World-class lithium business to strengthen Rio

Tinto’s position as global leader in

energy transition commodities

Counter-cyclical expansion into a high-growth

market, aligned with Rio Tinto’s long-term strategy and disciplined

capital allocation framework

Rio Tinto’s scale, project development

capabilities and financial strength to unlock full potential of

Arcadium Lithium’s Tier 1 resource base

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN, INTO OR FROM ANY JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Rio Tinto and Arcadium Lithium plc (“Arcadium Lithium” or

“Arcadium”) (NYSE: ALTM) (ASX: LTM) today announced a

definitive agreement (the “Transaction Agreement”) under which Rio

Tinto will acquire Arcadium in an all-cash transaction for US$5.85

per share (the “Transaction”). The Transaction represents a

premium of 90% to Arcadium’s closing price of $3.08 per share on 4

October 2024, a premium of 39% to Arcadium’s volume-weighted

average price (VWAP) since Arcadium was created on 4 January 2024,

and values Arcadium’s diluted share capital at approximately $6.7

billion1.

The Transaction will bring Arcadium’s world-class, complementary

lithium business into Rio Tinto’s portfolio, establishing a global

leader in energy transition commodities – from aluminium and copper

to high-grade iron ore and lithium.

Arcadium is a global, fast-growing, vertically integrated

lithium chemicals producer with an asset base of long-life,

low-cost operations and growth projects. It has leading

capabilities in lithium chemicals manufacturing and extraction

processes, including hard-rock mining, conventional brine

extraction and direct lithium extraction. Arcadium’s current annual

lithium production capacity across a range of products including

lithium hydroxide and lithium carbonate is 75,000 tonnes lithium

carbonate equivalent2, with expansion plans in place to more than

double capacity by the end of 20283. Arcadium’s global operations,

comprising approximately 2,400 employees, include facilities and

projects in Argentina, Australia, Canada, China, Japan, the United

Kingdom and the United States.

Rio Tinto Chief Executive Officer Jakob Stausholm said:

“Acquiring Arcadium Lithium is a significant step forward in Rio

Tinto’s long-term strategy, creating a world-class lithium business

alongside our leading aluminium and copper operations to supply

materials needed for the energy transition. Arcadium Lithium is an

outstanding business today and we will bring our scale, development

capabilities and financial strength to realise the full potential

of its Tier 1 portfolio. This is a counter-cyclical expansion

aligned with our disciplined capital allocation framework,

increasing our exposure to a high-growth, attractive market at the

right point in the cycle.

“We look forward to building on Arcadium Lithium’s contributions

to the countries and communities where it operates, drawing on the

strong presence we already have in these regions. Our team has deep

conviction in the long-term value that combining our offerings will

deliver to all stakeholders.”

Arcadium Lithium CEO Paul Graves said: “We are confident that

this is a compelling cash offer that reflects a full and fair

long-term value for our business and de-risks our shareholders’

exposure to the execution of our development portfolio and market

volatility. Arcadium Lithium is a leading global lithium producer

with the widest offering of lithium chemical products and a

world-class manufacturing network, backed by a broad technology

portfolio and expertise in all aspects of the lithium value chain.

This agreement with Rio Tinto demonstrates the value in what we

have built over many years at Arcadium Lithium and its predecessor

companies, and we are excited that this transaction will give us

the opportunity to accelerate and expand our strategy, for the

benefit of our customers, our employees, and the communities in

which we operate.”

Compelling Strategic and Financial Rationale

The transaction will bring Rio Tinto’s scale, development

capabilities and financial strength to realise the full potential

of the Arcadium portfolio.

- Tier 1 assets. Arcadium is one of the world’s leading

global lithium platforms, with diversified production and

processing capabilities, a broad range of high-performance lithium

products, a highly attractive suite of growth projects, and

long-term blue-chip customer relationships. Its Tier 1 assets have

maintained high margins through-the-cycle, and its resource base is

expected to support ~130% capacity growth by 2028 within Rio

Tinto’s existing geographies2. Rio Tinto’s and Arcadium’s combined

assets will represent the world’s largest lithium resource base and

make Rio Tinto one of the leading lithium producers globally on a

pro-forma basis.

