0001831840FALSE00018318402024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 5, 2024

Semrush Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or Other Jurisdiction

of Incorporation)

| | | | | | | | |

| 001-40276 | | 84-4053265 |

(Commission File Number) | | (I.R.S. Employer Identification No.) |

800 Boylston Street, Suite 2475 Boston, Massachusetts | | 02199 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(800) 851-9959

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

| | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Class A Common Stock, par value $0.00001 per share | | SEMR | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 5, 2024, Semrush Holdings, Inc. announced its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| Press Release issued by the registrant on August 5, 2024, furnished herewith. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| SEMRUSH HOLDINGS, INC. | |

| | | |

| Date: August 5, 2024 | By: | /s/ David Mason | |

| | Name: David Mason | |

| | Title: General Counsel and Secretary | |

Exhibit 99.1

Semrush Announces Second Quarter 2024 Financial Results

•Second quarter revenue of $91.0 million, up 22% year-over-year

•ARR of $377.7 million, up 25% year-over-year

•Second quarter net cash provided by operating activities of $12.1 million

•Raises full year 2024 revenue guidance

•Company announces Analyst Day on October 1st, 2024

August 5, 2024 — BOSTON — (BUSINESS WIRE) — Semrush Holdings, Inc. (NYSE: SEMR), a leading online visibility management SaaS platform, today reported financial results for the second quarter ended June 30, 2024.

“We delivered a strong second quarter, exceeding our guidance and positioning us to raise our full year 2024 revenue guidance. Revenue increased 22% year-over-year and ARR grew 25% year-over-year as we focused on continuing to grow our core business, upselling and cross selling our offerings, and expanding our platform. We are also confident in our ability to continue growing and scaling our business as demonstrated by increasing average ARR per customer year-over-year. Notably, our Enterprise SEO product is gaining traction in the market with new deals such as Digital Ocean, HSBC, and the Royal Bank of Canada. We look forward to hosting our first Analyst Day on October 1st to provide more details on our growth initiatives and long-term strategy,” said Oleg Shchegolev, CEO and Co-Founder of Semrush.

Second Quarter 2024 Financial Highlights

•Second quarter revenue of $91.0 million, up 22% year-over-year.

•Income from operations of $3.4 million for the second quarter, compared to a loss from operations of $2.3 million in the prior year period.

•Operating margin of 3.7% for the second quarter, compared to operating margin of (3.1)% in the prior year period.

•Non-GAAP income from operations of $12.2 million for the second quarter, compared to a non-GAAP income from operations of $2.3 million in the prior year period.

•Non-GAAP operating margin of 13.4% for the second quarter, compared to non-GAAP operating margin of 3.1% in the prior year period.

•Q2 free cash flow of $7.6 million and free cash flow margin of 8.4%.

•ARR of $377.7 million as of June 30, 2024, up 25% year-over-year.

•Over 116,000 paying customers as of June 30, 2024, up 11.5% from a year ago.

•Dollar-based net revenue retention of 107% as of June 30, 2024, consistent with the previous quarter.

See “Non-GAAP Financial Measures & Definitions of Key Metrics” below for how Semrush defines ARR, dollar-based net revenue retention, non-GAAP income (loss) from operations, non-GAAP operating margin, free cash flow, and free cash flow margin, and the financial tables that accompany this release

for reconciliations of each non-GAAP financial measure to its closest comparable GAAP financial measure.

Second Quarter 2024 Business Highlights

We are committed to empowering our customers with the best-in-class platform needed to boost their online presence and gain an edge in the market. In the second quarter, we advanced and expanded many of our offerings:

•Semrush Enterprise SEO Platform is receiving strong demand; new deals were signed with large multinational corporations including Digital Ocean, HSBC, and the Royal Bank of Canada.

•Launched AI Keyword Inspector for App Store Optimization. The product recommends high performing keywords for developers and marketers to use when listing and advertising their apps for increased visibility and downloads.

•Upgraded ContentShake AI with an AI Images feature. The feature allows users to generate visually compelling content to complement blog and social media posts using simple text prompts.

