UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 07, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED BALANCE SHEET

| | | | | | | | | | | | | | | | | |

| Note | | 03/31/2024 | | 12/31/2023 |

| ASSETS | | | | | |

| CURRENT | | | | | |

| Cash and cash equivalents | 5 | | 4,203,126 | | | 8,345,871 | |

| Marketable securities | 6 | | 14,671,943 | | | 12,823,886 | |

| Trade accounts receivable | 7 | | 6,634,735 | | | 6,848,454 | |

| Inventories | 8 | | 6,521,769 | | | 5,946,948 | |

| Recoverable taxes | 9 | | 886,659 | | | 888,539 | |

| Derivative financial instruments | 4.5 | | 1,961,643 | | | 2,676,526 | |

| Advances to suppliers | 10 | | 119,962 | | | 113,743 | |

| | | | | |

| Other assets | | | 871,969 | | | 925,105 | |

| Total current assets | | | 35,871,806 | | | 38,569,072 | |

| | | | | |

| NON-CURRENT | | | | | |

| Marketable securities | 6 | | 448,077 | | | 443,400 | |

| Recoverable taxes | 9 | | 1,401,124 | | | 1,373,647 | |

| Deferred taxes | 12 | | 1,368,618 | | | 545,213 | |

| Derivative financial instruments | 4.5 | | 1,544,010 | | | 1,753,928 | |

| Advances to suppliers | 10 | | 2,472,894 | | | 2,242,229 | |

| Judicial deposits | | | 401,758 | | | 361,693 | |

| Other assets | | | 207,984 | | | 182,463 | |

| | | | | |

| Biological assets | 13 | | 18,721,063 | | | 18,278,582 | |

| Investments | 14 | | 620,259 | | | 608,013 | |

| Property, plant and equipment | 15 | | 60,640,882 | | | 59,289,069 | |

| Right of use | 19.1 | | 5,146,347 | | | 5,196,631 | |

| Intangible | 16 | | 14,554,669 | | | 14,749,085 | |

| Total non-current assets | | | 107,527,685 | | | 105,023,953 | |

| TOTAL ASSETS | | | 143,399,491 | | | 143,593,025 | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED BALANCE SHEET

| | | | | | | | | | | | | | | | | |

| Note | | 03/31/2024 | | 12/31/2023 |

| LIABILITIES | | | | | |

| CURRENT | | | | | |

| Trade accounts payable | 17 | | 4,942,766 | | | 5,572,219 | |

| Loans, financing and debentures | 18.1 | | 5,043,997 | | | 4,758,247 | |

| Lease liabilities | 19.2 | | 759,368 | | | 753,399 | |

| Derivative financial instruments | 4.5 | | 82,556 | | | 578,763 | |

| Taxes payable | | | 480,149 | | | 443,454 | |

| Payroll and charges | | | 534,263 | | | 766,905 | |

| Liabilities for assets acquisitions and subsidiaries | 23 | | 94,770 | | | 93,405 | |

| Dividends and interest on own capital payable | | | 7,078 | | | 1,316,528 | |

| Advances from customers | | | 154,588 | | | 172,437 | |

| Other liabilities | | | 314,662 | | | 339,683 | |

| Total current liabilities | | | 12,414,197 | | | 14,795,040 | |

| | | | | |

| NON-CURRENT | | | | | |

| Loans, financing and debentures | 18.1 | | 73,905,644 | | | 72,414,445 | |

| Lease liabilities | 19.2 | | 5,534,430 | | | 5,490,383 | |

| Derivative financial instruments | 4.5 | | 2,507,363 | | | 1,857,309 | |

| Liabilities for assets acquisitions and subsidiaries | 23 | | 99,159 | | | 93,782 | |

| Provision for judicial liabilities | 20.1 | | 2,876,590 | | | 2,860,409 | |

| Employee benefit plans | 21.2 | | 839,185 | | | 833,683 | |

| Deferred taxes | 12 | | 12,596 | | | 11,377 | |

| Share-based compensation plans | 22 | | 320,806 | | | 268,489 | |

| Provision for loss on investments in associates | 14 | | 938 | | | |

| Advances from customers | | | 74,715 | | | 74,715 | |

| Other liabilities | | | 89,269 | | | 83,093 | |

| Total non-current liabilities | | | 86,260,695 | | | 83,987,685 | |

| TOTAL LIABILITIES | | | 98,674,892 | | | 98,782,725 | |

| | | | | |

| SHAREHOLDERS’ EQUITY | 24 | | | | |

| Share capital | | | 9,235,546 | | | 9,235,546 | |

| Capital reserves | | | 25,321 | | | 26,744 | |

| Treasury shares | | | (935,473) | | | (1,484,014) | |

| Profit reserves | | | 34,522,473 | | | 35,376,198 | |

| Other reserves | | | 1,522,641 | | | 1,538,296 | |

| Retained earnings | | | 233,267 | | | |

| Controlling shareholders' | | | 44,603,775 | | | 44,692,770 | |

| Non-controlling interest | | | 120,824 | | | 117,530 | |

| Total equity | | | 44,724,599 | | | 44,810,300 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | | 143,399,491 | | | 143,593,025 | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Note | | | | | | 03/31/2024 | | 03/31/2023 |

| | | | | | | | | |

| NET SALES | 27 | | | | | | 9,458,602 | | | 11,276,383 | |

| Cost of sales | 29 | | | | | | (5,699,870) | | | (5,968,674) | |

| GROSS PROFIT | | | | | | | 3,758,732 | | | 5,307,709 | |

| | | | | | | | | |

| OPERATING INCOME (EXPENSES) | | | | | | | | | |

| Selling | 29 | | | | | | (653,415) | | | (604,353) | |

| General and administrative | 29 | | | | | | (502,975) | | | (390,235) | |

| Income (expense) from associates and joint ventures | 14 | | | | | | (9,907) | | | 14,471 | |

| Other, net | 29 | | | | | | (40,209) | | | (21,304) | |

| OPERATING PROFIT BEFORE NET FINANCIAL INCOME (EXPENSES) | | | | | | | 2,552,226 | | | 4,306,288 | |

| | | | | | | | | |

| NET FINANCIAL INCOME (EXPENSES) | 26 | | | | | | | | |

| Financial expenses | | | | | | | (1,130,400) | | | (1,159,025) | |

| Financial income | | | | | | | 424,217 | | | 385,761 | |

| Derivative financial instruments | | | | | | | (634,537) | | | 1,995,253 | |

| Monetary and exchange variations, net | | | | | | | (1,699,328) | | | 1,248,118 | |

| NET INCOME (LOSS) BEFORE TAXES | | | | | | | (487,822) | | | 6,776,395 | |

| | | | | | | | | |

| Income and social contribution taxes | | | | | | | | | |

| Current | 12 | | | | | | (114,354) | | | (113,777) | |

| Deferred | 12 | | | | | | 822,208 | | | (1,419,825) | |

| NET INCOME FOR THE PERIOD | | | | | | | 220,032 | | | 5,242,793 | |

| | | | | | | | | |

| Attributable to | | | | | | | | | |

| Controlling shareholders’ | | | | | | | 215,392 | | | 5,237,371 | |

| Non-controlling interest | | | | | | | 4,640 | | | 5,422 | |

| | | | | | | | | |

| Earnings per share | | | | | | | | | |

| Basic | 25.1 | | | | | | 0.16755 | | | 3.96896 | |

| Diluted | 25.2 | | | | | | 0.16747 | | | 3.96752 | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | 03/31/2024 | | 03/31/2023 |

| Net income (loss) for the period | | | | | | 220,032 | | | 5,242,793 | |

| Other comprehensive income (loss) | | | | | | | | |

| Fair value investments in equity measured at fair value through other comprehensive income | | | | | | 258 | | | (634) | |

| Tax effect on the fair value of investments | | | | | | (88) | | | 216 | |

| Items with no subsequent effect on income (loss) | | | | | | 170 | | | (418) | |

| | | | | | | | |

| Exchange rate variations on conversion of financial information of the subsidiaries abroad | | | | | | 2,050 | | | (20,439) | |

| | | | | | | | |

| Items with subsequent effect on income (loss) | | | | | | 2,050 | | | (20,439) | |

| Total comprehensive income (loss) | | | | | | 222,252 | | | 5,221,936 | |

| | | | | | | | |

| Attributable to | | | | | | | | |

| Controlling shareholders’ | | | | | | 217,612 | | | 5,216,514 | |

| Non-controlling interest | | | | | | 4,640 | | | 5,422 | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to controlling shareholders’ | | | | |

| | Share capital | | Capital reserves | | | | Profit reserves | | | | | | | | | |

