SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

SONIDA

Senior Living, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

140475104

(CUSIP Number)

Shmuel Lieberman

c/o GF Investments

810 Seventh Avenue

28th Floor

New York, NY 10019

(212) 259-0300

with a copy to:

Robert W. Downes

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

(212) 558-4000

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out

for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 140475104 |

|

13D |

|

Page 2 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

Seymour Pluchenik |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

AF |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

0 |

| |

8. |

|

SHARED VOTING POWER

2,699,593(1) |

| |

9. |

|

SOLE DISPOSITIVE POWER

0 |

| |

10. |

|

SHARED DISPOSITIVE POWER

2,699,593(1) |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,699,593 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.6%(2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

IN |

|

|

| |

1 |

Represents 242,752 shares of common stock, $0.01 par value (“Common Stock”), of Sonida Senior Living, Inc., a Delaware corporation (the “Issuer”) owned by PF Investors, LLC (“PF Investors”) and 2,456,841 shares of Common Stock owned by Silk Partners, LP (“Silk”). |

| |

2 |

This calculation is based on 18,540,746 shares of Common Stock outstanding as of August 19, 2024, which includes 14,240,746 shares of Common Stock outstanding as reported on the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024 (the “Form 10-Q”) filed by the Issuer on August 12, 2024 and the 4,300,000 shares of Common Stock issued by the Issuer on August 19, 2024 pursuant to the prospectus of the issuer dated August 15, 2024. |

| |

|

|

|

|

| CUSIP No. 140475104 |

|

13D |

|

Page 3 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

Sam Levinson |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

OO |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

0 |

| |

8. |

|

SHARED VOTING POWER

2,456,841 (3) |

| |

9. |

|

SOLE DISPOSITIVE POWER

0 |

| |

10. |

|

SHARED DISPOSITIVE POWER

2,456,841 (3) |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,456,841 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3%(2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

IN |

|

|

| |

3 |

Represents 2,456,841 shares of Common Stock, owned by Silk. |

| CUSIP No. 140475104 |

|

13D |

|

Page 4 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

Simon Glick |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

AF |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

0 |

| |

8. |

|

SHARED VOTING POWER

2,456,841(3) |

| |

9. |

|

SOLE DISPOSITIVE POWER

0 |

| |

10. |

|

SHARED DISPOSITIVE POWER

2,456,841(3) |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,456,841 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3%(2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

IN |

|

|

| CUSIP No. 140475104 |

|

13D |

|

Page 5 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

Silk Partners, LP |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

WC |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

2,456,841 (3) |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

2,456,841 (3) |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,456,841 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3%( (2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

PN |

|

|

| CUSIP No. 140475104 |

|

13D |

|

Page 6 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

Siget NY Partners, L.P. |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

AF |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

0 |

| |

8. |

|

SHARED VOTING POWER

2,456,841 (3) |

| |

9. |

|

SOLE DISPOSITIVE POWER

0 |

| |

10. |

|

SHARED DISPOSITIVE POWER

2,456,841 (3) |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,456,841 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3%(2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

PN |

|

|

| CUSIP No. 140475104 |

|

13D |

|

Page 7 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

1271 Associates, LLC |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

AF |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

0 |

| |

8. |

|

SHARED VOTING POWER

2,456,841 (3) |

| |

9. |

|

SOLE DISPOSITIVE POWER

0 |

| |

10. |

|

SHARED DISPOSITIVE POWER

2,456,841 (3) |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,456,841 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3% (2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

OO |

|

|

| CUSIP No. 140475104 |

|

13D |

|

Page 8 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS

PF Investors, LLC |

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☒ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

WC |

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

242,752 (4) |

| |

8. |

|

SHARED VOTING POWER

0 |

| |

9. |

|

SOLE DISPOSITIVE POWER

242,752 (4) |

| |

10. |

|

SHARED DISPOSITIVE POWER

0 |

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

242,752 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ☒

|

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.3% (2) |

|

|

| 14. |

|

TYPE OF REPORTING PERSON (see instructions)

OO |

|

|

| |

4 |

Represents 242,752 shares of Common Stock owned by PF Investors. |

| CUSIP No. 140475104 |

|

13D |

|

Page 9 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

This Amendment No.