•Added daily and weekly metrics to .Trends, allowing businesses to uncover traffic insights on their competitors in real time.

•Acquired a majority stake in Brand24.

•Semrush customers who pay more than $10,000 annually grew by 37% year-over-year.

•Ended the quarter with approximately 1.1 million registered free active customers.

Business Outlook

“Growth was driven primarily by an expansion of our average revenue per customer as we continue to execute on our cross-sell and up-sell strategy,” said Brian Mulroy, CFO of Semrush. “We posted another quarter of strong profitability, with non-GAAP income from operations of $12.2 million and non-GAAP operating margin of 13.4%. We are executing well through the first half, gaining traction and strong returns on our strategic investments and remain confident in our ability to deliver long-term efficient growth.”

Based on information as of today, August 5, 2024, we are issuing the following financial guidance:

Third Quarter 2024 Financial Outlook

•For the third quarter, we expect revenue in a range of $96.0 to $97.0 million, which at the mid-point would represent growth of approximately 23% year-over-year.

•We expect third quarter non-GAAP operating margin to be approximately 11.0%.

Full-Year 2024 Financial Outlook

•For the full year, we expect revenue in a range of $373.0 to $375.0 million, which represents growth of 21% to 22% year-over-year.

•We expect a full year non-GAAP operating margin of 10.5% to 11.5%.

•We expect the full year free cash flow margin to be approximately 8.0%.

As previously disclosed, we are no longer providing guidance for non-GAAP net income, and instead are guiding both non-GAAP operating margin and free cash flow margin. Also as previously disclosed,

we have also updated our definitions of non-GAAP income (loss) from operations to exclude Amortization of Acquired Intangible Assets, Acquisition Related Costs, Restructuring Costs and other one-time expenses outside the ordinary course of business in addition to the prior exclusion of Stock Based Compensation. Our guidance for the third quarter 2024 and full year 2024, as well as actual results presented herein, reflect this change.

Reconciliations of non-GAAP operating margin and free cash flow margin guidance to the most directly comparable GAAP measures are not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures, in particular the measures and effects of share-based compensation expense, employer taxes and tax deductions specific to equity compensation awards that are directly impacted by future hiring, turnover and retention needs. We expect the variability of the above charges to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

Conference Call Details

Semrush will host a conference call and webcast to discuss its financial results, business highlights, outlook and other matters, the details for which are provided below.

Date: Tuesday, August 6, 2024

Time: 8:30 a.m. ET

Hosts: Oleg Shchegolev, CEO, Eugene Levin, President, and Brian Mulroy, CFO

Conference ID: 618536

Participant Toll Free Dial-In Number: +1 833 470 1428

Participant International Dial-In Number: +1 929 526 1599

Registration:

The live webcast of the conference call as well as the replay can be accessed for a limited time from the Semrush investor relations website at http://investors.semrush.com/.

About Semrush

Semrush is a leading online visibility management SaaS platform that enables businesses globally to run search engine optimization, pay-per-click, content, social media and competitive research campaigns and get measurable results from online marketing. Semrush offers insights and solutions for companies to build, manage, and measure campaigns across various marketing channels. Semrush is headquartered in Boston and has offices in Trevose, Austin, Dallas, Florida, Amsterdam, Barcelona, Belgrade, Berlin, Limassol, Prague, Warsaw, and Yerevan.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws, which are statements that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements include, but are not limited to, guidance on financial results for the third quarter and full year of 2024 (including revenue, non-GAAP operating margin, and free cash

flow margin); statements regarding the expectations of demand for our products, our upcoming Analyst Day, adoption of and demand for new products and features and results of recent acquisitions; statements about expansion of our platform, and launching new products; statements about future operating results, including revenue, growth opportunities, variability of expenses, future spending and incremental investments, business trends, our ability to deliver profits, and growth and value for shareholders.

The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our filings with the SEC, including our most recent annual report on form 10-K, and our subsequently filed quarterly reports and other SEC filings. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. The forward-looking statements in this release are based on information available to us as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Additional information regarding these and other factors that could affect our results is included in our SEC filings, which may be obtained by visiting our Investor Relations page on its website at investors.semrush.com or the SEC's website at www.sec.gov.