| | Share

Capital | | Share issuance costs | | Stock options granted | | Treasury shares | | Tax incentives | | Legal Reserve | | Reserve for capital increase | | Special statutory reserve | | Investment reserve | | Other reserves | | Retained earnings (losses) | | Total | | Non-controlling interest | | Total equity |

| Balances at December 31, 2022 | | 9,269,281 | | | (33,735) | | | 18,425 | | | (2,120,324) | | | 879,278 | | | 1,404,099 | | | 19,732,050 | | | 2,192,442 | | | | | | 1,719,516 | | | | | | 33,061,032 | | | 105,333 | | | 33,166,365 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the period | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 5,237,371 | | | 5,237,371 | | | 5,422 | | | 5,242,793 | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (20,857) | | | | | | (20,857) | | | | | | (20,857) | |

| Transactions with shareholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock options granted (Note 22.3) | | | | | | | | 2,080 | | | | | | | | | | | | | | | | | | | | | | | | | | | 2,080 | | | | | | 2,080 | |

| Shares granted (Note 22.3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share repurchase (note 24.2) | | | | | | | | | | | (87,243) | | | | | | | | | | | | | | | | | | | | | | | | (87,243) | | | | | | (87,243) | |

| Unclaimed dividends forfeited | | | | | | | | | | | 1,517,224 | | | | | | | | | | | | (1,517,224) | | | | | | | | | | | | | | | | | | |

| Fair value attributable to non-controlling interest | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,344) | | | (1,344) | |

| Internal changes in equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Realization of deemed cost, net of taxes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (27,771) | | | 27,771 | | | | | | | | | | |

| Balances at March 31, 2023 | | 9,269,281 | | | (33,735) | | | 20,505 | | | (690,343) | | | 879,278 | | | 1,404,099 | | | 19,732,050 | | | 675,218 | | | | | | 1,670,888 | | | 5,265,142 | | | 38,192,383 | | | 109,411 | | | 38,301,794 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balances at December 31, 2023 | | 9,269,281 | | | (33,735) | | | 26,744 | | | (1,484,014) | | | 998,237 | | | 1,847,109 | | | 15,670,952 | | | 1,887,576 | | | 14,972,324 | | | 1,538,296 | | | | | | 44,692,770 | | | 117,530 | | | 44,810,300 | |

| Total comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income for the period | | | | | | | | | | | | | | | | | | | | | | 215,392 | | | 215,392 | | | 4,640 | | | 220,032 | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | | | | | | | | 2,220 | | | | | 2,220 | | | | | 2,220 | |

| Transactions with shareholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock options granted (Note 22.3) | | | | | | 3,345 | | | | | | | | | | | | | | | | | | | 3,345 | | | | | 3,345 | |

| Shares granted | | | | | | (4,768) | | | 4,768 | | | | | | | | | | | | | | | | | | | | | | | |

| Shares repurchased (Note 24.2) | | | | | | | | (309,952) | | | | | | | | | | | | | | | | | (309,952) | | | | | (309,952) | |

| Treasury shares cancelled (Note 24.2) | | | | | | | | 853,725 | | | | | | | (813,258) | | | (40,467) | | | | | | | | | | | | | | | |

| Fair value attributable to non-controlling interest | | | | | | | | | | | | | | | | | | | | | | | | | | | (1,346) | | | (1,346) | |

| Internal changes in equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Realization of deemed cost, net of taxes | | | | | | | | | | | | | | | | | | | | (17,875) | | | 17,875 | | | | | | | | | |

| Balances at March 31, 2024 | | 9,269,281 | | | (33,735) | | | 25,321 | | | (935,473) | | | 998,237 | | | 1,847,109 | | | 14,857,694 | | | 1,847,109 | | | 14,972,324 | | | 1,522,641 | | | 233,267 | | | 44,603,775 | | | 120,824 | | | 44,724,599 | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| (In thousands of R$, unless otherwise stated) |

| | |

CONSOLIDATED STATEMENTS OF CASH FLOW

| | | | | | | | | | | |

| 03/31/2024 | | 03/31/2023 |

| OPERATING ACTIVITIES | | | |

| Net income for the period | 220,032 | | | 5,242,793 | |

| Adjustment to | | | |

| Depreciation, depletion and amortization | 1,899,297 | | | 1,681,182 | |

| Depreciation of right of use (Note 19.1) | 82,727 | | | 66,532 | |

| | | |

| Interest expense on lease liabilities | 109,806 | | | 111,966 | |

| Result from sale and disposal of property, plant and equipment and biological assets, net (Note 29) | 47,554 | | | 42,748 | |

| Income (expense) from associates and joint ventures (Note 14) | 9,907 | | | (14,471) | |

| Exchange rate and monetary variations, net (Note 26) | 1,699,328 | | | (1,248,118) | |

| Interest expenses on financing, loans and debentures (Note 26) | 1,230,849 | | | 1,152,740 | |

| Capitalized loan costs (Note 26) | (377,560) | | | (233,418) | |

| Accrual of interest on marketable securities | (312,425) | | | (196,013) | |

| Amortization of transaction costs, premium and discounts (Note 26) | 17,308 | | | 16,206 | |

| Derivative gains, net (Note 26) | 634,537 | | | (1,995,253) | |

| | | |

| Deferred income tax and social contribution (Note 12.2) | (822,208) | | | 1,419,825 | |

| Interest on actuarial liabilities (Note 21.2) | 18,963 | | | 17,307 | |

| Provision for judicial liabilities, net (Note 20.1) | 29,015 | | | 33,728 | |

| Tax litigation reduction program | | | 14,031 | |

| Provision (reversal) for doubtful accounts, net (Note 7.3) | (1,317) | | | 2,890 | |

| Provision (reversal) for inventory losses, net (Note 8.1) | 8,030 | | | (9,141) | |

| Provision (reversal) for loss of ICMS credits, net (Note 9.1) | (23,763) | | | 77,674 | |

| | | |

| Other | 15,121 | | | 7,308 | |

| Decrease (increase) in assets | | | |

| Trade accounts receivable | 373,116 | | | 74,816 | |

| Inventories | (298,050) | | | (371,738) | |

| Recoverable taxes | 8,363 | | | (69,807) | |

| Other assets | (15,658) | | | 109,343 | |

| Increase (decrease) in liabilities | | | |

| Trade accounts payable | (141,975) | | | (144,111) | |

| Taxes payable | 90,822 | | | 88,148 | |

| Payroll and charges | (232,642) | | | (226,775) | |

| Other liabilities | (15,767) | | | (115,175) | |

| Cash generated from operations | 4,253,410 | | | 5,535,217 | |

| Payment of interest on financing, loans and debentures (Note 18.3) | (1,749,517) | | | (1,597,534) | |

| Capitalized loan costs paid | 377,560 | | | 233,418 | |

| Interest received on marketable securities | 228,249 | | | 168,762 | |

| Payment of income taxes | (55,574) | | | (42,653) | |

| Cash provided by operating activities | 3,054,128 | | | 4,297,210 | |

| | | | | |

| INVESTING ACTIVITIES | | | | |

| Additions to property, plant and equipment (Note 15) | (2,556,172) | | | (2,449,752) | |

| Additions to intangible (Note 16) | (55,110) | | | (17) | |

| Additions to biological assets (Note 13) | (1,631,502) | | | (1,393,291) | |

| Proceeds from sales of property, plant and equipment and biological assets | 26,719 | | | 24,941 | |

| Capital increase in affiliates (Note 14.3) | (18,908) | | | (20,263) | |

| Marketable securities, net | (1,566,266) | | | (4,734,298) | |

| Advances for acquisition (receipt) of wood from operations with development and partnerships | (235,775) | | | (261,018) | |

| | | |

| | | |

| | | |

| | | |

| Cash used in investing activities | (6,037,014) | | | (8,833,698) | |

| | | | | |

| FINANCING ACTIVITIES | | | |

| Proceeds from loans, financing and debentures (Note 18.3) | 4,244,874 | | | 50,691 | |

| Proceeds from derivative transactions (Note 4.5.4) | 444,112 | | | 365,724 | |

| Payment of loans, financing and debentures (Note 18.3) | (4,038,400) | | | (59,053) | |

| Payment of leases (Note 19.2) | (320,643) | | | (292,682) | |

| Payment of interest on own capital | (1,309,450) | | | 5 | |

| Liabilities for assets acquisitions and subsidiaries | | | (16,929) | |

| Shares repurchased (Note 24.2) | (309,952) | | | (87,243) | |

| Cash provided (used) by financing activities | (1,289,459) | | | (39,487) | |

| | | | |

| EXCHANGE VARIATION ON CASH AND CASH EQUIVALENTS | 129,600 | | | (168,712) | |

| | | | | |

| Decrease in cash and cash equivalents, net | (4,142,745) | | | (4,744,687) | |

| At the beginning of the period | 8,345,871 | | | 9,505,951 | |

| At the end of the period | 4,203,126 | | | 4,761,264 | |

| Decrease in cash and cash equivalents, net | (4,142,745) | | | (4,744,687) | |

The accompanying notes are an integral part of this unaudited condensed consolidated interim financial information.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

.

