000170916412/312024Q1FALSEhttp://fasb.org/us-gaap/2023#AccountsPayableCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableCurrenthttp://fasb.org/us-gaap/2023#AccountsPayableCurrentP1Y505000017091642024-01-012024-03-310001709164us-gaap:CommonClassAMember2024-05-03xbrli:shares0001709164us-gaap:CommonClassBMember2024-05-0300017091642024-03-31iso4217:USD00017091642023-12-3100017091642023-03-31iso4217:USDxbrli:shares0001709164us-gaap:CommonClassAMember2024-03-310001709164us-gaap:CommonClassAMember2023-12-310001709164us-gaap:CommonClassAMember2023-03-310001709164us-gaap:CommonClassBMember2024-03-310001709164us-gaap:CommonClassBMember2023-12-310001709164us-gaap:CommonClassBMember2023-03-3100017091642023-01-012023-03-3100017091642022-12-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001709164us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001709164us-gaap:AdditionalPaidInCapitalMember2023-12-310001709164us-gaap:TreasuryStockCommonMember2023-12-310001709164us-gaap:RetainedEarningsMember2023-12-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001709164us-gaap:RetainedEarningsMember2024-01-012024-03-310001709164us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001709164us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001709164us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-03-310001709164us-gaap:AdditionalPaidInCapitalMember2024-03-310001709164us-gaap:TreasuryStockCommonMember2024-03-310001709164us-gaap:RetainedEarningsMember2024-03-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001709164us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001709164us-gaap:AdditionalPaidInCapitalMember2022-12-310001709164us-gaap:TreasuryStockCommonMember2022-12-310001709164us-gaap:RetainedEarningsMember2022-12-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001709164us-gaap:RetainedEarningsMember2023-01-012023-03-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001709164us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-01-012023-03-310001709164us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001709164us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001709164us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001709164us-gaap:AdditionalPaidInCapitalMember2023-03-310001709164us-gaap:TreasuryStockCommonMember2023-03-310001709164us-gaap:RetainedEarningsMember2023-03-310001709164us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001709164srt:MaximumMember2024-03-3100017091642023-01-012023-12-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-03-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-03-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2024-03-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2023-03-310001709164us-gaap:FairValueMeasurementsRecurringMember2024-03-310001709164us-gaap:FairValueMeasurementsRecurringMember2023-12-310001709164us-gaap:FairValueMeasurementsRecurringMember2023-03-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2024-03-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2023-12-310001709164us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2023-03-310001709164us-gaap:LetterOfCreditMemberhbb:HBBFacilityMember2024-03-31xbrli:pure0001709164us-gaap:CommonClassBMember2024-01-012024-03-310001709164us-gaap:CommonClassBMember2023-01-012023-03-310001709164us-gaap:CommonClassAMember2024-01-012024-03-310001709164us-gaap:CommonClassAMember2023-01-012023-03-310001709164hbb:IncentivePlanMemberus-gaap:CommonClassAMember2024-03-052024-03-050001709164us-gaap:CommonClassAMember2023-11-300001709164us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001709164us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-03-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310001709164us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-03-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310001709164us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001709164us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310001709164us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001709164us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001709164us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001709164srt:MaximumMemberhbb:ElectricAppliancesMember2024-01-012024-03-310001709164srt:MinimumMemberus-gaap:ProductAndServiceOtherMember2024-01-012024-03-310001709164srt:MaximumMemberus-gaap:ProductAndServiceOtherMember2024-01-012024-03-310001709164hbb:ConsumerProductMembersrt:MaximumMember2024-01-012024-03-310001709164srt:MaximumMemberhbb:CommercialProductMember2024-01-012024-03-310001709164hbb:ConsumerProductMember2024-01-012024-03-310001709164hbb:ConsumerProductMember2023-01-012023-03-310001709164hbb:CommercialProductMember2024-01-012024-03-310001709164hbb:CommercialProductMember2023-01-012023-03-310001709164hbb:LicensingMember2024-01-012024-03-310001709164hbb:LicensingMember2023-01-012023-03-310001709164us-gaap:GeographicConcentrationRiskMemberhbb:CommercialProductMembercountry:USus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-03-310001709164us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberhbb:CommercialProductMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-03-310001709164srt:MinimumMember2024-03-31hbb:numberOfSite0001709164hbb:HealthBeaconMember2024-02-022024-02-02iso4217:EUR0001709164hbb:HealthBeaconMember2024-01-012024-03-310001709164hbb:HealthBeaconMember2024-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 10-Q

| | | | | | | | | | | |

| (Mark One) | | | |

| ☑ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended | March 31, 2024 |

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number: 001-38214

| | | | | | | | | | | | | | | | | |

| HAMILTON BEACH BRANDS HOLDING COMPANY | |

| (Exact name of registrant as specified in its charter) |

| | | | | |

| Delaware | | | 31-1236686 | |

| (State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer Identification No.) | |

| | | | | |

| 4421 WATERFRONT DR. | GLEN ALLEN | VA | 23060 | |

| (Address of principal executive offices) | (Zip code) | |

| | | | | |

| | (804) | 273-9777 | | |

| (Registrant’s telephone number, including area code) |

| | | | | |

| | N/A | | |

| (Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

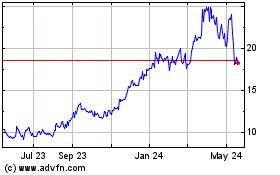

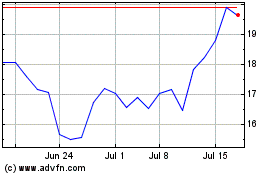

| Class A Common Stock, Par Value $0.01 Per Share | | HBB | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | þ | Non-accelerated filer | o | Smaller reporting company | ☑ | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

Number of shares of Class A Common Stock outstanding as of May 3, 2024: 10,534,277

Number of shares of Class B Common Stock outstanding as of May 3, 2024: 3,611,746

HAMILTON BEACH BRANDS HOLDING COMPANY

TABLE OF CONTENTS

| | | | | | | | | | | | | | | | | |

| | | | | | Page Number |

Part I. | | FINANCIAL INFORMATION | |

| | | | | |

| | | Item 1 | | Financial Statements | |

| | | | | |

| | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | Item 2 | | | |

| | | | | |

| | Item 3 | | | |

| | | | | |

| | Item 4 | | | |

| | | | | |

Part II. | | OTHER INFORMATION | |

| | | | | |

| | Item 1 | | | |

| | | | | |

| | Item 1A | | | |

| | | | | |

| | Item 2 | | | |

| | | | | |

| | Item 3 | | | |

| | | | | |

| | Item 4 | | | |

| | | | | |

| | Item 5 | | | |

| | | | | |

| | Item 6 | | Exhibits | |

| | | | | |

| | | | | |

| | | | | |

Part I

FINANCIAL INFORMATION

Item 1. Financial Statements

HAMILTON BEACH BRANDS HOLDING COMPANY

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | |

| MARCH 31

2024 | | DECEMBER 31

2023 | | MARCH 31

2023 |

| | (In thousands) |

| Assets | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 26,279 | | | $ | 15,370 | | | $ | 2,218 | |

| Trade receivables, net | 89,596 | | | 135,434 | | | 90,310 | |

| Inventory | 133,523 | | | 126,554 | | | 131,542 | |

| | | | | |

| Prepaid expenses and other current assets | 12,893 | | | 9,457 | | | 11,618 | |

