0001030469FALSE00010304692025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 22, 2025

________________

OFG BANCORP

(Exact name of registrant as specified in its charter)

________________

| | | | | | | | | | | | | | |

Commonwealth of Puerto Rico | | 001-12647 | | 66-0538893 |

| (State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

Oriental Center, 15th Floor | | |

| 254 Munoz Rivera Avenue | | |

San Juan, Puerto Rico | | 00918 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (787) 771-6800 |

| | | | |

| Not applicable |

| (Former name or former address, if changed since last report) |

________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

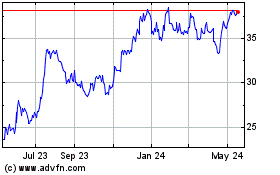

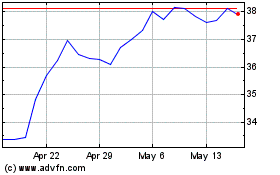

| Common shares, par value $1.00 per share | | OFG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 22, 2025, OFG Bancorp (the “Company”) announced the results for the quarter ended December 31, 2024. A copy of the Company’s press release is attached as an exhibit to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Document |

| | |

| 99 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

OFG BANCORP

| | | | | | | | |

Date: January 22, 2025 | By: | /s/ Maritza Arizmendi |

| | Maritza Arizmendi |

| | Chief Financial Officer |

OFG Bancorp Reports 4Q24 & 2024 Results

SAN JUAN, Puerto Rico, January 22, 2025 – OFG Bancorp (NYSE: OFG), the financial holding company for Oriental Bank, today reported results for the fourth quarter and year ended December 31, 2024.

4Q24: EPS diluted of $1.09 compared to $1.00 in 3Q24 and $0.98 in 4Q23. Total core revenues of $181.9 million compared to $174.1 million in 3Q24 and $175.6 million in 4Q23.

Full Year 2024: EPS diluted of $4.23 compared to $3.83 in 2023. Total core revenues of $709.6 million compared to $682.7 million in 2023.

CEO Comment

José Rafael Fernández, Chief Executive Officer, said: “The fourth quarter and last year reflected solid performance with strong financial results. 4Q24 EPS-diluted increased 11.2% year-over-year on a 3.6% increase in total core revenues. 2024 EPS increased 10.4% year-over-year on a 3.9% increase in total core revenues. We demonstrated consistent and excellent operational execution on our plans, with our Digital First strategy helping to grow our banking franchise and market share. Results also benefited from lower taxes, and we bought back 1.8 million shares in 2024. Thanks to our team members for their hard work and dedication. This is a great way to conclude the celebration of our 60th year in business bringing progress to all our stakeholders.”

4Q24 Highlights

Performance Metrics: Net interest margin of 5.40%, return on average assets of 1.75%, return on average tangible common stockholders’ equity of 16.71%, and efficiency ratio of 54.82%.

Total Interest Income of $190.2 million compared to $189.0 million in 3Q24 and $176.2 million in 4Q23. Compared to 3Q24, 4Q24 increased $1.1 million, primarily reflecting higher balances and higher yields on investment securities, higher loan balances, $0.7 million accretion for commercial loan prepayments, and reduced interest income from cash.

Total Interest Expense of $41.0 million compared to $41.2 million in 3Q24 and $32.7 million in 4Q23. Compared to 3Q24, 4Q24 decreased $0.1 million, primarily reflecting slightly lower average balances and cost of core deposits and higher average balances of borrowings and brokered deposits.

Total Banking & Financial Service Revenues of $32.8 million compared to $26.3 million in 3Q24 and $32.1 million in 4Q23. Compared to 3Q24, 4Q24 included $2.1 million annual insurance commission recognition, $4.8 million favorable MSR valuation, and $0.8 million from the August 2024 acquisition of a Puerto Rico residential mortgage servicing portfolio.

Pre-Provision Net Revenues of $83.0 million compared to $83.1 million in 3Q24 and $88.2 million in 4Q23.

Total Provision for Credit Losses of $30.2 million compared to $21.4 million in 3Q24 and $19.7 million in 4Q23. 4Q24 primarily reflected $18.1 million for increased loan volume, $7.6 million for a specific reserve related to four U.S. commercial loans, and $2.6 million recovery from the sale of auto and consumer loans. 4Q24 also included $5.7 million qualitative adjustment to account for uncertainty of recent increasing auto delinquency trends the model does not fully capture.

Credit Quality: Net charge-offs of $15.9 million (0.82% of average loans) compared to $17.1 million (0.90%) in 3Q24 and $16.3 million (0.88%) in 4Q23. NCOs benefited from the above-mentioned sale of auto and consumer loans. 4Q24 early and total delinquency rates were 2.95% and 4.38%, respectively. The nonperforming loan rate was 1.06%.

Total Non-Interest Expense of $99.7 million compared to $91.6 million in 3Q24 and $94.1 million in 4Q23. Compared to 3Q24, 4Q24 included $3.4 million in early retirement and business rightsizing, $1.4 million in annual performance incentives assessment, and the absence of 3Q24’s $2.3 million credit and debit card processing contract renewal rebate.

Income Tax Expense of $2.4 million compared to $14.8 million in 3Q24 and $21.8 million in 4Q23. 4Q24 decreased due to a reduction in the 2024 ETR for higher than previously forecasted business activities with preferential tax treatment and $2.3 million of discrete benefit. Excluding discrete items, ETR was 24.03% for 2024 compared to 32.08% for 2023.

Loans Held for Investment (EOP) of $7.79 billion compared to $7.75 billion in 3Q24 and $7.53 billion in 4Q23. Compared to 3Q24, 4Q24 loans increased 0.5%, reflecting growth in auto, U.S. commercial, and consumer loans, and repayments of P.R. commercial and residential mortgage loans. Year over year, loans increased 3.4%.

New Loan Production of $609.0 million compared to $572.2 million in 3Q24 and $663.9 million in 4Q23. Compared to 3Q24, 4Q24 reflected increases in P.R. commercial, auto, and residential mortgage lending, partially offset by a decrease in U.S. commercial and P.R. consumer lending.

Total Investments (EOP) of $2.72 billion compared to $2.61 billion in 3Q24 and $2.69 billion in 4Q23. 4Q24 primarily reflected purchases of $264 million of mortgage-backed securities yielding 5.3%, partially offset by MBS repayments of $103 million.

Customer Deposits (EOP) of $9.45 billion compared to $9.53 billion in 3Q24 and $9.60 billion in 4Q23. Compared to 3Q24, 4Q24 reflected a decline in government deposits and increases in commercial and retail deposits.

Total Borrowings & Brokered Deposits (EOP) of $557.2 million compared to $346.5 million in 3Q24 and $363.0 million in 4Q23.

Cash & Cash Equivalents (EOP) of $591.1 million compared to $680.6 million in 3Q24 and $748.2 million in 4Q23.

Share Buybacks: $45.9 million of common shares were acquired in 4Q24, leaving $29.7 million in remaining repurchase authorization as of December 31, 2024.

Capital: CET1 ratio was 14.26% compared to 14.37% in 3Q24 and 14.12% in 4Q23. The Tangible Common Equity ratio was 10.13% compared to 10.72% in 3Q24 and 9.68% in 4Q23. Tangible Book Value per share was $25.43 compared to $26.15 in 3Q24 and $23.13 in 4Q23. 4Q24 TBVPS reflected the above mentioned share buybacks and lower Other Comprehensive Income.

Conference Call, Financial Supplement & Presentation

A conference call to discuss 4Q24 results, outlook and related matters will be held today at 10:00 AM ET. Phone (800) 225-9448 or (203) 518-9708. Conference ID: OFGQ424. The call can also be accessed live on www.ofgbancorp.com with webcast replay shortly thereafter. OFG’s Financial Supplement, with full financial tables for the quarter and year ended December 31, 2024, and the 4Q24 Conference Call Presentation, can be found on the Quarterly Results page on OFG’s Investor Relations website at www.ofgbancorp.com.

Non-GAAP Financial Measures

In addition to our financial information presented in accordance with GAAP, management uses certain “non-GAAP financial measures” within the meaning of SEC Regulation G, to clarify and enhance understanding of past performance and prospects for the future. Please refer to Tables 8-1 and 8-2 in OFG’s above-mentioned Financial Supplement for a reconciliation of GAAP to non-GAAP measures and calculations.

Forward Looking Statements

The information included in this document contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and involve certain risks and uncertainties that may cause actual results to differ materially from those expressed in the forward-looking statements. Factors that might cause such a difference include but are not limited to (i) general business and economic conditions, including changes in interest rates; (ii) cybersecurity breaches; (iii) hurricanes, earthquakes, pandemics, and other natural disasters; and (iv) competition in the financial services industry. For a discussion of such factors and certain risks and uncertainties to which OFG is subject, please refer to OFG’s annual report on Form 10-K for the year ended December 31, 2023, as well as its other filings with the U.S. Securities and Exchange Commission. Other than to the extent required by applicable law, including the requirements of applicable securities laws, OFG assumes no obligation to update any forward-looking statements to reflect occurrences or unanticipated events or circumstances after the date of such statements.

About OFG Bancorp

Now in its 61st year in business, OFG Bancorp is a diversified financial holding company that operates under U.S., Puerto Rico and U.S. Virgin Islands banking laws and regulations. Its three principal subsidiaries, Oriental Bank, Oriental Financial Services, and Oriental Insurance, provide a wide range of retail and commercial banking, lending and wealth management products, services, and technology, primarily in Puerto Rico and U.S. Virgin Islands. Our mission is to make progress possible for our customers, employees, shareholders, and the communities we serve. Visit us at www.ofgbancorp.com.

