JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today filed its Form 10-K for the year ended December 31, 2023 and

reported its financial results.

Additional information regarding our results of operations,

properties, and tenants can be found in our Fourth Quarter 2023

Investor Package, which is posted in the Investor Relations section

of our website at www.jbgsmith.com. We encourage investors to

consider the information presented here with the information in

that document.

Fourth Quarter 2023 Highlights

- Net income (loss), Funds From Operations ("FFO") and Core FFO

attributable to common shareholders were:

FOURTH QUARTER AND FULL YEAR

COMPARISON

in millions, except per share amounts

Three Months Ended

Year Ended

December 31, 2023

December 31, 2022

December 31, 2023

December 31, 2022

Amount

Per Diluted Share

Amount

Per Diluted Share

Amount

Per Diluted Share

Amount

Per Diluted Share

Net income (loss) (1)

$

(32.6)

$

(0.35)

$

(18.6)

$

(0.17)

$

(80.0)

$

(0.78)

$

85.4

$

0.70

FFO

$

33.9

$

0.35

$

31.1

$

0.27

$

140.4

$

1.33

$

156.0

$

1.31

Core FFO

$

36.1

$

0.38

$

34.3

$

0.30

$

154.1

$

1.46

$

155.3

$

1.30

_____________

(1)

Includes impairment losses of $30.9

million and $90.2 million related to real estate assets recorded

during the three months and year ended December 31, 2023, and

impairment losses recorded by our unconsolidated real estate

ventures, of which our proportionate share was $25.3 million and

$3.9 million during the three months ended December 31, 2023 and

2022, and $28.6 million and $19.3 million during the years ended

December 31, 2023 and 2022. Also includes gains on the sale of real

estate of $37.7 million and $3.3 million during the three months

ended December 31, 2023 and 2022, and $79.3 million and $161.9

million during the years ended December 31, 2023 and 2022.

- Annualized Net Operating Income ("NOI") for the three months

ended December 31, 2023 was $322.4 million, compared to $319.8

million for the three months ended September 30, 2023, at our

share. Excluding the assets that were sold or recapitalized,

Annualized NOI for the three months ended December 31, 2023 was

$318.6 million, compared to $309.4 million for the three months

ended September 30, 2023, at our share.

- The increase in Annualized NOI excluding the assets that were

sold or recapitalized was substantially attributable to (i) an

increase in our multifamily portfolio NOI due to lower concessions

and lower operating expenses, and (ii) a decrease in our commercial

portfolio NOI due to higher abatement and tenant expirations,

partially offset by lower utilities due to seasonality.

- Same Store NOI ("SSNOI") at our share increased 7.1%

quarter-over-quarter to $80.3 million for the three months ended

December 31, 2023. SSNOI at our share increased 1.6% year-over-year

to $299.9 million for the year ended December 31, 2023.

- The increase in SSNOI for the three months ended December 31,

2023 was substantially attributable to (i) higher rents and

occupancy, partially offset by higher operating expenses in our

multifamily portfolio and (ii) burn off of rent abatements and

lower operating expenses, partially offset by lower occupancy in

our commercial portfolio.

Operating Portfolio

- The operating multifamily portfolio was 96.0% leased and 94.7%

occupied as of December 31, 2023, compared to 96.9% and 95.6% as of

September 30, 2023, at our share.

- Across our multifamily portfolio, we increased effective rents

by 7.0% upon renewal for fourth quarter lease expirations while

achieving a 56.0% renewal rate.

- The operating commercial portfolio was 86.3% leased and 84.9%

occupied as of December 31, 2023, compared to 85.6% and 84.4% as of

September 30, 2023, at our share.

- Executed approximately 170,000 square feet of office leases at

our share during the three months ended December 31, 2023,

comprising approximately 20,000 square feet of first-generation

leases and approximately 150,000 square feet of second-generation

leases, which generated a 3.5% rental rate increase on a cash basis

and a 0.2% rental rate increase on a GAAP basis.

- Executed approximately 927,000 square feet of office leases at

our share during the year ended December 31, 2023, comprising

approximately 70,000 square feet of first-generation leases and

approximately 857,000 square feet of second-generation leases,

which generated a 1.2% rental rate increase on a cash basis and a

2.1% rental rate increase on a GAAP basis.

Development Portfolio

Under-Construction

- As of December 31, 2023, we had two multifamily assets under

construction consisting of 1,583 units at our share.

Development Pipeline

- As of December 31, 2023, we had 17 assets in the development

pipeline consisting of 8.8 million square feet of estimated

potential development density at our share.

Third-Party Asset Management and Real Estate Services

Business

- For the three months ended December 31, 2023, revenue from

third-party real estate services, including reimbursements, was

$22.5 million. Excluding reimbursements and service revenue from

our interests in real estate ventures, revenue from our third-party

asset management and real estate services business was $11.0

million, primarily driven by $6.3 million of property and asset

management fees, $1.9 million of leasing fees, $1.2 million of

development fees and $1.2 million of other service revenue.

