Warnaco Guides Down After Dismal 2Q - Analyst Blog

August 08 2012 - 6:45AM

Zacks

Warnaco Group Inc.

(WRC) reported second quarter 2012

adjusted earnings of 72 cents per share, which surpassed the Zacks

Consensus Estimate of 65 cents by 10.8%. Cost control coupled with

strong business by brands like Calvin Klein and Speedo enabled the

earnings beat. However, earnings were short of the prior-year

earnings of 82 cents per share by 12.2%.

The adjusted earnings excludes

restructuring expenses of 28 cents, and the impairment charge for

the note receivable related to the sale of Lejaby to Palmers

Textile AG in 2008 of 29 cents. It also included a benefit of 8

cents. On a GAAP basis, the company reported earnings per diluted

share from continuing operations of 23 cents compared with $1.01 in

the prior-year quarter.

Consolidated Revenue and

Margins

Warnaco’s quarterly net sales

slipped 5% to $563.9 million compared with $591.4 million in the

prior-year period. The sales decline was a result of poor business

in Sportswear and Intimate Apparel coupled with macroeconomic

headwinds in U.S. and Europe and unfavorable foreign currency

translation. The sales missed Zacks Consensus estimate of $574.0

million.

Gross profit decreased 8.0% to

$238.9 million in the second quarter from $258.3 in the prior-year

quarter, while gross margin declined 130 basis points to 42.4% in

the quarter owing to increased product costs, increasing level of

customer allowances and weak business environment in select

markets. Operating income declined 38.0% year on year to $32.8

million.

Segment by

Details

The Sportswear

Group segment manufactures and sells premium priced men’s,

women’s and children’s jeanswear, sportswear and accessories, which

are marketed under well-known brands like Calvin Klein and Chaps.

The segment’s net sales went down 7.4% year over year to $265.0

million in the second quarter compared with $286.3 million in the

year ago period. Net sales declined 1.2% on a constant currency

basis. The segment reported an operating loss of $11.3 million,

representing a negative 4.3% of net revenue compared with an

operating income of $15.9 million or 5.6% of net revenue in the

prior-year quarter.

The Intimate Apparel

Group manufactures and sells upper moderate to premium

priced intimate apparel and other products for women, and premium

priced men’s underwear and loungewear, which are marketed under

brands like Calvin Klein Underwear, Warner’s, Olga, Olga’s

Christina, Body Nancy Ganz and Bodyslimmers. Net sales at Intimate

Apparel Group declined 6.3% to $212.1 million compared with $226.4

million in the prior-year quarter. Net sales declined 2.7% on a

constant currency basis. Operating income of the Intimate Apparel

Group segment came down to $25.9 million in the second quarter,

representing 12.3% of net revenue compared with operating income of

$34.5 million or 15.2% of net revenue in the prior-year

quarter.

The Swimwear Group

manufactures and sells premium priced swimwear, swim accessories

and related products, which are marketed under brands like Speedo,

Calvin Klein and Lifeguard. Net sales at Swimwear Group went up

10.3% to $86.7 million compared with $78.6 million in the

prior-year quarter. Net sales climbed 11.9% on a constant currency

basis. The segment’s operating income also increased to $13.7

million in the second quarter, representing 15.7% of net revenue

compared with operating income of $10.7 million or 13.6% of net

revenue in the prior-year quarter.

Other Financial

Updates

The company exited the quarter with

cash and cash equivalents of $295.3 million as on June 30, 2012,

compared to $294.8 million in the prior year quarter.

Inventories came down to $330.6

million in the second quarter from $355.4 million in the prior year

quarter.

Guidance

Based on the second quarter 2012

results, Warnaco lowered its full year 2012 outlook to a range of

$4.00 - $4.15 from the previously announced guidance of

$4.00-$4.25. Including one-time expenses and based on foreign

currency exchange rates, Warnaco expects its reported earnings per

share to be in the range of $2.94-$3.00 per diluted share compared

to previous guidance of $3.32-$3.40 for full year 2012.

The current Zacks Consensus

Estimate is $1.21 per share for the third quarter and for full year

2012 the estimate is pegged at $4.03.

For 2012, Warnaco anticipates total

revenue growth to be flat to up 2% year over year.

Warnaco designs, sources, markets,

licenses, and distributes a range of intimate apparel, sportswear,

and swimwear worldwide. The company offers its products primarily

under the Calvin Klein, Speedo, Chaps, Warner’s, and Olga brand

names.

The company operates in a highly

competitive apparel industry with tough competitors like

Limited Brands, Inc. (LTD) and Maidenform

Brands, Inc. (MFB). Moreover, Warnaco depends on license

agreements with third parties for generating a significant portion

of its revenues, which have inherent risks.

Warnaco currently holds a Zacks #3

Rank, which translates into a short-term Hold rating. On a

long-term basis, we have a Neutral recommendation on Warnaco.

LIMITED BRANDS (LTD): Free Stock Analysis Report

MAIDENFORM BRND (MFB): Free Stock Analysis Report

WARNACO GRP INC (WRC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

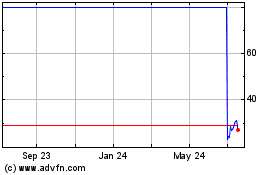

LandBridge (NYSE:LB)

Historical Stock Chart

From Jun 2024 to Jul 2024

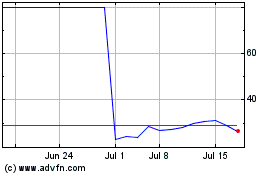

LandBridge (NYSE:LB)

Historical Stock Chart

From Jul 2023 to Jul 2024