false

0001980088

0001980088

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 5, 2025

Mach Natural Resources LP

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41849 |

|

93-1757616 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 14201 Wireless Way, Suite 300, Oklahoma City, Oklahoma |

|

73134 |

| (Address of principal executive offices) |

|

(Zip Code) |

(405) 252-8100

Registrant’s telephone number, including

area code

Not applicable.

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common units representing limited partner interests |

|

MNR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

Mach Natural Resources LP,

a Delaware limited partnership (the “Company,” “we” or “our”) intends to file a preliminary prospectus

supplement with the Securities and Exchange Commission (the “Preliminary Prospectus Supplement”) on February 5, 2025 in connection

with a proposed underwritten public offering (the “Offering”) of its common units representing limited partner interests.

The Preliminary Prospectus Supplement will provide an estimate of the range of our revenue, net income and Adjusted EBITDA for the year

ended December 31, 2024 and estimates of the range of our operational data for the year ended December 31, 2024. Our actual results for

the quarter ended December 31, 2024 have not yet been finalized. During the course of the preparation of our financial statements and

related notes, we may identify items that would require us to make material adjustments to the preliminary estimates presented below.

These estimates should not

be viewed as a substitute for full annual financial statements prepared in accordance with generally accepted accounting principles in

the U.S. (“GAAP”). In addition, these preliminary estimates for the year ended December 31, 2024 are not necessarily indicative

of the results to be achieved for any future period.

The preliminary estimates

presented below are subject to a variety of risks and uncertainties, including significant business, economic and competitive risks and

uncertainties described under the headings “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements”

in our Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended September

30, 2024. Accordingly, our actual results for the year ended December 31, 2024 may differ materially from those contained in the preliminary

estimates set forth below.

The preliminary financial

data included in this Current Report on Form 8-K below and in the Preliminary Prospectus Supplement has been prepared by, and is the sole

responsibility of, the Company. Our independent registered public accounting firm has not audited, reviewed, compiled or performed any

procedures with respect to such preliminary financial data. Accordingly, our independent registered public accounting firm does not express

an opinion or any other form of assurance with respect thereto.

As of December 31, 2024, we

had approximately $176 million of liquidity, including approximately $106 million of cash and cash equivalents and approximately $70 million

of available borrowing capacity under our $75.0 million senior secured revolving credit agreement, dated as of December 28, 2023, among

the Company, the lenders party thereto and MidFirst Bank as administrative agent. Subject to the qualifications set forth above, for the

year ended December 31, 2024, we currently expect to report net income of between $183.3 million and $187.0 million and Adjusted EBITDA

of between $594.7 million and $606.7 million. For a reconciliation of the preliminary estimate of Adjusted EBITDA and the preliminary

estimate of net income, the most directly comparable GAAP measure, for the year ended December 31, 2024, please see below.

| | |

Year Ended December 31,

2024 | |

| | |

Low Estimate | | |

High Estimate | |

| Reconciliation of Net Income to Adjusted EBITDA | |

| | |

| |

| (in thousands) | |

| | |

| |

| Revenues | |

$ | 959,932 | | |

$ | 979,324 | |

| Net income | |

$ | 183,327 | | |

$ | 187,031 | |

| Add: | |

| | | |

| | |

| Interest expense, net | |

| 99,177 | | |

| 101,181 | |

| Depreciation, depletion and amortization | |

| 268,257 | | |

| 273,677 | |

| Unrealized loss on derivative instruments | |

| 35,948 | | |

| 36,674 | |

| Equity-based compensation expense | |

| 6,466 | | |

| 6,596 | |

| Credit losses | |

| 2,218 | | |

| 2,262 | |

| Gain on sale of assets | |

| (679 | ) | |

| (693 | ) |

| Adjusted EBITDA | |

$ | 594,714 | | |

$ | 606,728 | |

Furthermore, subject to the

qualifications set forth above, for the year ended December 31, 2024, we currently expect total net production volumes between 31,412

MBoe and 32,046 MBoe and total revenues from oil, natural gas and NGL sales between $927.4 million and $946.2 million.

This preliminary financial

and operational information is not a comprehensive statement of our financial or operational results for this period, and our actual results

are subject to completion of our financial closing procedures, final adjustments and other developments that may arise. Management’s

estimates are preliminary and based on information available as of the date of this prospectus supplement. These preliminary results have

not been audited or reviewed by our independent registered public accounting firm and may change and those changes may be material.

Item 8.01. Other Events.

Offering of Common Units

On February 5, 2025, the

Company issued a press release announcing that the Company intends to offer (the “Offering”) for sale 12,000,000 common

units representing limited partner interests in the Company, assuming the underwriters exercise their option to purchase up to an

additional 1,800,000 common units, pursuant to a Registration Statement on Form S-3 filed by the Company with the Securities and

Exchange Commission pursuant to the Securities Act of 1933, as amended, which was declared effective on December 9, 2024.

A copy of the press release

is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Flycatcher Acquisition

On December 20, 2024, we

entered into a Purchase and Sale Agreement to purchase certain oil and gas assets (the “Flycatcher Assets”) near our

recently acquired oil and gas assets located in the Ardmore Basin of Oklahoma for consideration of $29.8 million, subject to

customary purchase price adjustments (the “Flycatcher Acquisition”). The transaction closed on January 31, 2025 with an

effective date of October 1, 2024. The assets included in the Flycatcher Acquisition have (i) total proved reserves of 9.6 MMBoe

with total PV-10 of $67.3 million as of December 31, 2024 based on strip pricing as of January 15, 2025 and (ii) total proved reserves of 9.6 MMBoe as of December 31, 2024 with total PV-10 of

$63.6 million based on SEC pricing. The total proved reserves mix is 60% liquids and 40% natural gas. As a

result of the Flycatcher Acquisition, we increased our total leasehold and mineral acreage to 1,046,662 net acres. To fund the purchase price of the Flycatcher Acquisition, the Company on January 31, 2025 borrowed $23.0 million under its super priority

credit facility, all of which will be paid off with the proceeds from the Offering.