1 COMPANY’S OPERATIONS

Suzano S.A. (“Suzano”) and its subsidiaries (collectively the “Company”) is a public company with its headquarters in Brazil, at Avenida Professor Magalhães Neto, No. 1,752 - 10th floor, rooms 1010 and 1011, Bairro Pituba, in the city of Salvador, State of Bahia, and its main business office in the city of São Paulo.

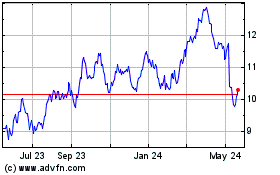

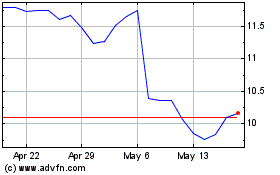

Suzano’s shares are traded on B3 S.A. (“Brasil, Bolsa, Balcão - “B3”), listed in the New Market under the ticker SUZB3, and its American Depositary Receipts (“ADRs”) in a ratio of 1 (one) per common share, Level II, are traded in the New York Stock Exchange (“NYSE”) under the ticker SUZ.

The Company has 13 industrial units, located in the cities of Cachoeiro de Itapemirim and Aracruz (Espírito Santo State), Belém (Pará State), Eunápolis and Mucuri (Bahia State), Maracanaú (Ceará State), Imperatriz (Maranhão State), Jacareí, Limeira, Mogi das Cruzes and two units in Suzano, (São Paulo State) and Três Lagoas (Mato Grosso do Sul State). Additionally, it has four technology centers, 30 distribution centers and four ports, all located in Brazil.

These units produce hardwood pulp from eucalyptus, coated paper, paperboard, uncoated paper and cut size paper and packages of sanitary paper (consumer goods - tissue) to serve the domestic and foreign markets.

Pulp and paper are sold in foreign markets by Suzano, as well as through its wholly-owned subsidiaries and/or its sales offices in Argentina, Austria, China, Ecuador, United States of America and Singapore.

The Company's operations also include the commercial management of eucalyptus forest for its own use, the operation of port terminals, and the holding of interests, as a partner or shareholder, in other companies or enterprises, and the generation of electricity in the pulp production process and its commercialization.

The Company is controlled by Suzano Holding S.A., through a voting agreement whereby it holds 47.70% of the common shares of its share capital.

These unaudited condensed consolidated interim financial information was authorized by the Board of Directors on May 07, 2024.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

1.1 Equity interests

The Company holds equity interests in the following entities:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | % equity interest |

| Entity/Type of investment | | Main activity | | Country | | 03/31/2024 | | 12/31/2023 |

| Consolidated | | | | | | | | |

| F&E Tecnologia do Brasil S.A. (Direct) | | Biofuel production, except alcohol | | Brazil | | 100.00 | % | | 100.00 | % |

| Fibria Celulose (USA) Inc. (Direct) | | Business office | | United States of America | | 100.00 | % | | 100.00 | % |

Fibria Overseas Finance Ltd. (Direct) (1) | | Financial fundraising | | Cayman Island | | | | | 100.00 | % |

| Fibria Terminal de Celulose de Santos SPE S.A. (Direct) | | Port operations | | Brazil | | 100.00 | % | | 100.00 | % |

| FuturaGene Ltd. | | Biotechnology research and development | | England | | 100.00 | % | | 100.00 | % |

| FuturaGene Delaware Inc. (Indirect) | | Biotechnology research and development | | United States of America | | 100.00 | % | | 100.00 | % |

| FuturaGene Israel Ltd. (Indirect) | | Biotechnology research and development | | Israel | | 100.00 | % | | 100.00 | % |

| FuturaGene Inc. (Indirect) | | Biotechnology research and development | | United States of America | | 100.00 | % | | 100.00 | % |

| Maxcel Empreendimentos e Participações S.A. (Direct) | | Holding | | Brazil | | 100.00 | % | | 100.00 | % |

| Itacel - Terminal de Celulose de Itaqui S.A. (Indirect) | | Port operations | | Brazil | | 100.00 | % | | 100.00 | % |

| Mucuri Energética S.A. (Direct) | | Power generation and distribution | | Brazil | | 100.00 | % | | 100.00 | % |

| Paineiras Logística e Transportes Ltda. (Direct) | | Road freight transport | | Brazil | | 100.00 | % | | 100.00 | % |

| Portocel - Terminal Espec. Barra do Riacho S.A. (Direct) | | Port operations | | Brazil | | 51.00 | % | | 51.00 | % |

| Projetos Especiais e Investimentos Ltda. (Direct) | | Commercialization of equipment and parts | | Brazil | | 100.00 | % | | 100.00 | % |

| SFBC Participações Ltda. (Direct) | | Packaging production | | Brazil | | 100.00 | % | | 100.00 | % |

| Stenfar S.A. Indl. Coml. Imp. Y. Exp. (Direct) | | Commercialization of paper and computer materials | | Argentina | | 100.00 | % | | 100.00 | % |

| Suzano Austria GmbH. (Direct) | | Business office | | Austria | | 100.00 | % | | 100.00 | % |

| Suzano Canada Inc. (Direct) | | Lignin research and development | | Canada | | 100.00 | % | | 100.00 | % |

| Suzano Ecuador S.A.S. (Direct) | | Business office | | Ecuador | | 100.00 | % | | 100.00 | % |

| Suzano Finland Oy (Direct) | | Industrialization and commercialization of cellulose, microfiber cellulose and paper | | Finland | | 100.00 | % | | 100.00 | % |

| Suzano International Finance B.V (Direct) | | Financial fundraising | | Netherlands | | 100.00 | % | | 100.00 | % |

| Suzano International Holding B.V. (Direct) | | Holding | | Netherlands | | 100.00 | % | | 100.00 | % |

| Suzano International Trade GmbH. (Direct) | | Business office | | Austria | | 100.00 | % | | 100.00 | % |

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | % equity interest |

| Entity/Type of investment | | Main activity | | Country | | 03/31/2024 | | 12/31/2023 |

| Suzano Material Technology Development Ltd. (Direct) | | Biotechnology research and development | | China | | 100.00 | % | | 100.00 | % |

| Suzano Netherlands B.V. (Direct) | | Financial fundraising | | Netherlands | | 100.00 | % | | 100.00 | % |

| Suzano Operações Industriais e Florestais S.A. (Direct) | | Industrialization, commercialization and exporting of pulp | | Brazil | | 100.00 | % | | 100.00 | % |

| Suzano Pulp and Paper America Inc. (Direct) | | Business office | | United States of America | | 100.00 | % | | 100.00 | % |

| Suzano Pulp and Paper Europe S.A. (Direct) | | Business office | | Switzerland | | 100.00 | % | | 100.00 | % |

| Suzano Shanghai Ltd. (Direct) | | Business office | | China | | 100.00 | % | | 100.00 | % |

| Suzano Shanghai Trading Ltd. (Direct) | | Financial fundraising | | China | | 100.00 | % | | 100.00 | % |

| Suzano Singapura Pte. Ltd (Direct) | | Business office | | Singapore | | 100.00 | % | | 100.00 | % |

| Suzano Trading International KFT(Direct) | | Business office | | Hungary | | 100.00 | % | | 100.00 | % |

| Suzano Ventures LLC (Direct) | | Corporate venture capital | | United States of America | | 100.00 | % | | 100.00 | % |

| | | | | | | | |

| Joint operation | | | | | | | | |

| Veracel Celulose S.A. (Direct) | | Industrialization, commercialization and exporting of pulp | | Brazil | | 50.00 | % | | 50.00 | % |

| | | | | | | | |

| Equity | | | | | | | | |

| Biomas Serviços Ambientais, Restauração e Carbono S.A. (Direct) | | Restoration, conservation and preservation of forests | | Brazil | | 16.66 | % | | 16.66 | % |

| Ensyn Corporation (Direct) | | Biofuel research and development | | United States of America | | 25.53 | % | | 25.53 | % |

| F&E Technologies LLC (Direct/Indirect) | | Biofuel production, except alcohol | | United States of America | | 50.00 | % | | 50.00 | % |

| Ibema Companhia Brasileira de Papel (Direct) | | Industrialization and commercialization of paperboard | | Brazil | | 49.90 | % | | 49.90 | % |

| Spinnova Plc (Direct) | | Research of sustainable raw materials for the textile industry | | Finland | | 18.78 | % | | 18.78 | % |

| Woodspin Oy (Direct/Indirect) | | Development and production of cellulose-based fibers, yarns and textile filaments | | Finland | | 50.00 | % | | 50.00 | % |

| | | | | | | | |

| Fair value through other comprehensive income | | | | | | | | |

| Celluforce Inc. (Direct) | | Nanocrystalline pulp research and development | | Canada | | 8.28 | % | | 8.28 | % |

Nfinite Nanotechnology Inc. (Indirect) (2) | | Research and development of smart nanocoatings | | Canada | | 5.00 | % | | |

(1)On March 27, 2024, the entity was liquidated.