| | | | | |

| Total current assets | 262,291 | | | 286,815 | | | 235,688 | |

| Property, plant and equipment, net | 36,851 | | | 27,401 | | | 27,216 | |

| Right-of-use lease assets | 37,848 | | | 39,423 | | | 42,652 | |

| Goodwill | 6,253 | | | 6,253 | | | 6,253 | |

| Other intangible assets, net | 2,375 | | | 1,292 | | | 1,442 | |

| Deferred income taxes | 2,410 | | | 2,581 | | | 3,047 | |

| Deferred costs | 14,550 | | | 14,613 | | | 14,371 | |

| | | | | |

| Other non-current assets | 6,372 | | | 6,324 | | | 5,938 | |

| | | | | |

| Total assets | $ | 368,950 | | | $ | 384,702 | | | $ | 336,607 | |

| Liabilities and stockholders’ equity | | | | | |

| Current liabilities | | | | | |

| Accounts payable | $ | 96,579 | | | $ | 99,704 | | | $ | 51,261 | |

| | | | | |

| | | | | |

| Accrued compensation | 5,701 | | | 14,948 | | | 13,464 | |

| Accrued product returns | 6,135 | | | 6,232 | | | 5,551 | |

| Lease liabilities | 6,086 | | | 6,155 | | | 5,918 | |

| Other current liabilities | 11,693 | | | 12,549 | | | 12,072 | |

| | | | | |

| Total current liabilities | 126,194 | | | 139,588 | | | 88,266 | |

| Revolving credit agreements | 50,000 | | | 50,000 | | | 79,333 | |

| Lease liabilities, non-current | 41,009 | | | 41,937 | | | 45,317 | |

| Other long-term liabilities | 6,340 | | | 5,910 | | | 5,262 | |

| | | | | |

| Total liabilities | 223,543 | | | 237,435 | | | 218,178 | |

| Stockholders’ equity | | | | | |

Preferred stock, par value $0.01 per share | — | | | — | | | — | |

| Class A Common stock | 114 | | | 112 | | | 111 | |

| Class B Common stock | 36 | | | 36 | | | 36 | |

| Capital in excess of par value | 72,303 | | | 70,401 | | | 65,803 | |

| Treasury stock | (12,567) | | | (12,013) | | | (8,939) | |

| Retained earnings | 96,705 | | | 99,398 | | | 74,001 | |

| Accumulated other comprehensive loss | (11,184) | | | (10,667) | | | (12,583) | |

| Total stockholders’ equity | 145,407 | | | 147,267 | | | 118,429 | |

| Total liabilities and stockholders’ equity | $ | 368,950 | | | $ | 384,702 | | | $ | 336,607 | |

See notes to unaudited consolidated financial statements.

HAMILTON BEACH BRANDS HOLDING COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | |

| | THREE MONTHS ENDED

MARCH 31 | | |

| | 2024 | | 2023 | | | | |

| | (In thousands, except per share data) | | |

| Revenue | $ | 128,277 | | | $ | 128,252 | | | | | |

| Cost of sales | 98,223 | | | 107,342 | | | | | |

| Gross profit | 30,054 | | | 20,910 | | | | | |

| Selling, general and administrative expenses | 30,947 | | | 25,919 | | | | | |

| Amortization of intangible assets | 50 | | | 50 | | | | | |

| Operating profit (loss) | (943) | | | (5,059) | | | | | |

| Interest expense, net | 156 | | | 1,269 | | | | | |

| Other expense (income), net | 173 | | | 16 | | | | | |

| Income (loss) before income taxes | (1,272) | | | (6,344) | | | | | |

| Income tax expense (benefit) | (110) | | | (1,567) | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) | $ | (1,162) | | | $ | (4,777) | | | | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted earnings (loss) per share | $ | (0.08) | | | $ | (0.34) | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic weighted average shares outstanding | 14,162 | | | 14,073 | | | | | |

| Diluted weighted average shares outstanding | 14,162 | | | 14,073 | | | | | |

See notes to unaudited consolidated financial statements.

HAMILTON BEACH BRANDS HOLDING COMPANY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| | | | | | | | | | | | | | | |

| | THREE MONTHS ENDED

MARCH 31 | | |

| | 2024 | | 2023 | | | | |

| | (In thousands) | | |

| Net income (loss) | $ | (1,162) | | | $ | (4,777) | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation adjustment | (1,097) | | | 69 | | | | | |

| (Loss) gain on long-term intra-entity foreign currency transactions | — | | | 452 | | | | | |

| Cash flow hedging activity | 37 | | | (1,437) | | | | | |

| | | | | | | |

| Reclassification of hedging activities into earnings | 472 | | | 187 | | | | | |

| | | | | | | |

| Reclassification of pension adjustments into earnings | 71 | | | 64 | | | | | |

| Total other comprehensive income (loss), net of tax | (517) | | | (665) | | | | | |

| Comprehensive income (loss) | $ | (1,679) | | | $ | (5,442) | | | | | |

See notes to unaudited consolidated financial statements.

HAMILTON BEACH BRANDS HOLDING COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) | | | | | | | | | | | |

| | THREE MONTHS ENDED

MARCH 31 |

| | 2024 | | 2023 |

| | (In thousands) |

| Operating activities | | | |

| Net income (loss) | $ | (1,162) | | | $ | (4,777) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | | | |

| Depreciation and amortization | 1,188 | | | 1,004 | |

| | | |

| Stock compensation expense | 1,904 | | | 797 | |

| | | |

| Other | 1,255 | | | (220) | |

| Net changes in operating assets and liabilities: | | | |

| | | |

| Trade receivables | 46,236 | | | 25,292 | |

| Inventory | (9,614) | | | 25,030 | |

| Other assets | (3,074) | | | 1,082 | |

| Accounts payable | (3,102) | | | (10,392) | |

| Other liabilities | (13,930) | | | (2,942) | |

| Net cash provided by (used for) operating activities | 19,701 | | | 34,874 | |

| Investing activities | | | |

| Expenditures for property, plant and equipment | (942) | | | (464) | |

| Acquisition of business, net of cash acquired | (7,412) | | | — | |

| | | |

| Issuance of secured loan | (600) | | | — | |

| Repayment of secured loan | 2,205 | | | — | |

| Other | — | | | (150) | |

| Net cash provided by (used for) investing activities | (6,749) | | | (614) | |

| Financing activities | | | |

| Net additions (reductions) to revolving credit agreements | — | | | (31,567) | |

| | | |

| Cash dividends paid | (1,531) | | | (1,460) | |

| | | |

| | | |

| Purchase of treasury stock | (554) | | | — | |

| Net cash provided by (used for) financing activities | (2,085) | | | (33,027) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (2) | | | 57 | |

| Cash, cash equivalents and restricted cash | | | |

| Increase (decrease) for the period | 10,865 | | | 1,290 | |

| | | |

| Balance at the beginning of the period | 16,379 | | | 1,905 | |

| Balance at the end of the period | $ | 27,244 | | | $ | 3,195 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash | | | |

| | | |

| Cash and cash equivalents | $ | 26,279 | | | $ | 2,218 | |

| Restricted cash included in prepaid expenses and other current assets | 51 | | | 62 | |

| Restricted cash included in other non-current assets | 914 | | | 915 | |

| | | |

| Total cash, cash equivalents and restricted cash | $ | 27,244 | | | $ | 3,195 | |

See notes to unaudited consolidated financial statements.

