Limited Brands' Comps Rise - Analyst Blog

May 07 2012 - 8:45AM

Zacks

Limited Brands

Inc. (LTD), a specialty retailer of women’s intimate and

other apparel, beauty and personal care products, posted

better-than-expected comparable-store sales for the four-week

period ended April 28, 2012. The increase was boosted by healthy

sales at its Victoria's Secret Stores and Bath & Body

Works.

The owner of Victoria's Secret

Direct and La Senza chains has sustained its growth momentum.

Limited Brands’ comparable-store sales for April 2012 rose 6%

following increases of 8% in March 2012 and 20% in April 2011.

Management had earlier predicted

comparable-store sales to rise in the low single digits for the

month under review.

Comparable-store sales for April

increased 8% at Victoria’s Secret Stores & Victoria’s Secret

Beauty and 4% at Bath & Body Works & The White Barn Candle

Co. but fell 5% at La Senza. Sales at Victoria’s Secret Direct

climbed 2%.

Limited Brands, which competes with

Hanesbrands Inc. (HBI), said that net sales for

April dropped 3.5% to $659 million from $683.2 million posted in

the comparable prior-year month. The prior-year period sales

included $59.2 million from a third-party apparel sourcing business

that was sold in November 2011.

In terms of performance, Limited

Brands fared far better than Gap Inc. (GPS), which

posted a comparable-store sales decline of 2% compared with a

growth of 8% registered in the prior-year period.

For the thirteen-week period ended

April 28, 2012, Limited Brands registered comparable-store sales

growth of 7%. However, net sales for the period fell 2.8% to $2,154

million from $2,217 million in the prior year. The prior-year sales

included $214 million from a third-party apparel sourcing business

that was sold in November 2011.

Strolling Through

Guidance

For the month of May, management

now expects comparable-store sales to rise in the low single-digit

range. The company now expects to post first-quarter 2012 earnings

between 38 cents and 40 cents a share. The current Zacks Consensus

Estimate for the quarter is 40 cents a share. The company will come

out with its first-quarter 2012 earnings results after the market

closes on May 16.

Let’s

Conclude

The company’s Bath & Body Works

segment is gaining traction, driven by a rise in store

transactions, enhancement in the direct channel business and new

stores. Victoria’s Secret Stores have been performing well, and the

company is also revamping its La Senza brand.

Limited Brands is keen to augment

its retail footprint across the globe by expanding aggressively in

Canada and other international markets. Moreover, the company’s

strong liquidity positions it for growth and higher returns.

However, stiff competition and erratic consumer behavior still

remain matters of concern.

Currently, we have a long-term

‘Neutral’ recommendation on the stock. However, Limited Brands

holds a Zacks #2 Rank that translates into a short-term ‘Buy’

rating.

GAP INC (GPS): Free Stock Analysis Report

HANESBRANDS INC (HBI): Free Stock Analysis Report

LIMITED BRANDS (LTD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

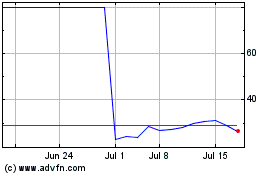

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

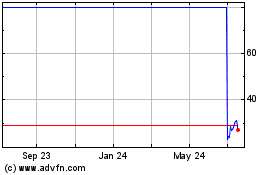

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024