Metals Acquisition Limited (NYSE: MTAL):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231114152626/en/

Figure 1 - CSA Copper Mine Recordable

Injuries Trailing 12 months (Graphic: Business Wire)

Metals Acquisition Limited (“MAC” or the “Company”) today

provides a market update on the following aspects of the CSA Copper

Mine for the September quarter:

- Total Reportable Injury Frequency Rate (“TRIFR”) reduced

slightly to 9.5 per million hours and zero Lost Time Injuries

(“LTI”)

- September quarter production of 9,845 tonnes of copper and

115,000 ounces of silver

- September quarter C11 costs of US$1.86/lb down from US$3.02/lb

and US$2.90/lb in the immediate two quarters prior to MAC

ownership, as post acquisition offtake terms and cost reductions

were implemented. Site general administration (“G+A”) costs are

inclusive of US$1.5 million of exploration costs equivalent to

US$0.07/lb

- Approval of the new Rehabilitation Cost Estimate (“RCE”) by the

NSW Resource Regulator at A$44 million and approval of the Stage 10

lift of the Tailings Storage Facility (“TSF”)

- Cash on hand as of the date of this release of US$48

million

Mick McMullen, CEO, commented, “Since acquiring the CSA Copper

Mine just five months ago, the results demonstrate that our team

has continued to identify opportunities to unlock value, while not

compromising safety. We have accomplished a lot in a short period

and the work being done now will yield strong returns in 2024 and

beyond. I am particularly excited about the positive trends in

safety, production and cost reduction that our team have been able

to implement in such a short period. The rapid advances made on the

various permitting initiatives further cement our view that CSA is

a Tier 1 asset in a mining friendly jurisdiction. We will continue

to work relentlessly to unlock additional value at CSA and any

future assets that fit within our strategy.”

Unless stated otherwise all references to dollar or $ are in

US$.

ESG

Safety

The TRIFR for the CSA Copper Mine has reduced slightly from 10.2

to 9.5 for the quarter (refer Figure 1). This is below the NSW

underground metalliferous TRIFR for 2022 of 11.97. The LTI rate of

zero compares favourably with the NSW underground metalliferous LTI

of 2.6 for 2022.

Whilst MAC believes that safety can continue to be improved in

the future, MAC also believes that remaining at this relatively low

level is a great result coming immediately after a change of

ownership and all the operational changes being made at the

mine.

ESG management at the CSA Copper Mine site has performed above

expectations throughout this quarter for the newly acquired asset

with various approvals received in short order and a strong

environmental performance.

Regulatory

Key regulatory activities that occurred throughout the quarter

include:

- The CSA Copper Mine’s rehabilitation objectives (“ROBJ’s”) were

reviewed to align with the NSW Resource Regulators requirements and

submitted on 27th September 2023.

- MAC received the acceptance from the NSW Resource Regulator for

the updated Rehabilitation Cost Estimate (“RCE”) for CML5 (being

the CSA Copper Mine’s key tenure). This RCE is a bond/guarantee

which needs to be provided to the NSW government to provide

security for the rehabilitation and closure requirements on the

site and is a total of A$44m.

Approvals

Approvals at the CSA Copper Mine are predominately through the

local Cobar Shire Council as the approving authority, as an

integrated development. The following development applications were

approved during the September Quarter.

- Stage 9 STSF buttress approved

- Stage 10 Lift and Stage 10 Buttress approved

- Railway dam Borrow Pit approved

MAC has been actioning significant changes at the CSA Copper

Mine and working closely with local stakeholders during this period

of change. The community and approval authorities have been

supportive during this period and MAC continues to believe that

Cobar in western NSW is a Tier 1 mining jurisdiction which is

becoming increasingly important in this period of global

instability.

Production

The September quarter is the first full quarter of CSA’s

ownership under MAC and was a period of significant change in the

organisation. Table 1 contains a summary by quarter for the year to

date.

Table 1 - Quarterly Operational Performance of the CSA Copper

Mine

Q1 2023

Q2 2023

Q3 2023

Ore Tonnes Milled

240,698

254,380

300,328

Grade Milled

3.7

%

3.1

%

3.4

%

Copper Produced (t)

8,691

7,779

9,845

Silver Produced (oz)

100,092

84,517

115,081

Mining Cost/t Ore Mined (US$)

$

97.5

$

88.8

$

79.1

Processing Cost/t Milled (US$)

$

26.4

$

28.0

$

19.8

G+A Cost/t Milled (US$)

$

28.9

$

33.0

$

29.3

C11 (US$/lb)

$

2.90

$

3.02

$

1.86

Average Cu Price Received (US$/lb)

$

4.12

$

3.80

$

3.81

Development Cost/metre (US$)

$

18,677

$

11,773

$

10,225

Total Capital Cost (US$ million)

$

12.66

$

13.15

$

10.62

The September quarter was the highest quarterly copper and

silver production (Fig 2) for 2023. Whilst this was a good result

from the operations team, the production in the month of September

was below plan as a result of a 4 week delay in accessing a high

grade stope due to a regulator imposed prohibition notice relating

to ventilation requirements, with actions being taken to reduce the

risk of such prohibitions occurring in the future.