HAMILTON BEACH BRANDS HOLDING COMPANY

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock | Class B Common Stock | Capital in Excess of Par Value | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total Stockholders’ Equity |

| (In thousands, except per share data) |

| Balance, January 1, 2024 | $ | 112 | | $ | 36 | | $ | 70,401 | | $ | (12,013) | | $ | 99,398 | | $ | (10,667) | | $ | 147,267 | |

| Net income (loss) | — | | — | | — | | — | | (1,162) | | — | | (1,162) | |

| Purchase of treasury stock | — | | — | | — | | (554) | | — | | — | | (554) | |

| Issuance of common stock, net of conversions | 2 | | — | | (2) | | — | | — | | — | | — | |

| Share-based compensation expense | — | | — | | 1,904 | | — | | — | | — | | 1,904 | |

Cash dividends, $0.11 per share | — | | — | | — | | — | | (1,531) | | — | | (1,531) | |

| Other comprehensive income (loss), net of tax | — | | — | | — | | — | | — | | (1,060) | | (1,060) | |

| Reclassification adjustment to net income (loss) | — | | — | | — | | — | | — | | 543 | | 543 | |

| Balance, March 31, 2024 | 114 | | 36 | | 72,303 | | (12,567) | | 96,705 | | (11,184) | | 145,407 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Balance, January 1, 2023 | $ | 107 | | $ | 38 | | $ | 65,008 | | $ | (8,939) | | $ | 80,238 | | $ | (11,918) | | $ | 124,534 | |

| Net income (loss) | — | | — | | — | | — | | (4,777) | | — | | (4,777) | |

| Issuance of common stock, net of conversions | 4 | | (2) | | (2) | | — | | — | | — | | — | |

| | | | | | | |

| Share-based compensation expense | — | | — | | 797 | | — | | — | | — | | 797 | |

Cash dividends, $0.105 per share | — | | — | | — | | — | | (1,460) | | — | | (1,460) | |

| Other comprehensive income (loss), net of tax | — | | — | | — | | — | | — | | (916) | | (916) | |

| Reclassification adjustment to net income (loss) | — | | — | | — | | — | | — | | 251 | | 251 | |

| Balance, March 31, 2023 | 111 | | 36 | | 65,803 | | (8,939) | | 74,001 | | (12,583) | | 118,429 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See notes to unaudited consolidated financial statements.

HAMILTON BEACH BRANDS HOLDING COMPANY

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2024

(Tabular amounts in thousands, except as noted and per share amounts)

NOTE 1—Basis of Presentation and Recently Issued Accounting Standards

Basis of Presentation

Throughout this Quarterly Report on Form 10-Q and the notes to unaudited consolidated financial statements, references to “Hamilton Beach Holding”, “the Company”, “we”, “us” and “our” and similar references are to Hamilton Beach Brands Holding Company and its subsidiaries on a consolidated basis unless otherwise noted or as the context otherwise requires. Hamilton Beach Brands Holding Company is a holding company and operates through its indirect, wholly owned subsidiary, Hamilton Beach Brands, Inc., a Delaware corporation (“HBB”). HBB is the Company’s single reportable segment.

We are a leading designer, marketer and distributor of a wide range of branded small electric household and specialty housewares appliances, as well as commercial products for restaurants, fast food chains, bars and hotels, and are a provider of connected devices and software for healthcare management.

The financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim financial information. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments of a normal recurring nature considered necessary for a fair presentation have been included. These financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Operating results for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the remainder of the year due to the highly seasonal nature of the Company’s primary markets. A majority of revenue and operating profit typically occurs in the second half of the calendar year when sales of products to retailers and consumers historically increase significantly for the fall holiday-selling season.

Accounting Standards Not Yet Adopted

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures,” which updates reportable segment disclosure requirements on an annual and interim basis. The amendments are effective for the annual period ending December 31, 2024, and the interim periods thereafter. Early adoption is permitted. Updates should be applied retrospectively to all prior periods presented in the financial statements. Adoption of this ASU may result in additional disclosure, but it will not impact the Company’s consolidated financial position, results of operations or cash flows.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which enhances income tax disclosure requirements primarily involving more detailed disclosure for income taxes paid and the effective tax rate reconciliation. The amendments are effective for annual periods beginning after December 15, 2024. Early adoption is permitted. The amendments should be applied prospectively but retrospective application is permitted. Adoption of this ASU may result in additional disclosure, but it will not impact the Company’s consolidated financial position, results of operations or cash flows.

U.S. Pension Plan Termination

During 2022, the Board approved the termination of our U.S. defined benefit pension plan (the “Plan”) with an effective date of September 30, 2022. The termination process is still ongoing and is expected to be completed in 2024. Benefit obligations under the Plan will be settled through a combination of lump sum payments to eligible plan participants and the purchase of a group annuity contract, under which future benefit obligations will be transferred to a third-party insurance company. The Company currently expects that all surplus assets remaining after the Plan termination will be transferred to a qualified replacement plan. The surplus assets as of December 31, 2023 were $12.2 million. The deferred loss of $6.6 million as of March 31, 2024 within Accumulated Other Comprehensive Income will be recognized fully when the plan is terminated or as settlements occur, which would trigger accelerated recognition.

Accounts payable - Supplier Finance Program

The Company has an agreement with a third-party administrator to provide an accounts payable tracking system which facilitates a participating supplier’s ability to monitor and voluntarily elect to sell payment obligations owed by the Company to the designated third-party financial institution. Participating suppliers can sell one or more of the Company’s payment obligations at their sole discretion. The Company has no economic interest in a supplier’s decision to sell one or more of its payment obligations. The Company’s rights and obligations with respect to such payment obligations, including amounts due and scheduled payment terms, are not impacted by suppliers’ decisions to sell amounts under these arrangements. The agreement has a limit of $60.0 million in payment obligations ($85.0 million during peak season from August to January). There is no requirement to provide assets pledged as security or other forms of guarantees under the agreement. The Company pays the third-party administrator based upon the original payment terms negotiated with participating suppliers. The payment of these obligations by the Company is included in cash used in operating activities in the Consolidated Statement of Cash Flows. As of March 31, 2024, December 31, 2023 and March 31, 2023, the Company has $54.8 million, $55.0 million and $30.4 million, respectively, in outstanding payment obligations that are presented in Accounts payable on the Consolidated Balance Sheets. Of these totals, the third-party financial institution has made payments to participating suppliers to settle $46.1 million, $48.9 million and $30.3 million, respectively, of our outstanding payment obligations.

NOTE 2—Transfer of Financial Assets

The Company has entered into an arrangement with a financial institution to sell certain U.S. trade receivables on a non-recourse basis. Under the terms of the agreement, the Company receives cash proceeds and retains no rights or interest and has no obligations with respect to the sold receivables. These transactions, which are accounted for as sold receivables, result in a reduction in trade receivables because the agreement transfers effective control over and risk related to the receivables to the buyer. Under this arrangement, the Company derecognized $30.1 million and $29.7 million of trade receivables during the three months ending March 31, 2024 and March 31, 2023, respectively, and $128.7 million during the year ending December 31, 2023. The loss incurred on sold receivables in the consolidated results of operations for the three months ended March 31, 2024 and 2023 was not material. The Company does not carry any servicing assets or liabilities. Cash proceeds from this arrangement are reflected as operating activities in the Consolidated Statements of Cash Flows.

