Delivered Record Year in Performance

Materials and Strategic Repositioning in Performance Chemicals Is

Already Demonstrating Results

Business Portfolio Review Is Progressing

with Recently Announced Strategic Alternatives Process for

Industrial Specialties Product Line and Evaluation of Additional

Portfolio and Cost Reduction Actions Ongoing

Provides Information About Engagement with

Vision One

Ingevity Corporation (NYSE: NGVT) today issued the following

letter to stockholders in response to the presentation issued by

Vision One Management Partners (“Vision One”) earlier today:

Dear Ingevity Stockholders,

The Ingevity Board of Directors and

leadership team are committed to taking aggressive actions to

deliver significant, sustainable value creation for all Ingevity

stockholders. Over the last year, we have undertaken a broad range

of initiatives to enhance our business performance, improve our

portfolio and strengthen our governance. These initiatives

include:

- Delivering a record year for Performance Materials. In

2024, we delivered record performance for our Performance Materials

business for both sales and EBITDA, with margins surpassing 50%,

driven by new pricing and operational efficiency initiatives. We

expect continued momentum in this business as we see ICE vehicles

continue to become more fuel efficient, as well as consumer

preferences trending toward hybrids. We are also making progress in

developing new markets for our carbon technologies in silicon anode

batteries through our investment in Nexeon.

- Transforming our Performance Chemicals segment. We have

made significant progress proactively managing our Performance

Chemicals business, exiting lower margin, cyclical end markets,

reducing our physical footprint to optimize costs and diversifying

our raw material streams. In addition, we have addressed uneconomic

long-term supply contracts, enhancing our ability to better manage

the cost and timing of key raw material purchases.

- Reviewing our portfolio, including a formal process for our

Industrial Specialties product line and North Charleston CTO

refinery. On October 30, 2024, we publicly announced that we

were reviewing our business portfolio, a review which began in

March 2024. As part of this review, we announced on January 16,

2025, a formal exploration of strategic alternatives for the

majority of the Industrial Specialties product line and our North

Charleston CTO refinery. We expect that exiting this product line

will further strengthen the Performance Chemicals segment and

enable us to focus our attention on higher growth and higher margin

opportunities within our portfolio while improving the company’s

earnings and cash flow profile. We are proceeding expeditiously

with the review of Industrial Specialties and the refinery and

expect to communicate a path forward by year end. We are also

continuing to review the rest of our portfolio.

- Continuing to enhance our Board with fresh, qualified

perspectives. In June 2024, as part of our ongoing board

refreshment process, we began a search for a new director with the

assistance of an independent search firm. This search culminated in

the appointment of J. Kevin Willis, Senior Vice President &

Chief Financial Officer of Ashland Inc., to our Board in December

2024. Mr. Willis played an integral role in Ashland’s successful

separation from Valvoline and the reorganization of Ashland’s

European operations. With Mr. Willis’s appointment, Ingevity has

now added three new independent directors over the last three

years.

Despite a challenging market backdrop, these

initiatives are already delivering results. In addition to our

record results in Performance Materials, we realized $84 million in

savings as part of our Performance Chemicals repositioning actions

in 2024 – materially above our target of $65-$75 million – and

expect to realize approximately $10-$25 million in 2025. As a

result, in 2024, our second half EBITDA margins increased to

approximately 28% and we delivered free cash flow that

significantly exceeded our prior guidance. We have used that

improved free cash flow to reduce debt and are targeting a net

leverage ratio of below 2.8x by year-end 2025. We expect to

continue our strong trajectory in 2025, targeting $400 to $415

million in EBITDA.

It is important to emphasize that in addition

to the meaningful actions already underway, the Company is

continuing to evaluate additional opportunities to further reduce

costs, as well as reviewing our portfolio with a “best owner”

mindset. The CEO search is progressing well and we are very pleased

with the quality of the candidates under consideration.

Background on

Engagement with Vision One

As you have likely seen, one of our recent

stockholders, Vision One, today issued a public presentation

outlining their perspectives on the Company and making specific

demands regarding our portfolio and governance.

Vision One first approached the Company in

November 2024 – well after we initiated a search for new directors

and announced our CEO transition and new strategic priorities,

including our portfolio review. Since first being made aware of

their concerns through a letter to our Board, members of Ingevity’s

Board and management team have met with Vision One’s principals to

hear their views on the Company, with the goal of developing a

constructive dialogue on how to deliver more stockholder value.

In January, Vision One formally nominated

four director candidates, including Vision One principals Courtney

Mather and Julio Acero, along with two other candidates, Merri

Sanchez and F. David Segal. Our Nominating and Governance Committee

carefully considered and interviewed each of the nominees pursuant

to our established process. At the conclusion of that process, the

Nominating and Governance Committee ultimately decided not to

recommend any of the candidates to the Board.

In coming to its conclusion, the Committee

determined that each of Vision One’s candidates lacked relevant

sector or public company executive experience and would not

meaningfully improve the mix of operational, portfolio or capital

allocation expertise on the Board, which are areas of expertise

that the Board believes are priorities given the Company’s ongoing

evaluation of operational improvements and the review of the

Company’s portfolio.

