Humana Profit Falls, But Guidance Comes in Above Views

February 10 2016 - 8:40AM

Dow Jones News

Humana Inc., which in July agreed to be acquired by rival Aetna

Inc., said profit fell 30% in the fourth quarter as it set aside a

reserve to account for losses expected on its 2016 Affordable Care

Act business, but the firm gave guidance for the year sharply above

Wall Street expectations.

"Humana faced challenges across a number of fronts in 2015,"

said Chief Financial Officer Brian Kane. But he said strength in

its clinical model and administrative cost discipline, along with

targeted pricing, helped position the company for "meaningful

margin improvement" in its core individual Medicare Advantage

business for the year.

For 2016, the health insurer expects adjusted earnings of $8.85

a share, compared with analysts' estimates for $8.73 a share,

according to Thomson Reuters.

The Louisville, Ky., company struck a $34.1 billion merger deal

with rival Aetna Inc. in July amid a flurry of consolidation in the

health care space, fueled by a desire to diversify and cut costs

amid a landscape changed by the Affordable Care Act. The tie up, if

approved by regulators, will vault Aetna toward the top of the

growing Medicare business.

Last month, Humana warned it would need to set aside a reserve

at the end of 2015 to account for losses expected on its 2016

Affordable Care Act business.

For Humana, Medicare Advantage membership increased 13% to 2.8

million while commercial membership declined 12% to 899,100. The

company said its commercial business continues to be challenged due

to volatility related to the start of the health care exchange

program created under the Affordable Care Act.

For 2016, Humana sees individual Medicare Advantage membership

growth of 100,000 to 120,000.

Humana's consolidated medical-loss ratio, or the share of

premiums paid out for members' health expenses, was 85.8%, up from

84.5% in the year-ago quarter.

Overall, the insurer reported a fourth-quarter profit of $101

million, or 67 cents a share, down from $145 million, or 94 cents a

share, a year earlier. During the quarter, Humana recorded a

so-called premium deficiency reserve of $176 million pretax, or 74

cents a share, related to some of its 2016 individual commercial

policies.

Excluding costs stemming from the Aetna merger, among other

items, quarterly earnings rose to $1.45 a share from $1.09 a year

earlier. Revenue increased 8.4% to $13.36 billion.

Analysts had projected adjusted profit of $1.45 a share on

$13.51 billion of revenue, according to Thomson Reuters.

Shares in the company, down 9.6% over the past three months,

were inactive premarket.

Aetna last week reported its overall profit leapt 38% in the

final quarter of the year, as a key measure of spending on medical

costs—its medical-loss ratio—fell. The strong quarterly results

were fueled largely by its government business, which includes

Medicare and Medicaid. However, Aetna joined other health insurers

to report losses on its 2015 Affordable Care Act business.

Humana's merger with Aetna is expected to close in the second

half of 2016.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 10, 2016 09:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

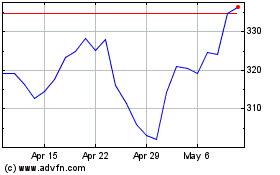

Humana (NYSE:HUM)

Historical Stock Chart

From Jun 2024 to Jul 2024

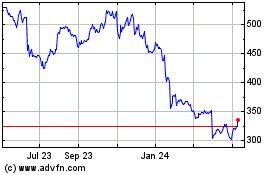

Humana (NYSE:HUM)

Historical Stock Chart

From Jul 2023 to Jul 2024