UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number: 001-35617

Sandstorm Gold Ltd.

(Translation of registrant’s name into English)

Suite 3200 - 733 Seymour Street

Vancouver, British Columbia

V6B 0SB Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

| |

SANDSTORM GOLD LTD. |

| |

|

| |

|

|

| Date: November 27,

2024 |

By: |

/s/ Erfan Kazemi |

| |

|

Name: Erfan Kazemi |

| |

|

Title: Chief Financial Officer |

EXHIBIT 99.1

November 27, 2024

Sandstorm Gold Royalties

Provides Updates on Producing and Key Development Assets

Vancouver, BC | Sandstorm Gold Ltd. (“Sandstorm

Gold Royalties”, “Sandstorm” or the “Company”) (NYSE: SAND, TSX: SSL) is pleased to provide various developments

within its diversified stream and royalty portfolio (dollar figures in USD unless otherwise indicated).

Robertson Receives Approval of

Key Environmental Permit

On November 15th, the U.S. Bureau

of Land Management filed a positive Record of Decision for the Robertson mine, following publication of the project’s Final Environmental

Impact Statement (“EIS”) and public review period. The Record of Decision is the last major Federal permit under the National

Environmental Protection Act of 1969 (“NEPA”). Robertson is owned by Nevada Gold Mines (“NGM”), a joint venture

between Barrick Gold Corp. and Newmont Corporation, and is located at the north end of Nevada’s Cortez District. The project is

less than 10 kilometres east of the Pipeline and Cortez Mine Complex, a well-known mining district that hosts NGM gold production from

the operating Pipeline, Cortez, and Goldrush mines. Robertson is planned as an open-pit, heap leach operation that will utilize certain

infrastructure and facilities at the Pipeline and Cortez Mine Complex. NGM most recently estimated first production at Robertson in 2027,

subject to permitting, and feasibility work remains ongoing. For more information about the Robertson mine visit www.barrick.com.

For information regarding the Record of Decision, visit the U.S. Bureau of Land Management’s website at www.blm.gov and refer to

the press release dated November 20, 2024.

Sandstorm has a 1.0%–2.25% sliding scale

net smelter returns (“NSR”) royalty on the Robertson project. At current gold prices, Sandstorm expects the upper-end of the

sliding scale would apply to its royalty.

Hod Maden Site Preparation Continues

SSR Mining Inc. (“SSR Mining”) reports

that engineering studies and site preparation activities continue at its Hod Maden project in Türkiye, as the company continues to

advance the project through to a construction decision. In the third quarter of 2024, approximately $10.9 million was spent at Hod Maden.

SSR Mining will provide guidance on the expected 2025 capital spend at Hod Maden with its annual 2025 guidance. For more information,

visit www.ssrmining.com and refer to the press release dated November 6, 2024.

Sandstorm holds a 2.0% NSR royalty and a 20%

gold stream on the Hod Maden project. Under the terms of the Hod Maden gold stream, Sandstorm has agreed to purchase 20% of all gold produced

from Hod Maden (on a 100% basis) for ongoing per ounce cash payments equal to 50% of the spot price of gold until 405,000 ounces of gold

are delivered. Sandstorm will then receive 12% of the gold produced for the life of the mine for ongoing per ounce cash payments equal

to 60% of the spot price of gold.

Underground Development Commences

at Hugo North Extension; Additional High-Grade Intercepts Released

Entrée Resources Ltd. (“Entrée”)

announced the commencement of underground development work at Oyu Tolgoi Lift 1 Panel 1 on the Entrée/Oyu Tolgoi joint venture

property in November. This initial phase involves up to 212 metres of lateral development in the southwest corner of the Hugo North Extension

(“HNE”), as outlined in the 2024 Oyu Tolgoi Mine Plan, intended to support the development of mine infrastructure. Entrée

continues to advance discussions with Rio Tinto and Oyu Tolgoi LLC (“OTLLC”) to finalize either (i) the execution and delivery

of the existing JV agreement between the parties or, (ii) conversion to an alternative agreement of equivalent economic value to govern

their relationship during the development and mining stages of the Entrée/Oyu Tolgoi joint venture property. Entrée, Rio

Tinto and OTLLC have identified a potential pathway forward, with corresponding definitive agreements subject to the approval of the entire

OTLLC board.

Entrée also released additional results

from the 2023 drilling program at HNE, which includes both infill and extension holes from surface and underground. In addition to confirming

long, high-grade intervals within the existing Hugo North Lift 2 block cave footprint, drill hole EGD 174 was terminated in mineralization

at a depth of 1,800 metres, highlighting that the deposit remains open at depth with continuity for deeper potential lifts at Oyu Tolgoi.

At depths, the Hugo North deposit dips to the northwest with an increasing proportion located on the Entrée/Oyu Tolgoi joint venture

ground. Underground geotechnical holes UGD 807A, UGD 807B, and UGD 808 confirmed continuity of mineralization outside the potential Hugo

North Lift 2 footprint.