In an effort to advance a constructive

resolution with Vision One, we offered to work collaboratively with

Vision One to identify a mutually agreed director candidate that

had expertise aligned with the needs of the Company and our

strategy at this time. We also invited them to present their

perspectives to the Board, in an effort to deepen our engagement

and dialogue.

However, with Ingevity in the midst of a CEO

transition and an active strategic review process, Vision One has

rejected our efforts to engage constructively and has been focused

on adding their four hand-picked representatives to the Board. It

has now launched a proxy contest to further this objective. While

the Company remains open to engagement with Vision One, we do not

believe that Vision One’s candidates are additive to our Board and

do not believe that their election would be in the best interests

of the Company. The Ingevity Board remains open to resolving this

matter constructively with Vision One – but will only do so in a

manner that serves the best interest of all Ingevity

stockholders.

We look forward to engaging with our

stockholders over the coming weeks to hear your perspectives, and

we thank you for your continued investment in and support of

Ingevity.

The Ingevity Board and its Nominating and Governance Committee

will present its formal recommendation regarding the election of

directors in the Company’s proxy statement and other materials, to

be filed with the Securities and Exchange Commission and mailed to

all stockholders eligible to vote at the Annual Meeting.

Stockholders are not required to take any action at this time.

Ingevity: Purify, Protect and Enhance

Ingevity provides products and technologies that purify, protect

and enhance the world around us. Through a team of talented and

experienced people, we develop, manufacture and bring to market

solutions that help customers solve complex problems and make the

world more sustainable. We operate in three reporting segments:

Performance Materials, which includes activated carbon; Advanced

Polymer Technologies, which includes caprolactone polymers; and

Performance Chemicals, which includes specialty chemicals and road

technologies. Our products are used in a variety of demanding

applications, including agrochemicals, asphalt paving, certified

biodegradable bioplastics, coatings, elastomers, pavement markings

and automotive components. Headquartered in North Charleston, South

Carolina, Ingevity operates from 31 countries around the world and

employs approximately 1,600 people. The company’s common stock is

traded on the New York Stock Exchange (NYSE: NGVT). For more

information, visit Ingevity.com.

Use of non-GAAP financial measures: This press release

includes certain non-GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures.

Reconciliations of non-GAAP financial measures to GAAP financial

measures are provided within the Appendix to this press release.

Investors are urged to consider carefully the comparable GAAP

measures and the reconciliations to those measures provided. The

company does not attempt to provide reconciliations of

forward-looking non-GAAP guidance to the comparable GAAP measure

because the impact and timing of the factors underlying the

guidance assumptions are inherently uncertain and difficult to

predict and are unavailable without unreasonable efforts. In

addition, Ingevity believes such reconciliations would imply a

degree of certainty that could be confusing to investors.

Forward-looking statements: This press release contains

“forward looking statements” within the meaning of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such statements generally include

the words “will,” “plans,” “intends,” “targets,” “expects,”

“outlook,” “guidance,” “believes,” “anticipates” or similar

expressions. Forward looking statements may include, without

limitation, anticipated timing, results, charges and costs of any

current or future repositioning of our Performance Chemicals

segment, including the announced review of strategic alternatives

for the Industrial Specialties product line and North Charleston,

South Carolina crude tall oil refinery, the oleo-based product

refining transition, closure of our plants in Crossett, Arkansas

and DeRidder, Louisiana; leadership transitions within our

organization; the potential benefits of any acquisition or

investment transaction, expected financial positions, guidance,

results of operations and cash flows; financing plans; business

strategies and expectations; operating plans; capital and other

expenditures; competitive positions; growth opportunities for

existing products; benefits from new technology and cost reduction

initiatives, plans and objectives; litigation-related strategies

and outcomes; and markets for securities. Actual results could

differ materially from the views expressed. Factors that could

cause actual results to materially differ from those contained in

the forward looking statements, or that could cause other forward

looking statements to prove incorrect, include, without limitation,

charges, costs or actions, including adverse legal or regulatory

actions, resulting from, or in connection with, the current or

future repositioning of our Performance Chemicals segment,

including the announced review of strategic alternatives for the

Industrial Specialties product line and North Charleston, South

Carolina crude tall oil refinery, the oleo-based product refining

transition, closure of our plants in Crossett, Arkansas and

DeRidder, Louisiana; losses due to resale of crude tall oil at less

than we paid for it; leadership transitions within our

organization; adverse effects from general global economic,

geopolitical and financial conditions beyond our control, including

inflation and the Russia Ukraine war and conflict in the middle

east; risks related to our international sales and operations;

adverse conditions in the automotive market; competition from

substitute products, new technologies and new or emerging

competitors; worldwide air quality standards; a decrease in

government infrastructure spending; adverse conditions in cyclical

end markets; the limited supply of or lack of access to sufficient

raw materials, or any material increase in the cost to acquire such

raw materials; issues with or integration of future acquisitions

and other investments; the provision of services by third parties

at several facilities; supply chain disruptions; natural disasters

and extreme weather events; or other unanticipated problems such as

labor difficulties (including work stoppages), equipment failure or

unscheduled maintenance and repair; attracting and retaining key

personnel; dependence on certain large customers; legal actions

associated with our intellectual property rights; protection of our

intellectual property and other proprietary information;