# # #

Contacts

Puerto Rico & USVI: Lumarie Vega López (lumarie.vega@orientalbank.com) and Victoria Maldonado Rodríguez (victoria.maldonado@orientalbank.com) at (787) 771-6800

US: Gary Fishman (gfishman@ofgbancorp.com) and Steven Anreder (sanreder@ofgbancorp.com) at (212) 532-3232

OFG Bancorp

Financial Supplement

The information contained in this Financial Supplement is preliminary and based on data available at the time of the earnings presentation, and investors should refer to our December 31, 2024 Quarterly Report on Form 10-K once it is filed with the Securities and Exchange Commission.

| | | | | | | | |

| Table of Contents | |

| | Pages |

| | |

| OFG Bancorp (Consolidated Financial Information) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

OFG Bancorp (NYSE: OFG)

Table 1-1: Financial and Statistical Summary - Consolidated

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | |

| (Dollars in thousands, except per share data) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | |

| Statement of Operations | | | | | | | | | | | | |

| Net interest income | | | $ | 149,138 | | $ | 147,875 | | $ | 147,325 | | $ | 144,102 | | $ | 143,542 | |

| Non-interest income, net (core) | (1) | | 32,766 | | 26,271 | | 32,085 | | 30,059 | | 32,061 | |

| Total core revenues | (2) | | 181,904 | | 174,146 | | 179,410 | | 174,161 | | 175,603 | |

| Non-interest expense | | | 99,718 | | 91,600 | | 92,960 | | 91,412 | | 94,099 | |

| Pre-provision net revenues | (21) | | 82,977 | | 83,143 | | 86,841 | | 83,038 | | 88,151 | |

| Total provision for credit losses | | | 30,190 | (a) | 21,359 | | 15,581 | | 15,121 | | 19,719 | |

| Net income before income taxes | | | 52,787 | | 61,784 | | 71,260 | | 67,917 | | 68,432 | |

| Income tax expense | | | 2,440 | (b) | 14,784 | | 20,129 | | 18,225 | | 21,835 | |

| Net income available to common stockholders | | | 50,347 | | 47,000 | | 51,131 | | 49,692 | | 46,597 | |

| Common Share Statistics | | | | | | | | | | | | |

| Earnings per common share - basic | (3) | | $ | 1.10 | | $ | 1.01 | | $ | 1.09 | | $ | 1.06 | | $ | 0.99 | |

| Earnings per common share - diluted | (4) | | $ | 1.09 | | $ | 1.00 | | $ | 1.08 | | $ | 1.05 | | $ | 0.98 | |

| Average common shares outstanding | | | 45,946 | | 46,560 | | 46,952 | | 47,096 | | 47,061 | |

| Average common shares outstanding and equivalents | | | 46,248 | | 46,846 | | 47,131 | | 47,343 | | 47,386 | |

| Cash dividends per common share | | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.22 | |

| Book value per common share (period end) | | | $ | 27.60 | | $ | 28.31 | | $ | 26.37 | | $ | 25.75 | | $ | 25.36 | |

| Tangible book value per common share (period end) | (5) | | $ | 25.43 | | $ | 26.15 | | $ | 24.18 | | $ | 23.55 | | $ | 23.13 | |

| Balance Sheet (Average Balances) | | | | | | | | | | | | |

| Loans | (6) | | $ | 7,717,566 | | $ | 7,634,511 | | $ | 7,613,307 | | $ | 7,541,757 | | $ | 7,417,084 | |

| Interest-earning assets | | | 10,981,886 | | 10,837,380 | | 10,758,623 | | 10,739,590 | | 10,129,061 | |

| Total assets | | | 11,523,140 | | 11,347,795 | | 11,233,202 | | 11,199,867 | | 10,588,584 | |

| Core deposits | | | 9,555,213 | | 9,588,752 | | 9,599,842 | | 9,532,790 | | 8,691,516 | |

| Total deposits | | | 9,651,748 | | 9,609,820 | | 9,601,408 | | 9,591,527 | | 8,834,234 | |

| Interest-bearing deposits | | | 7,107,550 | | 7,042,467 | | 7,023,192 | | 7,055,207 | | 6,282,916 | |

| Borrowings | | | 329,231 | | 241,062 | | 219,903 | | 220,773 | | 459,315 | |

| Stockholders' equity | | | 1,304,779 | | 1,280,760 | | 1,223,669 | | 1,213,469 | | 1,128,747 | |

| | | | | | | | | | | | |

| Performance Metrics | | | | | | | | | | | | |

| Net interest margin | (7) | | 5.40 | % | | 5.43 | % | | 5.51 | % | | 5.40 | % | | 5.62 | % | |

| Return on average assets | (8) | | 1.75 | % | | 1.66 | % | | 1.82 | % | | 1.77 | % | | 1.76 | % | |

| Return on average tangible common stockholders' equity | (9) | | 16.71 | % | | 15.94 | % | | 18.24 | % | | 17.92 | % | | 18.22 | % | |

| Efficiency ratio | (10) | | 54.82 | % | | 52.60 | % | | 51.81 | % | | 52.49 | % | | 53.59 | % | |

| Full-time equivalent employees, period end | | | 2,246 | | | 2,236 | | | 2,239 | | | 2,230 | | | 2,248 | | |

| Credit Quality Metrics | | | | | | | | | | | | |

| Allowance for credit losses | | | $ | 175,863 | (a) | $ | 161,500 | | $ | 157,301 | | $ | 156,563 | | $ | 161,106 | |

| Allowance as a % of loans held for investment | | | 2.26 | % | (a) | 2.08 | % | | 2.06 | % | | 2.08 | % | | 2.14 | % | |

| Net charge-offs | | | $ | 15,862 | (c) | $ | 17,103 | | $ | 15,013 | | $ | 19,812 | | $ | 16,282 | |

| Net charge-off rate | (11) | | 0.82 | % | (c) | 0.90 | % | | 0.79 | % | | 1.05 | % | | 0.88 | % | |

| Early delinquency rate (30 - 89 days past due) | | | 2.95 | % | | 2.78 | % | | 2.81 | % | | 2.41 | % | | 2.76 | % | |

| Total delinquency rate (30 days and over) | | | 4.38 | % | | 4.10 | % | | 3.71 | % | | 3.30 | % | | 3.76 | % | |

| Capital Ratios (period end) (Non-GAAP) | (12)(20) | | | | | | | | | | | |

| Leverage ratio | | | 10.93 | % | | 11.12 | % | | 10.86 | % | | 10.76 | % | | 11.03 | % | |

| Common equity Tier 1 capital ratio | | | 14.26 | % | | 14.37 | % | | 14.29 | % | | 14.45 | % | | 14.12 | % | |

| Tier 1 risk-based capital ratio | | | 14.26 | % | | 14.37 | % | | 14.29 | % | | 14.45 | % | | 14.12 | % | |

| Total risk-based capital ratio | | | 15.52 | % | | 15.63 | % | | 15.54 | % | | 15.71 | % | | 15.37 | % | |

| Tangible common equity ("TCE") ratio | | | 10.13 | % | | 10.72 | % | | 10.09 | % | | 10.06 | % | | 9.68 | % | |

(a)During 4Q 2024, a qualitative adjustment of $5.7 million was made for the auto portfolio to account for uncertainty related to the recent increasing delinquency trends that the model does not fully capture. The provision for credit losses also included $7.6 million for a specific reserve related to four U.S. commercial loans.

(b)During 4Q 2024, the Company’s effective income tax rate for the year decreased related to higher than previously forecasted business activities during 4Q 2024 with preferential tax treatment under the Puerto Rico tax code and $2.3 million of discrete benefit.

(c)During 4Q 2024, the Company sold auto and consumer loans that were previously fully charged off, recognizing a recovery of $2.6 million.

OFG Bancorp (NYSE: OFG)

Table 1-2: Financial and Statistical Summary - Consolidated (Continued)

| | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2023 | |

| (Dollars in thousands, except per share data) (unaudited) | | | YTD | | YTD | |

| Statement of Operations | | | | | | |

| Net interest income | | | $ | 588,440 | | | $ | 560,870 | | |

| Non-interest income, net (core) | (1) | | 121,181 | | | 121,855 | | |

| Total core revenues | (2) | | 709,621 | | | 682,725 | | |

| Non-interest expense | | | 375,690 | | | 363,365 | | |

| Pre-provision net revenues | (21) | | 335,999 | | | 325,886 | | |

| Total provision for credit losses | | | 82,251 | | | 60,638 | | (a) |

| Net income before income taxes | | | 253,748 | | | 265,248 | | |

| Income tax expense | | | 55,578 | | | 83,376 | | (b) |

| Net income available to common stockholders | | | 198,170 | | | 181,872 | | |

| Common Share Statistics | | | | | | |

| Earnings per common share - basic | (3) | | $ | 4.25 | | | $ | 3.85 | | |

| Earnings per common share - diluted | (4) | | $ | 4.23 | | | $ | 3.83 | | |

| Average common shares outstanding | | | 46,637 | | | 47,258 | | |

| Average common shares outstanding and equivalents | | | 46,902 | | | 47,552 | | |

| Cash dividends per common share | | | $ | 1.00 | | | $ | 0.88 | | |

| Book value per common share (period end) | | | $ | 27.60 | | | $ | 25.36 | | |

| Tangible book value per common share (period end) | (5) | | $ | 25.43 | | | $ | 23.13 | | |

| Balance Sheet (Average Balances) | | | | | | |

| Loans | (6) | | $ | 7,626,830 | | | $ | 7,121,176 | | |

| Interest-earning assets | | | 10,829,907 | | | 9,688,019 | | |

| Total assets | | | 11,326,121 | | | 10,174,624 | | |

| Core deposits | | | 9,569,167 | | | 8,610,084 | | |

| Total deposits | | | 9,613,722 | | | 8,649,184 | | |

| Interest-bearing deposits | | | 7,057,204 | | | 6,058,661 | | |

| Borrowings | | | 252,919 | | | 254,541 | | |

| Stockholders' equity | | | 1,255,872 | | | 1,110,919 | | |

| | | | | | |

| Performance Metrics | | | | | | |

| Net interest margin | (7) | | 5.43 | % | | 5.79 | % | |

| Return on average assets | (8) | | 1.75 | % | | 1.79 | % | |

| Return on average tangible common stockholders' equity | (9) | | 17.17 | % | | 18.14 | % | |

| Efficiency ratio | (10) | | 52.94 | % | | 53.22 | % | |

| Full-time equivalent employees, period end | | | 2,246 | | | 2,248 | | |

| Credit Quality Metrics | | | | | | |

| Allowance for credit losses | | | $ | 175,863 | | | $ | 161,106 | | (a) |

| Allowance as a % of loans held for investment | | | 2.26 | % | | 2.14 | % | (a) |

| Net charge-offs | | | $ | 67,790 | | | $ | 51,844 | | |

| Net charge-off rate | (11) | | 0.89 | % | | 0.73 | % | |

| Early delinquency rate (30 - 89 days past due) | | | 2.95 | % | | 2.76 | % | |

| Total delinquency rate (30 days and over) | | | 4.38 | % | | 3.76 | % | |

(a)Refer to “(a)” in Table 1-1.

(b)Refer to “(b)” in Table 1-2.