The reports prepared by Cawley,

Gillespie & Associates, Inc. relating to estimated quantities of proved oil and natural gas reserves of the Flycatcher Assets and

the net present value of such reserves as of December 31, 2024 are filed as Exhibits 99.2 and 99.3, respectively, to this Current Report

on Form 8-K and incorporated herein by reference.

Reserve Estimates as

of December 31, 2024

The report prepared by Cawley,

Gillespie & Associates, Inc. relating to the Company’s estimated quantities of its proved natural gas, natural gas liquids and

crude oil reserves as of December 31, 2024 is filed as Exhibit 99.4 to this Current Report on Form 8-K and is incorporated herein by reference.

New Credit Facility

As

of February 5, 2025, the Company has obtained commitments from a syndicate of commercial lenders arranged by Truist Securities, Inc. and

other joint lead arrangers to enter into a senior secured reserve-based revolving credit agreement (the “New Credit Facility”),

among the Company, the lenders and issuing banks party thereto from time to time and Truist Bank, as the administrative agent and collateral

agent. The New Credit Facility is expected to provide for an initial borrowing base and elected commitment amount of $750,000,000, with

a maximum commitment amount of $2,000,000,000 subject to borrowing base availability and to mature four years after the closing date of

the New Credit Facility (the “RBL Closing Date”). Loans under the New Credit Facility are expected to bear interest, at the

Company’s election, at term SOFR (subject to a 0.10% per annum adjustment) plus a margin ranging from 3.00-4.00% per annum or a

base rate plus a margin ranging from 2.00-3.00% per annum, with the margin dependent upon borrowing base utilization at the time of determination.

The New Credit Facility is expected to be guaranteed by all of the Company’s wholly-owned material subsidiaries and secured by substantially

all assets of the Company and the guarantors, including not less than 85% of their proved reserves. The other terms and provisions, including

the conditions precedent to the RBL Closing Date, affirmative and negative covenants and events of default are expected to be customary

for facilities of similar size and type and to include financial maintenance covenants requiring the Company to maintain a total net leverage

ratio not in excess of 3.00 to 1.00 and a current ratio of not less than 1.00 to 1.00, which financial maintenance covenants would be

tested quarterly. On the RBL Closing Date, we expect to use the net proceeds from the Offering, together with cash on hand and borrowings

under the New Credit Facility, to repay in full the borrowings under our Term Loan Credit Agreement, dated December 28, 2023, with

the lenders party thereto, Texas Capital Bank, as agent, and Chambers Energy Management, LP, as the arranger (our “Term Loan Credit

Facility”). The closing of the New Credit Facility is expected to

occur within 30 days of the closing of the Offering. The closing of the Offering is not conditioned upon the closing of the New Credit

Facility.

If consummated, management

expects our entry into the New Credit Facility, the completion of the Offering and the repayment of our Term Loan Credit Facility in full

to increase our cash available for distribution due to a reduction in debt amortization and interest payments. Upon entry into the New

Credit Facility and repayment of our Term Loan Credit Facility, we expect to decrease our required annual amortization payments by approximately

$82.5 million and to realize annual interest savings of approximately $38 million in 2025.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 23.1 |

|

Consent of Cawley, Gillespie & Associates, Inc. |

| 99.1 |

|

Press release, dated February 5, 2025. |

| 99.2 |

|

Report of Cawley, Gillespie & Associates, Inc., dated January 28, 2025, with respect to estimates of reserves of the Flycatcher Acquisition as of December 31, 2024 (SEC Pricing). |

| 99.3 |

|

Report of Cawley, Gillespie & Associates, Inc., dated January 28, 2025, with respect to estimates of reserves of the Flycatcher Assets as of December 31, 2024 (Strip Pricing). |

| 99.4 |

|

Report of Cawley, Gillespie & Associates, dated January 21, 2025, of reserves of Mach Natural Resources LP, as of December 31, 2024. |

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Mach Natural Resources LP |

| |

|

|

| |

By: |

Mach Natural Resources GP LLC, |

| |

|

its general partner |

| |

|

|

| Dated: February 5, 2025 |

By: |

/s/ Tom L. Ward |

| |

|

Name: |

Tom L. Ward |

| |

|

Title: |

Chief Executive Officer |

Exhibit 23.1

CONSENT OF INDEPENDENT PETROLEUM ENGINEERS

As independent petroleum engineers, we hereby consent to the references

to our firm, in the context in which they appear, and to the references to, and the inclusion of, our (a) summary reserve report dated

January 21, 2025, and oil, natural gas and NGL reserves estimates and forecasts of economics as of December 31, 2024, (b) our summary

reserve report dated January 28, 2025 entitled “Evaluation Summary – Strip Pricing, Flycatcher Acquisition Interests, Garvin

and Carter Counties, Oklahoma, Proved Reserves as of December 31, 2024” and (c) our summary reserve report dated January 28, 2025,

entitled “Evaluation Summary – SEC Pricing, Flycatcher Acquisition Interests, Garvin and Carter Counties, Oklahoma, Proved

Reserves as of December 31, 2024,” each included in or made part of this Current Report on Form 8-K of Mach Natural Resources LP

(the “Company”) as Exhibits 99.1, 99.2 and 99.3, respectively. We also consent to the incorporation by reference of such reports

in the Registration Statement on Form S-3 (No. 333-283511) of the Company (the “Registration

Statement”), filed with the U.S. Securities and Exchange Commission.