Non-GAAP Financial Measures & Definitions of Key Metrics

We believe that providing non-GAAP information to investors, in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial performance, but also to evaluate the efficacy of the methodology and information used by management to evaluate and measure such performance. We also believe that the use of non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures to investors. We also believe free cash flow margin is useful to investors as we monitor it as a measure of our overall business performance, which enables us to analyze our future performance without the effects of non-cash items and allows us to better understand the cash needs of our business. The non-GAAP information included in this press release should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Investors are encouraged to review the reconciliation of non-GAAP measures to their most directly comparable GAAP financial measures provided in the financial statement tables included below in this press release.

Annual Recurring Revenue (ARR) is defined as of a given date as the monthly recurring revenue that we expect to contractually receive from all paid subscription agreements that are actively generating revenue as of that date multiplied by 12. We include both monthly recurring paid subscriptions, which renew automatically unless canceled, as well as the annual recurring paid subscriptions so long as we do not have any indication that a customer has canceled or intends to cancel its subscription and we continue to generate revenue from them.

Dollar-based net revenue retention is defined as (a) the revenue from our customers during the twelve-month period ending one year prior to such period as the denominator and (b) the revenue

from those same customers during the twelve months ending as of the end of such period as the numerator. This calculation excludes revenue from new customers and any non-recurring revenue.

Free cash flow and free cash flow margin. We define free cash flow, a non-GAAP financial measure, as net cash provided by (used in) operating activities less purchases of property and equipment and capitalized software development costs. We define free cash flow margin as free cash flow divided by GAAP revenue.

Non-GAAP income (loss) from operations, and non-GAAP operating margin. As described above, we have updated our definitions for non-GAAP income (loss) from operations and have introduced non-GAAP operating margin; the updated definitions, which apply to our guidance for the third quarter and full year 2024, are as follows. We define non-GAAP income (loss) from operations as GAAP income (loss) from operations, excluding Stock Based Compensation, Amortization of Acquired Intangible Assets, Acquisition Related Costs, Restructuring Costs and other one-time expenses outside the ordinary course of business (for example, our Exit Costs incurred primarily in 2022). We define non-GAAP operating margin as non-GAAP income (loss) from operations divided by GAAP revenue. We believe investors may want to consider our results with and without the effects of these items in order to compare our financial performance with that of other companies that exclude such items and to compare our results to prior periods.

Stock-based compensation. Stock-based compensation is a non-cash expense accounted for in accordance with FASB ASC Topic 718. We believe that the exclusion of stock-based compensation expense allows for financial results that are more indicative of our operational performance and provide for a useful comparison of our operating results to prior periods and to our peer companies because stock-based compensation expense varies from period to period and company to company due to such things as differing valuation methodologies, timing of awards and changes in stock price.

Amortization of acquired intangible assets. Excluding amortization of acquired intangible assets from non-GAAP expense and income measures allows management and investors to evaluate results “as-if” the acquired intangible assets had been developed internally rather than acquired and, therefore, provides a supplemental measure of performance in which our acquired intellectual property is treated in a comparable manner to our internally developed intellectual property. These amounts are inconsistent in amount and frequency and are significantly impacted by the timing and size of acquisitions. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that such intangible assets contribute to revenue generation.

Restructuring and other costs. Restructuring and other costs include restructuring expenses as well as other charges that are unusual in nature, are the result of unplanned events, and arise outside the ordinary course of our business. Restructuring expenses consist of employee severance costs, charges for the closure of excess facilities and other contract termination costs. Other costs include litigation contingency reserves, asset impairment charges, relocation expenses associated with the migration of employees in 2022 that occurred throughout 2022 and early 2023, and gains or losses on the sale or disposition of certain non-strategic assets or product lines.

Acquisition-related costs, net. In recent years, we have completed a number of acquisitions, which result in transition, integration and other acquisition-related expense which would not otherwise have been incurred, are unpredictable and dependent on a significant number of factors that are deal-specific or outside of our control, are not indicative of our operational performance (or that of the acquired businesses or assets) and are likely to fluctuate as our acquisition activity increases or decreases in future periods. By excluding acquisition-related costs and adjustments from our non-GAAP measures, management is better able to evaluate our ability to utilize our existing assets and estimate the long-term value that acquired assets will generate for us.