- Complementary capabilities. Rio Tinto has the balance

sheet strength and proven project delivery capability to execute

and, over time, accelerate the full potential from Arcadium’s Tier

1 resource base. Rio Tinto and Arcadium have complementary

footprints and deep experience in Argentina and Quebec, where Rio

Tinto expects to establish world-class lithium hubs with clear

opportunities for sharing skillsets and reducing costs. Combining

Rio Tinto and Arcadium’s technological leadership in lithium

extraction, the transaction will position Rio Tinto to become a

market leader in lithium processing. Rio Tinto looks forward to

building on Arcadium’s history of commercial excellence that

includes multi-year relationships with leading OEMs and battery

companies, by ensuring reliable, low-cost and sustainable

supply.

- Compelling economics. The transaction offers compelling

value driven by accelerating volume growth in a rising market

contributing to significantly higher EBITDA and free cash flow in

the outer years, before anticipated synergies. Acquiring Arcadium

is consistent with Rio Tinto’s disciplined approach to capital

allocation and will unlock significant value for shareholders,

underpinned by the financial strength that we will bring. Rio Tinto

will maintain its strong balance sheet following the close of this

transaction, in line with its Single A credit rating, as well as

its long track record of shareholder returns. Rio Tinto expects

Arcadium’s projected growth capital expenditure to represent

approximately 5% of Rio Tinto’s group capital expenditure of up to

$10 billion across 2025 and 2026.

- Right timing. Rio Tinto is confident in the long-term

outlook for lithium, with more than 10% compound annual growth rate

in lithium demand expected through to 2040 leading to a supply

deficit4. With spot lithium prices down more than 80% versus peak

prices, this counter-cyclical acquisition comes at a time with

substantial long-term market and portfolio upside, underpinned by

an appealing market structure and established jurisdictions.

Transaction Details

The Transaction has been unanimously approved by both the Rio

Tinto and Arcadium Lithium Boards of Directors. The Transaction,

which will be implemented by way of a Jersey scheme of arrangement,

is expected to close in mid-2025. Key conditions to closing of the

Transaction include approval of Arcadium Lithium shareholders and

the Royal Court of Jersey. In addition, the Transaction is subject

to receipt of customary regulatory approvals and other closing

conditions.

Rio Tinto BM Subsidiary Limited, an indirect wholly owned

subsidiary of Rio Tinto plc, will acquire the Arcadium Lithium

shares pursuant to the Transaction Agreement.

Arcadium Lithium shareholders do not need to take any action at

the present time. A notice of meeting and proxy statement for the

required meeting of Arcadium Lithium shareholders, when available,

will contain additional information regarding the Transaction. A

majority in number of those Arcadium Lithium shareholders present

and voting, and representing at least 75% of the voting rights of

all shares voted, will be required to complete the Transaction.

Full details of the terms and conditions of the Transaction are

set out in the Transaction Agreement, which may be obtained, free

of charge, on the SEC's website (http://www.sec.gov) when

available, and Rio Tinto’s website at

https://www.riotinto.com/en/invest/exchange-releases.

Conference Call

Rio Tinto and Arcadium Lithium management will discuss the

Transaction during a live webcast for investors and analysts at

9:30 AM BST on 9 October 2024.

Participants can access the live webcast at

https://edge.media-server.com/mmc/p/rzeiv2dj or conference call at

https://register.vevent.com/register/BIc28a9d251f054b4fbd6c5685102bf8d6

Transaction Website

Additional information regarding the Transaction, including a

Rio Tinto investor presentation, can be found at

www.RioTintoAndArcadium.com.

As a result of its pending combination, Arcadium Lithium will

not hold an earnings conference call in connection with its third

quarter financial results.