Balance Sheet

- As of December 31, 2023, our total enterprise value was

approximately $4.3 billion, comprising 107.5 million common shares

and units valued at $1.8 billion, and debt (net of premium /

(discount) and deferred financing costs) at our share of $2.6

billion, less cash and cash equivalents at our share of $171.6

million.

- As of December 31, 2023, we had $164.8 million of cash and cash

equivalents ($171.6 million of cash and cash equivalents at our

share), and $687.5 million of availability under our revolving

credit facility.

- Net Debt to annualized Adjusted EBITDA at our share for the

three months ended December 31, 2023 was 8.7x, and our Net Debt /

total enterprise value was 57.2% as of December 31, 2023.

Investing and Financing Activities

- On October 4, 2023, we sold 5 M Street Southwest, an asset in

our development pipeline located in Washington, DC with an

estimated potential development density of 664,700 square feet, for

$29.5 million.

- On November 14, 2023, one of our unconsolidated real estate

ventures sold Rosslyn Gateway – North and South, commercial assets

totaling 250,490 square feet, and related land parcels with

estimated potential development density totaling 809,500 square

feet in Arlington, Virginia, for $9.4 million at our 18.0%

share.

- On November 30, 2023, we sold Crystal City Marriott, a 345-key

hotel in our commercial portfolio located in Arlington, Virginia,

for $80.0 million.

- On December 5, 2023, we sold Capitol Point – North – 75 New

York Avenue, an asset in our development pipeline located in

Washington, DC with an estimated potential development density of

286,900 square feet, for $11.5 million.

- Borrowings under our revolving credit facility decreased by

$30.0 million for the quarter.

- We repurchased and retired 4.1 million common shares for $58.6

million, a weighted average purchase price per share of

$14.17.

Subsequent to December 31, 2023

- We repurchased and retired 2.7 million common shares for $45.4

million, a weighted average purchase price per share of $16.52,

pursuant to a repurchase plan under Rule 10b5-1 of the Securities

Exchange Act of 1934, as amended.

- We repaid all amounts outstanding under our revolving credit

facility.

- On January 22, 2024, we sold North End Retail, a multifamily

asset with 27,355 square feet in Washington, DC, for $14.3

million.

- On February 13, 2024, one of our unconsolidated real estate

ventures sold Central Place Tower, a commercial asset with 551,594

square feet in Rosslyn, Virginia, for $162.5 million at our 50.0%

share.

Dividends

- On February 14, 2024, our Board of Trustees declared a

quarterly dividend of $0.175 per common share, payable on March 15,

2024 to shareholders of record as of March 1, 2024.

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC, most notably National Landing. Through

an intense focus on placemaking, JBG SMITH cultivates vibrant,

amenity-rich, walkable neighborhoods throughout the Washington, DC

metropolitan area. Approximately 75.0% of JBG SMITH's holdings are

in the National Landing submarket in Northern Virginia, which is

anchored by four key demand drivers: Amazon's new headquarters;

Virginia Tech's under-construction $1 billion Innovation Campus;

the submarket’s proximity to the Pentagon; and JBG SMITH’s

deployment of 5G digital infrastructure. JBG SMITH's dynamic

portfolio currently comprises 14.2 million square feet of

high-growth office, multifamily, and retail assets at share, 99% of

which are Metro-served. It also maintains a development pipeline

encompassing 8.8 million square feet of mixed-use, primarily

multifamily, development opportunities. JBG SMITH is committed to

the operation and development of green, smart, and healthy

buildings and plans to maintain carbon neutral operations annually.

For more information on JBG SMITH please visit

www.jbgsmith.com.

Forward-Looking Statements

Certain statements contained herein may constitute

"forward-looking statements" as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not guarantees of performance. They represent our

intentions, plans, expectations and beliefs and are subject to

numerous assumptions, risks and uncertainties. Consequently, the

future results, financial condition and business of JBG SMITH

Properties ("JBG SMITH", the "Company", "we", "us", "our" or

similar terms) may differ materially from those expressed in these

forward-looking statements. You can find many of these statements

by looking for words such as "approximate", "hypothetical",

"potential", "believes", "expects", "anticipates", "estimates",

"intends", "plans", "would", "may" or similar expressions in this

earnings release. We also note the following forward-looking

statements: our annual dividend per share and dividend yield;

whether in the case of our under-construction assets and assets in

the development pipeline, estimated square feet, estimated number

of units and estimated potential development density are accurate;

expected timing, completion, modifications and delivery dates for

the projects we are developing; the ability of any or all of our

demand drivers to materialize and their effect on economic impact,

job growth, expansion of public transportation and related demand

in the National Landing submarket; planned infrastructure and

educational improvements related to Amazon's additional

headquarters and the Virginia Tech Innovation Campus; our

development plans related to National Landing; whether we will be

able to successfully shift the majority of our portfolio to

multifamily; and whether the allocation of capital to our share

repurchase plan has any impact on our share price.

