Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 21 2025 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2025.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 21st, 2025

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcos Moreno Chagas Assumpção |

| Name: | Marcos Moreno Chagas Assumpção |

| Title: | Vice-President of Finance and Investor Relations |

SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

NOTICE TO THE MARKET

São Paulo, February 21st, 2025 – Suzano S.A. (“Company” or “Suzano”) (B3: SUZB3 | NYSE: SUZ) hereby informs its shareholders and the market that on this date it concluded the signing of an export prepayment agreement linked to sustainability (sustainability-linked loan), by its wholly-owned subsidiary Suzano International Finance B.V. ("Suzano Netherlands"), in the total principal amount of US$1,200 million (one billion, two hundred million U.S. dollars), at the cost of SOFR + 1.45% p.a., with an average term of 60 months and final maturity on March 8th, 2031.

The above-mentioned fund will be used, together with the company's cash, in the early settlement of principal of US$1,450 million (one billion, four hundred and fifty million U.S. dollars) of the export prepayment agreement disclosed in the Notice to the Market of February 11, 2021, whose initial amount was US$1,570 million (one billion, five hundred and seventy million U.S. dollars), at the original cost of Libor + 1.15% per annum, with an average maturity of 60 months and final maturity on March 10th, 2027. The remaining amount will follow the original schedule of maturities.

The new credit operation includes a sustainability performance indicator (KPI) linked to the biodiversity commitment, aligning with the implementation of the company's ambition declared in its Commitment to Renewing Life, which aims to connect half a million hectares of priority areas for biodiversity conservation across the Cerrado, Atlantic Forest, and Amazon biomes by 2030.

Suzano received an independent assessment from S&P Global, which ensures that the operation complies with the Sustainability Linked Loan Principles published by the International Capital Markets Association (ICMA).

In this way, the company demonstrates its constant focus on further enhancing its debt profile through liability management operations that extend its average maturity at a competitive cost.

Suzano reiterates its commitment to transparency in its communications with shareholders and investors.

São Paulo, February 21st, 2025.

Marcos Moreno Chagas Assumpção

Vice-President of Finance and Investor Relations

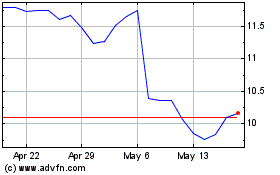

Suzano (NYSE:SUZ)

Historical Stock Chart

From Feb 2025 to Mar 2025

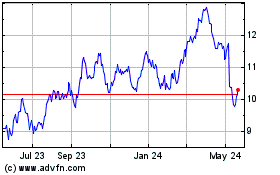

Suzano (NYSE:SUZ)

Historical Stock Chart

From Mar 2024 to Mar 2025