NOTE 3—Fair Value Disclosure

The following table presents the Company’s assets and liabilities accounted for at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Balance Sheet Location | | MARCH 31

2024 | | DECEMBER 31

2023 | | MARCH 31

2023 |

| Assets: | | | | | | | | |

| Interest rate swap agreements | | | | | | | | |

| Current | | Prepaid expenses and other current assets | | $ | 1,120 | | | $ | 511 | | | $ | 1,064 | |

| Long-term | | Other non-current assets | | 3,579 | | | 3,501 | | | 3,168 | |

| Foreign currency exchange contracts | | | | | | | | |

| Current | | Prepaid expenses and other current assets | | — | | | — | | | 49 | |

| | | | $ | 4,699 | | | $ | 4,012 | | | $ | 4,281 | |

| Liabilities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Foreign currency exchange contracts | | | | | | | | |

| Current | | Other current liabilities | | 607 | | | 538 | | | 357 | |

| | | | $ | 607 | | | $ | 538 | | | $ | 357 | |

The Company measures its derivatives at fair value using significant observable inputs, which is Level 2 as defined in the fair value hierarchy. The Company uses a present value technique that incorporates the Secured Overnight Financing Rate (SOFR) swap curve, foreign currency spot rates and foreign currency forward rates to value its derivatives, including its interest rate swap agreements and foreign currency exchange contracts. The Company also incorporates the effect of HBB and counterparty credit risk into the valuation.

Other Fair Value Measurement Disclosures

The carrying amounts of cash and cash equivalents, trade receivables and accounts payable approximate fair value due to the short-term maturities of these instruments. The fair value of HBB’s $150.0 million senior secured floating-rate revolving credit facility (the “HBB Facility”), including book overdrafts, which approximate book value, was determined using current rates offered for similar obligations taking into account HBB’s credit risk, which is Level 2 as defined in the fair value hierarchy.

There were no transfers into or out of Levels 1, 2 or 3 during the three months ended March 31, 2024.

NOTE 4—Stockholders’ Equity

Capital Stock

The following table sets forth the Company’s authorized capital stock information:

| | | | | | | | | | | | | | | | | |

| MARCH 31

2024 | | DECEMBER 31

2023 | | MARCH 31

2023 |

| |

Preferred stock, par value $0.01 per share | | | | | |

| Preferred stock authorized | 5,000 | | | 5,000 | | | 5,000 | |

| Preferred stock outstanding | — | | | — | | | — | |

Class A Common stock, par value $0.01 per share | | | | | |

| Class A Common authorized | 70,000 | | | 70,000 | | | 70,000 | |

Class A Common issued (1)(2) | 11,427 | | | 11,161 | | | 11,070 | |

Treasury Stock (3) | 907 | | | 877 | | | 626 | |

Class B Common stock, par value $0.01 per share, convertible into Class A Common stock on a one-for-one basis | | | | | |

| Class B Common authorized | 30,000 | | | 30,000 | | | 30,000 | |

Class B Common issued (1) | 3,612 | | | 3,616 | | | 3,629 | |

(1) Class B Common converted to Class A Common were 4 and 215 shares during the three months ending March 31, 2024 and 2023, respectively.

(2) The Company issued Class A Common of 262 and 192 shares during the three months ending March 31, 2024 and 2023, respectively.

(3) On March 5, 2024, a total of 30 mandatory cashless-exercise-award shares of Class A Common were surrendered to the Company by the participants of our Executive Long-Term Equity Incentive Compensation Plan (the “Incentive Plan”) in order to satisfy the participants’ tax withholding obligations with respect to shares of Class A Common awarded under the Incentive Plan on March 5, 2024.

Stock Repurchase Program: In November 2023, the Company’s Board approved a stock repurchase program for the purchase of up to $25 million of the Company’s Class A Common outstanding starting January 1, 2024 and ending December 31, 2025. This program replaced the previous stock repurchase plan that started February 22, 2022 and ended December 31, 2023. There were no share repurchases during the three months ended March 31, 2024 or 2023. During the year ended December 31, 2023, the Company repurchased 250,772 shares for an aggregate purchase price of $3.1 million. As of March 31, 2024, the Company had $25.0 million remaining authorized for repurchase.

Accumulated Other Comprehensive Loss: The following table summarizes changes in accumulated other comprehensive loss by component and related tax effects for periods shown:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Foreign Currency | | Deferred Gain (Loss) on Cash Flow Hedging | | Pension Plan Adjustment | | Total |

| | | | | | | |

| Balance, January 1, 2024 | $ | (6,412) | | | $ | 2,424 | | | $ | (6,679) | | | $ | (10,667) | |

| Other comprehensive income (loss) | (1,097) | | | 29 | | | — | | | (1,068) | |

| Reclassification adjustment to net income (loss) | — | | | 647 | | | 94 | | | 741 | |

| Tax effects | — | | | (167) | | | (23) | | | (190) | |

| Balance, March 31, 2024 | $ | (7,509) | | | $ | 2,933 | | | $ | (6,608) | | | $ | (11,184) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Balance, January 1, 2023 | $ | (8,924) | | | $ | 4,158 | | | $ | (7,152) | | | $ | (11,918) | |

| Other comprehensive income (loss) | 715 | | | (1,881) | | | — | | | (1,166) | |

| Reclassification adjustment to net income (loss) | — | | | 252 | | | 87 | | | 339 | |

| Tax effects | (194) | | | 379 | | | (23) | | | 162 | |

| Balance, March 31, 2023 | $ | (8,403) | | | $ | 2,908 | | | $ | (7,088) | | | $ | (12,583) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

NOTE 5—Revenue

Revenue is recognized when control of the promised goods or services is transferred to the Company’s customers, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services, which includes an estimate for variable consideration.

The Company’s warranty program to the consumer consists generally of an assurance-type limited warranty lasting for varying periods of up to ten years for electric appliances, with the majority of products having a warranty of one to three years. There is no guarantee to the consumer as the Company may repair or replace, in its discretion, products returned under warranty. Accordingly, the Company determined that no separate performance obligation exists.

The Company’s products are not sold with a general right of return. Subject to certain terms and conditions, however, the Company will agree to accept a portion of products sold that, based on historical experience, are estimated to be returned for reasons such as product failure and excess inventory stocked by the customer. Product returns, customer programs and incentive offerings, including special pricing agreements, price competition, promotions and other volume-based incentives are accounted for as variable consideration.

A description of revenue sources and performance obligations for the Company are as follows:

Consumer and Commercial product revenue

Transactions with both consumer and commercial customers generally originate upon the receipt of a purchase order from a customer, which in some cases are governed by master sales agreements, specifying product(s) that the customer desires. Contracts for product revenue have an original duration of one year or less, and payment terms are generally standard and based on customer creditworthiness. Revenue from product sales is recognized at the point in time when control transfers to the customer, which is either when a product is shipped from a Company facility, or delivered to customers, depending on the shipping terms. The amount of revenue recognized varies primarily with price concessions and changes in returns. The Company offers price concessions to its customers for incentive offerings, special pricing agreements, price competition, promotions or other volume-based arrangements. The Company evaluated such agreements with its customers and determined returns and price concessions should be accounted for as variable consideration.

Consumer product revenue consists of sales of small electric household and specialty housewares appliances to traditional brick and mortar and ecommerce retailers, distributors and directly to the end consumer. A majority of this revenue is in North America.

Commercial product revenue consists of sales of products for restaurants, fast-food chains, bars and hotels. Approximately one-half of the Company’s commercial sales is in the U.S. and the other half is in markets across the globe.

