Quarterly Dividend Increased 14.3% to $0.40

Per Common Share

Jefferies Financial Group Inc. (NYSE: JEF):

Q4 Financial Highlights

$ in thousands, except per share

amounts

Quarter End

Year-to-Date

4Q24

4Q23

2024

2023

Net earnings attributable to common

shareholders

$

205,746

$

65,639

$

669,273

$

263,072

Diluted earnings per common share from

continuing operations

$

0.91

$

0.29

$

2.96

$

1.10

Return on adjusted tangible shareholders'

equity from continuing operations1

12.7

%

4.1

%

10.8

%

3.9

%

Total net revenues

$

1,956,602

$

1,197,206

$

7,034,803

$

4,700,417

Investment banking net revenues14

$

986,824

$

571,828

$

3,444,787

$

2,272,218

Capital markets net revenues14

$

651,690

$

486,169

$

2,759,554

$

2,232,161

Asset management net revenues

$

314,750

$

140,646

$

803,669

$

188,345

Pre-tax earnings from continuing

operations

$

304,862

$

87,261

$

1,005,546

$

354,269

Book value per common share

$

49.42

$

46.10

$

49.42

$

46.10

Adjusted tangible book value per fully

diluted share3

$

32.36

$

30.82

$

32.36

$

30.82

Quarterly Cash Dividend

The Jefferies Board of Directors declared a quarterly cash

dividend equal to $0.40 per Jefferies common share, a 14.3%

increase from the prior dividend rate, payable on February 27, 2025

to record holders of Jefferies common shares on February 14,

2025.

Management Comments

"Our fourth quarter net revenues of $1.96 billion, pre-tax

earnings from continuing operations of $305 million and diluted

earnings per share from continuing operations of $0.91 are 63%,

249% and 214%, higher than the prior year quarter, respectively.

Our quarterly results reflect strong performance in Investment

Banking (up 73%), including a record quarter in Advisory (up 91%),

as well as another robust quarter for Equities (up 49%) and solid

performance in Fixed income (up 15%). Asset Management fee and

investment return net revenues of $116 million were substantially

higher than the prior year quarter, reflecting fee growth and

strong overall performance from a number of strategies.

“Our 2024 net revenues of $7.03 billion, pre-tax earnings from

continuing operations of $1.01 billion and diluted earnings per

share from continuing operations of $2.96 are 50%, 184% and 169%

higher than the prior year, respectively. Our annual results

reflect continued strength and sustained momentum across all lines

of business, primarily attributable to market share gains and a

stronger overall market for our services.

"We are laser focused on our core mission of building and being

the best full-service global investment banking and capital markets

firm and we are very excited about our progress. More normalized

market conditions and the maturation of our platform are beginning

to show our earnings potential, as our core businesses have

generated meaningfully improved underlying operating margins. Our

non-compensation expense ratio improved from 39% in 2023 to 34% in

2024, as our revenue growth outpaced expense growth. We are

optimistic about our ability to continue to further expand

operating margins as we continue to grow our core businesses. The

consolidation of Stratos and Tessellis caused meaningfully higher

gross revenues and expenses to be recorded in Other Investments in

our Asset Management segment for the fourth quarter and the full

year, however, Other investments had a nominal impact on

earnings.

"Our 2024 Investment Banking net revenues of $3.44 billion were

up 52% from the prior year, reflecting our second highest annual

results on record, as well as record market share across many of

our key products, sectors and regions. Following a period of

significant investment in our business, today we provide our

clients with an exceptional offering of full-service capabilities

that extend to the largest and most complex transactions and

underwritings, best-in-class talent, true local reach and access

across every major market. Critically, these capabilities are

underpinned by a culture of service, urgency and creative problem

solving.

"Capital Markets net revenues of $2.76 billion for 2024 were up

24% versus the prior year, driven by solid overall market

conditions and strength across most of our business lines. Equities

net revenues increased 40% from the prior year, with strong

performance in our cash and electronic businesses. We continue to

invest across our electronic trading, equity finance and equity

derivative platforms to deliver effective liquidity and execution

globally to our clients. Fixed Income net revenues increased 7%

from the prior year, driven by robust client demand and particular

strength in our distressed trading and securitization businesses,

partially offset by less favorable results in our global structured

solutions business. The growth of our Fixed Income franchise is the

result of the consistency of our strategy, which focuses on

long-term client partnerships and a commitment to fundamental

credit analysis, leading to an idea-driven, solutions-oriented

approach.

