Current Report Filing (8-k)

July 13 2015 - 10:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 13, 2015

MOHAWK INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 01 13697 | | 52-1604305 |

| | | | |

(State or Other | | Commission File | | (IRS Employer |

| | | | |

Jurisdiction of | | Number) | | Identification No.) |

| | | | |

Incorporation) | | | | |

|

| | | |

160 South Industrial Blvd., Calhoun, Georgia | | 30701 | |

(Address of Principal Executive Offices) | | (Zip code) | |

Registrant's telephone number, including area code (706) 629-7721

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communication pursuant to Rule 425 under Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act CFR 240.17R 240.13e-4(c))

Item 8.01 Other Matters

On July 13, 2015 Mohawk Industries, Inc. announced that it has realigned its reportable segments. Re-casted segment financials for the fiscal years ended 2013 and 2014, all four quarters of 2014 and the first quarter of 2015 are attached to this Current Report as Exhibit 99.1, and are incorporated herein by this reference.

Exhibit 99.1

Mohawk Industries, Inc.

Updated historical financial information based on new business segments

During the second quarter of 2015, the Company realigned its reportable segments to reflect how the company’s results will be reported by management. The Company has organized its carpet, wood, laminate and vinyl operations by geography into the Flooring North American segment and Rest of the World (“ROW”) segment with no change in the Global Ceramic segment.

The following summary describes each of the segments:

Flooring North America Segment includes North American operations in all product categories except ceramic. The new segment combines the former Carpet segment with the North American operations of the former Laminate and Wood segment as well as the North American operations of the recently acquired IVC Group.

Flooring ROW Segment includes operations outside of North America in all product categories except ceramic. The new segment combines the European and ROW operations of the former Laminate and Wood segment with the non-North American operations of the recently acquired IVC Group.

Global Ceramic Segment includes all worldwide ceramic operations, including the operations of the recently acquired KAI Group. There is no change in this segment.

As a result of the change in segment reporting, all historical financial information has been recasted to conform to the following new presentation:

|

|

MOHAWK INDUSTRIES, INC. AND SUBSIDIARIES |

Unaudited |

(Amounts in thousands) |

Recasted segments: |

|

| | | | | | | | | | | | | | | |

| Flooring North America | Global Ceramic | Flooring ROW | Corporate/ Eliminations | Mohawk Consolidated |

Year ended December 31, 2013 |

Net Sales | $ | 3,423,093 |

| $ | 2,677,058 |

| $ | 1,249,279 |

| $ | (676 | ) | $ | 7,348,754 |

|

Operating Income/(Expense) | 259,753 |

| 209,825 |

| 107,850 |

| (30,497 | ) | 546,931 |

|

Restructuring, acquisition and integration-related costs | 19,172 |

| 73,916 |

| 48,667 |

| 1,225 |

| 142,980 |

|

Adjusted Operating Income/(Expense) | $ | 278,925 |

| $ | 283,741 |

| $ | 156,517 |

| $ | (29,272 | ) | $ | 689,911 |

|

Quarter ended March 29, 2014 |

Net Sales | $ | 780,331 |

| $ | 695,094 |

| $ | 338,067 |

| $ | (397 | ) | $ | 1,813,095 |

|

Operating Income/(Expense) | 47,353 |

| 60,659 |

| 31,465 |

| (8,742 | ) | 130,735 |

|

Restructuring, acquisition and integration-related costs | 569 |

| 1,980 |

| 9,007 |

| 169 |

| 11,725 |

|

Adjusted Operating Income/(Expense) | $ | 47,922 |

| $ | 62,639 |

| $ | 40,472 |

| $ | (8,573 | ) | $ | 142,460 |

|

Quarter ended June 28, 2014 |

Net Sales | $ | 895,912 |

| $ | 796,724 |

| $ | 357,738 |

| $ | (2,127 | ) | $ | 2,048,247 |

|

Operating Income/(Expense) | 76,602 |

| 106,407 |

| 47,398 |

| (8,159 | ) | 222,248 |

|

Restructuring, acquisition and integration-related costs | 869 |

| 196 |

| 9,904 |

| 200 |

| 11,169 |

|

Adjusted Operating Income/(Expense) | $ | 77,471 |

| $ | 106,603 |

| $ | 57,302 |

| $ | (7,959 | ) | $ | 233,417 |

|

Quarter ended September 27, 2014 |

Net Sales | $ | 886,317 |

| $ | 779,842 |

| $ | 326,146 |

| $ | (1,647 | ) | $ | 1,990,658 |

|

Operating Income/(Expense) | 83,623 |

| 101,254 |

| 35,046 |

| (6,230 | ) | 213,693 |

|

Restructuring, acquisition, integration-related and legal reserve costs | 10,578 |

| 4,248 |

| 8,437 |

| 750 |

| 24,013 |

|

Adjusted Operating Income/(Expense) | $ | 94,201 |

| $ | 105,502 |

| $ | 43,483 |

| $ | (5,480 | ) | $ | 237,706 |

|

Quarter ended December 31, 2014 |

Net Sales | $ | 878,458 |

| $ | 743,619 |

| $ | 332,068 |

| $ | (2,699 | ) | $ | 1,951,446 |

|

Operating Income/(Expense) | 92,414 |

| 82,793 |

| 37,618 |

| (6,705 | ) | 206,120 |

|

Restructuring, acquisition and integration-related costs | 2,594 |

| 2,905 |

| 8,829 |

| 367 |

| 14,695 |

|

Adjusted Operating Income/(Expense) | $ | 95,008 |

| $ | 85,698 |

| $ | 46,447 |

| $ | (6,338 | ) | $ | 220,815 |

|

Year ended December 31, 2014 |

Net Sales | $ | 3,441,018 |

| $ | 3,015,279 |

| $ | 1,354,018 |

| $ | (6,869 | ) | $ | 7,803,446 |

|

Operating Income/(Expense) | 299,992 |

| 351,113 |

| 151,528 |

| (29,837 | ) | 772,796 |

|

Restructuring, acquisition, integration-related and legal reserve costs | 14,610 |

| 9,330 |

| 36,177 |

| 1,487 |

| 61,604 |

|

Adjusted Operating Income/(Expense) | $ | 314,602 |

| $ | 360,443 |

| $ | 187,705 |

| $ | (28,350 | ) | $ | 834,400 |

|

Quarter ended April 4, 2015 |

Net Sales | $ | 846,911 |

| $ | 719,828 |

| $ | 314,742 |

| $ | (304 | ) | $ | 1,881,177 |

|

Operating Income/(Expense) | (75,192 | ) | 85,327 |

| 44,641 |

| (11,002 | ) | 43,774 |

|

Restructuring, acquisition and integration-related costs | 130,825 |

| 362 |

| 5,155 |

| 1,187 |

| 137,529 |

|

Adjusted Operating Income/(Expense) | $ | 55,633 |

| $ | 85,689 |

| $ | 49,796 |

| $ | (9,815 | ) | $ | 181,303 |

|

The Company believes it is useful for itself and investors to review, as applicable, both GAAP and the above non-GAAP measures in order to assess the performance of the Company's business for planning and forecasting in subsequent periods. In particular, the Company believes excluding the impact of restructuring, acquisition, integration-related and legal reserve costs is useful because it allows investors to evaluate our performance for different periods on a more comparable basis.

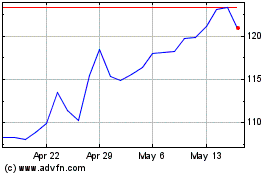

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024