OFG Bancorp (NYSE: OFG)

Table 2-1: Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarter Ended |

| (Dollars in thousands, except per share data) (unaudited) | | | December 31,

2024 | | September 30, 2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 |

| Interest income: | | | | | | | | | | | |

| Loans | | | | | | | | | | | |

| Non-PCD loans | | | $ | 139,659 | | | $ | 139,358 | | | $ | 137,741 | | | $ | 132,972 | | | $ | 131,167 | |

| PCD loans | | | 15,682 | | | 15,052 | | | 16,516 | | | 16,622 | | | 17,609 | |

| Total interest income from loans | | | 155,341 | | | 154,410 | | | 154,257 | | | 149,594 | | | 148,776 | |

| Investment securities and cash | | | 34,822 | | | 34,620 | | | 33,401 | | | 33,832 | | | 27,423 | |

| Total interest income | | | 190,163 | | | 189,030 | | | 187,658 | | | 183,426 | | | 176,199 | |

| Interest expense: | | | | | | | | | | | |

| Deposits | | | | | | | | | | | |

| Core deposits | | | 36,312 | | | 38,123 | | | 37,791 | | | 35,989 | | | 24,753 | |

| Brokered deposits | | | 1,020 | | | 221 | | | 21 | | | 803 | | | 1,980 | |

| Total deposits | | | 37,332 | | | 38,344 | | | 37,812 | | | 36,792 | | | 26,733 | |

| Borrowings | | | 3,693 | | | 2,811 | | | 2,521 | | | 2,532 | | | 5,924 | |

| Total interest expense | | | 41,025 | | | 41,155 | | | 40,333 | | | 39,324 | | | 32,657 | |

| Net interest income | | | 149,138 | | | 147,875 | | | 147,325 | | | 144,102 | | | 143,542 | |

| Provision for credit losses, excluding PCD loans | | | 32,838 | | (a) | 21,070 | | | 16,913 | | | 16,605 | | | 20,681 | |

| (Recapture of) provision for credit losses on PCD loans | | | (2,648) | | | 289 | | | (1,332) | | | (1,484) | | | (962) | |

| Total provision for credit losses | | | 30,190 | | | 21,359 | | | 15,581 | | | 15,121 | | | 19,719 | |

| Net interest income after provision for credit losses | | | 118,948 | | | 126,516 | | | 131,744 | | | 128,981 | | | 123,823 | |

| Non-interest income: | | | | | | | | | | | |

| Banking service revenues | | | 15,329 | | | 15,554 | | | 18,781 | | | 17,259 | | | 17,822 | |

| Wealth management revenues | | | 10,626 | | (b) | 8,449 | | | 8,440 | | | 8,107 | | | 9,985 | |

| Mortgage banking activities | | | 6,811 | | (c) | 2,268 | | | 4,864 | | | 4,693 | | | 4,254 | |

| Total banking and financial service revenues | | | 32,766 | | | 26,271 | | | 32,085 | | | 30,059 | | | 32,061 | |

| | | | | | | | | | | |

| Other income, net | | | 791 | | | 597 | | | 391 | | | 289 | | | 6,647 | |

| Total non-interest income, net | | | 33,557 | | | 26,868 | | | 32,476 | | | 30,348 | | | 38,708 | |

| Non-interest expense: | | | | | | | | | | | |

| Compensation and employee benefits | | | 42,959 | | (d) | 38,468 | | | 38,467 | | | 39,816 | | | 41,418 | |

| Occupancy, equipment and infrastructure costs | | | 15,284 | | | 15,124 | | | 14,393 | | | 14,322 | | | 15,729 | |

| General and administrative expenses | | | 39,672 | | | 36,736 | | | 40,831 | | | 36,606 | | | 35,803 | |

| Foreclosed real estate and other repossessed assets expenses (income), net | | | 1,803 | | | 1,272 | | | (731) | | | 668 | | | 1,149 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total non-interest expense | | | 99,718 | | | 91,600 | | | 92,960 | | | 91,412 | | | 94,099 | |

| Income before income taxes | | | 52,787 | | | 61,784 | | | 71,260 | | | 67,917 | | | 68,432 | |

| Income tax expense | | | 2,440 | | (e) | 14,784 | | | 20,129 | | | 18,225 | | | 21,835 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income available to common shareholders | | | $ | 50,347 | | | $ | 47,000 | | | $ | 51,131 | | | $ | 49,692 | | | $ | 46,597 | |

(a)Refer to “(a)” in Table 1-1.

(b)During 4Q 2024, annual insurance contingent commissions amounted to $2.1 million.

(c)During 4Q 2024, the Company recognized an increase of $4.8 million in mortgage servicing asset valuation.

(d)During 4Q 2024, the Company recognized $3.4 million in early retirement and business rightsizing expense.

(e)Refer to “(b)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 2-2: Consolidated Statements of Operations (Continued)

| | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share data) (unaudited) | | | Year Ended |

| December 31, 2024 | | December 31, 2023 | |

| Interest income: | | | | | | |

| Loans | | | | | | |

| Non-PCD loans | | | $ | 549,730 | | | $ | 482,043 | | |

| PCD loans | | | 63,872 | | | 72,701 | | |

| Total interest income from loans | | | 613,602 | | | 554,744 | | |

| Investment securities and cash | | | 136,675 | | | 94,136 | | |

| Total interest income | | | 750,277 | | | 648,880 | | |

| Interest expense: | | | | | | |

| Deposits | | | | | | |

| Core deposits | | | 148,215 | | | 73,945 | | |

| Brokered deposits | | | 2,065 | | | 2,020 | | |

| Total deposits | | | 150,280 | | | 75,965 | | |

| Borrowings | | | 11,557 | | | 12,045 | | |

| Total interest expense | | | 161,837 | | | 88,010 | | |

| Net interest income | | | 588,440 | | | 560,870 | | |

| Provision for credit losses, excluding PCD loans | | | 87,426 | | (a) | 62,125 | | |

| Recapture of credit losses on PCD loans | | | (5,175) | | | (1,487) | | |

| Total provision for credit losses | | | 82,251 | | | 60,638 | | |

| Net interest income after provision for credit losses | | | 506,189 | | | 500,232 | | |

| Non-interest income: | | | | | | |

| Banking service revenues | | | 66,923 | | | 70,078 | | |

| Wealth management revenues | | | 35,622 | | | 32,990 | | |

| Mortgage banking activities | | | 18,636 | | | 18,787 | | |

| Total banking and financial service revenues | | | 121,181 | | | 121,855 | | |

| | | | | | |

| Other income (loss), net | | | 2,068 | | | 6,526 | | |

| Total non-interest income, net | | | 123,249 | | | 128,381 | | |

| Non-interest expense: | | | | | | |

| Compensation and employee benefits | | | 159,710 | | (b) | 155,827 | | |

| Occupancy, equipment and infrastructure costs | | | 59,123 | | | 59,235 | | |

| General and administrative expenses | | | 153,845 | | | 148,708 | | |

| Foreclosed real estate and other repossessed assets expenses (income), net | | | 3,012 | | | (405) | | |

| | | | | | |

| | | | | | |

| Total non-interest expense | | | 375,690 | | | 363,365 | | |

| Income before income taxes | | | 253,748 | | | 265,248 | | |

| Income tax expense | | | 55,578 | | (c) | 83,376 | | |

| | | | | | |

| | | | | | |

| Net income available to common shareholders | | | $ | 198,170 | | | $ | 181,872 | | |

(a)Refer to “(a)” in Table 1-1.

(b)Refer to “(d)” in Table 2-1.

(c)Refer to “(b)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 3: Consolidated Statements of Financial Condition | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) (unaudited) | | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 |

| Cash and cash equivalents | | | $ | 591,137 | | | $ | 680,587 | | | $ | 740,429 | | | $ | 754,392 | | | $ | 748,173 | |

| Investments: | | | | | | | | | | | |

| Trading securities | | | 18 | | | 18 | | | 16 | | | 14 | | | 13 | |

| Investment securities available-for-sale, at fair value, no allowance for credit losses for any period | | | | | | | | | | | |

| Mortgage-backed securities | | | 2,336,505 | | | 2,228,399 | | | 1,895,067 | | | 1,746,195 | | | 1,801,849 | |

US treasury securities | | | 1,150 | | | 1,136 | | | 200,658 | | | 150,915 | | | 296,799 | |

| Other investment securities | | | 550 | | | 567 | | | 581 | | | 597 | | | 616 | |

| Total investment securities available-for-sale | | | 2,338,205 | | | 2,230,102 | | | 2,096,306 | | | 1,897,707 | | | 2,099,264 | |

| | | | | | | | | | | |

| Investment securities held-to-maturity, at amortized cost, no allowance for credit losses for any period | | | | | | | | | | | |

| Mortgage-backed securities | | | 292,158 | | | 297,713 | | | 303,621 | | | 309,764 | | | 314,710 | |

US treasury securities | | | — | | | — | | | — | | | 199,727 | | | 199,314 | |

| Other investment securities | | | 35,000 | | | 35,000 | | | 35,000 | | | 35,000 | | | 35,000 | |

| Total investment securities held-to-maturity | | | 327,158 | | | 332,713 | | | 338,621 | | | 544,491 | | | 549,024 | |

| Equity securities | | | 54,896 | | | 45,692 | | | 41,074 | | | 40,162 | | | 38,469 | |

| Total investments | | | 2,720,277 | | | 2,608,525 | | | 2,476,017 | | | 2,482,374 | | | 2,686,770 | |

| Loans, net | | | 7,633,831 | | | 7,604,700 | | | 7,503,142 | | | 7,411,378 | | | 7,401,618 | |

| Other assets: | | | | | | | | | | | |

| | | | | | | | | | | |

| Prepaid expenses | | | 72,010 | | | 98,755 | | | 88,137 | | | 61,916 | | | 62,858 | |

| Deferred tax asset, net | | | 6,248 | | | 4,130 | | | 4,094 | | | 4,379 | | | 4,923 | |

| Foreclosed real estate and repossessed properties | | | 10,597 | | | 11,388 | | | 12,239 | | | 17,694 | | | 14,812 | |

| Premises and equipment, net | | | 104,512 | | | 105,279 | | | 104,384 | | | 104,980 | | | 104,102 | |

| Goodwill | | | 84,241 | | | 84,241 | | | 84,241 | | | 84,241 | | | 84,241 | |

| Other intangibles | | | 14,782 | | | 16,260 | | | 17,738 | | | 19,216 | | | 20,694 | |

| Right of use assets | | | 19,197 | | | 20,355 | | | 20,298 | | | 21,606 | | | 21,725 | |

| Servicing asset | | | 70,435 | | | 68,512 | | | 49,789 | | | 49,553 | | | 49,520 | |

| Accounts receivable and other assets | | | 173,467 | | | 158,650 | | | 158,577 | | | 147,506 | | | 145,017 | |

| Total assets | | | $ | 11,500,734 | | | $ | 11,461,382 | | | $ | 11,259,085 | | | $ | 11,159,235 | | | $ | 11,344,453 | |

| | | | | | | | | | | |

| Deposits: | | | | | | | | | | | |

| Demand deposits | | | $ | 5,627,406 | | | $ | 5,859,787 | | | $ | 6,017,364 | | | $ | 6,036,891 | | | $ | 6,050,428 | |

| Savings accounts | | | 2,064,916 | | | 2,019,832 | | | 2,002,342 | | | 2,001,770 | | | 2,088,102 | |

| Time deposits | | | 1,756,389 | | | 1,653,402 | | | 1,585,126 | | | 1,507,037 | | | 1,461,459 | |

| Brokered deposits | | | 156,075 | | | 75,631 | | | 418 | | | 2,576 | | | 162,180 | |

| Total deposits | | | 9,604,786 | | | 9,608,652 | | | 9,605,250 | | | 9,548,274 | | | 9,762,169 | |

| Borrowings: | | | | | | | | | | | |

| Securities sold under agreements to repurchase | | | 75,222 | | | — | | | — | | | — | | | — | |

| Advances from FHLB and other borrowings | | | 325,952 | | | 270,827 | | | 200,741 | | | 200,766 | | | 200,770 | |

| | | | | | | | | | | |

| Total borrowings | | | 401,174 | | | 270,827 | | | 200,741 | | | 200,766 | | | 200,770 | |

| Other liabilities: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Acceptances outstanding | | | 31,526 | | | 26,055 | | | 28,504 | | | 25,826 | | | 25,576 | |

| Lease liability | | | 21,388 | | | 22,604 | | | 22,605 | | | 23,969 | | | 24,029 | |

| GNMA buy-back option program liability | (22) | | | 48,586 | | | 41,801 | | | 19,008 | | | 18,510 | | | 19,401 | |