Many of the factors that will determine the outcome of these and

our other forward-looking statements are beyond our ability to

control or predict. These factors include, among others: adverse

economic conditions in the Washington, DC metropolitan area, the

timing of and costs associated with development and property

improvements, financing commitments, and general competitive

factors. For further discussion of factors that could materially

affect the outcome of our forward-looking statements and other

risks and uncertainties, see "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and the Cautionary Statement Concerning Forward-Looking

Statements in the Company's Annual Report on Form 10‑K for the year

ended December 31, 2023 and other periodic reports the Company

files with the Securities and Exchange Commission. For these

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on our forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements contained or referred to in

this section. We do not undertake any obligation to release

publicly any revisions to our forward-looking statements to reflect

events or circumstances occurring after the date hereof.

Pro Rata Information

We present certain financial information and metrics in this

release "at JBG SMITH Share," which refers to our ownership

percentage of consolidated and unconsolidated assets in real estate

ventures (collectively, "real estate ventures") as applied to these

financial measures and metrics. Financial information "at JBG SMITH

Share" is calculated on an asset-by-asset basis by applying our

percentage economic interest to each applicable line item of that

asset's financial information. "At JBG SMITH Share" information,

which we also refer to as being "at share," "our pro rata share" or

"our share," is not, and is not intended to be, a presentation in

accordance with GAAP. Given that a substantial portion of our

assets are held through real estate ventures, we believe this form

of presentation, which presents our economic interests in the

partially owned entities, provides investors valuable information

regarding a significant component of our portfolio, its

composition, performance and capitalization.

We do not control the unconsolidated real estate ventures and do

not have a legal claim to our co-venturers' share of assets,

liabilities, revenue and expenses. The operating agreements of the

unconsolidated real estate ventures generally allow each

co-venturer to receive cash distributions to the extent there is

available cash from operations. The amount of cash each investor

receives is based upon specific provisions of each operating

agreement and varies depending on certain factors including the

amount of capital contributed by each investor and whether any

investors are entitled to preferential distributions.

With respect to any such third-party arrangement, we would not

be in a position to exercise sole decision-making authority

regarding the property, real estate venture or other entity, and

may, under certain circumstances, be exposed to economic risks not

present were a third-party not involved. We and our respective

co-venturers may each have the right to trigger a buy-sell or

forced sale arrangement, which could cause us to sell our interest,

or acquire our co-venturers' interests, or to sell the underlying

asset, either on unfavorable terms or at a time when we otherwise

would not have initiated such a transaction. Our real estate

ventures may be subject to debt, and the repayment or refinancing

of such debt may require equity capital calls. To the extent our

co-venturers do not meet their obligations to us or our real estate

ventures or they act inconsistent with the interests of the real

estate venture, we may be adversely affected. Because of these

limitations, the non-GAAP "at JBG SMITH Share" financial

information should not be considered in isolation or as a

substitute for our financial statements as reported under GAAP.

Occupancy, non-GAAP financial measures, leverage metrics,

operating assets and operating metrics presented in our investor

package exclude our 10.0% subordinated interest in one commercial

building, our 33.5% subordinated interest in four commercial

buildings, our 49.0% interest in three commercial buildings and our

9.9% interest in one commercial building, as well as the associated

non-recourse mortgage loans, held through unconsolidated real

estate ventures, as our investment in each real estate venture is

zero, we do not anticipate receiving any near-term cash flow

distributions from the real estate ventures, and we have not

guaranteed their obligations or otherwise committed to providing

financial support.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures. For these

measures, we have provided an explanation of how these non-GAAP

measures are calculated and why JBG SMITH's management believes

that the presentation of these measures provides useful information

to investors regarding JBG SMITH's financial condition and results

of operations. Reconciliations of certain non-GAAP measures to the

most directly comparable GAAP financial measure are included in

this earnings release. Our presentation of non-GAAP financial

measures may not be comparable to similar non-GAAP measures used by

other companies. In addition to "at share" financial information,

the following non-GAAP measures are included in this release:

Earnings Before Interest, Taxes, Depreciation and

Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre") and

"Adjusted EBITDA" are non-GAAP financial measures. EBITDA and

EBITDAre are used by management as supplemental operating

performance measures, which we believe help investors and lenders

meaningfully evaluate and compare our operating performance from

period-to-period by removing from our operating results the impact

of our capital structure (primarily interest charges from our

outstanding debt and the impact of our interest rate swaps and

caps) and certain non-cash expenses (primarily depreciation and

amortization expense on our assets). EBITDAre is computed in

accordance with the definition established by the National

Association of Real Estate Investment Trusts ("Nareit"). Nareit

defines EBITDAre as GAAP net income (loss) adjusted to exclude

interest expense, income taxes, depreciation and amortization

expense, gains and losses on sales of real estate and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments of unconsolidated real

estate ventures. These supplemental measures may help investors and

lenders understand our ability to incur and service debt and to

make capital expenditures. EBITDA and EBITDAre are not substitutes

for net income (loss) (computed in accordance with GAAP) and may

not be comparable to similarly titled measures used by other

companies.

