Amundi US Announces Proposed Transaction Relating to Pioneer Closed-End Funds

July 19 2024 - 3:05PM

Business Wire

Amundi US today announced a proposed transaction affecting the

following Pioneer closed-end funds:

- Pioneer Diversified High Income Fund, Inc. (NYSEAMER: HNW)

- Pioneer Floating Rate Fund, Inc. (NYSE: PHD)

- Pioneer High Income Fund, Inc. (NYSE: PHT)

- Pioneer Municipal High Income Advantage Fund, Inc. (NYSE:

MAV)

- Pioneer Municipal High Income Fund, Inc. (NYSE: MHI)

- Pioneer Municipal High Income Opportunities Fund, Inc. (NYSE:

MIO)

Amundi Asset Management US, Inc. (the “Adviser”), each fund’s

investment adviser, is currently an indirect, wholly-owned

subsidiary of Amundi. On July 9, 2024, Amundi announced that it had

entered into a definitive agreement with Victory Capital Holdings,

Inc. (“Victory Capital”) to combine the Adviser with Victory

Capital, and for Amundi to become a strategic shareholder of

Victory Capital (the “Transaction”). Victory Capital is

headquartered in San Antonio, Texas. The closing of the Transaction

is subject to certain regulatory approvals and other conditions.

There is no assurance that the Transaction will close.

The closing of the Transaction would cause each fund’s current

investment advisory agreement with the Adviser to terminate. Under

the terms of the Transaction, the fund’s Board of Directors will be

asked to approve a new investment advisory agreement for the fund

with Victory Capital Management Inc., an affiliate of Victory

Capital. If approved by the Board, the fund’s new investment

advisory agreement will be submitted to the shareholders of the

fund for their approval. There is no assurance that the Board or

the shareholders of the fund will approve the new investment

advisory agreement.

The funds are closed-end investment companies. Five of these

funds trade on the New York Stock Exchange (NYSE) under the

following symbols: PHD, PHT, MAV, MHI, and MIO; HNW trades on the

NYSE American (NYSEAMER).

About Amundi US Amundi US is the US business of Amundi,

Europe’s largest asset manager by assets under management and

ranked among the ten largest globally1. Boston is one of Amundi’s

six main global investment hubs2 and offers a broad range of

fixed-income, equity, and multi-asset investment solutions in close

partnership with wealth management firms, distribution platforms,

and institutional investors across the Americas, Europe, and

Asia-Pacific.

With our financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape. Amundi clients benefit

from the expertise and advice of 5,5003 team members and market

professionals in 35 countries3. A subsidiary of the Crédit Agricole

group and listed on the Paris stock exchange, Amundi currently

manages approximately $2.286 trillion of assets3.

Amundi, a Trusted Partner, working every day in the interest of

our clients and society

www.amundi.com/us

Follow us on linkedin.com/company/amundi-us/ and

twitter.com/amundi_us.

1 Source: IPE “Top 500 Asset Managers” published in June 2024,

based on assets under management as of December 31, 2023. 2 Boston,

Dublin, London, Milan, Paris, and Tokyo 3 Amundi data as of

3/31/2024

FORWARD-LOOKING STATEMENTS This press release may contain

forward-looking statements within the meaning of applicable U.S.

federal and non-U.S. securities laws. These statements may include,

without limitation, any statements preceded by, followed by or

including words such as “target,” “believe,” “expect,” “aim,”

“intend,” “may,” “anticipate,” “assume,” “budget,” “continue,”

“estimate,” “future,” “objective,” “outlook,” “plan,” “potential,”

“predict,” “project,” “will,” “can have,” “likely,” “should,”

“would,” “could” and other words and terms of similar meaning or

the negative thereof and include, but are not limited to,

statements regarding the proposed transaction. Such forward-looking

statements involve known and unknown risks, uncertainties and other

important factors beyond Amundi US’s and the Pioneer Funds’ control

and could cause actual results, performance or achievements to be

materially different from the expected results, performance or

achievements expressed or implied by such forward-looking

statements. Although it is not possible to identify all such risks

and factors, they include, among others, the risk that conditions

to closing will fail to be satisfied and that the transaction will

fail to close on the anticipated timeline, if at all.

Amundi Distributor US, Inc., Member SIPC 60 State Street,

Boston, MA 02109 ©2024 Amundi Asset Management US, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240719679253/en/

Shareholder Inquiries: Please contact your financial advisor or

visit www.amundi.com/us.

Broker/Advisor Inquiries Please Contact: 800-622-9876 Media

Inquiries Please Contact: Geoff Smith, 617-504-8520

Pioneer High Income (NYSE:PHT)

Historical Stock Chart

From Nov 2024 to Dec 2024

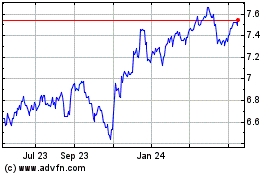

Pioneer High Income (NYSE:PHT)

Historical Stock Chart

From Dec 2023 to Dec 2024