Deferred tax liability, net | | | 40,718 | | | 57,503 | | | 33,873 | | | 22,876 | | | 22,444 | |

| Accrued expenses and other liabilities | | | 98,185 | | | 115,808 | | | 121,402 | | | 103,361 | | | 96,584 | |

| Total liabilities | | | 10,246,363 | | | 10,143,250 | | | 10,031,383 | | | 9,943,582 | | | 10,150,973 | |

| Stockholders' equity: | | | | | | | | | | | |

| | | | | | | | | | | |

| Common stock | | | 59,885 | | | 59,885 | | | 59,885 | | | 59,885 | | | 59,885 | |

| Additional paid-in capital | | | 639,786 | | | 639,487 | | | 637,895 | | | 636,208 | | | 638,667 | |

| Legal surplus | | | 169,537 | | | 164,990 | | | 160,560 | | | 155,732 | | | 150,967 | |

| Retained earnings | | | 771,993 | | | 737,815 | | | 706,807 | | | 672,455 | | | 639,324 | |

| Treasury stock, at cost | | | (296,991) | | | (251,055) | | | (250,951) | | | (226,896) | | | (228,350) | |

| Accumulated other comprehensive loss, net | | | (89,839) | | | (32,990) | | | (86,494) | | | (81,731) | | | (67,013) | |

| Total stockholders' equity | | | 1,254,371 | | | 1,318,132 | | | 1,227,702 | | | 1,215,653 | | | 1,193,480 | |

| Total liabilities and stockholders' equity | | | $ | 11,500,734 | | | $ | 11,461,382 | | | $ | 11,259,085 | | | $ | 11,159,235 | | | $ | 11,344,453 | |

OFG Bancorp (NYSE: OFG)

Table 4-1: Information on Loan Portfolio and Production

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) (unaudited) | | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 |

| Non-PCD: | | | | | | | | | | | |

| Mortgage, excluding GNMA buy-back option program | | | $ | 580,267 | | | $ | 577,320 | | | $ | 581,023 | | | $ | 591,429 | | | $ | 609,846 | |

| Mortgage GNMA buy-back option program | (22) | | 48,586 | | | 41,801 | | | 19,008 | | | 18,510 | | | 19,401 | |

| | | | | | | | | | | |

| Commercial PR | | | 2,310,281 | | | 2,318,964 | | | 2,291,753 | | | 2,178,748 | | | 2,186,228 | |

| Commercial US | | | 704,081 | | | 680,388 | | | 662,026 | | | 740,665 | | | 755,228 | |

| Consumer | | | 667,963 | | | 663,748 | | | 643,572 | | | 627,436 | | | 619,894 | |

| Auto | | | 2,549,033 | | | 2,483,611 | | | 2,427,089 | | | 2,339,836 | | | 2,272,530 | |

| | | 6,860,211 | | | 6,765,832 | | | 6,624,471 | | | 6,496,624 | | | 6,463,127 | |

| Less: Allowance for credit losses | | | (170,709) | | (a) | (155,133) | | | (150,849) | | | (148,767) | | | (152,610) | |

| Total non-PCD loans held for investment, net | | | 6,689,502 | | | 6,610,699 | | | 6,473,622 | | | 6,347,857 | | | 6,310,517 | |

| | | | | | | | | | | |

| PCD: | | | | | | | | | | | |

| Mortgage | | | 841,964 | | | 864,491 | | | 885,096 | | | 909,106 | | | 933,362 | |

| Commercial PR | | | 88,729 | | | 119,029 | | | 128,584 | | | 132,035 | | | 135,447 | |

| Consumer | | | 598 | | | 560 | | | 605 | | | 544 | | | 552 | |

| Auto | | | 460 | | | 664 | | | 951 | | | 1,358 | | | 1,891 | |

| | | 931,751 | | | 984,744 | | | 1,015,236 | | | 1,043,043 | | | 1,071,252 | |

| Less: Allowance for credit losses | | | (5,154) | | | (6,367) | | | (6,452) | | | (7,796) | | | (8,496) | |

| Total PCD loans held for investment, net | | | 926,597 | | | 978,377 | | | 1,008,784 | | | 1,035,247 | | | 1,062,756 | |

| Total loans held for investment | | | 7,616,099 | | | 7,589,076 | | | 7,482,406 | | | 7,383,104 | | | 7,373,273 | |

| Mortgage loans held for sale | | | 13,286 | | | 10,908 | | | 8,375 | | | 9,370 | | | — | |

| Other loans held for sale | | | 4,446 | | | 4,716 | | | 12,361 | | | 18,904 | | | 28,345 | |

| Total loans, net | | | $ | 7,633,831 | | | $ | 7,604,700 | | | $ | 7,503,142 | | | $ | 7,411,378 | | | $ | 7,401,618 | |

| | | | | | | | | | | |

| Loan Portfolio Summary: | | | | | | | | | | | |

| Loans held for investment: | | | | | | | | | | | |

| Mortgage, excluding GNMA buy-back option program | | | $ | 1,422,231 | | | $ | 1,441,811 | | | $ | 1,466,119 | | | $ | 1,500,535 | | | $ | 1,543,208 | |

| Mortgage GNMA buy-back option program | (22) | | 48,586 | | | 41,801 | | | 19,008 | | | 18,510 | | | 19,401 | |

| | | | | | | | | | | |

| Commercial PR | | | 2,399,010 | | | 2,437,993 | | | 2,420,337 | | | 2,310,783 | | | 2,321,675 | |

| Commercial US | | | 704,081 | | | 680,388 | | | 662,026 | | | 740,665 | | | 755,228 | |

| Consumer | | | 668,561 | | | 664,308 | | | 644,177 | | | 627,980 | | | 620,446 | |

| Auto | | | 2,549,493 | | | 2,484,275 | | | 2,428,040 | | | 2,341,194 | | | 2,274,421 | |

| | | 7,791,962 | | | 7,750,576 | | | 7,639,707 | | | 7,539,667 | | | 7,534,379 | |

| Less: Allowance for credit losses | | | (175,863) | | (a) | (161,500) | | | (157,301) | | | (156,563) | | | (161,106) | |

| Total loans held for investment, net | | | 7,616,099 | | | 7,589,076 | | | 7,482,406 | | | 7,383,104 | | | 7,373,273 | |

| Mortgage loans held for sale | | | 13,286 | | | 10,908 | | | 8,375 | | | 9,370 | | | — | |

| Other loans held for sale | | | 4,446 | | | 4,716 | | | 12,361 | | | 18,904 | | | 28,345 | |

| Total loans, net | | | $ | 7,633,831 | | | $ | 7,604,700 | | | $ | 7,503,142 | | | $ | 7,411,378 | | | $ | 7,401,618 | |

(a)Refer to “(a)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 4-2: Information on Loan Portfolio and Production

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Quarter Ended | | Year Ended |

| (Dollars in thousands) (unaudited) | | December 31, 2024 | | September 30, 2024 | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Loan production | (13) | | | | | | | | | | | | | | |

| Mortgage | | | $ | 42,562 | | | $ | 37,091 | | | $ | 38,501 | | | $ | 32,180 | | | $ | 33,332 | | | $ | 150,334 | | | $ | 132,954 | |

| Commercial PR | | | 211,217 | | | 149,856 | | | 192,122 | | | 186,412 | | | 285,517 | | | 739,607 | | | 744,668 | |

| Commercial US | | | 44,034 | | | 67,133 | | | 27,402 | | | 17,106 | | | 57,442 | | | 155,675 | | | 363,644 | |

| Consumer | | | 68,941 | | | 86,575 | | | 80,348 | | | 68,591 | | | 63,785 | | | 304,455 | | | 313,596 | |

| Auto | | | 242,225 | | | 231,573 | | | 250,638 | | | 232,314 | | | 223,780 | | | 956,750 | | | 919,678 | |

| Total | | | $ | 608,979 | | | $ | 572,228 | | | $ | 589,011 | | | $ | 536,603 | | | $ | 663,856 | | | $ | 2,306,821 | | | $ | 2,474,540 | |

OFG Bancorp (NYSE: OFG)