"Our 2024 Asset Management fee and investment return revenues of

$316 million were up 27% from the prior year, reflecting fee growth

and strong overall performance from a number of our strategies. We

are pleased with this performance, considering the unique

challenges the business faced during the year from Weiss

Multi-Strategy Advisors and 352 Capital. Other investments had 2024

net revenues of $550 million largely due to the consolidation of

Stratos and Tessellis causing the inclusion of significant gross

revenues and expenses.

"Jefferies begins 2025 in the best position ever in our firm’s

sixty-two year history. We believe our team is incredibly talented

and special, and they are driving our momentum forward. Our clients

are rewarding us with broad global growth and an enhanced market

position in almost everything Jefferies offers. After decades of

hard work, we are in the front row of the pack of competitors

serving clients across all sectors and regions in investment

banking and capital markets. We believe we have developed to where

we are today because of our unique culture of collaboration and

integrity. By emphasizing a sense of long-term ownership,

entrepreneurship and purpose, we have been able to achieve our

ever-better market position, and we will do everything in our power

to preserve and enhance it as we continue our journey."

Richard Handler, CEO, and Brian Friedman, President

Please refer to the just-released Jefferies Financial Group

Annual Letter from our CEO and President for broader perspective on

2024, as well as our strategy and outlook.

Financial Summary (Unaudited)

$ in thousands

Three Months Ended

Year Ended

November 30, 2024

August 31, 2024

November 30, 2023

November 30, 2024

November 30, 2023

Net revenues by source:

Advisory

$

596,707

$

592,462

$

312,310

$

1,811,634

$

1,198,916

Equity underwriting

191,218

150,096

132,158

799,804

560,243

Debt underwriting

171,456

183,078

129,436

689,227

410,208

Other investment banking14

27,443

17,930

(2,076

)

144,122

102,851

Total Investment Banking

986,824

943,566

571,828

3,444,787

2,272,218

Equities14

410,768

387,342

276,395

1,592,793

1,139,425

Fixed income

240,922

289,183

209,774

1,166,761

1,092,736

Total Capital Markets

651,690

676,525

486,169

2,759,554

2,232,161

Total Investment Banking and Capital

Markets Net revenues5

1,638,514

1,620,091

1,057,997

6,204,341

4,504,379

Asset management fees and revenues6

13,752

13,261

18,695

103,488

93,678

Investment return

101,762

(40,135

)

62,892

212,209

154,461

Allocated net interest4

(15,104

)

(16,016

)

(14,568

)

(62,135

)

(49,519

)

Other investments, inclusive of net

interest13

214,340

101,902

73,627

550,107

(10,275

)

Total Asset Management Net

revenues

314,750

59,012

140,646

803,669

188,345

Other

3,338

4,449

(1,437

)

26,793

7,693

Total Net revenues by source

$

1,956,602

$

1,683,552

$

1,197,206

$

7,034,803

$

4,700,417

Expenses:

Compensation and benefits

$

981,626

$

889,098

$

612,287

$

3,659,588

$

2,535,272

Compensation ratio15

50.2

%

52.8

%

51.1

%

52.0

%

53.9

%

Non-compensation expenses

$

670,114

$

541,767

$

497,658

$

2,369,669

$

1,810,876

Non-compensation ratio15

34.2

%

32.2

%

41.6

%

33.7

%

38.5

%

Total expenses

$

1,651,740

$

1,430,865

$

1,109,945

$

6,029,257

$

4,346,148

Net earnings from continuing operations

before income taxes

$

304,862

$

252,687

$

87,261

$

1,005,546

$

354,269

Income tax expense

$

86,117

$

78,011

$

16,828

$

293,194

$

91,881

Income tax rate

28.2

%

30.9

%

19.3

%

29.2

%

25.9

%

Net earnings from continuing

operations

$

218,745

$

174,676

$

70,433

$

712,352

$

262,388

Net earnings from discontinued operations

(including gain on disposal), net of income taxes

5,155

6,363

—

3,667

—

Net losses attributable to noncontrolling

interests

(8,262

)