11 (this “Amendment”) amends and supplements the statement on Schedule 13D filed by Sam Levinson, Silk Partners, LP, Siget

NY Partners, L.P, 1271 Associates, LLC, Seymour Pluchenik, Siget, LLC, Simon Glick and PF Investors, LLC (the “Reporting Persons”)

on September 10, 2018, as amended by Amendment No. 1 to Schedule 13D filed on October 9, 2018, Amendment No. 2 to Schedule 13D filed on

June 5, 2019, Amendment No. 3 to Schedule 13D filed on July 1, 2019, Amendment No. 4 to Schedule 13D filed on August 17, 2021, Amendment

No. 5 to Schedule 13D filed on September 13, 2021, Amendment No. 6 to Schedule 13D filed on October 4, 2021, Amendment No. 7 to Schedule

13D filed on November 9, 2021, Amendment No. 8 to Schedule 13D filed on December 10, 2021,Amendment No. 9 to Schedule 13D filed on February

5, 2024 and Amendment No. 10 to Schedule 13D filed on March 25, 2024 (the “Schedule 13D”), relating to the beneficial ownership

of Common Stock of the Issuer. Capitalized terms used herein and not otherwise defined shall have the respective meanings ascribed to

them in the Schedule 13D.

Except as specifically provided

herein, this Amendment does not modify any of the information previously reported in the Schedule 13D.

Item 1. Security and Issuer.

No changes.

Item 2. Identity and Background.

No changes.

Item 3. Source or Amount of Funds or Other Consideration.

Item 3 is hereby supplemented as follows:

On August 15, 2024, the Issuer entered into an

underwriting agreement with Morgan Stanley & Co. LLC, RBC Capital Markets, LLC and BMO Capital Markets Corp., as the representatives

of the underwriters named therein, relating to an underwritten public offering of Common Stock at a public offering price of $27.00 per

share. The public offering closed on August 19, 2024, and Silk and PF Investors purchased 222,087 and 27,913 shares of Common Stock, respectively,

in the public offering at a price of $27.00 per share. Silk and PF Investors used a portion of their working capital to fund the purchase.

Item 4. Purpose of Transaction.

Item 4 is hereby supplemented as follows:

The information set forth in Item 6 is incorporated

by reference into this Item 4.

Item 5. Interest in Securities of the Issuer.

Except as specifically set forth below, no changes.

Item 5(a) is hereby amended and restated in its

entirety as follows:

| |

(a) |

Messrs. Levinson and Glick, Silk, Siget, Siget NY and 1271 Associates may

be deemed to beneficially own 2,456,841 shares of Common Stock, or approximately 13.3% of the outstanding shares of Common Stock. Mr.

Pluchenik may be deemed to beneficially own 2,699,593 shares of Common Stock, or approximately 14.6% of the outstanding shares of Common

Stock. PF Investors may be deemed to beneficially own 242,752 shares of Common Stock, or approximately 1.3% of the outstanding shares

of Common Stock. The foregoing percentage calculations are based on 18,540,746 shares of Common Stock outstanding as of August 19, 2024,

which includes 14,240,746 shares of Common Stock outstanding as reported on the Issuer’s Form 10-Q filed by the Issuer on August

12, 2024 and the 4,300,000 shares of Common Stock issued by the Issuer on August 19, 2024 pursuant to the prospectus of the issuer dated

August 15, 2024.