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 90,951 | | | $ | 74,693 | | | $ | 176,763 | | | $ | 145,563 | |

| Cost of revenue (1) | 14,957 | | | 12,972 | | | 29,602 | | | 25,611 | |

| Gross profit | 75,994 | | | 61,721 | | | 147,161 | | | 119,952 | |

| Operating expenses | | | | | | | |

| Sales and marketing (1) | 35,000 | | | 30,237 | | | 68,921 | | | 65,733 | |

| Research and development (1) | 19,288 | | | 14,116 | | | 36,592 | | | 27,996 | |

| General and administrative (1) | 18,312 | | | 19,388 | | | 36,786 | | | 38,028 | |

| Exit costs | — | | | 309 | | | — | | | 1,292 | |

| Total operating expenses | 72,600 | | | 64,050 | | | 142,299 | | | 133,049 | |

| Income (loss) from operations | 3,394 | | | (2,329) | | | 4,862 | | | (13,097) | |

| Other income, net | 2,616 | | | 2,919 | | | 6,255 | | | 4,624 | |

| Income (loss) before income taxes | 6,010 | | | 590 | | | 11,117 | | | (8,473) | |

| Provision for income taxes | 4,649 | | | 869 | | | 7,753 | | | 1,666 | |

| Net income (loss) | 1,361 | | | (279) | | | 3,364 | | | (10,139) | |

| Net loss attributable to noncontrolling interest in consolidated subsidiaries | (298) | | | — | | | (433) | | | — | |

| Net income (loss) attributable to Semrush Holdings, Inc. | $ | 1,659 | | | $ | (279) | | | $ | 3,797 | | | $ | (10,139) | |

| | | | | | | |

| Net income (loss) attributable to Semrush Holdings, Inc. per share attributable to common stockholders—basic: | $ | 0.01 | | | $ | 0.00 | | | $ | 0.03 | | | $ | (0.07) | |

| Net income (loss) attributable to Semrush Holdings, Inc. per share attributable to common stockholders—diluted: | $ | 0.01 | | | $ | 0.00 | | | $ | 0.03 | | | $ | (0.07) | |

| | | | | | | |

| Weighted-average number of shares of common stock used in computing net income (loss) per share attributable to common stockholders—basic: | 145,678 | | | 142,239 | | | 145,122 | | | 141,946 | |

| Weighted-average number of shares of common stock used in computing net income (loss) per share attributable to common stockholders—diluted: | 148,825 | | | 142,239 | | | 148,261 | | | 141,946 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| ¹ includes stock-based compensation expense as follows: | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 59 | | | $ | 32 | | | $ | 98 | | | $ | 49 | |

| Sales and marketing | 1,209 | | | 840 | | | 1,979 | | | 1,368 | |

| Research and development | 1,371 | | | 542 | | | 2,007 | | | 885 | |

| General and administrative | 4,527 | | | 2,351 | | | 8,197 | | | 4,259 | |

| Total stock-based compensation | $ | 7,166 | | | $ | 3,765 | | | $ | 12,281 | | | $ | 6,561 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Non-GAAP income (loss) from operations | | ($) | | (%) | | ($) | | (%) | | ($) | | (%) | | ($) | | (%) |

| Income (loss) from operations | | $ | 3,394 | | | 4 | % | | $ | (2,329) | | | (3) | % | | $ | 4,862 | | | 3 | % | | $ | (13,097) | | | (9) | % |

| Stock-based compensation expense | | 7,166 | | | 8 | % | | 3,765 | | | 5 | % | | 12,281 | | | 7 | % | | 6,561 | | | 5 | % |

| Non-GAAP income (loss) from operations (prior definition) | | $ | 10,560 | | | 12 | % | | $ | 1,436 | | | 2 | % | | $ | 17,143 | | | 10 | % | | $ | (6,536) | | | (4) | % |

