov 2023 to Nov 2024