Amended Statement of Beneficial Ownership (sc 13d/a)

May 16 2023 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1) *

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO 240.13d-2(a)

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Haleon plc

(Name of Issuer)

Ordinary Shares,

nominal value £1.25 per share

(Title of Class of Securities)

405552100*

(CUSIP Number)

Victoria A. Whyte

GSK plc

980 Great West Road

Brentford, Middlesex TW8 9GS

England

Telephone: +44 (0)208 047 5000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May

16, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

*Represents the CUSIP of the Issuer’s American Depositary Shares

(“ADSs”), each representing two ordinary shares, nominal value £1.25 per share.

| CUSIP No. 405552100 | 13D | Page 2 of 9 |

| 1. |

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

GSK plc |

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

| 3. |

|

SEC USE ONLY |

| 4. |

|

SOURCE OF FUNDS (see instructions)

OO |

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

England and Wales |

| |

|

|

|

|

NUMBER OF SHARES

BENEFICIALLY OWNED BY

EACH REPORTING PERSON

WITH |

|

7. |

|

SOLE VOTING POWER

262,727,073 |

| |

8. |

|

SHARED VOTING POWER

955,320,110 (1) |

| |

9. |

|

SOLE DISPOSITIVE POWER

262,727,073 |

| |

10. |

|

SHARED DISPOSITIVE POWER

1,008,132,722 (1) (2) |

| |

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,008,132,722 (1) (2) |

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☐ |

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

10.9% (3) |

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

CO |

Footnotes:

(1) Includes (i) 262,727,073 ordinary shares, nominal

value £1.25 per share (“Ordinary Shares”) of Haleon plc (the “Issuer” or “Haleon”), which are

held by Glaxo Group Limited (“GGL”), an indirect wholly owned subsidiary of GSK plc (“GSK”), (ii) 437,718,800

Ordinary Shares held by GSK (No. 1) Scottish Limited Partnership (“SLP 1”), a Scottish limited partnership controlled by GSK,

(iii) 164,375,414 Ordinary Shares held by GSK (No. 2) Scottish Limited Partnership (“SLP 2”), a Scottish limited partnership

controlled by GSK, and (iv) 90,498,823 Ordinary Shares held by GSK (No. 3) Scottish Limited Partnership (“SLP 3”), a Scottish

limited partnership controlled by GSK (SLP 1, SLP 2 and SLP 3 together, the “SLPs”).

(2) Includes 52,812,612 Ordinary Shares held by GSK’s

consolidated Employee Share Ownership Plan (“ESOP”) trusts.

(3) Based on 9,234,573,831 Ordinary Shares outstanding

as of March 1, 2023, as reported in the Issuer’s Supplemental Prospectus furnished with the Securities and Exchange Commission (the

“SEC”) on March 24, 2023 (the “Prospectus”).

| CUSIP No. 405552100 | 13D | Page 3 of 9 |

Item 1. Security and Issuer.

This Amendment No. 1 to Schedule 13D (this “Statement”)

amends and supplements the statement on Schedule 13D originally filed on July 27, 2022 (the “Schedule 13D”) with respect to

the Ordinary Shares of Haleon, a public limited company incorporated under the laws of England and Wales. The Issuer’s principal

executive offices are located at Building 5, First Floor, The Heights, Weybridge KT13 0NY, England. Unless otherwise indicated, each capitalized

term used but not defined herein shall have the meaning assigned to such term in the Schedule 13D.

Item 2. Identity and background

The response set forth in Item 2 of the Schedule 13D

is hereby amended by deleting Schedule 1 in its entirety and replacing it with Schedule 1 attached.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended by (i) removing the heading

and the seventh paragraph under the heading “Lock-up Agreement” and (ii) adding the following paragraphs immediately after

the tenth paragraph (under the heading “Registration Rights Agreement”) and before the eleventh paragraph thereof:

Sale of Haleon Shares

On May 11, 2023, GGL, as the seller, entered into a secondary block trader

agreement (the “Secondary Block Trade Agreement”) with Merrill Lynch International (the “MLI”) as the placement

manager, pursuant to which MLI agreed to use its reasonable endeavors to procure purchasers for up to 240,000,000 Ordinary Shares at a

price to be determined pursuant to an accelerated book building process. Pursuant to the terms of sale dated May 11, 2023, the number

of Ordinary Shares sold was determined to be 240,000,000 at a price of 335 pence per Ordinary Share. The transaction closed on May 16,

2023 (the “Closing Date”).

In connection with the Secondary Block Trade Agreement,

on May 11, 2023, GGL entered into a lock-up deed (the “Lock-Up Deed”), with Pfizer and the SLPs, and MLI. Pursuant to the