| Amortization of acquired intangibles | | 890 | | | 1 | % | | 548 | | | 1 | % | | 1,582 | | | 1 | % | | 1,070 | | | 1 | % |

| Restructuring and other costs | | — | | | — | % | | 309 | | | — | % | | 2,124 | | | 1 | % | | 1,292 | | | 1 | % |

| Acquisition-related costs, net | | 737 | | | 1 | % | | — | | | — | % | | 1,075 | | | 1 | % | | — | | | — | % |

| Non-GAAP income (loss) from operations (new definition) | | $ | 12,187 | | | 14 | % | | $ | 2,293 | | | 3 | % | | $ | 21,924 | | | 13 | % | | $ | (4,174) | | | (2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of Free cash flow | | ($) | | (%) | | ($) | | (%) | | ($) | | (%) | | ($) | | (%) |

| Net cash provided by (used in) operating activities | | $ | 12,143 | | | 13 | % | | $ | (6,314) | | | (8) | % | | $ | 26,922 | | | 15 | % | | $ | (9,923) | | | (7) | % |

| Purchases of property and equipment | | (2,147) | | | (2) | % | | (689) | | | (1) | % | | (2,906) | | | (2) | % | | (957) | | | (1) | % |

| Capitalization of internal-use software costs | | (2,354) | | | (3) | % | | (1,574) | | | (2) | % | | (4,369) | | | (3) | % | | (2,630) | | | (2) | % |

| Free cash flow | | $ | 7,642 | | | 8 | % | | $ | (8,577) | | | (11) | % | | $ | 19,647 | | | 10 | % | | $ | (13,510) | | | (10) | % |

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 69,626 | | | $ | 58,848 | |

| Short-term investments | 161,906 | | | 179,721 | |

| Accounts receivable | 9,060 | | | 7,897 | |

| Deferred contract costs, current portion | 9,738 | | | 9,074 | |

| Prepaid expenses and other current assets | 30,268 | | | 10,014 | |

| Total current assets | 280,598 | | | 265,554 | |

| Property and equipment, net | 7,395 | | | 6,686 | |

| Operating lease right-of-use assets | 11,812 | | | 14,069 | |

| Intangible assets, net | 26,948 | | | 16,083 | |

| Goodwill | 40,630 | | | 24,879 | |

| Deferred contract costs, net of current portion | 2,997 | | | 3,586 | |

| Other long-term assets | 2,568 | | | 633 | |

| Total assets | $ | 372,948 | | | $ | 331,490 | |

| Liabilities, redeemable noncontrolling interest, and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 11,199 | | | $ | 9,187 | |

| Accrued expenses | 21,788 | | | 19,891 | |

| Deferred revenue | 66,589 | | | 58,310 | |

| Current portion of operating lease liabilities | 4,829 | | | 4,274 | |

| Other current liabilities | 7,601 | | | 2,817 | |

| Total current liabilities | 112,006 | | | 94,479 | |

| Deferred revenue, net of current portion | 237 | | | 331 | |

| Deferred tax liability | 1,932 | | | 839 | |

| Operating lease liabilities, net of current portion | 8,084 | | | 10,331 | |

| Other long-term liabilities | 1,534 | | | 1,195 | |

| Total liabilities | 123,793 | | | 107,175 | |

| Commitments and contingencies | | | |

| Redeemable noncontrolling interest | 8,733 | | | — | |

| Stockholders' equity | | | |

| Class A common stock | 1 | | | 1 | |

| Class B common stock | — | | | — | |

| Additional paid-in capital | 306,103 | | | 291,898 | |

| Accumulated other comprehensive loss | (2,284) | | | (752) | |

| Accumulated deficit | (68,201) | | | (71,998) | |

| Total stockholders' equity attributable to Semrush Holdings, Inc. | 235,619 | | | 219,149 | |

| Noncontrolling interest in consolidated subsidiaries | 4,803 | | | 5,166 | |

| Total stockholders’ equity | 240,422 | | | 224,315 | |

| Total liabilities, redeemable noncontrolling interest and stockholders' equity | $ | 372,948 | | | $ | 331,490 | |