Item 5(c) is supplemented as follows:

Except as set forth in Item 4, no Reporting Person has effected any transactions

in the Common Stock during the past 60 days.

|

| CUSIP No. 140475104 |

|

13D |

|

Page 10 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

Item 6 is hereby supplemented

as follows:

On August 15, 2024, the Issuer

entered into an underwriting agreement with Morgan Stanley & Co. LLC, RBC Capital Markets, LLC and BMO Capital Markets Corp., as the

representatives of the underwriters named therein, relating to an underwritten public offering of Common Stock (the “Public Offering”)

at a public offering price of $27.00 per share. The Public Offering closed on August 19, 2024, and Silk and PF Investors purchased 222,087

and 27,913 shares of Common Stock, respectively, in the Public Offering at a price of $27.00 per share. In connection with the Public

Offering, Silk and PF Investors entered into a lock-up agreement with the underwriters (the “Lock-Up Agreement”) which prohibits the offer,

pledge, sale or other transfer or disposition, directly or indirectly, of any shares of Common Stock or any other securities of the Issuer

that are convertible, exchangeable or exercisable into shares of Common Stock for a period of 90 days after the date of the final prospectus

supplement, subject to certain exceptions contained therein. The foregoing summary of the Lock-Up Agreement is qualified in its entirety

by the full text of the Lock-Up Agreement, a copy of which is included as Exhibit 4, to this Amendment and is incorporated herein by reference.

| CUSIP No. 140475104 |

|

13D |

|

Page 11 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

Item 7. Material to Be Filed as Exhibits.

Item 7 is supplemented as follows:

Lock-Up Agreement, dated as of August 15, 2024.

INDEX TO EXHIBITS

| Exhibit 1 |

Joint Filing Agreement, dated as of September 7, 2018, by and among the Reporting Persons (incorporated by reference to Exhibit 1 to the Schedule 13D filed by the Reporting Persons on September 10, 2018). |

| Exhibit 2 |

Form of Investor Rights Agreement, by and among the Issuer, Silk and the Conversant Investors (incorporated by reference to Exhibit 10.1 to the Issuer's Current Report on Form 8-K filed on November 4, 2021). |

| Exhibit 3 |

Securities Purchase Agreement, dated as of February 1, 2024, by and among the Issuer and the Purchasers listed on Annex A thereto (incorporated by reference to Exhibit 3 to the Schedule 13D filed by the Reporting Persons on February 5, 2024). |

| Exhibit 4 |

Lock-Up Agreement, dated as of August 15, 2024. |

| CUSIP No. 140475104 |

|

13D |

|

Page 12 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 19, 2024

| |

SAM LEVINSON |

| |

|

| |

/s/ Sam Levinson |

| |

|

| |

SIMON GLICK |

| |

|

| |

/s/ Simon Glick |

| |

|

| |

SEYMOUR PLUCHENIK |

| |

|

| |

/s/ Seymour Pluchenik |

| |

|

| |

SILK PARTNERS, LP |

| |

|

| |

By |

Siget NY Partners, LP, a New York limited partnership and general partner of Silk Partners, LP |

| |

|

|

| |

By |

1271 ASSOCIATES, LLC, a Delaware limited liability company, and general partner of Siget NY Partners, LP |

| |

|

|

| |

By |

/s/ Seymour Pluchenik |

| |

|

Name: Seymour Pluchenik

Title: Managing Member |

| |

|

| |

SIGET NY PARTNERS, L.P. |

| |

|

| |

By |

1271 ASSOCIATES, LLC, a Delaware limited liability company and general partner of Siget NY Partners, L.P. |

| |

|

|

| |

By |

/s/ Seymour Pluchenik |

| |

|

Name: Seymour Pluchenik

Title: Managing Member |

| |

|

| |

1271 ASSOCIATES, LLC |

| |

|

| |

By |

/s/ Seymour Pluchenik |

| |

|

Name: Seymour Pluchenik

Title: Managing Member |

| CUSIP No. 140475104 |

|

13D |

|

Page 13 of 13 Pages |

| |

|

|

|

|

| |

|

|

|

|

| |

PF INVESTORS, LLC |

| |

|

| |

By |

/s/ Seymour Pluchenik |

| |

|

Name: Seymour Pluchenik

Title: Manager |

Exhibit 4

LOCK-UP AGREEMENT

August 15, 2024

Morgan Stanley & Co. LLC

RBC Capital Markets, LLC

BMO Capital Markets Corp.