| |

CAWLEY, GILLESPIE & ASSOCIATES, INC. |

| |

|

| |

Texas Registered Engineering Firm F-693 |

| |

|

| Fort Worth, Texas |

|

| |

|

| February 5, 2025 |

/s/

J. Zane Meekins, P.E. |

| |

J. Zane Meekins, P.E. |

| |

Executive Vice President |

Exhibit 99.1

NATURAL RESOURCES

Mach Natural Resources LP Announces Launch of Public Offering

of Common Units

February 5, 2025

OKLAHOMA CITY, Oklahoma—Mach Natural Resources LP (“Mach”)

announced today the launch of its public offering (the “Offering”) of 12,000,000 common units representing limited partner

interests in Mach (the “common units”). Mach will also grant the underwriters an option to purchase up to an additional 1,800,000

common units at the public offering price, less underwriting discounts and commissions. Mach intends to use the net proceeds from the

Offering to repay in full the approximately $23.0 million of borrowings outstanding under its super priority credit facility, and the

remainder to repay a portion of its term loan credit facility. Mach expects to repay the remainder of borrowings under and terminate its

term loan credit facility with cash on hand and proceeds from the credit facility it intends to enter into following the consummation

of the Offering. Mach’s common units trade on the New York Stock Exchange under the ticker symbol “MNR.”

Stifel, Nicolaus & Company, Incorporated, Raymond James &

Associates, Inc., TCBI Securities, Inc., doing business as Texas Capital Securities, and Truist Securities, Inc. are acting as joint book-running

managers for the Offering. The Offering

of these securities is being made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933,

as amended. When available, a copy of the preliminary prospectus may be obtained from any of the following sources:

|

Stifel, Nicolaus & Company, Incorporated

Attention: Syndicate Department |

|

Raymond James & Associates, Inc.

Attention: Syndicate |

|

TCBI Securities, Inc., doing business as Texas Capital Securities

Attention: Prospectus Department

|

|

Truist Securities, Inc

Attention: Equity Capital Markets |

| 1 South Street, 15th Floor |

|

880 Carillon Parkway |

|

2000 McKinney Avenue, 7th Floor |

|

3333 Peachtree Road NE, 9th Floor |

| Baltimore, MD 21202 |

|

St. Petersburg, Florida 33716 |

|

Dallas, Texas 75201 |

|

Atlanta, GA 30326 |

| Telephone: (855) 300-7136 |

|

Telephone: (800) 248-8863 |

|

Telephone: (866) 355-6329 |

|

Telephone: (800) 685-4786 |

Email:

syndprospectus@stifel.com |

|

Email:

prospectus@raymondjames.com |

|

Email:

prospectus@texascapital.com |

|

Email:

truistsecurities.prospectus@truist.com |

Important Information

A registration statement

on Form S-3 relating to these securities has been filed with the Securities and Exchange Commission (the “SEC”) and has

become effective. The Offering may be made only by means of a prospectus supplement and accompanying prospectus. Copies of the

preliminary prospectus supplement and accompanying prospectus related to the Offering can be obtained by visiting the SEC’s

website at www.sec.gov under “Mach Natural Resources LP.” This press release does not constitute an offer to sell or

the solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

About Mach Natural Resources LP

Mach Natural Resources LP is an independent upstream oil and gas company

focused on the acquisition, development and production of oil, natural gas and NGL reserves in the Anadarko Basin region of Western Oklahoma,

Southern Kansas and the panhandle of Texas.

Cautionary Statement Concerning Forward-Looking Statements

This release contains statements that express Mach’s opinions,

expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements

that reflect historical facts. All statements, other than statements of historical fact included in this release regarding our strategy,

future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are

forward-looking statements, including, but not limited to, statements regarding the anticipated entry into our new credit facility, including

timing, ability to close the new credit facility, anticipated terms of the new credit facility, and anticipated uses of the funds from

the new credit facility, the size of the Offering, our ability to complete the Offering and the anticipated use of the net proceeds from

the Offering. When used in this release, words such as “may,” “assume,” “forecast,” “could,”

“should,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” “budget” and similar expressions are used to identify forward-looking statements,

although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s

current belief, based on currently available information as to the outcome and timing of future events at the time such statement was

made. Such statements are subject to a number of assumptions, risk and uncertainties, many of which are beyond the control of Mach, including

prevailing market conditions and other factors. Please read Mach’s filings with the SEC, including “Risk Factors” in

Mach’s Annual Report on Form 10-K, which is on file with the SEC, for a discussion of risks and uncertainties that could cause actual

results to differ from those in such forward-looking statements.

As a result, these forward-looking statements are not a guarantee of

our performance, and you should not place undue reliance on such statements. Any forward-looking statement speaks only as of the date

on which such statement is made, and Mach undertakes no obligation to correct or update any forward-looking statement, whether as a result

of new information, future events or otherwise.

Contacts

Mach Natural Resources LP

Investor Relations Contact: ir@machnr.com

Exhibit 99.2

January 28, 2025

John Bergman

Vice President - Reservoir Engineering

Mach Resources

14201 Wireless Way

Oklahoma City, OK 73134

| Re: | Evaluation Summary – SEC Pricing |

| | | Flycatcher

Acquisition Interests |

| | | Garvin and Carter Counties,

Oklahoma |

| | | Proved Reserves |

| | | As

of December 31, 2024 |

Dear Mr. Bergman:

As

requested, we are submitting our estimates of proved reserves and our forecasts of the resulting economics attributable to the

Flycatcher Acquisition interests in properties located in Garvin and Carter Counties

in Oklahoma. It is our understanding that the proved reserves estimated in this report constitute 100 percent of all proved reserves owned

by the Flycatcher Acquisition entity.

