Reinsurance Group of America, Incorporated Launches Ruby Reinsurance Company

December 06 2023 - 8:15AM

Business Wire

Leading U.S. financial services firms step

forward to provide initial investment in venture

Reinsurance Group of America, Incorporated (NYSE: RGA), a

leading global life and health reinsurer, announced today the

launch of Ruby Reinsurance Company (Ruby Re), a Missouri-domiciled

third-party life reinsurance company targeting U.S. asset-intensive

business. Ruby Re has closed its first round of funding and secured

equity capital commitments from lead investors Golub Capital,

Hudson Structured Capital Management Ltd. (doing its re/insurance

business as HSCM Bermuda), and Sammons Financial Group.

Ruby Re will reinsure business from RGA and will not face

clients directly. Initially, RGA will retrocede a block of $2.5

billion of existing liabilities to Ruby Re, and Ruby Re will

automatically receive a quota share from RGA of all future

qualifying business (subject to certain conditions, such as meeting

underwriting standards and regulatory approvals).

“As a pioneer in the asset-intensive business, I am excited

about the next step in our continuing support for this growing

market segment,” said Tony Cheng, President, RGA. “Ruby Re provides

RGA with alternative capital that expands our capacity at

attractive terms benefiting our clients, shareholders, and Ruby

investors.”

“This is Golub Capital’s inaugural insurance capital sidecar

transaction and is a culmination of a shared investment approach

and valuable partnership with RGA since 2010,” said Gregory

Robbins, Vice Chair of Golub Capital. “We are delighted to be able

to leverage our financing capabilities to support RGA’s continued

growth.”

“We are excited to be partnering with RGA. The combined

capabilities of Ruby Re, along with RGA’s outstanding reputation

and underwriting, will allow us to quickly establish a dynamic new

platform in the fast-growing asset-intensive market,” said Gokul

Sudarsana, Managing Director and Chief Actuary, HSCM Bermuda.

“For decades, we have recognized RGA as one of our trusted

partners and are excited to be a lead investor in Ruby Re,” said

Esfand Dinshaw, Sammons Financial Group Chief Executive Officer.

“We are proud to continue to build upon our strong relationship in

support of our long-term growth strategy.”

Jefferies acted as financial advisor and Oliver Wyman provided

actuarial support. Latham & Watkins acted as legal advisors to

RGA and Sidley Austin were legal advisors to the lead investors.

Additional terms are not being disclosed at this time.

About RGA

Reinsurance Group of America, Incorporated (NYSE: RGA) is a

global industry leader specializing in life and health reinsurance

and financial solutions that help clients effectively manage risk

and optimize capital. Founded in 1973, RGA is today one of the

world’s largest and most respected reinsurers and remains guided by

a powerful purpose: to make financial protection accessible to all.

As a global capabilities and solutions leader, RGA empowers

partners through bold innovation, relentless execution, and

dedicated client focus – all directed toward creating sustainable

long-term value. RGA has approximately $3.5 trillion of life

reinsurance in force and assets of $87.4 billion as of September

30, 2023. To learn more about RGA and its businesses, please visit

rgare.com or follow RGA on LinkedIn and Facebook. Investors can

learn more at investor.rgare.com.

About Golub Capital

Golub Capital is a market-leading, award-winning direct lender

and experienced credit asset manager. We specialize in delivering

reliable, creative and compelling financing solutions to companies

backed by private equity sponsors. Our sponsor finance expertise

also forms the foundation of our Broadly Syndicated Loan and Credit

Opportunities investment programs. We nurture long-term, win-win

partnerships that inspire repeat business from private equity

sponsors and investors.

As of October 1, 2023, Golub Capital had over 850 employees and

over $60 billion of capital under management, a gross measure of

invested capital including leverage. The firm has lending offices

in New York, Chicago, Miami, San Francisco and London. For more

information, please visit golubcapital.com.

About HSCM

Hudson Structured Capital Management Ltd. is an asset manager

focused on alternative investments seeking mezzanine level returns.

HSCM invests across the Re/Insurance and Transportation sectors.

The Firm launched in 2016 and focuses on core economic sectors that

are likely to outgrow global GDP, offer low correlations with

broader markets, and are experiencing a shift from balance sheet

and to market financing. For more information, please visit

www.hscm.com.

About Sammons Financial Group

The companies of Sammons® Financial Group, Inc. help families

and businesses by empowering futures and changing lives. Sammons

Financial Group is privately owned with member companies that are

among the most enduring and stable in the financial services

industry. Our companies include Midland National® Life Insurance

Company, North American Company for Life and Health Insurance®,

Sammons Institutional Group®, and Beacon Capital Management, Inc.

Committed to our communities, Sammons Financial Group is

Midwest-based, with offices in Iowa, Illinois, North Dakota, Ohio,

and South Dakota.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231206514325/en/

RGA Contacts: Lynn Phillips Vice

President, Corporate Communications 636-736-2351

lphillips@rgare.com

Lizzie Curry Director, Public Relations 636-736-8521

lizzie.curry@rgare.com

Jeff Hopson Senior Vice President, Investor Relations

636-736-2068 jhopson@rgare.com

Golub Capital Contact:

press@golubcapital.com

HSCM Contact: info@hscm.com

Sammons Financial Group Contact:

Kevin Waetke Associate Vice President, Sammons Financial Group

515-608-2558 kwaetke@sfgmembers.com

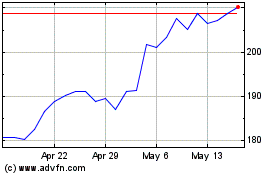

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Jan 2024 to Jan 2025