(2)On March 8, 2024, Suzano Ventures LLC acquired equity interest in the legal entity Nfinite Nanotechnology Inc., which is an indirect subsidiary of Suzano S.A.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

1.2 Major events in the three-month period ended March 31, 2024

1.2.1 Effects of the war between Russia and Ukraine, and Middle East conflict

The Company has continuously monitored the impacts of the current war between Russia and Ukraine, and the Middle East conflict, both direct and indirect, on society, the economy and markets (global and domestic), with the objective of evaluating possible impacts and risks for the business.

The Company's assessment has covered five main areas:

(i)Personnel: Suzano has local employees and facilities in the city of Rehovot in Israel, through its subsidiary, FuturaGene Israel Ltd. The Company continuously monitors the situation.

In the context of the conflict between Russia and Ukraine, Suzano does not have employees or facilities of any kind in locations related to the conflict.

(ii)Supply Chain: the Company did not identify any short-term or long-term risk of possible interruptions or shortages of materials for its industrial and forestry activities. So far, the only effects observed have been greater volatility in commodities and energy prices.

(iii)Logistics: internationally, there was no change in the Company’s logistical operations, with all the routes used remaining unchanged and the moorings in the planned locations being maintained. At the domestic level, no changes in logistical flows were identified.

(iv)Commercial: to date, the Company has continued with its transactions as planned, maintaining service to its customers in all its sectors of activity. Sales to a few customers located in Russia were suspended, without any significant financial impact.

(v)Continuity of operations: The conflict in Israel may result in disruptions to biotechnology research and development operations at FuturaGene Israel Ltd.

As a result of the current scenario, the Company has taken steps to expand its monitoring of the situation, together with its main stakeholders, in order to ensure any updates and information flows required for its global decision-making are available in a timely manner.

1.2.2 Cerrado Project

On October 28, 2021, the Company's Board of Directors approved the realization of the Cerrado Project, which consists of building a pulp production mill in the municipality of Ribas do Rio Pardo, in the state of Mato Grosso do Sul.

The plant will have an estimated nominal capacity of 2,550,000 tons of eucalyptus pulp production per year, with an estimated period for starting operations in the first semester of 2024. The total investment is R$22,200,000, with substantial payments during the years of 2021 to 2025.

1.2.3 Cancellation of shares and new share buyback program

On January 26, 2024, the Board of Directors approved the cancellation of 20,000,000 common shares, with an average cost of R$42.69 (forty-two reais and sixty-nine cents) per share, in the amount of R$853,725, which were held in treasury, without changing the share capital and against the balances of retained earnings reserves available. After the cancellation of the shares, the share capital of R$9,269,281 is divided into 1,304,117,615 common shares, all nominative, book-entry and with no par value.

On the same date, the Company decided on a new share buyback program, in which it may acquire up to a maximum of 40,000,000 (forty million) common shares of its own issue with a maximum period of 18 (eighteen) months, which will end on July 26, 2025.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

2 BASIS OF PREPARATION AND PRESENTATION OF UNAUDITED CONDENSED CONSOLIDATED FINANCIAL INFORMATION

The Company’s unaudited condensed consolidated interim financial information, for the three-month period ended March 31, 2024, are prepared in compliance with the international standard IAS 34 Interim Financial Reporting issued by the International Accounting Standards Board (“IASB”) and disclose all the applicable significant information related to the financial information, which is consistent with the information used by Management in the performance of its duties.

The Company’s unaudited condensed consolidated interim financial information are expressed in thousands of Brazilian Reais (“R$”), as well as the amounts of other currencies, when applicable, were also expressed in thousands, unless otherwise stated.

The preparation of unaudited condensed consolidated interim financial information requires Management to make judgments, use estimates and adopt policies in the process of applying accounting practices that affect the disclosed amounts of revenues, expenses, assets and liabilities, including the disclosure of contingent liabilities assumed. However, the uncertainty inherent to these judgements, assumptions and estimates could result in material adjustments to the carrying amount of certain assets and liabilities in future periods.

The Company reviews its judgments, estimates and assumptions continually as disclosed in the annual financial statements for the year ended December 31, 2023 (Note 3.2.34). For the three-month period ended March 31, 2024, there were no changes in these judgments, estimates and assumptions compared to disclosed on December 31, 2023.

The unaudited condensed consolidated interim financial information was prepared on historical cost basis, except for the following material items recognized:

(i)Derivative and non-derivative financial instruments measured at fair value;

(ii)Share-based payments and employee benefits measured at fair value; and

(iii)Biological assets measured at fair value;

The unaudited condensed consolidated interim financial information was prepared under the going concern assumption.

3 SUMMARY OF MATERIAL ACCOUNTING POLICIES

The unaudited condensed consolidated interim financial information was prepared based on the information of Suzano and its subsidiaries on the same base date, except for associates Ensyn, Futuragene and Spinnova, as well as in accordance with consistent accounting policies and practices.

The unaudited condensed consolidated interim financial information should be read in conjunction with the annual financial statements for the year ended December 31, 2023, considering that its purpose is to provide an update on the activities, events and significant circumstances in relation to those disclosed in the consolidated financial statements. Therefore, unaudited condensed consolidated interim financial information focus on new activities, events and circumstances and do not duplicate the information previously disclosed, except when Management judges that the maintenance of the information is relevant.

The accounting policies have been consistently applied to all consolidated companies.

There were no changes on such policies and estimates calculation methodologies, which were disclosed in the annual financial statements of December 31, 2023.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4 FINANCIAL INSTRUMENTS AND RISKS MANAGEMENT

4.1 Financial risks management

4.1.1 Overview

In the three-month period ended March 31, 2024, there were no significant changes in the financial risk management policies and procedures compared to those disclosed in the annual financial statements for the year ended December 31, 2023 (Note 4).

The Company maintained its conservative approach and strong cash and marketable securities position, as well as its hedging policy.

4.1.2 Classification

All transactions with financial instruments are recognized for accounting purposes and classified in the following categories:

| | | | | | | | | | | | | | | | | |

| Note | | 03/31/2024 | | 12/31/2023 |

| Assets | | | | | |

| Amortized cost | | | | | |

| Cash and cash equivalents | 5 | | 4,203,126 | | | 8,345,871 | |

| Trade accounts receivable | 7 | | 6,634,735 | | | 6,848,454 | |

| | | | | |

Other assets (1) |

| | 703,249 | | | 737,222 | |

|

| | 11,541,110 | | | 15,931,547 | |

| Fair value through other comprehensive income |

| | | | |

| Investments | 14.1 | | 28,970 | | | 23,606 | |

|

| | 28,970 | | | 23,606 | |

| Fair value through profit or loss |

| | | | |

| Derivative financial instruments | 4.5.1 | | 3,505,653 | | | 4,430,454 | |

| Marketable securities | 6 | | 15,120,020 | | | 13,267,286 | |

|

| | 18,625,673 | | | 17,697,740 | |

|

| | 30,195,753 | | | 33,652,893 | |

| Liabilities |

| | | | |

| Amortized cost |

| | | | |

| Trade accounts payable | 17 | | 4,942,766 | | | 5,572,219 | |

| Loans, financing and debentures | 18.1 | | 78,949,641 | | | 77,172,692 | |

| Lease liabilities | 19.2 | | 6,293,798 | | | 6,243,782 | |

| Liabilities for assets acquisitions and subsidiaries | 23 | | 193,929 | | | 187,187 | |

| Dividends and interests on own capital payable |

| | 7,078 | | | 1,316,528 | |

Other liabilities (1) |

| | 117,098 | | | 116,716 | |

|

| | 90,504,310 | | | 90,609,124 | |

| Fair value through profit or loss |

| | | | |

| Derivative financial instruments | 4.5.1 | | 2,589,919 | | | 2,436,072 | |

| | | 2,589,919 | | | 2,436,072 | |

| | | 93,094,229 | | | 93,045,196 | |

| | | 62,898,476 | | | 59,392,303 | |

(1)Does not include items not classified as financial instruments.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.1.3 Fair value of loans and financing