Advisors

Goldman Sachs and J.P. Morgan are acting as financial advisors

to Rio Tinto and Linklaters LLP is acting as lead legal advisor.

Gordon Dyal & Co. is serving as lead financial advisor and UBS

Investment Bank as financial advisor to Arcadium Lithium, and Davis

Polk & Wardwell LLP is serving as legal counsel.

About Arcadium Lithium

Arcadium Lithium is a leading global lithium chemicals producer

committed to safely and responsibly harnessing the power of lithium

to improve people’s lives and accelerate the transition to a clean

energy future. Arcadium Lithium collaborates with their customers

to drive innovation and power a more sustainable world in which

lithium enables exciting possibilities for renewable energy,

electric transportation and modern life. Arcadium Lithium is

vertically integrated, with industry-leading capabilities across

lithium extraction processes, including hard-rock mining,

conventional brine extraction and direct lithium extraction (DLE),

and in lithium chemicals manufacturing for high performance

applications. They have operations around the world, with

facilities and projects in Argentina, Australia, Canada, China,

Japan, the United Kingdom and the United States. For more

information, please visit www.ArcadiumLithium.com.

Important Notices

This announcement is for information purposes only and is not

intended to and does not constitute or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any securities

or the solicitation of any vote or approval in any jurisdiction in

contravention of applicable law. In connection with the

Transaction, Arcadium Lithium will file with the US Securities and

Exchange Commission (the “SEC”) certain proxy materials,

which shall constitute the scheme document and the proxy statement

relating to the proposed Transaction (the “proxy

statement”).

The proxy statement will contain the full terms and conditions

of the Transaction, including details with respect to the Arcadium

Lithium shareholder vote in respect of the Transaction and will be

sent or otherwise disseminated to Arcadium Lithium’s shareholders

and will contain important information about the proposed

Transaction and related matters. Any decision in respect of, or

other response to, the Transaction should be made only on the basis

of the information contained in the proxy statement.

SHAREHOLDERS OF ARCADIUM LITHIUM ARE ADVISED TO READ THE PROXY

STATEMENT AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY

BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION.

The proxy statement and other relevant documents may be

obtained, free of charge, on the SEC's website

(http://www.sec.gov), when available. Arcadium Lithium’s

shareholders may obtain free copies of the proxy statement once it

is available from Arcadium Lithium by going to Arcadium Lithium’s

website at www.arcadiumlithium.com.

This announcement does not constitute a prospectus or prospectus

exemption document.

Goldman Sachs International ("Goldman Sachs"), which is

authorised by the Prudential Regulation Authority and regulated by

the Financial Conduct Authority and the Prudential Regulation

Authority in the United Kingdom, is acting exclusively for Rio

Tinto and no one else in connection with the Transaction and will

not be responsible to anyone other than Rio Tinto for providing the

protections afforded to clients of Goldman Sachs, or for providing

advice in relation to the matters referred to herein. Neither

Goldman Sachs nor any of Goldman Sachs' subsidiaries, affiliates or

branches owes or accepts any duty, liability or responsibility

whatsoever (whether direct, indirect, consequential, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Goldman Sachs in connection with this announcement,

any statement contained herein or otherwise.

J.P. Morgan Securities plc which is authorised in the United

Kingdom by the Prudential Regulation Authority (the “PRA”) and

regulated by the PRA and the Financial Conduct Authority and J.P.

Morgan Securities LLC, which is a US registered broker dealer and

regulated by the Financial Industry Regulatory Authority (J.P.

Morgan Securities plc and J.P. Morgan Securities LLC together “J.P.

Morgan”) are acting as financial adviser exclusively for Rio Tinto

and no one else in connection with the Transaction and will not

regard any other person as its client in relation to the

Transaction and will not be responsible to anyone other than Rio

Tinto for providing the protections afforded to clients of J.P.

