Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 13 2025 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 13, 2025

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcos Moreno Chagas Assumpção |

| Name: | Marcos Moreno Chagas Assumpção |

| Title: | Vice-President of Finance and Investor Relations |

Earnings Conference Call 4Q24

Disclaimer 2 This presentation contains what are considered “forward-looking statements,” as defined in Section 27A of the 1933 Securities Act and Section 21E of the 1934 Securities Exchange Act, as amended. Some of these forward-looking statements are identified with words such as “believe,” “may,” “could,” “would,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” as well as the negative forms of these words, other terms of similar meaning or the use of future dates. The forward-looking statements include, without limitation, statements related to the declaration or payment of dividends, implementation of the key operational and financial strategies and investment plans, guidance about future operations and factors or trends that influence the financial situation, liquidity or operational results. Such statements reflect the current view of the management and are subject to diverse risks and uncertainties. These are qualified in accordance with the inherent risks and uncertainties involving future expectations in general, and actual results could differ materially from those currently anticipated due to various risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on diverse assumptions and factors, including general economic and market conditions, industry conditions and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. Suzano does not undertake any obligation to update any such forward-looking statements as a result of new information, future events or otherwise, except as expressly required by law. All forward-looking statements in this presentation are covered in their entirety by this disclaimer. In addition, this presentation contains some financial indicators that are not recognized by the BR GAAP or IFRS. These indicators do not have a standard meaning and may not be comparable to indicators with a similar description used by other companies. We provide these indicators because we use them as measurements of Suzano's performance; they should not be considered separately or as a replacement for other financial metrics that have been disclosed in accordance with BR GAAP or IFRS.

3 2024: Ribas’ outstanding performance drives record sales, enhances competitiveness and deleveraging HIGHLIGHTS 1 Excluding Consumer Goods – Includes October and November/24 operations of Suzano Packaging US (assets acquired from Pactiv Evegreen). 2 Operating Cash Generation = Adjusted EBITDA less Sustaining Capex. | 3 Includes RCF and Finnvera credit line. | 4 Net Debt / Adjusted EBITDA in the last twelve months. Adjusted EBITDA: Liquidity3: Sales Volume Financial Management Operating Performance 10.9 million tons (vs. 10.2 million tons in 2023) Pulp: 1.2 million tons (vs. 1.1 million tons in 2023) Paper and packaging1: Pulp Inventory: Tight operational levels globally Operating Cash Generation2: Cash cost ex-downtimes: R$23.8 bn (vs. R$18.3 billion in 2023) R$16.2 bn (vs. R$11.6 billion in 2023) R$828/ton (vs. R$882/ton in 2023) US$12.8 bn (vs. US$11.5 billion in 4Q23) Leverage4: US$5.7 bn (vs. US$6.8 billion in 4Q23) Net debt: 2.9x in US$ (vs. 3.1x in 4Q23)

2,568 2,165577 601 560 6,377 5,9555,793 5,985 6,195 736 761 353 428 1,103 1,188 Paper Sales¹ (‘000 ton) Average Net Price (R$/ton) 4Q23 3Q24 4Q24 2023 202 200 230 117 95 137 320 295 367 4Q23 3Q24 4Q24 2024 PAPER AND PACKAGING BUSINESS Solid operational performance in the quarter, with integration of US operations progressing as planned 2023 2024 Rest of the WorldBrazil 4 Paper Adjusted EBITDA and EBITDA Margin² R$ MM R$/ton Margin % 1 Excluding Consumer Goods – Includes October and November/24 operations of Suzano Packaging US (assets acquired from Pactiv Evegreen). ² Excluding impact of Mgmt. LTI; 4Q23: -R$16/ton; 1Q24: -R$49/ton; 2Q24: -R$5/ton; 3Q24: -R$15/ton; 4Q24: - R$39/ton; 2023: -R$27/ton; 2024: -R$34/ton. 4Q23 3Q24 2,327 1,8221,806 2,038 1,527 31% 34% 36% 4Q24 30% 32% 2023 2024

572 670 583 2,999 3,472 Average FX 3,756 5,697 5,730 600 644 2,761 2,635 3,284 PULP BUSINESS Sales Volume (‘000 ton) 4Q23 3Q24 4Q24 10,215 10,865 2023 Average Net Price – Export Market ($/ton) Adjusted EBITDA and EBITDA Margin (%) 15,195 20,866 4Q23 3Q24 4Q24 2023 R$ 4.96 R$ 5.55 R$ 5.84 R$ 5.00 Record volume and favorable FX drive solid EBITDA, offsetting price headwinds in the quarter 5 1,360 2,162 1,745 R$ MM R$/ton Margin % 4Q23 3Q24 4Q24 2024 2,835 3,718 3,407 US$ BRL 48% 58% 51% 50% 2024 2023 2024 R$ 5.39 56% 1,487 1,921