As representatives of the several Underwriters

| c/o |

Morgan Stanley & Co. LLC |

| |

1585 Broadway |

| |

New York, New York 10036 |

| |

|

| c/o |

RBC Capital Markets, LLC |

| |

200 Vesey Street, 8th Floor |

| |

New York, New York 10281 |

| |

|

| c/o |

BMO Capital Markets Corp. |

| |

151 W 42nd Street, 32nd Floor |

| |

New York, New York 10036 |

Ladies and Gentlemen:

The undersigned understands

that Morgan Stanley & Co. LLC, RBC Capital Markets, LLC and BMO Capital Markets Corp. (collectively, the “Representatives”)

propose to enter into an Underwriting Agreement (the “Underwriting Agreement”) with Sonida Senior Living, Inc., a Delaware

corporation (the “Company”), providing for the public offering (the “Public Offering”) by the several

Underwriters, including the Representatives (the “Underwriters”), of 4,300,000 shares (the “Shares”)

of common stock, par value $0.01 per share, of the Company (the “Common Stock”) pursuant to a Registration Statement

on Form S-3 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “SEC”)

on July 19, 2024.

To induce the Underwriters

that may participate in the Public Offering to continue their efforts in connection with the Public Offering, the undersigned hereby agrees

that, without the prior written consent of the Representatives on behalf of the Underwriters, it will not, and will not cause any direct

or indirect controlled affiliate to (which, for the avoidance of doubt, will not include the Company), and will not publicly disclose

an intention to, during the period commencing on the date hereof and ending 90 days after the date of the final prospectus supplement

(the “Restricted Period”) relating to the Public Offering (the “Prospectus”), (1) offer, pledge,

sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant

to purchase, lend, make any short sale or otherwise transfer or dispose of, directly or indirectly, any shares of Common Stock beneficially

owned (as such term is used in Rule 13d-3 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”)), by

the undersigned or any other securities so owned that are convertible into or exercisable or exchangeable (directly or indirectly) for,

or that represent the right to receive, shares of Common Stock (“Other Securities”) or (2) enter into any swap,

hedging transaction or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership

of the Common Stock or Other Securities, whether any such transaction described in clause (1) or (2) above is to be settled by delivery

of Common Stock or Other Securities, in cash or otherwise. The undersigned acknowledges and agrees that the foregoing precludes the undersigned

from engaging in any hedging or other transactions or arrangements (including, without limitation, any short sale or the purchase or sale

of, or entry into, any put or call option, or combination thereof, forward, swap or any other derivative transaction or instrument, however

described or defined) designed or intended, or which would reasonably be expected to lead to or result in, a sale or disposition or transfer

(whether by the undersigned or any other person) of any economic consequences of ownership, in whole or in part, directly or indirectly,

of any Common Stock or Other Securities, whether any such transaction or arrangement (or instrument provided for thereunder) would be

settled by delivery of Common Stock, Other Securities, in cash or otherwise.

Notwithstanding the foregoing,

the provisions of the immediately preceding paragraph shall not apply to or prohibit any of the following transactions:

| (a) | transactions relating to shares of Common Stock or Other Securities acquired in open market transactions

after the completion of the Public Offering; provided that if any filing under Section 16(a) of the Exchange Act shall be required

or shall be voluntarily made in connection with subsequent sales of Common Stock or Other Securities acquired in such open market transactions,

such filing shall clearly indicate that such filing relates to the Shares of Common Stock or Other Securities acquired in open market

transactions after the completion of the Public Offering; |

| (b) | transfers of shares of Common Stock or Other Securities as a bona fide gift or charitable contribution; |

| (c) | transfers of shares of Common Stock or Other Securities by will or intestacy; |

| (d) | transfers of shares of Common Stock or Other Securities to any trust or other bona fide estate planning

vehicle for the direct or indirect benefit of the undersigned or the immediate family of the undersigned, or if the undersigned is a trust

or other bona fide estate planning vehicle, to a trustor or beneficiary of the trust or other bona fide estate planning vehicle to the

estate of a beneficiary of such trust or other bona fide estate planning vehicle (for purposes of this agreement, “immediate family”

shall mean any relationship by blood, current or former marriage, domestic partnership or adoption, not more remote than first cousin); |

| (e) | transfers of shares of Common Stock or Other Securities to a partnership, limited liability company or