On an annual basis the mine turns over approximately 70 stopes,

the top 5 or 6 of which account for up to 1/3 of the contained

metal mined. Therefore, any delays accessing these high-grade

stopes can negatively impact production in the short term. Access

to this stoping area has subsequently been restored and the high

grade (+4% copper) material is now being mined.

Site G+A costs are inclusive of exploration costs that total

US$1.5 million in the September quarter, equivalent to US$0.07/lb

of the C1 cash cost.

The average received copper price was flat quarter on quarter

and declined slightly from the first quarter in line with market

prices.

A large number of staffing changes were carried out during the

quarter.

Specific changes include:

- Rob Walker commenced as the new General Manager on 31 July

2023

- MAC corporate environmental manager appointed and

commenced

- Underground manager appointed and commenced

- MAC corporate contracts manager appointed and commenced

- HR Manager appointed and commenced

Total headcount of employees and contractors has been

significantly reduced during the September quarter and now sits at

just over 500 people on an FTE basis.

A total of US$1.1 million in restructuring costs were incurring

during the September quarter associated with headcount reductions

and have been excluded from the C1 costs as non-recurring.

As seen in Figure 3, C1 cash costs have shown a rapid decline

under MAC’s ownership. As discussed below, MAC is refining the

split between mining operating and mining capital costs in the

current quarter.

MAC management believes that there are additional opportunities

at the CSA Copper Mine to reduce costs with increased focus on

productivity improvements and will continue to implement additional

productivity measures to further reduce C1 costs. Figure 4 provides

an illustration of the improvements in productivity that has

already been demonstrated at the mine.

Productivity will have an inverse relationship to C1 as seen in

Figures 3 and 4.

Apart from copper production, the largest driver of C1 costs is

the mining unit rate as mining accounts for approximately 60% of

total site operating costs. Figure 5 illustrates the improvement in

the mining unit rate since MAC took ownership of the mine which

directional improvement, however these unit rates are still high in

the Australian context and many of the changes made in late

September will only make an impact in the fourth quarter. The mine

has a high fixed cost base and the contractor and headcount

reductions are targeted at reducing those fixed costs but

ultimately material unit rate reductions will need to also see

volume increases.

Work is underway to achieve a higher degree of granularity on

the mining costs and to more accurately determine the split between

operating and capital mining costs.

The other significant component of the mining capital costs are

development costs, which have been very high at CSA historically.

Figure 6 demonstrates the improvements that have been achieved in

the cost per metre of development over the course of the year, and

under new management. It should be noted that these are still high

unit rates as compared to Australian peers and MAC believes that

further opportunities for reductions exists.

Figures 7 and 8 shows the unit rates for processing and site

G+A, with the former improving strongly and the latter slightly

improving quarter on quarter. Both are heavily dependent on milled

ore volumes due to their high fixed cost nature.

Capital spend (including capitalized development) has trended

down over the year as seen in Figure 9. This reflects both the

completion of the mill replacement works in the second quarter and

the reduction in mine development unit rates into the third

quarter.

During the month of September 19 of the 21 major projects team

were demobilised from site (all contractors) with the cost

reduction benefit from this to be seen from October onwards.

Preliminary construction works on the next lift for TSF

commenced in September which will slightly increase capital spend

in the fourth quarter relative to the third quarter. Overall

capital spend for the year is likely to be lower than the US$58

million that MAC had previously estimated and will likely be closer

to US$50 million with a H2 run rate of US$44 - $46 million.

Overall, considering the significant changes at the mine, the

production and cost performance trends are pleasing and provide a

strong platform to build on for the December quarter and into

2024.

Mine Plan, Resource and Reserve

Since taking ownership the MAC team has been actively looking

for ways to improve on the previous mine plan. Figure 10

illustrates the known mineralisation in the immediate mine

environment.

The bulk of the current mining is in QTSN (circa 75% of

production) and QTSC with additional minor production from the East

and West deposits (not shown due to angle of section). The mine

commenced production as a lead-zinc-silver mine near surface from

the Upper Level Zone A mineralisation and then progressed into the

current copper deposit from the Upper Level Zone B approximately

400m below surface. There is significant remnant mineralisation in

both the Upper Zone A and Zone B areas and none of this is in the

current mineral resource estimate as all the data is in hard copy.

Work is underway to digitize this material to bring it into the

mineral resource estimate in the future.

The Upper Level Zone C is the top of the current mineral

resource and contains significant mineralisation that is not in the

current mine plan. Work is under way to bring that material into

the mine plan and a significant number of stopes have been designed

and physical inspections completed. This material is typically in

the circa 3% Cu diluted grade range however it is very close

vertically to the crusher dump pocket and would have lower unit

rate costs than the ore from the bottom of QTSN.