Highlights from the surface drill results include:

| · | EGD 174: 448 metres grading 1.31% copper, including: |

| — | 172 metres grading 1.58% copper. |

| · | EGD 1771: 143 metres grading 1.09% copper, including: |

| — | 51 metres grading 1.75% copper. |

Highlights from the underground drill results

include:

| · | UGD 805B: 177.3 metres grading 1.79% copper. |

| · | UGD 808: 613.6 metres grading 0.69% copper, including: |

| — | 214 metres grading 1.04% copper. |

| · | UGD 813: 56 metres grading 1.45% copper. |

| · | UGD 814: 138 metres grading 1.92% copper. |

During 2024, drilling has continued at HNE with

all holes targeting the potential Lift 2 mineralized footprint. As of October 31, 2024, OTLLC had advised Entrée that approximately

5,287 metres of underground drilling in 23 diamond drill holes and 2,476 metres of surface drilling in four diamond drill holes had been

completed. Entrée will report on the drill results once they have been received and reviewed.

For more information, including full details

of the drill results, visit www.entreeresourcesltd.com and refer to the press releases dated October 29 and November 4, 2024. Sandstorm

has a copper and precious metal stream with Entrée on the HNE whereby the Company has the right to purchase 0.42% of the copper,

5.62% of gold, and 4.26% of silver produced for ongoing cash payments of $0.50 per pound of copper, $220 per ounce of gold, and $5 per

ounce of silver.

Equinox Gold to Restart Mining

at Aurizona Piaba Pit; Expansion Plans Ongoing

Equinox Gold Corp. (“Equinox Gold”)

expects to resume mining at its Aurizona Piaba pit in the fourth quarter of 2024, following remediation from a geotechnical event caused

by persistent heavy rains earlier in the year. Mining has been paused at Piaba since March 2024, while ore feed at Aurizona has relied

on existing stockpiles and mining from the Tatajuba open pit. A revised mine plan incorporating the Tatajuba, Boa Esperança, and

Piaba pits has been prepared, and Equinox Gold has concluded that the geotechnical event does not have a significant negative impact on

the long-term economic performance of Aurizona.

Despite weather challenges, exploration activities

in 2024 have included over 6,500 metres of regional drilling at Aurizona, focused on high potential targets. In the first nine months

of 2024, nearly 3,500 metres of drilling has focused on resource delineation of the western extension of the Tatajuba deposit.

Expansion plans at Aurizona aim to extend the

mine life beyond 10 years and increase annual gold production through the development of an underground mine that would operate concurrently

with the open pits. Engineering studies for the underground mine beneath the Piaba pit are ongoing, with efforts focused on refining ventilation

systems, access layouts, and ore extraction plans. Construction of a portal and underground decline is expected to begin in 2025, enabling

underground drilling and bulk sampling and ultimately supporting production operations.

For more information, visit www.equinoxgold.com

and refer to the company’s 2024 third quarter Management Discussion & Analysis. Sandstorm has a sliding scale NSR royalty on

the Aurizona mine, including the Piaba, Tatajuba, and Boa Esperança pits. When gold prices are above $2,000 per ounce, Sandstorm’s

royalty is a 5% NSR.

Chapada Optimization Plan Improves

Project Cash Flows

Following optimization efforts at Lundin Mining

Corporation’s (“Lundin Mining”) Chapada mine in Brazil, mining costs have decreased by 46% compared to 2022. In addition

to improved haulage cycle times, fleet availability, and blasting fragmentation, the stockpile feed levels were also optimized. A redesigned

mining plan was implemented with a lower annual stripping requirement, reducing annual mining rates by 30 million tonnes.

These changes are expected to streamline operations

while maintaining output, further improving free cash flow generated from the mine. Lundin Mining is concluding a scoping study on the

Sauva deposit, and an updated technical report for the Chapada mine is expected to be filed in 2025.

For more information, visit www.lundinmining.com

and refer to Lundin Mining’s conference call held on November 7, 2024, discussing the company’s 2024 third quarter financial

results. Sandstorm holds a copper stream on the Chapada mine, whereby Sandstorm has agreed to purchased, for ongoing per pound cash payments

equal to 30% of the spot price of copper, 4.2% of the copper produced up to maximum of 3.9 million pounds (“Mlbs”) annually

until 39 Mlbs are delivered, then 3.0% of the copper until 50 Mlbs are delivered; then 1.5% of the copper for the life of mine.

Updated PEA for High-Grade Coringa

Gold Project

Serabi Gold plc (“Serabi”) has published

an updated Preliminary Economic Assessment (“PEA”) for the Coringa gold project in Brazil, highlighting significant improvements

compared to the 2019 study. Annual production is estimated at 28 thousand ounces (“koz”) in 2025 then averaging 36 koz per

year between 2026 and 2031 with an 11-year mine life until 2034. The updated PEA reflects an updated Mineral Resource Inventory at Coringa

that includes Measured & Indicated Resources of 795 thousand tonnes (“kt”) at 7.03 grams per tonne (“g/t”)

gold containing 179 koz gold and Inferred Resources are 1.45 million tonnes (“Mt”) at 5.81 g/t gold containing 271 koz gold.