other entity of which the undersigned and the immediate family of the undersigned are the legal and beneficial owner of all of the outstanding

equity securities or similar interests; |

| (f) | transfers of shares of Common Stock or Other Securities to a nominee or custodian of a person or entity

to whom a disposition or transfer would be permissible under clauses (b) through (e) above; |

| (g) | distributions of shares of Common Stock or Other Securities to limited partners, members, owners or stockholders

of the undersigned; |

| (h) | transfers of shares of Common Stock or Other Securities by operation of law, such as pursuant to a qualified

domestic order, divorce settlement, divorce decree or separation agreement; |

| (i) | transfers of shares of Common Stock or Other Securities to the Company from an employee or director of

the Company upon death, disability or termination of employment, in each case, of such employee or director; |

| (j) | transfers or dispositions of shares of Common Stock or Other Securities to the Company in connection with

vesting, settlement, or exercise of restricted stock awards, restricted stock units, options, warrants or other rights to purchase shares

of Common Stock (including, in each case, by way of “net” or “cashless” exercise), including for the payment of

exercise price and tax and remittance payments due as a result of the vesting, settlement, or exercise of such restricted stock awards,

restricted stock units, options, warrants or rights, provided that any such shares of Common Stock received upon such exercise, vesting

or settlement shall be subject to the terms of this agreement, and provided further that any such restricted stock awards, restricted

stock units, options, warrants or rights are held by the undersigned pursuant to an agreement or equity awards granted under a stock incentive

plan or other equity award plan, each such agreement or plan which is described in the Registration Statement and the Prospectus; |

| (k) | transfers of shares of Common Stock or Other Securities pursuant to a bona fide third-party tender offer,

merger, consolidation or other similar transaction that is approved by the Board of Directors of the Company and made to all holders of

the Company’s capital stock involving a Change of Control (as defined below) of the Company (for purposes hereof, “Change

of Control” shall mean the transfer (whether by tender offer, merger, consolidation or other similar transaction), in one transaction

or a series of related transactions, to a person or group of affiliated persons, of shares of capital stock if, after such transfer, such

person or group of affiliated persons would hold at least a majority of the outstanding voting securities of the Company (or the surviving

entity)); provided that in the event that such tender offer, merger, consolidation or other similar transaction is not completed,

the undersigned’s shares of Common Stock or Other Securities shall remain subject to the provisions of this agreement; |

| (l) | establishing a trading plan on behalf of a shareholder, officer or director of the Company pursuant to

Rule 10b5-1 under the Exchange Act for the transfer of shares of Common Stock, provided that (i) such plan does not provide for

the transfer of Common Stock during the Restricted Period and (ii) to the extent a public announcement or filing under the Exchange Act,

if any, is required of or voluntarily made by or on behalf of the undersigned or the Company regarding the establishment of such plan,

such announcement or filing |

shall include a statement to the effect

that no transfer of Common Stock may be made under such plan during the Restricted Period; or

| (m) | transfers of shares of Common Stock or Other Securities to the undersigned’s affiliates or to any

investment fund or other entity controlled by or controlling the undersigned; |

provided that (A) in the case of any

transfer pursuant to clause (b), such transfer shall not involve a disposition for value and each donee shall sign and deliver a lock

up agreement substantially in the form of this agreement, (B) in the case of any transfer or distribution pursuant to clause (c), (d),

(e), (f), (g), (h) and (m), each devisee, transferee or distributee shall sign and deliver a lock up agreement substantially in the form

of this agreement, (C) in the case of any transfer or distribution pursuant to clause (c), (d), (e) and (f), (g) and (m), no filing under

Section 16(a) of the Exchange Act by the undersigned reporting a reduction in beneficial ownership of shares of Common Stock shall be

required or shall be voluntarily made during the Restricted Period, and (D) in the case of any transfer or dispositions pursuant to clause

(b), (h), (i) and (j), it shall be a condition to such transfer that no public filing, report or announcement shall be voluntarily made

and if any filing under Section 16(a) of the Exchange Act, or other public filing, report or announcement by the undersigned reporting

a reduction in beneficial ownership of shares of Common Stock in connection with such transfer or disposition shall be legally required

during the Restricted Period, then such filing, report or announcement shall clearly indicate in the footnotes thereto the nature and

conditions of such transfer or disposition.