This report, completed on

January 28, 2025, utilized an effective date of December 31, 2024 and was prepared using constant prices and costs and conforms to Item

1202(a)(8) of Regulation S-K and the other rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). This

report has been prepared for use in filings with the SEC. In our opinion the assumptions, data, methods, and procedures used in the preparation

of this report are appropriate for such purpose.

Composite reserve estimates

and economic forecasts for the reserves are presented in the attached tables and are summarized below:

| | |

| |

Proved | | |

| | |

| |

| | |

| |

Developed | | |

Proved | | |

| |

| | |

| |

Producing | | |

Undeveloped | | |

Proved | |

| Net Reserves | |

| |

| | |

| | |

| |

| Oil | |

- Mbbl | |

| 630.9 | | |

| 1,323.2 | | |

| 1,954.0 | |

| Gas | |

- MMcf | |

| 7,013.5 | | |

| 15,727.5 | | |

| 22,741.0 | |

| NGL | |

- Mbbl | |

| 1,176.3 | | |

| 2,660.7 | | |

| 3,837.0 | |

| Revenue | |

| |

| | | |

| | | |

| | |

| Oil | |

- M$ | |

| 46,775.4 | | |

| 98,114.3 | | |

| 144,889.7 | |

| Gas | |

- M$ | |

| 1,251.2 | | |

| 2,830.9 | | |

| 4,082.2 | |

| NGL | |

- Mbbl | |

| 19,599.2 | | |

| 44,182.9 | | |

| 63,782.2 | |

| Severance and | |

| |

| | | |

| | | |

| | |

| Ad Valorem Taxes | |

- M$ | |

| 4,684.0 | | |

| 8,814.2 | | |

| 13,498.2 | |

| Operating Expenses | |

- M$ | |

| 13,392.6 | | |

| 27,135.1 | | |

| 40,527.6 | |

| Investments | |

- M$ | |

| 165.4 | | |

| 45,124.9 | | |

| 45,290.4 | |

| Operating Income (BFIT) | |

- M$ | |

| 49,383.9 | | |

| 64,054.0 | | |

| 113,437.8 | |

| Discounted at 10.0% | |

- M$ | |

| 28,687.2 | | |

| 34,940.9 | | |

| 63,628.1 | |

Evaluation Summary

As of December 31, 2024

Page 2

In accordance with the SEC

guidelines, the operating income (BFIT) has been discounted at an annual rate of 10% to determine its “present worth”. The

discounted value shown above should not be construed to represent an estimate of the fair market value by Cawley, Gillespie & Associates,

Inc.

The detailed forecasts of

reserves and economics are presented in the attached tables. Tables I-Proved, I-PDP, and I-PUD are summaries of the reserves and associated

economics by reserve category. Table II’s are one-line summaries of the ultimate recovery, gross and net reserves, ownership, revenue,

expenses, investments, net income and discounted cash flows for individual forecasts in each reserve category summary Table I. The entries

in these tables are sorted by operated/non-operated, well direction and well name. Page 1 of the appendix explains the types of data in

these tables. The methods employed in estimating reserves are described in page 2 of the Appendix.

The annual average Henry Hub

spot market gas price of $2.130 per MMBtu and the annual average WTI Cushing spot oil price of $75.48 per barrel were used in this report.

In accordance with the Securities and Exchange Commission guidelines, these prices are determined as an unweighted arithmetic average

of the first-day-of-the-month price for 12 months prior to the effective date of the evaluation. Oil and gas prices were held constant

and were adjusted for each property based on historical differentials. NGL prices were forecast as fractions of the above SEC oil price.

Deductions were applied to the net gas volumes for fuel and shrinkage. The adjusted volume-weighted average product prices over the life

of the properties are $74.15 per barrel of oil, $0.18 per Mcf of gas, and $16.62 per barrel of NGL.

Operating expenses and capital

costs were supplied by Mach Resources and were accepted as furnished. Severance taxes were forecast as 7.195% of net revenues. Neither

expenses nor investments were escalated. Net plugging costs were scheduled as $50,000 per well.

The proved reserves classifications

conform to criteria of the SEC. The estimates of reserves in this report have been prepared in accordance with the definitions and disclosure

guidelines set forth in the SEC Title 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January

14, 2009 in the Federal Register (SEC regulations). The reserves and economics are predicated on the regulatory agency classifications,

rules, policies, laws, taxes and royalties in effect on the effective date except as noted herein. In evaluating the information at our

disposal concerning this report, we have excluded from our consideration all matters as to which the controlling interpretation may be

legal or accounting, rather than engineering and geoscience. Therefore, the possible effects of changes in legislation or other Federal

or State restrictive actions have not been considered. An on-site field inspection of the properties has not been performed. The mechanical

operation or conditions of the wells and their related facilities have not been examined nor have the wells been tested by Cawley, Gillespie

& Associates, Inc. Possible environmental liability related to the properties has not been investigated nor considered.

The reserves were estimated

using a combination of the production performance and analogy methods, in each case as we considered to be appropriate and necessary to

establish the conclusions set forth herein. All reserve estimates represent our best judgment based on data available at the time of preparation

and assumptions as to future economic and regulatory conditions. It should be realized that the reserves actually recovered, the revenue

derived therefrom and the actual cost incurred could be more or less than the estimated amounts.

The reserve estimates were

based on interpretations of factual data furnished by Mach Resources. Ownership interests were supplied by Mach Resources and were accepted

as furnished. To some extent, information from public records has been used to check and/or supplement these data. The basic engineering

and geological data were utilized subject to third party reservations and qualifications. Nothing has come to our attention, however,

that would cause us to believe that we are not justified in relying on such data. An on-site inspection of these properties has not been

made nor have the wells been tested by Cawley, Gillespie & Associates, Inc.