(6,874

)

(1,506

)

(27,364

)

(14,846

)

Net losses attributable to redeemable

noncontrolling interests

—

—

—

—

(454

)

Preferred stock dividends

26,416

20,785

6,300

74,110

14,616

Net earnings attributable to common

shareholders

$

205,746

$

167,128

$

65,639

$

669,273

$

263,072

Quarterly Results 2024 Versus

2023

Year-to-Date Results 2024 Versus

2023

- Net earnings attributable to common shareholders of $206

million, or $0.91 per diluted common share from continuing

operations.

- Return on adjusted tangible shareholders' equity from

continuing operations1 of 12.7%.

- We had 205.5 million common shares outstanding and 253.9

million common shares outstanding on a fully diluted basis2 at

November 30, 2024. Our book value per common share was $49.42 and

tangible book value per fully diluted share3 was $32.36.

- Effective tax rate from continuing operations of 28.2% compared

to 19.3% for the prior year quarter. The lower rate for the prior

year quarter was driven by the release of certain tax reserves

which was not repeated in the current year quarter.

- Net earnings attributable to common shareholders of $669

million, or $2.96 per diluted common share from continuing

operations.

- Return on adjusted tangible shareholders' equity from

continuing operations1 of 10.8%.

- Repurchased 1.1 million shares of common stock for $44 million,

at an average price of $40.72 per share in connection with

net-share settlements related to our equity compensation

plans.

- Effective tax rate from continuing operations of 29.2% compared

to 25.9% for the prior year period.

Investment Banking and Capital

Markets

Investment Banking and Capital

Markets

- Investment Banking net revenues of $987 million were 73% higher

than the prior year quarter, with particular strength in

Advisory.

- Advisory net revenues of $597 million represents our best

quarter ever, due to market share gains and increased global

mergers and acquisitions activity.

- Underwriting net revenues of $363 million were higher than the

prior year quarter, due to market share gains and increased

activity from both equity and debt underwriting.

- Capital Markets net revenues of $652 million were higher

compared to the prior year quarter primarily due to stronger

performance in Equities attributable to increased volumes and more

favorable trading opportunities, while Fixed Income net revenues

increased primarily reflecting stronger results across our credit

trading businesses.

- Investment Banking net revenues of $3.44 billion were 52%

higher than the prior year, with strength across all lines of

business attributable primarily to market share gains and a

stronger overall market for our services.

- Advisory net revenues of $1.81 billion were higher than prior

year period, attributable primarily to market share gains and

increased overall market opportunity.

- Underwriting net revenues of $1.49 billion increased from the

prior year period, due to increased activity from both equity and

debt underwriting. Momentum in the equity markets was compounded by

continued market share gains.

- Capital Markets net revenues of $2.76 billion were higher

compared to the prior year period primarily driven by stronger

Equities net revenues attributable to continued market share gains

and overall increased levels of activity during the period. Fixed

Income net revenues increased from the prior year period driven by

strong results in our distressed trading and securitization

business, partially offset by less favorable results in our global

structured solutions business.

Asset Management

Asset Management

- Asset Management fees and revenues and investment return of

$116 million were substantially higher than the prior year quarter,

reflecting strong investment return performance from a number of

strategies. In addition, Other investments13 net revenues were

meaningfully higher, primarily due to the consolidation of

Tessellis, as well as asset sales at HomeFed.

- Asset Management fees and revenues and investment return of

$316 million were substantially higher than the prior year period,

reflecting fee growth and strong overall performance from multiple

strategies, even with challenges arising from the Weiss

Multi-Strategy and 352 Capital funds. In addition, Other

investments13 net revenues were meaningfully higher than the prior

year period largely due to the consolidation of Stratos and

Tessellis.

Expenses

Expenses

- Compensation and benefits expense as a percentage of Net

revenues was 50.2%, compared to 51.1% for the prior year

period.