Table 5-1: Average Balances, Net Interest Income and Net Interest Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 Q4 | | 2024 Q3 | | 2024 Q2 | | 2024 Q1 | | 2023 Q4 |

| (Dollars in thousands) (unaudited) | | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate |

| Interest earning assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash equivalents | | | $ | 560,013 | | | $ | 6,534 | | | 4.64 | % | | $ | 630,836 | | | $ | 8,362 | | | 5.27 | % | | $ | 656,728 | | | $ | 8,735 | | | 5.35 | % | | $ | 600,291 | | | $ | 7,996 | | | 5.36 | % | | $ | 517,025 | | | $ | 6,906 | | | 5.30 | % |

| Investment securities | | | 2,704,307 | | | 28,288 | | | 4.18 | % | | 2,572,033 | | | 26,258 | | | 4.08 | % | | 2,489,488 | | | 24,666 | | | 3.96 | % | | 2,597,542 | | | 25,836 | | | 3.98 | % | | 2,194,952 | | | 20,517 | | | 3.74 | % |

| Loans held for investment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-PCD loans | | | 6,763,828 | | | 139,659 | | | 8.21 | % | | 6,634,043 | | | 139,358 | | | 8.36 | % | | 6,576,634 | | | 137,741 | | | 8.42 | % | | 6,476,048 | | | 132,972 | | | 8.26 | % | | 6,320,321 | | | 131,167 | | | 8.23 | % |

| PCD loans | | | 953,738 | | | 15,682 | | | 6.58 | % | | 1,000,468 | | | 15,052 | | | 6.02 | % | | 1,035,773 | | | 16,516 | | | 6.38 | % | | 1,065,709 | | | 16,622 | | | 6.24 | % | | 1,096,763 | | | 17,609 | | | 6.42 | % |

| Total loans | | | 7,717,566 | | | 155,341 | | | 8.01 | % | | 7,634,511 | | | 154,410 | | | 8.05 | % | | 7,612,407 | | | 154,257 | | | 8.15 | % | | 7,541,757 | | | 149,594 | | | 7.98 | % | | 7,417,084 | | | 148,776 | | | 7.96 | % |

| Total interest-earning assets | | | $ | 10,981,886 | | | $ | 190,163 | | | 6.89 | % | | $ | 10,837,380 | | | $ | 189,030 | | | 6.94 | % | | $ | 10,758,623 | | | $ | 187,658 | | | 7.02 | % | | $ | 10,739,590 | | | $ | 183,426 | | | 6.87 | % | | $ | 10,129,061 | | | $ | 176,199 | | | 6.90 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW accounts | | | $ | 3,282,808 | | | $ | 16,871 | | | 2.04 | % | | $ | 3,395,425 | | | $ | 20,013 | | | 2.34 | % | | $ | 3,448,144 | | | $ | 20,964 | | | 2.45 | % | | $ | 3,472,852 | | | $ | 20,516 | | | 2.38 | % | | $ | 2,559,135 | | | $ | 9,551 | | | 1.48 | % |

| Savings accounts | | | 2,038,523 | | | 5,062 | | | 0.99 | % | | 2,009,028 | | | 4,777 | | | 0.95 | % | | 2,020,653 | | | 4,587 | | | 0.91 | % | | 2,042,865 | | | 4,417 | | | 0.87 | % | | 2,141,230 | | | 4,986 | | | 0.92 | % |

| Time deposits | | | 1,689,684 | | | 13,247 | | | 3.12 | % | | 1,616,946 | | | 12,202 | | | 3.00 | % | | 1,552,829 | | | 11,109 | | | 2.88 | % | | 1,480,753 | | | 9,924 | | | 2.70 | % | | 1,439,833 | | | 8,895 | | | 2.45 | % |

| Brokered deposits | | | 96,535 | | | 1,020 | | | 4.21 | % | | 21,068 | | | 221 | | | 4.17 | % | | 1,566 | | | 21 | | | 5.28 | % | | 58,737 | | | 803 | | | 5.50 | % | | 142,718 | | | 1,980 | | | 5.50 | % |

| | | | 7,107,550 | | | 36,200 | | | 2.03 | % | | 7,042,467 | | | 37,213 | | | 2.10 | % | | 7,023,192 | | | 36,681 | | | 2.10 | % | | 7,055,207 | | | 35,660 | | | 2.03 | % | | 6,282,916 | | | 25,412 | | | 1.60 | % |

| Non-interest bearing deposit accounts | | | 2,544,198 | | | — | | | — | | | 2,567,353 | | | — | | | — | | | 2,578,216 | | | — | | | — | | | 2,536,320 | | | — | | | — | | | 2,551,318 | | | — | | | — | |

| Fair value premium and core deposit intangible amortization | | | — | | | 1,132 | | | — | | | — | | | 1,131 | | | — | | | — | | | 1,131 | | | — | | | — | | | 1,132 | | | — | | | — | | | 1,321 | | | — | |

| Total deposits | | | 9,651,748 | | | 37,332 | | | 1.54 | % | | 9,609,820 | | | 38,344 | | | 1.59 | % | | 9,601,408 | | | 37,812 | | | 1.58 | % | | 9,591,527 | | | 36,792 | | | 1.54 | % | | 8,834,234 | | | 26,733 | | | 1.20 | % |

| Borrowings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Securities sold under agreements to repurchase | | | 44,837 | | | 542 | | | 4.81 | % | | — | | | — | | | — | % | | — | | | — | | | — | % | | — | | | — | | | — | % | | 183,858 | | | 2,578 | | | 5.56 | % |

| Advances from FHLB and other borrowings | | | 284,394 | | | 3,151 | | | 4.41 | % | | 241,062 | | | 2,811 | | | 4.64 | % | | 219,903 | | | 2,521 | | | 4.61 | % | | 220,773 | | | 2,532 | | | 4.61 | % | | 275,457 | | | 3,346 | | | 4.82 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total borrowings | | | 329,231 | | | 3,693 | | | 4.46 | % | | 241,062 | | | 2,811 | | | 4.64 | % | | 219,903 | | | 2,521 | | | 4.61 | % | | 220,773 | | | 2,532 | | | 4.61 | % | | 459,315 | | | 5,924 | | | 5.12 | % |

| Total interest-bearing liabilities | | | $ | 9,980,979 | | | $ | 41,025 | | | 1.64 | % | | $ | 9,850,882 | | | $ | 41,155 | | | 1.66 | % | | $ | 9,821,311 | | | $ | 40,333 | | | 1.65 | % | | $ | 9,812,300 | | | $ | 39,324 | | | 1.61 | % | | $ | 9,293,549 | | | $ | 32,657 | | | 1.39 | % |

| Interest rate spread | | | | | $ | 149,138 | | | 5.25 | % | | | | $ | 147,875 | | | 5.28 | % | | | | $ | 147,325 | | | 5.36 | % | | | | $ | 144,102 | | | 5.26 | % | | | | $ | 143,542 | | | 5.51 | % |

| Net interest margin | | | | | | | 5.40 | % | | | | | | 5.43 | % | | | | | | 5.51 | % | | | | | | 5.40 | % | | | | | | 5.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Core deposits: (Non-GAAP) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW accounts | | | $ | 3,282,808 | | | $ | 16,871 | | | 2.04 | % | | $ | 3,395,425 | | | $ | 20,013 | | | 2.34 | % | | $ | 3,448,144 | | | $ | 20,964 | | | 2.45 | % | | $ | 3,472,852 | | | $ | 20,516 | | | 2.38 | % | | $ | 2,559,135 | | | $ | 9,551 | | | 1.48 | % |

| Savings accounts | | | 2,038,523 | | | 5,062 | | | 0.99 | % | | 2,009,028 | | | 4,777 | | | 0.95 | % | | 2,020,653 | | | 4,587 | | | 0.91 | % | | 2,042,865 | | | 4,417 | | | 0.87 | % | | 2,141,230 | | | 4,986 | | | 0.92 | % |

| Time deposits | | | 1,689,684 | | | 13,247 | | | 3.12 | % | | 1,616,946 | | | 12,202 | | | 3.00 | % | | 1,552,829 | | | 11,109 | | | 2.88 | % | | 1,480,753 | | | 9,924 | | | 2.70 | % | | 1,439,833 | | | 8,895 | | | 2.45 | % |

| | | | 7,011,015 | | | 35,180 | | | 2.00 | % | | 7,021,399 | | | 36,992 | | | 2.10 | % | | 7,021,626 | | | 36,660 | | | 2.10 | % | | 6,996,470 | | | 34,857 | | | 2.00 | % | | 6,140,198 | | | 23,432 | | | 1.51 | % |

| Non-interest bearing deposit accounts | | | 2,544,198 | | | — | | | — | | | 2,567,353 | | | — | | | — | | | 2,578,216 | | | — | | | — | | | 2,536,320 | | | — | | | — | | | 2,551,318 | | | — | | | — | |

| Total core deposits | | | $ | 9,555,213 | | | $ | 35,180 | | | 1.46 | % | | $ | 9,588,752 | | | $ | 36,992 | | | 1.53 | % | | $ | 9,599,842 | | | $ | 36,660 | | | 1.54 | % | | $ | 9,532,790 | | | $ | 34,857 | | | 1.47 | % | | $ | 8,691,516 | | | $ | 23,432 | | | 1.07 | % |

Total borrowings and brokered deposits: (Non-GAAP) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total borrowings | | | $ | 329,231 | | | $ | 3,693 | | | 4.46 | % | | $ | 241,062 | | | $ | 2,811 | | | 4.64 | % | | $ | 219,903 | | | $ | 2,521 | | | 4.61 | % | | $ | 220,773 | | | $ | 2,532 | | | 4.61 | % | | $ | 459,315 | | | $ | 5,924 | | | 5.12 | % |

Brokered deposits | | | 96,535 | | | 1,020 | | | 4.21 | % | | 21,068 | | | 221 | | | 4.17 | % | | 1,566 | | | 21 | | | 5.28 | % | | 58,737 | | | 803 | | | 5.50 | % | | 142,718 | | | 1,980 | | | 5.50 | % |

Total borrowings and brokered deposits | | | $ | 425,766 | | | $ | 4,713 | | | 4.40 | % | | $ | 262,130 | | | $ | 3,032 | | | 4.60 | % | | $ | 221,469 | | | $ | 2,542 | | | 4.62 | % | | $ | 279,510 | | | $ | 3,335 | | | 4.80 | % | | $ | 602,033 | | | $ | 7,904 | | | 5.21 | % |

OFG Bancorp (NYSE: OFG)

Table 5-2: Average Balances, Net Interest Income and Net Interest Margin (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 YTD | | 2023 YTD |

| (Dollars in thousands) (unaudited) | | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate |

| | | | | | | | | | | | | |

| Interest earning assets: | | | | | | | | | | | | | |

| Cash equivalents | | | $ | 611,976 | | | $ | 31,589 | | | 5.16 | % | | $ | 626,067 | | | $ | 31,406 | | | 5.02 | % |

| Investment securities | | | 2,591,101 | | | 105,086 | | | 4.06 | % | | 1,940,776 | | | 62,730 | | | 3.23 | % |

| Loans held for investment | | | | | | | | | | | | | |

| Non-PCD loans | | | 6,613,109 | | | 549,730 | | | 8.31 | % | | 5,976,521 | | | 482,043 | | | 8.07 | % |

| PCD loans | | | 1,013,721 | | | 63,872 | | | 6.30 | % | | 1,144,655 | | | 72,701 | | | 6.35 | % |

| Total loans | | | 7,626,830 | | | 613,602 | | | 8.05 | % | | 7,121,176 | | | 554,744 | | | 7.79 | % |

| Total interest-earning assets | | | $ | 10,829,907 | | | $ | 750,277 | | | 6.93 | % | | $ | 9,688,019 | | | $ | 648,880 | | | 6.70 | % |

| | | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | | | |

| Deposits | | | | | | | | | | | | | |

| NOW accounts | | | $ | 3,399,476 | | | $ | 78,362 | | | 2.31 | % | | $ | 2,489,560 | | | $ | 25,710 | | | 1.03 | % |