In addition, the undersigned

agrees that, without the prior written consent of the Representatives on behalf of the Underwriters, it will not, during the Restricted

Period, make any demand for or exercise any right with respect to, the registration of any shares of Common Stock or Other Securities;

provided, that the forgoing shall not restrict the Company from preparing and filing with the SEC a registration statement of the

Company providing for the registration and resale of all of the shares of Common Stock issued by the Company to the Purchasers under the

Securities Purchase Agreement, dated February 1, 2024. The undersigned also agrees and consents to the entry of stop transfer instructions

with the Company’s transfer agent and registrar against the transfer of the undersigned’s shares of Common Stock and Other

Securities except in compliance with the foregoing restrictions.

The undersigned understands

that the Company and the Underwriters are relying upon this agreement in proceeding toward consummation of the Public Offering. The undersigned

further understands that this agreement is irrevocable and shall be binding upon the undersigned’s heirs, legal representatives,

successors and assigns.

The undersigned acknowledges

and agrees that none of the Underwriters has made any recommendation or provided any investment or other advice to the undersigned with

respect to this agreement or the subject matter hereof nor have the Underwriters solicited any action from the undersigned with respect

to the Public Offering of the Shares and the undersigned has consulted its own legal, accounting, financial, regulatory, tax and other

advisors with respect to this agreement and the subject matter hereof to the extent the undersigned has deemed appropriate. The undersigned

further acknowledges and agrees that, although the Underwriters may provide certain Regulation Best Interest and Form CRS disclosures

or other related documentation to you in connection with the Public Offering, the Underwriters are not making a recommendation to you

to

participate in the Public Offering or sell

any Shares at the price determined in the Public Offering, and nothing set forth in such disclosures or documentation is intended to suggest

that any Underwriter is making such a recommendation.

This agreement shall automatically

terminate, and the undersigned will be released from all of its obligations hereunder, upon the earliest to occur, if any, of (a) the

date that the Company advises the Representatives, in writing, prior to the execution of the Underwriting Agreement, that it has determined

not to proceed with the Public Offering, (b) the date that the Company withdraws the Registration Statement related to the Public Offering

before the execution of the Underwriting Agreement, (c) if the Underwriting Agreement is executed but terminated prior to payment for

and delivery of the Shares to be sold thereunder, the date that the Underwriting Agreement is terminated (without regard to any provisions

thereof that survive termination), or (d) August 30, 2024 if the Public Offering of the Shares has not been completed by such date. In

addition, in the event that the Representatives consent to the release of the restrictions set forth herein with respect to any shares

of Common Stock or Other Securities held by Conversant Capital, LLC or its affiliates, the Representatives will agree to a proportional

release of the restrictions set forth herein with respect to the shares of Common Stock or Other Securities, as applicable, held by the

undersigned and its affiliates.

Whether or not the Public

Offering actually occurs depends on a number of factors, including market conditions. Any Public Offering will only be made pursuant to

an Underwriting Agreement, the terms of which are subject to negotiation between the Company and the Underwriters.

This agreement may be delivered

via facsimile, electronic mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions

Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

This agreement shall be

governed by and construed in accordance with the laws of the State of New York.

Very truly yours,

SILK PARTNERS, LP

By: /s/ Seymour Pluchenik

Name: Seymour Pluchenik

Title: Managing Member

Address:

Silk Partners, LP

810 Seventh Avenue, 28th Floor New York, NY 10019

PF INVESTORS, LLC

By: /s/ Seymour Pluchenik

Name: Seymour Pluchenik

Title: Manager

Address:

PF Investors, LLC

810 Seventh Avenue, 28th Floor New York, NY 10019

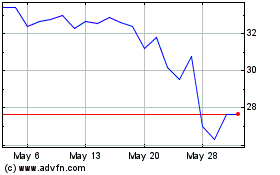

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Jan 2024 to Jan 2025