The mine plan utilizes 81% of the total Measured & Indicated Resource inventory and 89% of Inferred Resources (3.16 g/t cut-off).

The Coringa project has been in production since July 2022 as an underground operation using open stoping

mining methods. Processing of Coringa ore is undertaken at Serabi’s Palito Complex, utilizing existing process plant capacity.

For more information, visit www.serabigold.com

and refer to the press release dated October 21, 2024. Sandstorm holds a 2.5% NSR royalty on the Coringa project.

Notes

| 1. | Drill hole EGD177 is the upper portion of “daughter” drill hole EGD177A, which was previously reported by Entrée

Resources Ltd. on July 18, 2024. |

Qualified Person

Imola Götz (M.Sc., P.Eng, F.E.C.), Sandstorm’s

Vice President, Mining & Engineering is a Qualified Person as defined by Canadian National Instrument 43-101. Ms. Götz has reviewed

and approved the scientific and technical information in this news release.

Contact Information

For more information about Sandstorm Gold Royalties,

please visit our website at www.sandstormgold.com or email us at info@sandstormgold.com.

| Nolan Watson |

Mark Klausen |

| President & CEO |

Corporate Communications |

| 604 689 0234 |

604 628 1164 |

ABOUT

SANDSTORM GOLD ROYALTIES

Sandstorm

is a precious metals-focused royalty company that provides upfront financing to mining companies and receives the right to a percentage

of production from a mine, for the life of the mine. Sandstorm holds a portfolio of over 230 royalties, of which 41 of the underlying

mines are producing. Sandstorm plans to grow and diversify its low-cost production profile through the acquisition of additional gold

royalties. For more information visit: www.sandstormgold.com.

CAUTIONARY

STATEMENTS TO U.S. SECURITYHOLDERS

The

financial information included or incorporated by reference in this press release or the documents referenced herein has been prepared

in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which differs

from US generally accepted accounting principles (“US GAAP”) in certain material respects, and thus are not directly comparable

to financial statements prepared in accordance with US GAAP.

This

press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards

for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United

States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”,

“proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated

mineral resources,” “measured mineral resources” and “mineral resources” used or referenced herein and the

documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian

National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted

by the CIM Council, as amended (the “CIM Definition Standards”).

For

United States reporting purposes, the United States Securities and Exchange Commission (the “SEC”) has adopted amendments

to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers

whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules

more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory

practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that

were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning

on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional

disclosure system, the Corporation is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and

will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource

information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies

subject to the United States federal securities laws and the rules and regulations thereunder.

As

a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions

of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the

corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”, U.S. investors should not assume that all or any

part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves

without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence

and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that

all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will

be economically or legally mineable without further work and analysis. Further, “inferred mineral resources” have a greater

amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to

assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under

Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. While the above terms are “substantially similar” to CIM Definitions, there are differences

in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral

reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”,

“measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under

NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization

Rules or under the prior standards of SEC Industry Guide 7.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING INFORMATION

This

press release contains “forward-looking statements”, within the meaning of the U.S. Securities Act of 1933, the U.S. Securities

Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning

of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Sandstorm

Gold Royalties. Forward-looking statements include the future price of gold, silver, copper, iron ore and other metals, the estimation

of mineral reserves and resources, realization of mineral reserve estimates, and the timing and amount of estimated future production.

Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”,

“plans”, or similar terminology.

Forward-looking

statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances

or achievements of Sandstorm Gold Royalties to be materially different from future results, performances or achievements expressed or

implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies

and the environment in which Sandstorm Gold Royalties will operate in the future, including the receipt of all required approvals, the

price of gold and copper and anticipated costs. Certain important factors that could cause actual results, performances or achievements

to differ materially from those in the forward-looking statements include, amongst others, failure to receive necessary approvals, changes

in business plans and strategies, market conditions, share price, best use of available cash, gold and other commodity price volatility,

discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries, mining operational

and development risks relating to the parties which produce the gold or other commodity the Company will purchase, regulatory restrictions,

activities by governmental authorities (including changes in taxation), currency fluctuations, the global economic climate, dilution,

share price volatility and competition.

Forward-looking

statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level

of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking

statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations

from which the Company will purchase gold, other commodities or receive royalties from, and risks related to those mining operations,

including risks related to international operations, government and environmental regulation, actual results of current exploration activities,

conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals,

fluctuations in the price of gold and other commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility,

as well as those factors discussed in the section entitled “Risks to Sandstorm” in the Company’s annual report for the

financial year ended December 31, 2023 and the section entitled “Risk Factors” contained in the Company’s annual information

form dated March 27, 2024 available at www.sedarplus.com. Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results

not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance

on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained or incorporated

by reference, except in accordance with applicable securities laws.

|  |

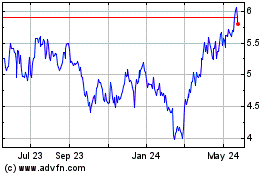

Sandstorm Gold (NYSE:SAND)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sandstorm Gold (NYSE:SAND)

Historical Stock Chart

From Jan 2024 to Jan 2025