| Savings accounts | | | 2,027,746 | | | 18,843 | | | 0.93 | % | | 2,214,256 | | | 17,727 | | | 0.80 | % |

| Time deposits | | | 1,585,427 | | | 46,482 | | | 2.93 | % | | 1,315,745 | | | 25,225 | | | 1.92 | % |

| Brokered deposits | | | 44,555 | | | 2,065 | | | 4.63 | % | | 39,100 | | | 2,020 | | | 5.16 | % |

| | | 7,057,204 | | | 145,752 | | | 2.07 | % | | 6,058,661 | | | 70,682 | | | 1.17 | % |

| Non-interest bearing deposit accounts | | | 2,556,518 | | | — | | | — | % | | 2,590,523 | | | — | | | — | % |

| Fair value premium and core deposit intangible amortization | | | — | | | 4,528 | | | — | | | — | | | 5,283 | | | — | |

| Total deposits | | | 9,613,722 | | | 150,280 | | | 1.56 | % | | 8,649,184 | | | 75,965 | | | 0.88 | % |

| Borrowings | | | | | | | | | | | | | |

| Securities sold under agreements to repurchase | | | 11,270 | | | 542 | | | 4.81 | % | | 59,541 | | | 3,306 | | | 5.55 | % |

| Advances from FHLB and other borrowings | | | 241,649 | | | 11,015 | | | 4.56 | % | | 195,000 | | | 8,739 | | | 4.48 | % |

| | | | | | | | | | | | | |

| Total borrowings | | | 252,919 | | | 11,557 | | | 4.57 | % | | 254,541 | | | 12,045 | | | 4.73 | % |

| Total interest-bearing liabilities | | | $ | 9,866,641 | | | $ | 161,837 | | | 1.64 | % | | $ | 8,903,725 | | | $ | 88,010 | | | 0.99 | % |

| Interest rate spread | | | | | $ | 588,440 | | | 5.29 | % | | | | $ | 560,870 | | | 5.71 | % |

| Net interest margin | | | | | | | 5.43 | % | | | | | | 5.79 | % |

| | | | | | | | | | | | | |

| Core deposits: (Non-GAAP) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| NOW accounts | | | $ | 3,399,476 | | | $ | 78,362 | | | 2.31 | % | | $ | 2,489,560 | | | $ | 25,710 | | | 1.03 | % |

| Savings accounts | | | 2,027,746 | | | 18,843 | | | 0.93 | % | | 2,214,256 | | | 17,727 | | | 0.80 | % |

| Time deposits | | | 1,585,427 | | | 46,482 | | | 2.93 | % | | 1,315,745 | | | 25,225 | | | 1.92 | % |

| | | 7,012,649 | | | 143,687 | | | 2.05 | % | | 6,019,561 | | | 68,662 | | | 1.14 | % |

| Non-interest bearing deposit accounts | | | 2,556,518 | | | — | | | — | % | | 2,590,523 | | | — | | | — | % |

| Total core deposits | | | $ | 9,569,167 | | | $ | 143,687 | | | 1.50 | % | | $ | 8,610,084 | | | $ | 68,662 | | | 0.80 | % |

Total borrowings and brokered deposits: (Non-GAAP) | | | | | | | | | | | | | |

Total borrowings | | | $ | 252,919 | | | $ | 11,557 | | | 4.57 | % | | $ | 254,541 | | | $ | 12,045 | | | 4.73 | % |

Brokered deposits | | | 44,555 | | | 2,065 | | | 4.63 | % | | 39,100 | | | 2,020 | | | 5.16 | % |

Total borrowings and brokered deposits | | | $ | 297,474 | | | $ | 13,622 | | | 4.58 | % | | $ | 293,641 | | | $ | 14,065 | | | 4.79 | % |

OFG Bancorp (NYSE: OFG)

Table 6-1: Loan Information and Performance Statistics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Net Charge-offs | | | | | | | | | | | |

| Non-PCD | | | | | | | | | | | |

| Mortgage: | | | | | | | | | | | |

| Charge-offs | | | $ | 24 | | | $ | 37 | | | $ | 1 | | | $ | 64 | | | $ | 150 | |

| Recoveries | | | (190) | | | (72) | | | (540) | | | (267) | | | (483) | |

| Total mortgage | | | (166) | | | (35) | | | (539) | | | (203) | | | (333) | |

| Commercial PR: | | | | | | | | | | | |

| Charge-offs | | | 713 | | | 139 | | | 160 | | | 3,567 | | | 377 | |

| Recoveries | | | (381) | | | (1,455) | | | (111) | | | (52) | | | (114) | |

| Total commercial PR | | | 332 | | | (1,316) | | | 49 | | | 3,515 | | | 263 | |

| Commercial US: | | | | | | | | | | | |

| Charge-offs | | | 315 | | | — | | | 1,574 | | | 1,749 | | | 689 | |

| Recoveries | | | — | | | (24) | | | (45) | | | — | | | (23) | |

| Total commercial US | | | 315 | | | (24) | | | 1,529 | | | 1,749 | | | 666 | |

| Consumer: | | | | | | | | | | | |

| Charge-offs | | | 8,242 | | | 8,863 | | | 8,180 | | | 7,981 | | | 6,799 | |

| Recoveries | | | (1,792) | | (a) | (830) | | | (851) | | | (693) | | | (650) | |

| Total consumer | | | 6,450 | | | 8,033 | | | 7,329 | | | 7,288 | | | 6,149 | |

| Auto: | | | | | | | | | | | |

| Charge-offs | | | 18,503 | | | 16,371 | | | 12,559 | | | 14,218 | | | 14,658 | |

| Recoveries | | | (8,137) | | (a) | (6,300) | | | (5,926) | | | (5,971) | | | (4,982) | |

| Total auto | | | 10,366 | | | 10,071 | | | 6,633 | | | 8,247 | | | 9,676 | |

| Total | | | $ | 17,297 | | | $ | 16,729 | | | $ | 15,001 | | | $ | 20,596 | | | $ | 16,421 | |

| | | | | | | | | | | |

| PCD | | | | | | | | | | | |

| Mortgage: | | | | | | | | | | | |

| Charge-offs | | | $ | — | | | $ | 66 | | | $ | 29 | | | $ | 83 | | | $ | 94 | |

| Recoveries | | | (345) | | | (250) | | | (93) | | | (638) | | | (111) | |

| Total mortgage | | | (345) | | | (184) | | | (64) | | | (555) | | | (17) | |

| Commercial PR: | | | | | | | | | | | |

| Charge-offs | | | 39 | | | 663 | | | 265 | | | — | | | — | |

| Recoveries | | | (1,026) | | | (70) | | | (158) | | | (157) | | | (315) | |

| Total commercial PR | | | (987) | | | 593 | | | 107 | | | (157) | | | (315) | |

| Consumer: | | | | | | | | | | | |

| Charge-offs | | | — | | | — | | | — | | | — | | | 244 | |

| Recoveries | | | (13) | | | (19) | | | (7) | | | (23) | | | (19) | |

| Total consumer | | | (13) | | | (19) | | | (7) | | | (23) | | | 225 | |

| Auto: | | | | | | | | | | | |

| Charge-offs | | | 1 | | | 9 | | | 6 | | | 9 | | | 12 | |

| Recoveries | | | (91) | | | (25) | | | (30) | | | (58) | | | (44) | |

| Total auto | | | (90) | | | (16) | | | (24) | | | (49) | | | (32) | |

| Total | | | $ | (1,435) | | | $ | 374 | | | $ | 12 | | | $ | (784) | | | $ | (139) | |

| | | | | | | | | | | |

| Total Net Charge-offs | | | $ | 15,862 | | | $ | 17,103 | | | $ | 15,013 | | | $ | 19,812 | | | $ | 16,282 | |

| Net Charge-off Rates | | | | | | | | | | | |

| Mortgage | | | (0.14) | % | | (0.06) | % | | (0.16) | % | | (0.20) | % | | (0.09) | % |

| Commercial PR | | | (0.11) | % | | (0.12) | % | | 0.03 | % | | 0.58 | % | | (0.01) | % |

| Commercial US | | | 0.18 | % | | (0.01) | % | | 0.85 | % | | 0.92 | % | | 0.36 | % |

| Consumer | | | 3.72 | % | (a) | 4.70 | % | | 4.42 | % | | 4.45 | % | | 3.95 | % |

| Auto | | | 1.63 | % | (a) | 1.64 | % | | 1.11 | % | | 1.42 | % | | 1.72 | % |

| Total | | | 0.82 | % | | 0.90 | % | | 0.79 | % | | 1.05 | % | | 0.88 | % |

| Average Loans Held For Investment | | | | | | | | | | | |

| Mortgage | | | $ | 1,429,022 | | | $ | 1,446,855 | | | $ | 1,479,583 | | | $ | 1,511,281 | | | $ | 1,562,135 | |

| Commercial PR | | | 2,386,204 | | | 2,393,891 | | | 2,363,831 | | | 2,312,561 | | | 2,230,342 | |

| Commercial US | | | 689,310 | | | 658,908 | | | 716,989 | | | 756,409 | | | 736,640 | |

| Consumer | | | 692,119 | | | 681,391 | | | 663,315 | | | 652,843 | | | 644,834 | |

| Auto | | | 2,520,911 | | | 2,453,466 | | | 2,389,589 | | | 2,308,663 | | | 2,243,133 | |

| Total | | | $ | 7,717,566 | | | $ | 7,634,511 | | | $ | 7,613,307 | | | $ | 7,541,757 | | | $ | 7,417,084 | |