Adjusted EBITDA represents EBITDAre adjusted for items we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

right-of-use assets associated with leases in which we are a

lessee, gain (loss) on the extinguishment of debt, earnings

(losses) and distributions in excess of our investment in

unconsolidated real estate ventures, lease liability adjustments,

income from investments, business interruption insurance proceeds,

litigation settlement proceeds and share-based compensation expense

related to the Formation Transaction and special equity awards. We

believe that adjusting such items not considered part of our

comparable operations, provides a meaningful measure to evaluate

and compare our performance from period-to-period.

Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as

analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to

supplement GAAP financial measures. Additionally, we believe that

users of these measures should consider EBITDA, EBITDAre and

Adjusted EBITDA in conjunction with net income (loss) and other

GAAP measures in understanding our operating results.

Funds from Operations ("FFO"), "Core FFO" and Funds Available

for Distribution ("FAD") are non-GAAP financial measures. FFO

is computed in accordance with the definition established by Nareit

in the Nareit FFO White Paper - 2018 Restatement. Nareit defines

FFO as net income (loss) (computed in accordance with GAAP),

excluding depreciation and amortization expense related to real

estate, gains and losses from the sale of certain real estate

assets, gains and losses from change in control and impairment

write-downs of certain real estate assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity,

including our share of such adjustments for unconsolidated real

estate ventures.

Core FFO represents FFO adjusted to exclude items which we

believe are not representative of ongoing operating results, such

as Transaction and Other Costs, impairment write-downs of

right-of-use assets associated with leases in which we are a

lessee, gain (loss) on the extinguishment of debt, earnings

(losses) and distributions in excess of our investment in

unconsolidated real estate ventures, share-based compensation

expense related to the Formation Transaction and special equity

awards, lease liability adjustments, income from investments,

business interruption insurance proceeds, litigation settlement

proceeds, amortization of the management contracts intangible and

the mark-to-market of derivative instruments, including our share

of such adjustments for unconsolidated real estate ventures.

FAD represents Core FFO adjusted for recurring tenant

improvements, leasing commissions and other capital expenditures,

net deferred rent activity, third-party lease liability assumption

(payments) refunds, recurring share-based compensation expense,

accretion of acquired below-market leases, net of amortization of

acquired above-market leases, amortization of debt issuance costs

and other non-cash income and charges, including our share of such

adjustments for unconsolidated real estate ventures. FAD is

presented solely as a supplemental disclosure that management

believes provides useful information as it relates to our ability

to fund dividends.

We believe FFO, Core FFO and FAD are meaningful non‑GAAP

financial measures useful in comparing our levered operating

performance from period-to-period and as compared to similar real

estate companies because these non‑GAAP measures exclude real

estate depreciation and amortization expense, which implicitly

assumes that the value of real estate diminishes predictably over

time rather than fluctuating based on market conditions, and other

non-comparable income and expenses. FFO, Core FFO and FAD do not

represent cash generated from operating activities and are not

necessarily indicative of cash available to fund cash requirements

and should not be considered as an alternative to net income (loss)

(computed in accordance with GAAP) as a performance measure or cash

flow as a liquidity measure. FFO, Core FFO and FAD may not be

comparable to similarly titled measures used by other

companies.

"Net Debt" is a non-GAAP financial measurement. Net Debt

represents our total consolidated and unconsolidated indebtedness

less cash and cash equivalents at our share. Net Debt is an

important component in the calculations of Net Debt to Annualized

Adjusted EBITDA and Net Debt / total enterprise value. We believe

that Net Debt is a meaningful non-GAAP financial measure useful to

investors because we review Net Debt as part of the management of

our overall financial flexibility, capital structure and leverage.

We may utilize a considerable portion of our cash and cash

equivalents at any given time for purposes other than debt

reduction. In addition, cash and cash equivalents at our share may

not be solely controlled by us. The deduction of cash and cash

equivalents at our share from consolidated and unconsolidated

indebtedness in the calculation of Net Debt, therefore, should not

be understood to mean that it is available exclusively for debt

reduction at any given time.

Net Operating Income ("NOI") and "Annualized NOI" are

non-GAAP financial measures management uses to assess an asset's

performance. The most directly comparable GAAP measure is net

income (loss) attributable to common shareholders. We use NOI

internally as a performance measure and believe NOI provides useful

information to investors regarding our financial condition and

results of operations because it reflects only property related

revenue (which includes base rent, tenant reimbursements and other

operating revenue, net of Free Rent and payments associated with

assumed lease liabilities) less operating expenses and ground rent

for operating leases, if applicable. NOI also excludes deferred

rent, related party management fees, interest expense, and certain

other non-cash adjustments, including the accretion of acquired

below-market leases and the amortization of acquired above-market

leases and below-market ground lease intangibles. Management uses

NOI as a supplemental performance measure of our assets and

believes it provides useful information to investors because it

reflects only those revenue and expense items that are incurred at

the asset level, excluding non-cash items. In addition, NOI is

considered by many in the real estate industry to be a useful

starting point for determining the value of a real estate asset or

group of assets. However, because NOI excludes depreciation and

amortization expense and captures neither the changes in the value

of our assets that result from use or market conditions, nor the

level of capital expenditures and capitalized leasing commissions

necessary to maintain the operating performance of our assets, all

of which have real economic effect and could materially impact the

financial performance of our assets, the utility of NOI as a

measure of the operating performance of our assets is limited. NOI

presented by us may not be comparable to NOI reported by other

REITs that define these measures differently. We believe to

facilitate a clear understanding of our operating results, NOI

should be examined in conjunction with net income (loss)

