Form 8-K - Current report

September 05 2024 - 10:59AM

Edgar (US Regulatory)

00009276538-K2024-09-05false00009276532024-09-052024-09-050000927653us-gaap:CommonStockMember2024-09-052024-09-050000927653mck:A1.500NotesDue2025Member2024-09-052024-09-050000927653mck:A1.625NotesDue2026Member2024-09-052024-09-050000927653mck:A3.125NotesDue2029Member2024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 5, 2024

McKESSON CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-13252 | | 94-3207296 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

6555 State Hwy 161

Irving, TX 75039

(Address of Principal Executive Offices, and Zip Code)

(972) 446-4800

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, $0.01 par value | | MCK | | New York Stock Exchange |

| 1.500% Notes due 2025 | | MCK25 | | New York Stock Exchange |

| 1.625% Notes due 2026 | | MCK26 | | New York Stock Exchange |

| 3.125% Notes due 2029 | | MCK29 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

McKesson Corporation participated in the Wells Fargo 2024 Healthcare Conference on September 5, 2024, as previously noticed in the company’s August 7, 2024 earnings release and on its investor relations website investor.mckesson.com.

During the conference webcast, McKesson affirmed fiscal 2025 full year Adjusted Earnings per Diluted Share guidance in the range of $31.75 to $32.55. McKesson also indicated it anticipates second quarter fiscal 2025 Adjusted earnings per Diluted Share to be in the range of $6.70 to $7.00.

Non-GAAP Financial Measures

Adjusted Earnings per Diluted Share (Non-GAAP): We define Adjusted Earnings per Diluted Share as GAAP earnings per diluted common share attributable to McKesson, excluding per share impacts of amortization of acquisition-related intangibles, transaction-related expenses and adjustments, LIFO inventory-related adjustments, gains from antitrust legal settlements, restructuring, impairment, and related charges, claims and litigation charges, other adjustments, as well as the related income tax effects for each of these items, as applicable, divided by diluted weighted-average shares outstanding.

McKesson does not provide forward-looking guidance on a GAAP basis as the company is unable to provide a quantitative reconciliation of forward-looking Non-GAAP measures to the most directly comparable forward-looking GAAP measure, without unreasonable effort. McKesson cannot reasonably forecast LIFO inventory-related adjustments, certain litigation loss and gain contingencies, restructuring, impairment and related charges, and other adjustments, which are difficult to predict and estimate. These items are generally uncertain and depend on various factors, many of which are beyond the company's control, and as such, any associated estimate and its impact on GAAP performance could vary materially.

Cautionary Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Readers should not place undue reliance on forward-looking statements, such as financial performance forecasts, which speak only as of the date they are first made. Except to the extent required by law, we undertake no obligation to update or revise our forward-looking statements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied. Although it is not possible to predict or identify all such risks and uncertainties, we encourage investors to read the risk factors described in our publicly available filings with the Securities and Exchange Commission and news releases.

These risk factors include, but are not limited to: we experience costly and disruptive legal disputes and settlements, including regarding our role in distributing controlled substances such as opioids; we might experience losses not covered by insurance or indemnification; we are subject to frequently changing, extensive, complex, and challenging healthcare and other laws; we from time to time record significant charges from impairment to goodwill, intangibles, and other long-lived assets; we experience cybersecurity incidents that might significantly compromise our technology systems or might result in material data breaches; we may be unsuccessful in achieving our strategic growth objectives; we may be unsuccessful in our efforts to implement initiatives to reduce or optimize our costs; we are impacted by customer purchase reductions, contract non-renewals, payment defaults, and bankruptcies; our contracts with government entities involve future funding and compliance risks; we might be harmed by changes in our relationships or contracts with suppliers; our use of third-party data is subject to limitations that could impede the growth of our data services business; we might be adversely impacted by healthcare reform such as changes in pricing and reimbursement models; we might be adversely impacted by competition and industry consolidation; we are adversely impacted by changes or disruptions in product supply and have had difficulties in sourcing or selling products due to a variety of causes; we might be adversely impacted as a result of our distribution of generic pharmaceuticals; we might be adversely impacted by changes in the economic environments in which we operate; changes affecting capital and credit markets might impede access to credit, increase borrowing costs, and disrupt banking services for us and our customers and suppliers and might impair the financial soundness of our customers and suppliers; we might be adversely impacted by changes in tax legislation or challenges to our tax positions; we might be adversely impacted by events outside of our control, such as widespread public health issues, natural disasters, political events and other catastrophic events; we may be adversely affected by global climate change or by legal, regulatory, or market responses to such change; and governance issues and regulations, including those related to social issues, climate change, and sustainability, and stakeholder response thereto may have an adverse effect on our business, financial condition, and results of operations and damage our reputation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 5, 2024

| | | | | | | | |

| | |

| McKesson Corporation |

| |

| By: | /s/ Britt J. Vitalone |

| | Britt J. Vitalone |

| | Executive Vice President and |

| | Chief Financial Officer |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A1.500NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A1.625NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A3.125NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

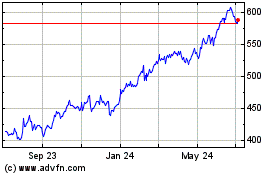

McKesson (NYSE:MCK)

Historical Stock Chart

From Nov 2024 to Dec 2024

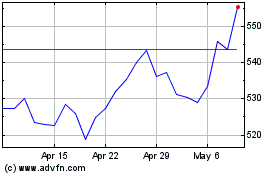

McKesson (NYSE:MCK)

Historical Stock Chart

From Dec 2023 to Dec 2024