Drilling of the QTS S Upper A mineralisation was completed over

the last 3 months with a view to bringing that into the mineral

resource estimate. This is a relatively narrow but very high-grade

zone and during October the Company completed a mine design and is

out to tender on the mining works associated with the development

of this. During the December quarter a decision will be made on the

optimal development plan and whether to carry out the works as an

owner mining or contractor operation.

Finally, the Company has been remodelling the resource at a

lower cut-off grade based on the new cost structure post-closing.

This work is well underway and will be fed into the mine planning

for the 2023 resource and reserve update.

Finance and Corporate

The Company continues to progress work and consideration of

undertaking an additional listing on the Australian Securities

Exchange (ASX). The Company is well progressed with this

work stream and, subject to board approval and various factors out

of the Company’s control (including market conditions), anticipates

proceeding with the ASX listing in calendar Q1 2024. The timing and

quantum of any associated equity raise would be market dependent

and the Company cannot provide any certainty as to when or if an

ASX listing or associated equity raise would occur.

Subsequent to the end of the quarter, on 13 October 2023, the

Company completed a Private Placement (PIPE) with new and existing

investors for gross proceeds of US$20,098,056 at a price of

US$11/share for a total of 1,827,096 new shares issued. At the time

of this report the Company’s share capital is as shown below in

Table 2.

Table 2

Pro Forma Ownership

M Shares

M Securities

% of Capital Structure

Shares on Issue/Oct PIPE

50.13

50.13

72.5

%

Founder / Sponsor Warrants

(6,535,304 at $11.50/sh strike)

-

6.54

9.5

%

Investor Warrants

(8,838,260 at $11.50/sh strike)

-

8.84

13

%

Subordinated Debt Warrants

(3,187,500 at $12.50/sh strike)

-

3.18

5

%

Total

50.13

68.80

100

%

During the quarter, the Company delivered 3,375 tonnes of copper

into the hedge book at an average price of US$3.72/lb.

At the end of September, the remaining copper hedge book

consisted of the following:

Year

Tonnes

Price

US$/lb

2023

3,375

$3.72

2024

12,420

$3.72

2025

12,420

$3.72

As of the date of this report the Company had US$48 million of

cash on hand.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL) is a company focused on

operating and acquiring metals and mining businesses in high

quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s

actual results may differ from expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward- looking statements. These

forward-looking statements include, without limitation, MAC’s

expectations with respect to future performance of the CSA Mine .

These forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the ability to recognize the anticipated

benefits of the business combination, which may be affected by,

among other things; the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in mineral

resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks; and

dependence on key management personnel and executive officers; and

other risks and uncertainties indicated from time to time in the

definitive proxy statement/prospectus relating to the business

combination that MAC filed with the SEC relating to its acquisition

of the CSA Copper Mine, including those under “Risk Factors”

therein, and in MAC’s other filings with the SEC. MAC cautions

readers not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. MAC does not

undertake or accept any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

to reflect any change in its expectations or any change in events,

conditions, or circumstances on which any such statement is

based.

More information on potential factors that could affect MAC’s or

CSA Copper Mine’s financial results is included from time to time

in MAC’s public reports filed with the SEC. If any of these risks

materialize or MAC’s assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that MAC

does not presently know, or that MAC currently believes are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward- looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

Non-IFRS financial information

MAC’s results are reported under International Financial

Reporting Standards (IFRS). This release may also include certain

non-IFRS measures including C1 costs. These C1 cost measures are

used internally by management to assess the performance of our

business, make decisions on the allocation of our resources and

assess operational management. Non-IFRS measures have not been

subject to audit or review and should not be considered as an

indication of or alternative to an IFRS measure of financial

performance.

1 MAC’s results are reported under International Financial

Reporting Standards (IFRS). This release may also include certain

non-IFRS measures including C1 costs. These C1 cost measures are

used internally by management to assess the performance of our

business, make decisions on the allocation of our resources and

assess operational management. Non-IFRS measures have not been

subject to audit or review and should not be considered as an

indication of or alternative to an IFRS measure of financial

performance. Historical C1 costs for the CSA Copper Mine prior to

the acquisition by MAC include the costs of the previous offtake

agreement that was terminated on closing of the acquisition by MAC

in June 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114152626/en/

Mick McMullen Chief Executive Officer Metals Acquisition

Limited. +1 (817) 698-9901 mick.mcmullen@metalsacqcorp.com

Dan Vujcic Chief Development Officer and Interim Chief Financial

Officer Metals Acquisition Limited. +61 451 634 120

dan.vujcic@metalsacqcorp.com

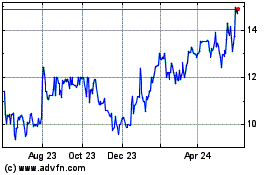

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

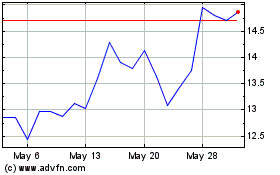

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Jan 2024 to Jan 2025