attributable to common shareholders as presented in our financial

statements. NOI should not be considered as an alternative to net

income (loss) attributable to common shareholders as an indication

of our performance or to cash flows as a measure of liquidity or

our ability to make distributions. Annualized NOI, for all assets

except Crystal City Marriott, represents NOI for the three months

ended December 31, 2023 multiplied by four. Due to seasonality in

the hospitality business, Annualized NOI for Crystal City Marriott

represents the trailing 12-month NOI as of December 31, 2023.

Management believes Annualized NOI provides useful information in

understanding our financial performance over a 12‑month period,

however, investors and other users are cautioned against

attributing undue certainty to our calculation of Annualized NOI.

Actual NOI for any 12‑month period will depend on a number of

factors beyond our ability to control or predict, including general

capital markets and economic conditions, any bankruptcy,

insolvency, default or other failure to pay rent by one or more of

our tenants and the destruction of one or more of our assets due to

terrorist attack, natural disaster or other casualty, among others.

We do not undertake any obligation to update our calculation to

reflect events or circumstances occurring after the date of this

earnings release. There can be no assurance that the Annualized NOI

shown will reflect our actual results of operations over any

12‑month period.

Definitions

"Development Pipeline" refers to assets that have the

potential to commence construction subject to receipt of full

entitlements, completion of design and market conditions where we

(i) own land or control the land through a ground lease or (ii) are

under a long-term conditional contract to purchase, or enter into,

a leasehold interest with respect to land.

"Estimated Potential Development Density" reflects

management's estimate of developable gross square feet based on our

current business plans with respect to real estate owned or

controlled as of December 31, 2023. Our current business plans may

contemplate development of less than the maximum potential

development density for individual assets. As market conditions

change, our business plans, and therefore, the Estimated Potential

Development Density, could change accordingly. Given timing, zoning

requirements and other factors, we make no assurance that Estimated

Potential Development Density amounts will become actual density to

the extent we complete development of assets for which we have made

such estimates.

"First-generation" is a lease on space that had been

vacant for at least nine months or a lease on newly delivered

space.

"Formation Transaction" refers collectively to the

spin-off on July 17, 2017 of substantially all of the assets and

liabilities of Vornado Realty Trust's Washington, DC segment, which

operated as Vornado / Charles E. Smith, and the acquisition of the

management business and certain assets and liabilities of The JBG

Companies.

"Free Rent" means the amount of base rent and tenant

reimbursements that are abated according to the applicable lease

agreement(s).

"GAAP" means accounting principles generally accepted in

the United States of America.

"In-Service" refers to multifamily or commercial

operating assets that are at or above 90% leased or have been

operating and collecting rent for more than 12 months as of

December 31, 2023.

"Non-Same Store" refers to all operating assets excluded

from the same store pool.

"Same Store" refers to the pool of assets that were

in-service for the entirety of both periods being compared, except

for assets for which significant redevelopment, renovation, or

repositioning occurred during either of the periods being

compared.

"Second-generation" is a lease on space that had been

vacant for less than nine months.

"Transaction and Other Costs" include pursuit costs

related to completed, potential and pursued transactions,

demolition costs, and severance and other costs.

"Under-Construction" refers to assets that were under

construction during the three months ended December 31, 2023.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

in thousands

December 31, 2023

December 31, 2022

ASSETS

Real estate, at cost:

Land and improvements

$

1,194,737

$

1,302,569

Buildings and improvements

4,021,322

4,310,821

Construction in progress, including

land

659,103

544,692

5,875,162

6,158,082

Less: accumulated depreciation

(1,338,403)

(1,335,000)

Real estate, net

4,536,759

4,823,082

Cash and cash equivalents

164,773

241,098

Restricted cash

35,668

32,975

Tenant and other receivables

44,231

56,304

Deferred rent receivable

171,229

170,824

Investments in unconsolidated real estate

ventures

264,281

299,881

Deferred leasing costs, net

81,477

94,069

Intangible assets, net

56,616

68,177

Other assets, net

163,481

117,028

TOTAL ASSETS

$

5,518,515

$

5,903,438

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND EQUITY

Liabilities:

Mortgage loans, net

$

1,783,014

$

1,890,174

Revolving credit facility

62,000

—

Term loans, net

717,172

547,072

Accounts payable and accrued expenses

124,874

138,060

Other liabilities, net

138,869

132,710

Total liabilities

2,825,929

2,708,016

Commitments and contingencies

Redeemable noncontrolling interests

440,737

481,310

Total equity

2,251,849

2,714,112

TOTAL LIABILITIES, REDEEMABLE

NONCONTROLLING INTERESTS AND EQUITY

$

5,518,515

$

5,903,438

Note: For complete financial statements,

please refer to our Annual Report on Form 10-K for the year ended

December 31, 2023.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

in thousands, except per share data

Three Months Ended December

31,

Year Ended

December 31,

2023

2022

2023

2022

REVENUE

Property rental

$

118,240

$

123,293

$

483,159

$

491,738

Third-party real estate services,

including reimbursements

22,463

21,050

92,051

89,022

Other revenue

6,876

6,397

28,988

25,064

Total revenue

147,579

150,740

604,198

605,824

EXPENSES

Depreciation and amortization

57,281

56,174

210,195

213,771

Property operating

34,937

37,535

144,049

150,004

Real estate taxes

13,607

14,297

57,668

62,167

General and administrative:

Corporate and other

12,376

15,611

54,838

58,280

Third-party real estate services

21,615

22,107

88,948

94,529

Share-based compensation related to

Formation Transaction and special equity awards

152

1,022

549

5,391

Transaction and other costs

943

879

8,737

5,511

Total expenses

140,911

147,625

564,984

589,653

OTHER INCOME (EXPENSE)

Loss from unconsolidated real estate

ventures, net

(25,679)

(4,600)

(26,999)

(17,429)

Interest and other income, net

1,649

1,715

15,781

18,617

Interest expense

(28,080)

(25,679)

(108,660)

(75,930)

Gain on the sale of real estate, net

37,729

3,263

79,335

161,894

Loss on the extinguishment of debt

—

—

(450)

(3,073)

Impairment loss

(30,919)

—

(90,226)

—

Total other income (expense)

(45,300)

(25,301)

(131,219)

84,079

INCOME (LOSS) BEFORE INCOME TAX (EXPENSE)

BENEFIT

(38,632)

(22,186)

(92,005)

100,250

Income tax (expense) benefit

968

1,336

296

(1,264)

NET INCOME (LOSS)

(37,664)

(20,850)

(91,709)

98,986

Net (income) loss attributable to

redeemable noncontrolling interests

4,635

2,468

10,596

(13,244)

Net (income) loss attributable to

noncontrolling interests

432

(197)

1,135

(371)

NET INCOME (LOSS) ATTRIBUTABLE TO

COMMON SHAREHOLDERS

$

(32,597)

$

(18,579)

$

(79,978)

$

85,371

EARNINGS (LOSS) PER COMMON SHARE - BASIC

AND DILUTED

$

(0.35)

$

(0.17)

$

(0.78)

$

0.70

WEIGHTED AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING - BASIC AND DILUTED

95,434

113,854

105,095

119,005

Note: For complete financial statements,

please refer to our Annual Report on Form 10-K for the year ended

December 31, 2023.

EBITDA, EBITDAre AND ADJUSTED

EBITDA RECONCILIATIONS (NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended December

31,

Year Ended

December 31,

2023

2022

2023

2022

EBITDA, EBITDAre and Adjusted

EBITDA

Net income (loss)

$

(37,664)

$

(20,850)

$

(91,709)

$

98,986

Depreciation and amortization expense

57,281

56,174

210,195

213,771

Interest expense

28,080

25,679

108,660

75,930

Income tax expense (benefit)

(968)

(1,336)

(296)

1,264

Unconsolidated real estate ventures

allocated share of above adjustments

3,892

3,738

16,673

30,786

EBITDA attributable to noncontrolling

interests

32

22

28

(79)

EBITDA

$

50,653

$

63,427

$

243,551

$

420,658

Gain on the sale of real estate, net

(37,729)

(3,263)

(79,335)

(161,894)

(Gain) loss on the sale of unconsolidated

real estate assets

230

(618)

(411)

(6,797)

Real estate impairment loss

30,919

—

90,226

—

Impairment related to unconsolidated real

estate ventures (1)

25,279

3,885

28,598

19,286

EBITDAre

$

69,352

$

63,431

$

282,629

$

271,253

Transaction and other costs, net of

noncontrolling interests (2)

943

879

8,737

5,477

Litigation settlement proceeds, net

—

—

(3,455)

—

(Income) loss from investments, net

182

298

(932)

(14,423)

Loss on the extinguishment of debt

—

—

450

3,073

Share-based compensation related to

Formation Transaction and special equity awards

152

1,022

549

5,391

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(118)

(405)

(706)

(988)

Lease liability adjustments

6

—

(148)

—

Unconsolidated real estate ventures

allocated share of above adjustments

27

26

60

2,105

Adjusted EBITDA

$

70,544

$

65,251

$

287,184

$

271,888

Net Debt to Annualized Adjusted EBITDA

(3)

8.7

x

8.6

x

8.5

x

8.2

x

December 31, 2023

December 31, 2022

Net Debt (at JBG SMITH Share)

Consolidated indebtedness (4)

$

2,551,987

$

2,431,730

Unconsolidated indebtedness (4)

66,271

54,975

Total consolidated and unconsolidated

indebtedness

2,618,258

2,486,705

Less: cash and cash equivalents

171,631

253,698

Net Debt (at JBG SMITH Share)

$

2,446,627

$

2,233,007

Note: All EBITDA measures as shown above

are attributable to common limited partnership units ("OP Units")

and certain fully vested incentive equity awards that may be

convertible into OP Units.