Evaluation Summary

As of December 31, 2024

Page 3

Cawley, Gillespie & Associates,

Inc. is independent with respect to Mach Resources as provided in the Standards Pertaining to the Estimating and Auditing of Oil and Gas

Reserve Information promulgated by the Society of Petroleum Engineers (“SPE Standards”). Neither Cawley, Gillespie & Associates,

Inc. nor any of its employees has any interest in the subject properties. Neither the employment to make this study nor the compensation

is contingent on the results of our work or the future production rates for the subject properties.

Our work papers and related

data are available for inspection and review by authorized parties.

| |

Respectfully submitted, |

| |

|

| |

|

| |

|

| |

CAWLEY, GILLESPIE & ASSOCIATES, INC. |

| |

|

| JZM:ptn |

Texas Registered Engineering

Firm F-693 |

Exhibit 99.3

January 28, 2025

John Bergman

Vice President - Reservoir Engineering

Mach Resources

14201 Wireless Way

Oklahoma City, OK 73134

| Re: | Evaluation Summary – Strip Pricing |

| | | Flycatcher

Acquisition Interests |

| | | Garvin and Carter Counties,

Oklahoma |

| | | Proved Reserves |

| | | As

of December 31, 2024 |

Dear Mr. Bergman:

As

requested, we are submitting our estimates of proved reserves and our forecasts of the resulting economics attributable to the

Flycatcher Acquisition interests in properties located in Garvin and Carter counties

in Oklahoma. It is our understanding that the proved reserves estimated in this report constitute 100 percent of all proved reserves owned

by the Flycatcher Acquisition entity.

Composite reserve estimates

and economic forecasts for the reserves are presented in the attached tables and are summarized below:

| | |

| |

Proved | | |

| | |

| |

| | |

| |

Developed | | |

Proved | | |

| |

| | |

| |

Producing | | |

Undeveloped | | |

Proved | |

| Net Reserves | |

| |

| | |

| | |

| |

| Oil | |

- Mbbl | |

| 628.1 | | |

| 1,327.2 | | |

| 1,955.3 | |

| Gas | |

- MMcf | |

| 6,994.3 | | |

| 15,872.6 | | |

| 22,866.9 | |

| NGL | |

- Mbbl | |

| 1,173.1 | | |

| 2,685.3 | | |

| 3,858.4 | |

| Revenue | |

| |

| | | |

| | | |

| | |

| Oil | |

- M$ | |

| 40,210.8 | | |

| 85,640.1 | | |

| 125,850.9 | |

| Gas | |

- M$ | |

| 11,264.0 | | |

| 26,256.8 | | |

| 37,520.8 | |

| NGL | |

- Mbbl | |

| 16,751.8 | | |

| 38,041.0 | | |

| 54,792.8 | |

| Severance and | |

| |

| | | |

| | | |

| | |

| Ad Valorem Taxes | |

- M$ | |

| 4,704.9 | | |

| 9,106.8 | | |

| 13,811.7 | |

| Operating Expenses | |

- M$ | |

| 13,162.6 | | |

| 27,842.0 | | |

| 41,004.6 | |

| Investments | |

- M$ | |

| 165.4 | | |

| 45,124.9 | | |

| 45,290.4 | |

| Operating Income (BFIT) | |

- M$ | |

| 50,193.6 | | |

| 67,864.2 | | |

| 118,057.8 | |

| Discounted at 10.0% | |

- M$ | |

| 29,990.2 | | |

| 37,309.0 | | |

| 67,299.2 | |

The discounted value shown

above should not be construed to represent an estimate of the fair market value by Cawley, Gillespie & Associates, Inc.

Evaluation Summary

As of December 31, 2024

Page 2

The detailed forecasts of

reserves and economics are presented in the attached tables. Tables I-Proved, I-PDP, and I-PUD are summaries of the reserves and associated

economics by reserve category. Table II’s are one-line summaries of the ultimate recovery, gross and net reserves, ownership, revenue,

expenses, investments, net income and discounted cash flows for individual forecasts in each reserve category summary Table I. The entries

in these tables are sorted by operated/non-operated, well direction and well name. Page 1 of the appendix explains the types of data in

these tables. The methods employed in estimating reserves are described in page 2 of the Appendix.

As requested, January 15,

2025 strip pricing was applied as follows:

| Year | |

WTI

Cushing Oil

($/bbl) | | |

Henry

Hub Gas

($/MMBtu) | |

| 2025 | |

| 73.89 | | |

| 3.860 | |

| 2026 | |

| 68.46 | | |

| 3.999 | |

| 2027 | |

| 66.30 | | |

| 3.805 | |

| 2028 | |

| 65.08 | | |

| 3.680 | |

| 2029 | |

| 64.25 | | |

| 3.554 | |

| 2030 | |

| 63.63 | | |

| 3.472 | |

| 2031 | |

| 63.08 | | |

| 3.324 | |

| 2032 | |

| 62.61 | | |

| 3.261 | |

| 2033 | |

| 62.16 | | |

| 3.243 | |

| 2034 | |

| 62.16 | | |

| 3.344 | |

| 2035 | |

| 62.16 | | |

| 3.451 | |

| Thereafter | |

| Flat | | |

| Flat | |

| Cap | |

| 62.16 | | |

| 3.451 | |

The above oil and

gas prices were adjusted for each property based on historical differentials. NGL prices were forecast as fractions of the above oil prices.

Deductions were applied to the net gas volumes for fuel and shrinkage.

Operating expenses and capital

costs were supplied by Mach Resources and were accepted as furnished. Severance taxes were forecast as 7.195% of net revenues. Neither

expenses nor investments were escalated. Net plugging costs were scheduled as $50,000 per well.