License revenue

From time to time, the Company enters into exclusive and non-exclusive licensing agreements which grant the right to use certain of the Company’s intellectual property (“IP”) in connection with designing, manufacturing, distributing, advertising, promoting and selling the licensees’ products during the term of the agreement. The IP that is licensed generally consists of trademarks, trade names, patents, trade dress, logos and/or products (the “Licensed IP”). In exchange for granting the right to use the Licensed IP, the Company receives a royalty payment, which is a function of (1) the total net sales of products that use the Licensed IP and (2) the royalty percentage that is stated in the licensing agreement. The Company recognizes revenue at the later of when the subsequent sales occur or when the performance obligation is satisfied over time. Additionally, the Company enters into agreements which grant the right to use software for healthcare management. The Company receives a license payment which is recognized when the performance obligation is satisfied over time.

Lease revenue

The Company leases connected devices to specialty pharmacy networks and pharmaceutical companies and is accounted for under Accounting Standards Codification 842, Leases as operating leases.

The following table sets forth Company’s revenue on a disaggregated basis for the three months ended March 31:

| | | | | | | | | | | | | | | |

| THREE MONTHS ENDED

MARCH 31 | | |

| | 2024 | | 2023 | | | | |

| Type of good or service: | | | | | | | |

| Consumer products | $ | 112,750 | | | $ | 113,432 | | | | | |

| Commercial products | 13,453 | | | 13,404 | | | | | |

| Licensing | 1,615 | | | 1,416 | | | | | |

| Leasing | 459 | | | — | | | | | |

| Total revenues | $ | 128,277 | | | $ | 128,252 | | | | | |

NOTE 6—Contingencies

The Company is involved in various legal and regulatory proceedings and claims that have arisen in the ordinary course of business, including product liability, patent infringement, asbestos related claims, environmental and other claims. Although it is difficult to predict the ultimate outcome of these proceedings and claims, the Company believes the ultimate disposition of these matters will not have a material adverse effect on the financial condition, results of operation or cash flows of the Company. Any costs that the Company estimates will be paid as a result of these claims are accrued when the liability is considered probable and the amount of such costs can be reasonably estimated. If a range of amounts can be reasonably estimated and no amount within the range is a better estimate than any other amount, then the minimum of the range is accrued. The Company does not accrue liabilities when the likelihood that the liability has been incurred is probable but the amount cannot be reasonably estimated or when the liability is believed to be only reasonably possible or remote. For contingencies where an unfavorable outcome is probable or reasonably possible and which are material, the Company discloses the nature of the contingency and, in some circumstances, an estimate of the possible loss.

Proceedings and claims asserted against the Company are subject to inherent uncertainties and unfavorable rulings could occur. If an unfavorable ruling were to occur, there exists the possibility of an adverse impact on the Company’s financial position and on the results of operations and cash flows for the period in which the ruling occurs, or in future periods.

Environmental matters

The Company is investigating or remediating historical environmental contamination at some current and former sites operated by the Company or by businesses it acquired. Based on the current stage of the investigation or remediation at each known site, the Company estimates the total investigation and remediation costs and the period of assessment and remediation activity required for each site. The estimate of future investigation and remediation costs is primarily based on variables associated with site clean-up, including, but not limited to, physical characteristics of the site, the nature and extent of the contamination and applicable regulatory programs and remediation standards.

No assessment can fully characterize all subsurface conditions at a site. There is no assurance that additional assessment and remediation efforts will not result in adjustments to estimated remediation costs or the time frame for remediation at these sites.

The Company’s estimates of investigation and remediation costs may change if it discovers contamination at additional sites or additional contamination at known sites, if the effectiveness of its current remediation efforts change, if applicable federal or state regulations change or if the Company’s estimate of the time required to remediate the sites changes. The Company’s current estimates may differ materially from original estimates.

As of March 31, 2024, December 31, 2023 and March 31, 2023, the Company had accrued undiscounted obligations of $3.3 million, $3.4 million and $3.3 million, respectively, for environmental investigation and remediation activities. The Company estimates that it is reasonably possible that it may incur additional expenses in the range of zero to $1.5 million related to the environmental investigation and remediation at these sites. As of March 31, 2024, the Company has $1.0 million, classified as restricted cash, associated with reimbursement of environmental investigation and remediation costs from a responsible party in exchange for release from all future obligations for one site. Additionally, the Company has a $1.2 million asset associated with the reimbursement of costs associated with two sites.

NOTE 7—Income Taxes

The Company’s provision for income taxes for interim periods is determined using an estimate of its annual effective tax rate, adjusted for discrete items, if any, that arise during the period. Each quarter, the Company updates its estimate of the annual effective tax rate, and if the estimated annual effective tax rate changes, the Company makes a cumulative adjustment in such period.

The effective tax rate was 8.6% and 24.7% on loss for the three months ended March 31, 2024 and 2023, respectively. The effective tax rate for the three months ended March 31, 2024 was impacted by the exclusion of the foreign losses of HealthBeacon PLC (“HealthBeacon”) requiring a full valuation allowance for which no benefit can be recognized.

NOTE 8—Acquisitions

On February 2, 2024, we completed the acquisition of HealthBeacon, a medical technology firm and strategic partner of the Company, for €6.9 million (approximately $7.5 million). The transaction was funded with cash on hand.

The acquisition of HealthBeacon was accounted for as a business combination using the acquisition method of accounting. The results of operations for HealthBeacon are included in the accompanying Consolidated Statements of Operations from the acquisition date (February 2, 2024) until March 31, 2024. HealthBeacon had $0.6 million in revenue and $1.1 million in operating loss that was included in our consolidated financial statements for the three months ended March 31, 2024. Pro forma financial information has not been presented, as revenue and expenses related to the acquisition do not have a material impact on the Company’s unaudited consolidated financial statements.

The determination and allocation of purchase price consideration is based on preliminary estimates of fair value; such estimates and assumptions are subject to change within the measurement period (up to one year from the acquisition date). As of March 31, 2024, the purchase price allocation for HealthBeacon is preliminary as we assess and gather additional information regarding the fair value of the assets acquired and liabilities assumed as of the acquisition date, primarily in the relation to the valuations of property and equipment and intangible assets as well as certain working capital related accounts. These differences could have a material impact on our results of operations and financial position

During the three months ended March 31, 2024, we incurred transaction costs of approximately $1.0 million, which are included in Selling, general, and administrative expenses.

The following table presents the preliminary value of assets acquired and liabilities assumed and will be finalized pending completion of purchase accounting matters:

| | | | | |

| Preliminary Fair Values as of

February 2, 2024

|

| Cash and cash equivalents | $ | 147 | |

| |

| |

| Current assets | 1,452 | |

| Property, plant and equipment, net | 7,449 | |

| |

| Other intangible assets, net | 1,133 | |

| |

| Total assets acquired | 10,181 | |

| Liabilities, current | 2,006 | |

| Liabilities, non-current | 616 | |

| Total liabilities acquired | 2,622 | |

| Purchase Price | $ | 7,559 | |

Item 2. - Management’s Discussion and Analysis of Financial Condition and Results of Operations

(Dollars in thousands, except as noted and per share data)

Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon management’s current expectations and are subject to various uncertainties and changes in circumstances. Important factors that could cause actual results to differ materially from those described in these forward-looking statements are set forth below under the heading “Forward-Looking Statements.”

HBB is the Company’s single reportable segment.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

For a summary of the Company’s critical accounting policies, refer to “Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies and Estimates” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as there have been no material changes from those disclosed in the Annual Report.