- Non-compensation expenses were higher primarily due to costs

associated with brokerage and clearing fees associated with

increased trading volumes, and higher technology and communications

and business development expenses. In addition, the increase in

Non-Compensation expenses reflects the inclusion of Tessellis as an

operating subsidiary following its consolidation at the end of the

fourth quarter of 2023 and higher cost of sales largely from the

sale of certain assets by HomeFed.

- Compensation and benefits expense as a percentage of Net

revenues was 52.0%, compared to 53.9% for the prior year

period.

- Non-compensation expenses were higher primarily due to

increased brokerage and clearing fees associated with increased

trading volumes and higher technology and communication and

business development expenses. Other expenses include bad debt

expenses largely related to our losses associated with Weiss

Multi-Strategy Advisers, LLC upon its shutdown in the first quarter

of 2024. In addition, the increase in Non-compensation expenses

reflects the inclusion of Stratos and Tessellis as operating

subsidiaries following the consolidation of these entities in the

fourth quarter of 2023, partially offset by the impact of the

spin-off of Vitesse Energy in January 2023 and sale of Foursight in

April 2024. Non-compensation expenses as a percentage of Net

revenues improved from 38.5% in 2023 to 33.7% in 2024 as our

revenue growth outpaced expense growth. The ratio includes our

Other investments portfolio, which has higher non-compensation

expense ratios.

Amounts herein pertaining to November 30, 2024 represent a

preliminary estimate as of the date of this earnings release and

may be revised upon filing our Annual Report on Form 10-K with the

Securities and Exchange Commission (“SEC”). More information on our

results of operations for the year ended November 30, 2024 will be

provided upon filing our Annual Report on Form 10-K with the SEC,

which we expect to file on or about January 28, 2025.

This press release contains certain “forward-looking statements”

within the meaning of the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking

statements are based on current views and include statements about

our future and statements that are not historical facts. These

forward-looking statements are usually preceded by the words

“should,” “expect,” “intend,” “may,” “will,” "would," or similar

expressions. Forward-looking statements may contain expectations

regarding revenues, earnings, operations, and other results, and

may include statements of future performance, plans, and

objectives. Forward-looking statements may also include statements

pertaining to our strategies for future development of our

businesses and products. Forward-looking statements represent only

our belief regarding future events, many of which by their nature

are inherently uncertain. It is possible that the actual results

may differ, possibly materially, from the anticipated results

indicated in these forward-looking statements. Information

regarding important factors, including Risk Factors that could

cause actual results to differ, perhaps materially, from those in

our forward-looking statements is contained in reports we file with

the SEC. You should read and interpret any forward-looking

statement together with reports we file with the SEC. We undertake

no obligation to update or revise any such forward-looking

statement to reflect subsequent circumstances.

Past performance may not be indicative of future results.

Different types of investments involve varying degrees of risk.

Therefore, it should not be assumed that future performance of any

specific investment or investment strategy will be profitable or

equal the corresponding indicated performance level(s).

Consolidated Statements of Earnings

(Unaudited)

$ in thousands, except per share

amounts

Year Ended November

30,

2024

2023

Revenues

Investment banking

$

3,309,060

$

2,169,366

Principal transactions

1,816,963

1,413,283

Commissions and other fees

1,085,349

905,665

Asset management fees and revenues

86,106

82,574

Interest

3,543,497

2,868,674

Other

674,094

1,837

Total revenues

10,515,069

7,441,399

Interest expense

3,480,266

2,740,982

Net revenues

7,034,803

4,700,417

Non-interest expenses

Compensation and benefits

3,659,588

2,535,272

Brokerage and clearing fees

432,721

366,702

Underwriting costs

68,492

61,082

Technology and communications

546,655

477,028

Occupancy and equipment rental

118,611

106,051

Business development

283,459

177,541

Professional services

296,204

266,447

Depreciation and amortization

190,326

112,201

Cost of sales

206,283

29,435

Other expenses

226,918

214,389

Total non-interest expenses

6,029,257

4,346,148

Earnings from continuing operations before

income taxes

1,005,546

354,269

Income tax expense

293,194

91,881

Net earnings from continuing

operations

712,352

262,388

Net earnings from discontinued operations

(including gain on disposal), net of income tax

3,667

—

Net earnings

716,019

262,388

Net losses attributable to noncontrolling

interests

(27,364

)