(1) Related to decreases in the value of

the underlying real estate assets.

(2) Includes pursuit costs related to

completed, potential and pursued transactions, demolition costs,

severance and other costs.

(3) Quarterly Adjusted EBITDA is

annualized by multiplying by four.

(4) Net of premium/discount and deferred

financing costs.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

FFO and Core FFO

Net income (loss) attributable to common

shareholders

$

(32,597)

$

(18,579)

$

(79,978)

$

85,371

Net income (loss) attributable to

redeemable noncontrolling interests

(4,635)

(2,468)

(10,596)

13,244

Net income (loss) attributable to

noncontrolling interests

(432)

197

(1,135)

371

Net income (loss)

(37,664)

(20,850)

(91,709)

98,986

Gain on the sale of real estate, net of

tax

(37,729)

(3,263)

(79,335)

(158,769)

(Gain) loss on the sale of unconsolidated

real estate assets

230

(618)

(411)

(6,797)

Real estate depreciation and

amortization

55,588

54,153

203,269

204,752

Real estate impairment loss

30,919

—

90,226

—

Impairment related to unconsolidated real

estate ventures (1)

25,279

3,885

28,598

19,286

Pro rata share of real estate depreciation

and amortization from unconsolidated real estate ventures

2,690

2,884

11,545

21,169

FFO attributable to noncontrolling

interests

321

(326)

1,024

(735)

FFO Attributable to OP Units

$

39,634

$

35,865

$

163,207

$

177,892

FFO attributable to redeemable

noncontrolling interests

(5,770)

(4,776)

(22,820)

(21,846)

FFO Attributable to Common

Shareholders

$

33,864

$

31,089

$

140,387

$

156,046

FFO attributable to OP Units

$

39,634

$

35,865

$

163,207

$

177,892

Transaction and other costs, net of tax

and noncontrolling interests (2)

969

981

8,434

5,313

Litigation settlement proceeds, net

—

—

(3,455)

—

(Income) loss from investments, net of

tax

137

109

(699)

(10,819)

(Gain) loss from mark-to-market on

derivative instruments, net of noncontrolling interests

439

1,487

7,153

(6,686)

Loss on the extinguishment of debt

—

—

450

3,073

Earnings and distributions in excess of

our investment in unconsolidated real estate venture

(118)

(405)

(706)

(988)

Share-based compensation related to

Formation Transaction and special equity awards

152

1,022

549

5,391

Lease liability adjustments

6

—

(148)

—

Amortization of management contracts

intangible, net of tax

1,032

1,106

4,193

4,422

Unconsolidated real estate ventures

allocated share of above adjustments

26

21

130

1,150

Core FFO Attributable to OP

Units

$

42,277

$

40,186

$

179,108

$

178,748

Core FFO attributable to redeemable

noncontrolling interests

(6,155)

(5,883)

(25,013)

(23,424)

Core FFO Attributable to Common

Shareholders

$

36,122

$

34,303

$

154,095

$

155,324

FFO per common share - diluted

$

0.35

$

0.27

$

1.33

$

1.31

Core FFO per common share - diluted

$

0.38

$

0.30

$

1.46

$

1.30

Weighted average shares - diluted (FFO and

Core FFO)

95,545

113,917

105,195

119,036

See footnotes under table below.

FFO, CORE FFO AND FAD

RECONCILIATIONS (NON-GAAP)

(Unaudited)

in thousands, except per share data

Three Months Ended

December 31,

Year Ended December

31,

2023

2022

2023

2022

FAD

Core FFO attributable to OP Units

$

42,277

$

40,186

$

179,108

$

178,748

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

(3)

(12,055)

(16,780)

(40,676)

(53,876)

Straight-line and other rent adjustments

(4)

(3,568)

(7,655)

(23,482)

(17,442)

Third-party lease liability assumption

(payments) refunds

—

—

70

(25)

Share-based compensation expense

4,887

8,084

29,367

34,462

Amortization of debt issuance costs

3,755

1,162

9,777

4,595

Unconsolidated real estate ventures

allocated share of above adjustments

932

2,315

2,850

(1,240)

Non-real estate depreciation and

amortization

318

546

1,337

3,114

FAD available to OP Units (A)

$

36,546

$

27,858

$

158,351

$

148,336

Distributions to common shareholders and

unitholders (B)

$

25,216

$

29,625

$

109,320

$

123,829

FAD Payout Ratio (B÷A) (5)