RESULTS OF OPERATIONS

The Company’s business is seasonal, and a majority of revenue and operating profit typically occurs in the second half of the year when sales of small electric appliances and kitchenware historically increase significantly for the fall holiday-selling season.

First Quarter of 2024 Compared with First Quarter of 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THREE MONTHS ENDED

MARCH 31 |

| | | | | | | | | Increase / (Decrease) |

| 2024 | | % of Revenue | | 2023 | | % of Revenue | | $ Change | | % Change |

| Revenue | $ | 128,277 | | | 100.0 | % | | $ | 128,252 | | | 100.0 | % | | $ | 25 | | | — | % |

| Cost of sales | 98,223 | | | 76.6 | % | | 107,342 | | | 83.7 | % | | (9,119) | | | (8.5) | % |

| Gross profit | 30,054 | | | 23.4 | % | | 20,910 | | | 16.3 | % | | 9,144 | | | 43.7 | % |

| Selling, general and administrative expenses | 30,947 | | | 24.1 | % | | 25,919 | | | 20.2 | % | | 5,028 | | | 19.4 | % |

| Amortization of intangible assets | 50 | | | — | % | | 50 | | | — | % | | — | | | — | % |

| Operating profit (loss) | (943) | | | (0.7) | % | | (5,059) | | | (3.9) | % | | 4,116 | | | (81.4) | % |

| Interest expense, net | 156 | | | 0.1 | % | | 1,269 | | | 1.0 | % | | (1,113) | | | (87.7) | % |

| Other expense (income), net | 173 | | | 0.1 | % | | 16 | | | — | % | | 157 | | | 981.3 | % |

| Income (loss) before income taxes | (1,272) | | | (1.0) | % | | (6,344) | | | (4.9) | % | | 5,072 | | | (79.9) | % |

| Income tax expense (benefit) | (110) | | | (0.1) | % | | (1,567) | | | (1.2) | % | | 1,457 | | | (93.0) | % |

| Net income (loss) | $ | (1,162) | | | (0.9) | % | | $ | (4,777) | | | (3.7) | % | | $ | 3,615 | | | (75.7) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Effective income tax rate | 8.6 | % | | | | 24.7 | % | | | | | | |

The following table identifies the components of the change in revenue:

| | | | | |

| | Revenue |

| 2023 | $ | 128,252 | |

| Increase (decrease) from: | |

| Unit volume and product mix | 12,159 | |

| Average sales price | (12,954) | |

| Foreign currency | 820 | |

| 2024 | $ | 128,277 | |

Revenue - Revenue was flat compared to the prior year. Revenue overall benefited from an 8% increase in unit volume and a more favorable product mix. Those benefits were offset by a lower average selling prices compared to the first quarter of 2023. Additionally, sales increased in the Latin American and Mexican Consumer markets, while sales decreased in the U.S. and Canadian Consumer markets. The Global Commercial market had a slight increase compared to the prior year. Our acquisition of HealthBeacon during the quarter created a new source of revenue in the Health market that was not material.

Gross profit - As a percentage of revenue, gross profit margin increased to 23.4% compared to 16.3% in the prior year primarily due to lower product costs and a favorable product mix partially offset by the impact of a $0.7 million non-cash lease impairment related to the consolidation of warehouses.

Selling, general and administrative expenses - Selling, general and administrative expenses increased by $5.0 million compared to the first quarter of 2023. Approximately one-half of this increase is related to the addition of HealthBeacon’s selling, general and administrative expenses along with $1.0 million of transaction costs that will not recur. The remaining half is related to an increase in employee-related costs including non-cash stock incentive compensation due to stock price appreciation.

Interest expense - Interest expense, net decreased $1.1 million due to decreased average borrowings outstanding under the HBB Facility and lower interest rates compared to the first quarter of 2023.

Other expense (income), net - Other expense (income) includes currency losses of $0.1 million in the current year compared to currency gains of $0.1 million in the prior year.

Income tax expense (benefit) - The effective tax rate on loss was 8.6% and 24.7% for three months ended March 31, 2024 and 2023, respectively. The effective tax rate for the three months ended March 31, 2024 was impacted by the exclusion of the foreign losses of HealthBeacon requiring a full valuation allowance for which no benefit can be recognized.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity

Our cash flows are provided by dividends paid or distributions made by HBB. The only material assets held by us are the investments in our consolidated subsidiary. As a result, certain statutory limitations or regulatory or financing agreements could affect the levels of distributions allowed to be made by our subsidiary. We have not guaranteed any of the obligations of HBB.

Our principal sources of cash to fund liquidity needs are: (1) cash generated from operations and (2) borrowings available under the HBB Facility. Our primary use of funds consists of working capital requirements, operating expenses, payment of dividends, repurchase of shares, capital expenditures and payments of principal and interest on debt.

The HBB Facility expires on June 30, 2025. We believe funds available from cash on hand, the HBB Facility and operating cash flows will provide sufficient liquidity to meet its operating needs and commitments arising during the next twelve months.

The following table presents selected cash flow information:

| | | | | | | | | | | |

| THREE MONTHS ENDED

MARCH 31 |

| | 2024 | | 2023 |

| Net cash provided by (used for) operating activities | $ | 19,701 | | | $ | 34,874 | |

| Net cash provided by (used for) investing activities | $ | (6,749) | | | $ | (614) | |

| Net cash provided by (used for) financing activities | $ | (2,085) | | | $ | (33,027) | |

Operating activities - Net cash provided by operating activities was $19.7 million compared to $34.9 million in the prior year. The decrease was primarily due to the payment of incentive compensation during the first quarter of 2024 which was paid out during the second quarter of 2023. Net working capital provided cash of $33.5 million in 2024 compared to cash provided of $39.9 million in 2023. The company significantly reduced excess inventory during the first quarter of 2023.

Investing activities - Net cash used for investing activities in 2024 increased compared to 2023 related primarily to the acquisition of HealthBeacon offset by the extinguishment of our secured loan to HealthBeacon in the first quarter of 2024 which provided net cash of $1.6 million.

Financing activities - Net cash used for financing activities was $2.1 million in 2024 compared to net cash used for financing activities of $33.0 million in 2023. The change is due to a decrease in HBB’s net borrowing activity on the HBB Facility.

Capital Resources

The Company does not expect to make voluntary repayments under the HBB Facility within the next twelve months as the rate of return to invest excess cash exceeds the average interest rate of the HBB Facility. A material decrease in interest rates could cause us to re-evaluate. The obligations under the HBB Facility are secured by substantially all of HBB’s assets. As of March 31, 2024, the borrowing base under the HBB Facility was $120.5 million and borrowings outstanding were $50.0 million. As of March 31, 2024, the excess availability under the HBB Facility was $70.5 million.

The maximum availability under the HBB Facility is governed by a borrowing base derived from advance rates against eligible trade receivables, inventory and trademarks of the borrowers, as defined in the HBB Facility. Borrowings bear interest at a floating rate, which can be a base rate, SOFR or bankers’ acceptance rate, as defined in the HBB Facility, plus an applicable margin. The applicable margins, effective March 31, 2024, for base rate loans and SOFR loans denominated in U.S. dollars were 0.0% and 1.55%, respectively. The applicable margins, effective March 31, 2024, for base rate loans and bankers’ acceptance loans denominated in Canadian dollars were 0.0% and 1.55%, respectively. The HBB Facility also requires a fee of 0.25% per annum on the unused commitment. The margins and unused commitment fee under the HBB Facility are subject to quarterly adjustment based on average excess availability. The weighted average interest rate applicable to the HBB Facility for the three months ended March 31, 2024 was 3.17% including the floating rate margin and the effect of the interest rate swap agreements described below.