Morgan or its affiliates, nor for providing advice in relation to

the Transaction or any other matter or arrangement referred to

herein.

Participants in the Solicitation

Rio Tinto, Arcadium Lithium and certain of their respective

directors and officers may be deemed participants in the

solicitation of proxies of Arcadium Lithium’s shareholders in

connection with the proposed Transaction. Additional information

regarding the foregoing persons, including their direct and

indirect interests, by security holdings or otherwise, will be set

forth in the proxy statement and other relevant documents to be

filed with the SEC. Arcadium Lithium’s shareholders and other

interested persons may obtain, without charge, more detailed

information regarding the directors and officers of Arcadium

Lithium in Arcadium Lithium’s Annual Report on Form 10-K/A for the

fiscal year ended December 31, 2023, which was filed with the SEC

on April 29, 2024, and regarding the directors and officers of Rio

Tinto in Rio Tinto’s Annual Report on Form 20-F, for the fiscal

year ended December 31, 2023, which was filed with the SEC on

February 23, 2024.

General

The release, publication or distribution of this announcement in

or into certain jurisdictions may be restricted by the laws of

those jurisdictions. Accordingly, copies of this announcement and

all other documents relating to the Transaction are not being, and

must not be, released, published, mailed or otherwise forwarded,

distributed or sent in, into or from any such jurisdictions.

Persons receiving such documents (including, without limitation,

nominees, trustees and custodians) should observe these

restrictions. Failure to do so may constitute a violation of the

securities laws of any such jurisdiction. To the fullest extent

permitted by applicable law, the companies and persons involved in

the Transaction disclaim any responsibility or liability for the

violations of any such restrictions by any person.

Forward Looking Statements

This announcement (including information incorporated by

reference in this announcement), oral statements made regarding the

Transaction, and other information published by Arcadium Lithium,

Rio Tinto or any member of the Rio Tinto Group contain statements

which are, or may be deemed to be, “forward looking statements”

within the meaning of Section 27A of the Securities Act and Section

21E of the US Securities Exchange Act of 1934. Such forward looking

statements are prospective in nature and are not based on

historical facts, but rather on current expectations and on

numerous assumptions regarding the business strategies and the

environment in which Rio Tinto, any member of the Rio Tinto Group

or the enlarged group following the Transaction (“Enlarged

Group”) shall operate in the future and are subject to risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by those statements. The

forward looking statements contained in this announcement relate to

Rio Tinto, any member of the Rio Tinto Group or the Enlarged

Group’s future prospects, developments and business strategies, the

expected timing and scope of the Transaction and other statements

other than historical facts. In some cases, these forward looking

statements can be identified by the use of forward looking

terminology, including the terms “believes”, “estimates”, “will

look to”, “shall look to”, “would look to”, “plans”, “prepares”,

“anticipates”, “expects”, “is expected to”, “is subject to”,

“budget”, “scheduled”, “forecasts”, “synergy”, “strategy”, “goal”,

“cost-saving”, “projects” “intends”, “may”, “will”, “shall”, or

“should” or their negatives or other variations or comparable

terminology. Forward-looking statements may include statements

relating to the following: (i) future capital expenditures,

expenses, revenues, earnings, synergies, economic performance,

indebtedness, financial condition, dividend policy, losses and

future prospects; (ii) business and management strategies and the

expansion and growth of Rio Tinto’s, any member of the Rio Tinto

Group or Arcadium Lithium’s operations and potential synergies

resulting from the Transaction; and (iii) the effects of global

economic conditions and governmental regulation on Rio Tinto’s, any

member of the Rio Tinto Group or Arcadium Lithium’s business. By

their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that shall occur in the future. These events and