Lock-Up Deed, GGL has agreed not, directly or indirectly, to offer, sell, lend, pledge or engage in any other disposal of Ordinary Shares

for 60 days after the Closing Date. The Lock-Up Deed provides that the lock-up may be released during such period (which shall apply pro

rata to Pfizer, on the one hand, and the GSK group (including the SLPs), on the other hand, in accordance with their relative ownership

of Issuer shares as of the date of the release) upon MLI’s written agreement.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended by replacing it with the following:

| a. | GSK beneficially owns 1,008,132,722 Ordinary Shares, which represents 10.9%

of 9,234,573,831 Ordinary Shares outstanding as of March 1, 2023, as reported in the Issuer’s Prospectus furnished with the SEC

on March 24, 2023. |

| b. | GSK has (i) the sole power to vote or direct the vote, and the sole power

to dispose or to direct the disposition of 262,727,073 Ordinary Shares held by GGL, (ii) the shared power to vote or direct the vote,

and the shared power to dispose or to direct the disposition of 692,593,037 Ordinary Shares held by the SLPs and (iii) the shared power

to dispose or to direct the disposition of 52,812,612 Ordinary Shares held by the ESOP trusts. |

| c. | Except as described herein, no transaction in shares of Ordinary Shares

were effected during the past 60 days by GSK. |

| d. | No person, other than (i) GSK, (ii) the SLPs, (iii) the GSK Pension Scheme,

the GSK Pension Fund and the SmithKline Beecham Pension Plan (which each hold a limited partnership interest in a separate SLP) (together,

the “GSK UK Pension Schemes”) and (iv) the ESOP trusts, is known to have the right to receive or the power to direct the receipt

of dividends from, or any proceeds from the sale of, the shares of Ordinary Shares beneficially owned by GSK. |

| CUSIP No. 405552100 | 13D | Page 4 of 9 |

In addition, by virtue of the Orderly Marketing

Agreement and the Lock-Up Agreement, GSK, the SLPs and Pfizer may be deemed to have formed a “group” for purposes of Section

13(d)(3) of the Act. Based on information contained in the Pfizer Schedule 13D filing (as defined below), the “group” may

collectively be deemed to beneficially own an aggregate of 3,910,383,736 Ordinary Shares (including interests in Ordinary Shares held

indirectly through holdings of ADSs), which represents approximately 42.3% of the Issuer’s outstanding Ordinary Shares. Neither

the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission that GSK, the SLPs and Pfizer are members

of any such group. Pursuant to Rule 13d-4 under the Act, GSK expressly disclaims beneficial ownership of any securities of the Issuer

held by Pfizer, and nothing herein shall be deemed an admission by GSK as to the beneficial ownership of any such securities. Pfizer has

filed a separate statement of beneficial ownership on Schedule 13D pursuant to Rule 13d-1(k)(2) under the Act containing the required

information for itself (the “Pfizer Filing”). GSK assumes no responsibility for the information contained in any filings by

any other person, including the Pfizer Filing. Except as disclosed herein, this Schedule 13D does not reflect any Ordinary Shares or ADSs

beneficially owned by Pfizer.

Item 7. Material to Be Filed as Exhibits.

Descriptions of documents set forth on this Schedule are qualified in their

entirety by reference to the exhibits listed in this Item 7.

| CUSIP No. 405552100 | 13D | Page 5 of 9 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: May 16, 2023

| |

GSK PLC |

| |

|

| |

By: /s/ Victoria A. Whyte |

| |

Name: Victoria A. Whyte |

| |

Title: Authorized Signatory |

| CUSIP No. 405552100 | 13D | Page 6 of 9 |

Schedule 1

|

Name |

Business Address |

Principal Occupation or Employment |

Citizenship |

| |

|

|

|

| Board of Directors |

|

|

|

| Sir Jonathan Symonds |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chairman and Company Director |

British |

| Emma Walmsley |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Executive Director and Chief Executive Officer |

British |

| Julie Brown |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director and Chief Financial Officer |

British |

| Elizabeth McKee Anderson |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| Charles Bancroft |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| Dr. Hal Barron |

2000 Bridge Parkway

Redwood City, CA 94065

United States |

Company Director |

US |

| Dr. Anne Beal |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| Dr. Harry (Hal) Dietz |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| Dr. Jesse Goodman |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| CUSIP No. 405552100 | 13D | Page 7 of 9 |

|

Name |

Business Address |

Principal Occupation or Employment |

Citizenship |

| |

|

|

|

| Urs Rohner |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

Swiss |

| Dr. Vishal Sikka |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Company Director |

US |

| |

|

|

|

| CUSIP No. 405552100 | 13D | Page 8 of 9 |

| GSK Leadership Team |

|

|

|

|

Name |

Business Address |

Principal Occupation or Employment |

Citizenship |

| |

|

|

|

| Emma Walmsley |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief Executive Officer |

British |

| Julie Brown |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief Financial Officer |

British |

| Diana Conrad |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief People Officer |

Canadian |

| James Ford |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

SVP and Group General Counsel, Legal and Compliance |

British & US |

| Sally Jackson |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

SVP, Global Communications and CEO Office |

British |

| Luke Miels |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief Commercial Officer |

Australian |

| Shobana Ramakrishnan |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief Digital & Technology Officer |

US |

| David Redfern |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

President, Corporate Development |

British |

| Regis Simard |

980 Great West Road

Brentord

Middlesex TW8 9GS, England |

President, Global Supply Chain |

French & British |

| Philip Thomson |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

President, Global Affairs |

British |

| Deborah Waterhouse |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

CEO of ViiV Healthcare |

British |

| Tony Wood |

980 Great West Road

Brentford

Middlesex TW8 9GS, England |

Chief Scientific Officer |

British |

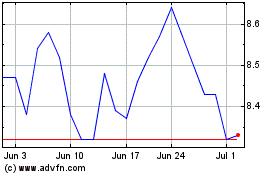

Haleon (NYSE:HLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

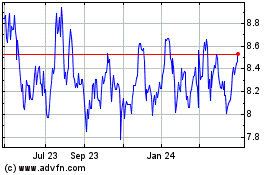

Haleon (NYSE:HLN)

Historical Stock Chart

From Feb 2024 to Feb 2025