(14,846

)

Net losses attributable to redeemable

noncontrolling interests

—

(454

)

Preferred stock dividends

74,110

14,616

Net earnings attributable to common

shareholders

$

669,273

$

263,072

Financial Data and Metrics

(Unaudited)

Three Months Ended

Year Ended

November 30, 2024

August 31, 2024

November 30, 2023

November 30, 2024

November 30, 2023

Other Data:

Number of trading days

63

63

63

251

251

Number of trading loss days7

8

7

7

19

26

Average VaR (in millions)8

$

12.75

$

11.35

$

12.36

$

13.13

$

13.57

In millions, except other data

Three Months Ended

November 30, 2024

August 31, 2024

November 30, 2023

Financial position:

Total assets

$

64,360

$

63,275

$

57,905

Cash and cash equivalents

12,153

10,573

8,526

Financial instruments owned

24,138

24,039

21,747

Level 3 financial instruments owned9

734

693

681

Goodwill and intangible assets

2,054

2,073

2,045

Total equity

10,225

10,115

9,802

Total shareholders' equity

10,157

10,046

9,710

Tangible shareholders' equity10

8,103

7,973

7,665

Other data and financial

ratios:

Leverage ratio11

6.3

6.3

5.9

Tangible gross leverage ratio12

7.7

7.7

7.3

Number of employees at period end

7,822

7,624

7,564

Number of employees excluding OpNet,

Tessellis and Stratos at period end

5,968

5,926

5,661

Components of Numerators and

Denominators for Earnings Per Common Share

$ in thousands, except per share

amounts

Three Months Ended November

30,

Year Ended November

30,

2024

2023

2024

2023

Numerator for earnings per common share

from continuing operations:

Net earnings from continuing

operations

$

218,746

$

70,433

$

712,352

$

262,388

Less: Net losses attributable to

noncontrolling interests

(7,826

)

(1,506

)

(24,367

)

(15,300

)

Mandatorily redeemable convertible

preferred share dividends

—

—

—

(2,016

)

Allocation of earnings to participating

securities

(26,416

)

(6,389

)

(74,110

)

(14,729

)

Net earnings from continuing operations

attributable to common shareholders for basic earnings per

share

$

200,156

$

65,550

$

662,609

$

260,943

Net earnings from continuing operations

attributable to common shareholders for diluted earnings per

share

$

200,156

$

65,550

$

662,609

$

260,943

Numerator for earnings per common share

from discontinued operations:

Net earnings from discontinued operations

(including gain on disposal), net of taxes

$

5,155

$

—

$

3,667

$

—

Less: Net losses attributable to

noncontrolling interests

(436

)

—

(2,997

)

—

Net earnings from discontinued

operations attributable to common shareholders for basic and

diluted earnings per share

$

5,591

$

—

$

6,664

$

—

Net earnings attributable to common

shareholders for basic earnings per share

$

205,747

$

65,550

$

669,273

$

260,943

Net earnings attributable to common

shareholders for diluted earnings per share

$

205,747

$

65,550

$

669,273

$

260,943

Denominator for earnings per common

share:

Weighted average common shares

outstanding

205,499

210,505

208,873

222,325

Weighted average shares of restricted

stock outstanding with future service required

(2,298

)

(1,907

)

(2,334

)

(1,920

)

Weighted average restricted stock units

outstanding with no future service required

10,546

11,843

10,540

12,204

Weighted average basic common

shares

213,747

220,441

217,079

232,609

Stock options and other share-based

awards

4,968

2,224

3,638

2,085

Senior executive compensation plan

restricted stock unit awards

3,619

1,919

2,933

1,926

Weighted average diluted common

shares

222,334

224,584

223,650

236,620

Earnings per common share:

Basic from continuing operations

$

0.94

$

0.30

$

3.05

$

1.12

Basic from discontinued operations

0.02

—

0.03

—

Basic

$

0.96

$

0.30

$

3.08

$

1.12

Diluted from continuing operations

$

0.91

$

0.29

$

2.96

$

1.10

Diluted from discontinued operations

0.02

—

0.03

—

Diluted

$

0.93

$

0.29

$

2.99

$

1.10

Non-GAAP Reconciliations

The following tables reconcile our non-GAAP financial measures

to their respective U.S. GAAP financial measures. Management

believes such non-GAAP financial measures are useful to investors

as they allow them to view our results through the eyes of

management, while facilitating a comparison across historical

periods. These measures should not be considered a substitute for,

or superior to, measures prepared in accordance with U.S. GAAP.

Return on Adjusted Tangible Equity

Reconciliation

$ in thousands

Three Months Ended November

30,

Year Ended November

30,

2024

2023

2024

2023

Net earnings attributable to common

shareholders (GAAP)

$

205,747

$

65,639

$

669,273

$

263,072

Intangible amortization and impairment

expense, net of tax

5,871

1,939

21,771

6,638

Adjusted net earnings to common

shareholders (non-GAAP)

211,618

67,578

691,044

269,710

Preferred stock dividends

26,416

6,300

74,110

14,616

Adjusted net earnings to total

shareholders (non-GAAP)

$

238,034

$

73,878

$

765,154

$

284,326

Adjusted net earnings to total

shareholders (non-GAAP)1

$

952,136

$

295,512

$

765,154

$

284,326

Net earnings impact for net (earnings)

losses from discontinued operations, net of noncontrolling

interests

(5,591

)

—

(6,664

)

—

Adjusted net earnings to total

shareholders from continuing operations (non-GAAP)

232,443

73,878

758,490

284,326

Adjusted net earnings to total

shareholders from continuing operations (non-GAAP)1

929,772

295,512

758,490

284,326

August 31,

November 30,

2024

2023

2023

2022

Shareholders' equity (GAAP)

$

10,045,945

$

9,698,847

$

9,709,827

$

10,232,845

Less: Intangible assets, net and

goodwill

(2,073,105

)

(1,872,144

)

(2,044,776

)

(1,875,576

)

Less: Deferred tax asset, net

(572,772

)

(573,630

)

(458,343

)

(387,862

)

Less: Weighted average impact of dividends

and share repurchases

(58,519

)

(50,727

)

(199,572

)

(732,517

)

Adjusted tangible shareholders' equity

(non-GAAP)

$

7,341,549

$

7,202,346

$

7,007,136

$

7,236,890

Return on adjusted tangible shareholders'

equity (non-GAAP)1

13.0

%

4.1

%

10.9

%

3.9

%

Return on adjusted tangible shareholders'

equity from continuing operations (non-GAAP)1

12.7

%

4.1

%

10.8

%

3.9

%

Adjusted Tangible Book Value and Fully

Diluted Shares Outstanding GAAP Reconciliation

Reconciliation of book value

(shareholders' equity) to adjusted tangible book value and common

shares outstanding to fully diluted shares outstanding:

$ in thousands, except per share

amounts

November 30, 2024

Book value (GAAP)

$

10,156,772

Stock options(1)

114,939

Intangible assets, net and goodwill

(2,054,310

)

Adjusted tangible book value

(non-GAAP)

$

8,217,401

Common shares outstanding (GAAP)

205,504

Preferred shares

27,563

Restricted stock units ("RSUs")

14,381

Stock options(1)

5,065

Other

1,388

Adjusted fully diluted shares

outstanding (non-GAAP)(2)

253,901

Book value per common share

outstanding

$

49.42

Adjusted tangible book value per fully

diluted share outstanding (non-GAAP)

$

32.36

(1)

Stock options added to book value are

equal to the total number of stock options outstanding as of

November 30, 2024 of 5.1 million multiplied by the weighted average

exercise price of $22.69 on November 30, 2024.

(2)

Fully diluted shares outstanding include

vested and unvested RSUs as well as the target number of RSUs

issuable under the senior executive compensation plans until the

performance period is complete. Fully diluted shares outstanding

also include all stock options and the impact of convertible

preferred shares if-converted to common shares.