176 339 359 337 316 (36) 4Q23 (25) Wood (12) Input (2) Fixed Cost (6) Energy 35 FX 174 (42) 4Q24 816 807 -1% 185 364 359 347 316 (33) 3Q24 (32) Wood (15) Input (11) Fixed Cost (9) Energy 11 FX 174 (42) 4Q24 863 807 -7% PULP BUSINESS Pulp Cash Cost – 4Q24 vs. 3Q24 (ex-downtimes – R$/ton) Pulp Cash Cost – 4Q24 vs. 4Q23 (ex-downtimes – R$/ton) 6 Enhanced efficiency and Ribas learning curve completion drive lower cash costs Commodity price effect: -R$8/ton Commodity price effect: -R$36/ton Δ Δ Δ Δ Δ Δ Δ Δ Wood Input Fixed Cost Energy FX

RIBAS DO RIO PARDO UNIT A new record set to the P&P industry: learning curve completion in less than 6 months Learning curve progress Total capex timeline (R$ billion) 0.1 0.7 7.4 8.5 4.5 0.9 2020 2021 2022 2023 2024 2025 Actual Expected 71% 89% 98% 100% 80% 100% 3Q24 4Q24 1Q25 2Q25 Expected progress Actual progress Concluded on December 29th, 2024

Net Debt Dec. 2023 1.8 Capital for Allocation¹ 1.5 Capex ex-maintenance² Pro-forma Dec. 2024 0.7 0.8 Share buyback and Interest on Equity Net Debt Dec. 2024 11.5 11.2 12.8 3.0 3.2 3.33.1 3.1 2.9 3.6 1.5 1.5 1.8 1.6 2.5 1.3 0.8 5.7 7.4 Net Debt (US$ billion) 8 Sep/24Dec/23 Dec/24 1 Adjusted EBITDA (-) maintenance capex, (+/-) working capital, (-) accrued net interest, (-) income taxes, among others. | 2 Do not include forestry assets, Lenzing and Pactiv. | 3Finnvera credit lines. | 4Considers the portion of debt with currency swaps for foreign currency. | 5Forestry assets acquisition from BTG, minority stake acquisition on Lenzing and Pactiv acquisition as per Material Facts of July 31, August 30 and October 01, respectively. Stand-by facilities Leverage (Net debt/EBITDA LTM) Liquidity 2025 2026 2027 2028 2030 onwards 2029 Finnvera3 FINANCIAL MANAGEMENT 86% 61% 66% 46% 86% 73% Forestry assets, Lenzing and Pactiv5 In R$ In US$ Average Cost (in US$): 5.0% p.a. Average Term: 73 months Amortization Schedule (US$ billion) Cash on hand (29% in US$) % of debt in fixed rate (US$)4 Deleveraging path even with strong investment cycle and sizable shareholder compensation

Put / Call 5.36 6.16 Portfolio Average 73% FX gap coverage Notional @ Dec/24: US$ 6.9 billion Current portfolio – ZCC Cash Flow Hedging (R$) Financial Results - 4Q24 (R$ billion) -1.1 -9.8 -3.8 -0.1 -0.1 -15.6 -1.2 Effects related to cash flow hedge Net interest over debt ∆ FX on debt in US$ ∆ MtM of debt hedges ∆ MtM of cash flow hedges Effects related to debt management Others10.5 1 Includes: other financial income and expenses, capitalized interests, other foreign exchange variations and other hedges (commodities and embedded) Financial results impacted by weaker BRL – positive over time FINANCIAL MANAGEMENT Cash disbursements of debt hedges Cash disbursements of cash flow hedges

2024 Shareholder remuneration FINANCIAL MANAGEMENT Interest on Equity Total in 2024: R$4.3 bn R$1.5 bn Disbursement2: Jan. 10th, 2024 Payment per share3: R$1.16 R$2.8 bn Amount of Shares1: 51 million Average price: R$54.88 Share Buyback ¹ 4th program completed and 5th program ongoing | 2 Distribution date in Brazil | 3 Gross payment R$2.5 bn Disbursement2: Jan. 10th, 2025 Payment per share3: R$2.02

Looking ahead… o Unexpected events once again are playing a significant role in pulp price dynamics o Higher pulp sales volume still to come in 2025 with Ribas mill o Flattish cash cost in 2025 over 4Q24, despite short-term uptick in 1Q25 o Suzano Packaging US operations progressing in line with business plan o Continued focus on deleveraging

Q&A 4Q24 Investor Relations ir.suzano.com.br ri@suzano.com.br

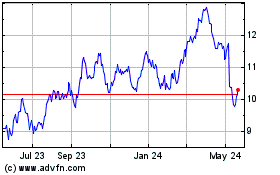

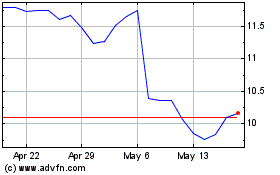

Suzano (NYSE:SUZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

Suzano (NYSE:SUZ)

Historical Stock Chart

From Mar 2024 to Mar 2025