The estimated fair values of loans and financing are set forth below:

| | | | | | | | | | | | | | | | | |

| Yield used to discount/methodology | | 03/31/2024 | | 12/31/2023 |

| Quoted in the secondary market | | | | | |

| In foreign currency |

| | | | |

| Bonds | Secondary Market | | 39,682,795 | | | 38,703,379 | |

| Estimated present value | | | | | |

| In foreign currency | | | | | |

| Export credits (“Prepayment”) | SOFR | | 18,567,479 | | | 17,783,760 | |

| Assets Financing | SOFR | | 415,868 | | | 278,107 | |

| IFC - International Finance Corporation | SOFR | | 3,310,378 | | | 3,198,761 | |

| BNDES - Currency basket | DI 1 | | | | |

| In local currency | | | | | |

| BNDES – TJLP | DI 1 | | 209,493 | | | 215,458 | |

| BNDES – TLP | DI 1 | | 2,569,170 | | | 2,712,762 | |

| BNDES – Fixed | DI 1 | | 2,959 | | | 3,903 | |

| BNDES – Selic (“Special Settlement and Custody System”) | DI 1 | | 687,691 | | | 686,798 | |

| Assets Financing | DI 1 | | 75,727 | | | 75,622 | |

| Debentures | DI 1/IPCA | | 8,904,672 | | | 8,881,277 | |

| NCE (“Export Credit Notes”) | DI 1 | | 107,381 | | | 110,396 | |

| NCR (“Rural Credit Notes”) | DI 1 | | 2,360,685 | | | 2,228,806 | |

| Export credits (“Prepayment”) | DI 1 | | 844,798 | | | 824,035 | |

| | | 77,739,096 | | | 75,703,064 | |

The book values of loans and financing are disclosed in Note 18.

Management considers that, for its other financial assets and liabilities measured at amortized cost, their book values approximate their fair values, and therefore the fair value information is not being presented.

4.2 Liquidity risk management

The Company’s purpose is to maintain a strong cash and marketable securities position to meet its financial and operating commitments. The amount held in cash is intended to cover the expected outflows in the normal course of its operations, while the cash surplus is generally invested in highly liquid financial investments according to the Cash Management Policy.

The cash position is monitored by the Company’s Management, by means of management reports and participation in performance meetings with determined frequencies. During the three-month period ended March 31, 2024, the variations in cash and marketable securities were as expected, and the cash generated from operations was mostly used for investments and debt service.

All derivative financial instruments were traded over the counter and do not require deposit guarantee margins.

The remaining contractual maturities of financial liabilities are presented as of the balance sheet date. The amounts as set forth below consist of undiscounted cash flow, and include interest payments and exchange rate variations, and therefore may not reconcile with the amounts disclosed in the balance sheet.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | 03/31/2024 |

| Book value | | Undiscounted cash flow | | Up to 1 year | | 1 - 2 years | | 2 - 5 years | | More than 5 years |

| Liabilities | | | | | | | | | | | |

| Trade accounts payables | 4,942,766 | | | 4,942,766 | | | 4,942,766 | | | | | | | |

| Loans, financing and debentures | 78,949,641 | | | 108,119,681 | | | 7,461,736 | | | 11,527,112 | | | 44,823,040 | | | 44,307,793 | |

| Lease liabilities | 6,293,798 | | | 11,081,535 | | | 1,179,574 | | | 1,389,557 | | | 2,459,741 | | | 6,052,663 | |

| Liabilities for asset acquisitions and subsidiaries | 193,929 | | | 221,124 | | | 96,828 | | | 18,900 | | | 89,804 | | | 15,592 | |

| Derivative financial instruments | 2,589,919 | | | 3,700,014 | | | 86,443 | | | 1,232,234 | | | 1,124,775 | | | 1,256,562 | |

| Dividends and interests on own capital payable | 7,078 | | | 7,078 | | | 7,078 | | | | | | | |

| Other liabilities | 117,098 | | | 117,098 | | | 58,893 | | | 58,205 | | | | | |

| 93,094,229 | | | 128,189,296 | | | 13,833,318 | | | 14,226,008 | | | 48,497,360 | | | 51,632,610 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | 12/31/2023 |

| Book

value | | Undiscounted cash flow | | Up to 1 year | | 1 - 2

years | | 2 - 5

years | | More than 5 years |

| Liabilities | | | | | | | | | | | |

| Trade accounts payables | 5,572,219 | | | 5,572,219 | | | 5,572,219 | | | | | | | |

| Loans, financing and debentures | 77,172,692 | | | 105,526,852 | | | 7,648,237 | | | 12,983,542 | | | 31,355,362 | | | 53,539,711 | |

| Lease liabilities | 6,243,782 | | | 11,021,519 | | | 1,172,568 | | | 1,045,795 | | | 2,743,793 | | | 6,059,363 | |

| Liabilities for asset acquisitions and subsidiaries | 187,187 | | | 215,891 | | | 94,948 | | | 18,314 | | | 87,520 | | | 15,109 | |

| Derivative financial instruments | 2,436,072 | | | 2,801,258 | | | 66,433 | | | 1,278,953 | | | 1,191,014 | | | 264,858 | |

| Dividends and interests on own capital payable | 1,316,528 | | | 1,316,528 | | | 1,316,528 | | | | | | | |

| Other liabilities | 116,716 | | | 116,716 | | | 58,955 | | | 57,761 | | | | | |

| 93,045,196 | | | 126,570,983 | | | 15,929,888 | | | 15,384,365 | | | 35,377,689 | | | 59,879,041 | |

4.3 Credit risk management

In the three-month period ended March 31, 2024, there were no significant changes in the credit risk management policies compared to those disclosed in the annual financial statements for the year ended of December 31, 2023 (Note 4).

4.4 Market risk management

In the three-month period ended March 31, 2024, there were no significant changes in the market risk management policies and procedures compared to those disclosed in the annual financial statements for the year ended December 31, 2023 (Note 4).

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.4.1 Exchange rate risk management

As disclosed in the financial statements for the year ended December 31, 2023 (Note 4), the Company enters into U.S.Dollar selling transactions in the futures markets, including strategies involving options, to ensure attractive levels of operating margins for a portion of revenue. Such transactions are limited to a percentage of the net surplus foreign currency over a 24-months’ time horizon and therefore, are matched to the availability of currency for sale in the short term. The Company's Board of Directors approved the contracting of extraordinary hedge, in addition to the strategy mentioned above, for investments in the Cerrado Project, with a term of up to 36 months as of November 2021, in an amount of up to US$1,000,000. On July 27, 2022, the Board of Directors approved the expansion of the program, increasing the maximum amount (notional) to US$1,500,000, maintaining the previously established deadline. In order to provide transparency on the hedge program for the Cerrado Project, since December 31, 2021 the Company has started to prominently disclose the respective contracted operations.

The assets and liabilities that are exposed to foreign currency, substantially in U.S. Dollars, are set forth below:

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| Assets | | | |

| Cash and cash equivalents | 1,145,829 | | | 6,432,557 | |

| Marketable securities | 5,217,853 | | | 7,378,277 | |

| Trade accounts receivable | 4,887,668 | | | 5,049,609 | |

| Derivative financial instruments | 2,789,018 | | | 3,070,594 | |

| 14,040,368 | | | 21,931,037 | |

| Liabilities | | | |

| Trade accounts payable | (1,088,141) | | | (1,625,011) | |

| Loans and financing | (63,568,492) | | | (61,304,673) | |

| Liabilities for asset acquisitions and subsidiaries | (132,557) | | | (127,598) | |

| Derivative financial instruments | (2,284,198) | | | (1,867,882) | |

| (67,073,388) | | | (64,925,164) | |

| (53,033,020) | | | (42,994,127) | |

4.4.1.1 Sensitivity analysis – foreign exchange rate exposure – except for derivative financial instruments

For market risk analysis, the Company uses scenarios to evaluate both its asset and liability positions in foreign currency, and the possible effects on its results. The probable scenario represents the amounts recognized, as they reflect the conversion into Brazilian Reais on the balance sheet date (R$ to U.S.$ = R$4.9962).

This analysis assumes that all other variables, particularly interest rates, remain constant. The other scenarios considered the depreciation of the Brazilian Real against the U.S. Dollar at the rates of 25% and 50% before taxes.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

The following table set forth the potential impacts at their absolute amounts:

| | | | | | | | | | | | | | | | | |

| 03/31/2024 |

| Effect on profit or loss |

| Probable (base value) | | Possible (25%) | | Remote (50%) |

| Cash and cash equivalents | 1,145,829 | | | 286,457 | | | 572,915 | |

| Marketable securities | 5,217,853 | | | 1,304,463 | | | 2,608,927 | |

| Trade accounts receivable | 4,887,668 | | | 1,221,917 | | | 2,443,834 | |

| Trade accounts payable | (1,088,141) | | | (272,035) | | | (544,071) | |

| Loans and financing | (63,568,492) | | | (15,892,123) | | | (31,784,246) | |

| Liabilities for asset acquisitions and subsidiaries | (132,557) | | | (33,139) | | | (66,279) | |

4.4.1.2 Sensitivity analysis – foreign exchange rate exposure – derivative financial instruments

The Company has sales operations in US$ in the futures markets, including strategies using options, to ensure attractive levels of operating margins for a portion of its revenue. These operations are limited to a percentage of the total exposure to US$ over a 24-month horizon, or to investments in the Cerrado Project, according to the extraordinary hedge described above, and are therefore pegged to the availability of ready-to-sell foreign exchange in the short term.