The proved reserves

classifications conform to criteria of the SEC. However, the pricing assumptions do not conform to the reporting criteria of the SEC.

It is not intended that these estimates be used for any purpose requiring such conformity. The reserves

and economics are predicated on the regulatory agency classifications, rules, policies, laws, taxes and royalties in effect on the effective

date except as noted herein. In evaluating the information at our disposal concerning this report, we have excluded from our consideration

all matters as to which the controlling interpretation may be legal or accounting, rather than engineering and geoscience. Therefore,

the possible effects of changes in legislation or other Federal or State restrictive actions have not been considered. An on-site field

inspection of the properties has not been performed. The mechanical operation or conditions of the wells and their related facilities

have not been examined nor have the wells been tested by Cawley, Gillespie & Associates, Inc. Possible environmental liability related

to the properties has not been investigated nor considered.

The reserves were estimated

using a combination of the production performance and analogy methods, in each case as we considered to be appropriate and necessary to

establish the conclusions set forth herein. All reserve estimates represent our best judgment based on data available at the time of preparation

and assumptions as to future economic and regulatory conditions. It should be realized that the reserves actually recovered, the revenue

derived therefrom and the actual cost incurred could be more or less than the estimated amounts.

The reserve estimates were

based on interpretations of factual data furnished by Mach Resources. Ownership interests were supplied by Mach Resources and were accepted

as furnished. To some extent, information from public records has been used to check and/or supplement these data. The basic engineering

and geological data were utilized subject to third party reservations and qualifications. Nothing has come to our attention, however,

that would cause us to believe that we are not justified in relying on such data. An on-site inspection of these properties has not been

made nor have the wells been tested by Cawley, Gillespie & Associates, Inc.

Evaluation Summary

As of December 31, 2024

Page 3

Cawley, Gillespie & Associates,

Inc. is independent with respect to Mach Resources as provided in the Standards Pertaining to the Estimating and Auditing of Oil and Gas

Reserve Information promulgated by the Society of Petroleum Engineers (“SPE Standards”). Neither Cawley, Gillespie & Associates,

Inc. nor any of its employees has any interest in the subject properties. Neither the employment to make this study nor the compensation

is contingent on the results of our work or the future production rates for the subject properties.

Our work papers and related

data are available for inspection and review by authorized parties.

| |

Respectfully submitted, |

| |

|

| |

|

| |

|

| |

CAWLEY, GILLESPIE &

ASSOCIATES, INC. |

| JZM:ptn |

Texas Registered Engineering

Firm F-693 |

Exhibit 99.4

January 21, 2025

John Bergman

Vice President - Reservoir Engineering

Mach Natural Resources LP

14201 Wireless Way

Oklahoma City, OK 73134

| Re: | Evaluation Summary – SEC Pricing |

| | | Mach Natural Resources LP Interests |

| | | Oklahoma, Texas and Kansas |

| | | Proved Reserves |

| | | As

of December 31, 2024 |

Dear Mr. Bergman:

As requested, we are submitting

our estimates of proved reserves and our forecasts of the resulting economics attributable to the Mach Natural Resources LP (“Mach”)

interests in properties located in Oklahoma, Texas and Kansas. It is our understanding that the proved reserves estimated in this report

constitute 100 percent of all proved reserves owned by Mach.

This report, completed on

January 21, 2025, utilized an effective date of December 31, 2024, and was prepared using constant prices and costs and conforms to Item

1202(a)(8) of Regulation S-K and the other rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). This

report has been prepared for use in filings with the SEC. In our opinion the assumptions, data, methods, and procedures used in the preparation

of this report are appropriate for such purpose.

Composite reserve estimates and economic forecasts

for the reserves are summarized below:

| | |

| | |

| | |

Proved | | |

| | |

| | |

| |

| | |

| | |

Proved | | |

Developed | | |

Proved | | |

| | |

| |

| | |

| | |

Developed | | |

Non- | | |

Developed | | |

Proved | | |

| |

| | |

| | |

Producing | | |

Producing | | |

Shut-In | | |

Undeveloped | | |

Proved | |

| Net Reserves | |

| | |

| | |

| | |

| | |

| | |

| |

| Oil | |

| - Mbbl | | |

| 44,771.3 | | |

| 1,284.5 | | |

| 0.0 | | |

| 21,378.6 | | |

| 67,434.5 | |

| Gas | |

| - MMcf | | |

| 788,704.4 | | |

| 20,116.6 | | |

| 0.0 | | |

| 263,181.6 | | |

| 1,072,002.6 | |

| NGL | |

| - Mbbl | | |

| 64,519.5 | | |

| 2,252.1 | | |

| 0.0 | | |

| 24,378.1 | | |

| 91,149.8 | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Oil | |

| - M$ | | |

| 3,327,876.3 | | |

| 94,122.1 | | |

| 0.0 | | |

| 1,591,273.3 | | |

| 5,013,270.8 | |

| Gas | |

| - M$ | | |

| 1,004,086.0 | | |

| 11,864.5 | | |

| 0.0 | | |

| 218,476.4 | | |

| 1,234,426.9 | |

| NGL | |

| - M$ | | |

| 1,307,633.2 | | |

| 41,346.0 | | |

| 0.0 | | |

| 477,464.6 | | |

| 1,826,444.1 | |

| Other | |

| - M$ | | |

| 46,427.6 | | |

| 0.0 | | |

| 0.0 | | |

| 0.1 | | |

| 46,428.7 | |

| Severance and | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ad Valorem Taxes | |

