Morgan Stanley Study Unpacks Plan Sponsor Trends Amid Increasing Demand for Consultancy Services

October 21 2024 - 8:30AM

Business Wire

• 80% of plan sponsors surveyed are using consultants in

managing retirement plans

• Trends indicate preference is tipping toward higher-touch

services

• Fund lineup and participant education singled out as strategic

priorities

Morgan Stanley today announced results of its 2024 Retirement

Plan Survey, providing insight into shifting 401(k) plan sponsor

attitudes and tactics amid a constantly evolving financial

landscape.

Retirement benefits remain essential for attracting and

retaining employees, but as markets grow more complex, so do

demands on defined contribution (DC) plan sponsors to help

employees prepare for retirement. To compete, plan sponsors are

under pressure to offer attractive benefit packages that address

myriad employee needs and business demands. In response, most are

turning to consultants for support—and seeking more holistic

services.

Polling nearly 200 plan sponsor decision-makers with 401(k)

plans with at least $50 million in assets—and 56 from organizations

with 401(k) plans with more than $1 billion—the survey provides a

comprehensive look at how retirement leaders are approaching their

choices around selecting support, investment lineups and strategies

for engaging participants. Key insights include:

1. Consultant Relationships Are in Demand

- Reflecting the need for guidance in an increasingly complex

landscape, over 80% of plan sponsor respondents say they are

currently using a consultant.

- The structure of consultant arrangements is also shifting

toward higher-touch services: A 3(21) fiduciary acts as an

investment advisor who makes investment recommendations regarding

plan assets, while by contrast a 3(38) investment manager reviews

investment options, makes investment decisions, and ultimately

takes more fiduciary responsibility for the plan's day-to-day

investments. Today, 3(21) relationships are still nearly twice as

common as 3(38) relationships, (55% vs. 27%, respectively), but the

gap appears to be closing—with most 3(38) users beginning their

engagement within the past five years. In fact, nearly half of plan

sponsors are either highly (6%) or partly (42%) considering working

with a 3(38) investment manager.

- Among those not utilizing or considering a 3(38) investment

manager, satisfaction with their current approach was the primary

reason. On the other hand, top reasons plan sponsors cited for

considering the switch to a 3(38) investment manager include

reduced workload for executives, maximum investment liability

transfer under ERISA, and the 3(38) investment manager’s ability to

take immediate action for fund changes.

2. As Investment Lineups Expand, So Do Opportunities for

Support

- Though most plan sponsors are not currently seeking to increase

the number of asset managers they use, more than a third plan to

expand the number of investment options they offer. Yet, a quarter

cited challenges in changing their investment lineup, particularly

when it comes to participant communication, regulatory filings and

the cost of moving assets—indicating key areas where consultant

guidance adds value.

- Most retirement plan sponsors are adding or have added target

date funds with guaranteed payouts (71%), multi-asset strategies

(65%), and hybrid default investment options (56%) to their

offerings. Currently, 64% offer managed accounts, with another 22%

planning to do so. And despite initial hesitation, 41% of sponsors

now provide retirement income solutions—with an additional 44%

intending to introduce this option to help workers turning savings

into income post-retirement.

3. Participant Education Key to Success

- Given so much complexity, educational materials and other tools

to engage participants are very important to the success of

retirement plans, especially when adding new solutions. The top

three popular tools provided through a 401(k) include online

retirement planning tools (85%), online account review and analysis

tools (74%) and written education content (73%).

- Consultants and investment advisors are now the most common

source for participant educational resources, with nearly half of

plan sponsors turning to their consultants (47%) to provide these

services. This trend is expected to continue as consultants

increasingly incorporate participant education into their

offerings. Online tools are a favorite format, but nearly half of

sponsors also offer live training, either online or in-person.

- Many plan sponsors identified participant understanding and

involvement as key barriers to adding retirement income solutions

to their plans, stressing the need for education resources.

"Retirement plans are adapting to address both company and

employee needs, and our survey results show that it's not just

about improving financial results, but about doing what's best for

the future," said Jeremy France, Head of Institutional Consulting

Solutions at Morgan Stanley. “Plan sponsors are looking for a

variety of solutions to help them maintain competitive benefits,

foster employee understanding and fulfill fiduciary

responsibilities, but there’s no one-size-fits-all recipe. Instead,

we believe that it’s only through tailored guidance that

organizations can find the right blend of support, investment

options and education to unlock the full impact of their

plans.”