In addition to the transaction described above, the Company also taken out derivative instruments linked to the US$ and subject to exchange fluctuations, seeking to adjust the debt's currency indexation to the cash generation currency, as provided for in its financial policies.

For the calculation of the mark-to-market (“MtM”) price, the exchange rate of the last business day of the period is used. These market movements caused a negative impact on the mark-to-market position entered into by the Company.

This analysis below assumes that all other variables, particularly the interest rates, remain constant. The other scenarios considered the depreciation of the Brazilian Real against the US$ by 25% and 50%, before taxes, based on the base scenario on March 31, 2024.

The following table set out the possible impacts assuming these scenarios:

| | | | | | | | | | | | | | | | | |

| 03/31/2024 |

| Effect on profit or loss |

| Probable (base value) | | Possible 25% | | Remote 50% |

| Dollar/Real | | | | | |

| Derivative financial instruments | | | | | |

| Derivative options | 1,307,777 | | | (3,763,848) | | | (9,147,180) | |

| Derivative swaps | (834,843) | | | (1,962,332) | | | (3,918,962) | |

| Derivative Non-Deliverable Forward (‘NDF’) Contracts | 95,988 | | | (518,817) | | | (1,037,661) | |

| Embedded derivatives | 197,318 | | | (126,255) | | | (252,510) | |

NDF parity derivatives (1) | 37,094 | | | 7,884 | | | 16,880 | |

| Commodity Derivatives | 112,399 | | | 28,106 | | | 56,206 | |

| | | | | |

| Dollar/Euro | | | | | |

| Derivative financial instruments | | | | | |

NDF parity derivatives (1) | 37,094 | | | (213,274) | | | (426,549) | |

(1)Long positions at US$/EUR parity in order to protect the Capex cash flow of the Cerrado Project against the appreciation of the Euro.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.4.2 Interest rate risk management

Fluctuations in interest rates could increase or reduce the costs of new loans and existing contracted operations.

The Company is constantly looking for alternatives for the use of financial instruments in order to avoid negative impacts on its cash flow due to fluctuations in interest rates in Brazil or abroad.

4.4.2.1 Sensitivity analysis – exposure to interest rates – except for derivative financial instruments

For its market risk analysis, the Company uses scenarios to evaluate the sensitivity of changes in operations impacted by the following rates: Interbank Deposit Rate (“CDI”), Long Term Interest Rate (“TJLP”), Special System for Settlement and Custody (“SELIC”) and SOFR, which could impact the results. The probable scenario represents the amounts already booked, as they reflect Management’s best estimates.

This analysis assumes that all other variables, particularly exchange rates, will remain constant. The other scenarios considered a depreciation of 25% and 50% in market interest rates.

The following table set forth the possible impacts assuming these scenarios in absolute amounts:

| | | | | | | | | | | | | | | | | |

| 03/31/2024 |

| Effect on profit or loss |

| Probable | | Possible (25%) | | Remote (50%) |

| CDI/SELIC | | | | | |

| Cash and cash equivalents | 2,983,209 | | | (79,428) | | | (158,856) | |

| Marketable securities | 9,698,406 | | | (258,220) | | | (516,440) | |

| Loans and financing | 8,938,421 | | | 237,985 | | | 475,971 | |

| TJLP | | | | | |

| Loans and financing | 236,864 | | | 3,867 | | | 7,734 | |

| SOFR | | | | | |

| Loans and financing | 21,093,446 | | | 281,070 | | | 562,140 | |

4.4.2.2 Sensitivity analysis – exposure to interest rates – derivative financial instruments

This analysis assumes that all other variables remain constant. The other scenarios considered a depreciation of 25% and 50% in market interest rates.

The following table sets out the possible impacts of these assumed scenarios:

| | | | | | | | | | | | | | | | | |

| 03/31/2024 |

| Effect on profit or loss |

| Probable | | Probable 25% | | Remote 50% |

| CDI | | | | | |

| Derivative financial instruments | | | | | |

| Liabilities | | | | | |

| Derivative options | 1,307,777 | | | (406,268) | | | (786,201) | |

| Derivative swaps | (834,843) | | | (31,958) | | | (65,457) | |

| SOFR | | | | | |

| Derivative financial instruments | | | | | |

| Liabilities | | | | | |

| Derivative swaps | (834,843) | | | (10,925) | | | (18,378) | |

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.4.2.3 Sensitivity analysis to changes in the consumer price indices of the US economy

For the measurement of the probable scenario, the United States Consumer Price Index (“US-CPI”) was considered on March 31, 2024. The probable scenario was extrapolated considering a depreciation of 25% and 50% in the US-CPI to define the possible and remote scenarios, respectively.

The following table sets out the possible impacts, assuming these scenarios in absolute amounts:

| | | | | | | | | | | | | | | | | |

| 03/31/2024 |

| Effect on profit or loss |

| Probable (base value) | | Possible (25%) | | Remote (50%) |

| | | | | |

| Embedded derivative in a commitment to purchase standing wood, originating from a forest partnership agreement | 197,318 | | | (33,193) | | | (68,466) | |

4.4.3 Commodity price risk management

The Company is exposed to commodity prices, mainly in the selling price of pulp in the international market. The dynamics of rising and falling production capacities in the global market and macroeconomic conditions may impact the Company´s operating results.

Through a specialized team, the Company monitors hardwood pulp prices and analyses future trends, adjusting the forecasts aimed at assisting with preventive measures to calculate the different scenarios. There is no sufficiently liquid financial market to mitigate the risk of a material portion of the Company’s operations. Hardwood pulp price protection instruments available on the market have low liquidity and low volume, and high levels of distortion in price formation.

The Company is also exposed to international oil prices, reflected in logistical costs for selling in the export market, and indirectly in the costs of other supply, logistics and service contracts. In such cases, the Company evaluates whether to contract derivative financial instruments to mitigate the risk of price variations in its results.

4.5 Derivative financial instruments

The Company determines the fair value of derivative contracts, which differ from the amounts realized in the event of early settlement due to bank spreads and market factors at the time of quotation. The amounts presented by the Company are based on an estimate using market factors and use data provided by third parties, measured internally and compared to calculations performed by external consultants and by counterparties.

Details of derivative financial instruments and their respective calculation methodologies are disclosed in the annual financial statements for the year ended December 31, 2023 (Note 4).

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.5.1 Outstanding derivatives by contract type, including embedded derivatives

The positions of outstanding derivatives are set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Notional value, net in U.S.$ | | Fair value in R$ |

| | 03/31/2024 | | 12/31/2023 | | 03/31/2024 | | 12/31/2023 |

| Instruments as part of protection strategy | | | | | | | | |

| Operational hedges | | | | | | | | |

| Zero Cost Collar | | 5,254,000 | | | 4,500,200 | | | 1,307,777 | | | 1,968,337 | |

| NDF (R$ x US$) | | 420,000 | | | 505,000 | | | 95,988 | | | 162,776 | |

| NDF (€ x US$) | | 164,400 | | | 262,088 | | | 37,094 | | | 100,362 | |

| | | | | | | | |

| Debt hedges | | | | | | | | |

| Swap SOFR to Fixed (US$) | | 1,598,038 | | | 2,555,626 | | | 452,625 | | | 741,492 | |

| Swap IPCA to CDI (notional in Brazilian Reais) | | 4,211,759 | | | 4,274,397 | | | (138,399) | | | 47,645 | |

| | | | | | | | |

| Swap CDI x Fixed (US$) | | 1,248,518 | | | 1,025,000 | | | (1,149,055) | | | (1,081,964) | |

| Pre-fixed Swap to US$ (US$) | | | | | 200,000 | | | | | | (203,045) | |

| Swap CDI x SOFR (US$) | | 350,000 | | | 125,000 | | | 15,698 | | | 25,774 | |

| Swap SOFR to SOFR (US$) | | 150,961 | | | 150,961 | | | (15,711) | | | (16,615) | |

| | | | | | | | |

| Commodity Hedge | | | | | | | | |

Swap US$ e US-CPI (1) | | 131,296 | | | 131,510 | | | 197,318 | | | 230,471 | |

| Zero Cost Collar (Brent) | | 149,205 | | | 163,100 | | | 39,265 | | | (3,148) | |

| Swap VLSFO/Brent | | 113,849 | | | 142,794 | | | 73,134 | | | 22,297 | |

| | | | | | 915,734 | | | 1,994,382 | |

| Current assets | | | | | | | | |

| Non-current assets | | | | | | 1,961,643 | | | 2,676,526 | |

| Current liabilities | | | | | | 1,544,010 | | | 1,753,928 | |

| Non-current liabilities | | | | | | (82,556) | | | (578,763) | |

| | | | | | (2,507,363) | | | (1,857,309) | |

| | | | | | 915,734 | | | 1,994,382 | |

(1)The embedded derivative refers to a swap contract for the sale of price variations in United States Dollars and US-CPI within the term of a forest partnership with a standing wood supply contract.

