Pacific Retail Capital Partners Acquires Kings’ Shops in Waikoloa, Hawaii Alongside JV Partners Starwood Property Trust and Taconic Capital Advisors

October 23 2024 - 8:00AM

Business Wire

Solidifies PRCP’s presence on The Big Island,

reflecting its deep appreciation for the Hawaiian culture and the

Aloha spirit

Expects to carry over the recent positive

leasing momentum to 2025 and beyond to create a world-class

shopping and dining destination

Pacific Retail Capital Partners (“PRCP” or the “Company”), one

of the nation's premier retail operating groups, today announced

that together with its joint venture partners, Starwood Property

Trust (“Starwood”) and Taconic Capital Advisors LP (“Taconic”), it

has acquired Kings’ Shops located in Waikoloa, Hawaii. The

acquisition of the nearly 70,000 square foot luxury resort retail

destination marks the second asset in PRCP’s portfolio in Hawaii.

The Company also manages Queen Kaʻahumanu Center in Maui and has

been actively involved in shaping the future of that property to

solidify its position as one of the most vibrant and exciting

family-friendly retail destinations on the island.

PRCP, Starwood and Taconic have a deep appreciation for the

Hawaiian culture and the Aloha spirit that permeates throughout The

Big Island and will leverage their collective expertise and

relationships to further elevate the environment at Kings’ Shops to

create a world-class shopping and dining experience. The companies

plan to carry over the leasing momentum that has occurred at the

property over the past few years into 2025 and beyond to ensure it

continues to meet the evolving needs of the vibrant Waikoloa

community. The partnership also expects to unveil its ‘Big Changes

for the Big Island’ campaign at the asset, which will see it make a

number of extensive common area capital improvements designed to

boost Kings’ Shops’ appeal and build a stronger sense of connection

with the people it serves.

“We are thrilled to have acquired Kings’ Shops alongside

highly-respected institutional partners Starwood and Taconic,”

stated Oscar Parra, an Executive on PRCP’s Capital Markets team.

“We have inherent familiarity with this asset given we have managed

it for the past several years and know firsthand how important of

an economic engine it is for The Big Island. We truly believe that

no one understands this property better than we do and are very

excited to continue building upon the progress we have already made

to improve the shopping experience while also overseeing its

long-term success. We look forward to ensuring Kings’ Shops remains

a vibrant and prideful fixture in this community for years to

come.”

PRCP’s differentiated approach to property management and

customer engagement were critical to attracting several of the new

high-profile retailers at Kings’ Shops, including Travis Matthews,

Lululemon and Kahala. The Company specializes in taking a very

hands-on role in the day-to-day operations of its centers and

conceiving unique and targeted events and campaigns that resonate

broadly throughout each community it serves. For instance, at

Kings’ Shops, PRCP organizes and hosts the highly anticipated Great

Waikoloa Rubber Duckie Race in partnership with local businesses

that attracts thousands of people from all over The Big Island each

year.

Taconic investment team member Austin Friedman added, “Kings'

Shops stands out as a cornerstone of the Waikoloa community. Our

partnership with PRCP and Starwood represents an investment in both

an exceptional asset and the vibrant future of The Big Island.

PRCP's proven ability to weave local culture into world-class

retail experiences gives us confidence that together, we'll write

an exciting new chapter for Kings' Shops.”

Jason Jones, Starwood’s Chief Investment Officer, Real Estate

Investing Division added that “Starwood is excited to be working

with our longstanding partners on this new vision for Kings’ Shops.

The reimagining of this asset will bring a tremendous energy to the

neighborhood, visitors and residents of The Big Island.”

Kings’ Shops is located in the heart of the Kohala Coast and

features a dynamic mix of local and national retailers, such as

Tiffany & Co., Tommy Bahama and Tori Richard, and full-service

restaurants, including Roy’s Waikoloa Bar & Grill by Chef Roy

Yamaguchi, Foster’s Kitchen and A-Bay’s Island Grill. In addition

to shopping and dining, the family-friendly destination hosts live

entertainment, including music and fire dancing, weekly farmers

markets and monthly night market events.

About Pacific Retail Capital Partners Pacific Retail

Capital Partners (PRCP) is one of the nation’s premier retail

operating groups of large open- air and enclosed shopping centers,

with more than $3.0 billion in assets under management across the

United States. Based in Southern California, the company’s

portfolio totals 24 properties encompassing over 20 million square

feet. With a highly experienced team that has a proven track record

of generating value to its stakeholders, PRCP is dedicated to

evolving real estate for the next generation by working with the

communities it serves to design master plans that transform its

assets into high-performing mixed-use destinations. The

vertically-integrated company provides end-to-end sourcing,

assessment, underwriting, valuing, developing, marketing, design

and asset management services. To learn more visit

pacificretail.com or follow on social media at: Facebook:

@PacificRetailCapitalPartners and Instagram: @PacificRetail.

About Taconic Capital Advisors LP Taconic Capital

Advisors LP (“Taconic”) is a global institutional investment firm

that pursues an event-driven, multi-strategy investment approach

designed to generate strong, risk-adjusted returns over multiple

market cycles. Taconic was founded in 1999 by former Goldman Sachs

partners Frank Brosens and Ken Brody. The firm has approximately $6

billion of total assets under management with offices in New York

and London and more than 100 employees worldwide.

Taconic’s full-service commercial real estate platform invests

in all asset classes and across the capital structure in both

public and private markets. The strategy’s broad mandate offers

flexibility to capitalize on shifting market opportunities,

creating uncorrelated risk-adjusted return profiles for investors.

Rooted in distressed and opportunistic investing, the team applies

high-touch asset management capabilities to drive strong

asset-level performance and capital market executions.

Well-established relationships drive Taconic’s differentiated and

diverse transaction sourcing channels which include local operating

partners, investor partners and a broad network of lenders, CMBs

special servicers, trading desks and brokerage houses.

Taconic’s series of closed-ended real estate funds are fully

discretionary and have received over $1 billion in capital

commitments. Investments to date across all Taconic funds total

over $3 billion of gross asset value across roughly 175 distinct

transactions. For more information, please visit

www.taconiccapital.com.

About Starwood Property Trust, Inc. Starwood Property

Trust (NYSE: STWD) is a leading diversified finance company with a

core focus on the real estate and infrastructure sectors. An

affiliate of global private investment firm, Starwood Capital

Group, the Company has successfully deployed over $98 billion of

capital since inception and manages a portfolio of over $26 billion

across debt and equity investments. Starwood Property Trust's

investment objective is to generate attractive and stable returns

for shareholders, primarily through dividends, by leveraging a

premiere global organization to identify and execute on the best

risk-adjusted returning investments across its target assets.

Additional information can be found at

www.starwoodpropertytrust.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023970573/en/

Media Contacts:

Pacific Retail Capital Partners prcp@icrinc.com

Taconic Capital mgeller@prosek.com / ekapsack@prosek.com

Starwood Property Trust ztanenbaum@starwood.com

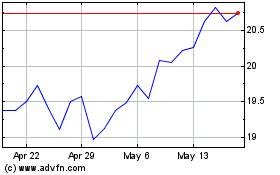

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Dec 2023 to Dec 2024