| - M$ | | |

| 468,560.8 | | |

| 9,757.6 | | |

| 0.0 | | |

| 142,974.6 | | |

| 621,293.0 | |

| Operating Expenses | |

| - M$ | | |

| 2,337,867.4 | | |

| 30,980.6 | | |

| 0.0 | | |

| 499,718.3 | | |

| 2,868,566.2 | |

| Investments | |

| - M$ | | |

| 224,556.2 | | |

| 6,889.3 | | |

| 66,708.9 | | |

| 852,255.1 | | |

| 1,150,409.5 | |

| Operating Income (BFIT) | |

| - M$ | | |

| 2,655,038.4 | | |

| 99,705.1 | | |

| -66,708.9 | | |

| 792,266.2 | | |

| 3,480,301.5 | |

| Discounted at 10.0% | |

| - M$ | | |

| 1,588,701.1 | | |

| 58,362.8 | | |

| -11,903.7 | | |

| 255,204.3 | | |

| 1,890,364.5 | |

Evaluation Summary

As of December 31, 2024

Page 2

We evaluated cases that comprise

approximately 92% of the cumulative discounted cash flows of the proved developed producing reserves from the company’s internal

evaluation of the upstream cases and 100% of the reserves in the remaining categories. We refer to these cases as the “Major Upstream”

properties, and composite reserve estimates and economic forecasts for these properties are summarized below:

| | |

| | |

Major | | |

Proved | | |

| | |

| |

| | |

| | |

Proved | | |

Developed | | |

Proved | | |

| |

| | |

| | |

Developed | | |

Non- | | |

Developed | | |

Proved | |

| | |

| | |

Producing | | |

Producing | | |

Shut-In | | |

Undeveloped | |

| Net Reserves | |

| | |

| | |

| | |

| | |

| |

| Oil | |

| - Mbbl | | |

| 38,478.4 | | |

| 1,284.5 | | |

| 0.0 | | |

| 21,378.6 | |

| Gas | |

| - MMcf | | |

| 622,758.4 | | |

| 20,116.6 | | |

| 0.0 | | |

| 263,181.6 | |

| NGL | |

| - Mbbl | | |

| 52,879.5 | | |

| 2,252.1 | | |

| 0.0 | | |

| 24,378.1 | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | |

| Oil | |

| - M$ | | |

| 2,860,760.2 | | |

| 94,122.1 | | |

| 0.0 | | |

| 1,591,273.3 | |

| Gas | |

| - M$ | | |

| 289,020.4 | | |

| 11,864.5 | | |

| 0.0 | | |

| 160,034.2 | |

| NGL | |

| - M$ | | |

| 1,021,604.4 | | |

| 41,346.0 | | |

| 0.0 | | |

| 477,464.6 | |

| Other | |

| - M$ | | |

| -180.3 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Severance and | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ad Valorem Taxes | |

| - M$ | | |

| 304,827.6 | | |

| 9,757.6 | | |

| 0.0 | | |

| 142,974.6 | |

| Operating Expenses | |

| - M$ | | |

| 1,294,466.1 | | |

| 30,980.6 | | |

| 0.0 | | |

| 506,317.6 | |

| Investments | |

| - M$ | | |

| 61,668.6 | | |

| 6,889.3 | | |

| 66,708.9 | | |

| 852,255.1 | |

| Operating Income (BFIT) | |

| - M$ | | |

| 2,510,242.3 | | |

| 99,705.1 | | |

| -66,708.9 | | |

| 727,224.8 | |

| Discounted at 10.0% | |

| - M$ | | |

| 1,347,017.1 | | |

| 58,362.8 | | |

| -11,903.7 | | |

| 221,196.5 | |

The remaining upstream cases

are referred to as the “Minor Upstream” properties, and the company’s internal reserve estimates and economic forecasts

for these properties are summarized below:

| | |

| | |

Minor | |

| | |

| | |

Proved | |

| | |

| | |

Developed | |

| | |

| | |

Producing | |

| Net Reserves | |

| | |

| |

| Oil | |

| - Mbbl | | |

| 6,293.0 | |

| Gas | |

| - MMcf | | |

| 165,946.0 | |

| NGL | |

| - Mbbl | | |

| 11,640.0 | |

| Revenue | |

| | | |

| | |

| Oil | |

| - M$ | | |

| 467,116.3 | |

| Gas | |

| - M$ | | |

| 116,729.5 | |

| NGL | |

| - M$ | | |

| 226,843.1 | |

| Other | |

| - M$ | | |

| 0.0 | |

| Severance and | |

| | | |

| | |

| Ad Valorem Taxes | |

| - M$ | | |

| 62,196.9 | |

| Operating Expenses | |

| - M$ | | |

| 398,896.8 | |

| Investments | |

| - M$ | | |

| 162,887.6 | |

| Operating Income (BFIT) | |

| - M$ | | |

| 186,706.9 | |

| Discounted at 10.0% | |

| - M$ | | |

| 118,722.1 | |

Evaluation Summary

As of December 31, 2024

Page 3

Composite forecasts of revenues

and expenses for company-owned plants, gas gathering systems and water disposal systems are summarized below:

| | |

| | |

Major | | |

Minor | | |

| | |

| |

| | |

| | |

Proved | | |

Proved | | |

| | |

| |

| | |

| | |

Developed | | |

Developed | | |

Proved | | |

Total | |

| | |

| | |

Producing | | |

Producing | | |

Undeveloped | | |

Proved | |

| | |

| | |

Midstream | | |

Midstream | | |

Midstream | | |

Midstream | |

| Net Reserves | |

| | |

| | |

| | |

| | |

| |

| Oil | |

| - Mbbl | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Gas | |

| - MMcf | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| NGL | |

| - Mbbl | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | |

| Oil | |

| - M$ | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Gas | |

| - M$ | | |

| 598,336.4 | | |

| 0.0 | | |

| 58,442.2 | | |

| 656,778.6 | |

| NGL | |

| - M$ | | |

| 59,185.7 | | |

| 0.0 | | |

| 0.0 | | |

| 59,185.7 | |

| Other | |

| - M$ | | |

| 9,881.9 | | |

| 36,725.5 | | |

| 0.0 | | |

| 46,607.3 | |

| Severance and | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ad Valorem Taxes | |