The current contracts and the respective protected risks are set forth below:

(i)Swap CDI x Fixed US$: positions in conventional swaps exchanging the variation of the Interbank Deposit rate (“DI”) for a fixed rate in United States Dollars (“US$”). The objective is to change the debt indexed in Brazilian Reais to US$, in compliance with the Company's natural exposure to US$ receivables.

(ii)Swap IPCA x CDI (notional in Brazilian Reais): positions in conventional swaps exchanging the variation of the Amplified Consumer Price Index (“IPCA”) for the DI rate. The objective is to change the debt indexed in reais, in compliance with the Company's cash position in Brazilian Reais, which is also indexed to DI.

(iii)Swap SOFR x Fixed US$: positions in conventional swaps exchanging a post-fixed rate (SOFR) for a fixed rate in US$. The objective is to protect the cash flow against changes in the US interest rate.

(iv)Pre-Fixed Swap R$ x Fixed US$: positions in conventional swaps of a fixed rate in Reais for a fixed rate in US$. The objective is to change the exposure of debts in Brazilian Reais to US$, in compliance with the Company's natural exposure to US$ receivables.

(v)SOFR x SOFR Swap: swap position exchanging a fixed rate added to SOFR for another fixed rate added to SOFR. The objective is to generate a fee discount for Prepayment with the banking institution, allowing for reversal mechanisms.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

(vi)CDI x SOFR Swap: positions in conventional swaps exchanging the variation in the Interbank Deposit rate (“DI”) for a post-fixed rate (“SOFR”) in United States Dollars (“US$”). The objective is to change the debt index in reais to US$, aligning with the natural exposure of the Company's US$ receivables and capturing a lower cost of debt through the fluctuation of SOFR rate projections.

(vii)Zero Cost Collar: positions in an instrument that consists of the simultaneous combination of a purchase of put options and the sale of call options in US$, with the same principal amount and maturity, with the objective of protecting the cash flow of exports. Under this strategy, an interval is established where there is no deposit or receipt of financial margin at the option maturity. The objective is to protect the cash flow of exports against the depreciation of the Brazilian Real.

(viii)Non-Deliverable Forward contracts (“NDF”): short positions in US$ futures contracts with the objective of protecting the cash flow from exports against the depreciation of the Brazilian Real.

(ix)Swap US-CPI: The embedded derivative refers to the swap contracts for selling price variations in US$ and the US-CPI in forest partnership with a standing wood supply contract.

(x)Non-Deliverable Forward contracts: EUR and US$: call positions at EUR/US$ parity to protect the Capex cash flow of the Cerrado project against the appreciation of the Euro.

(xi)Swap Very Low Sulphur Fuel Oil / Brent (“VLSFO”): Long positions in oil, aimed at hedging logistical costs related to maritime freight contracts against the increase in oil prices.

(xii)Zero Cost Collar (Brent): positions in an instrument that consists of the simultaneous combination of buying call options and selling put options for oil - Brent, with the same principal value and maturity, with the objective of protecting input costs of oil derivatives. In this strategy, an interval is established where there is no deposit or receipt of financial margin at the expiration of the options. The objective is to protect costs against rising oil prices.

The variation in the fair values of derivatives on March 31, 2024 compared to the fair values measured on December 31, 2023 are explained substantially by the depreciation of the Brazilian Real against the US Dollar and by settlements during the period. There were also impacts caused by the variations in the Pre Fixed, Foreign Exchange Coupon and SOFR curves in the operations.

It is important to highlight that the outstanding agreements on March 31, 2024 are over-the-counter market operations, without any type of collateral margin or forced early settlement clause due to variations from market marking.

4.5.2 Fair Value Maturity Schedule

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| 2024 | 1,879,087 | | | 2,097,763 | |

| 2025 | (183,928) | | | 233,072 | |

| 2026 | (583,430) | | | (574,871) | |

| 2027 onwards | (195,995) | | | 238,418 | |

| 915,734 | | | 1,994,382 | |

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.5.3 Outstanding assets and liabilities derivatives positions

The outstanding derivatives positions are set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Notional value | | Fair value |

| | Currency | | 03/31/2024 | | 12/31/2023 | | 03/31/2024 | | 12/31/2023 |

| Debt hedges | | | | | | | | | | |

| Assets | | | | | | | | | | |

| Swap CDI to Fixed | | US$ | | 5,007,955 | | | 3,898,011 | | | 454,027 | | | 223,776 | |

| Swap Pre-Fixed to US$ | | US$ | | | | | 738,800 | | | | | | |

| Swap SOFR to Fixed | | US$ | | 1,598,038 | | | 2,555,626 | | | 478,393 | | | 1,104,984 | |

| Swap IPCA to CDI | | R$ | | 4,322,848 | | | 4,320,471 | | | 110,101 | | | 161,542 | |

| | | | | | | | | | |

| Swap CDI to SOFR | | US$ | | 1,762,475 | | | 644,850 | | | 249,509 | | | 32,560 | |

| Swap SOFR to SOFR | | US$ | | 150,961 | | | 150,961 | | | 6,316 | | | 6,681 | |

| | | | | | | | 1,298,346 | | | 1,529,543 | |

| Liabilities | | | | | | | | | | |

| Swap CDI to Fixed | | US$ | | 1,248,518 | | | 1,025,000 | | | (1,603,082) | | | (1,305,740) | |

| Swap Pre-Fixed to US$ | | US$ | | | | | 200,000 | | | | | | (203,045) | |

| Swap SOFR to Fixed | | US$ | | 1,598,038 | | | 2,555,626 | | | (25,768) | | | (363,492) | |

| Swap IPCA to CDI | | R$ | | 4,211,759 | | | 4,274,397 | | | (248,500) | | | (113,897) | |

| | | | | | | | | | |

| Swap CDI to SOFR | | US$ | | 350,000 | | | 125,000 | | | (233,811) | | | (6,786) | |

| Swap SOFR to SOFR | | US$ | | 150,961 | | | 150,961 | | | (22,027) | | | (23,296) | |

| | | | | | | | (2,133,188) | | | (2,016,256) | |

| | | | | | | | (834,842) | | | (486,713) | |

| Operational hedge | | | | | | | | | | |

| Zero Cost Collar (US$ x R$) | | US$ | | 5,254,000 | | | 4,500,200 | | | 1,307,777 | | | 1,968,337 | |

| NDF (R$ x US$) | | US$ | | 420,000 | | | 505,000 | | | 95,988 | | | 162,776 | |

| NDF (€ x US$) | | US$ | | 164,400 | | | 262,088 | | | 37,094 | | | 100,362 | |

| | | | | | | | 1,440,859 | | | 2,231,475 | |

| Commodity hedge | | | | | | | | | | |

| Swap US-CPI (standing wood) (1) | | US$ | | 131,296 | | | 131,510 | | | 197,318 | | | 230,471 | |

| Zero Cost Collar (Brent) | | US$ | | 149,205 | | | 163,100 | | | 39,265 | | | (3,148) | |

| Swap VLSFO/Brent | | US$ | | 113,849 | | | 142,794 | | | 73,134 | | | 22,297 | |

| | | | | | | | 309,717 | | | 249,620 | |

| | | | | | | | 915,734 | | | 1,994,382 | |

(1)The embedded derivative refers to the swap contracts for selling price variations in US$ and the US-CPI in forest partnership with a standing wood supply contract.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

4.5.4 Fair value settled amounts

The settled derivatives positions are set forth below:

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| Operational hedge | | | |

| Zero Cost Collar (R$ x US$) | 271,915 | | | 2,987,953 | |

| NDF (R$ x US$) | 17,862 | | | 155,458 | |

| NDF (€ x US$) | 31,954 | | | 84,332 | |

| 321,731 | | | 3,227,743 | |

| | | |

| Commodity hedge | 32,327 | | | 80,516 | |

| Swap VLSFO/other | 32,327 | | | 80,516 | |

| | | |

| Debt hedge | | | |

| Swap CDI to Fixed (US$) | 41,112 | | | (438,417) | |

| Swap IPCA to CDI (Brazilian Reais) | (9,358) | | | 256,683 | |

| Swap IPCA to Fixed (US$) | | | | 21,139 | |

| Swap Pre-Fixed to US$ | (221,462) | | | (104,827) | |

| Swap SOFR to SOFR | 800 | | | |

| Swap CDI to SOFR (US$) | 1,847 | | | 7,729 | |

| Swap SOFR to Fixed (US$) | 277,115 | | | 508,720 | |

| 90,054 | | | 251,027 | |

| 444,112 | | | 3,559,286 | |

4.6 Fair value hierarchy

Financial instruments are measured at fair value, which considers the fair value as the price that would be received from selling an asset or paid to transfer a liability in an unforced transaction between market participants at the measurement date.