(a) Refer to “(c)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 6-2: Loan Information and Performance Statistics (Excludes PCD Loans) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Early Delinquency (30 - 89 days past due) | | | | | | | | | | | |

| Mortgage | | | $ | 11,431 | | | $ | 10,822 | | | $ | 12,767 | | | $ | 13,080 | | | $ | 15,703 | |

| Commercial | | | 6,825 | | | 2,426 | | | 7,781 | | | 6,128 | | | 3,653 | |

| | | | | | | | | | | |

| Consumer | | | 14,281 | | | 13,485 | | | 13,102 | | | 10,901 | | | 11,366 | |

| Auto | | | 170,013 | | (a) | 161,025 | | | 152,817 | | | 126,704 | | | 147,681 | |

| Total | | | $ | 202,550 | | | $ | 187,758 | | | $ | 186,467 | | | $ | 156,813 | | | $ | 178,403 | |

| Early Delinquency Rates (30 - 89 days past due) | | | | | | | | | | | |

| Mortgage | | | 1.82 | % | | 1.75 | % | | 2.13 | % | | 2.14 | % | | 2.50 | % |

| Commercial | | | 0.23 | % | | 0.08 | % | | 0.26 | % | | 0.21 | % | | 0.12 | % |

| | | | | | | | | | | |

| Consumer | | | 2.14 | % | | 2.03 | % | | 2.04 | % | | 1.74 | % | | 1.83 | % |

| Auto | | | 6.67 | % | (a) | 6.48 | % | | 6.30 | % | | 5.42 | % | | 6.50 | % |

| Total | | | 2.95 | % | | 2.78 | % | | 2.81 | % | | 2.41 | % | | 2.76 | % |

| Total Delinquency (30 days and over past due) | | | | | | | | | | | |

| Mortgage: | | | | | | | | | | | |

| Traditional, Non traditional, and Loans under Loss Mitigation | | | $ | 22,840 | | | $ | 22,954 | | | $ | 23,443 | | | $ | 25,985 | | | $ | 27,859 | |

| GNMA's buy-back option program | (22) | | 48,586 | | | 41,801 | | | 19,008 | | | 18,509 | | | 19,401 | |

| Total mortgage | | | 71,426 | | | 64,755 | | | 42,451 | | | 44,494 | | | 47,260 | |

| Commercial | | | 20,193 | | | 17,460 | | | 17,703 | | | 14,171 | | | 14,298 | |

| | | | | | | | | | | |

| Consumer | | | 18,471 | | | 17,094 | | | 16,405 | | | 14,760 | | | 14,742 | |

| Auto | | | 190,068 | | (a) | 178,003 | | | 169,506 | | | 141,220 | | | 166,737 | |

| Total | | | $ | 300,158 | | | $ | 277,312 | | | $ | 246,065 | | | $ | 214,645 | | | $ | 243,037 | |

| Total Delinquency Rates (30 days and over past due) | | | | | | | | | | |

| Mortgage: | | | | | | | | | | | |

| Traditional, Non traditional, and Loans under Loss Mitigation | | | 3.63 | % | | 3.71 | % | | 3.91 | % | | 4.26 | % | | 4.43 | % |

| GNMA's buy-back option program | (22) | | 7.73 | % | | 6.75 | % | | 3.17 | % | | 3.03 | % | | 3.08 | % |

| Total mortgage | | | 11.36 | % | | 10.46 | % | | 7.07 | % | | 7.29 | % | | 7.51 | % |

| Commercial | | | 0.67 | % | | 0.58 | % | | 0.60 | % | | 0.49 | % | | 0.49 | % |

| | | | | | | | | | | |

| Consumer | | | 2.77 | % | | 2.58 | % | | 2.55 | % | | 2.35 | % | | 2.38 | % |

| Auto | | | 7.46 | % | (a) | 7.17 | % | | 6.98 | % | | 6.04 | % | | 7.34 | % |

| Total | | | 4.38 | % | | 4.10 | % | | 3.71 | % | | 3.30 | % | | 3.76 | % |

| Nonperforming Assets | (14) | | | | | | | | | | |

| Mortgage | | | $ | 16,928 | | | $ | 18,723 | | | $ | 17,325 | | | $ | 19,044 | | | $ | 20,007 | |

| Commercial | | | 38,913 | | | 36,099 | | | 34,477 | | | 33,794 | | | 36,096 | |

| | | | | | | | | | | |

| Consumer | | | 4,207 | | | 3,627 | | | 3,329 | | | 3,893 | | | 3,376 | |

| Auto | | | 20,055 | | (a) | 16,978 | | | 16,689 | | | 14,516 | | | 19,056 | |

| Total nonperforming loans | | | 80,103 | | | 75,427 | | | 71,820 | | | 71,247 | | | 78,535 | |

| Foreclosed real estate | | | 4,002 | | | 4,419 | | | 6,526 | | | 10,850 | | | 10,780 | |

| Other repossessed assets | | | 6,595 | | | 6,969 | | | 5,713 | | | 6,844 | | | 4,032 | |

| Total nonperforming assets | | | $ | 90,700 | | | $ | 86,815 | | | $ | 84,059 | | | $ | 88,941 | | | $ | 93,347 | |

| Nonperforming Loan Rates | | | | | | | | | | | |

| Mortgage | | | 2.69 | % | | 3.02 | % | | 2.89 | % | | 3.12 | % | | 3.18 | % |

| Commercial | | | 1.29 | % | | 1.20 | % | | 1.17 | % | | 1.16 | % | | 1.23 | % |

| | | | | | | | | | | |

| Consumer | | | 0.63 | % | | 0.55 | % | | 0.52 | % | | 0.62 | % | | 0.54 | % |

| Auto | | | 0.79 | % | | 0.68 | % | | 0.69 | % | | 0.62 | % | | 0.84 | % |

| Total loans | | | 1.17 | % | | 1.11 | % | | 1.08 | % | | 1.10 | % | | 1.22 | % |

(a) Refer to “(a)” in Table 1-1.

(a)Refer to “(b)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 6-3: Loan Information and Performance Statistics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Nonperforming PCD Loans | (14) | | | | | | | | | | |

| Mortgage | | | $ | 239 | | | $ | 241 | | | $ | 244 | | | $ | 247 | | | $ | 250 | |

| Commercial | | | 2,641 | | | 3,920 | | | 4,748 | | | 5,969 | | | 6,424 | |

| | | | | | | | | | | |

| Total nonperforming loans | | | $ | 2,880 | | | $ | 4,161 | | | $ | 4,992 | | | $ | 6,216 | | | $ | 6,674 | |

| Nonperforming PCD Loan Rates | | | | | | | | | | | |

| Mortgage | | | 0.03 | % | | 0.03 | % | | 0.03 | % | | 0.03 | % | | 0.03 | % |

| Commercial | | | 2.98 | % | | 3.29 | % | | 3.69 | % | | 4.52 | % | | 4.74 | % |

| | | | | | | | | | | |

| Total | | | 0.31 | % | | 0.42 | % | | 0.49 | % | | 0.60 | % | | 0.62 | % |

| Total PCD Loans Held for Investment | | | | | | | | | | | |

| Mortgage | | | $ | 841,964 | | | $ | 864,491 | | | $ | 885,096 | | | $ | 909,106 | | | $ | 933,362 | |

| Commercial | | | 88,729 | | | 119,029 | | | 128,584 | | | 132,035 | | | 135,447 | |

| Consumer | | | 598 | | | 560 | | | 605 | | | 544 | | | 552 | |

| Auto | | | 460 | | | 664 | | | 951 | | | 1,358 | | | 1,891 | |

| Total loans | | | $ | 931,751 | | | $ | 984,744 | | | $ | 1,015,236 | | | $ | 1,043,043 | | | $ | 1,071,252 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Total Nonperforming Loans | (14) | | | | | | | | | | |

| Mortgage | | | $ | 17,167 | | | $ | 18,964 | | | $ | 17,569 | | | $ | 19,291 | | | $ | 20,257 | |

| Commercial | | | 41,554 | | | 40,019 | | | 39,225 | | | 39,763 | | | 42,520 | |

| | | | | | | | | | | |

| Consumer | | | 4,207 | | | 3,627 | | | 3,329 | | | 3,893 | | | 3,376 | |

| Auto | | | 20,055 | | (a) | 16,978 | | | 16,689 | | | 14,516 | | | 19,056 | |

| Total nonperforming loans | | | $ | 82,983 | | | $ | 79,588 | | | $ | 76,812 | | | $ | 77,463 | | | $ | 85,209 | |

| Total Nonperforming Loan Rates | | | | | | | | | | | |

| Mortgage | | | 1.17 | % | | 1.28 | % | | 1.18 | % | | 1.27 | % | | 1.30 | % |

| Commercial | | | 1.34 | % | | 1.28 | % | | 1.27 | % | | 1.30 | % | | 1.38 | % |

| | | | | | | | | | | |

| Consumer | | | 0.63 | % | | 0.55 | % | | 0.52 | % | | 0.62 | % | | 0.54 | % |

| Auto | | | 0.79 | % | (a) | 0.68 | % | | 0.69 | % | | 0.62 | % | | 0.84 | % |

| Total | | | 1.06 | % | | 1.03 | % | | 1.01 | % | | 1.03 | % | | 1.13 | % |

| Total Loans Held for Investment | | | | | | | | | | | |

| Mortgage | | | $ | 1,470,817 | | | $ | 1,483,612 | | | $ | 1,485,127 | | | $ | 1,519,045 | | | $ | 1,562,609 | |

| Commercial | | | 3,103,091 | | | 3,118,381 | | | 3,082,363 | | | 3,051,448 | | | 3,076,903 | |

| | | | | | | | | | | |

| Consumer | | | 668,561 | | | 664,308 | | | 644,177 | | | 627,980 | | | 620,446 | |

| Auto | | | 2,549,493 | | | 2,484,275 | | | 2,428,040 | | | 2,341,194 | | | 2,274,421 | |

| Total loans | | | $ | 7,791,962 | | | $ | 7,750,576 | | | $ | 7,639,707 | | | $ | 7,539,667 | | | $ | 7,534,379 | |

(a) Refer to “(a)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 7: Allowance for Credit Losses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended December 31, 2024 |

| (Dollars in thousands) (unaudited) | | Mortgage | | Commercial | | Consumer | | Auto | | Total |

| Allowance for credit losses Non-PCD: | | | | | | | | | | |

| Balance at beginning of period | | $ | 6,890 | | | $ | 36,077 | | | $ | 31,303 | | | $ | 80,863 | | | $ | 155,133 | |

| (Recapture of) provision for credit losses | | (661) | | | 9,384 | | | 6,965 | | | 17,185 | | (a) | 32,873 | |

| Charge-offs | | (24) | | | (1,028) | | | (8,242) | | | (18,503) | | | (27,797) | |

| Recoveries | | 190 | | | 381 | | | 1,792 | | (b) | 8,137 | | (b) | 10,500 | |

| Balance at end of period | | $ | 6,395 | | | $ | 44,814 | | | $ | 31,818 | | | $ | 87,682 | | | $ | 170,709 | |

| | | | | | | | | | |

| Allowance for credit losses PCD: | | | | | | | | | | |

| Balance at beginning of period | | $ | 5,402 | | | $ | 947 | | | $ | 11 | | | $ | 7 | | | $ | 6,367 | |

| Recapture of credit losses | | (1,233) | | | (1,312) | | | (13) | | | (90) | | | (2,648) | |

| Charge-offs | | — | | | (39) | | | — | | | (1) | | | (40) | |

| Recoveries | | 345 | | | 1,026 | | | 13 | | | 91 | | | 1,475 | |

| Balance at end of period | | $ | 4,514 | | | $ | 622 | | | $ | 11 | | | $ | 7 | | | $ | 5,154 | |

| | | | | | | | | | |

| Allowance for credit losses summary: | | | | | | | | | | |

| Balance at beginning of period | | $ | 12,292 | | | $ | 37,024 | | | $ | 31,314 | | | $ | 80,870 | | | $ | 161,500 | |

| (Recapture of) provision for credit losses | | (1,894) | | | 8,072 | | | 6,952 | | | 17,095 | | (a) | 30,225 | |

| Charge-offs | | (24) | | | (1,067) | | | (8,242) | | | (18,504) | | | (27,837) | |

| Recoveries | | 535 | | | 1,407 | | | 1,805 | | (b) | 8,228 | | (b) | 11,975 | |

| Balance at end of period | | $ | 10,909 | | | $ | 45,436 | | | $ | 31,829 | | | $ | 87,689 | | | $ | 175,863 | |

| Allowance coverage ratio | | 0.74 | % | | 1.46 | % | | 4.76 | % | | 3.44 | % | | 2.26 | % |

| | | | | | | | | | |

(a) Refer to “(a)” in Table 1-1.