| - M$ | | |

| 101,058.5 | | |

| 477.7 | | |

| 0.0 | | |

| 101,536.2 | |

| Operating Expenses | |

| - M$ | | |

| 619,932.2 | | |

| 24,571.2 | | |

| -6,599.3 | | |

| 637,904.1 | |

| Investments | |

| - M$ | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | | |

| 0.0 | |

| Operating Income (BFIT) | |

| - M$ | | |

| -53,586.8 | | |

| 11,676.6 | | |

| 65,041.5 | | |

| 23,131.2 | |

| Discounted at 10.0% | |

| - M$ | | |

| 117,788.3 | | |

| 5,172.9 | | |

| 34,007.8 | | |

| 156,969.0 | |

The above revenues and expenses

are limited to those associated only with Mach volumes. No revenues resulting from the gathering or processing of third party volumes

are included. The minor proved developed producing revenues and expenses are from the company’s internal evaluation of the midstream

cases.

In accordance with the SEC

guidelines, the operating income (BFIT) has been discounted at an annual rate of 10% to determine its “present worth”. The

discounted value shown above should not be construed to represent an estimate of the fair market value by Cawley, Gillespie & Associates,

Inc.

The annual average Henry Hub

spot market gas price of $2.130 per MMBtu and the annual average WTI Cushing spot oil price of $75.48 per barrel were used in this report.

In accordance with the Securities and Exchange Commission guidelines, these prices are determined as an unweighted arithmetic average

of the first-day-of-the-month price for 12 months prior to the effective date of the evaluation. Oil and gas prices were held constant

and were adjusted for each property based on historical differentials. NGL prices were forecast as fractions of the above SEC oil price.

Deductions were applied to the net gas volumes for fuel and shrinkage. The adjusted volume-weighted average product prices over the life

of the properties are $74.34 per barrel of oil, $1.15 per Mcf of gas, and $20.04 per barrel of NGL.

Operating expenses and capital

costs were supplied by Mach and reviewed for reasonableness. Severance taxes were forecast by state based on statutory rates, and ad valorem

taxes were forecast as 3.0% of net revenue for operated properties in Texas and Kansas. Neither expenses nor investments were escalated.

Net plugging costs were scheduled as $50,000 per well. The plugging costs for shut-in wells with no remaining reserves are captured in

the proved developed shut-in category.

The proved reserves classifications

conform to criteria of the SEC. The estimates of reserves in this report have been prepared in accordance with the definitions and disclosure

guidelines set forth in the SEC Title 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January

14, 2009 in the Federal Register (SEC regulations). The reserves and economics are predicated on the regulatory agency classifications,

rules, policies, laws, taxes and royalties in effect on the effective date except as noted herein. In evaluating the information at our

disposal concerning this report, we have excluded from our consideration all matters as to which the controlling interpretation may be

legal or accounting, rather than engineering and geoscience. Therefore, the possible effects of changes in legislation or other Federal

or State restrictive actions have not been considered. An on-site field inspection of the properties has not been performed. The mechanical

operation or conditions of the wells and their related facilities have not been examined nor have the wells been tested by Cawley, Gillespie

& Associates, Inc. Possible environmental liability related to the properties has not been investigated nor considered.

Evaluation Summary

As of December 31, 2024

Page 4

The reserves were estimated

using a combination of the production performance and analogy methods, in each case as we considered to be appropriate and necessary to

establish the conclusions set forth herein. All reserve estimates represent our best judgment based on data available at the time of preparation

and assumptions as to future economic and regulatory conditions. It should be realized that the reserves actually recovered, the revenue

derived therefrom and the actual cost incurred could be more or less than the estimated amounts.

The reserve estimates were

based on interpretations of factual data furnished by Mach Natural Resources LP. Ownership interests were supplied by Mach Natural Resources

LP and were accepted as furnished. To some extent, information from public records has been used to check and/or supplement these data.

The basic engineering and geological data were utilized subject to third party reservations and qualifications. Nothing has come to our

attention, however, that would cause us to believe that we are not justified in relying on such data. An on-site inspection of these properties

has not been made nor have the wells been tested by Cawley, Gillespie & Associates, Inc.

Cawley, Gillespie & Associates,

Inc. is independent with respect to Mach Natural Resources LP as provided in the Standards Pertaining to the Estimating and Auditing of

Oil and Gas Reserve Information promulgated by the Society of Petroleum Engineers (“SPE Standards”). Neither Cawley, Gillespie

& Associates, Inc. nor any of its employees has any interest in the subject properties. Neither the employment to make this study

nor the compensation is contingent on the results of our work or the future production rates for the subject properties.

Our work papers and related

data are available for inspection and review by authorized parties.

| |

Respectfully submitted, |

| |

|

| |

|

| |

|

| |

J. Zane Meekins, P.E. |

| |

Executive Vice President |

| |

|

| |

CAWLEY, GILLESPIE & ASSOCIATES, INC. |

| JZM:ptn |

Texas Registered Engineering Firm F-693 |

| |

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

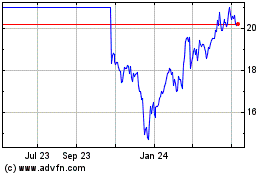

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Feb 2025 to Mar 2025

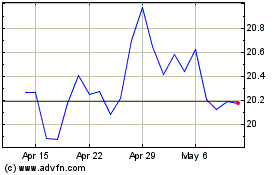

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Mar 2024 to Mar 2025