Integer Holdings Corporation to Divest Non-Medical Business for $50 million

September 30 2024 - 7:00AM

Integer Holdings Corporation (NYSE: ITGR), a leading medical device

contract development and manufacturing organization (CDMO), today

announced it has entered into an agreement to divest its

Electrochem business, which focuses on non-medical applications for

the energy, military and environmental sectors, to Ultralife

Corporation (NASDAQ: ULBI). Ultralife is acquiring Electrochem for

$50 million in cash, subject to customary working capital

adjustments, and the transaction is expected to close by the end of

October.

“The divestiture of our non-medical business is another example

of Integer managing our portfolio to accomplish our strategic

financial objectives,” said Joe Dziedzic, Integer’s president &

CEO. “Following the transaction, Integer will be a pure-play

medical business with additional cash to pay down debt and execute

our inorganic growth strategy. Ultralife is an ideal buyer for

Electrochem because they are a leader in providing critical power

solutions to a variety of industries that include energy, defense,

and environmental markets.”

Going forward, Integer will report the results of its

Electrochem business, currently included in its “Non-Medical”

segment, as part of discontinued operations. This will include any

gain or loss recognized on the sale of the business. The Company

intends to use the proceeds from the sale to pay down outstanding

debt and for general corporate purposes.

In the 2024 full year guidance provided as part of our second

quarter 2024 earnings release, we assumed the following in relation

to our non-medical segment, adjusted to include $3 million of

allocated interest expense as part of discontinued operations:

- Sales of $36 million.

- GAAP operating income of $3 million.

Non-GAAP adjusted operating income of $4 million.

- Adjusted EBITDA of $5 million.

- GAAP net income of $0 million.

Non-GAAP adjusted net income of $1 million.

- GAAP diluted EPS of $0.00. Non-GAAP

adjusted EPS of $0.02.

We expect this transaction to be neutral to EPS.

Please see “Notes Regarding Non-GAAP Financial Information” and

“2024 Outlook” in our earnings release for the second quarter of

2024, dated July 25, 2024 for additional information regarding our

use of the non-GAAP financial measures set forth above.

About Integer®Integer Holdings

Corporation (NYSE:ITGR) is one of the largest medical device

contract development and manufacturing organizations (CDMO) in the

world, serving the cardiac rhythm management, neuromodulation, and

cardio and vascular markets. As a strategic partner of choice to

medical device companies and OEMs, the Company is committed to

enhancing the lives of patients worldwide by providing innovative,

high-quality products and solutions. The Company's brands include

Greatbatch Medical®, Lake Region

Medical® and Electrochem®.

Additional information is available at www.integer.net.

Forward-Looking StatementsSome of the

statements contained in this press release are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including the statements relating to the

expected timing for the closing of the divestiture of the

Electochem business, the intended use of proceeds by the Company

from the transaction, and the impact of the transaction on the

Company’s EPS. You can identify forward-looking statements by

terminology such as “may,” “will,” “should,” “could,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or variations or the negative

of these terms or other comparable terminology. These statements

are only predictions and actual events or results may differ

materially from those stated or implied by these forward-looking

statements. In evaluating these statements, you should carefully

consider a number of factors, including, but not limited to, risks

and uncertainties that arise from time to time and are described in

our earnings release, dated July 25, 2024 (filed as Exhibit 99.1 to

our Current Report on Form 8-K filed July 25, 2024), Item 1A “Risk

Factors” of our Annual Report on Form 10-K and in our other

periodic filings with the SEC. Except as may be required by

law, we assume no obligation to update forward-looking statements

in this press release, whether to reflect changed assumptions, the

occurrence of unanticipated events or changes in future operating

results, financial conditions or prospects, or otherwise.

|

Investor Relations:Andrew

Sennandrew.senn@integer.net763.951.8312 |

Media Relations:Kelly

Butlerkelly.butler@integer.net469.731.6617 |

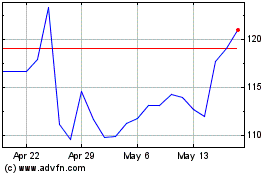

Integer (NYSE:ITGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Integer (NYSE:ITGR)

Historical Stock Chart

From Dec 2023 to Dec 2024