To reduce the exposure to changes in the market rate of interest, we have entered into interest rate swap agreements for a portion of the HBB Facility. Terms of the interest rate swap agreements require us to receive a variable interest rate and pay a fixed interest rate. We have interest rate swaps with notional values totaling $50.0 million as of March 31, 2024 at an average fixed interest rate of 1.59%.

The HBB Facility includes restrictive covenants, which, among other things, limit the payment of dividends, subject to achieving availability thresholds. Dividends are not to exceed $7.0 million during any calendar year to the extent that for the thirty days prior to the dividend payment date, and after giving effect to the dividend payment, HBB maintains excess availability of at least $18.0 million. Dividend amounts are discretionary to the extent that for the thirty days prior to the dividend payment date, and after giving effect to the dividend payment, HBB maintains excess availability of at least $30.0 million. The HBB Facility also requires the Company to achieve a minimum fixed charge coverage ratio in certain circumstances, as defined in the HBB Facility. As of March 31, 2024, we were in compliance with all financial covenants in the HBB Facility.

In December 2015, the Company entered into an arrangement with a financial institution to sell certain U.S. trade receivables on a non-recourse basis. See Note 2 of the unaudited consolidated financial statements.

Contractual Obligations, Contingent Liabilities and Commitments

For a summary of the Company’s contractual obligations, contingent liabilities and commitments, refer to “Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Contractual Obligations, Contingent Liabilities and Commitments” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as there have been no material changes from those disclosed in the Annual Report.

Off Balance Sheet Arrangements

For a summary of the Company’s off balance sheet arrangements, refer to “Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - Off Balance Sheet Arrangements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as there have been no material changes from those disclosed in the Annual Report.

FORWARD-LOOKING STATEMENTS

The statements contained in this Form 10-Q that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. These forward-looking statements are made subject to certain risks and uncertainties, which could cause actual results to differ materially from those presented. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Such risks and uncertainties include, without limitation: (1) uncertain or unfavorable global economic conditions and impacts from global military conflicts; (2) the Company’s ability to source and ship products to meet anticipated demand; (3) the Company’s ability to successfully manage constraints throughout the global transportation supply chain; (4) changes in the sales prices, product mix or levels of consumer purchases of small electric and specialty housewares appliances; (5) changes in consumer retail and credit markets, including the increasing volume of transactions made through third-party internet sellers; (6) bankruptcy of or loss of major retail customers or suppliers; (7) changes in costs, including transportation costs, of sourced products; (8) delays in delivery of sourced products; (9) changes in or unavailability of quality or cost effective suppliers; (10) exchange rate fluctuations, changes in the import tariffs and monetary policies and other changes in the regulatory climate in the countries in which the Company operates or buys and/or sells products; (11) the impact of tariffs on customer purchasing patterns; (12) product liability, regulatory actions or other litigation, warranty claims or returns of products; (13) customer acceptance of, changes in costs of or delays in the development of new products; (14) increased competition, including consolidation within the industry; (15) changes in customers’ inventory management strategies; (16) shifts in consumer shopping patterns, gasoline prices, weather conditions, the level of consumer confidence and disposable income as a result of economic conditions, unemployment rates or other events or conditions that may adversely affect the level of customer purchases of the Company’s products; (17) changes mandated by federal, state and other regulation, including tax, health, safety or environmental legislation; (18) the Company’s ability to identify, acquire or develop, and successfully integrate, new businesses or new product lines; and (19) other risk factors, including those described in the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2023. Furthermore, the future impact of unfavorable economic conditions, including inflation, changing interest rates, availability of capital markets and consumer spending rates remains uncertain. In uncertain economic environments, we cannot predict whether or when such circumstances may improve or worsen, or what impact, if any, such circumstances could have on our business, results of operations, cash flows and financial position.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

INTEREST RATE RISK

We enter into certain financing arrangements that require interest payments based on floating interest rates. As such, our financial results are subject to changes in the market rate of interest. There is an inherent rollover risk for borrowings as they mature and are renewed at current market rates. The extent of this risk is not quantifiable or predictable because of the variability of future interest rates and business financing requirements. To reduce the exposure to changes in the market rate of interest, we have entered into interest rate swap agreements for a portion of its floating rate financing arrangements. We do not enter into interest rate swap agreements for trading purposes. Terms of the interest rate swap agreements require us to receive a variable interest rate and pay a fixed interest rate.

For the purpose of risk analysis, we use sensitivity analysis to measure the potential loss in fair value of financial instruments sensitive to changes in interest rates. We assume that a loss in fair value is an increase in its receivables. The fair value of the Company’s interest rate swap agreements was an asset of $4.7 million as of March 31, 2024. A hypothetical 10% relative decrease in interest rates would cause a decrease of $0.2 million in the fair value of interest rate swap agreements. Additionally, a hypothetical 10% relative increase in interest rates would cause an increase of $0.2 million in the fair value of interest rate swap agreements. Neither would have a material impact to the Company’s interest expense, net of $0.2 million for the three months ended March 31, 2024.

FOREIGN CURRENCY EXCHANGE RATE RISK

We operate internationally through its foreign operating subsidiaries and enters into transactions denominated in foreign currencies, principally the Canadian dollar, the Mexican peso and, to a lesser extent, the Chinese yuan, Brazilian real and the European Union euro. As such, our financial results are subject to the variability that arises from exchange rate movements. The fluctuation in the value of the U.S. dollar against other currencies affects the reported amounts of revenues, expenses, assets and liabilities. The potential impact of currency fluctuation increases as international expansion increases.

We use forward foreign currency exchange contracts to partially reduce risks related to transactions denominated in foreign currencies and not for trading purposes. These contracts generally mature within twelve months and require us to buy or sell the functional currency in which the applicable subsidiary operates and buy or sell U.S. dollars at rates agreed to at the inception of the contracts.

For the purpose of risk analysis, we use sensitivity analysis to measure the potential loss in fair value of financial instruments sensitive to changes in foreign currency exchange spot rates. We assume that a loss in fair value is either a decrease to its assets or an increase to its liabilities. The fair value of our foreign currency exchange contracts was a net payable of $0.6 million as of March 31, 2024. Assuming a hypothetical 10% weakening of the U.S. dollar as of March 31, 2024, the fair value of foreign currency-sensitive financial instruments, which represents forward foreign currency exchange contracts, would be decreased by $2.9 million compared with its fair value as of March 31, 2024.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Company management, with the participation of the Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company’s disclosure controls and procedures as of March 31, 2024. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that the Company’s disclosure controls and procedures were effective as of March 31, 2024.

Changes in Internal Control Over Financial Reporting

There were no changes, except as noted below, in the Company’s internal control over financial reporting identified during the quarter ended March 31, 2024, in connection with the evaluation by the Company’s management required by paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

On February 2, 2024, we acquired HealthBeacon, as discussed in Note 8: Acquisition in Part I, Item 1 in this Quarterly Report on Form 10-Q. We are currently integrating HealthBeacon into our operations and internal control processes, and, as permitted by the SEC rules and regulations, we have not yet included HealthBeacon in our assessment of the effectiveness of our internal control over financial reporting. We anticipate HealthBeacon will be included in management’s evaluation of internal control over financial reporting as of December 31, 2025.