For the three-month period ended March 31, 2024, there were no changes between the 3 (three) levels of hierarchy and no transfers between levels 2 and 3.

| | | | | | | | | | | | | | | | | | | | |

| | | | 03/31/2024 |

| | Level 2 | | Level 3 | | Total |

| Assets | | | | | | |

| At fair value through profit or loss | | | | | | |

| Derivative financial instruments | | 3,505,653 | | | | | 3,505,653 | |

| Marketable securities | | 15,120,020 | | | | | 15,120,020 | |

| | 18,625,673 | | | | | | 18,625,673 | |

| At fair value through other comprehensive income | | | |

|

|

|

| Other investments | | | | 28,970 | | | 28,970 | |

| | | | | 28,970 | | | 28,970 | |

| |

|

|

|

|

|

| Biological assets | | | | 18,721,063 | | | 18,721,063 | |

| | | | | 18,721,063 | | | 18,721,063 | |

| Total assets | | 18,625,673 | | | 18,750,033 | | | 37,375,706 | |

| | | | | | |

| | | | | | |

| Liabilities | |

|

|

|

|

|

| At fair value through profit or loss | |

|

|

|

|

|

| Derivative financial instruments | | 2,589,919 | | | | | 2,589,919 | |

| | 2,589,919 | | | | | | 2,589,919 | |

| | 2,589,919 | | | | | | 2,589,919 | |

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

| | | | | | | | | | | | | | | | | |

| | | | | 12/31/2023 |

| Level 2 | | Level 3 | | Total |

| Assets | | | | | |

| At fair value through profit or loss | | | | | |

| Derivative financial instruments | 4,430,454 | | | | | | 4,430,454 | |

| Marketable securities | 13,267,286 | | | | | | 13,267,286 | |

| 17,697,740 | | | | | | 17,697,740 | |

| | | | | |

| At fair value through other comprehensive income | | |

|

|

|

| Other investments - CelluForce | | | | 23,606 | | | 23,606 | |

| | | | 23,606 | | | 23,606 | |

| | | | | |

| Biological assets | | | | 18,278,582 | | | 18,278,582 | |

| | | | 18,278,582 | | | 18,278,582 | |

| Total assets | 17,697,740 | | | 18,302,188 | | | 35,999,928 | |

| | | | | |

| Liabilities | | | | | |

| At fair value through profit or loss | | | | | |

| Derivative financial instruments | 2,436,072 | | | | | | 2,436,072 | |

| 2,436,072 | | | | | | 2,436,072 | |

| Total liabilities | 2,436,072 | | | | | | 2,436,072 | |

4.7 Cybersecurity

Suzano has a Public Information Security Policy, which aims to establish guidelines regarding cyber security management and controls at Suzano, seeking to mitigate vulnerabilities, preserve and protect assets, mainly information and personal data, in accordance with current laws, regulations and contractual obligations, covering the confidentiality, integrity, availability, authenticity and legality of information. The Policy establishes responsibilities to avoid damages, which may represent financial impacts, image and reputation, exposure of information, interruption of operations, among other damages due to cyber-attacks.

For the three-month period ended March 31, 2024, no material incidents associated with cybersecurity were identified that could affect the confidentiality, integrity and/or availability of the systems used by the Company.

4.8 Climate change

In the annual financial statements for the year ended December 31, 2023, the risks and opportunities information linked to climate change and the sustainability strategy were disclosed, which did not change significant during the three-month period ended March 31, 2024.

4.9 Capital management

The main objective is to strengthen the Company’s capital structure, aiming to maintain an appropriate level of financial leverage while mitigating risks that could affect the availability of capital for business development.

The Company continuously monitors significant indicators, such as consolidated financial leverage, which is the ratio of total net debt to adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (“Adjusted EBITDA”).

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

5 CASH AND CASH EQUIVALENTS

| | | | | | | | | | | | | | | | | |

| Average yield p.a. % | | 03/31/2024 | | 12/31/2023 |

Cash and banks (1) | 5.03% | | 1,219,917 | | | 6,561,558 | |

| | | | | |

| Cash equivalents | | | | | |

| Local currency | | | | | |

| Fixed-term deposits (compromised) | 102.63 | % of CDI | | 2,983,209 | | | 1,784,313 | |

| | | | | |

| | | | | |

| | | | | |

| | | 4,203,126 | | | 8,345,871 | |

(1)Refers mainly to investments in foreign currency under the Sweep Account modality, which is a remunerated account the balance of which is invested and made available automatically each day.

6 MARKETABLE SECURITIES

| | | | | | | | | | | | | | | | | |

| Average yield p.a. % | | 03/31/2024 | | 12/31/2023 |

| In local currency | | | | | |

| Private funds | 112.79% of CDI | | 1,501,275 | | | 1,295,296 | |

Public Securities (1) | IPCA + 5,55% | | 203,761 | | | | |

| Private Securities ("CDBs") | 102.20% of CDI | | 7,749,054 | | | 4,150,313 | |

CDBs - Escrow Account (2) | 107.80% of CDI | | 448,077 | | | 443,400 | |

|

| | 9,902,167 | | | 5,889,009 | |

| Foreign currency |

| | | | |

Time deposits (3) | 6.71% | | 5,045,943 | | | 7,333,308 | |

| Other |

| | 171,910 | | | 44,969 | |

|

| | 5,217,853 | | | 7,378,277 | |

| | | 15,120,020 | | | 13,267,286 | |

| | | | | |

| Current | | | 14,671,943 | | | 12,823,886 | |

| Non-Current | | | 448,077 | | | 443,400 | |

(1)Acquisition of Brazil National Treasury Notes indexed to IPCA (NTN-B)

(2)Includes escrow accounts, which will be released only after obtaining the applicable governmental approvals, and pending compliance by the Company with the conditions precedent in transactions involving the sale of rural properties.

(3)Refers to Time Deposit investments, with maturities over 90 days, which are remunerated bank deposits with specific maturity periods.

| | | | | | | | |

| | |

| Suzano S.A. | |

| Notes to the unaudited condensed consolidated interim financial information |

| Three-month period ended March 31, 2024 |

| |

| | |

7 TRADE ACCOUNTS RECEIVABLE

7.1 Breakdown of balances

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| Domestic customers | | | |

| Third parties | 1,719,666 | | | 1,785,157 | |

Related parties (Note 11.1) (1) | 56,210 | | | 45,650 | |

| | | |

| Foreign customers | | | |

| Third parties | 4,887,668 | | | 5,049,609 | |

| Related parties (Note 11.1) | 220 | | | | |

| | | |

| (-) Expected credit losses | (29,029) | | | (31,962) | |

| 6,634,735 | | | 6,848,454 | |

(1)The balance refers to transactions with Ibema Companhia Brasileira de Papel.

The Company carries out factoring transactions for certain customer receivables where transfers the control and all risks and rewards related to these receivables to the counterparty, so these receivables are derecognized from accounts receivable in the balance sheet. This transaction refers to an additional cash generation opportunity and is therefore classified as a financial asset measured at amortized cost. The impact of these factoring transactions on the accounts receivable as of March 31, 2024, was R$4,148,287 (R$4,273,623 as of December 31, 2023).

7.2 Breakdown of trade accounts receivable by maturity

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| Current | 5,908,498 | | | 5,904,402 | |

| Overdue | | | |

| Up to 30 days | 524,213 | | | 644,644 | |

| From 31 to 60 days | 55,430 | | | 57,395 | |

| From 61 to 90 days | 61,545 | | | 97,639 | |

| From 91 to 120 days | 33,462 | | | 40,533 | |

| From 121 to 180 days | 15,937 | | | 34,708 | |

| From 181 days | 35,650 | | | 69,133 | |

| 6,634,735 | | | 6,848,454 | |

7.3 Roll-forward of expected credit losses

| | | | | | | | | | | |

| 03/31/2024 | | 12/31/2023 |

| Opening balance | (31,962) | | | (21,109) | |

| Reversals (additions), net | 1,317 | | | (35,202) | |

| | | |

| Write-offs | 1,752 | | | 24,230 | |

| Exchange rate variations | (136) | | | 119 | |

| Closing balance | (29,029) | | | (31,962) | |