Morgan Stanley has built a robust offering across the full

spectrum of advice, workplace and self-directed solutions. Through

Institutional Consulting Solutions, comprehensive retirement

services include investment advice and solutions for institutional

investors; support for plan sponsors in managing retirement plans,

navigating regulations and educating employees; and plan

participant education and personalized guidance. For more

information, visit Morgan Stanley Institutional Consulting

Solutions.

The 2024 plan sponsor survey is the second in an annual series

from Morgan Stanley Wealth Management focused on insights into the

institutional landscape. The full 2024 survey results are available

here.

About Morgan Stanley Wealth Management

Morgan Stanley Wealth Management, a global leader, provides

access to a wide range of products and services to individuals,

businesses and institutions, including brokerage and investment

advisory services, financial and wealth planning, cash management

and lending products and services, annuities and insurance,

retirement and trust services.

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services

firm providing a wide range of investment banking, securities,

wealth management and investment management services. With offices

in 42 countries, the Firm’s employees serve clients worldwide

including corporations, governments, institutions and individuals.

For further information about Morgan Stanley, please visit

www.morganstanley.com.

This has been prepared for informational purposes only and is

not a solicitation of any offer to buy or sell any security or

other financial instrument, or to participate in any trading

strategy. This material does not provide individually tailored

investment advice. It has been prepared without regard to the

individual financial circumstances and objectives of persons who

receive it. Morgan Stanley recommends that investors independently

evaluate particular investments and strategies and encourages

investors to seek the advice of a Financial Advisor.

When Morgan Stanley Smith Barney LLC, its affiliates and Morgan

Stanley Financial Advisors and Private Wealth Advisors

(collectively, “Morgan Stanley”) provide “investment advice”

regarding a retirement or welfare benefit plan account, an

individual retirement account or a Coverdell education savings

account (“Retirement Account”), Morgan Stanley is a “fiduciary” as

those terms are defined under the Employee Retirement Income

Security Act of 1974, as amended (“ERISA”), and/or the Internal

Revenue Code of 1986 (the “Code”), as applicable. When Morgan

Stanley provides investment education, takes orders on an

unsolicited basis or otherwise does not provide “investment

advice”, Morgan Stanley will not be considered a “fiduciary” under

ERISA and/or the Code. For more information regarding Morgan

Stanley’s role with respect to a Retirement Account, please visit

www.morganstanley.com/disclosures/dol. Tax laws are complex and

subject to change. Morgan Stanley does not provide tax or legal

advice. Individuals are encouraged to consult their tax and legal

advisors (a) before establishing a Retirement Account, and (b)

regarding any potential tax, ERISA and related consequences of any

investments or other transactions made with respect to a Retirement

Account.

Past performance is not a guarantee or indicative of future

performance. Historical data shown represents past performance and

does not guarantee comparable future results.

This material contains forward-looking statements and there can

be no guarantee that they will come to pass.

Diversification and asset allocation do not guarantee a profit

or protect against loss in a declining financial market.

This material should not be viewed as investment advice or

recommendations with respect to asset allocation or any particular

investment.

Morgan Stanley Wealth Management is the trade name of Morgan

Stanley Smith Barney LLC, a registered broker-dealer in the United

States.

© 2024 Morgan Stanley Smith Barney LLC. Member SIPC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017986889/en/

Media Relations: Susan Siering Susan.Siering@morganstanley.com;

Jeanne Joe Perrone Jeanne.Perrone@morganstanley.com

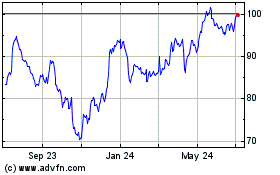

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Nov 2024 to Dec 2024

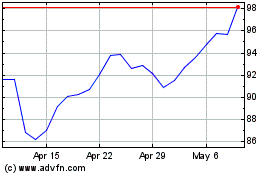

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Dec 2023 to Dec 2024