Notes

- Return on adjusted tangible shareholders' equity and Return on

adjusted tangible shareholders' equity from continuing operations

represent non-GAAP financial measures. The quarterly periods are

based on annualized amounts. Refer to schedule on page 9 for a reconciliation to U.S. GAAP amounts.

- Shares outstanding on a fully diluted basis (a non-GAAP

financial measure) is defined as common shares outstanding plus

preferred shares, restricted stock units, stock options and other

shares. Refer to schedule on page 10

for a reconciliation to U.S. GAAP amounts.

- Adjusted tangible book value per fully diluted share (a

non-GAAP financial measure) is defined as adjusted tangible book

value (a non-GAAP financial measure) divided by shares outstanding

on a fully diluted basis (a non-GAAP financial measure). Refer to

schedule on page 10 for a

reconciliation to U.S. GAAP amounts.

- Allocated net interest represents an allocation to Asset

Management of certain of our long-term debt interest expense, net

of interest income on our Cash and cash equivalents and other

sources of liquidity. Allocated net interest has been disaggregated

to increase transparency and to present direct Asset Management

revenues. We believe that aggregating Allocated net interest would

obscure the revenue results by including an amount that is unique

to our credit spreads, debt maturity profile, capital structure,

liquidity risks and allocation methods.

- Allocated net interest is not separately disaggregated for

Investment Banking and Capital Markets. This presentation is

aligned to our Investment Banking and Capital Markets internal

performance measurement.

- Asset management fees and revenues include management and

performance fees from funds and accounts managed by us as well as

our share of fees received by affiliated asset management companies

with which we have revenue and profit share arrangements, as well

as earnings on our ownership interest in affiliated asset

managers.

- Number of trading loss days is calculated based on trading

activities in our Investment Banking and Capital Markets and Asset

Management business segments, excluding certain Other

investments.

- VaR estimates the potential loss in value of trading positions

due to adverse market movements over a one-day time horizon with a

95% confidence level. For a further discussion of the calculation

of VaR, see "Value-at-Risk" in Part II, Item 7A "Quantitative and

Qualitative Disclosures About Market Risk" in our Annual Report on

Form 10-K for the year ended November 30, 2024.

- Level 3 financial instruments represent those financial

instruments classified as such under Accounting Standards

Codification 820, accounted for at fair value and included within

Financial instruments owned.

- Tangible shareholders' equity (a non-GAAP financial measure) is

defined as shareholders' equity less Intangible assets and

goodwill. We believe that tangible shareholders' equity is

meaningful for valuation purposes, as financial companies are often

measured as a multiple of tangible shareholders' equity, making

these ratios meaningful for investors.

- Leverage ratio equals total assets divided by total

equity.

- Tangible gross leverage ratio (a non-GAAP financial measure)

equals total assets less goodwill and intangible assets divided by

tangible shareholders' equity. The tangible gross leverage ratio is

used by rating agencies in assessing our leverage ratio.

- Beginning in fiscal 2024, we now refer to "Merchant banking" as

“Other investments” in our Asset Management reportable

segment.

- Beginning in the fourth quarter of 2024, revenues from

corporate equity derivative transactions historically included

within Other investment banking net revenues were reclassified to

Equities net revenues as the underlying business has matured and

has started to generate meaningful revenues. Prior year amounts

have been revised to conform to this reclassification change to the

current year reporting.

- Compensation ratio equals total compensation expense divided by

total net revenues. Non-compensation ratio equals total

non-compensation expense divided by total net revenues.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108694644/en/

FOR MORE INFORMATION Jonathan Freedman 212.778.8913

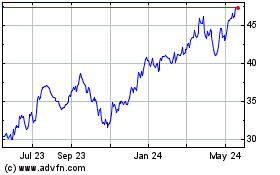

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Dec 2024 to Jan 2025

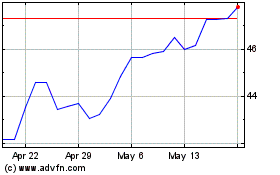

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Jan 2024 to Jan 2025