0001672013falseAugust 09, 202400016720132024-08-092024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 09, 2024

| | |

| Acushnet Holdings Corp. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-37935 | 45-2644353 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 333 Bridge Street | Fairhaven, | Massachusetts | 02719 |

| (Address of principal executive offices) | | | (Zip Code) |

(800) 225-8500

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock - $0.001 par value per share | | GOLF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 9, 2024, Magnus Holdings Co., Ltd. ("Magnus"), which is wholly-owned by Fila Holdings Corp. ("Fila"), sold 1,110,000 shares of common stock of Acushnet Holdings Corp. (the "Company") in a transaction exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Rule 144 (the "Rule 144 transaction"). Fila has informed the Company that the Rule 144 transaction was executed for liquidity purposes and that Fila currently plans to retain its majority stake in the Company. In connection with the Rule 144 transaction, Magnus entered into a lock-up agreement with the Company pursuant to which it has agreed to certain sale and transfer restrictions for a period of 30 days relating to its shares of the Company's common stock, subject to certain exceptions. The lock-up agreement is attached hereto as Exhibit 10.1 and incorporated by reference herein. Following the Rule 144 transaction, Magnus beneficially owned 50.7% of the outstanding common stock of the Company.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ACUSHNET HOLDINGS CORP. |

| |

| By: | /s/ Sean Sullivan |

| Name: | Sean Sullivan |

| Title: | Executive Vice President and Chief Financial Officer |

Date: August 09, 2024

Exhibit 10.1

LOCK-UP AGREEMENT

August 9, 2024

Acushnet Holdings Corp.

333 Bridge Street

Fairhaven, Massachusetts 02719

Ladies and Gentlemen:

The undersigned hereby agrees that, without the prior written consent of Acushnet Holdings Corp. (the “Company”), the undersigned will not, during the period ending 30 days after the date hereof (the “Lock-Up Period”), offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any shares of Common Stock, $0.001 per share par value, of the Company (the “Common Stock”) or any securities convertible into or exercisable or exchangeable for Common Stock (including without limitation, Common Stock or such other securities which may be deemed to be beneficially owned by the undersigned in accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”) and securities which may be issued upon exercise of a stock option or warrant) (collectively, the “Undersigned’s Securities”), or publicly disclose the intention to make any offer, sale, pledge or disposition, other than (A) (i) transfers to another corporation, partnership, limited liability company, trust or other business entity that is a direct or indirect affiliate (as defined in Rule 405 promulgated under the Securities Act of 1933, as amended (the “Securities Act”)) of the undersigned or (ii) distributions of the Undersigned’s Securities to limited partners, limited liability company members or stockholders of the undersigned or holders of similar equity interests in the undersigned, (B) transfers to a nominee or custodian of a person or entity to whom a disposition or transfer would be permissible under clause (A), (C) transfers to the Company, (D) tenders, sales or other transfers of the Undersigned’s Securities pursuant to a bona fide third-party tender offer, merger, consolidation or other similar transaction, made to all holders of Common Stock involving a Change of Control (as defined below) after the date hereof, provided that in the event that the tender offer, merger, consolidation or other such transaction is not consummated, the Undersigned’s Securities shall remain subject to the restrictions set forth herein, (E) transfers of the Undersigned’s Securities by operation of law or pursuant to an order of a court or regulatory agency; provided that in the case of any transfer or distribution pursuant to clauses (A) or (B), (i) such transfer shall not involve a disposition for value and (ii) each distributee shall execute and deliver to the Company a lock-up letter in the form of this letter agreement (“Letter Agreement”). For purposes of this Letter Agreement, “Change of Control” shall mean the transfer (whether by tender offer, merger, consolidation or other similar transaction), in one transaction or a series of related transactions, to a person or group of affiliated persons, of the Company’s voting securities if, after such transfer, such person or group of affiliated persons would hold more than 50% of the outstanding voting securities of the Company (or the surviving entity).

In addition, the foregoing restrictions shall not apply to pledges of shares of Common Stock or securities convertible into or exercisable or exchangeable for Common Stock pursuant to the requirements of one or more credit agreements entered into by the undersigned (the “Pledged Shares”); provided that the pledgee shall (x) if such pledge is in existence prior to the date hereof, execute and deliver to the Company a lock-up letter in the form of this Letter Agreement upon receipt of such shares of Common Stock or securities convertible into or exercisable or exchangeable for Common Stock or any exercise of its rights in respect of such shares of Common Stock or securities convertible into or exercisable or exchangeable for shares of Common Stock pursuant to the terms of such credit agreement and (y) if such pledge occurs on or after the date hereof, execute and deliver to the Company a lock-up agreement in the form of this Letter Agreement at the time such pledge is granted; provided, further, that, for the avoidance of doubt, upon the exercise of remedies and foreclosure of the Pledged Shares by the pledgee pursuant to the terms of such credit agreement as a result of an event of default thereunder, the undersigned may transfer, directly or indirectly, its Pledged Shares to the pledgee.

In furtherance of the foregoing, the Company, and any duly appointed transfer agent for the registration or transfer of the securities described herein, are hereby authorized to decline to make any transfer of securities if such transfer would constitute a violation or breach of this Letter Agreement.

The undersigned hereby represents and warrants that the undersigned has full power and authority to enter into this Letter Agreement. All authority herein conferred or agreed to be conferred and any obligations of the undersigned shall be binding upon the successors, assigns, or heir of the undersigned.

This Letter Agreement and any claim, controversy or dispute arising under or related to this Letter Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, without regard to the conflict of laws principles thereof. Any action brought in connection with this Letter Agreement shall be brought in the federal or state courts located in the Borough of Manhattan in the City of New York, and the parties hereby irrevocably consent to the jurisdiction of such courts and waive any objections as to venue or inconvenient forum.

[Remainder of page intentionally left blank]

| | | | | |

| Very truly yours, |

| MAGNUS HOLDINGS CO., LTD. |

|

| By: | /s/ Ho Yeon Lee |

| Name: | Ho Yeon Lee |

| Title: | Chief Executive Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

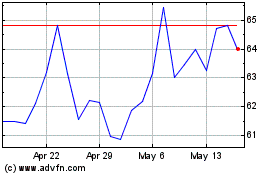

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Oct 2024 to Nov 2024

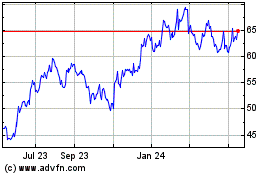

Acushnet (NYSE:GOLF)

Historical Stock Chart

From Nov 2023 to Nov 2024