PART II

OTHER INFORMATION

Item 1 Legal Proceedings

The information required by this Item 1 is set forth in Note 6 “Contingencies” included in the unaudited consolidated financial statements contained in Part I of this Form 10-Q and is hereby incorporated herein by reference to such information.

Item 1A Risk Factors

There are no material changes to the risk factors for the Company from those disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Item 2 Unregistered Sales of Equity Securities and Use of Proceeds

In November 2023, the Company’s Board approved a stock repurchase program for the purchase of up to $25 million of the Company’s Class A Common outstanding starting January 1, 2024 and ending December 31, 2025.

There were no share repurchases during the three months ended March 31, 2024 or 2023. During the year ended December 31, 2023, the Company repurchased 250,772 shares for an aggregate purchase price of $3.1 million.

Item 3 Defaults Upon Senior Securities

None.

Item 4 Mine Safety Disclosures

None.

Item 5 Other Information

None of the Company’s directors or "officers" (as defined in Rule 16a-1(f) promulgated under the Exchange Act) adopted, modified, or terminated a “Rule 10b5-1 trading arrangement” or a “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408 of Regulation S-K, during the Company's fiscal quarter ended March 31, 2024.

Item 6 Exhibits

| | | | | | | | |

| Exhibit | | |

| Number* | | Description of Exhibits |

| | |

| 10.1 | | Amendment to Stockholders’ Agreement, dated as of March 11, 2024, by and among the Depository, Hamilton Beach Brands Holding Company, the new Participating Stockholders identified on the signature pages thereto and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 29, 2017, as amended, by and among the Participating Stockholders, Hamilton Beach Brands Holding Company and the Depository is incorporated by reference to Exhibit 26 filed with Amendment 9 to the Statement on Schedule 13D, filed by the reporting persons named therein on March 13, 2024. Commission File Number 005-90132. |

| 31(i)(1) | | |

| 31(i)(2) | | |

| 32 | | |

| 101.INS | | Inline XBRL Instance Document |

| 101.SCH | | Inline XBRL Taxonomy Extension Schema Document |

| 101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

* Numbered in accordance with Item 601 of Regulation S-K.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | Hamilton Beach Brands Holding Company (Registrant) |

| Date: | May 7, 2024 | /s/ Sally M. Cunningham |

| | Sally M. Cunningham |

| | Senior Vice President, Chief Financial Officer and Treasurer (Principal Financial Officer)/(Principal Accounting Officer) |

AMENDMENT TO STOCKHOLDERS’ AGREEMENT

This AMENDMENT TO STOCKHOLDERS’ AGREEMENT, dated as of March 11, 2024 (this “Amendment”), by and among the Depository, Hamilton Beach Brands Holding Company, a Delaware corporation (the “Corporation”), the new Participating Stockholder identified on the signature pages hereto (the “New Participating Stockholder”) and the Participating Stockholders under the Stockholders’ Agreement, dated as of September 29, 2017, as amended (the “Stockholders’ Agreement”), by and among the Depository, the Corporation and the Participating Stockholders. Capitalized terms defined in the Stockholders’ Agreement are used herein as so defined.

This Amendment sets forth the terms and conditions on which the New Participating Stockholder will join in and become a party to the Stockholders’ Agreement.

Pursuant to Section 8 of the Stockholders’ Agreement, prior to the acquisition of Class B Common Stock by a Permitted Transferee, the Stockholders’ Agreement may be amended to add a Permitted Transferee as a Participating Stockholder by a writing signed by the Signatories, the Corporation and such Permitted Transferee.

In consideration of the mutual promises hereinafter set forth and other good and valuable consideration had and received, the parties hereto agree as follows:

1.Representations and Warranties. The New Participating Stockholder represents and warrants to the other Participating Stockholders and the Corporation as follows:

(a)The New Participating Stockholder is the beneficial owner of, or simultaneously with the execution hereof will acquire and be deemed to be the beneficial owner of, the shares of Class B Common Stock identified below such New Participating Stockholder’s name on the signature pages hereto (except as otherwise described thereon), and except as otherwise described thereon such New Participating Stockholder does not own of record or beneficially or have any interest in any other shares of Class B Common Stock or any options to purchase or rights to subscribe or otherwise acquire any other shares of Class B Common Stock other than pursuant to the Stockholders’ Agreement;

(b)The New Participating Stockholder has the right, power and authority to execute and deliver this Amendment and to perform such New Participating Stockholder’s obligations hereunder and under the Stockholders’ Agreement; if this Amendment is being executed by a trustee on behalf of a trust, such trustee has full right, power and authority to enter into this Amendment on behalf of the trust and to bind the trust and its beneficiaries to the terms hereof; if this Amendment is being executed on behalf of a Participating Stockholder Organization, the person executing this Amendment is a duly authorized representative of such Participating Stockholder Organization with full right, power and authority to execute and deliver this Amendment on behalf of such Participating Stockholder Organization and to bind such Participating Stockholder Organization to the terms hereof; the execution, delivery and performance of this Amendment by such New Participating Stockholder will not constitute a violation of, conflict with or result in a default under (i) any contract, understanding or arrangement to which such New Participating Stockholder is a party or by which such New Participating Stockholder is bound or require the consent of any other person or any party pursuant thereto; (ii) any organizational, charter or other governance documents (including, without limitation, any partnership agreement, certificate of incorporation, or bylaws) of the New Participating Stockholder, (iii) any judgment, decree or order applicable to such New Participating Stockholder; or (iv) any law, rule or regulation of any governmental body;

(c)This Amendment and the Stockholders’ Agreement constitute legal, valid and binding agreements on the part of such New Participating Stockholder; the shares of Class B Common Stock owned beneficially by such New Participating Stockholder are fully paid and non-assessable; and

(d)The shares of Class B Common Stock owned beneficially by the New Participating Stockholder

are now held by the New Participating Stockholder, free and clear of all adverse claims, liens, encumbrances and security interests (except as created by the Stockholders’ Agreement and any Amendments thereto, including this Amendment, and the Restated Certificate).

2.Address for Notices. The address for all notices to each New Participating Stockholder provided pursuant to the Stockholders’ Agreement shall be the address set forth below such New Participating Stockholder’s name on the signature pages hereto, or to such other address as such New Participating Stockholder may specify to the Depository.

3.Agreement to be Bound by Stockholders’ Agreement. The New Participating Stockholder agrees to be bound by all of the terms and provisions of the Stockholders’ Agreement applicable to Participating Stockholders.

4.Beneficiaries. The New Participating Stockholder acknowledges that the Corporation and each Participating Stockholder is a beneficiary of this Amendment.

5.Amendment of Stockholders’ Agreement. The Stockholders’ Agreement is hereby amended to add the New Participating Stockholder as a Participating Stockholder.

6.Signature of Amendment by Trusts, Minors and Incompetents.

(a)In order for a trust exclusively (as defined in Section 1.11 of the Stockholders’ Agreement) for the benefit of a Family Member or Members to be considered a Participating Stockholder:

(i)the trustee and all adult beneficiaries of such trusts having a current trust interest (as well as all Charitable Organization beneficiaries having a current trust interest) shall have previously signed the Stockholders’ Agreement or shall sign this Amendment as a Participating Stockholder;

(ii)the trustee and a parent or legal guardian, for trusts with minor beneficiaries having a current trust interest, shall sign this Amendment on behalf of any such minor beneficiaries; or