69.0

%

106.3

%

69.0

%

83.5

%

Capital Expenditures

Maintenance and recurring capital

expenditures

$

7,151

$

6,282

$

18,795

$

22,137

Share of maintenance and recurring capital

expenditures from unconsolidated real estate ventures

17

72

62

550

Second-generation tenant improvements and

leasing commissions

4,747

10,276

21,516

30,621

Share of Second-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

140

150

303

568

Recurring capital expenditures and

Second-generation tenant improvements and leasing commissions

12,055

16,780

40,676

53,876

Non-recurring capital expenditures

2,595

11,822

33,614

52,016

Share of non-recurring capital

expenditures from unconsolidated real estate ventures

5

5

10

63

First-generation tenant improvements and

leasing commissions

3,046

5,075

17,633

27,349

Share of First-generation tenant

improvements and leasing commissions from unconsolidated real

estate ventures

479

229

1,126

1,267

Non-recurring capital expenditures

6,125

17,131

52,383

80,695

Total JBG SMITH Share of Capital

Expenditures

$

18,180

$

33,911

$

93,059

$

134,571

(1)

Related to decreases in the value of the

underlying real estate assets.

(2)

Includes pursuit costs related to

completed, potential and pursued transactions, demolition costs,

severance and other costs.

(3)

Includes amounts, at JBG SMITH Share,

related to unconsolidated real estate ventures.

(4)

Includes straight-line rent, above/below

market lease amortization and lease incentive amortization.

(5)

The quarterly FAD payout ratio is not

necessarily indicative of an amount for the full year due to

fluctuation in the timing of capital expenditures, the commencement

of new leases and the seasonality of our operations.

NOI RECONCILIATIONS

(NON-GAAP)

(Unaudited)

dollars in thousands

Three Months Ended December

31,

Year Ended December

31,

2023

2022

2023

2022

Net income (loss) attributable to common

shareholders

$

(32,597)

$

(18,579)

$

(79,978)

$

85,371

Add:

Depreciation and amortization expense

57,281

56,174

210,195

213,771

General and administrative expense:

Corporate and other

12,376

15,611

54,838

58,280

Third-party real estate services

21,615

22,107

88,948

94,529

Share-based compensation related to

Formation Transaction and special equity awards

152

1,022

549

5,391

Transaction and other costs

943

879

8,737

5,511

Interest expense

28,080

25,679

108,660

75,930

Loss on the extinguishment of debt

—

—

450

3,073

Impairment loss

30,919

—

90,226

—

Income tax expense (benefit)

(968)

(1,336)

(296)

1,264

Net income (loss) attributable to

redeemable noncontrolling interests

(4,635)

(2,468)

(10,596)

13,244

Net income (loss) attributable to

noncontrolling interests

(432)

197

(1,135)

371

Less:

Third-party real estate services,

including reimbursements revenue

22,463

21,050

92,051

89,022

Other revenue

2,624

1,663

10,902

7,421

Loss from unconsolidated real estate

ventures, net

(25,679)

(4,600)

(26,999)

(17,429)

Interest and other income, net

1,649

1,715

15,781

18,617

Gain on the sale of real estate, net

37,729

3,263

79,335

161,894

Consolidated NOI

73,948

76,195

299,528

297,210

NOI attributable to unconsolidated real

estate ventures at our share

4,475

4,483

19,452

26,861

Non-cash rent adjustments (1)

(3,568)

(7,655)

(23,482)

(17,442)

Other adjustments (2)

5,174

7,069

22,994

27,739

Total adjustments

6,081

3,897

18,964

37,158

NOI

$

80,029

$

80,092

$

318,492

$

334,368

Less: out-of-service NOI loss (3)

(905)

(805)

(3,512)

(4,849)

Operating Portfolio NOI

$

80,934

$

80,897

$

322,004

$

339,217

Non-Same Store NOI (4)

618

5,889

22,125

44,174

Same Store NOI (5)

$

80,316

$

75,008

$

299,879

$

295,043

Change in Same Store NOI

7.1

%

1.6

%

Number of properties in Same Store

pool

44

42

(1)

Adjustment to exclude straight-line rent,

above/below market lease amortization and lease incentive

amortization.

(2)

Adjustment to include other revenue and

payments associated with assumed lease liabilities related to

operating properties and to exclude commercial lease termination

revenue and related party management fees.

(3)

Includes the results of our

Under-Construction assets and assets in the Development

Pipeline.

(4)

Includes the results of properties that

were not In-Service for the entirety of both periods being

compared, including disposed properties, and properties for which

significant redevelopment, renovation or repositioning occurred

during either of the periods being compared.

(5)

Includes the results of the properties

that are owned, operated and In-Service for the entirety of both

periods being compared.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220370937/en/

Kevin Connolly Executive Vice President, Portfolio Management

& Investor Relations (240) 333‑3837 kconnolly@jbgsmith.com

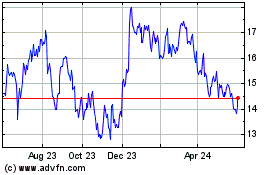

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

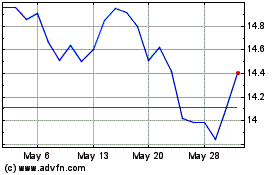

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Jan 2024 to Jan 2025