circumstances include changes in the global, political, economic,

business, competitive, market and regulatory forces, future

exchange and interest rates, changes in tax rates and future

business combinations or disposals and other risks and

uncertainties detailed in Rio Tinto’s filings with the SEC,

including Rio Tinto’s Annual Report on Form 20-F, for the fiscal

year ended December 31, 2023, which was filed with the SEC on

February 23, 2024. If any one or more of these risks or

uncertainties materialises or if any one or more of the assumptions

prove incorrect, actual results may differ materially from those

expected, estimated or projected. Such forward looking statements

should therefore be construed in the light of such factors. Neither

Arcadium Lithium or any of Rio Tinto or any member of the Rio Tinto

Group, nor any of their respective associates or directors,

officers or advisers, provides any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward looking statements in this announcement shall actually

occur. Given these risks and uncertainties, potential investors

should not place any reliance on forward looking statements.

Specifically, statements of estimated cost savings and synergies

relate to future actions and circumstances which, by their nature

involve, risks, uncertainties and contingencies. As a result, the

cost savings and synergies referred to may not be achieved, may be

achieved later or sooner than estimated, or those achieved could be

materially different from those estimated. Due to the scale of the

Enlarged Group, there may be additional changes to the Enlarged

Group’s operations. As a result, and given the fact that the

changes relate to the future, the resulting cost synergies may be

materially greater or less than those estimated.

The forward-looking statements speak only at the date of this

announcement. All subsequent oral or written forward-looking

statements attributable to any member of the Rio Tinto Group or

Arcadium Lithium Group, or any of their respective associates,

directors, officers, employees or advisers, are expressly qualified

in their entirety by the cautionary statement above.

Arcadium Lithium, the Rio Tinto Group and Rio Tinto expressly

disclaim any obligation to update such statements other than as

required by law or by the rules of any competent regulatory

authority, whether as a result of new information, future events or

otherwise.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings or

earnings per share for Rio Tinto or Arcadium Lithium, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings or

earnings per share for Rio Tinto or Arcadium Lithium, as

appropriate.

LEI: 213800YOEO5OQ72G2R82

This announcement contains inside information.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

1 Includes conversion of all outstanding convertible senior

notes due 2025.

2 Excludes the Mt Cattlin spodumene operation.

3 Source: Arcadium Lithium company disclosures.

4 Benchmark Mineral Intelligence (BMI) benchmark supply and

demand forecast as of September 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008650501/en/

Please direct all enquiries

to media.enquiries@riotinto.com

Media Relations, United Kingdom Matthew Klar

M +44 7796 630 637 David Outhwaite M +44 7787

597 493

Media Relations, Australia Matt Chambers M +61

433 525 739 Michelle Lee M +61 458 609 322 Rachel

Pupazzoni M +61 438 875 469

Media Relations, Canada Vanessa Damha M +1 514

715 Malika Cherry M +1 418 592 7293

Media Relations, US Jesse Riseborough M +1 202

394 9480

Investor Relations, United Kingdom David Ovington

M +44 7920 010 978 Laura Brooks M +44 7826 942

797 Wei Wei Hu M +44 7825 907 230

Investor Relations, Australia Tom Gallop M +61

439 353 948 Amar Jambaa M +61 472 865 948

Arcadium Lithium contacts

Investors Daniel Rosen M +1 215 299 6208

daniel.rosen@arcadiumlithium.com Phoebe Lee M +61 413 557

780 phoebe.lee@arcadiumlithium.com

Media Karen Vizental M+54 9 114 414 4702

karen.vizental@arcadiumlithium.com

Teneo Katherine Kim M +61 439 288 212

katherine.kim@teneo.com Mark Stokes M +1 646 522 6268

mark.stokes@teneo.com

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in

Australia ABN 96 004 458 404

riotinto.com

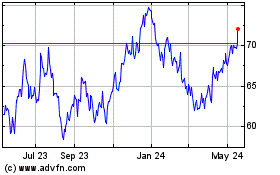

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

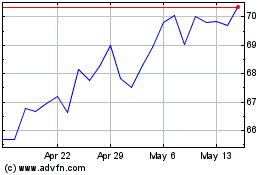

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Nov 2023 to Nov 2024