information technology security breaches and other disruptions;

complications with designing or implementing our new enterprise

resource planning system; government policies and regulations,

including, but not limited to, those affecting the environment,

climate change, tax policies, tariffs and the chemicals industry;

losses due to lawsuits arising out of environmental damage or

personal injuries associated with chemical or other manufacturing

processes; and the other factors detailed from time to time in the

reports we file with the Securities and Exchange Commission (the

“SEC”), including those described in Part I, Item 1A. Risk Factors

in our most recent Annual Report on Form 10 K as well as in our

other filings with the SEC. These forward looking statements speak

only to management’s beliefs as of the date of this press release.

Ingevity assumes no obligation to provide any revisions to, or

update, any projections and forward looking statements contained in

this press release.

Important Additional Information Regarding Proxy

Solicitation: Ingevity intends to file a proxy statement and

WHITE proxy card with the SEC in connection with the solicitation

of proxies for Ingevity’s 2025 annual meeting of stockholders (the

“Proxy Statement” and such meeting the “2025 Annual Meeting”).

Ingevity, its directors and certain of its executive officers may

be deemed to be participants in the solicitation of proxies from

stockholders in respect of the 2025 Annual Meeting. Additional

information regarding the identity of these potential participants

and their respective interests in Ingevity by security holdings or

otherwise will be set forth in the Proxy Statement and other

materials to be filed with the SEC in connection with the 2025

Annual Meeting. Information relating to the foregoing can also be

found in Ingevity’s definitive proxy statement for its 2024 annual

meeting of stockholders, filed with the SEC on March 11, 2024 (the

“2024 Proxy Statement”). Please refer to the sections captioned

“Ownership of Equity Securities,” “Director Compensation,”

“Compensation Discussion and Analysis” and “Compensation Tables and

Other Matters” in the 2024 Proxy Statement. To the extent the

holdings of such participants in Ingevity’s securities have changed

since the amounts described in the 2024 Proxy Statement, such

changes have been reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Change in Ownership on Form 4

filed with the SEC, including: Forms 4 filed by Mary Dean Hall on

April 23, 2024 and February 21, 2025; Form 4 filed by Steve Hulme

on February 21, 2025; Form 4 filed by Ed Woodcock on February 21,

2025; Form 4 filed by Benjamin (Shon) Wright on April 26, 2024;

Form 4 filed by Dan Sansone on April 26, 2024; Form 4 filed by

Karen Narwold on April 26, 2024; Form 4 filed by Fred Lynch on

April 26, 2024; Form 4 filed by Bruce Hoechner on April 26, 2024;

Form 4 filed by Diane Gulyas on April 26, 2024; Form 4 filed by

Jean Blackwell on April 26, 2024; Forms 4 filed by Rich White on

July 3, 2024 and February 21, 2025; Form 3 filed by Ryan Fisher on

April 8, 2024 and Forms 4 filed by Ryan Fisher on May 7, 2024, July

8, 2024 and February 21, 2025; Forms 4 filed by Phillip Platt on

August 13, 2024 and February 21, 2025; Form 4 filed by Terry Dyer

on August 13, 2024; Forms 4 filed by Luis Fernandez-Moreno on April

26, 2024 and October 4, 2024; and Form 3 filed by Kevin Willis on

December 19, 2024 and Forms 4 filed by Kevin Willis on December 19,

2024 and January 3, 2025. Additional information can also be found

in Ingevity’s Annual Report on Form 10-K for the year ended

December 31, 2024, filed with the SEC on February 19, 2025. Details

concerning the nominees of Ingevity’s Board of Directors for

election at the 2025 Annual Meeting will be included in the Proxy

Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND

STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR

FURNISHED TO THE SEC, INCLUDING INGEVITY’S PROXY STATEMENT WHEN IT

BECOMES AVAILABLE (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO)

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. These documents, including the Proxy Statement (and

any amendments or supplements thereto) and other documents filed by

Ingevity with the SEC, are available free of charge at the SEC’s

website at http://www.sec.gov and at Ingevity’s investor relations

website at http://ir.ingevity.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225540940/en/

Media: Caroline Monahan 843-740-2068

media@ingevity.com

Kara Brickman / Greg Klassen Joele Frank, Wilkinson Brimmer

Katcher 212-355-4449

Investors: John E. Nypaver, Jr. 843-740-2002

investors@ingevity.com

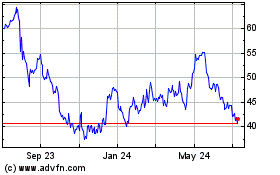

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

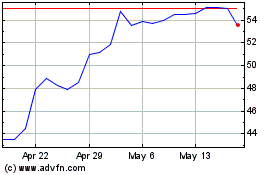

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Feb 2024 to Feb 2025