OSI Restaurant Partners, Inc. Announces Completion of Acquisition by Bain Capital, Catterton Partners and Company Founders

June 14 2007 - 11:06AM

PR Newswire (US)

TAMPA, Fla., June 14 /PRNewswire/ -- OSI Restaurant Partners, Inc.

(NYSE:OSI) today announced the completion of its acquisition by an

investor group comprised of private equity firms Bain Capital

Partners, LLC and Catterton Management Company, LLC, as well as

company founders Chris T. Sullivan, Robert D. Basham and J. Timothy

Gannon, and certain members of OSI management. Under the terms of

the $3.5 billion transaction, OSI stockholders are entitled to

receive $41.15 per share in cash. Messrs. Sullivan, Basham and

Gannon agreed with Kangaroo Holdings, Inc., an entity controlled by

funds associated with Bain Capital Partners and Catterton

Management Company to receive only $40.00 per share in cash for

their shares in a sale transaction with a member of the investor

group consummated immediately prior to completion of the

transaction. Separately, Messrs. Sullivan, Basham and Gannon

contributed shares to Kangaroo Holdings, Inc. in exchange for its

stock, and those shares have been exchanged at a per share

valuation of $40.00 per share. With the transaction complete, Bain

Capital owns a majority interest in OSI, and Catterton Management

and the company founders own a minority stake. The current OSI

senior management team, led by Bill Allen and Paul Avery, will

continue to operate the business, and has also acquired a minority

stake in the company. "We believe that our restaurant concepts are

better positioned to focus on opportunities and to execute our

business initiatives as a private company," said Bill Allen, Chief

Executive Officer of OSI Restaurant Partners, Inc. With the support

and loyalty of our partners we are confident we can accomplish our

objectives. Our team looks forward to working with Bain Capital and

Catterton Partners, whose support and extensive experience in the

restaurant industry will help us open a new and exciting chapter in

our company's history." OSI common stock has ceased trading on the

New York Stock Exchange prior to the open of the market on June 14,

2007, and is no longer listed. As previously announced, on June 5,

2007, OSI stockholders approved the merger at a special meeting.

Stockholders who hold shares through a bank or broker will not have

to take any action to have their shares converted into cash, since

these conversions will be handled by the bank or broker.

Stockholders who hold certificates can exchange their certificates

for $41.15 per share in cash, without interest, through OSI's

transfer agent, Bank of New York. Bank of New York will be mailing

out instructions to registered stockholders in the next several

days regarding specific actions they will need to take to exchange

their shares for the cash consideration. About OSI Restaurant

Partners OSI Restaurant Partners' portfolio of brands consists of

Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill,

Fleming's Prime Steakhouse & Wine Bar, Roy's, Lee Roy Selmon's,

Blue Coral Seafood & Spirits and Cheeseburger in Paradise

restaurants. It has operations in 50 states and 20 countries

internationally. About Bain Capital Bain Capital Partners, LLC

(http://www.baincapital.com/ ) is a global private investment firm

that manages several pools of capital including private equity,

venture capital, public equity and leveraged debt assets with

approximately $50 billion in assets under management. Since its

inception in 1984, Bain Capital has made private equity investments

and add-on acquisitions in over 230 companies around the world,

including such restaurant concepts as Domino's Pizza, Dunkin'

Brands and Burger King, and retailers including Toys "R" Us, AMC

Entertainment, Michael's Stores, Staples and Burlington Coat

Factory. Headquartered in Boston, Bain Capital has offices in New

York, London, Munich, Tokyo, Hong Kong and Shanghai. About

Catterton With more than $2 billion under management, Catterton

Partners is a leading private equity firm in the U.S. focused

exclusively on the consumer industry. Since its founding in 1990,

Catterton has leveraged its investment capital, strategic and

operating skills, and network of industry contacts to establish one

of the strongest investment track records in the consumer industry.

Catterton invests in all major consumer segments, including Food

and Beverage, Retail and Restaurants, Consumer Products and

Services, and Media and Marketing Services. Catterton has led

investments in companies such as Build-A-Bear Workshop, Cheddar's

Restaurant Holdings Inc., P.F. Chang's China Bistro, Baja Fresh

Mexican Grill, First Watch Restaurants, Frederic Fekkai, Kettle

Foods, Farley's and Sathers Candy Co., and Odwalla, Inc., More

information about the firm can be found at

http://www.cpequity.com/. Forward-Looking Statements This document

includes statements that do not directly or exclusively relate to

historical facts. Such statements are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements include statements regarding benefits of

the completed transaction and future performance. These statements

are based on the current expectations of management of OSI

Restaurant Partners. There are a number of risks and uncertainties

that could cause actual results to differ materially from the

forward-looking statements included in this document. For example,

among other things, OSI Restaurant Partners may be adversely

affected by unexpected costs of the transaction or by other

economic, business and/or competitive factors. Additional factors

that may affect the future results of OSI Restaurant Partners are

set forth in its filings with the Securities and Exchange

Commission ("SEC"), which are available at http://www.sec.gov/.

Unless required by law, OSI Restaurant Partners undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. DATASOURCE: OSI Restaurant Partners, Inc. CONTACT:

Dirk Montgomery, Chief Financial Officer of OSI Restaurant

Partners, Inc., +1-813-282-1225; Alex Stanton of Stanton Crenshaw

Communications, +1-212-780-1900, , for Bain Capital; Barrett Golden

of Joele Frank, Wilkinson Brimmer Katcher, +1-212-355-4449, for

Catterton Partners Web site: http://www.osirestaurantpartners.com/

Copyright

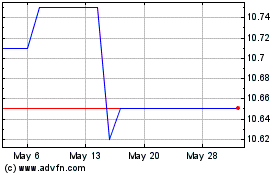

Osiris Acquisition (NYSE:OSI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Osiris Acquisition (NYSE:OSI)

Historical Stock Chart

From Jan 2024 to Jan 2025