(b) Refer to “(c)” in Table 1-1.

OFG Bancorp (NYSE: OFG)

Table 8-1: Reconciliation of GAAP to Non-GAAP Measures and Calculation of Regulatory Capital

In addition to disclosing required regulatory capital measures, we also report certain non-GAAP capital measures that management uses in assessing its capital adequacy. These non-GAAP measures include tangible common equity ("TCE") and TCE ratio. The table below provides the details of the calculation of our regulatory capital and non-GAAP capital measures. While our non-GAAP capital measures are widely used by investors, analysts and bank regulatory agencies to assess the capital position of financial services companies, they may not be comparable to similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Stockholders' Equity to Non-GAAP Tangible Common Equity | | | | | | | | | | |

| Total stockholders' equity | | $ | 1,254,371 | | | $ | 1,318,132 | | | $ | 1,227,702 | | | $ | 1,215,653 | | | $ | 1,193,480 | |

| Less: Intangible assets | | (99,023) | | | (100,501) | | (101,979) | | (103,457) | | (104,935) |

| | | | | | | | | | |

| | | | | | | | | | |

| Tangible common equity | | $ | 1,155,348 | | | $ | 1,217,631 | | $ | 1,125,723 | | $ | 1,112,196 | | $ | 1,088,545 |

| | | | | | | | | | |

| Common shares outstanding at end of period | | 45,440 | | | 46,559 | | | 46,562 | | | 47,217 | | | 47,065 | |

| Tangible book value per common share (Non-GAAP) | | $ | 25.43 | | | $ | 26.15 | | | $ | 24.18 | | | $ | 23.55 | | | $ | 23.13 | |

| Total Assets to Tangible Assets | | | | | | | | | | |

| Total assets | | $ | 11,500,734 | | | $ | 11,461,382 | | | $ | 11,259,085 | | | $ | 11,159,235 | | | $ | 11,344,453 | |

| Less: Intangible assets | | (99,023) | | (100,501) | | (101,979) | | (103,457) | | (104,935) |

| Tangible assets (Non-GAAP) | | $ | 11,401,711 | | | $ | 11,360,881 | | | $ | 11,157,106 | | | $ | 11,055,778 | | | $ | 11,239,518 | |

| Non-GAAP TCE Ratio | | | | | | | | | | |

| Tangible common equity | | $ | 1,155,348 | | | $ | 1,217,631 | | $ | 1,125,723 | | $ | 1,112,196 | | $ | 1,088,545 |

| Tangible assets | | 11,401,711 | | | 11,360,881 | | | 11,157,106 | | | 11,055,778 | | | 11,239,518 | |

| TCE ratio | | 10.13 | % | | 10.72 | % | | 10.09 | % | | 10.06 | % | | 9.68 | % |

| Average Equity to Non-GAAP Average Tangible Common Equity | | | | | | | | | | |

| Average total stockholders' equity | | $ | 1,304,779 | | | $ | 1,280,760 | | | $ | 1,223,669 | | | $ | 1,213,469 | | | $ | 1,128,747 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Less: Average intangible assets | | (99,558) | | | (101,042) | | (102,499) | | (103,988) | | (105,560) |

| Average tangible common equity | | $ | 1,205,221 | | | $ | 1,179,718 | | $ | 1,121,170 | | $ | 1,109,481 | | $ | 1,023,187 |

OFG Bancorp (NYSE: OFG)

Table 8-2: Reconciliation of GAAP to Non-GAAP Measures and Calculation of Regulatory Capital Measures (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | BASEL III |

| | | Standardized |

| | | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| (Dollars in thousands) (unaudited) | | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Regulatory Capital Metrics | | | | | | | | | | | |

| Common equity Tier 1 capital | | | $ | 1,256,906 | | $ | 1,260,944 | | $ | 1,223,031 | | $ | 1,205,231 | | $ | 1,174,205 |

| Tier 1 capital | | | 1,256,906 | | 1,260,944 | | 1,223,031 | | 1,205,231 | | 1,174,205 |

| Total risk-based capital | (15) | | 1,367,692 | | 1,371,041 | | 1,330,474 | | 1,309,893 | | 1,278,537 |

| Risk-weighted assets | | | 8,812,422 | | 8,772,207 | | 8,561,549 | | 8,338,168 | | 8,317,802 |

| Regulatory Capital Ratios | | | | | | | | | | | |

| Common equity Tier 1 capital ratio | (16) | | 14.26 | % | | 14.37 | % | | 14.29 | % | | 14.45 | % | | 14.12 | % |

| Tier 1 risk-based capital ratio | (17) | | 14.26 | % | | 14.37 | % | | 14.29 | % | | 14.45 | % | | 14.12 | % |

| Total risk-based capital ratio | (18) | | 15.52 | % | | 15.63 | % | | 15.54 | % | | 15.71 | % | | 15.37 | % |

| Leverage ratio | (19) | | 10.93 | % | | 11.12 | % | | 10.86 | % | | 10.76 | % | | 11.03 | % |

| | | | | | | | | | | | |

| Common Equity Tier 1 Capital Ratio Under Basel III Standardized Approach | | | | | | | | | | |

| Total stockholders' equity | | | $ | 1,254,371 | | $ | 1,318,132 | | | $ | 1,227,702 | | | $ | 1,215,653 | | | $ | 1,193,480 | |

| Plus: CECL transition adjustment | (20) | | 6,852 | | 6,852 | | 6,852 | | 6,852 | | 13,704 |

| | | | | | | | | | | |

| | | | | | | | | | | |

Plus: Unrealized losses on available-for-sale securities, net of

income tax | | | 89,839 | | 32,990 | | 86,494 | | 81,731 | | 67,013 |

| | | | | | | | | | | |

| Total adjusted stockholders’equity | | | 1,351,062 | | 1,357,974 | | 1,321,048 | | 1,304,236 | | 1,274,197 |

| Less: Disallowed goodwill | | | (82,355) | | (84,241) | | (84,241) | | (84,241) | | (84,241) |

| Disallowed other intangible assets, net | | | (11,801) | | (12,789) | | (13,776) | | (14,764) | | (15,751) |

| Disallowed deferred tax assets, net | | | — | | — | | — | | — | | — |

| Common equity Tier 1 capital and Tier 1 capital | | | 1,256,906 | | 1,260,944 | | 1,223,031 | | 1,205,231 | | 1,174,205 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Plus Tier 2 capital: Qualifying allowance for credit losses | | | 110,786 | | 110,097 | | 107,443 | | 104,662 | | 104,332 |

| Total risk-based capital | | | $ | 1,367,692 | | $ | 1,371,041 | | | $ | 1,330,474 | | | $ | 1,309,893 | | | $ | 1,278,537 | |

OFG Bancorp (NYSE: OFG)

Table 9: Notes to Financial Summary, Selected Metrics, Loans, and Consolidated Financial Statements (Tables 1 - 8)

| | | | | |

| (1) | Total banking and financial service revenues. |

| (2) | Net interest income plus non-interest income, net (core) |

| (3) | Calculated based on net income available to common shareholders divided by average common shares outstanding for the period. |

| (4) | Calculated based on net income available to common shareholders divided by total average common shares outstanding and equivalents for the period as if converted. |

| (5) | Tangible book value per common share is a non-GAAP measure calculated based on tangible common equity divided by common shares outstanding. See "Tables 8-1 and 8-2: Reconciliation of GAAP to Non-GAAP Measures and Calculation of Regulatory Capital Measures" for additional information. |

| (6) | Information includes all loans held for investment, including PCD loans. |

| (7) | Calculated based on annualized net interest income for the period divided by average interest-earning assets for the period. |

| (8) | Calculated based on annualized income, net of tax, for the period divided by average total assets for the period. |

| (9) | Calculated based on annualized income available to common shareholders for the period divided by average tangible common equity for the period. |

| (10) | Calculated based on non-interest expense for the period divided by total net interest income and total banking and financial services revenues for the period. |

| (11) | Calculated based on annualized net charge-offs for the period divided by average loans held for investment for the period. |

| (12) | Non-GAAP ratios. See "Tables 8-1 and 8-2: Reconciliation of GAAP to Non-GAAP Measures and Calculation of Regulatory Capital Measures" for information on the calculation of each of these ratios. |

| (13) | Production of new loans (excluding renewals). |

| (14) | Most PCD loans are considered to be performing due to the application of the accretion method, in which these loans will accrete interest income over the remaining life of the loans using estimated cash flow analyses. Therefore, they are not included as non-performing loans. PCD loan pools that are not accreting interest income are deemed to be non-performing loans and presented separately. |

| (15) | Total risk-based capital equals the sum of Tier 1 capital and Tier 2 capital. |

| (16) | Common equity Tier 1 capital ratio is a regulatory capital measure calculated based on Common equity Tier 1 capital divided by risk-weighted assets. |

| (17) | Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets. |

| (18) | Total risk-based capital ratio is a regulatory capital measure calculated based on Total risk-based capital divided by risk-weighted assets. |

| (19) | Leverage capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by average assets, after certain adjustments. |

| (20) | In March 2020, in light of strains on the U.S. economy as a result of the coronavirus disease (COVID-19), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued an interim final rule that provided the option to temporarily delay the effects of CECL on regulatory capital for two years, followed by a three-year transition period. In addition, for the first two years, a uniform 25% “scaling factor” is introduced to approximate the portion of the post day-one allowance attributable to CECL relative to the incurred loss methodology. The 25% scaling factor is calibrated to approximate an overall after-tax impact of differences in allowances under CECL versus the incurred loss methodology. |

| (21) | Pre-provision net revenues is a non-GAAP measure calculated based on net interest income plus total non-interest income, net, less total non-interest expenses for the period. |

| (22) | Under the GNMA program, issuers such as OFG Bancorp have the option but not the obligation to repurchase loans that are 90 days or more past due. For accounting purposes, these loans subject to the repurchase option are required to be reflected (rebooked) on the financial statements of the Company with an offsetting liability. |

| |

Cover page

|

Jan. 22, 2025 |

| Cover [Abstract] |

|