Semrush Holdings, Inc.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Operating Activities | | | |

| Net income (loss) | $ | 3,364 | | | $ | (10,139) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities | | | |

| Depreciation and amortization expense | 4,269 | | | 3,135 | |

| Amortization of deferred contract costs | 6,054 | | | 4,855 | |

| Amortization (accretion) of premiums and discounts on investments | (2,023) | | | (3,201) | |

| Non-cash lease expense | 2,233 | | | 1,886 | |

| Stock-based compensation expense | 12,281 | | | 6,561 | |

| Non-cash interest expense | — | | | 105 | |

| Change in fair value of convertible debt securities | — | | | (380) | |

| Deferred taxes | (217) | | | 81 | |

| Other non-cash items | 1,400 | | | 649 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable | (774) | | | (422) | |

| Deferred contract costs | (6,129) | | | (5,768) | |

| Prepaid expenses and other current assets | (4,017) | | | (5,869) | |

| Accounts payable | 1,906 | | | (5,184) | |

| Accrued expenses | 2,917 | | | (1,390) | |

| Other current liabilities | 360 | | | — | |

| Deferred revenue | 7,353 | | | 6,958 | |

| Other long-term liabilities | 92 | | | — | |

| Change in operating lease liability | (2,147) | | | (1,800) | |

| Net cash provided by (used in) operating activities | 26,922 | | | (9,923) | |

| Investing Activities | | | |

| Purchases of property and equipment | (2,906) | | | (957) | |

| Capitalization of internal-use software costs | (4,369) | | | (2,630) | |

| Purchases of short-term investments | (83,605) | | | (172,687) | |

| Proceeds from sales and maturities of short-term investments | 102,500 | | | 132,741 | |

| Purchases of convertible debt securities | (650) | | | (323) | |

| Funding of investment loan receivable | (7,000) | | | — | |

| Cash paid for acquisition of businesses, net of cash acquired | (10,026) | | | (1,082) | |

| Purchases of other investments | (131) | | | (150) | |

| Net cash used in investing activities | (6,187) | | | (45,088) | |

| Financing Activities | | | |

| Proceeds from exercise of stock options | 3,053 | | | 302 | |

| Proceeds from issuance of shares in connection with employee stock purchase plan | — | | | 264 | |

| Payment of finance leases | (493) | | | (1,209) | |

| Net cash provided by (used in) financing activities | 2,560 | | | (643) | |

| Effect of exchange rate changes on cash and cash equivalents | (614) | | | (39) | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 22,681 | | | (55,693) | |

| Cash, cash equivalents and restricted cash, beginning of period | 58,848 | | | 79,765 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 81,529 | | | $ | 24,072 | |

| | | |

Investor

Brinlea C. Johnson

The Blueshirt Group

Semrush Holdings, Inc.

ir@semrush.com

Media

Jesse Platz

VP of Analyst and Public Relations

Semrush Holdings, Inc.

jesse.platz@semrush.com

v3.24.2.u1

Cover

|

Aug. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity Registrant Name |

Semrush Holdings, Inc.

|

| Entity File Number |

001-40276

|

| Entity Tax Identification Number |

84-4053265

|

| Entity Address, Postal Zip Code |

02199

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Address Line One |

800 Boylston Street

|

| Entity Address, Address Line Two |

Suite 2475

|

| City Area Code |

800

|

| Local Phone Number |

851-9959

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.00001 per share

|

| Trading Symbol |

SEMR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001831840

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

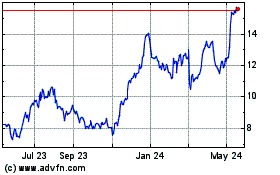

SEMrush (NYSE:SEMR)

Historical Stock Chart

From Oct 2024 to Nov 2024

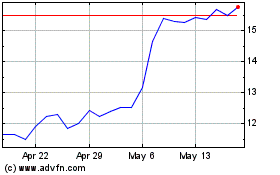

SEMrush (NYSE:SEMR)

Historical Stock Chart

From Nov 2023 to Nov 2024